This is “In a Set of Financial Statements, What Information Is Conveyed about Shareholders’ Equity?”, chapter 16 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 16 In a Set of Financial Statements, What Information Is Conveyed about Shareholders’ Equity?

Video Clip

(click to see video)In this video, Professor Joe Hoyle introduces the essential points covered in Chapter 16 "In a Set of Financial Statements, What Information Is Conveyed about Shareholders’ Equity?".

16.1 Selecting a Legal Form for a Business

Learning Objectives

At the end of this section students should be able to meet the following objectives:

- Describe the three primary legal forms available for a business in the United States.

- Discuss the advantages and disadvantages of incorporating a business rather than maintaining it as a sole proprietorship or partnership.

- Explain the double taxation that is inherent in operating a corporate organization.

- Describe the impact that issuing capital stock has on a corporation.

Creating a Corporation

Question: In the United States, businesses and other organizations must operate as one of three legal forms.Over the decades, a number of variations of these legal forms have been allowed, each with its own particular characteristics. For example, limited liability companies (LLC) and limited liability partnerships (LLP) are hybrids that exhibit characteristics of both partnerships and corporations and are permitted to exist in certain states. A proprietorshipA business created, owned, and operated by a single individual; business is not legally separate from its owner; it is also referred to as a sole proprietorship. has a single owner whereas a partnershipAn unincorporated business created, owned, and operated by more than one individual; the business is not legally separate from its owners. is started and owned by two or more parties. In both of these cases, establishing the business is often an unstructured process. For example, a partnership can be created by a mere handshake or other informal agreement.

The third legal form of organization is a corporationAn organization that has been formally recognized by the state government as a separate legal entity so that it can sell ownership shares to raise money for capital expenditures and operations., which is brought into existence by means of a formal request made to a state government. Incorporation creates a separate entity, one that is owned by a group of stockholders. The number of owners is usually not relevant in the operation of a corporation. Because corporations are the dominant legal form (at least monetarily) in the United States, they have been the primary emphasis throughout this text. Numerically, more proprietorships and partnerships do exist but virtually every business of any size operates as a corporation. How is a corporation established, and what characteristics make it attractive?

Answer: Organizers only need to satisfy the incorporation process in one state regardless of their entity’s size. To start, they submit articles of incorporation to that government along with any other necessary information.A list of the typical contents of the articles of incorporation can be found at “Articles of Incorporation,” http://en.wikipedia.org/wiki/Articles_of_Incorporation. Rules, regulations, and requirements vary significantly so that these procedures are more complicated in some states than others. For example, many well-known businesses are incorporated in Delaware because of the traditional ease of the laws in that state.

After necessary documents have been filed and all other requirements met, the state government issues a corporate charter that recognizes the organization as a legal entity separate from its owners. This separation of the business from its owners is what differentiates a corporation from a partnership or proprietorship. Following incorporation in one state, the entity is then allowed to operate in any other state.

As mentioned in an earlier chapter, ownership of a corporation is physically represented by shares of stock that are issued to raise funds. In general, these shares are referred to as capital stock and the owners as shareholders or stockholders. For example, by December 31, 2010, Nucor Corporation had issued approximately 375 million of these shares to its stockholders. Unless restricted contractually, capital stock can be exchanged freely. After being issued by a corporation, shares can be resold dozens or even hundreds of times. Operations are usually unaffected by these ownership changes. Information about the current market price of most stocks as well as considerable other information about thousands of businesses can be found at sites such as http://www.google.com/finance and http://www.yahoo.com/finance.

Thus, a corporation is able to continue in existence even after owners die or decide to switch to other investments. In partnerships and proprietorships, capital stock does not exist. Consequently, transfer of an ownership interest is much more complicated. Partnerships and proprietorships often operate only for as long as the original owners are willing and able to continue being actively involved.

As a result of the legal separation of ownership and business, shareholders have no personal liability for the debts of the corporation.When money is loaned to a corporation, especially one that is either new or small, the lender might require the owners to guarantee the debt personally. Unless such a guarantee is made, the debt is that of the corporation and not the members of the ownership. An owner of a share of Nucor Corporation is not responsible for any of the liabilities of that company. Thus, the maximum loss a shareholder can suffer is the amount contributed to the corporation (or paid to a previous owner) in acquiring capital stock. The limited liabilityA legal characteristic associated with the ownership of a corporation whereby the maximum amount of money that can be lost is the owner’s capital investment; an attribute of a corporation that does not exist with the ownership of proprietorships or partnerships. offered by a corporation is one of the primary reasons for its popularity.

In contrast, the owners of a partnership or proprietorship are liable personally for all business debts. No separation exists between the business and ownership. For example, a partner or proprietor could invest $1,000 but wind up losing almost any amount of money if funds are borrowed by the business that cannot be repaid. Such potential losses are especially worrisome in a partnership because of the legal concept of mutual agencyA characteristic of a partnership whereby any partner can obligate other partners to an agreement without their direct consent; does not have a parallel in corporate ownership. where each partner serves as an agent for the entire organization. Thus, a partner can obligate the partnership and, if the debt is not paid when due, the creditor can seek redress from any partner. This possibility of unlimited losses typically restricts the number of potential investors because most people have a strong preference for being able to quantify the amount of risk they face.

The Double Taxation of Corporations

Question: Ownership shares of most corporations can be transferred. Thus, the life of an incorporated business can extend indefinitely as one owner leaves and another arrives. Caswell-Massey Co. is a perfect example. It has been in operation now for over 250 years. According to the corporate Web site (http://www.caswellmassey.com/about/about.aspx), “Before there was the United States of America, there was Caswell-Massey, the original purveyor of the finest personal care products and accessories and America’s oldest operating retailer. The company was founded in Newport, Rhode Island, by Scottish-born Dr. William Hunter in 1752.”

Investors are able to move into and out of corporate investments quickly. In addition, the availability of limited liability restricts potential losses to the amounts invested. These characteristics help explain the immense popularity of the corporate form in the United States. However, a significant number of partnerships and proprietorships continue to be created each year. If no problems existed, incorporation would be the only practical option. What disadvantages are associated with the corporation form?

Answer: Incorporation is often a time-consuming and costly legal process. However, in most states, proprietorships and partnerships can be created informally with little effort. Owners of many small businesses may feel that the creation of a corporation is more trouble than it is worth. Furthermore, corporations are often more susceptible to a plethora of government regulations.

The most obvious problem associated with corporations is the double taxationA negative feature associated with the corporate form; corporate earnings are taxed when earned by the business and then taxed again when distributed to owners in the form of dividends. of income. As noted, proprietorships and partnerships are not deemed to be separate entities. Therefore, the owners (but not the business) must pay a tax when any income is generated. However, the income is taxed only that one time when earned by the business.

For a proprietorship, Form 1040 Schedule C is an income statement attached to the owner’s individual income tax return to include the business’s profit or loss. A partnership does file its own tax return on Form 1065, but that is merely for information purposes; no income tax is paid. Instead, the various business revenues and expenses are assigned to the partners for inclusion on their individual tax returns. Any eventual conveyance of this income from the business to the owner does not create a second tax.

In contrast, as separate legal entities, corporations pay their own taxes by reporting all taxable income on Form 1120.Tax rules do allow smaller corporations to file their income taxes as S corporations if certain guidelines are met. S corporations follow virtually the same tax rules as partnerships so that income is only taxed one time when initially earned. However, when any dividends are eventually distributed from those earnings, this transfer is also viewed as taxable income to the stockholders. Income is taxed once when earned by the corporation and again when distributed to the owners. Critics have long argued that the conveyance of the dividend is not a new earning process. To mitigate the impact of this second tax, the U. S. Congress has established a maximum tax rate of 15 percent on much of the dividend income collected by individuals. This rate is considerably lower than that applied to most other types of income (such as salaries). Whether that reduced tax rate for dividends should continue at 15 percent or be raised or lowered is the subject of intense political debate.

To illustrate, assume that income tax rates are 30 percent except for the 15 percent tax on dividends. A proprietorship (or partnership) earns a profit of $100. For this type business, the $100 is only taxable to the owner or owners when earned. Payment of the resulting $30 income tax ($100 × 30 percent) leaves $70 as the remaining disposal income. Any distribution of this money to an owner has no impact on taxes. The government has collected $30.

If a corporation reports income of $100, a tax of $30 is assessed to the business so that only $70 remains. This residual amount can then be conveyed to owners as a dividend. However, if distributed, another tax must be paid, this time by the stockholder. The second income tax is $70 times 15 percent, or $10.50. The owner is left with only $59.50 ($70.00 less $10.50) in disposal income. The government has collected a total of $40.50 ($30.00 plus $10.50). The increase in the amount taken by the government is significant enough to reduce the inclination of many owners to incorporate their businesses.

Test Yourself

Question:

James Erskine and Pamela White are starting a new business. They are trying to determine whether to go to the trouble of incorporating or simply shake hands to form a partnership. Which of the following is a reason to create a partnership?

- Partnerships can raise large amounts of money more easily than corporations.

- Partnerships offer limited liability for their owners.

- Partnerships are not subject to double taxation of income.

- Partnerships are more likely to have a continuous life than a corporation.

Answer:

The correct answer is choice c: Partnerships are not subject to double taxation of income.

Explanation:

Because ownership of a corporation is viewed as separate from the business, capital shares can be issued to raise money—often large sums. These shares allow frequent changes in ownership that provides an easy way for a business to exist beyond the life of the original owners. Corporations provide only limited liability for their owners, a major reason for their popularity. However, partnerships are not subject to the same double taxation effect as corporations. The owners save money.

Key Takeaway

Legally, businesses can be created to function as corporations, partnerships, or sole proprietorships. Corporations are formed by meeting the legal requirements of an individual state. In contrast, partnerships and proprietorships can be started with little formal activity. A corporation differs from these other two forms because it is an entity legally separate from its ownership. Because of that separation, the maximum possible loss for the stockholders in a corporation is limited to the amount invested. Without that separation, owners of a partnership or proprietorship face the risk of unlimited liability. Ownership shares of a corporation (capital stock) are issued to raise money for operations and growth. In many cases, these shares can be readily sold by one owner to the next, often on a stock exchange. The ability to buy and sell capital shares enables a corporation to raise funds and have a continuous life. Disadvantages associated with the corporate form include the cost and difficulty of incorporation and government regulation. The double taxation of corporate income (which is not found with partnerships and sole proprietorships) is often the biggest drawback to incorporation. This second tax effect results because dividends are taxed to the recipients, although a reduced rate is often applied.

16.2 The Issuance of Common Stock

Learning Objectives

At the end of this section students should be able to meet the following objectives:

- Identify the legal rights normally held by the owners of a corporation’s common stock.

- Describe the responsibilities of a board of directors.

- Explain the terms “authorized,” “outstanding,” “issued,” and “par value” in relation to common stock.

- Record the issuance of common stock for cash.

- Record the issuance of common stock for a service or for an asset other than cash.

Common Stock

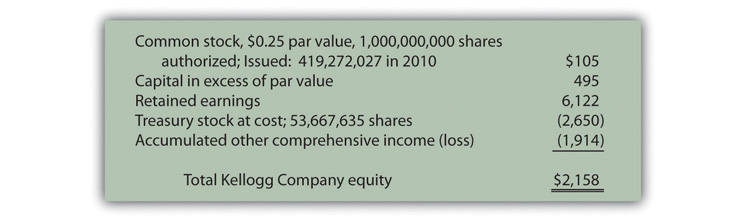

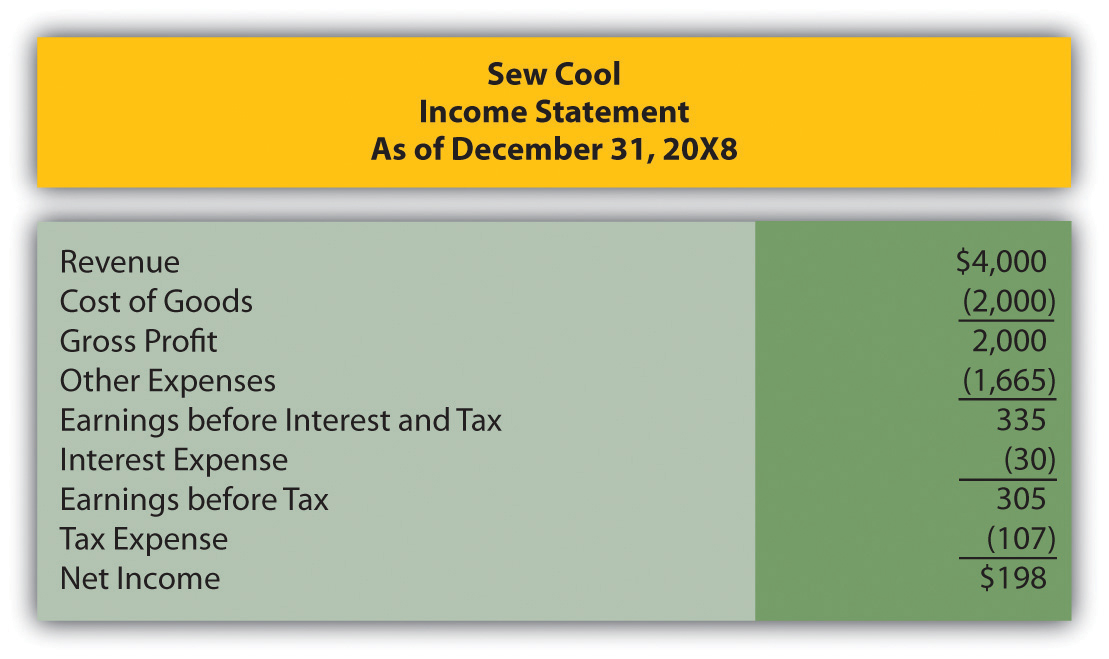

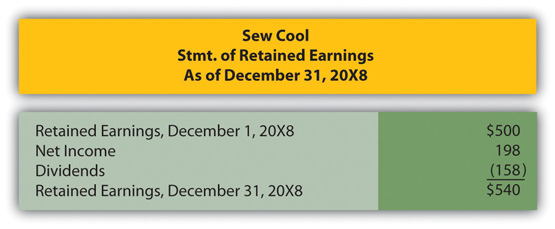

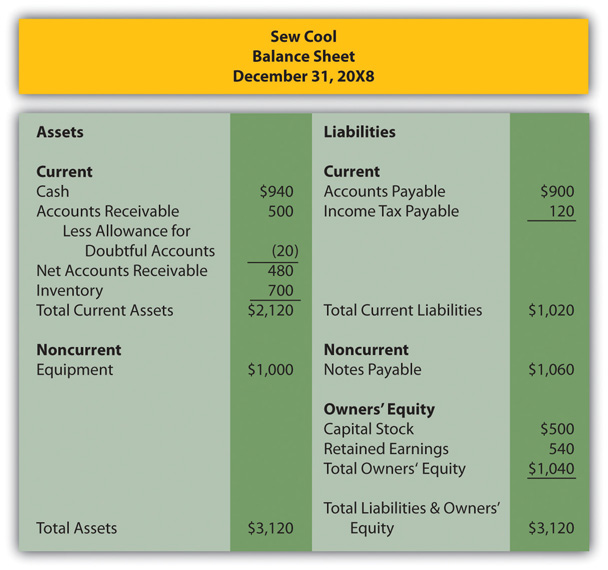

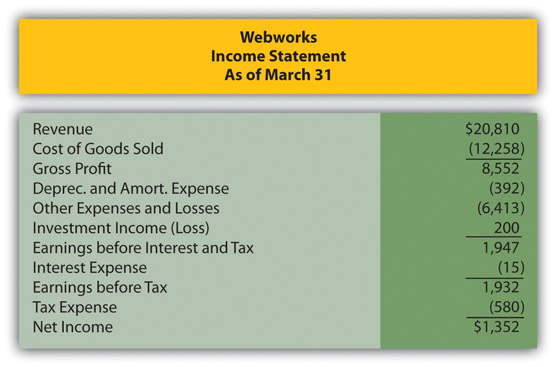

Question: Several accounts frequently appear in the shareholders’ equity section of a balance sheet reported by a corporation. Each has its own particular meaning. For example, as of January 1, 2011, the Kellogg Company reported the information shown in Figure 16.1 "Shareholders’ Equity—Kellogg Company as of January 1, 2011" (all numbers in millions).

Figure 16.1 Shareholders’ Equity—Kellogg Company as of January 1, 2011

Some of the terms shown in Figure 16.1 "Shareholders’ Equity—Kellogg Company as of January 1, 2011" have been examined previously, others have not.

- For example, “retained earnings” was described in earlier chapters as the increase in net assets generated as net income over the life of a business less any amounts distributed as dividends during that same period.

- In the earlier discussion of investments in available for sale securities, “accumulated other comprehensive income” was introduced because this balance sheet category reflected unrealized changes in fair value. For those investments, gains and losses caused by the rise and fall of stock prices are not included within net income. Rather, they are reported within this section of stockholders’ equity.

Common stockA type of capital stock that is issued by every corporation; it provides rights to the owner that are specified by the laws of the state in which the organization is incorporated. has also been mentioned in connection with the capital contributed to a corporation by its owners. As can be seen in Figure 16.1 "Shareholders’ Equity—Kellogg Company as of January 1, 2011", Kellogg communicates additional information about its common stock such as the number of authorized and issued shares as well as par value. What is common stock? Answering this question seems a logical first step in analyzing the information provided by a company about its capital shares.

Answer: Common stock represents the basic ownership of a corporation. One survey found that common stock is the only type of capital stock issued by approximately 90 percent of corporations.Matthew Calderisi, senior editor, Accounting Trends & Techniques, 63rd edition (New York: American Institute of Certified Public Accountants, 2009), 299. Obtaining shares of a company’s common stock provides several distinct rights. However, the specific rights are set by the laws of the state of incorporation and do vary a bit from state to state, although the following are typical.Although the Kellogg Company has its headquarters in Battle Creek, Michigan, the company is incorporated in the state of Delaware. Thus, the laws of Delaware set the rights of the common stock shares for this company.

- Based on state laws and the corporation’s own rules, the owners of common stock are allowed to vote on a few specified issues. By far the most prevalent is the election of the board of directorsA group that oversees the management of a corporation; the members are voted to this position by stockholders; it hires the management to run the company on a daily basis and then meets periodically to review operating, investing, and financing results and also to approve policy and strategy.. As mentioned previously, these individuals represent the ownership of the corporation in overseeing the management. The board of directors meets periodically (annually, quarterly, or as necessary) to review the financial results as well as the future plans and operating strategy developed by management. The board provides guidance and changes where necessary. A list of the individuals (often ten to twenty-five) who serve in this capacity is typically included in a corporation’s annual report, often just after the financial statements.

- The responsibilities of the board of directors can vary rather significantly from company to company. Some boards do little whereas others are heavily involved in policy making. For example, a note to the financial statements of Starbucks Corporation explained, “We may repurchase shares of Starbucks common stock under a program authorized by our Board of Directors.” Apparently, approval of this particular program fell within the designated responsibilities of the Starbucks board.

- One of the most important decisions for any board of directors is the declaration of dividends. Management cannot pay dividends to shareholders without specific approval by the board. Dividends cause the company (and specifically its cash balances) to get smaller so careful consideration of the impact must be made before declaration is approved. Stockholders like to receive dividends but do not want the company’s future to be imperiled as the size shrinks.

- If dividends are paid on common stock, all stockholders share in them proportionally. Although dividends are never guaranteed, the owners must be treated fairly if dividends are distributed. An owner who holds 12 percent of the outstanding common stock is entitled to 12 percent of any dividends paid on common stock. The board of directors cannot reward some common shareholders while ignoring others.

- Should the company ever be liquidated, the common stock shareholders are entitled to share proportionally in any assets that remain after all liabilities and other claims are settled. Unfortunately, most liquidations result from a severe financial crisis so that holding assets at the end of the process is rare.

Capital Stock Terminology

Question: “Authorized,” “issued,” “outstanding,” and “par value” are terms mentioned by the Kellogg Company in Figure 16.1 "Shareholders’ Equity—Kellogg Company as of January 1, 2011" in describing its ownership shares. What terms are associated with capital stock and what do each of them mean?

Answer:

AuthorizedThe maximum number of shares that a corporation can issue based on the articles of incorporation approved by the state government at the time of incorporation.. In applying to the state government as part of the initial incorporation process, company officials indicate the maximum number of capital shares they want to be allowed to issue. This approved limit is the authorized total. Corporations often set this figure so high that they never have to worry about reaching it. However, states normally permit authorization levels to be raised if necessary.

IssuedThe number of shares of a corporation that have been sold or conveyed to owners.. The number of issued shares is simply the quantity that has been sold or otherwise conveyed to owners. According to Figure 16.1 "Shareholders’ Equity—Kellogg Company as of January 1, 2011", Kellogg reports that the state of Delaware authorized one billion shares of common stock, but only about 419 million have actually been issued to stockholders as of the balance sheet date. The remaining unissued shares are still available if the company needs to raise money in the future by selling additional capital stock.

OutstandingThe number of shares of a corporation that are currently in the hands of the public; it is the shares that have been issued since operations first began less any treasury shares repurchased and still held by the corporation.. The total amount of stock currently in the hands of the public is referred to as the shares “outstanding.” Shares are often bought back by a corporation from its stockholders and recorded as treasury stock. Thus, originally issued shares are not always still outstanding. According to the information provided, Kellogg has acquired nearly 54 million treasury shares. Thus, on the balance sheet date, the company has roughly 365 million shares of common stock outstanding in the hands of its stockholders (419 million issued less 54 million treasury shares). This number is quite important because it serves as the basis for dividend payments as well as any votes taken of the stockholders.

Par valueA number printed on a stock certificate to indicate the minimum amount of money owners must legally leave in the business; it is generally set at a low amount to avoid legal complications.. The most mysterious term on a set of financial statements might well be “par value.” Decades ago, the requirement was established in many states that a par value had to be set in connection with the issuance of capital stock. This par value is printed on the face of each stock certificate and indicates (depending on state law) the minimum amount of money that owners must legally leave in the business. By requiring a par value to be specified, lawmakers hoped to prevent the declaration of a cash dividend that was so large it would bankrupt the company, leaving creditors with no chance of repayment. The owners had to leave the set par value in the company.

Traditionally, companies have gotten around this limitation by setting the par value at an extremely low number.Many other laws have been passed over the years that have been much more effective at protecting both creditors and stockholders. For example, Kellogg discloses a par value of $0.25 for its common stock, which is actually quite high. Many companies report par values that fall between a penny and a nickel. The April 30, 2011, balance sheet for Barnes & Noble shows a par value for its common stock of one-tenth of a penny.

Test Yourself

Question:

Several years ago the Catawba Corporation was incorporated. The company was authorized to issue ten million shares of $0.02 par value common stock. Currently, eight million shares remain unissued. In addition, the company is holding 25,000 treasury shares. How many shares are issued and how many shares are outstanding, respectively, for Catawba Corporation?

- Issued—18,000,000, Outstanding—1,975,000

- Issued—10,000,000, Outstanding—2,000,000

- Issued—2,000,000, Outstanding—2,025,000

- Issued—2,000,000, Outstanding—1,975,000

Answer:

The correct answer is choice d: Issued—2,000,000, Outstanding—1,975,000.

Explanation:

The Catawba Corporation was authorized to issue ten million shares but still has eight million shares unissued. Apparently, two million have been issued to date. However, 25,000 of these shares were bought back from stockholders as treasury stock. Thus, only 1,975,000 shares are outstanding (in the hands of the stockholders) at the current time.

Reporting the Issuance of Common Stock

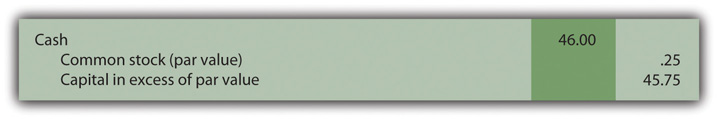

Question: Over the years, one residual accounting effect has remained from the legal requirement to include a par value on stock certificates. This figure continues to be used in reporting the issuance of capital stock. Thus, if Kellogg sells one share for cash of $46.00 (the approximate value on the New York Stock Exchange during the fall of 2011), the common stock account is increased but only by its $0.25 par value. Kellogg receives $46.00 but the par value is $0.25. How can this journal entry balance? How does a company report the issuance of a share of common stock for more than par value?

Answer: A potential stockholder contributes assets to a company to obtain an ownership interest. In accounting, this conveyance is not viewed as an exchange. It is fundamentally different than selling inventory or a piece of land to an outside party. Instead, the contribution of monetary capital is an expansion of both the company and its ownership. As a result, no gain, loss, or other income effect is ever reported by an organization as a result of transactions occurring in its own stock. An investor is merely transferring assets to a corporation to be allowed to join the ownership.

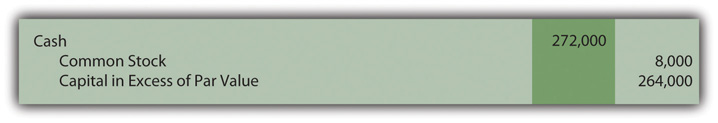

Consequently, a second shareholders’ equity balance is created to report the amount received from owners above par value. As shown in Figure 16.1 "Shareholders’ Equity—Kellogg Company as of January 1, 2011", Kellogg uses the title capital in excess of par valueA figure that represents the amount received by a corporation from the original issuance of capital stock that is above the par value listed on the stock certificate; it is also referred to as additional paid in capital. but a number of other terms are frequently encountered in practice such as “additional paid-in capital.” Therefore, Kellogg records the issuance of a share of $0.25 par value common stock for $46 in cash as shown in Figure 16.2 "Issuance of a Share of Common Stock for Cash".A few states allow companies to issue stock without a par value. In that situation, the entire amount received is entered in the common stock account.

Figure 16.2 Issuance of a Share of Common Stock for Cash

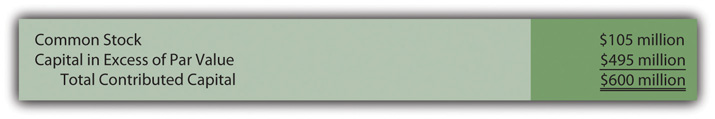

On a balance sheet, within the stockholders’ equity section, the amount owners put into a corporation when they originally bought stock is the summation of the common stock and capital in excess of par value accounts. This total reflects the assets conveyed to the business to gain capital stock. For Kellogg, this figure is $600 million as shown in Figure 16.3 "Kellogg Common Stock and Capital in Excess of Par Value, January 1, 2011". That is the amount of assets received by this company from its owners since operations first began.

As mentioned in a previous chapter, the sales of capital stock that occur on the New York Stock Exchange or other stock markets are between two investors and have no direct effect on the company. Those transactions simply create a change in the ownership.

Figure 16.3 Kellogg Common Stock and Capital in Excess of Par Value, January 1, 2011

Test Yourself

Question:

When incorporated by the state of Nebraska, Stan Company was authorized to issue ten million shares of common stock with a $0.10 par value. At first, one million shares were issued for $5 per share. Later, another four million were issued at $6 per share. What is the amount to be reported as the capital in excess of par value and also as the total of contributed capital?

- Capital in Excess of Par Value—$500,000, Contributed Capital—$1,000,000

- Capital in Excess of Par Value—$28,500,000, Contributed Capital—$29,000,000

- Capital in Excess of Par Value—$28,800,000, Contributed Capital—$30,000,000

- Capital in Excess of Par Value—$29,000,000, Contributed Capital—$30,000,000

Answer:

The correct answer is choice b: Capital in Excess of Par Value—$28,500,000, Contributed Capital—$29,000,000.

Explanation:

Stan issued one million shares for $5 each for contributed capital of $5 million. The corporation then issued four million more shares for $6 each or a total of $24 million. Total contributed capital is $29 million ($5 million plus $24 million). Common stock is recorded at the par value of these shares or $500,000 (five million shares issued with a par value of $0.10 each). The remaining $28.5 million of the contribution ($29 million less $500,000) is reported as capital in excess of par value.

Issuing Common Stock in Noncash Exchanges

Question: Common stock is sometimes issued in exchange for property or personal services rather than for cash. Such capital contributions are especially prevalent when a small corporation is first getting started. Potential owners may hold land, buildings, machinery, or other assets needed by the business. Or, an accountant, attorney, engineer, or the like might be willing to provide expert services and take payment in stock. This arrangement can be especially helpful if the business is attempting to conserve cash. What recording is made if common stock is issued for a service or an asset other than cash?

Answer: The issuance of stock for a service or asset is not technically a tradeAs mentioned earlier, the issuance of capital stock is not viewed as a trade by the corporation because it merely increases the number of capital shares outstanding. It is an expansion of both the company and its ownership. That is different than, for example, giving up an asset such as a truck in exchange for a computer or some other type of property. but merely an expansion of the ownership. However, the accounting rules are the same. The asset or the service received by the corporation is recorded at the fair value of the capital stock surrendered. That figure is the equivalent of historical cost. It reflects the sacrifice made by the business to obtain the asset or service. However, if the fair value of the shares of stock is not available (which is often the case for both new and small corporations), the fair value of the property or services received becomes the basis for reporting.

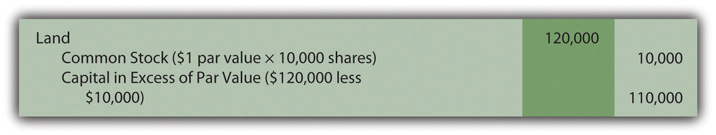

To illustrate, assume that a potential investor is willing to convey land with a fair value of $125,000 to the Maine Company in exchange for an ownership interest. During negotiations, officials for Maine offer to issue ten thousand shares of $1 par value common stock for this property. The shares are currently selling on a stock exchange for $12 each. The investor decides to accept this proposal rather than go to the trouble of trying to sell the land.

The “sacrifice” made by the Maine Company to acquire this land is $120,000 ($12 per share × 10,000 shares). Those shares could have been sold to the public to raise that much money. Instead, Maine issues them directly in exchange for the land and records the transaction as shown in Figure 16.4 "Issue Ten Thousand Shares of Common Stock Worth $12 per Share for Land".

Figure 16.4 Issue Ten Thousand Shares of Common Stock Worth $12 per Share for Land

If this stock was not selling on a stock exchange, fair value might not have been apparent. In that situation, the Maine Company recognizes the land at its own fair value of $125,000 with an accompanying $5,000 increase in the capital in excess of par value account.

Key Takeaway

Common stock forms the basic ownership units of most corporations. The rights of the holders of common stock shares are set by state law but normally include voting for the board of directors, the group that oversees operations and guides future plans. Financial statements often disclose the number of authorized shares (the maximum allowed), issued shares (the number that have been sold), and outstanding shares (those currently in the hands of owners). Common stock usually has a par value although the meaning of this figure has faded in importance over the decades. Upon issuance, common stock is recorded at par value with any amount received above that balance reported in an account such as capital in excess of par value. If issued for a service or asset other than cash, the financial recording is based on the fair value of the shares surrendered. However, if a reasonable estimation of value is not available, the fair value of the asset or service is used.

16.3 Issuing and Accounting for Preferred Stock and Treasury Stock

Learning Objectives

At the end of this section students should be able to meet the following objectives:

- Explain the difference between preferred stock and common stock.

- Discuss the distribution of dividends to preferred stockholders.

- Record the issuance of preferred stock.

- Provide reasons for a corporation to spend its money to reacquire its own capital stock as treasury stock.

- Account for the purchase and resale of treasury stock when both gains and losses occur.

Differentiating Preferred Stock from Common Stock

Question: Some corporations also issue a second type of capital stock referred to as preferred stockA capital stock issued by some companies that has one or more specified preferences over common shareholders, usually in the form of cash dividends.. Approximately 5–15 percent of the corporations in the United States have preferred stock outstanding but the practice is especially prevalent in certain industries. How is preferred stock different from common stock?

Answer: Preferred stock is another version of capital stock where the rights of those owners are set by the contractual terms of the stock certificate rather than state law. In effect, common stockholders voluntarily surrender one or more of their legal rights in hopes of enticing additional investors to contribute money to the corporation. For common stockholders, preferred stock is often another possible method of achieving financial leverage in a manner similar to using money raised from bonds and notes. If the resulting funds can be used to generate more profit than the dividends paid on the preferred stock, the residual income for the common stock will be higher.

The term “preferred stock” comes from the preference that is conveyed to these owners. They are being allowed to step in front of common stockholders when specified rights are applied. A wide variety of such benefits can be assigned to the holders of preferred shares, including additional voting rights, assured representation on the board of directors, and the right to residual assets if the company ever liquidates.

By far the most typical preference is to cash dividends. As mentioned earlier in this chapter, all common stockholders are entitled to share proportionally in any dividend distributions. However, if a corporation issues preferred stock with a stipulated dividend, that amount must be paid before any money is conveyed to the owners of common stock. No dividend is ever guaranteed, not even one on preferred shares. A dividend is only legally required if declared by the board of directors. But, if declared, the preferred stock dividend normally must be paid before any common stock dividend. Common stock is often referred to as a residual ownership because these shareholders are entitled to all that remains after other claims have been settled including those of preferred stock.

The issuance of preferred stock is accounted for in the same way as common stock. Par value, though, often serves as the basis for stipulated dividend payments. Thus, the par value listed for a preferred share frequently approximates fair value. To illustrate, assume a corporation issues ten thousand shares of preferred stock. A $100 per share par value is printed on each stock certificate. If the annual dividend is listed as 4 percent, cash of $4 per year ($100 par value × 4 percent) must be paid on preferred stock before any distribution is made on common stock.

If ten thousand shares of this preferred stock are each issued for $101 in cash ($1,010,000 in total), the company records the journal entry shown in Figure 16.5 "Issue Ten Thousand Shares of $100 Par Value Preferred Stock for $101 per Share".

Figure 16.5 Issue Ten Thousand Shares of $100 Par Value Preferred Stock for $101 per Share

For recording purposes, companies often establish separate “capital in excess of par value” accounts—one for common stock and one for preferred stock. Those amounts are then frequently combined in reporting the balances within stockholders’ equity.

Test Yourself

Question:

The Gatellan Company wants to acquire a building worth $2 million from Alice Wilkinson. The company does not have sufficient cash and does not want to take out a loan so it offers to issue 90,000 shares of its $1 par value common stock in exchange for the building. Wilkinson wants more assurance of receiving a dividend each year and asks for 18,000 shares of the company’s $100 par value preferred stock paying an annual dividend rate of 5 percent. Eventually, the parties come to an agreement and the Gatellan Company records capital in excess of par value of $200,000. Which of the following happened?

- Gatellan issued the common stock but it had no known fair value.

- Gatellan issued the common stock and it had a $20 per share fair value.

- Gatellan issued the preferred stock and it had no known fair value.

- Gatellan issued the preferred stock and it had a $102 per share fair value.

Answer:

The correct answer is choice c: Gatellan issued the preferred stock and it had no known fair value.

Explanation:

In a, the asset is recorded at $2 million, the stock is its $90,000 par value, and the capital in excess is $1.91 million. In b, the asset is recorded at $1.8 million, the stock is its $90,000 par value, and the capital in excess is $1.71 million. In c, the asset is recorded at $2 million, the stock is its $1.8 million par value, and the capital in excess is $200,000. In d, the asset is recorded at $1,836,000, the stock is its $1.8 million par value, and the capital in excess is $36,000.

The Acquisition of Treasury Stock

Question: An account called treasury stockIssued shares of a corporation’s own stock that have been reacquired; balance is shown within the stockholders’ equity section of the balance sheet as a negative amount unless the shares are retired (removed from existence). is often found near the bottom of the shareholders’ equity section of a balance sheet. Treasury stock represents issued shares of a corporation’s own stock that have been reacquired. For example, the September 30, 2011, balance sheet for Viacom Inc. reports a negative balance of over $8.2 billion identified as treasury stock.

An earlier story in the Wall Street Journal indicated that Viacom had been buying and selling its own stock for a number of years: “The $8 billion buyback program would enable the company to repurchase as much as 13 percent of its shares outstanding. The buyback follows a $3 billion stock-purchase program announced in 2002, under which 40.7 million shares were purchased.”Joe Flint, “Viacom Plans Stock Buy Back, Swings to Loss on Blockbuster,” The Wall Street Journal, October 29, 2004, B-2.

Why does a company voluntarily give billions of dollars back to stockholders in order to repurchase its own stock? That is a huge amount of money leaving the company. Why not invest these funds in inventory, buildings, investments, research and development, and the like? Why does a corporation buy back its own shares as treasury stock?

Answer: Numerous possible reasons exist to justify spending money to reacquire an entity’s own stock. Several of these strategies are rather complicated and a more appropriate topic for an upper-level finance course. However, an overview of various ideas should be helpful in understanding the rationale for such transactions.

- As a reward for service, businesses often give shares of their stock to key employees or sell shares to them at a relatively low price. In some states, using unissued shares for such purposes is restricted legally. The same rules do not apply to shares that have been reacquired. Thus, some corporations acquire treasury shares to have available as needed for compensation purposes.

- Acquisition of treasury stock can be used as a tactic to push up the market price of a company’s stock in order to please the remaining stockholders. Usually, a large scale repurchase (such as made by Viacom) indicates that management believes the stock is undervalued at its current market price. Buying treasury stock reduces the supply of shares in the market and, according to economic theory, forces the price to rise. In addition, because of the announcement of the repurchase, outside investors often rush in to buy the stock ahead of the expected price increase. The supply of shares is decreased while demand is increased. Stock price should go up. Not surprisingly, current stockholders often applaud a decision to buy treasury shares as they anticipate a jump in their investment values.

- Corporations can also repurchase shares of stock to reduce the risk of a hostile takeover. If another company threatens to buy sufficient shares to gain control, the board of directors of the target company must decide if acquisition is in the best interest of the stockholders.If the board of directors does agree to the purchase of the corporation by an outside party, the two sides then negotiate a price for the shares as well as any other terms of the acquisition. If not, the target might attempt to buy up shares of its own stock in hopes of reducing the number of owners in the market who are willing to sell their shares. Here, repurchase is a defensive strategy designed to make the takeover more difficult to accomplish. Plus, as mentioned previously, buying back treasury stock should drive the price up, making purchase more costly for the predator.

Reporting the Purchase of Treasury Stock

Question: To illustrate the financial reporting of treasury stock, assume that the Chauncey Company has been in business for over twenty years. During that time, the company has issued ten million shares of its $1 par value common stock at an average price of $3.50 per share. The company now reacquires three hundred thousand of these shares for $4 each. How is the acquisition of treasury stock reported?

Answer: Under U.S. GAAP, several methods are allowed for reporting the purchase of treasury stock. Most companies use the cost method because of its simplicity. As shown in Figure 16.6 "Purchase of Three Hundred Thousand Shares of Treasury Stock at a Cost of $4 Each", the acquisition of these shares is recorded by Chauncey at the $1.2 million cost (300,000 shares at $4 each) that was paid.

Figure 16.6 Purchase of Three Hundred Thousand Shares of Treasury Stock at a Cost of $4 Each

Because the money spent on treasury stock represents assets that have left the business, this balance is shown within stockholders’ equity as a negative, reflecting a decrease in net assets instead of an increase.

Except for possible legal distinctions, treasury stock held by a company is the equivalent of unissued stock. The shares do not receive dividends and have no voting privileges.

Reporting the Reissuance of Treasury Stock above Cost

Question: Treasury shares can be held by a corporation forever or eventually reissued at prices that might vary greatly from original cost. If sold for more than cost, is a gain recognized? If sold for less, is a loss reported? What is the impact on a corporation’s financial statements if treasury stock shares are reissued?

To illustrate, assume that Chauncey Company subsequently sells one hundred thousand shares of its treasury stock (shown in Figure 16.6 "Purchase of Three Hundred Thousand Shares of Treasury Stock at a Cost of $4 Each") for $5.00 each. That is $1.00 more than these shares had cost to reacquire. Is this excess reported by Chauncey as a gain on its income statement?

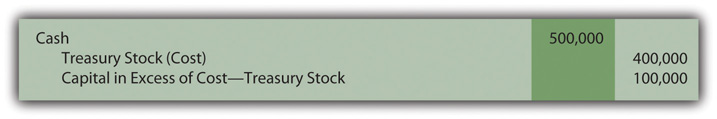

Answer: As discussed previously, transactions in a corporation’s own stock are considered expansions and contractions of the ownership and never impact reported net income. The buying and selling of capital stock are transactions viewed as fundamentally different from the buying and selling of assets such as inventory and land. Therefore, no gains and losses are recorded in connection with treasury stock. As shown in Figure 16.7 "Sale of One Hundred Thousand Shares of Treasury Stock Costing $4 Each for $5 per Share", an alternative reporting must be constructed.

Figure 16.7 Sale of One Hundred Thousand Shares of Treasury Stock Costing $4 Each for $5 per Share

The “capital in excess of cost-treasury stock” is the same type of account as the “capital in excess of par value” that was recorded in connection with the issuance of both common and preferred stocks. Within stockholders’ equity, these individual accounts can be grouped into a single balance or reported separately.

Reporting the Reissuance of Treasury Stock below Cost

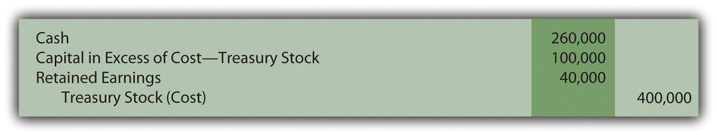

Question: The first group of treasury shares was reissued for more than cost. Assume that Chauncey subsequently sells another one hundred thousand of treasury shares, but this time for only $2.60 each. The proceeds in this transaction are below the acquisition cost of $4 per share. What recording is made if treasury stock is sold at the equivalent of a loss?

Answer: Interestingly, the reissuance of treasury stock for an amount below cost is a transaction not well covered in U.S. GAAP. Authoritative rules fail to provide a definitive rule for reporting such reductions except that stockholders’ equity is decreased with no direct impact recorded in net income. Absolute rules are not always available in U.S. GAAP.

The most common approach seems to be to first remove any capital in excess of cost recorded by the reissuance of earlier shares of treasury stock at above cost. If that balance is not large enough to absorb the entire reduction, a decrease is then made in retained earnings as shown in Figure 16.8 "Sale of One Hundred Thousand Shares of Treasury Stock Costing $4 Each for $2.60 per Share". The $100,000 balance in capital in excess of cost-treasury stock was created in the previous reissuance illustrated in Figure 16.7 "Sale of One Hundred Thousand Shares of Treasury Stock Costing $4 Each for $5 per Share".

Figure 16.8 Sale of One Hundred Thousand Shares of Treasury Stock Costing $4 Each for $2.60 per Share

One outcome of this handling should be noted. In earlier chapters of this textbook, “retained earnings” was defined as a balance equal to all income reported over the life of a business less all dividend distributions to the owners. Apparently, this definition is not correct in every possible case. In Figure 16.8 "Sale of One Hundred Thousand Shares of Treasury Stock Costing $4 Each for $2.60 per Share", the retained earnings balance is also reduced as a result of a stock transaction where a loss occurred that could not otherwise be reported.

Test Yourself

Question:

Several years ago, Ashkroft Inc. issued 800,000 shares of $2 par value stock for $3 per share in cash. Early in the current year, Ashkroft repurchases 100,000 of these shares at $8 per share. A month later, 40,000 of these treasury shares are sold back to the public at $10 per share. What is the total impact on reported shareholders’ equity of these transactions?

- $1,920,000 increase

- $2,000,000 increase

- $2,280,000 increase

- $2,420,000 increase

Answer:

The correct answer is choice b: $2,000,000 increase.

Explanation:

The initial issuance of stock increases net assets by $2.4 million (800,000 shares × $3). The purchase of treasury stock reduces net assets by $800,000 (100,000 shares × $8). The reissuance of a portion of the treasury stock increases net assets by $400,000 (40,000 shares × $10). The individual account balances have not been computed here but the overall increase in shareholders’ equity is $2 million ($2.4 million less $800,000 plus $400,000).

Test Yourself

Question:

Several years ago, the Testani Corporation issued 800,000 shares of $2 par value stock for $3 per share in cash. Early in the current year, Testani repurchases 100,000 shares at $8 per share. A month later, 40,000 of these shares are sold back to the public at $10 per share. Several weeks later, after a drop in market price, 50,000 more shares of the treasury stock were reissued for $5 per share. What is the overall impact on reported retained earnings of the reissuance of the 90,000 shares of treasury stock?

- No effect

- $50,000 reduction

- $70,000 reduction

- $90,000 reduction

Answer:

The correct answer is choice c: $70,000 reduction.

Explanation:

The first batch of 40,000 shares of treasury stock was sold at $2 above cost, creating a capital in excess of cost account of $80,000. The second batch of 50,000 shares was sold at $3 below cost or $150,000 in total. In recording this second reissuance, the $80,000 capital in excess of cost is first removed entirely with the remaining $70,000 shown as a decrease in retained earnings.

Key Takeaway

A corporation can issue preferred stock as well as common stock. Preferred shares are given specific rights that come before those of common stockholders. Frequently, these rights involve the distribution of dividends. A set amount is often required to be paid before common stockholders can receive any dividends. After issuance, capital stock shares can be bought back by a company from its investors for a number of reasons. For example, repurchase might be carried out in hopes of boosting the stock price. These shares are usually reported at cost and referred to as treasury stock. In acquiring such shares, money flows out of the company so the account appears as a negative balance within stockholders’ equity. When reissued above cost, the treasury stock account is reduced and capital in excess of cost is recognized. To record a loss, any previous capital in excess of cost balance is removed followed by a possible reduction in retained earnings. Net income is not impacted by a transaction in a company’s own stock.

16.4 The Issuance of Cash and Stock Dividends

Learning Objectives

At the end of this section students should be able to meet the following objectives:

- Identify the various dates associated with a dividend distribution.

- Prepare journal entries to report a cash dividend declaration and payment to stockholders.

- Define the characteristics of a cumulative dividend.

- Explain a company’s rationale for issuing a stock dividend or stock split.

- Record the issuance of a stock dividend

Reporting Dividend Distributions

Question: As stated in an early section of this textbook, a vast majority of investors purchase capital stock for only two reasons: price appreciation and dividend payments. Cash dividends and long-term capital gains (gains on the sale of certain investments that have been held for over one year) are especially appealing to individual investors because they are taxed at a lower rate than most other types of income.

Dividends represent the profits of a business that are being passed along to the owners. Because the corporation is effectively giving away assets, dividends require formal approval by the board of directors. This action is known as a dividend declaration. The board considers current cash balances as well as the projected needs of the business before deciding on the amount, if any, of a dividend payment. How does a corporation report the declaration and distribution of a cash dividend?

Answer: Dividends provide a meaningful signal to investors about the financial health of a business. Some corporations even boast about having paid a constant or rising annual dividend for many years. Unfortunately, a number of businesses have been forced recently to reduce or even eliminate their dividend distributions as a result of general economic difficulties. Such decisions typically lead to a drop in the market price of a corporation’s stock because of the negative implications.

Other businesses stress rapid growth and rarely, if ever, pay a cash dividend. The board of directors prefers that all profits remain in the business to stimulate future growth. For example, Google Inc. reported net income of $4.2 billion (2008), $6.5 billion (2009), and $8.5 billion (2010) but paid no dividends in any of those years.

Chronologically, accounting for dividends involves several dates with approximately two to five weeks passing between each:

- The date of declarationDate on which dividend payments are formally declared (approved) by the board of directors; it is the day on which a liability is recorded by the corporation.

- The date of recordDate on which stock must be held for a shareholder to be entitled to the receipt of a dividend; the date of record is specified by the board of directors when the dividend is declared. (and the related ex-dividend date)

- The date of paymentDate on which a cash dividend is distributed to those shareholders who held a corporation’s stock on the date of record; it is also known as the date of distribution. (also known as the date of distribution)

To illustrate, assume that the Hurley Corporation has one million shares of authorized common stock. Since incorporation several years ago, three hundred thousand shares have been issued to the public but twenty thousand were recently bought back as treasury stock. Thus, 280,000 shares are presently outstanding, in the hands of investors. In the current year, Hurley earned a reported net income of $780,000. After some deliberations, the board of directors votes to distribute a $1.00 cash dividend to the owner of each share of common stock.

The day on which Hurley’s board of directors formally decides on the payment of this dividend is known as the date of declaration. Legally, this action creates a liability for the company that must be recognized through the journal entry shown in Figure 16.9 "$1.00 per Share Dividend Declared by Board of Directors, 280,000 Shares Outstanding". Dividends are only paid on shares that are outstanding so the liability balance is $280,000.

Figure 16.9 $1.00 per Share Dividend Declared by Board of Directors, 280,000 Shares Outstanding

As discussed previously, dividend distributions reduce the amount reported as retained earnings but have no impact on net income.

When the dividend is declared by the board, the date of record is also set. Only the shareholders who own the stock on that day qualify for receipt. The ex-dividend date is the first day on which an investor is not entitled to the dividend. Because receipt of the dividend has been lost, the market price of the stock typically drops by approximately the amount of the dividend on the ex-dividend date (although myriad other market factors influence the movement of stock prices).

No journal entry is recorded by a corporation on either the date of record or the ex-dividend date because they do not represent an event or transaction. Those dates simply allow Hurley to identify the owners to whom the dividend will be paid.

On the date of payment, the corporation mails checks to the appropriate recipients. That is a simple event to record as shown in Figure 16.10 "Payment of $1.00 per Share Cash Dividend".

Figure 16.10 Payment of $1.00 per Share Cash Dividend

Cumulative Preferred Stock

Question: Assume that Wington Company issues 1,000 shares of $100 par value preferred stock to an investor on January 1, Year One. The preferred stock certificate specifies an annual dividend rate of 8 percent. Thus, dividend payment to the owner is supposed to be $8 per share each year ($100 × 8 percent).

At the end of Year One, Wington faces a cash shortage and the board of directors chooses not to pay this dividend. Have the owners of the preferred shares lost the right to the Year One dividend? Must a corporation report a liability if a preferred stock dividend is not paid at the appointed time?

Answer: Preferred stock dividends are often identified on the stock certificate as cumulativeFeature attached to most types of preferred stock so that any dividend payments that are omitted must still be paid before the holders of common stock receive any dividends.. This term indicates that any obligation for unpaid dividends on these shares must be met before dividends can be distributed to the owners of common stock. Cumulative dividends are referred to as “in arrears” when past due.

Thus, if the dividend on the preferred shares of Wington is cumulative, the $8 per share is in arrears at the end of Year One. In the future, this (and any other) missed dividend will have to be paid before any distribution to the owners of common stock can be considered. Conversely, if a preferred stock is noncumulative, a missed dividend is simply lost to those owners. It has no impact on the future allocation of dividends between preferred and common shares.

The existence of a cumulative preferred stock dividend in arrears is information that must be disclosed through a note to the financial statements. However, the balance is not reported as a liability. Only dividends that have been formally declared by the board of directors are recorded through a journal entry.

Test Yourself

Question:

The Hansbrough Company has 20,000 shares outstanding of $100 par value preferred stock with a 6 percent annual dividend rate. This company also has five million shares of $1 par value common stock outstanding. No dividends at all were paid in either Year One or Year Two. Near the end of Year Three, a cash dividend of $400,000 is scheduled to be distributed. If the preferred stock dividend is cumulative, how is this dividend allocated?

- Preferred—$ 60,000, Common—$340,000

- Preferred—$120,000, Common—$180,000

- Preferred—$240,000, Common—$160,000

- Preferred—$360,000, Common—$ 40,000

Answer:

The correct answer is choice d: Preferred—$360,000, Common—$ 40,000.

Explanation:

Owners of the preferred stock are entitled to $6 per year ($100 par value × 6 percent) or $120,000 ($6 × 20,000 shares outstanding). Because the preferred stock dividend is cumulative, dividends for Years One and Two are settled first. After those distributions, another $120,000 is paid for Year Three. A total of $360,000 is conveyed to the preferred stockholders. The remaining $40,000 dividend ($400,000 less $360,000) goes to the residual ownership, the holders of the common stock.

Test Yourself

Question:

The Singler Company has 20,000 shares outstanding of $100 par value preferred stock with a 6 percent annual dividend rate. The company also has five million shares of $1 par value common stock outstanding. No dividends at all were paid in either Year One or Year Two. Near the end of Year Three, a cash dividend of $400,000 is scheduled to be distributed. If the preferred stock dividend is noncumulative, how is this dividend distributed?

- Preferred—$60,000, Common—$340,000

- Preferred—$120,000, Common—$280,000

- Preferred—$240,000, Common—$160,000

- Preferred—$360,000, Common—$ 40,000

Answer:

The correct answer is choice b: Preferred—$120,000, Common—$280,000.

Explanation:

The preferred stock dividend is noncumulative. Thus, the amounts that were missed during Years One and Two do not carry over into the future. Owners of the preferred stock are only entitled to receive a dividend distribution for the current period ($120,000 or $100 par value × 6 percent × 20,000 shares). The owners of the common stock receive the remainder of the dividend ($280,000 or $400,000 less $120,000).

Distribution of Stock Dividends

Question: A corporate press release issued by Ross Stores Inc. on November 17, 2011, informed the public that “its Board of Directors has approved a two-for-one stock splitA division of each share of outstanding stock to increase the number of those shares; it is a method of reducing the market price of the stock; the process is carried out in hopes that a lower price will generate more market activity in the stock and, therefore, a faster rise in price. to be paid in the form of a 100% stock dividendA dividend distributed to shareholders by issuing additional shares of stock rather than cash; it increases the number of shares outstanding but each owners interest in the company stays the same; as with a stock split, it reduces the price of the stock in hopes of stimulating market interest. on December 15, 2011 to stockholders of record as of November 29, 2011.”

Obviously, as shown by this press release, a corporation can distribute additional shares of its stock to shareholders instead of paying only cash dividends. These shares are issued as a stock dividend or a stock split. Although slightly different in a legal sense, most companies (such as Ross Stores) use the terms “stock dividend” and “stock split” interchangeably.As can be seen in this press release, the terms “stock dividend” and “stock split” have come to be virtually interchangeable to the public. However, minor legal differences do exist that actually impact reporting. Par value is changed to create a stock split but not for a stock dividend. Interestingly, stock splits have no reportable impact on financial statements but stock dividends do. Therefore, only stock dividends will be described in this textbook. No assets are distributed in either scenario—just more shares of the company’s own stock. Are stockholders better off when they receive additional shares of a company’s stock in the form of a stock dividend?

Answer: When a stock dividend (or stock split) is issued, the number of shares held by every investor increases but their percentage of the ownership stays the same. Their interest in the corporation remains proportionally unchanged. They have gained nothing.

To illustrate, assume that the Red Company reports net assets of $5 million. Janis Samples owns one thousand of the ten thousand shares of this company’s outstanding common stock. Thus, she holds a 10 percent interest (1,000 shares/10,000 shares) in a business with net assets of $5 million.

The board of directors then declares and distributes a 4 percent stock dividend. For each one hundred shares that a stockholder possesses, Red Company issues an additional 4 shares (4 percent times one hundred). Therefore, four hundred new shares of Red’s common stock are conveyed to the ownership as a whole (4 percent times ten thousand). This distribution raises the number of outstanding shares to 10,400. However, a stock dividend has no actual impact on the corporation. There are simply more shares outstanding. Nothing else has changed.

Janis Samples receives forty of these newly issued shares (4 percent times one thousand) so that her holdings have grown to 1,040 shares. After this stock dividend, she still owns 10 percent of the outstanding stock of Red Company (1,040/10,400), and the company still reports net assets of $5 million. The investor’s financial position has not improved. She has gained nothing as a result of the stock dividend.

Not surprisingly, investors make no journal entry in accounting for the receipt of a stock dividend. No change has taken place except for the number of shares held.

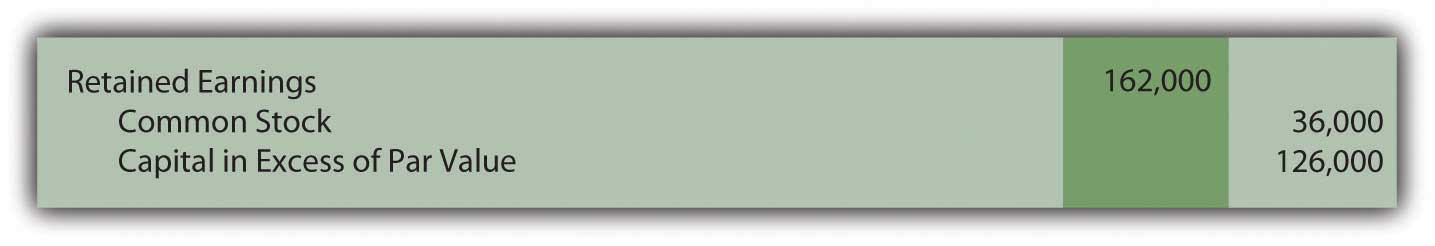

However, the corporation does make a journal entry to record the issuance of a stock dividend although distribution creates no impact on either assets or liabilities. The retained earnings balance is decreased by the fair value of the shares issued while contributed capital (common stock and capital in excess of par value) is also increased by this same amount. Fair value is used here because the company could have issued those new shares for that amount of cash and then paid the money out as a dividend. Issuing a stock dividend creates the same overall impact.

One exception to this method of reporting is applied. According to U.S. GAAP, if a stock dividend is especially large (in excess of 20–25 percent of the outstanding shares), the change in retained earnings and contributed capital is recorded at par value rather than fair value.A stock dividend of between 20 and 25 percent can be recorded at either fair value or par value. When the number of shares issued becomes this large, fair value is no longer viewed as a reliable indicator of the financial effect of the distribution.

Test Yourself

Question:

The Hazelton Corporation has 600,000 shares outstanding of $2 per share par value common stock that was issued for $5 per share but currently trades on a stock market for $9 per share. The board of directors opts to issue a 3 percent stock dividend. What will be the reported reduction in retained earnings as a result of this action?

- Zero

- $36,000

- $126,000

- $162,000

Answer:

The correct answer is choice d: $162,000.

Explanation:

As a small stock dividend (under 20–25 percent of the outstanding shares), retained earnings is decreased by the fair value of the shares issued while contributed capital goes up by the same amount. Hazelton issues 18,000 new shares (3 percent of 600,000) with a fair value of $9 each or $162,000 in total (18,000 × $9). The par value is only $36,000 (18,000 × $2) with the difference recorded as capital in excess of par value. The journal entry to record this stock dividend is as follows.

Figure 16.11

Test Yourself

Question:

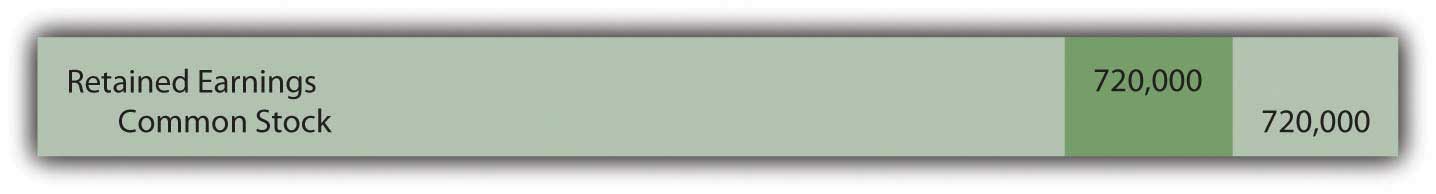

The Pitino Corporation has 600,000 shares outstanding of $2 per share par value common stock that was issued for $5 per share but currently trades for $9 per share. The board of directors opts to issue a 60 percent stock dividend. What will be the reported reduction in retained earnings?

- $360,000

- $720,000

- $2,520,000

- $3,240,000

Answer:

The correct answer is choice b: $720,000.

Explanation:

As a large stock dividend (over 20–25 percent of the outstanding shares), retained earnings is decreased by the par value of the shares issued while contributed capital goes up by the same amount. Pitino issues 360,000 new shares (60 percent of 600,000) with a par value of $2 each or $720,000 in total (360,000 × $2). The journal entry to record this stock dividend is as follows.

Figure 16.12

Why Issue a Stock Dividend?

Question: If no changes occur in the makeup of a corporation as the result of a stock dividend, why does a board of directors choose to issue one?

Answer: The primary purpose served by a stock dividend (or a stock split) is a reduction in the market price of the corporation’s capital stock. When the price of a share rises to a relatively high level, fewer investors are willing to make purchases. At some point, market interest wanes. This reduction in demand will likely have a negative impact on the stock price. A growing business might find that a previously escalating trend in its market value has hit a plateau when the price of each share rises too high.

By issuing a large quantity of new shares (sometimes two to five times as many shares as were outstanding), the price falls, often precipitously. For example, an investor who held one hundred shares at a market price of $120 per share (total value of $12,000) might now own two hundred shares selling at $60 per share or three hundred shares selling at $40 per share (but with the same total market value of $12,000). The stockholder’s investment remains unchanged but, hopefully, the stock is now more attractive to potential investors at the lower price so that the level of active trading increases.

Stock dividends also provide owners with the possibility of other benefits. For example, cash dividend payments usually drop after a stock dividend but not always in proportion to the change in the number of outstanding shares. An owner might hold one hundred shares of common stock in a corporation that has paid $1 per share as an annual cash dividend over the past few years (a total of $100 per year). After a 2-for-1 stock dividend, this individual now owns two hundred shares. The board of directors might then choose to reduce the annual cash dividend to only $0.60 per share so that future payments go up to $120 per year (two hundred shares × $0.60 each). Such a benefit, though, is not guaranteed. The investors can merely hope that additional cash dividends will be received.

Key Takeaway

Many corporations distribute cash dividends after a formal declaration is passed by the board of directors. Journal entries are required on both the date of declaration and the date of payment. The date of record and the ex-dividend date are important in identifying the owners entitled to receive the dividend but no transaction occurs. Hence, no recording is made on either of those dates. Preferred stock dividends are often cumulative so that any dividends in arrears must be paid before a common stock distribution can be made. Dividends in arrears are not recorded as liabilities until declared although note disclosure is needed. Stock dividends and stock splits are issued to reduce the market price of capital stock and keep potential investors interested in the possibility of acquiring ownership. A stock dividend is recorded as a reduction in retained earnings and an increase in contributed capital. However, stock dividends have no direct impact on the financial condition of either the company or its stockholders.

16.5 The Computation of Earnings per Share

Learning Objectives

At the end of this section students should be able to meet the following objectives:

- Compute and explain return on equity.

- Discuss the reasons that earnings per share (EPS) figures are so closely watched by investors.

- Calculate basic EPS with or without the existence of preferred stock.

- Explain the relevance of the P/E ratio.

- Identify the informational benefit provided by diluted EPS.

The Calculation of Return on Equity

Question: Throughout this textbook, various vital signs have been presented. They include ratios, numbers, percentages, and the like that are commonly studied by decision makers as an indication of current financial health and future prosperity. One common measure is return on equity (ROE)Ratio computed to measure the profitable use of a business’s resources; it is determined by dividing net income by average stockholders’ equity for the period.. How does an interested party calculate the return on equity reported by a business?

Answer: Return on equity reflects the profitability of a business based on the size of the owners’ claim to net assets. It is simply the reported net income divided by average stockholders’ equity for the period.

return on equity = net income/average stockholders’ equityFor example, PPG Industries Inc. began 2010 with total stockholders’ equity of $3,922 million. Partly because of a large acquisition of treasury stock and the payment of a $360 million cash dividend, the company ended that year with stockholders’ equity of only $3,833 million. For the year ended December 31, 2010, PPG reported net income of $880 million for a return on equity of 22.7 percent.

average stockholders’ equity: ($3,922 million + $3,833 million)/2 = $3,877.5 million return on equity: $880 million/$3,877.5 million = 22.7%As with all such vital signs, the strength or weakness of PPG’s 22.7 percent return on equity is difficult to evaluate in isolation. Comparison with other similar companies can be very helpful as is the trend for this particular company over time. For example, decision makers looking at PPG were likely to be particularly impressed with the 2010 return on equity after learning that the 2009 return on equity was 11.5 percent.

Earnings per Share and the P/E Ratio

Question: No single “vital sign” that is computed to help investors analyze a business and its financial health is more obsessively watched than earnings per share (EPS). Corporations even call press conferences to announce their latest EPS figures. According to U.S. GAAP, public companies are required to present EPS for each period that net income is reported. As just one example, Pfizer Inc. disclosed basic EPS of $1.03 on its income statement for the year ended December 31, 2010. Why is the EPS reported by a corporation so closely monitored by the investment community?

Answer: The simple reason for the public fascination with EPS is that this number is generally considered to be linked to the market price of a company’s capital stock. Therefore, constant and wide-scale speculation takes place about future EPS figures as a technique for forecasting future stock prices. If analysts merely predict an increase in EPS, this forecast alone can lead to a surge in the traded price of a company’s shares.

A price-earnings ratio (P/E ratio)A ratio computed by dividing the current market price of an entity’s stock by the latest earnings per share balance; it is used to help predict future stock prices based on anticipated EPS figures. is even computed to help quantify this relationship. The P/E ratio is the current price of the stock divided by the latest EPS figure. It enables investors to anticipate movements in the price of a stock based on projections of earnings per share. If a company’s P/E ratio is twenty and is expected to remain constant, then an increase in EPS of $1 should lead to a $20 rise in stock price.

Theories abound as to how P/E ratios should be used. Some investors only buy capital shares of companies with high P/E ratios. They believe the P/E ratio indicates businesses that the stock market has assessed as particularly strong with excellent future prospects. Other investors prefer companies with low P/E ratios because those stocks may well be undervalued by the market with more room for the price to grow.

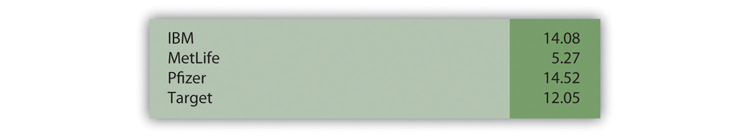

Figure 16.13 As of November 23, 2011, the P/E ratio for Several Prominent Companies

The ongoing debate as to whether EPS and the P/E ratio are over emphasized as investing tools is a controversy better left to upper-level finance courses. The fascination is certainly real regardless of whether the perceived benefits are as great as many decision makers believe.

Calculating Earnings per Share

Question: EPS is obviously a much analyzed number in a set of financial statements. How is EPS calculated?

Answer: EPS is a common stock computation designed to measure operating results after all other claims have been satisfied. In simplest form, EPS (often referred to as basic EPSA figure that must be reported by corporations that have their stock publicly traded; it is net income less preferred stock dividends divided by the weighted-average number of shares of common stock outstanding during the period.) is the net income for the period divided by the weighted average number of outstanding shares of common stock. The computation allocates a company’s income equally to each of its shares.

To illustrate, assume the Maris Company reports its most recent net income as $700,000. If the company has a weighted average of 200,000 shares of common stock outstanding for this period of time, EPS is $700,000/200,000 or $3.50 per share. Furthermore, if the market price of Maris Company stock is $35, then the P/E ratio is 35/3.50, or ten.

Because EPS only relates to common stock, this computation is altered slightly if any preferred stock shares are also outstanding. Preferred stock is normally entitled to a specified dividend before common stock has any claim. However, most preferred stocks get nothing other than that dividend. Therefore, in determining basic EPS, any preferred stock dividend must be removed to arrive at the portion of income that is attributed to the ownership of common stock.

Basic EPS (net income – preferred stock dividend)/average number of common shares outstandingTest Yourself

Question:

Daryl Corporation’s net income for the current year is reported as $450,000. Preferred stock dividends for the same period amount to $10,000. On January 1, 100,000 shares of common stock were outstanding. On July 1, 20,000 additional shares of common stock were issued. What is Daryl’s EPS?

- $3.67

- $4.00

- $4.40

- $4.50

Answer:

The correct answer is choice b: $4.00.

Explanation:

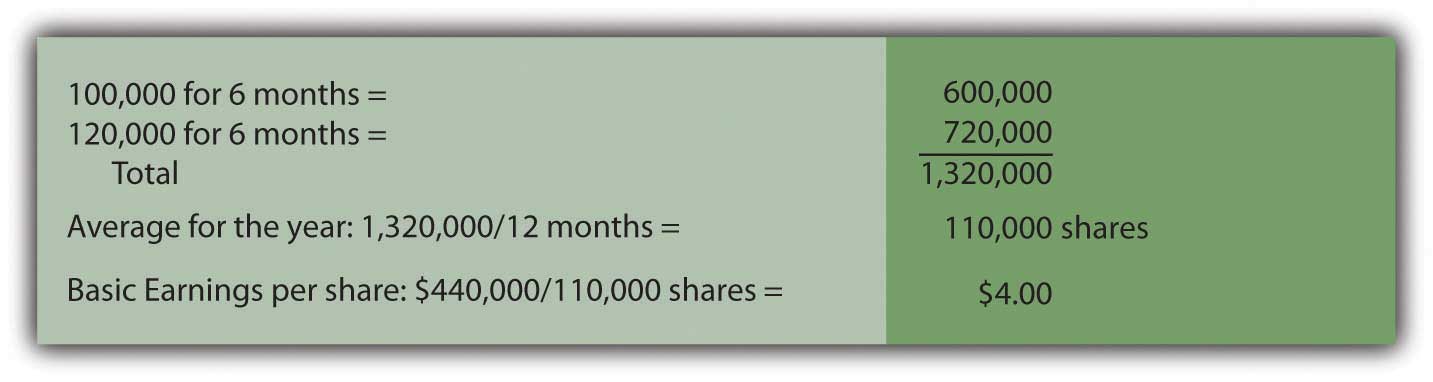

The income attributed to common stock is $440,000, the reported balance of $450,000 less the $10,000 preferred stock dividend. The weighted average number of outstanding common shares for this year was 110,000. The company had 100,000 shares of common stock outstanding during the first six months and 120,000 shares for the second six months.

Figure 16.14

Test Yourself

Question:

The latest income statement for the St. John Corporation reports net income of $828,000. Preferred dividends for the period were $30,000. On January 1, 200,000 shares of common stock were outstanding. However, on October 1, 40,000 shares of this common stock were repurchased as treasury stock. What is St. John’s basic EPS?

- $3.28

- $3.78

- $4.20

- $4.73

Answer:

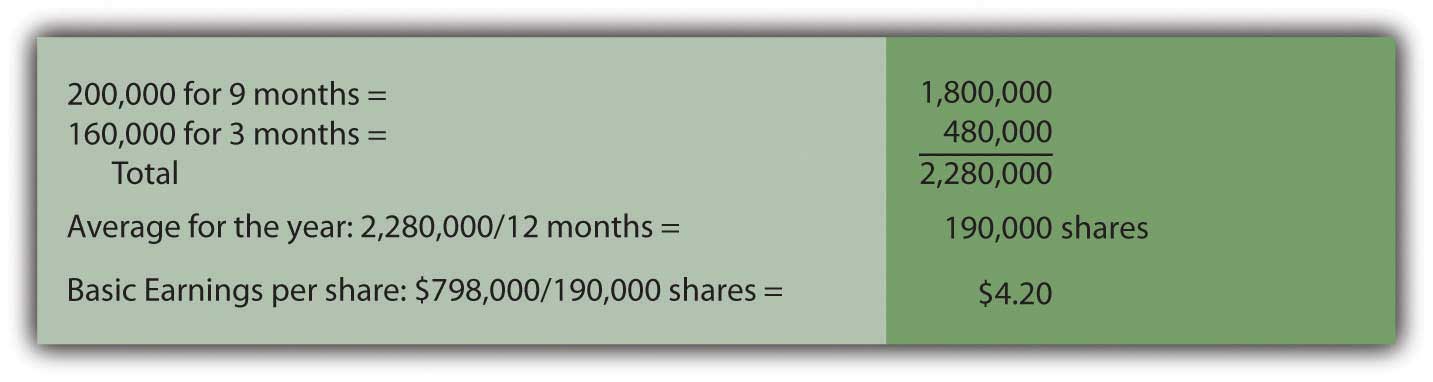

The correct answer is choice c: $4.20.

Explanation: