This is “Individual Decision Making: How You Spend Your Income”, section 4.1 from the book Theory and Applications of Economics (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

4.1 Individual Decision Making: How You Spend Your Income

Learning Objectives

- What are an individual’s budget set and budget line?

- What is an opportunity cost?

- How do people make choices about how much to consume?

- What features do we expect most people’s preferences to have?

- What does it mean to make rational choices?

We start with the decision about how to spend your income. We want to know what possibilities are available to you, given that your income is limited but your desires are not.

The Budget Set

We describe your personal decision making on a month-by-month basis (although we could equally well look at daily, weekly, or even annual decisions because the same basic ideas would apply). Suppose you receive a certain amount of income each month—perhaps from a job or a student grant. The government takes away some of this income in the form of taxes, and the remainder is available for you to spend. We call the income that remains after taxes your disposable incomeIncome after taxes are paid to the government..

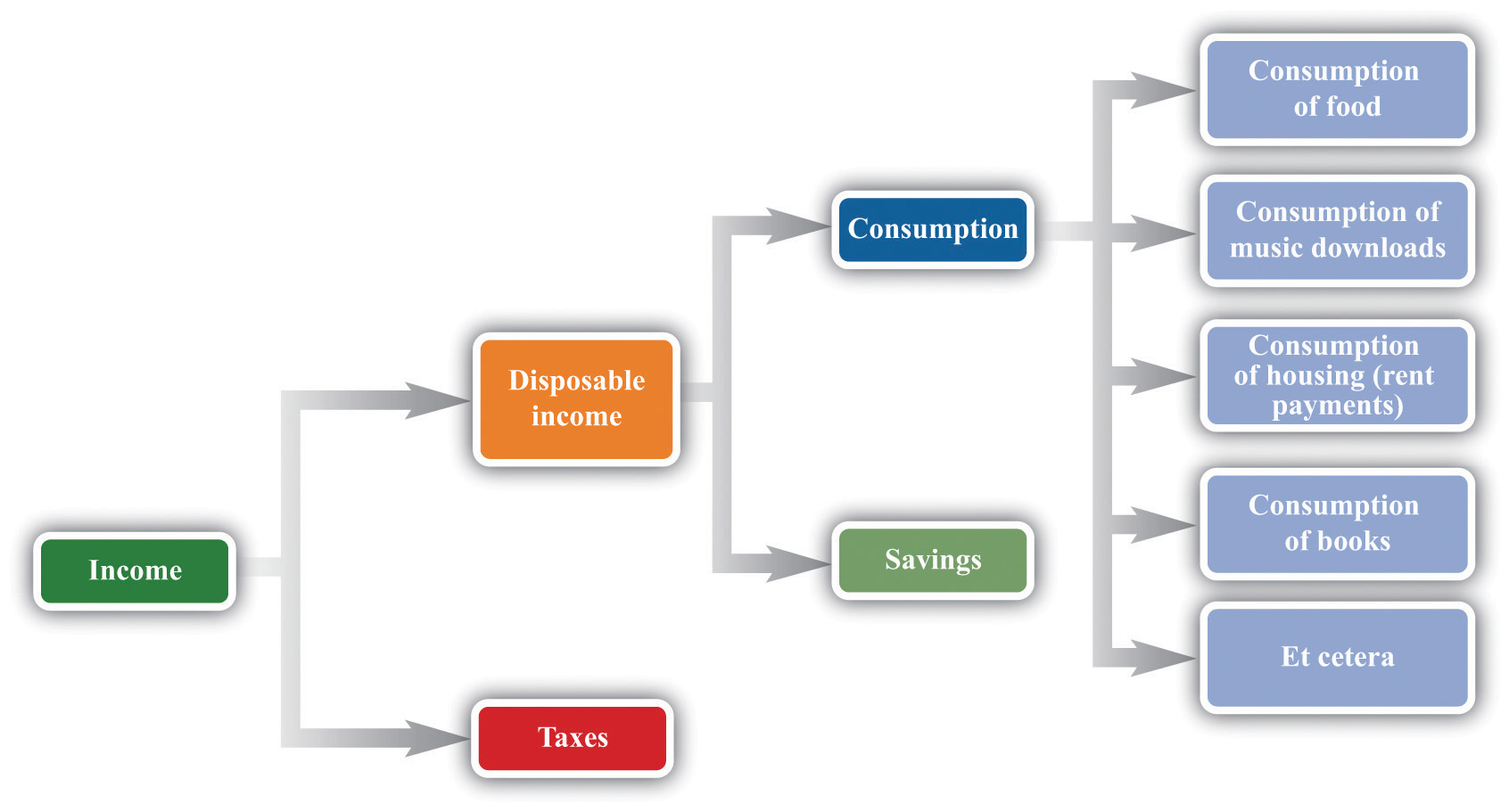

You may want to put aside some of this income for the future; this is your savings. The remainder is your consumption, which is your spending on all the goods and services you buy this month: rent, food, meals out, movies, cups of coffee, CDs, music downloads, DVD rentals, chocolate bars, books, bus rides, haircuts, and so on. Figure 4.1 "What You Do with Your Income" shows this process.

Figure 4.1 What You Do with Your Income

Here is a schematic view of what happens to your income.

This view of your paycheck involves several economic decisions. Some of these are decisions made by the government. Through its tax policies, the government decides how much of your income it takes from you and how much is left as disposable income. You make other decisions when you allocate your disposable income among goods and services today and in the future. You choose how to divide your disposable income between consumption this month and saving for the future. You also decide exactly how much of each good and service you purchase this month. We summarize your ability to purchase goods and services by your budget setAll the possible combinations of goods and services that are affordable, given income and the prices of all goods and services..

Toolkit: Section 31.1 "Individual Demand"

The budget set is a list of all the possible combinations of goods and services that are affordable, given both income and the prices of all goods and services. It is defined by

total spending ≤ disposable income.Begin by supposing you neither save nor borrow. We can construct your budget set in three steps.

-

Look at spending on each good and service in turn. For example, your monthly spending on cups of coffee is as follows:

spending on coffee = number of cups purchased × price per cup.A similar equation applies to every other good and service that you buy. Your spending on music downloads equals the number of downloads times the price per download, your spending on potato chips equals the number of bags you buy times the price per bag, and so on.

-

Now add together all your spending to obtain your total spending:

total spending = spending on coffee + spending on downloads + … ,where … means including the spending on every different good and service that you buy.

-

Observe that your total spending cannot exceed your income after taxes:

total spending ≤ disposable income.You are consuming within your budget set when this condition is satisfied.

In principle, your list of expenditures includes every good and service you could ever imagine purchasing, even though there are many goods and services you never actually buy. After all, your spending on Ferraris every month equals the number of Ferraris that you purchase times the price per Ferrari. If you buy 0 Ferraris, then your spending on Ferraris is also $0, so your total spending does include all the money you spend on Ferraris.

Imagine now that we take some bundle of products. Bundle here refers to any collection of goods and services—think of it as being like a grocery cart full of goods. The bundle might contain 20 cups of coffee, 5 music downloads, 3 bags of potato chips, 6 hours of parking, and so on. If you can afford to buy this bundle, given your income, then it is in the budget set. Otherwise, it is not.

The budget set, in other words, is a list of all the possible collections of goods and services that you can afford, taking as given both your income and the prices of the goods and services you might want to purchase. It would be very tedious to write out the complete list of such bundles, but fortunately this is unnecessary. We merely need to check whether any given bundle is affordable or not. We are using affordable not in the casual everyday sense of “cheap” but in a precise sense: a bundle is affordable if you have enough income to buy it.

It is easiest to understand the budget set by working though an example. To keep things really simple, suppose there are only two products: chocolate bars and music downloads. An example with two goods is easy to understand and draw, but everything we learn from this example can be extended to any number of goods and services.

Suppose your disposable income is $100. Imagine that the price of a music download is $1, while the price of a chocolate bar is $5. Table 4.1 "Spending on Music Downloads and Chocolate Bars" shows some different bundles that you might purchase. Bundle number 1, in the first row, consists of one download and one chocolate bar. This costs you $6—certainly affordable with your $100 income. Bundle number 2 contains 30 downloads and 10 chocolate bars. For this bundle, your total spending on downloads is $30 (= 30 × $1), and your total spending on chocolate bars is $50 (= 10 × $5), so your overall spending is $80. Again, this bundle is affordable. You can imagine many other combinations that would cost less than $100 in total.

Table 4.1 Spending on Music Downloads and Chocolate Bars

| Bundle | Number of Downloads | Price per Download ($) | Spending on Downloads ($) | Number of Chocolate Bars | Price per Chocolate Bar ($) | Spending on Chocolate Bar ($) | Total Spending ($) |

|---|---|---|---|---|---|---|---|

| 1 | 1 | 1 | 1 | 1 | 5 | 5 | 6 |

| 2 | 30 | 1 | 30 | 10 | 5 | 50 | 80 |

| 3 | 50 | 1 | 50 | 10 | 5 | 50 | 100 |

| 4 | 20 | 1 | 20 | 16 | 5 | 80 | 100 |

| 5 | 65 | 1 | 65 | 7 | 5 | 35 | 100 |

| 6 | 100 | 1 | 100 | 0 | 5 | 0 | 100 |

| 7 | 0 | 1 | 0 | 20 | 5 | 100 | 100 |

| 8 | 50 | 1 | 50 | 11 | 5 | 55 | 105 |

| 9 | 70 | 1 | 70 | 16 | 5 | 80 | 150 |

| 10 | 5,000 | 1 | 5,000 | 2,000 | 5 | 10,000 | 15,000 |

Bundles 3, 4, 5, 6, and 7 are special because they are affordable if you spend all your income. For example, you could buy 50 downloads and 10 chocolate bars (bundle 3). You would spend $50 on music downloads and $50 on chocolate bars, so your total spending would be exactly $100. Bundle 4 consists of 20 downloads and 16 chocolate bars; bundle 5 is 65 downloads and 7 chocolate bars. Again, each bundle costs exactly $100. Bundle 6 shows that, if you chose to buy nothing but downloads, you could purchase 100 of them without exceeding your income, while bundle 7 shows that you could buy 20 chocolate bars if you chose to purchase no downloads. We could find many other combinations that—like those in bundles 3–7—cost exactly $100.

Bundles 8, 9, and 10 are not in the budget set. Bundle 8 is like bundle 3, except with an additional chocolate bar. Because bundle 3 cost $100, bundle 8 costs $105, but it is not affordable with your $100 income. Bundle 9 costs $150. Bundle 10 shows that you cannot afford to buy 5,000 downloads and 2,000 chocolate bars because this would cost $15,000. There is quite literally an infinite number of bundles that you cannot afford to buy.

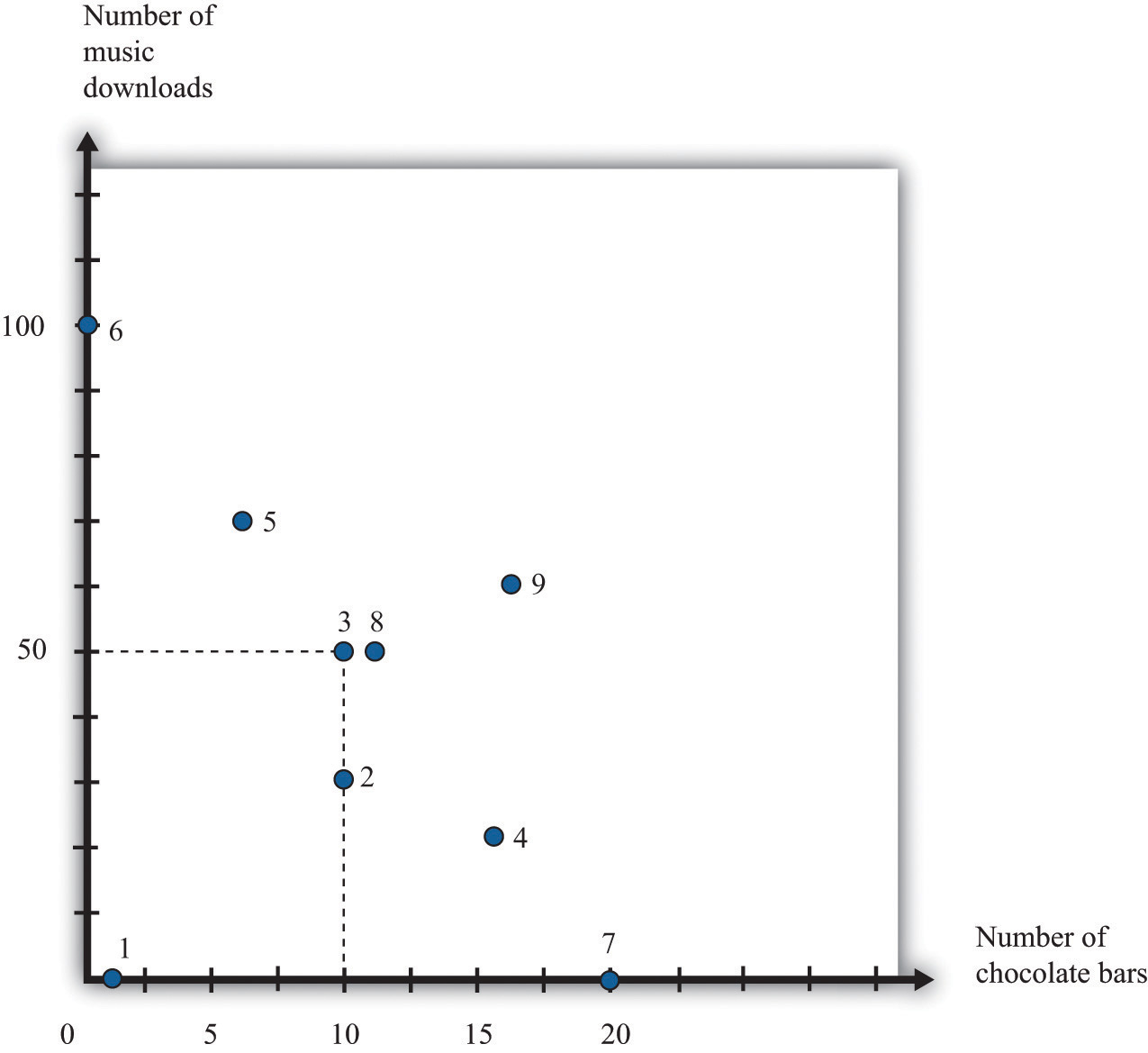

Figure 4.2 Various Bundles of Chocolate Bars and Downloads

This figure shows the combinations of chocolate bars and music downloads from Table 4.1 "Spending on Music Downloads and Chocolate Bars".

Figure 4.2 "Various Bundles of Chocolate Bars and Downloads" illustrates the bundles from Table 4.1 "Spending on Music Downloads and Chocolate Bars". The vertical axis measures the number of music downloads, and the horizontal axis measures the number of chocolate bars. Any point on the graph therefore represents a consumption bundle—a combination of music downloads and chocolate bars. We show the first nine bundles from Table 4.1 "Spending on Music Downloads and Chocolate Bars" in this diagram. (Bundle 10 is several feet off the page.) If you inspect this figure carefully, you may be able to guess for yourself what the budget set looks like. Look in particular at bundles 3, 4, 5, 6, and 7. These are the bundles that are just affordable—that cost exactly $100. It appears as if these bundles all lie on a straight line, which is in fact the case. All the combinations of downloads and chocolate bars that are just affordable represent a straight line.

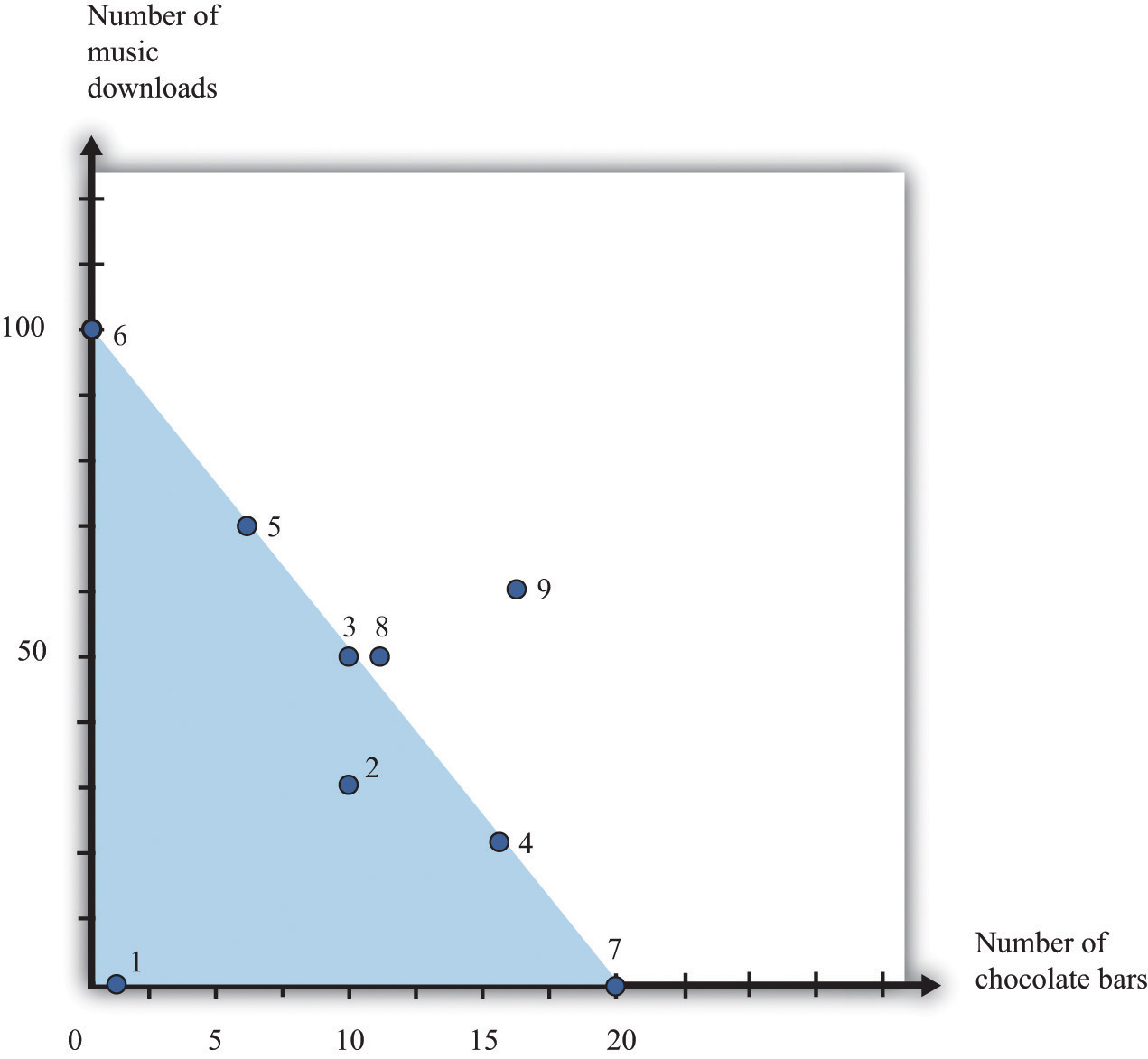

Meanwhile, the bundles that are affordable with income to spare—like bundles 1 and 2—are below the line, and the bundles you cannot afford—like bundles 8, 9, and 10—are above the line. Building on these discoveries, we find that the budget set is a triangle (Figure 4.3 "The Budget Set").

Figure 4.3 The Budget Set

The bundles that are affordable are in the budget set, shown here as a triangle.

Every point—that is, every combination of downloads and chocolate bars—that lies on or inside this triangle is affordable. Points outside the triangle are not affordable, so they are not in the budget set.

What Have We Assumed?

We now have a picture of the budget set. However, you might be curious about whether we have sneaked in any assumptions to do this. This is a Principles of Economics book, so we must start by focusing on the basics. We do our best throughout the book to be clear about the different assumptions we make, including their importance.

- We have assumed that there are only two products. Once we have more than two products, we cannot draw simple diagrams. Beyond this, though, there is nothing special about our downloads-and-chocolate-bar example. We are using an example with two products simply because it makes our key points more transparent. We can easily imagine a version of Table 4.1 "Spending on Music Downloads and Chocolate Bars" with many more goods and services, even if we cannot draw the corresponding diagram.

- We assume that you cannot consume negative quantities of downloads or chocolate bars. In our diagram, this means that the horizontal and vertical axes give us two sides of the triangle. This seems reasonable: it is not easy to imagine consuming a negative quantity of chocolate bars. (If you started out with some chocolate bars and then sold them, this is similar to negative consumption.)

- An easier way to look at this is to add any money you get from selling goods or services to your income. Then we can focus on buying decisions only.

- By shading in the entire triangle, we suppose that you can buy fractional quantities of these products. For example, the bundle consisting of 17.5 downloads and 12.7 chocolate bars is inside the triangle, even though iTunes, for example, would not allow you to purchase half a song, and you are unlikely to find a store that will sell you 0.7 chocolate bars. For the most part, this is a technical detail that makes very little difference, except that it makes our lives much easier.

- We have supposed that the price per unit of downloads and chocolate bars is the same no matter how few or how many you choose to buy. In the real world, you may sometimes be able to get quantity discounts. For example, a store might have a “buy two get one free” offer. In more advanced courses in microeconomics, you will learn that we can draw versions of Figure 4.3 "The Budget Set" that take into account such pricing schemes.

-

We assume no saving or borrowing. It is easy to include saving or borrowing in this story, though. We think of borrowing as being an addition to your income, and we think of saving as one more kind of spending. Thus if you borrow, the budget set is described by

total spending ≤ disposable income + borrowing.If you save, the budget set is described by

total spending + spending ≤ disposable income.

The Budget Line

Continuing with our two-goods example, we know that

spending on chocolate = number of chocolate bars × price of a chocolate barand

spending on downloads = number of downloads × price of download.When total spending is exactly equal to total disposable income, then

(number of chocolate bars × price of a chocolate bar) + (number of downloads × price of download) = disposable income.Toolkit: Section 31.1 "Individual Demand"

The budget line lists all the goods and services that are affordable, given prices and income, assuming you spend all your income.

The difference between the definitions of the budget set and the budget lineAll the goods and services that are affordable, given prices and income, assuming you spend all your income. is that there is an inequality in the budget set and an equality in the budget line:

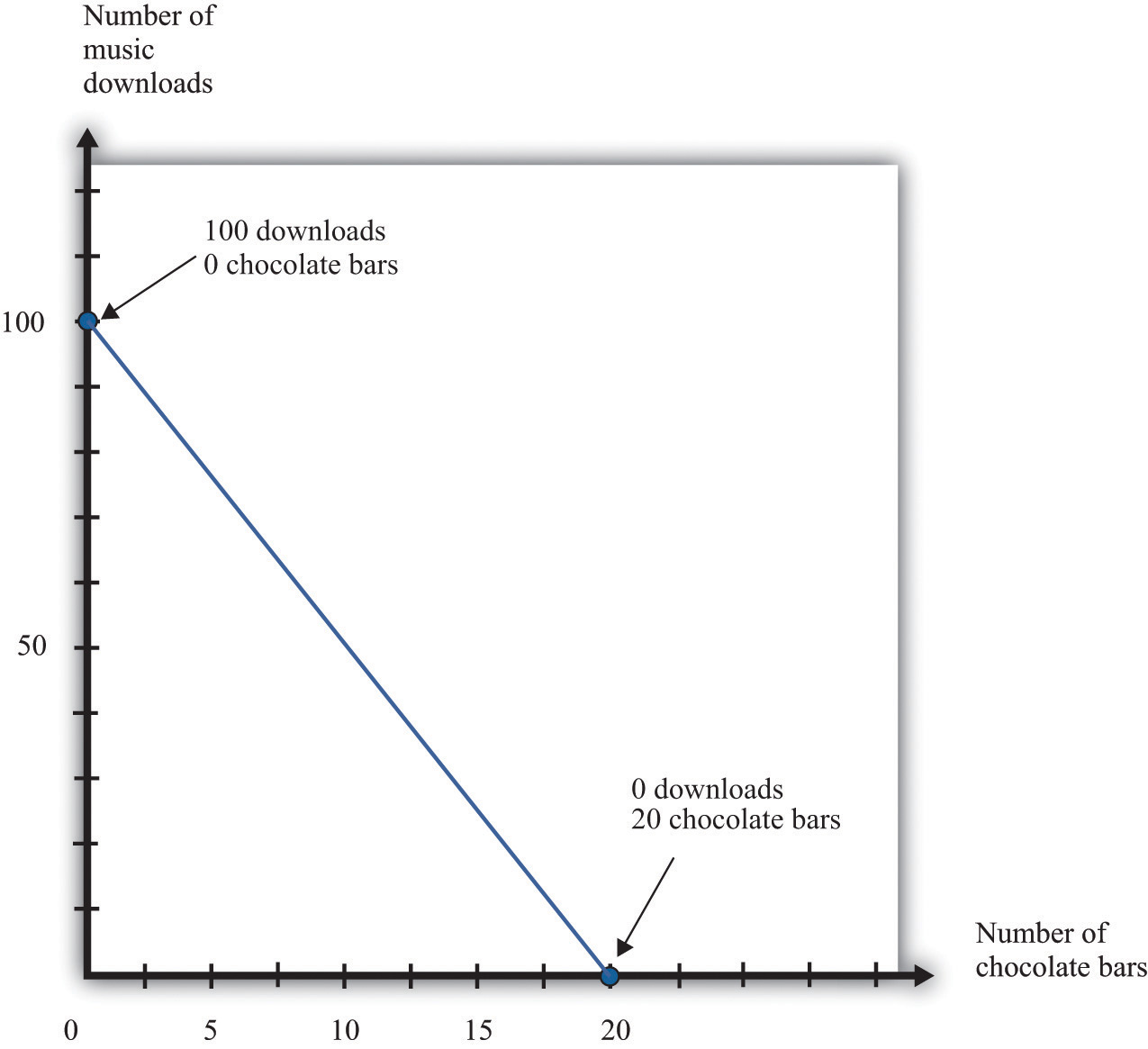

total spending = disposable income.Figure 4.4 The Budget Line

The bundles that are exactly affordable are on the budget line.

In the two-goods example, the budget line is the outside edge of the budget set triangle, as shown in Figure 4.4 "The Budget Line". What information do we need to draw the budget line? If we know both prices and the total amount of income, then this is certainly enough. In fact, we need only two pieces of information (not three) because basic mathematics tells us that it is enough to know two points on a line: once we have two points, we can draw a line. In practice, the easiest way to draw a budget line is to find the intercepts—the points on each axis. These correspond to how much you can obtain of each product if you consume 0 of the other. If you don’t buy any chocolate bars, you have enough income to buy 100 downloads. If the number of chocolate bars is 0, then the budget line becomes

number of downloads × price of download = disposable income,so

Similarly, if the number of downloads is 0,

So we have two points on the budget line: (1) 0 chocolate bars and 100 downloads and (2) 0 downloads and 20 chocolate bars.

Another way to describe the budget line is to write the equation of the line in terms of its intercept (on the vertical axis) and its slope:To derive this equation, go back to the budget line and divide both sides by the price of a download:Rearranging, we get the equation in the text.

The intercept is which answers the following question: “How many downloads can you obtain if you buy no chocolate?” As we have already seen, this is 100 in our example.

The slope is

which answers the following question: “What is the rate at which you can trade off downloads for chocolate bars?” In our example, this is −5. If you give up 1 chocolate bar, you will have an extra $5 (the price of a chocolate bar), which allows you to buy 5 more downloads.

The negative slope of the budget line says that to get more downloads, you must give up some chocolate bars. The cost of getting more downloads is that you no longer have the opportunity to buy as many chocolate bars. More generally, economists say that the opportunity costWhat you must give up to carry out an action. of an action is what you must give up to carry out that action. Likewise, to get more chocolate bars, you must give up some downloads. The opportunity cost of buying a chocolate bar is that you do not have that the money available to purchase downloads. The idea of opportunity cost pervades economics.

You may well have heard the following quotation that originated in economics: “There is no such thing as a free lunch.” This statement captures the insight that everything has an opportunity cost, even if it is not always obvious who pays. Economists’ habit of pointing out this unpleasant truth is one reason that economics is labeled “the dismal science.”Although economists may dislike this characterization of their profession, they can take pride in its origin. The term was coined by Thomas Carlyle about 150 years ago, in the context of a debate about race and slavery. Carlyle criticized famous economists of the time, such as John Stuart Mill and Adam Smith, who argued that some nations were richer than others not because of innate differences across races but because of economic and historical factors. These economists argued for the equality of people and supported the freedom of slaves.

We said that a goal of this chapter is to help you make good decisions. One ingredient of good decision making is to understand the trade-offs that you face. Are you thinking of buying a new $200 mobile phone? The cost of that phone is best thought of, not as a sum of money, but as the other goods or services that you could have bought with that $200. Would you rather have 200 new songs for your existing phone instead? Or would you prefer 20 trips to the movies, 40 ice cream cones, or $200 worth of gas for your car? Framing decisions in this way can help you make better choices.

Your Preferences

Your choices reflect two factors. One is what you can afford. The budget set and the budget line are a way of describing the combinations of goods and services you can afford. The second factor is what you like, or—to use the usual economic term—your preferences.

Economists don’t pretend to know what makes everyone happy. In our role as economists, we pass no judgment on individual tastes. Your music downloads might be Gustav Mahler, Arctic Monkeys, Eminem, or Barry Manilow. But we think it is reasonable to assume three things about the preferences that underlie your choices: (1) more is better, (2) you can choose, and (3) your choices are consistent.

More Is Better

Economists think that you are never satisfied. No matter how much you consume, you would always like to have more of something. Another way of saying this is that every good is indeed “good”; having more of something will never make you less happy. This assumption says nothing more than people don’t usually throw their income away. Even Bill Gates is not in the habit of burning money.

“More is better” permits us to focus on the budget line rather than the budget set. In Figure 4.3 "The Budget Set", you will not choose to consume at a point inside the triangle of the budget set. Instead, you want to be on the edge of the triangle—that is, on the budget line itself. Otherwise, you would be throwing money away. It also allows us to rank some of the different bundles in Table 4.1 "Spending on Music Downloads and Chocolate Bars". For example, we predict you would prefer to have bundle 3 rather than bundle 2 because it has the same number of chocolate bars and more downloads. Likewise, we predict you would prefer bundle 8 to bundle 3: bundle 8 has the same number of downloads as bundle 3 but more chocolate bars.

By the way, we are not insisting that you must eat all these chocolate bars. You are always allowed to give away or throw away anything you don’t want. Equally, the idea that more is better does not mean that you might not be sated with one particular good. It is possible that one more chocolate bar would make you no happier than before. Economists merely believe that there is always something that you would like to have more of.

“More is better” does not mean that you necessarily prefer a bundle that costs more. Look at bundles 7 and 9. Bundle 7 contains 0 downloads and 20 chocolate bars; it costs $100. Bundle 9, which contains 70 downloads and 16 chocolate bars, costs $150. Yet someone who loves chocolate bars and has no interest in music would prefer bundle 7, even though its market value is less.

You Can Choose

Economists suppose that you can always make the comparison between any two bundles of goods and services. If you are presented with two bundles—call them A and B—then the assumption that “you can choose” says that one of the following is true:

- You prefer A to B.

- You prefer B to A.

- You are equally happy with either A or B.

Look back at Table 4.1 "Spending on Music Downloads and Chocolate Bars". The assumption that “you can choose” says that if you were presented with any pair of bundles, you would be able to indicate which one you liked better (or that you liked them both equally much). This assumption says that you are never paralyzed by indecision.

“More is better” allows us to draw some conclusions about the choices you would make. If we gave you a choice between bundle 3 and bundle 8, for example, we know you will choose bundle 8. But what if, say, we presented you with bundle 4 and bundle 5? Bundle 5 has more downloads, but bundle 4 has more chocolate bars. “You can choose” says that, even though we may not know which bundle you would choose, you are capable of making up your mind.

Your Choices Are Consistent

Finally, economists suppose that your preferences lead you to behave consistently. Based on Table 4.1 "Spending on Music Downloads and Chocolate Bars", suppose you reported the following preferences across combinations of downloads and chocolate bars:

- You prefer bundle 3 to 4.

- You prefer bundle 4 to 5.

- You prefer bundle 5 to 3.

Each choice, taken individually, might make sense, but all three taken together are not consistent. They are contradictory. If you prefer bundle 3 to bundle 4 and you prefer bundle 4 to bundle 5, then a common-sense interpretation of the word “prefer” means that you should prefer bundle 3 to bundle 5.

Consistency means that your preferences must not be contradictory in this way. Put another way, if your preferences are consistent and yet you made these three choices, then at least one of these choices must have been a mistake—a bad decision. You would have been happier had you made a different choice.

Your Choice

We have now looked at your opportunities, as summarized by the budget set, and also your preferences. By combining opportunities and preferences, we obtain the economic approach to individual decision making. Economists make a straightforward assumption: they suppose you look at the bundles of goods and services you can afford and choose the one that makes you happiest. If the claims we made about your preferences are true, then you will be able to find a “best” bundle of goods and services, and this bundle will lie on the budget line. We know this because (1) you can compare any two points and (2) your preferences will not lead you to go around in circles.

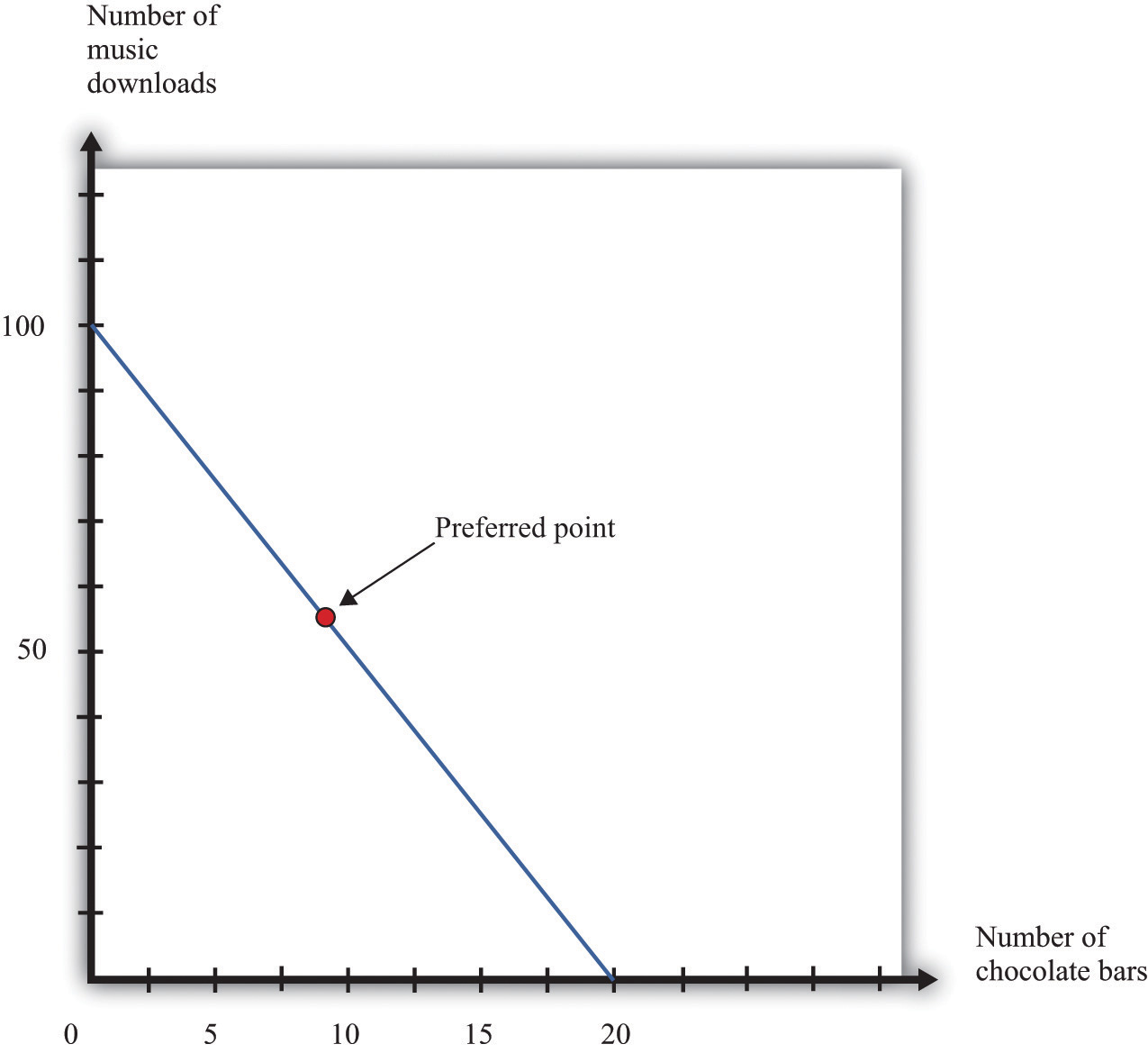

Figure 4.5 Choosing a Preferred Point on the Budget Line

An individual’s preferred point reflects opportunities, as given by the budget line, and preferences. The preferred point will lie on the budget line, not inside, because of the assumption that more is better.

In Figure 4.5 "Choosing a Preferred Point on the Budget Line", we indicate an example of an individual’s preferred point. The preferred point is on the budget line and—by definition—is the best combination for the individual that can be found in the budget set. At the preferred point, the individual cannot be better off by consuming any other affordable bundle of goods and services.

There is one technical detail that we should add. It is possible that an individual might have more than one preferred point. There could be two or more combinations on the budget line that make an individual equally happy. To keep life simple, economists usually suppose that there is only a single preferred point, but nothing important hinges on this.

Rationality

Economists typically assume rationalityThe ability of individuals to (1) evaluate the opportunities that they face and (2) choose among them in a way that serves their own best interests. of decision makers, which means that people can do the following:

- evaluate the opportunities that they face

- choose among those opportunities in a way that serves their own best interests

Is this a good assumption? Are people really as rational as economists like to think they are? We would like to know if people’s preferences do satisfy the assumptions that we have made and if people behave in a consistent way. If we could hook someone up to a machine and measure his or her preferences, then we could evaluate our assumptions directly. Despite advances in neurobiology, our scientific understanding has not reached that point. We see what people do, not the preferences that lie behind these choices. Therefore, one way to evaluate the economic approach is to look at the choices people make and see if they are consistent with our assumptions.

Imagine you have an individual’s data on download and chocolate bar consumption over many months. Also, suppose you know the prices of downloads and chocolate bars each month and the individual’s monthly income. This would give you enough information to construct the individual’s budget sets each month and look for behavior that is inconsistent with our assumptions. Such inconsistency could take different forms.

- She might buy a bundle of goods inside the budget line and throw away the remaining income.

- In one month, she might have chosen a bundle of goods—call it bundle A—in preference to another affordable bundle—call it bundle B. Yet, in another month, that same individual might have chosen bundle B when she could also have afforded bundle A.

The first option is inconsistent with our idea that “more is better.” As for the second option, it is generally inconsistent to prefer bundle A over bundle B at one time yet prefer bundle B over bundle A at a different time. (It is not necessarily inconsistent, however. The individual might be indifferent between bundles A and B, so she doesn’t care which bundle she consumes. Or her preferences might change from one month to the next.)

Inconsistent Choices

Economists are not the only social scientists who study how we make choices. Psychologists also study decision making, although their focus is different because they pay more attention to the processes that lie behind our choices. The decision-making process that we have described, in which you evaluate each possible option available to you, can be cognitively taxing. Psychologists and economists have argued that we therefore often use simpler rules of thumb when we make decisions. These rules of thumb work well most of the time, but sometimes they lead to biases and inconsistent choices. This book is about economics, not psychology, so we will not discuss these ideas in too much detail. Nevertheless, it is worth knowing something about how our decision making might go awry.

On occasion, we make choices that are apparently inconsistent. Here are some examples.

The endowment effect. Imagine you win a prize in a contest and have two scenarios to consider:

- The prize is a ticket to a major sporting event taking place in your town. After looking on eBay, you discover that equivalent tickets are being bought and sold for $500.

- The prize is $500 cash.

Rational decision makers would treat these two situations as essentially identical: if you get the ticket, you can sell it on eBay for $500; if you get $500 cash, you can buy a ticket on eBay. Yet many people behave differently in the two situations. If they get the ticket, they do not sell it, but if they get the cash, they do not buy the ticket. Apparently, we often feel differently about goods that we actually have in our possession compared to goods that we could choose to purchase.

Mental states. We may be in a different mental state when we buy a good from when we consume it. If you are hungry when you go grocery shopping, then you may buy too much food. When we buy something, we have to predict how we will be feeling when we consume it, and we are not always very good at making these predictions. Thus our purchases may be different, depending on our state of mind, even if prices and incomes are the same.

Anchoring. Very often, when you go to a store, you will see that goods are advertised as “on sale” or “reduced from” some price. Our theory suggests that people simply look at current prices and their current income when deciding what to buy, in which case they shouldn‘t care if the good used to sell at a higher price. In reality, the “regular price” serves as an anchor for our judgments. A higher price tends to increase our assessment of how much the good is worth to us. Thus we may make inconsistent choices because we sometimes use different anchors.

How should we interpret the evidence that people are—sometimes at least—not quite as rational as economics usually supposes? Should we give up and go home? Not at all. Such findings deepen our understanding of economic behavior, but there are many reasons why it is vital to understand the behavior of rational individuals.

-

Economics helps us make better decisions. The movie Heist has dialogue that sums up this idea:

D. A. Freccia: You’re a pretty smart fella. Joe Moore: Ah, not that smart. D. A. Freccia: [If] you’re not that smart, how’d you figure it out? Joe Moore: I tried to imagine a fella smarter than myself. Then I tried to think, “what would he do?” Most of us are “not that smart”; that is, we are not smart enough to determine what the rational thing to do is in all circumstances. Knowing what someone smarter would do can be very useful indeed.The quote comes from the Internet Movie Database (http://www.imdb.com). We first learned of the scene from B. Nalebuff and I. Ayres, Why Not? (Boston: Harvard Business School Press, 2003), 46. Further, if we understand the biases and mistakes to which we are all prone, then we can do a better job of recognizing them in ourselves and adjusting our behavior accordingly.

- Rationality imposes a great deal of discipline on our thinking as economists. If we suppose that people are irrational, then anything is possible. A better approach is to start with rational behavior and then see if the biases that psychologists and economists have identified are likely to alter our conclusions in a major way.

- Economics has a good track record of prediction in many settings. A lot of the time, even if not all the time, the idea that people behave rationally seems more right than wrong.

More Complicated Preferences

People may be rational yet have more complicated preferences than we have considered.

Fairness. People sometimes care about fairness and so may refuse to buy something because the price seems unfair to them. In one famous example, people were asked to imagine that they are on the beach and that a friend offers to buy a cold drink on their behalf.See Richard Thaler, “Mental Accounting and Consumer Choice, Marketing Science 4 (1985): 199–214. They are asked how much they are willing to pay for this drink. The answer to this question should not depend on where the drink is purchased. After all, they are handing over some money and getting a cold drink in return. Yet people are prepared to pay more if they know that the friend is going to buy the drink from a hotel bar rather than a local corner store. They think it is reasonable for hotels to have high prices, but if the corner store charged the same price as the hotel, people think that this is unfair and are unwilling to pay.

Altruism. People sometimes care not only about what they themselves consume but also about the well-being of others. Such altruism leads people to give gifts, to give to charity, to buy products such as “fair-trade” coffee, and so on.

Relative incomes. Caring about the consumption of others can take more negative forms as well. People sometimes care about whether they are richer or poorer than other people. They may want to own a car or a barbecue grill that is bigger and better than that of their neighbors.

More complicated preferences such as these are not irrational, but they require a more complex framework for decision making than we can tackle in a Principles of Economics book.We say more about some of these ideas in Chapter 13 "Superstars".

Key Takeaways

- The budget set consists of all combinations of goods and services that are affordable, and the budget line consists of all combinations of goods and services that are affordable if you spend all your income.

- The opportunity cost of an action (such as consuming more of one good) is what must be given up to carry out that action (consuming less of some other good).

- Your choices reflect the interaction between what you can afford (your budget set) and what you like (your preferences).

- Economists think that most people prefer having more to having less, are able to choose among the combinations in their budget set, and make consistent choices.

- Rational agents are able to evaluate their options and make choices that maximize their happiness.

Checking Your Understanding

- Suppose that all prices and income were converted into a different currency. For example, imagine that prices were originally in dollars but were then converted to Mexican pesos. Would the budget set change? If so, explain how. If not, explain why not.

- Assume your disposable income is $100, the price of a music download is $2, and the price of a chocolate bar is $5. Redo Table 4.1 "Spending on Music Downloads and Chocolate Bars". Find (or create) three combinations of chocolate bars and downloads that are on the budget line. Find a combination that is not affordable and another combination that is in the budget set but not on the budget line.

- What is the difference between your budget set and your budget line?