This is “The Liability Risk Management”, chapter 12 from the book Enterprise and Individual Risk Management (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 12 The Liability Risk Management

As noted in Chapter 11 "Property Risk Management", liability risk is the risk that we may hurt a third party and will be sued for bodily injury or other damages. Most of us have heard about auto liability; pollution liability; product liability; medical malpractice; and the professional liability of lawyers, accountants, company directors and officers, and more. In the early 2000s, the United States was mired in the accounting scandals of Enron and WorldCom. In the mid-2000s, AIG added its name to the list of lawsuits and criminal allegations with accounting improprieties that padded company results. Shareholders and participants in the 401(k) plans of these companies filed lawsuits, some of which were class-action suits. In February 2005, President Bush signed a bill to redirect class-action lawsuits in excess of $5 million and with geographically dispersed plaintiffs from state courts to federal courts.For class-action lawsuits, see major business and insurance journals during February 2005. Examples include Allison Bell, “Industry Welcomes Class-Action Victory,” National Underwriter Online News Service, February 10, 2005; Jim Drinkard, “Bush to Sign Bill on Class-Action Suits,” USA Today, February 18, 2005, http://www.usatoday.com/money/2005-02-17-lawsuits-usat_x.htm (accessed March 16, 2009). For AIG stories, see all media outlets in 2005, for example, “401(k) Participants File Class-Action Suit Against AIG,” BestWire, May 13, 2005. Also, review many articles in the media during the fall of 2008 and the winter of 2009. Cases of this type are expected to continue to emerge. In 2008, the credit crisis began and the allegations of misconduct and negligence by directors and officers are expected to bring about a large numbers of lawsuits.

While liability insurance is for unintentional actions, the fear of having to pay liability claims because of the errors and omissions of accountants and the directors and officers of companies have caused insurance rates in these types of coverage to jump dramatically. The relationships between behavior and coverage will be strongly demonstrated in this chapter, which will cover the following:

- Links

- Nature of the liability exposure

- Major sources of liability

- Liability issues and possible solutions

Links

As discussed in the Links section in Chapter 11 "Property Risk Management", liability coverage is coverage for a third party that may suffer a loss because of your actions. It also covers you in case you are hurt or your property is damaged because of someone else’s actions, such as the actions of the accountants and executives of Enron, WorldCom, and AIG. The harmed parties are investors and the employees of these companies who lost all or part of their investments or pensions. In personal lines coverage, such as homeowners and auto policies, the liability of property damage or bodily injury you may inflict on others is covered up to a limit. In commercial lines, you may use a packaged multilines policy that also includes liability coverage. In this chapter, we focus only on the liability sections of these policies.

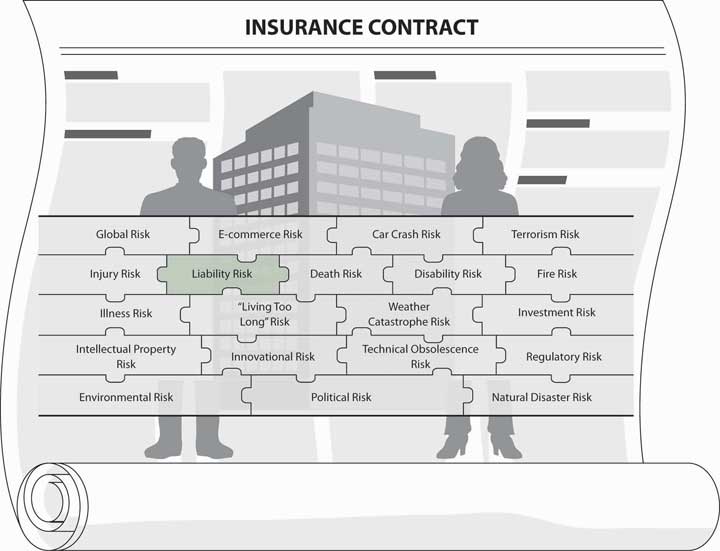

As part of your holistic risk management program, you now realize that you need a myriad of policies to cover all your liability exposures. In many cases, both the property and liability are in the same policies, but what liability coverage is actually included in each policy? As we delve further into insurance policies, we find many types of liability coverage. As you will see in this chapter, businesses have a vast number of liabilities: product, errors and omissions, professional, directors and officers, e-commerce, medical, employment, employee benefits, and more. The aftermath of September 11, 2001, revealed additional liabilities from terrorism. Liability risk exposure is scary for any individual or business, especially in such a litigious society as the United States. Nonetheless, it is important to have the recourse when someone has been wronged, for example, during the scandals of accounting irregularities and management fraud.

To better understand the complete holistic risk management process, it is imperative for us to understand all sections of the liability coverages in all the policies we hold. Figure 12.1 "Links between Liability Risks and Insurance Contracts" shows the connection among the types of coverage and the complete puzzle of risk. At this point we are drilling down into a massive type of risk exposure, which is covered by a myriad of policies. Our ability to connect them all allows us to complete the picture of our holistic risk.

Figure 12.1 Links between Liability Risks and Insurance Contracts