This is “Comparisons to Current Risk-Handling Methods”, section 4.5 from the book Enterprise and Individual Risk Management (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

4.5 Comparisons to Current Risk-Handling Methods

Learning Objectives

- In this section we return to the risk map and compare the risk map created for the identification purpose to that created for the risk management tools already used by the business.

- If the solution the firm uses does not fit within the solutions suggested by the risk management matrix, the business has to reevaluate its methods of managing the risks.

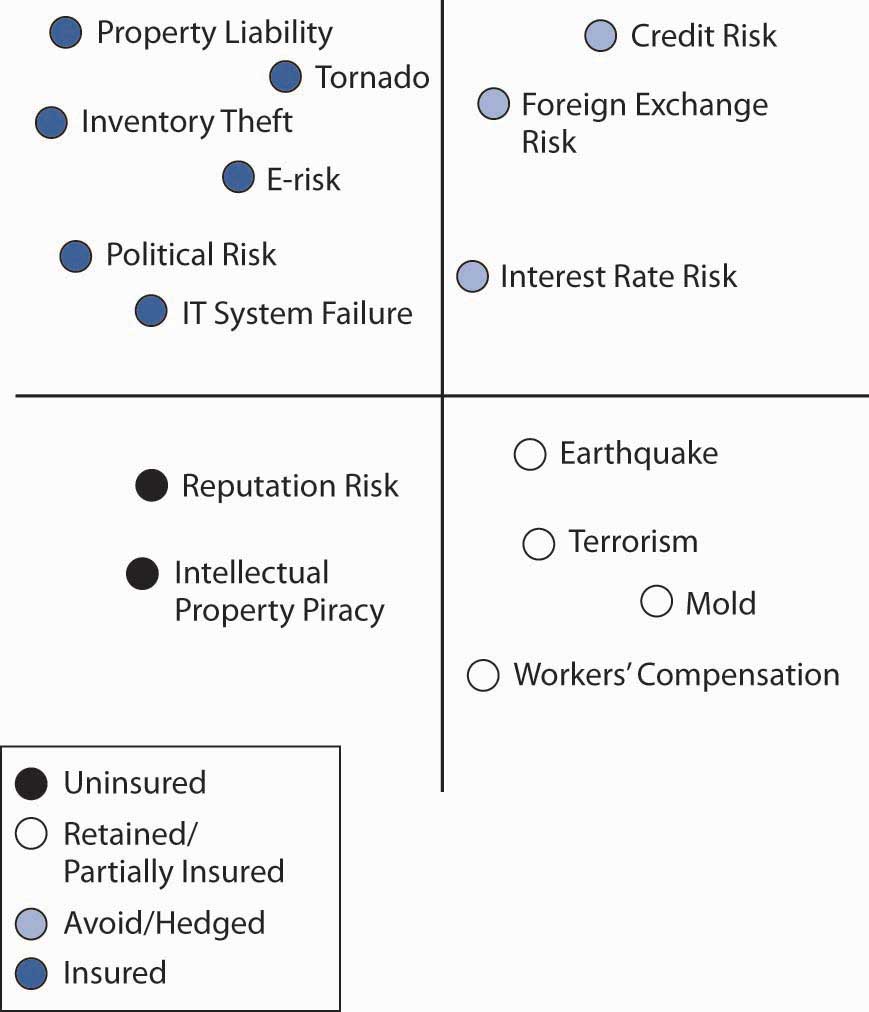

At this point, the risk manager of Notable Notions can see the potential impact of its risks and its best risk management strategies. The next step in the risk mapping technique is to create separate graphs that show how the firm is currently handling each risk. Each of the risks in Figure 4.4 "Notable Notions Current Risk Handling" is now graphed according to whether the risk is uninsured, retained, partially insured or hedged (a financial technique to lower the risk by using the financial instrument discussed in Chapter 6 "The Insurance Solution and Institutions"), or insured. Figure 4.4 "Notable Notions Current Risk Handling" is the new risk map reflecting the current risk management handling.

Figure 4.4 Notable Notions Current Risk Handling

When the two maps, the one in Figure 4.2 "Notable Notions Risk Map" and the one in Figure 4.4 "Notable Notions Current Risk Handling", are overlaid, it can be clearly seen that some of the risk strategies suggested in Table 4.4 "The Traditional Risk Management Matrix (for One Risk)" differ from current risk handling as shown in Figure 4.4 "Notable Notions Current Risk Handling". For example, a broker convinced the risk manager to purchase an expensive policy for e-risk. The risk map shows that for Notable Notions, e-risk is low severity and low frequency and thus should remain uninsured. By overlaying the two risk maps, the risk manager can see where current risk handling may not be appropriate.

The Effect of Risk Handling Methods

We can create another map to show how a particular risk management strategy of the maximum severity that will remain after insurance. This occurs when insurance companies give only low limits of coverage. For example, if the potential severity of Notable Notions’ earthquake risk is $140 million, but coverage is offered only up to $100 million, the risk falls to a level of $40 million.

Using holistic risk mapping methodology presents a clear, easy-to-read presentation of a firm’s overall risk spectrum or the level of risks that are still left after all risk mitigation strategies were put in place. It allows a firm to discern between those exposures that after all mitigation efforts are still

- unbearable,

- difficult to bear, and

- relatively unimportant.

In summary, risk mapping has five main objectives:

- To aid in the identification of risks and their interrelations

- To provide a mechanism to see clearly what risk management strategy would be the best to undertake

- To compare and evaluate the firm’s current risk handling and to aid in selecting appropriate strategies

- To show the leftover risks after all risk mitigation strategies are put in place

- To easily communicate risk management strategy to both management and employees

Ongoing Monitoring

The process of risk management is continuous, requiring constant monitoring of the program to be certain that (1) the decisions implemented were correct and have been implemented appropriately and that (2) the underlying problems have not changed so much as to require revised plans for managing them. When either of these conditions exists, the process returns to the step of identifying the risks and risk management tools and the cycle repeats. In this way, risk management can be considered a systems process, one in never-ending motion.

Key Takeaways

- In this section we return to the risk map and compare the risk map created for the identification purpose to that created for the risk management tools already used by the business. This is part of the decision making using the highly regarded risk management matrix tool.

- If the projected frequency and severity indicate different risk management solutions, the overlay of the maps can immediately clarify any discrepancies. Corrective actions can be taken and the ongoing monitoring continues.

Discussion Questions

- Use the designed risk map for the small child-care company you created above. Create a risk management matrix for the same risks indentified in the risk map of question 1.

- Overlay the two risk maps to see if the current risk management tools fit in with what is required under the risk management matrix.

- Propose corrective measures, if any.

- What would be the suggestions for ongoing risk management for the child-care company?