This is “Appendix: Present Value Tables”, section 8.8 from the book Accounting for Managers (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

8.8 Appendix: Present Value Tables

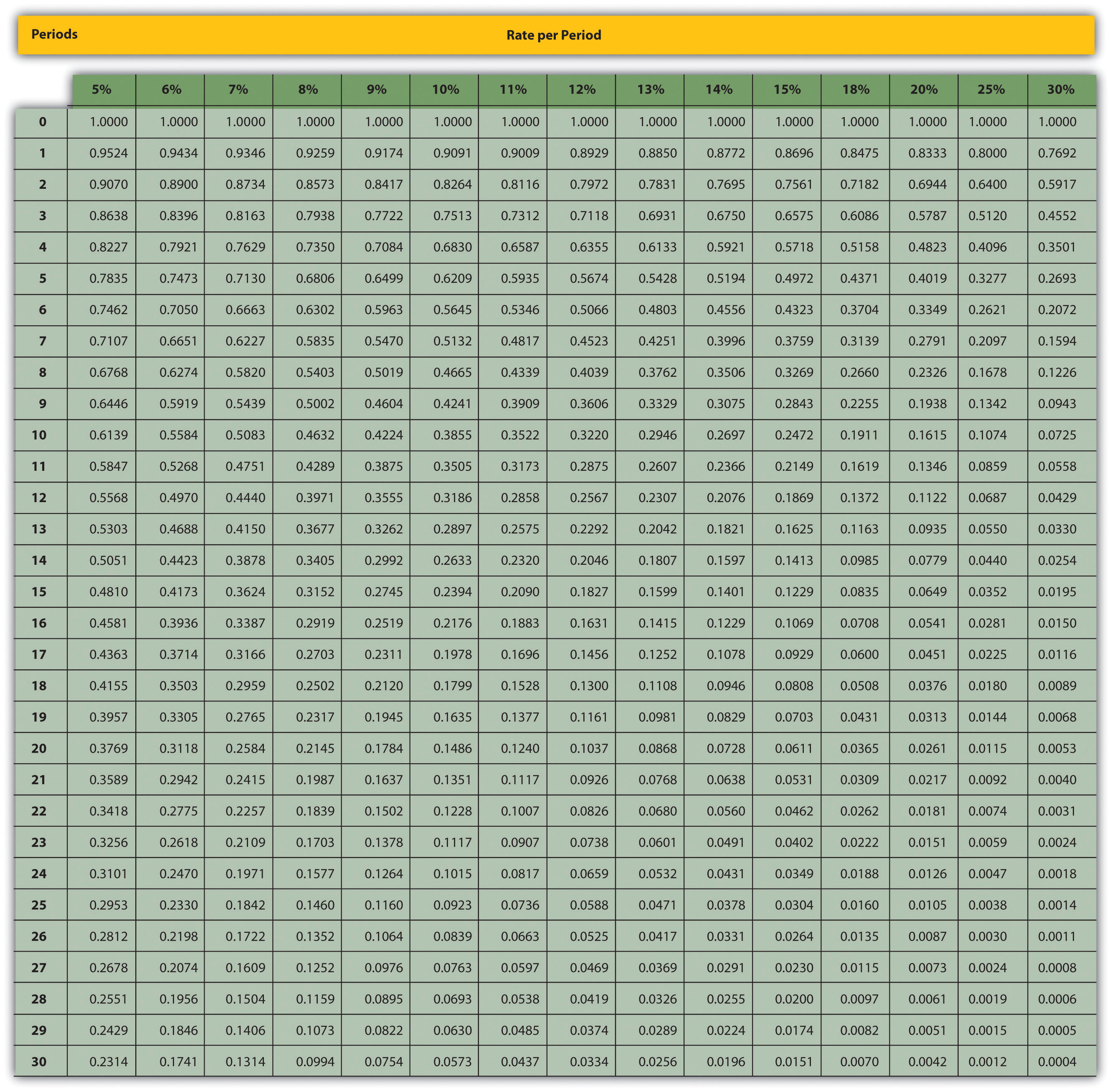

Figure 8.9 Present Value of $1 Received at the End of n Periods

Note:

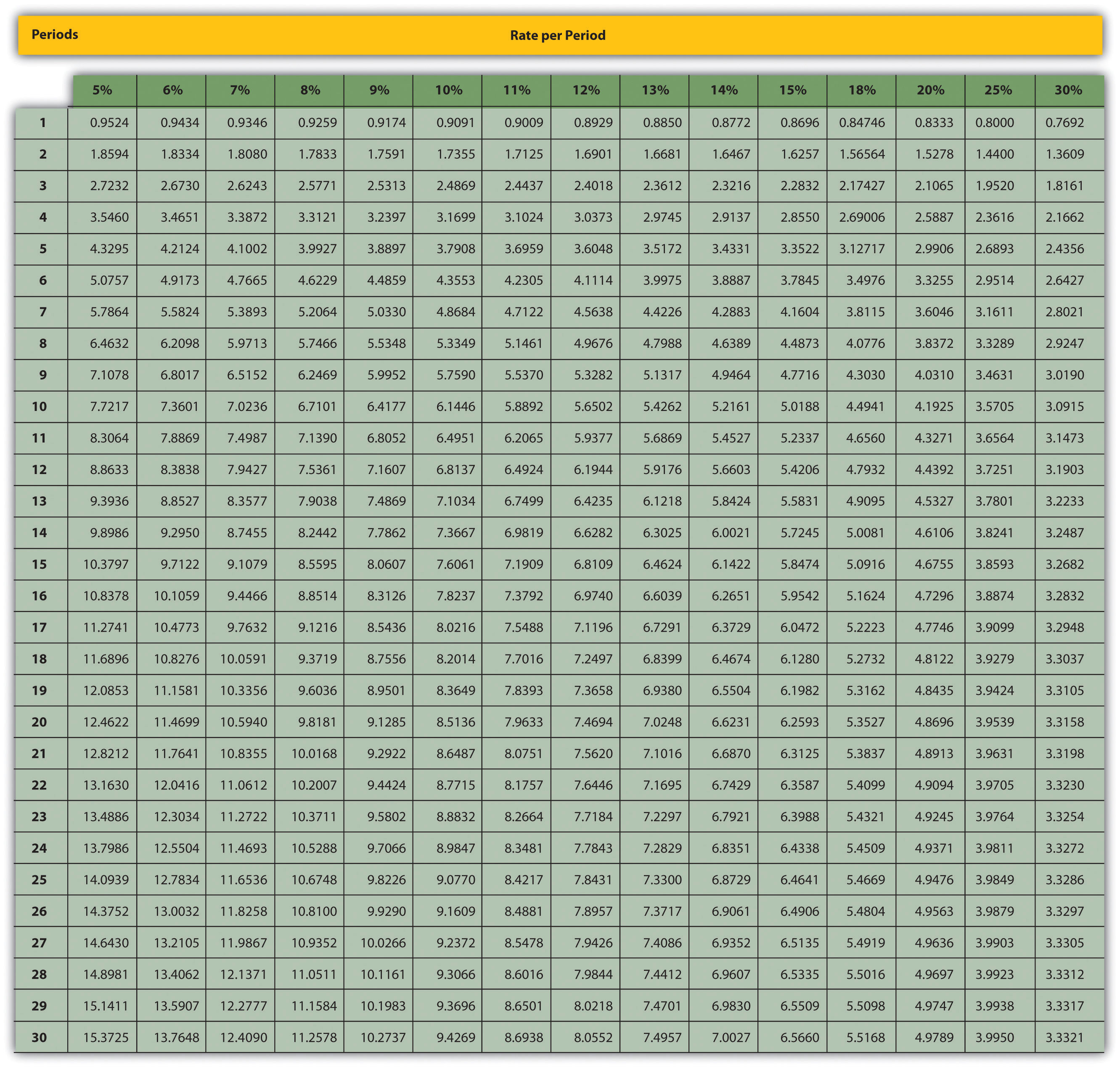

Figure 8.10 Present Value of a $1 Annuity Received at the End of Each Period for n Periods

Note:

End-of-Chapter Exercises

Questions

- What is the difference between capital budgeting decisions covered in this chapter and management decisions covered in Chapter 7 "How Are Relevant Revenues and Costs Used to Make Decisions?"?

- What concept must be considered when looking at cash flows over several years for a long-term investment? Explain.

- What is meant by the term present value?

- What is the formula used to calculate the present value of a future cash flow? Describe each component.

- Describe the three steps required to evaluate investments using the net present value method.

- How do most firms establish the required rate of return used to calculate the net present value?

- What is meant by the term internal rate of return? Explain the IRR decision rule?

- For the purpose of calculating net present value and internal rate of return, do companies use the accrual basis of accounting? Explain.

- Why might a firm choose to accept a long-term investment even if the net present value is below zero?

- What might cause a manager to reject a long-term investment even though the net present value is positive?

- Describe the two steps required to calculate net present value and internal rate of return when using Excel.

- What is the payback method, and why do managers use this method?

- What are the two weaknesses associated with the payback method?

- Refer to Note 8.30 "Business in Action 8.4" What method of evaluating long-term investments is most popular? Why do you think the payback method is the least-used method?

- What does the term working capital refer to, and how does working capital affect the evaluation of long-term investments?

- Assume a company pays income taxes. How are revenue and expense cash flows adjusted for income taxes when calculating the net present value?

- Assume a company pays income taxes. How does depreciation expense affect cash flows even though it is a noncash expense?

Brief Exercises

- Investment Decision at Jackson’s Quality Copies. Refer to the dialogue at Jackson’s Quality Copies presented at the beginning of the chapter. What is Julie Jackson proposing? What information did Mike, the accountant, get from Julie to evaluate the proposal?

-

Present Value Calculations. For each of the following independent scenarios, use Figure 8.9 "Present Value of $1 Received at the End of " in the appendix to calculate the present value of the cash flow described.

- $10,000 will be received 4 years from today. The rate is 10 percent.

- $10,000 will be received 4 years from today. The rate is 20 percent.

- $50,000 will be received 15 years from today. The rate is 12 percent.

- $50,000 will be received 15 years from today. The rate is 6 percent.

-

Present Value Calculations (Annuities). For each of the following independent scenarios, use Figure 8.10 "Present Value of a $1 Annuity Received at the End of Each Period for " in the appendix to calculate the present value of the cash flow described. Round to the nearest dollar.

- $1,000 will be received at the end of each year for 6 years. The rate is 12 percent.

- $1,000 will be received at the end of each year for 6 years. The rate is 15 percent.

- $10,000 will be received at the end of each year for 6 years. The rate is 7 percent.

- $250,000 will be received at the end of each year for 4 years. The rate is 10 percent.

-

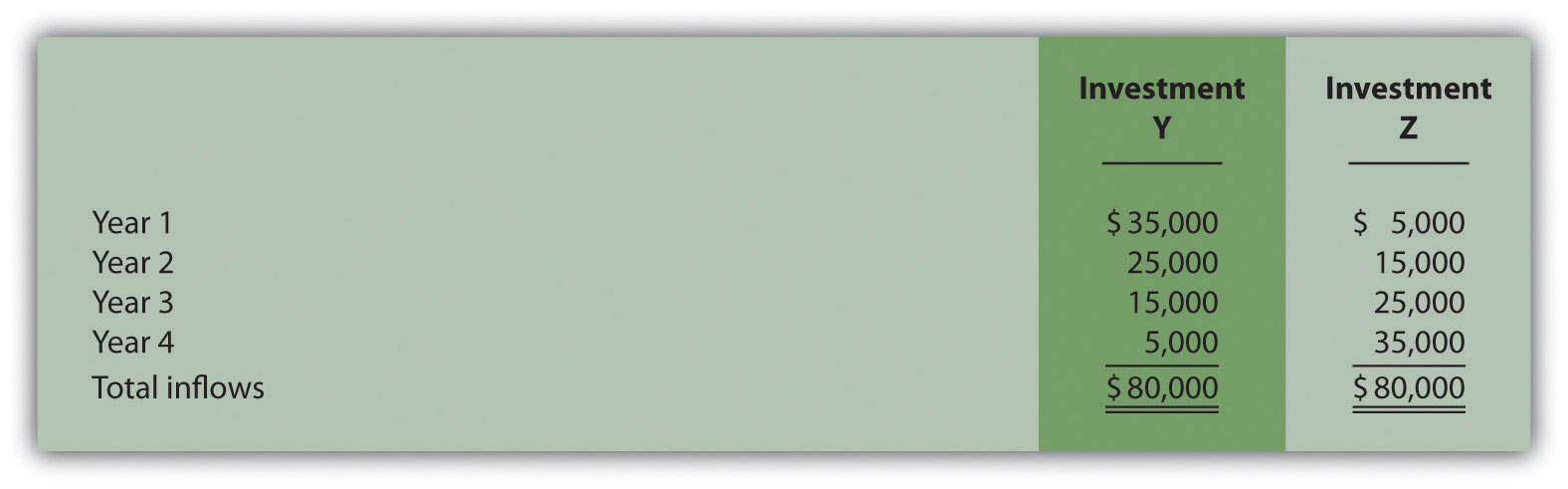

Net Present Value Calculations. Freefall, Inc., has two independent investment opportunities, each requiring an initial investment of $65,000. The company’s required rate of return is 8 percent. The cash inflows for each investment are provided as follows.

Required:

- Without resorting to calculations, which investment will have the highest net present value? Explain.

- Calculate the net present value for each investment (remember to include the initial investment cash outflow in your calculation). Should the company invest in either investment? Round to the nearest dollar.

- Internal Rate of Return Calculation. An investment costing $50,000 today will result in cash savings of $5,000 per year for 15 years. Use trial and error to approximate the internal rate of return for this investment proposal.

- Evaluating Qualitative Factors. Chem, Inc., produces chemical products. The company recently decided to invest in expensive pollution control devices even though the negative net present value pointed toward rejecting this investment. What qualitative factor likely led the company to make the investment in spite of the negative net present value?

-

Ethical Issues in Making a Capital Budgeting Decision. Assume the manager of a store earns an annual bonus based on meeting a certain level of net income, which has been achieved consistently over the past five years. The company is currently considering the addition of a second store, which is expected to become profitable after two years. The manager is responsible for making the final decision whether the second store should be opened and would receive an annual bonus only if a certain level of net income were achieved for both stores combined.

Why might the manager refuse to invest in the new store even though the investment is projected to achieve a return greater than the company’s required rate of return?

- Net Present Value Calculation Using Excel. An investment costing $200,000 today will result in cash savings of $85,000 per year for 3 years. The company’s required rate of return is 11 percent. Use Excel to calculate the net present value of this investment in a format similar to the one in the Computer Application box in the chapter.

- Payback Period Calculation. Textile Services, Inc., plans to invest $80,000 in a new machine. Annual cash inflows from this investment will be $25,000, and annual cash outflows will be $5,000. Determine the payback period for this investment.

- Net Present Value Analysis with Multiple Investments. A project requiring an investment of $20,000 today and $10,000 one year from today, will result in cash savings of $4,000 per year for 15 years. Find the net present value of this investment using a rate of 10 percent. Round to the nearest dollar.

- Net Present Value Calculation with Taxes. An investment costing $200,000 today will result in cash savings of $85,000 per year for 3 years. The company has a tax rate of 40 percent, and requires an 11 percent rate of return. Find the net present value of this investment using the format shown in Figure 8.7 "NPV Calculation with Income Taxes for Scientific Products, Inc.". Round to the nearest dollar.

Exercises: Set A

-

Net Present Value Analysis. Architect Services, Inc., would like to purchase a blueprint machine for $50,000. The machine is expected to have a life of 4 years, and a salvage value of $10,000. Annual maintenance costs will total $14,000. Annual savings are predicted to be $30,000. The company’s required rate of return is 11 percent.

Required:

- Ignoring the time value of money, calculate the net cash inflow or outflow resulting from this investment opportunity.

- Find the net present value of this investment using the format presented in Figure 8.2 "NPV Calculation for Copy Machine Investment by Jackson’s Quality Copies".

- Should the company purchase the blueprint machine? Explain.

-

Internal Rate of Return Analysis. Architect Services, Inc., would like to purchase a blueprint machine for $50,000. The machine is expected to have a life of 4 years, and a salvage value of $10,000. Annual maintenance costs will total $14,000. Annual savings are predicted to be $30,000. The company’s required rate of return is 11 percent (this is the same data as the previous exercise).

Required:

- Use trial and error to approximate the internal rate of return for this investment proposal. Round to the nearest dollar.

- Should the company purchase the blueprint machine? Explain.

- Payback Period Calculation. Architect Services, Inc., would like to purchase a blueprint machine for $50,000. The machine is expected to have a life of 4 years, and a salvage value of $10,000. Annual maintenance costs will total $14,000. Annual savings are predicted to be $30,000 (this is the same data as the previous exercise). Determine the payback period for this investment using the format shown in Table 8.1 "Calculating the Payback Period for Jackson’s Quality Copies".

-

Net Present Value Analysis with Multiple Investments, Alternative Format. Conway Construction Corporation would like to purchase a fleet of trucks at a cost of $260,000. Additional equipment needed to maintain the fleet of trucks will be purchased at the end of year 2 for $40,000. The trucks are expected to have a life of 8 years, and a salvage value of $20,000. Annual costs for maintenance, insurance, and other cash expenses will total $42,000. Annual net cash receipts resulting from this purchase are predicted to be $135,000. The company’s required rate of return is 14 percent.

Required:

- Find the net present value of this investment using the format presented in Figure 8.4 "Alternative NPV Calculation for Jackson’s Quality Copies".

- Should the company purchase the new fleet of trucks? Explain.

-

Calculating NPV and IRR Using Excel. Wood Products Company would like to purchase a computerized wood lathe for $100,000. The machine is expected to have a life of 5 years, and a salvage value of $5,000. Annual maintenance costs will total $20,000. Annual net cash receipts resulting from this machine are predicted to be $45,000. The company’s required rate of return is 15 percent.

Required:

- Use Excel to calculate the net present value and internal rate of return in a format similar to the Computer Application spreadsheet shown in the chapter.

- Should the company purchase the wood lathe? Explain.

-

Net Present Value Analysis with Taxes. Timberline Company would like to purchase a new machine for $100,000. The machine will have a life of 5 years with no salvage value, and is expected to generate annual cash revenue of $50,000. Annual cash expenses, excluding depreciation, will total $24,000. The company uses the straight-line depreciation method, has a tax rate of 40 percent, and requires a 12 percent rate of return.

Required:

- Find the net present value of this investment using the format presented in Figure 8.7 "NPV Calculation with Income Taxes for Scientific Products, Inc.". Round to the nearest dollar.

- Should the company purchase the machine? Explain.

Exercises: Set B

-

Net Present Value Analysis. Wood Products Company would like to purchase a computerized wood lathe for $100,000. The machine is expected to have a life of 5 years, and a salvage value of $5,000. Annual maintenance costs will total $20,000. Annual net cash receipts resulting from this machine are predicted to be $45,000. The company’s required rate of return is 15 percent.

Required:

- Ignoring the time value of money, calculate the net cash inflow or outflow resulting from this investment opportunity.

- Find the net present value of this investment using the format presented in Figure 8.2 "NPV Calculation for Copy Machine Investment by Jackson’s Quality Copies". Round to the nearest dollar.

- Should the company purchase the wood lathe? Explain.

-

Internal Rate of Return Analysis. Wood Products Company would like to purchase a computerized wood lathe for $100,000. The machine is expected to have a life of 5 years, and a salvage value of $5,000. Annual maintenance costs will total $20,000. Annual net cash receipts resulting from this machine are predicted to be $45,000. The company’s required rate of return is 15 percent (this is the same data as the previous exercise).

Required:

- Use trial and error to approximate the internal rate of return for this investment proposal.

- Should the company purchase the wood lathe? Explain.

- Payback Period Calculation. Wood Products Company would like to purchase a computerized wood lathe for $100,000. The machine is expected to have a life of 5 years, and a salvage value of $5,000. Annual maintenance costs will total $20,000. Annual net cash receipts resulting from this machine are predicted to be $45,000. The company’s required rate of return is 15 percent (this is the same data as the previous exercise). Determine the payback period for this investment using the format shown in Table 8.1 "Calculating the Payback Period for Jackson’s Quality Copies".

-

Net Present Value Analysis and Qualitative Factors, Alternative Format. Pete’s Plumbing Supplies would like to expand into a new warehouse at a cost of $500,000. The warehouse is expected to have a life of 20 years, and a salvage value of $100,000. Annual costs for maintenance, insurance, and other cash expenses will total $60,000. Annual net cash receipts resulting from this expansion are predicted to be $115,000. The company’s required rate of return is 12 percent.

Required:

- Find the net present value of this investment using the format presented in Figure 8.4 "Alternative NPV Calculation for Jackson’s Quality Copies". Round to the nearest dollar.

- Should the company purchase the new warehouse? Explain.

- Provide one qualitative factor that might cause the company to reach a different conclusion than the one reached in requirement b.

-

Calculating NPV and IRR Using Excel. Pete’s Plumbing Supplies would like to expand into a new warehouse at a cost of $500,000. The warehouse is expected to have a life of 20 years, and a salvage value of $100,000. Annual costs for maintenance, insurance, and other cash expenses will total $60,000. Annual net cash receipts resulting from this expansion are predicted to be $115,000. The company’s required rate of return is 12 percent.

Required:

- Use Excel to calculate the net present value and internal rate of return in a format similar to the Computer Application spreadsheet shown in the chapter.

- Should the company purchase the warehouse? Explain.

-

Net Present Value Analysis with Taxes. Quality Chocolate, Inc., would like to purchase a new machine for $200,000. The machine will have a life of 4 years with no salvage value, and is expected to generate annual cash revenue of $90,000. Annual cash expenses, excluding depreciation, will total $10,000. The company uses the straight-line depreciation method, has a tax rate of 30 percent, and requires a 14 percent rate of return.

Required:

- Find the net present value of this investment using the format presented in Figure 8.7 "NPV Calculation with Income Taxes for Scientific Products, Inc.". Round to the nearest dollar.

- Should the company purchase the machine? Explain.

Problems

-

Evaluating Alternative Investments. Washington Brewery has two independent investment opportunities to purchase brewing equipment so the company can meet growing customer demand. The first option (equipment A) requires an initial investment of $230,000 for equipment with an expected life of 5 years and a salvage value of $20,000. The second option (equipment B) requires an initial investment of $120,000 for equipment with an expected life of 4 years and a salvage value of $15,000. The company’s required rate of return is 10 percent. Additional cash flow information for each investment is provided as follows.

Year 1 Year 2 Year 3 Year 4 Year 5 Equipment A Utility savings $ 12,000 $ 14,000 $ 15,000 $ 16,000 $ 17,000 Additional revenue 45,000 48,000 50,000 55,000 60,000 Maintenance costs (5,000) (8,000) (10,000) (13,000) (16,000) Equipment B Utility savings $ 8,000 $ 9,000 $ 10,000 $ 10,000 - Additional revenue 35,000 36,000 38,000 42,000 - Maintenance costs (6,000) (8,000) (9,000) (11,000) - Required:

- Calculate the net present value for each investment using the format presented in Figure 8.2 "NPV Calculation for Copy Machine Investment by Jackson’s Quality Copies". (Remember to include the initial investment cash outflow and salvage value in your calculation.) Round to the nearest dollar.

- Which, if any, investment is preferable? Explain.

-

Net Present Value, Internal Rate of Return, and Payback Period Analyses. Sherwin Moore Paint Company would like to further automate its production process by purchasing production equipment for $660,000. The equipment is expected to have a useful life of 8 years, and will be sold at the end of 8 years for $40,000. The equipment requires significant maintenance work at an annual cost of $75,000. Labor and material cost savings, shown in the table, are also expected to be significant.

Year 1 $160,000 Year 2 $190,000 Year 3 $200,000 Year 4 $240,000 Year 5 $280,000 Year 6 $220,000 Year 7 $180,000 Year 8 $155,000 The company’s required rate of return is 11 percent. Assume the company requires all investments to be recovered within five years.

Required:

- Find the net present value of this investment using the format presented in Figure 8.2 "NPV Calculation for Copy Machine Investment by Jackson’s Quality Copies". Round to the nearest dollar.

- Use trial and error to approximate the internal rate of return for this investment proposal.

- Determine the payback period for this investment using the format shown in Table 8.1 "Calculating the Payback Period for Jackson’s Quality Copies".

- Based on your findings in requirements a, b, and c, should the company purchase the production equipment? Explain.

-

Calculating NPV and IRR Using Excel. Sherwin Moore Paint Company would like to further automate its production process by purchasing production equipment for $660,000. The equipment is expected to have a useful life of 8 years, and will be sold at the end of 8 years for $40,000. The equipment requires significant maintenance work at an annual cost of $75,000. Labor and material cost savings, shown in the table, are also expected to be significant.

Year 1 $160,000 Year 2 $190,000 Year 3 $200,000 Year 4 $240,000 Year 5 $280,000 Year 6 $220,000 Year 7 $180,000 Year 8 $155,000 The company’s required rate of return is 11 percent.

Required:

- Use Excel to calculate the net present value and internal rate of return in a format similar to the Computer Application spreadsheet shown in the chapter.

- Should the company purchase the production equipment? Explain.

-

Net Present Value Analysis, Multiple Investments, and Qualitative Factors. Oil Production, Inc., would like to drill oil from land the company already owns. The equipment is expected to cost $4,000,000, has a useful life of 5 years, and will be sold at the end of 5 years for $400,000. Annual costs for maintenance and other cash expenses will total $550,000. Annual net cash receipts resulting from the sale of oil are predicted to be $1,900,000. Working capital of $270,000 is required at the beginning of the project and will be returned at the end of 5 years. The equipment will require refurbishing at the end of year 3 at a cost of $300,000. Although the company’s cost of capital is 15 percent, management established a required rate of return of 20 percent due to the high risk associated with this project.

Required:

- Find the net present value of this investment using the format presented in Figure 8.4 "Alternative NPV Calculation for Jackson’s Quality Copies". Round to the nearest dollar.

- Use trial and error to approximate the internal rate of return for this investment proposal.

- Should the company accept the proposal? Explain.

- What qualitative factors might improve management’s view of this proposal?

-

Calculating NPV and IRR Using Excel. Oil Production, Inc., would like to drill oil from land the company already owns. The equipment is expected to cost $4,000,000, has a useful life of 5 years, and will be sold at the end of 5 years for $400,000. Annual costs for maintenance and other cash expenses will total $550,000. Annual net cash receipts resulting from the sale of oil are predicted to be $1,900,000. Working capital of $270,000 is required at the beginning of the project and will be returned at the end of 5 years. The equipment will require refurbishing at the end of year 3 at a cost of $300,000. Although the company’s cost of capital is 15 percent, management established a required rate of return of 20 percent due to the high risk associated with this project.

Required:

- Use Excel to calculate the net present value and internal rate of return in a format similar to the Computer Application spreadsheet shown in the chapter.

- Should the company accept the proposal? Explain.

-

Net Present Value, Internal Rate of Return, and Payback Period Analyses; Ethical Issues. Tower CD Stores would like to open a retail store in Houston. The initial investment to purchase the building is $420,000, and an additional $50,000 in working capital is required. Since this store will be operating for many years, the working capital will not be returned in the near future. Tower expects to remodel the store at the end of 3 years at a cost of $100,000. Annual net cash receipts from daily operations (cash receipts minus cash payments) are expected to be as follows.

Year 1 $ 80,000 Year 2 $115,000 Year 3 $118,000 Year 4 $140,000 Year 5 $155,000 Year 6 $167,000 Year 7 $175,000 The company’s required rate of return is 13 percent. Assume management decided to limit the analysis to 7 years.

Required:

- Find the net present value of this investment using the format presented in Figure 8.2 "NPV Calculation for Copy Machine Investment by Jackson’s Quality Copies". Round to the nearest dollar.

- Use trial and error to approximate the internal rate of return for this investment proposal.

- Based on your answer to requirements a and b, should Tower open the new store? Explain.

- Use the format presented in Table 8.1 "Calculating the Payback Period for Jackson’s Quality Copies" to calculate the payback period (include working capital in the initial investment). Assuming management requires all investments to be recovered within three years, should Tower CD Store open the new store?

- What is the weakness of using the payback period method to evaluate long-term investments?

- Assume the manager of the company wanted to live in Houston and intentionally inflated the projected annual cash receipts so that the proposal would be accepted. The proposal would otherwise have been rejected. Explain how the company’s use of a postaudit would help to prevent this type of unethical behavior.

-

Net Present Value with Taxes. Refer to the Tower CD Stores information presented in the previous problem. Assume the costs associated with the purchase of the building are depreciated over 20 years using the straight-line method, with no salvage value. Costs associated with the building remodel are depreciated over 10 years with no salvage value, starting with year 4. The company’s tax rate is 40 percent. Again, management will limit the analysis to seven years.

Required:

- Find the net present value of this investment using the format presented in Figure 8.7 "NPV Calculation with Income Taxes for Scientific Products, Inc.". Round to the nearest dollar.

- Should Tower open the new store? Explain.

- How did income taxes affect the decision being made by Tower CD Stores?

One Step Further: Skill-Building Cases

- Opening New Retail Stores. Refer to Note 8.5 "Business in Action 8.1" Provide two examples of cash outflows and one example of cash inflows resulting from the decision to open a new store.

- Determining the Cost of Capital by Industry. Refer to the Note 8.13 "Business in Action 8.2" Why do you think the cost of capital in the beverage industry is low relative to the cost of capital in other industries?

- The California Lottery and Present Value Concepts. Refer to the Note 8.15 "Business in Action 8.3" Why does the State of California need only $550,000 to pay a $1,000,000 lottery winner?

-

Internet Project: Capital Expenditures at Intel. Go to Intel’s Web site (http://www.intel.com) and enter “annual report” or “10K report” in the search feature. Find the most recent annual report or 10K report and review the Consolidated Statements of Cash Flows portion of the company’s financial statements. Find the Additions to property, plant and equipment line item in the Investing Activities section of the statement, and answer the following questions. Be sure to submit a printed copy of the consolidated statements of cash flows with your answers.

- How much cash did Intel spend on additions to property, plant, and equipment in the most current year? How does this amount compare with amounts spent in the previous two years?

- Describe two capital budgeting decision techniques that were likely used by Intel to make long-term investment decisions.

-

Group Activity: Qualitative Factors. Each of the following scenarios is being considered at three separate companies.

- A large regional energy company uses coal to produce electricity that is sold to local power companies. Although government regulations will not require a cleaner process for at least five years, the company is considering spending millions of dollars on equipment that will reduce pollutants from its production process. However, the net present value analysis indicates this proposal should be rejected.

- A producer of mountain bikes known for its expensive, high-quality bikes would like to introduce a less expensive entry-level line of mountain bikes. However, the projected internal rate of return for this proposal is lower than the company’s minimum required rate of return.

-

A maker of computer chips with a reputation of staying on the cutting edge of technology would like to invest in a new production facility. However, the net present value analysis indicates this proposal should be rejected.

Required:

Your instructor will divide the class into groups of two to four students, and assign one of the three independent scenarios listed previously to each group. Each group must perform the requirements listed here:

- Identify at least two qualitative factors that may lead to accepting the proposal.

- Discuss each option, based on the findings of your group, with the class.

Comprehensive Cases

-

Ethical Issues in Capital Budgeting. Loomis Nursery grows a variety of plants for wholesale distribution. The company would like to expand its operations and is considering a move to one of two locations. The first location, Wyatville, is one hour from the ocean and therefore attractive for employees who like to travel on weekends. The second location, Kenton, is not as close to the ocean, and much further from desirable vacation destinations.

The company’s controller, Lisa Lennox, created a net present value analysis for each location. The Kenton location had a positive net present value, and the Wyatville location had a negative net present value. Upon providing this information to the chief financial officer of the company, Max Madden, Lisa was asked to “review the numbers carefully and make sure all the benefits of moving to Wyatville were included in the analysis.” Lisa knew that Max preferred vacationing near the ocean and had a strong desire to move operations to Wyatville. However, she was unable to find any errors in her analysis and could not identify any additional benefits.

Lisa approached Max with this information. Max responded, “There is no way Kenton should have a higher net present value than Wyatville. Redo your analysis to show that Wyatville has the highest net present value, and have it on my desk by the end of the week.”

Required:

- Is Max Madden’s request ethical? Explain.

- How should Lisa handle this situation? (It may be helpful to review the presentation of ethics in Chapter 1 "What Is Managerial Accounting?".)

-

Ethical Issues in Capital Budgeting. Toyonda Motor Company produces a variety of products including motorcycles, all-terrain vehicles, marine engines, automobiles, light trucks, and heavy-duty trucks. Each division manager at Toyonda Motor Company is paid a base salary and is given an annual cash bonus if the division achieves profits of at least 10 percent of the value of assets invested in the division (this is called return on investment).

Peggy Parkins, manager of the Light Truck Division, is considering investing in new production equipment. The net present value of the proposal is positive, and Peggy is convinced the new equipment will provide a competitive edge in future years. However, because of the significant up-front cost and related depreciation, short-term profits will be negatively affected by this investment. In fact, the new equipment will reduce return on investment below the 10 percent threshold for at least 3 years, which will prevent Peggy from receiving her annual bonuses for at least 3 years. However, profits are expected to increase significantly after the three-year period. Peggy is planning to retire in two years and therefore would prefer to reject the proposal to invest in new production equipment.

Required:

- Describe the ethical conflict facing Peggy Parkins.

- What type of employee compensation system might prevent this type of conflict?