This is “How Do Organizations Identify Cost Behavior Patterns?”, chapter 5 from the book Accounting for Managers (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 5 How Do Organizations Identify Cost Behavior Patterns?

© Thinkstock

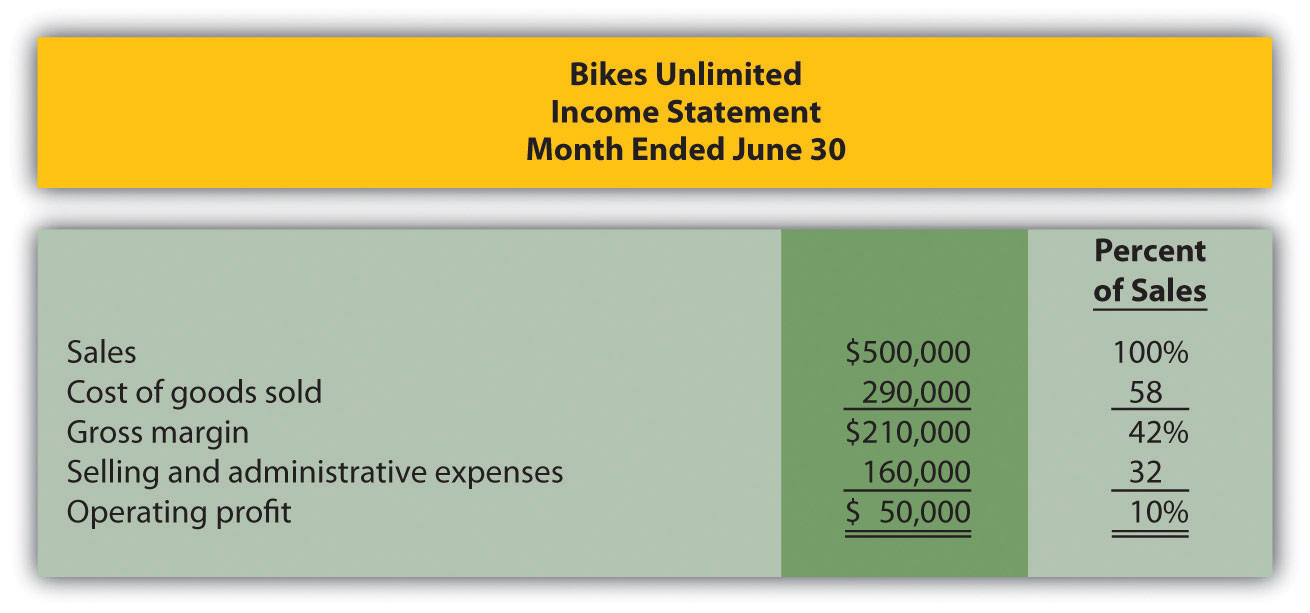

Eric Mendez is the chief financial officer (CFO) of Bikes Unlimited, a company that produces mountain bikes and sells them to retail bicycle stores. Bikes Unlimited obtains the bulk of its parts from outside suppliers and assembles them into the mountain bikes prior to shipment. Last month (June), Bikes Unlimited sold 5,000 mountain bikes for $100 each. Last month’s income statement shows total revenue of $500,000 and operating profit of $50,000:

Susan Wesley is Bikes Unlimited’s cost accountant. Planning for July was completed during June. Senior management is now planning for next month (August) and has asked Eric, the CFO, to obtain some vital financial information for budgeting purposes. Eric arranged a meeting with Susan to discuss the August budget.

| Eric: | As you know, we are in the middle of our planning for next month. The senior management group asked me to make some projections based on expected changes to our sales next month. |

| Susan: | Where do you think sales are headed? |

| Eric: | We expect unit sales to increase 10 percent, perhaps 20 percent if all goes well. |

| Susan: | If sales increase 10 percent, I would expect profit to increase by more than 10 percent since some costs are fixed. |

| Eric: | Sounds reasonable. What’s the next step to get a reasonable estimate of profit? |

| Susan: | First, we have to identify how costs behave with changes in sales and production—whether the costs are variable, fixed, or some other type. Then we can set up the income statement in a contribution margin format and determine if the numbers are within the relevant range. |

| Eric: | Perhaps you and your staff can discuss this and get me some accurate estimates. |

| Susan: | I’ll meet with them tomorrow and should have some information for you within a few days. |