This is “Variations of Activity-Based Costing (ABC)”, section 3.6 from the book Accounting for Managers (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

3.6 Variations of Activity-Based Costing (ABC)

Learning Objective

- Expand the use of activity-based costing.

Question: The primary focus of activity-based costing thus far has been on allocating manufacturing overhead costs to products. Although this is important for external reporting purposes, we can expand ABC to include costs beyond manufacturing overhead. Also, we can organize costs in different ways to help managers evaluate performance. What different approaches can be used to organize cost data in a way that helps managers make better decisions?

Answer: Cost data can be organized in a number of ways to help managers make decisions. Four common approaches are addressed in this section:

- Expanding ABC to include nonmanufacturing costs

- Allocating service department costs to production departments

- Using the hierarchy of costs to organize cost information

- Measuring the costs of controlling and failing to control quality

External Reporting and Internal Decision Making

Question: U.S. Generally Accepted Accounting Principles require the allocation of all manufacturing costs to products for inventory costing purposes. The choice of an allocation method is not critical to this process. Companies that use direct labor hours, machine hours, activity-based costing, or some other method to allocate overhead costs to products are likely to be in compliance with U.S. GAAP. Throughout this chapter, we have illustrated how ABC is used to allocate manufacturing overhead costs. However, organizations often use ABC for purposes that go beyond allocating costs solely for external reporting. How might ABC be used to help companies in areas other than external reporting?

Answer: Commissions paid to sales people for the sale of specific products (often called selling, general, and administrative) are included as an operating expense in financial reports prepared for external users as required by U.S. GAAP. However, many organizations may assign commission costs to specific products for internal decision-making purposes. This treatment is not in compliance with U.S. GAAP, but it is perfectly acceptable for internal reporting purposes and may be done using activity-based costing. It is important to understand that managers have ultimate control over which costs should be allocated to products for internal reporting purposes, and this allocation often involves going beyond overhead costs.

Table 3.1 "Examples of Costs Allocated to Products" provides examples of costs that could be allocated to products. It also includes cost categories—product, selling, and general and administrative (G&A)—and indicates whether the cost allocation complies with U.S. GAAP for external reporting. As you can see in the far right column, all costs can be allocated to products for internal reporting purposes.

Table 3.1 Examples of Costs Allocated to Products

| Cost | Cost Category* | OK to Allocate to Products for External Reporting (U.S. GAAP)? | OK to Allocate to Products for Internal Reporting? |

|---|---|---|---|

| Direct materials | Product | Yes | Yes |

| Direct labor | Product | Yes | Yes |

| Manufacturing overhead** | Product | Yes | Yes |

| Sales commissions | Selling | No | Yes |

| Shipping products to customers | Selling | No | Yes |

| Product advertising | Selling | No | Yes |

| Legal costs for product lawsuit | G&A | No | Yes |

| Processing payroll for production personnel | G&A | No | Yes |

| Company president’s salary | G&A | No | Yes |

| Costs of implementing ABC | G&A | No | Yes |

|

*See Chapter 2 "How Is Job Costing Used to Track Production Costs?" for information about category definitions. **Includes all manufacturing costs other than direct labor and direct materials, such as factory related costs for supervisors, building rent, machine maintenance, utilities, and indirect materials. See Chapter 2 "How Is Job Costing Used to Track Production Costs?" for more detail. |

|||

Allocating Service Department Costs Using the Direct Method

Question: Most companies have departments that are classified as either service departments or production departments. Service departmentsDepartments that provide services to other departments within a company. provide services to other departments within the company and include such functions as accounting, human resources, legal, maintenance, and computer support. Production departmentsDepartments directly involved with producing goods or providing services for customers. are directly involved with producing goods or providing services for customers and include such functions as ordering materials, assembling products, and performing quality inspections. Why do companies often allocate a share of service department costs to production departments for internal reporting purposes even though U.S. GAAP generally does not allow it for external reporting?

Answer: Companies allocate service department costs to production departments for several reasons:

- The services provided by departments within a company are not free, and they should be used as efficiently as possible. Managers of production departments that use these services thus have an incentive to minimize their use.

- To minimize costs, Hewlett Packard and other large companies often “outsource” services like building maintenance and legal support (i.e., they have other companies provide the services for them). This creates an incentive for the company’s service departments to provide services at a reasonable cost.

- Organizations often include service department costs when determining product costs for internal decision-making purposes, as described earlier (refer to Table 3.1 "Examples of Costs Allocated to Products" for examples).

Question: How do companies allocate service department costs to production departments and how might this be done at SailRite?

Answer: Several methods of allocating service department costs to production departments are available. We introduce the simplest approach—the direct method—here (complex approaches are presented in more advanced cost accounting texts). The direct methodA method of allocating costs that allocates service department costs directly to production departments but not to other service departments. allocates service department costs directly to production departments but not to other service departments.

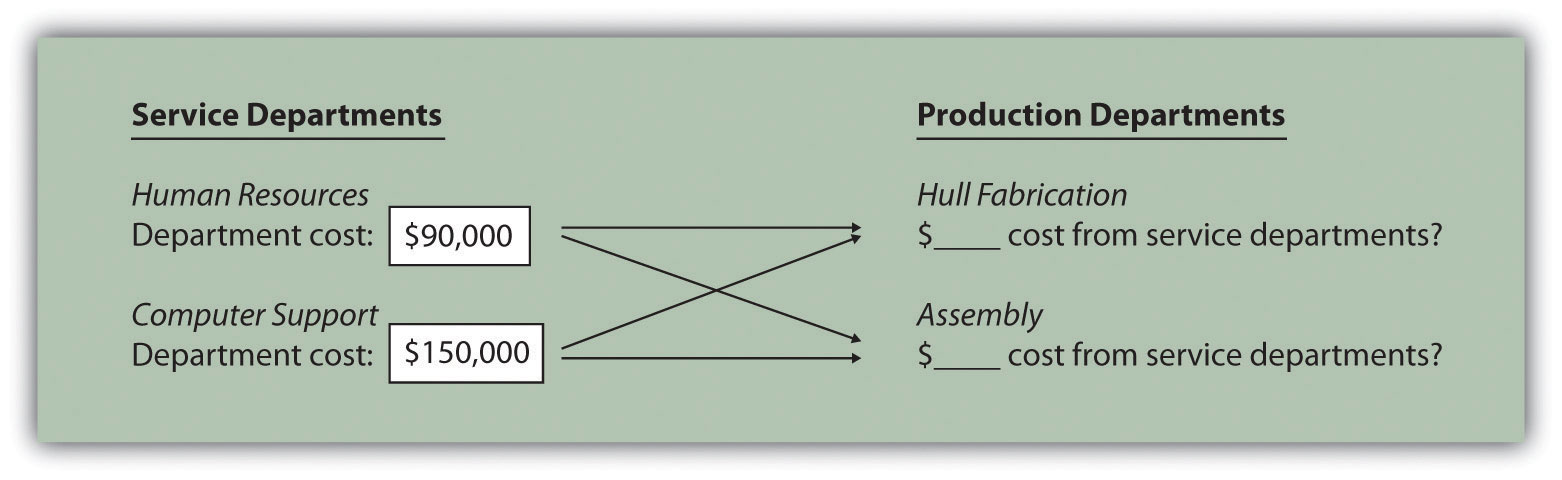

For example, assume that SailRite Company has two service departments—Human Resources and Computer Support. Costs associated with Human Resources and Computer Support total $90,000 and $150,000, respectively. Recall that SailRite has two production departments—Hull Fabrication and Assembly. The goal is to allocate service department costs to the two production departments, as shown in Figure 3.10 "Allocating Service Department Costs to Production Departments at SailRite Company: Direct Method (Before Allocations)".

Figure 3.10 Allocating Service Department Costs to Production Departments at SailRite Company: Direct Method (Before Allocations)

SailRite would like to allocate service department costs using an allocation base that drives these costs. Assume management decides to use the number of employees as the allocation base to allocate Human Resources costs, and the number of computers as the allocation base to allocate Computer Support costs. Allocation base activity for each production department is as follows:

| Hull Fabrication | Assembly | Total | |

| Number of employees | 35 | 85 | 120 |

| Number of computers | 42 | 33 | 75 |

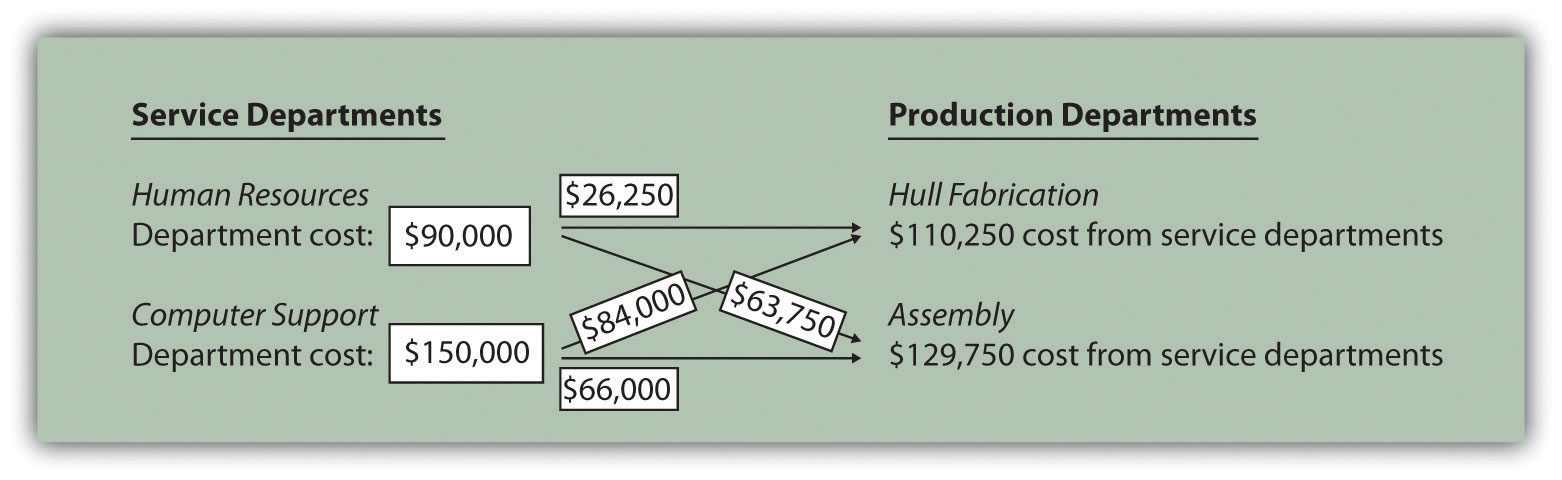

The allocation rate for human resource services is $750 per employee (= $90,000 department costs ÷ 120 employees). The allocation rate for computer support services is $2,000 per computer (= $150,000 ÷ 75 computers). Thus the Hull Fabrication department receives an allocation of $26,250 in human resource costs (= 35 employees × $750 rate) and $84,000 in computer support costs (= 42 computers × $2,000 rate). The Assembly department receives an allocation of $63,750 in human resource costs (= 85 employees × $750 rate) and $66,000 in computer support costs (= 33 computers × $2,000 rate).

The allocations to production departments are shown in Figure 3.11 "Allocating Service Department Costs to SailRite’s Production Departments: Direct Method (After Allocations)". If management chooses to allocate service department costs to production departments as described here, there must be some benefit to going through the process. Should these costs be assigned to activity cost pools for the purpose of costing products (activity-based costing)? Should production department managers be evaluated based on the use of these services? Should actual service department usage be compared to budgeted usage for each production department? The answers to these questions vary from one organization to the next. However, one point is certain—the benefits of implementing this allocation system must outweigh the costs!

Figure 3.11 Allocating Service Department Costs to SailRite’s Production Departments: Direct Method (After Allocations)

The Hierarchy of Costs

Question: Some organizations group activities into four cost categories, called the hierarchy of costs, to help managers form cost pools for activity-based costing purposes. The cost hierarchyA method of costing that groups costs based on whether the activity is at the facility level, product or customer level, batch level, or unit level.Credit for developing the cost hierarchy is generally given to R. Cooper and R. S. Kaplan, “Profit Priorities from Activity-Based Costing,” Harvard Business Review, May 1991, 130–35.groups costs based on whether the activity is at the facility level, product or customer level, batch level, or unit level. What is the difference between each of these categories, and how does this information help managers?

Answer: Each category within the cost hierarchy is described as follows:

- Facility-level activitiesActivities required to sustain facility operations and include items such as building rent and management of the factory. (or costs) are required to sustain facility operations and include items such as building rent and management of the factory. These costs are generally changed over long time horizons and are incurred regardless of how many product-, batch-, or unit-level activities take place.

- Product-level activitiesActivities required to develop, produce, and sell specific types of products. (or customer-level activities) are required to develop, produce, and sell specific types of products. This category includes items such as product development and product advertising. These costs can be changed over a shorter time horizon than facility-level activities and are incurred regardless of the number of batches run or units produced.

- Batch-level activitiesActivities required to produce batches (or groups) of products. are required to produce batches (or groups) of products and include items such as machine setups and quality inspections. These costs can be changed over a shorter time horizon than product- and facility-level activities and are driven by the number of batches run rather than the number of units produced. For example, a batch can consist of producing 5 units or 10,000 units. The costs in this category are driven by the number of batches, not the number of units in each batch.

- Unit-level activitiesActivities required to produce individual units of product, such as direct materials and direct labor. are required to produce individual units of product and include items such as energy to run machines, direct labor, and direct materials. These costs can be changed over a short time horizon based on how many units management chooses to produce.

The cost hierarchy serves as a framework for managers to establish cost pools and determine what drives the change in costs for each cost pool. It also provides a sense of how quickly (or slowly) costs change based on decisions made by management. Examples of activities often identified by companies using activity-based costing, and how these activities fit in the cost hierarchy, appear in Table 3.2 "Cost Hierarchy Examples".

Table 3.2 Cost Hierarchy Examples

| Cost Hierarchy Category | Activity/Cost |

|---|---|

| Facility-level | Plant depreciation |

| Building rent | |

| Management of facility | |

| Product/customer-level | New product development |

| Product engineering | |

| Product marketing and advertising | |

| Maintaining customer records | |

| Batch-level | Machine setups |

| Processing purchase orders | |

| Batch quality inspections | |

| Unit-level | Energy to run production machines |

| Direct labor | |

| Direct materials |

Measuring the Costs of Controlling and Improving Quality

Question: The hierarchy of costs is not the only approach organizations use to group costs. Managers are also concerned about measuring the costs associated with quality. Quality-related costs can be organized into four categories. The first two categories—prevention and appraisal—are costs incurred to control and improve quality. The final two categories—internal failure and external failure—are costs incurred as a result of failing to control and improve quality. What is the difference between these cost categories, and how does this information help managers improve quality?

- Prevention costsCosts for activities that prevent defects in products and services. are costs incurred to prevent defects in products and services. Examples include designing production processes that minimize defects, providing quality training to employees, and inspecting raw materials before they are placed in production.

- Appraisal costsCosts for activities that detect defective products before they are delivered to customers. (often called detection costs) are costs incurred to detect defective products before they are delivered to customers. The cost of finished goods inspections falls in this category.

- Internal failure costsCosts incurred as a result of detecting defective products before they are delivered to customers. are the costs incurred as a result of detecting defective products before they are delivered to customers. Examples include the reworking of defective products, the scrapping of defective products, and the machine downtime resulting from process problems that cause defects.

- External failure costsCosts for activities that result from delivering defective products to customers. are the costs incurred as a result of delivering defective products to customers. Examples include warranty repairs, warranty replacements, and product liability resulting from unsafe defective products.

Companies that measure these costs of quality typically calculate the costs in each category as a percent of total revenue. The goal is to steadily shift costs toward the prevention and appraisal categories and away from the internal and external failure categories. As organizations concentrate more on preventing defects, total quality costs as a percent of revenue tends to decline and product quality improves. Table 3.3 "Summary of Quality Costs" provides a summary of the four classifications of quality-related costs.

Table 3.3 Summary of Quality Costs

| Quality Cost Category | Description |

|---|---|

| Prevention cost | Cost of activities that prevent defects in products, such as quality training and raw materials inspections |

| Appraisal cost | Cost of activities that detect defective products before they are delivered to customers, such as finished goods inspections and field inspections |

| Internal failure cost | Cost of activities that result from detecting defective products before they are delivered to customers, such as rework and scrap |

| External failure cost | Cost of activities that result from delivering defective products to customers, such as warranty repairs and warranty replacements |

Key Takeaway

- Activity-based costing is not simply used to allocate manufacturing overhead costs to products for external reporting purposes; it is also often used to allocate selling, general, and administrative costs to products for internal decision-making purposes. A number of methods can be used to assist in the cost allocation process. For example, the cost of service departments can be allocated to production departments using the direct method. Also the cost hierarchy can be used to help establish cost pools and identify cost drivers used to allocate costs. Organizations are also concerned with measuring and reducing the cost of quality by categorizing quality costs into four categories—prevention, appraisal, internal failure, and external failure.

Review Problem 3.6

Fill in the following table to identify if the cost item can be included in the cost of products for external reporting purposes and/or internal reporting purposes. The first item is completed for you.

| Cost | OK to Allocate to Products for External Reporting (U.S. GAAP)? | OK to Allocate to Products for Internal Reporting? |

| Direct materials | Yes | Yes |

| Salaries of sales people | ||

| Indirect materials used in production | ||

| Rent for headquarters building | ||

| Product promotions | ||

| Direct labor | ||

| Legal costs for patent applications | ||

| Processing payroll for human resource personnel | ||

| Depreciation of factory equipment | ||

| Marketing vice president’s salary | ||

| Depreciation of administrative department equipment |

Solution to Review Problem 3.6

| Cost | OK to Allocate to Products for External Reporting (U.S. GAAP)? | OK to Allocate to Products for Internal Reporting? |

| Direct materials | Yes | Yes |

| Salaries of sales people | No | Yes |

| Indirect materials used in production | Yes | Yes |

| Rent for headquarters building | No | Yes |

| Product promotions | No | Yes |

| Direct labor | Yes | Yes |

| Legal costs for patent applications | No | Yes |

| Processing payroll for human resource personnel | No | Yes |

| Depreciation of factory equipment | Yes | Yes |

| Marketing vice president’s salary | No | Yes |

| Depreciation of administrative department equipment | No | Yes |

End-of-Chapter Exercises

Questions

- Why do managers allocate overhead costs to products?

- Describe the three methods of allocating overhead costs.

- What is a cost pool, and how does it relate to allocating overhead to products?

- What is the difference between an activity and a cost driver?

- How do cost flows using activity-based costing differ from cost flows using one plantwide rate?

- Describe the five steps required to implement activity-based costing.

- What are some advantages of using an activity-based costing system?

- What are some disadvantages of using an activity-based costing system?

- Review Note 3.14 "Business in Action 3.1" What were the two common characteristics of the 130 U.S. manufacturing companies that used activity-based costing?

- Explain how to record the application of overhead to products using activity-based costing.

- Describe the three steps required to implement activity-based management.

- How does activity-based management differ from activity-based costing?

-

What is the difference between a value-added activity and a non-value-added activity? Provide two examples of non-value-added activities for each of the following:

- Fast-food restaurant

- Clothing store

- College bookstore

- Review Note 3.16 "Business in Action 3.2" How did activity-based costing help BuyGasCo Corporation settle its predatory pricing case?

- Review Note 3.23 "Business in Action 3.3" What did the survey of 296 users of ABC and ABM show were the top two objectives in using these systems?

- Review Note 3.26 "Business in Action 3.4" What was management’s primary concern in deciding to implement an activity-based costing system?

- What selling costs and general and administrative costs might be allocated to products using activity-based costing? Why do some managers prefer allocating these costs to products?

- What are service departments? Why do some managers allocate service department costs to production departments?

- Describe the four categories included in the hierarchy of costs.

- What is the difference between a facility-level cost and a unit-level cost?

- How does the hierarchy of costs help managers allocate overhead costs?

- Describe the four categories related to the costs of quality. How might the allocation of quality costs to these four categories help managers?

Brief Exercises

-

Product Costing at SailRite. Refer to the dialogue presented at the beginning of the chapter and the follow-up dialogue before Figure 3.7 "Activity-Based Costing Versus Plantwide Costing at SailRite Company".

Required:

- In the opening dialogue, why was the owner concerned about the product costs for each of the company’s boats?

- In the follow-up dialogue before Figure 3.7 "Activity-Based Costing Versus Plantwide Costing at SailRite Company", what did the company’s accountant discover about the profitability of each boat using activity-based costing? (Refer to Figure 3.7 "Activity-Based Costing Versus Plantwide Costing at SailRite Company" as you prepare your answer.)

-

Calculating Plantwide Predetermined Overhead Rate. Manufacturing overhead costs totaling $5,000,000 are expected for this coming year. The company also expects to use 50,000 direct labor hours and 20,000 machine hours.

Required:

- Calculate the plantwide predetermined overhead rate using direct labor hours as the base. Provide a one-sentence description of how the rate will be used to allocate overhead costs to products.

- Calculate the plantwide predetermined overhead rate using machine hours as the base. Provide a one-sentence description of how the rate will be used to allocate overhead costs to products.

-

Calculating Department Predetermined Overhead Rates. Manufacturing overhead costs totaling $1,000,000 are expected for this coming year—$400,000 in the Assembly department and $600,000 in the Finishing department. The Assembly department expects to use 4,000 machine hours, and the Finishing department expects to use 30,000 direct labor hours.

Required:

- Assume this company uses the department approach for allocating overhead costs. Calculate the predetermined overhead rate for each department, and explain how these rates will be used to allocate overhead costs to products.

- Why do different departments use different allocation bases (e.g., direct labor hours or machine hours)?

-

Identifying Cost Drivers. Ehrman Company identified the activities listed in the following as being most important (step 1 and step 2 of activity-based costing), and it formed cost pools for each activity.

- Purchasing raw materials

- Inspecting raw materials

- Storing raw materials

- Maintaining production equipment

- Setting up machines to produce batches of product

- Testing finished products

Required:

Perform step 3 of the activity-based costing process by identifying a possible cost driver for each activity.

-

Identifying Cost Drivers: Service Company. McHale Architects, Inc., designs, engineers, and supervises the construction of custom homes. The following activities were identified as being most important (step 1 and step 2 of activity-based costing), and cost pools were formed for each activity.

- Meeting with customers

- Coordinating inspections with the building department

- Consulting with contractors

- Maintaining office equipment

- Processing customer billings (invoices)

Required:

Perform step 3 of the activity-based costing process by identifying a possible cost driver for each activity.

-

Value-Added and Non-Value-Added Activities. Novak Corporation manufactures custom-made kayaks and accessories. The company performs the following activities.

- Storing parts and materials

- Queuing orders before beginning production

- Assembling kayaks

- Waiting for materials to arrive to continue production

- Painting kayaks

- Designing kayaks to maximize comfort

- Scrapping defective materials

Required:

Label each activity as value-added or non-value-added.

-

Allocation Base for Service Departments. Valencia Company has 15 production departments and produces hundreds of products. Service department costs are allocated to production departments using the direct method. Five service departments provide the following services to the production departments.

- The Computer Technology department provides computer support.

- The Personnel department posts job openings, hires employees, and coordinates employee benefits.

- The Accounting department processes accounting data, provides financial reports, and performs general accounting duties.

- The Maintenance department maintains buildings and equipment.

- The Legal department provides legal services.

Required:

- For each service department, provide a possible allocation base. Explain why the base you chose for each service department is reasonable.

- Does the direct method provide for allocations from one service department to another? Explain.

Exercises: Set A

-

Plantwide Versus Department Allocations of Overhead. San Juan Company expects to incur $600,000 in overhead costs this coming year—$100,000 in the Cutting department, $300,000 in the Assembly department, and $200,000 in the Finishing department. Direct labor hours worked in all departments are expected to total 40,000 (used for the plantwide rate). The Cutting department expects to use 20,000 machine hours, the Assembly department expects to use 25,000 direct labor hours, and the Finishing department expects to incur $100,000 in direct labor costs (this information will be used for department rates).

Required:

- Assume San Juan Company uses the plantwide approach for allocating overhead costs and direct labor hours as the allocation base. Calculate the predetermined overhead rate, and explain how this rate will be used to allocate overhead costs.

- Assume San Juan Company uses the department approach for allocating overhead costs. Calculate the predetermined overhead rate for each department, and explain how these rates will be used to allocate overhead costs.

-

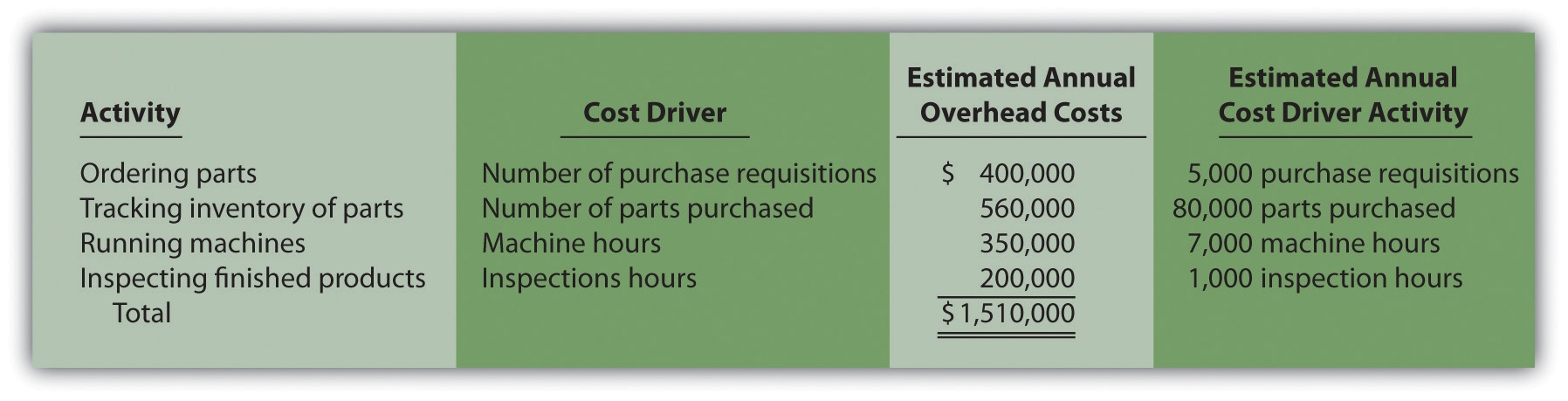

Computing Product Costs Using Activity-Based Costing. Stillwater Company identified the following activities, estimated costs for each activity, and identified cost drivers for each activity for this coming year. (These are the first three steps of activity-based costing.)

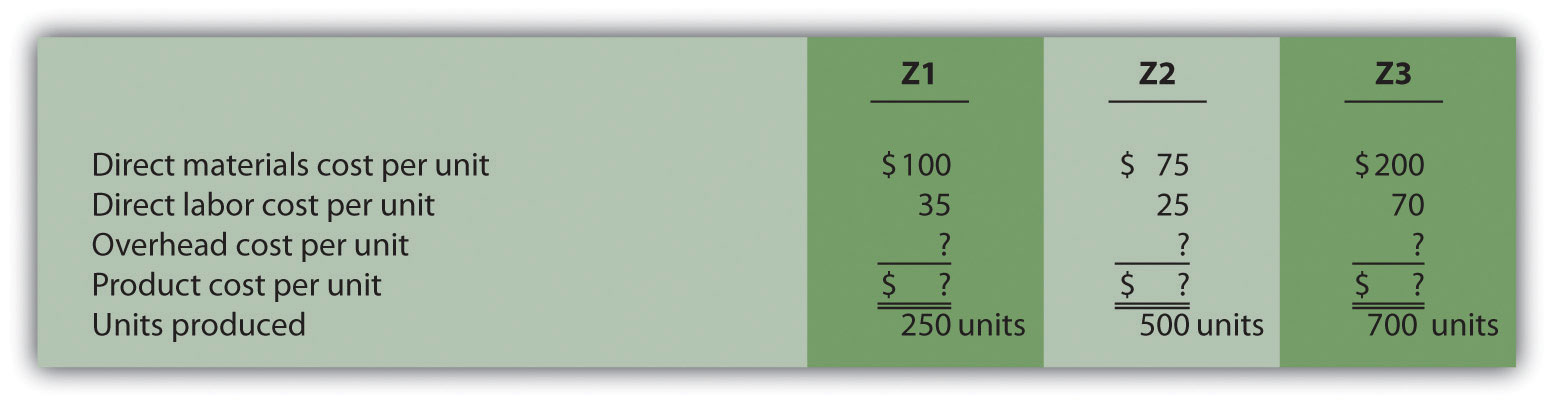

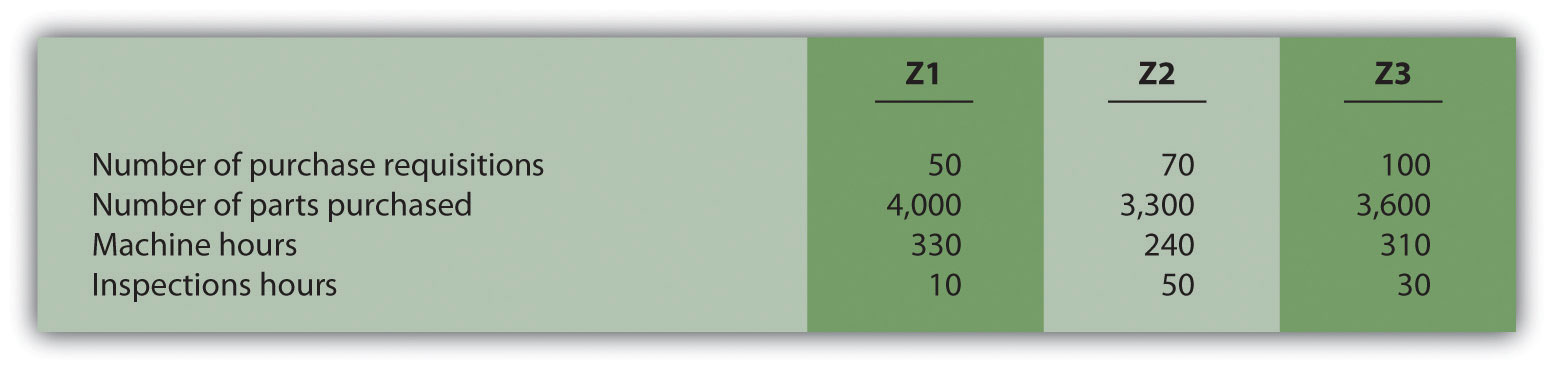

The company produces three products, Z1, Z2, and Z3. Information about these products for the month of January follows:

Actual cost driver activity levels for the month of January are as follows:

Required:

- Using the estimates for the year, compute the predetermined overhead rate for each activity (this is step 4 of the activity-based costing process).

- Using the activity rates calculated in requirement a and the actual cost driver activity levels shown for January, allocate overhead to the three products for the month of January (this is step 5 of the activity-based costing process).

- For each product, calculate the overhead cost per unit for the month of January. Round results to the nearest cent.

- For each product, calculate the product cost per unit for the month of January. Round results to the nearest cent.

-

Journal Entry to Apply Overhead. Caspian Company is deciding which of three approaches it should use to apply overhead to products. Information for each approach is provided in the following.

- One plantwide rate. The predetermined overhead rate is 150 percent of direct labor cost.

- Department rates. The Machining department uses a rate of $55 per machine hour, and the Assembly department uses a rate of $35 per direct labor hour.

-

Activity-based costing rates. Three activities were identified and rates were calculated for each activity.

Purchase requisitions $15 per requisition processed Production setup $50 per setup Quality control $70 per inspection Required:

- Direct labor costs for the year totaled $80,000. Using the plantwide method, calculate the amount of overhead applied to products and make the appropriate journal entry.

- During the year, the Machining department used 1,000 machine hours, and the Assembly department used 1,200 direct labor hours. Using the department method, calculate the amount of overhead applied to products and make the appropriate journal entry.

- During the year, 900 purchase requisitions were processed, 1,300 production setups were performed, and 400 products were inspected. Using the activity-based costing approach, calculate the amount of overhead applied to products, and make the appropriate journal entry.

-

Allocating Service Department Costs. Crandall Company has two production departments (P1 and P2) and three service departments (S1, S2, and S3). Service department costs are allocated to production departments using the direct method. The $400,000 costs of department S1 are allocated based on the number of employees in each production department. The $600,000 costs of department S2 are allocated based on the square footage of space occupied by each production department. The $300,000 costs of department S3 are allocated based on hours of computer support used by each production department. Information for each production department follows.

Required:

- Calculate the service department costs allocated to each production department.

- In general, do U.S. Generally Accepted Accounting Principles allow for the allocation of service department costs to production departments for the purpose of valuing inventory?

-

Cost Hierarchy. The following activities and costs are for Tanaka Company.

- Direct materials used by workers to assemble products

- Purchase requisitions issued for raw materials

- Machines set up to produce groups of products

- New product research and development

- Maintenance performed on the factory building

- Direct labor assembling products

- Product designed for a specific customer

- Factory building rent

Required:

- Determine whether each item is a facility-level, product- or customer-level, batch-level, or unit-level cost.

- Provide one example of an appropriate allocation base for each item. (For instance, an appropriate allocation base for item 1 is the quantity of direct materials used.)

Exercises: Set B

-

Plantwide Versus Department Allocations of Overhead: Service Company. Chan and Associates provides wetlands design and maintenance services for its customers, most of whom are developers. Billing is based on costs plus a 30 percent markup. Thus costs are allocated to customers rather than to products.

Total overhead costs this coming year are expected to be $2,000,000 ($600,000 in the Design department and $1,400,000 in the Wetlands Maintenance department). Direct labor costs are expected to total $800,000 (used for the plantwide rate). The Design department expects to incur direct labor costs of $500,000, and the Wetlands Maintenance department expects to work 30,000 direct labor hours (this information is used for the department rates).

Required:

- Assume Chan and Associates uses the plantwide approach to allocating overhead costs and direct labor costs as the allocation base. Calculate the predetermined overhead rate, and explain how this rate will be used to allocate overhead costs. Round results to the nearest cent.

- Assume Chan and Associates uses the department approach for allocating overhead costs. Calculate the predetermined overhead rate for each department, and explain how these rates will be used to allocate overhead costs. Round results to the nearest cent.

- What are two possible interpretations of the term costs in the following statement? “Customers are billed based on costs plus a 30 percent markup.”

-

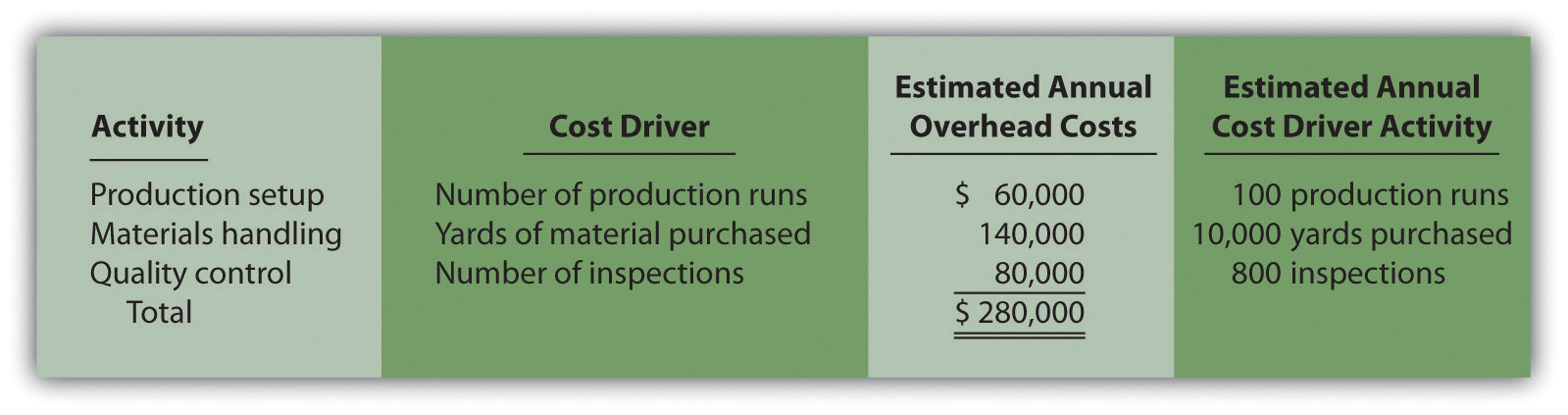

Computing Product Costs Using Activity-Based Costing. Petrov Company identified the following activities, estimated costs for each activity, and identified cost drivers for each activity for this coming year. (These are the first three steps of activity-based costing.)

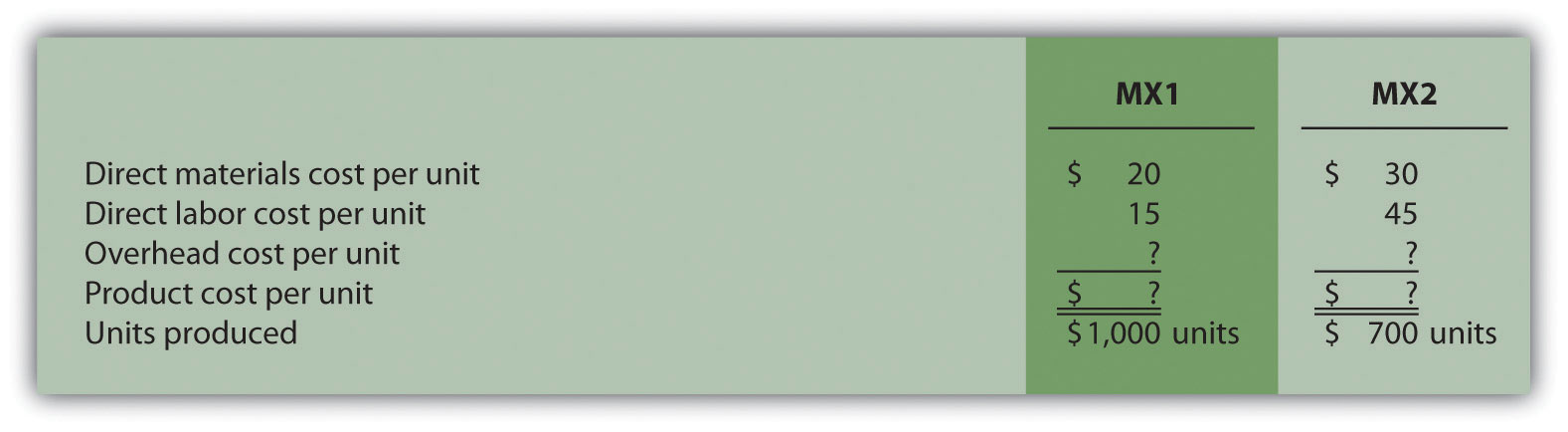

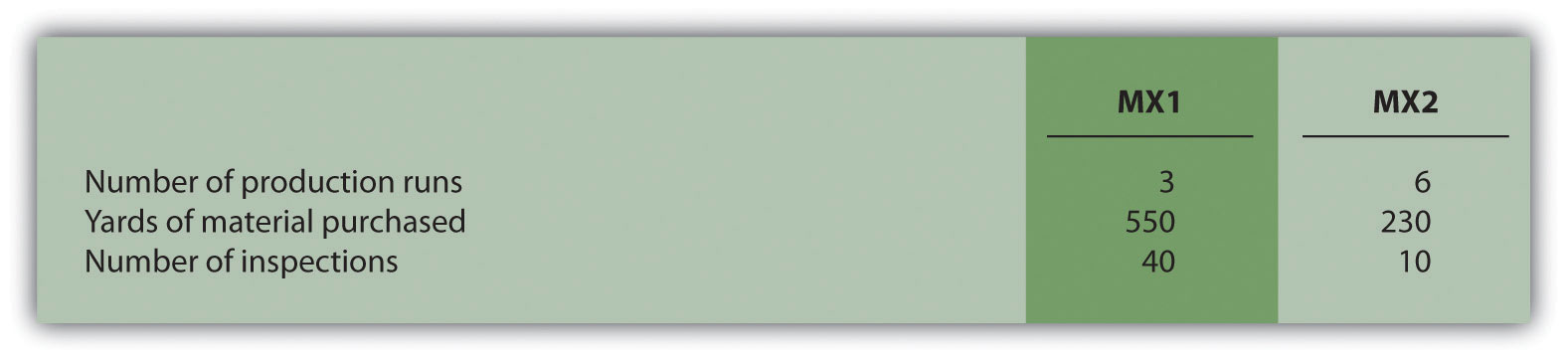

The company produces two products, MX1 and MX2. Information about these products for the month of March follows:

Actual cost driver activity levels for the month of March are as follows:

Required:

- Using the estimates for the year, compute the predetermined overhead rate for each activity (this is step 4 of the activity-based costing process).

- Using the activity rates calculated in requirement a and the actual cost driver activity levels shown for March, allocate overhead to the three products for the month of March (this is step 5 of the activity-based costing process).

- For each product, calculate the overhead cost per unit for the month of March. Round results to the nearest cent.

- For each product, calculate the product cost per unit for the month of March. Round results to the nearest cent.

-

Journal Entry to Apply Overhead, Closing Overhead Account. Premium Products, Inc., is deciding which of three approaches it should use to apply overhead to products. Information for each approach is provided as follows.

- One plantwide rate. The predetermined overhead rate is $130 per direct labor hour.

- Department rates. The Cutting department uses a rate of 200 percent of direct labor cost, and the Finishing department uses a rate of $50 per machine hour.

-

Activity-based costing rates. Three activities were identified, and rates were calculated for each activity.

Materials handling $8 per pound of material purchased Production setup $60 per setup Quality control $110 per batch inspected Required:

- Direct labor hours totaled 2,000 for the year. Using the plantwide method, calculate the amount of overhead applied to products, and make the appropriate journal entry.

- During the year, the Cutting department incurred $80,000 in direct labor costs, and the Finishing department used 1,800 machine hours. Using the department method, calculate the amount of overhead applied to products, and make the appropriate journal entry.

- During the year, 6,000 pounds of material were purchased, 1,600 production setups were performed, and 1,300 batches of products were inspected. Using the activity-based costing approach, calculate the amount of overhead applied to products, and make the appropriate journal entry.

-

Premium Products, Inc., closes overapplied or underapplied overhead to the cost of goods sold account at the end of each year. Prepare the journal entry to close the manufacturing overhead account at the end of the year for each of the following independent scenarios assuming the company made the journal entry to apply overhead in requirement c.

- The company recorded $302,500 in actual overhead costs for the year.

- The company recorded $243,000 in actual overhead costs for the year.

-

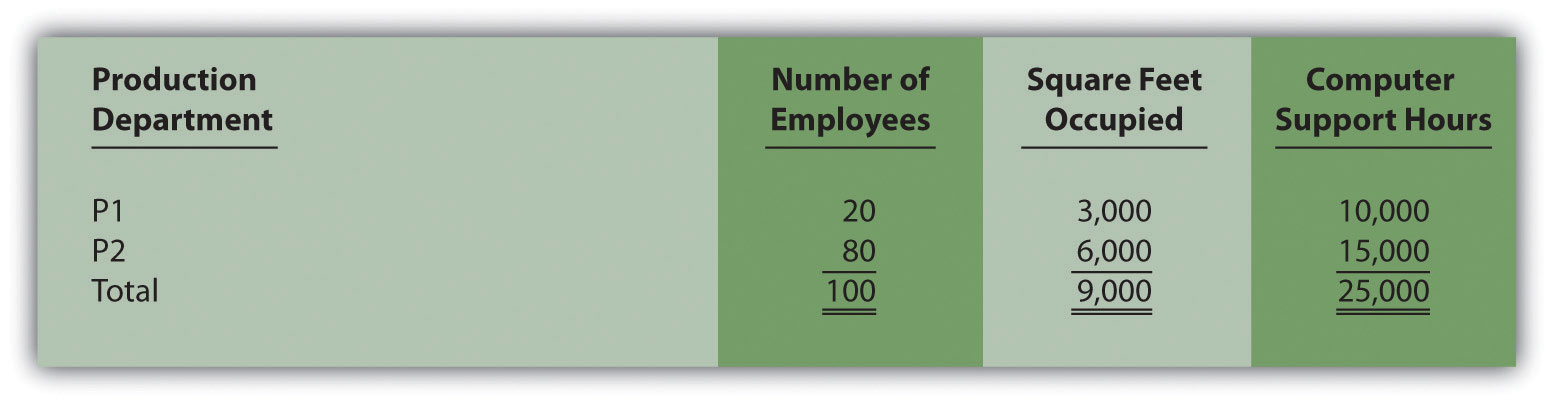

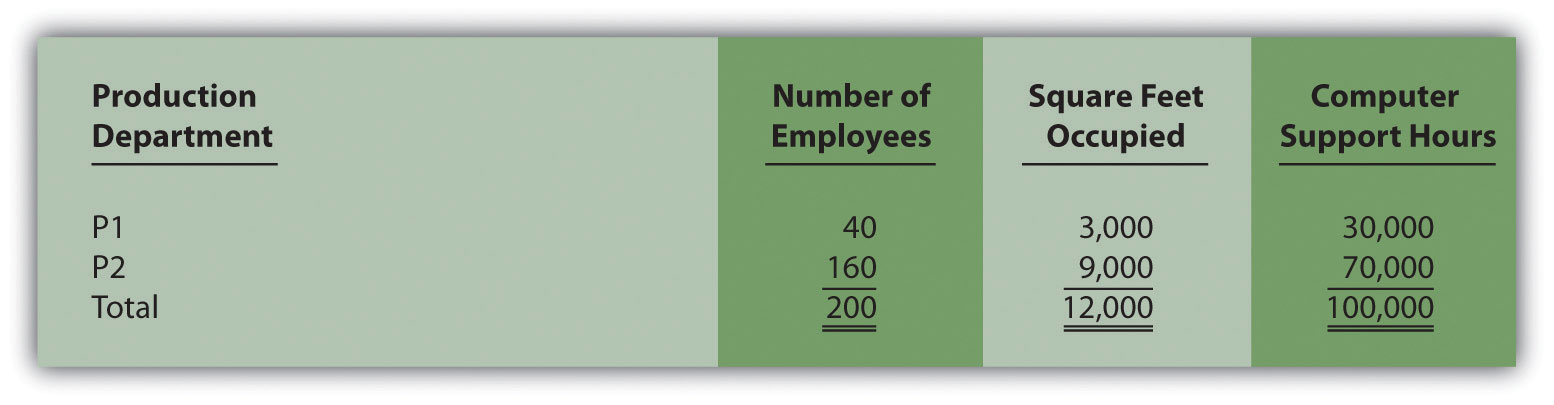

Allocating Service Department Costs. Southwest, Inc., has two production departments (P1 and P2) and three service departments (S1, S2, and S3). Service department costs are allocated to production departments using the direct method. The $800,000 costs of department S1 are allocated based on the number of employees in each production department. The $300,000 costs of department S2 are allocated based on the square footage of space occupied by each production department. The $600,000 costs of department S3 are allocated based on hours of computer support used by each production department. Information for each production department follows.

Required:

- Calculate the service department costs allocated to each production department.

- In general, do U.S. Generally Accepted Accounting Principles allow for the allocation of service department costs to production departments for the purpose of valuing inventory?

-

Cost Hierarchy. The following activities and costs are for Rios Corporation.

- Salary of a supervisor responsible for one product line

- Moving groups of products to the finished goods warehouse upon completion

- New product design

- Factory building depreciation

- Direct materials used by workers to assemble products

- Machines set up to produce groups of products

- Product designed for a specific customer

- Maintenance performed on the factory building

Required:

- Determine whether each item is a facility-level, product- or customer-level, batch-level, or unit-level cost.

- Provide one example of an appropriate allocation base for each item.

Problems

-

Activity-Based Costing Versus Traditional Approach. Techno Company produces a regular computer monitor that sells for $175 and a flat panel computer monitor that sells for $300. Last year, total overhead costs of $3,675,000 were allocated based on direct labor hours. A total of 63,000 direct labor hours were required last year to build 36,000 regular monitors (1.75 hours per unit), and 42,000 direct labor hours were required to build 12,000 flat panel monitors (3.50 hours per unit). Total direct labor and direct materials costs for last year were as follows:

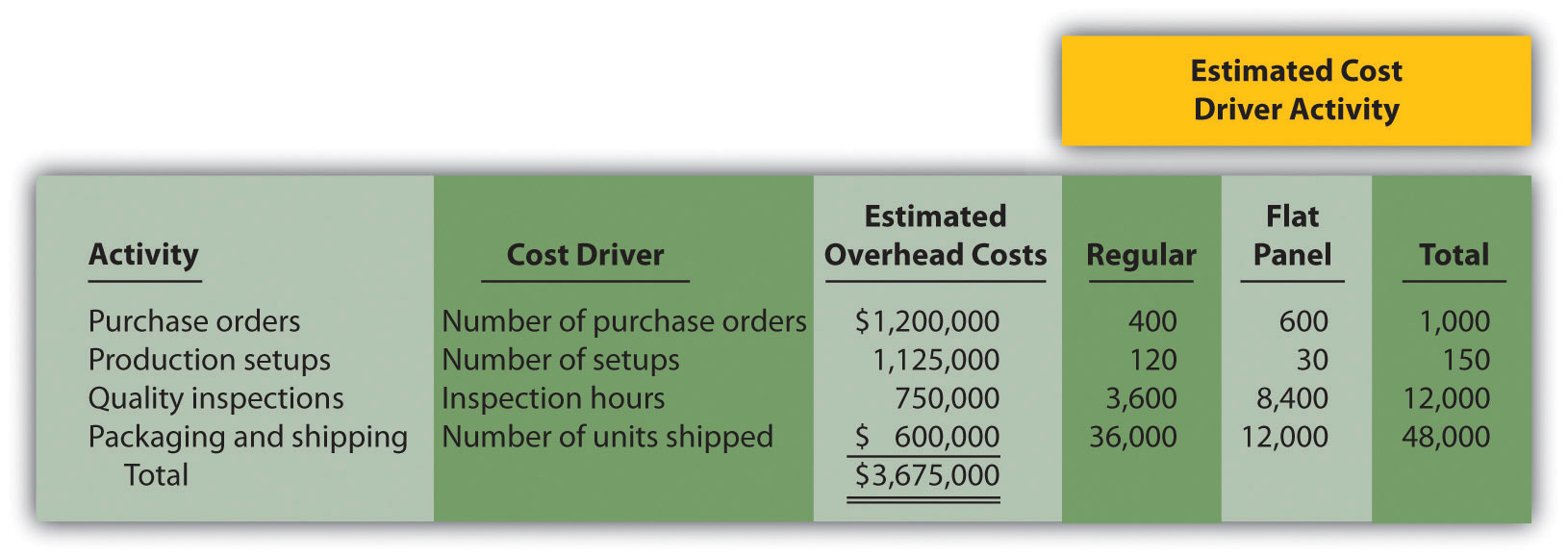

Regular Monitor Flat Panel Monitor Direct materials $1,908,000 $ 900,000 Direct labor $1,728,000 $1,200,000 The management of Techno Company would like to use activity-based costing to allocate overhead rather than one plantwide rate based on direct labor hours. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

Required:

- Calculate the direct materials cost per unit and direct labor cost per unit for each product.

-

- Using the plantwide allocation method, calculate the predetermined overhead rate and determine the overhead cost per unit allocated to the regular and flat panel products.

- Using the plantwide allocation method, calculate the product cost per unit for the regular and flat panel products. Round results to the nearest cent.

-

- Using the activity-based costing allocation method, calculate the predetermined overhead rate for each activity. (Hint: Step 1 through step 3 in the activity-based costing process have already been done for you; this is step 4.)

- Using the activity-based costing allocation method, allocate overhead to each product. (Hint: This is step 5 in the activity-based costing process.) Determine the overhead cost per unit. Round results to the nearest cent.

- What is the product cost per unit for the regular and flat panel products?

- Calculate the per unit profit for each product using the plantwide approach and the activity-based costing approach.

- How much did the profit per unit change for each product when moving from the plantwide approach to the activity-based costing approach? What caused this change?

-

Activity-Based Costing Versus Traditional Approach, Activity-Based Management. Quality Furniture, Inc., produces a wood desk that sells for $500 and a wood table that sells for $900. Last year, total overhead costs of $6,000,000 were allocated based on direct labor costs. Direct labor costs totaled $2,000,000 last year, and Quality Furniture produced 15,000 desks and 5,000 tables. Total direct labor and direct materials costs by product for last year were as follows:

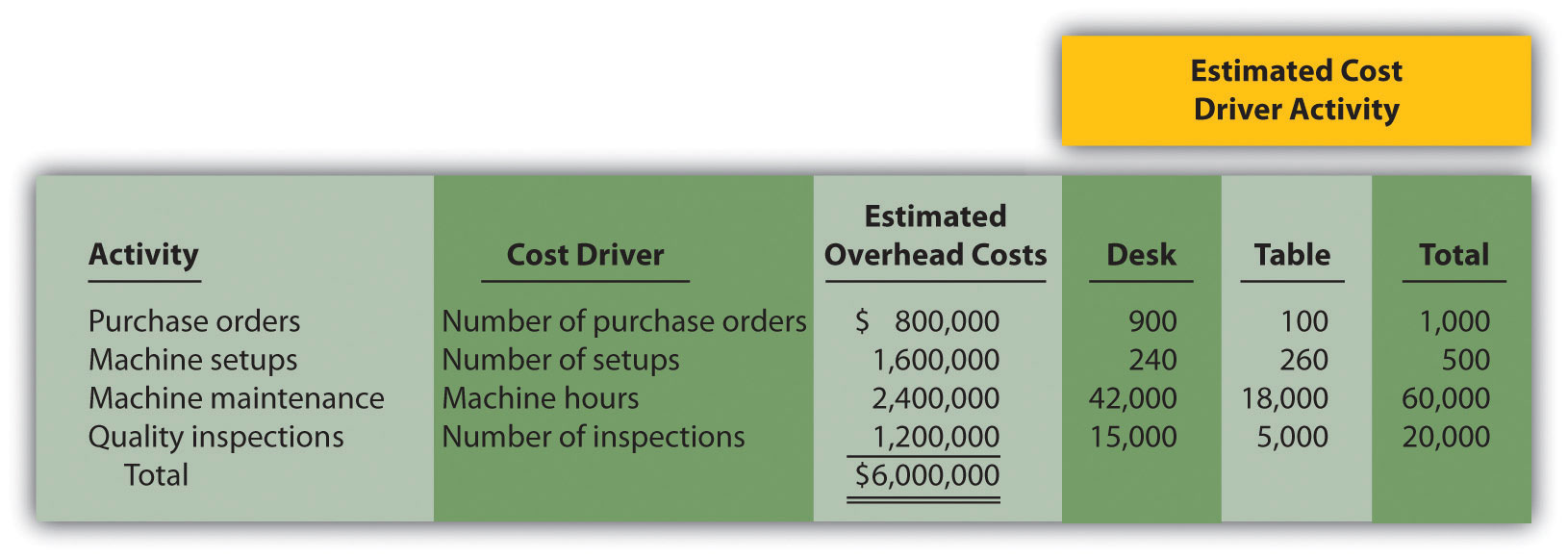

Desk Table Direct materials $1,575,000 $950,000 Direct labor $1,200,000 $800,000 The management of Quality Furniture would like to use activity-based costing to allocate overhead rather than one plantwide rate based on direct labor costs. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

Required:

- Calculate the direct materials cost per unit and direct labor cost per unit for each product.

-

- Using the plantwide allocation method, calculate the predetermined overhead rate and determine the overhead cost per unit allocated to the desk and table products.

- Using the plantwide allocation method, calculate the product cost per unit for the desk and table products. Round results to the nearest cent.

-

- Using the activity-based costing allocation method, calculate the predetermined overhead rate for each activity. (Hint: Step 1 through step 3 in the activity-based costing process have already been done for you; this is step 4.)

- Using the activity-based costing allocation method, allocate overhead to each product. (Hint: This is step 5 in the activity-based costing process.) Determine the overhead cost per unit. Round results to the nearest cent.

- What is the product cost per unit for the desk and table products?

- Calculate the per unit profit for each product using the plantwide approach and the activity-based costing approach. How much did the per unit profit change when moving from one approach to the other?

- Refer to the estimated cost driver activity provided. Calculate the percent of each activity consumed by each product (e.g., the desk product issued 900 of the 1,000 purchase orders issued in total and therefore consumes 90 percent of this activity). These percentages represent the amount of overhead costs allocated to each product using activity-based costing. Using the plantwide approach, 60 percent of all overhead costs are allocated to the desk and 40 percent to the table. Compare the activity-based costing percentages to the percentage of overhead allocated to each product using the plantwide approach. Use this information to explain what caused the shift in overhead costs to the desk product using activity-based costing.

-

Calculating and Recording Overhead Applied. Assume Quality Furniture, Inc., discussed in Problem 41, uses activity-based costing.

Required:

- Using the data presented at the beginning of Problem 41, calculate the predetermined overhead rate for each activity.

-

The following activity associated with the desk product was reported for the month of March.

Number of purchase orders processed 40 Number of machine setups 22 Number of machine hours 2,425 Number of quality inspections 890 Using the predetermined overhead rates calculated in requirement a, determine the amount of overhead applied to the desk product for the month of March.

- Make the journal entry to record overhead applied to the desk product for the month of March.

- Assume you are the manager of the desk product line and would like to reduce the amount of overhead costs being applied to your products. Which activity would you focus on first? Why?

-

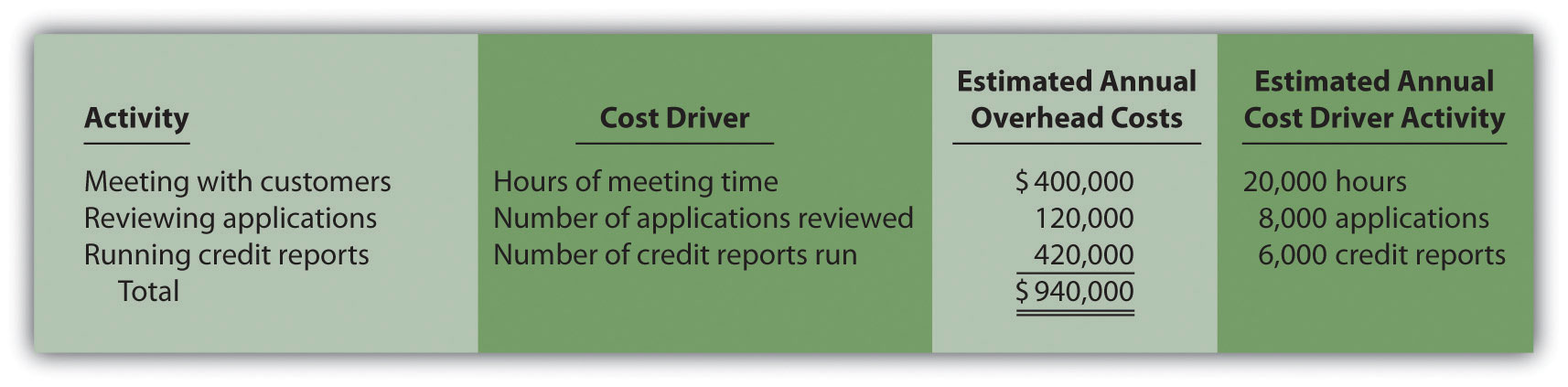

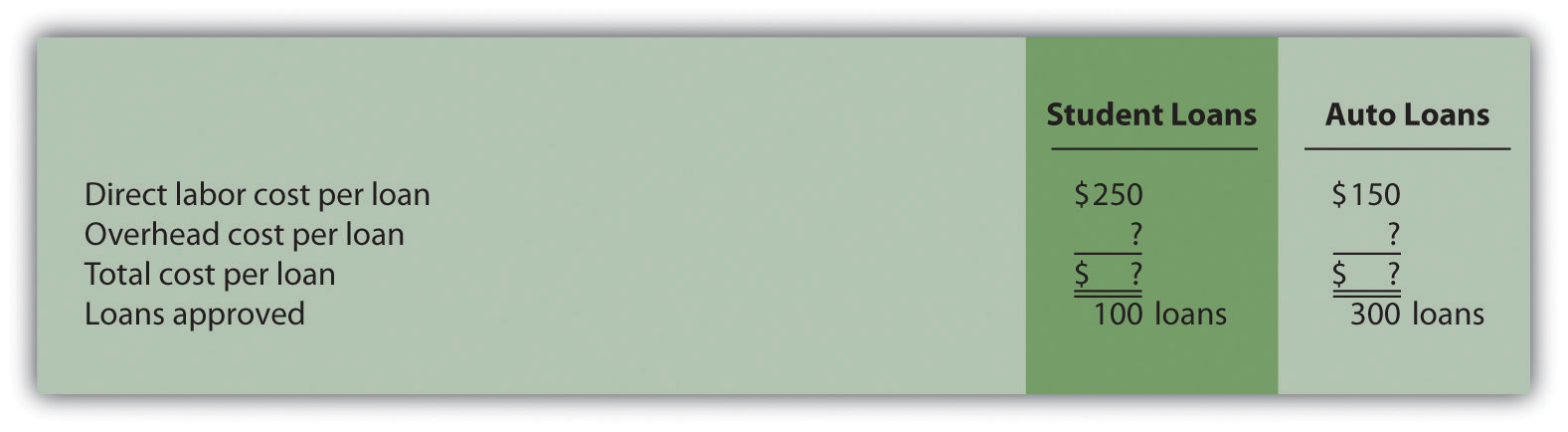

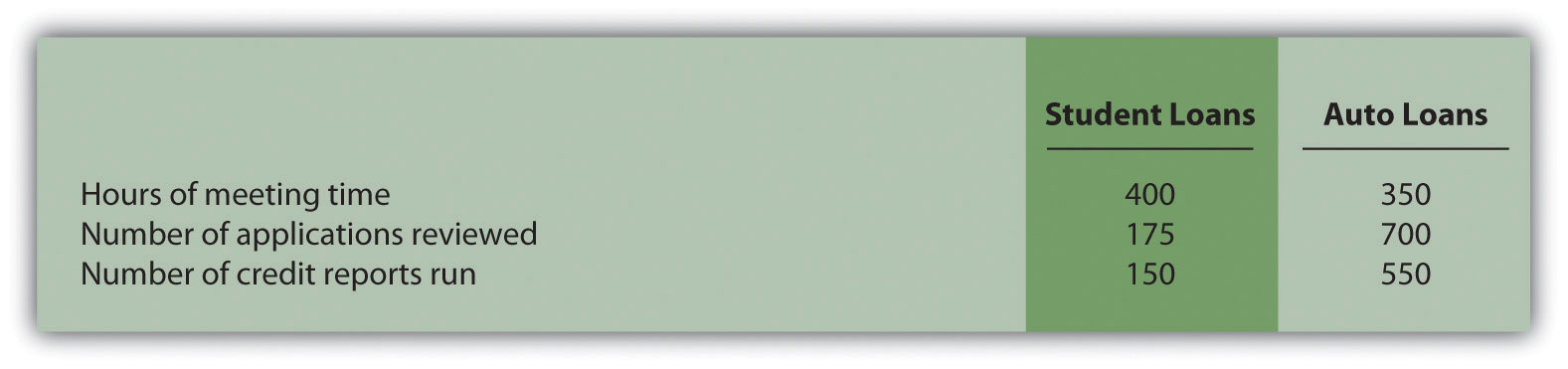

Computing Product Costs Using Activity-Based Costing, Service Company. Roseville Community Bank uses activity-based costing to assign overhead costs to two different loan products—student loans and auto loans. The bank identified the following activities, estimated costs for each activity, and identified cost drivers for each activity for this coming year. (These are the first three steps of activity-based costing.)

The following information for the two loan products offered by Roseville Community Bank is for the month of July:

Actual cost driver activity levels for the month of July are as follows:

Required:

- Using the estimates for the year, compute the predetermined overhead rate for each activity (this is step 4 of the activity-based costing process).

- Using the activity rates calculated in requirement a and the actual cost driver activity levels shown for July, allocate overhead to the two products for the month of July.

- For each loan product, calculate the overhead cost per loan approved for the month of July. Round results to the nearest cent.

- For each loan product, calculate the total cost per loan approved for the month of July. Round results to the nearest cent.

- Assume you are the manager of the auto loans product line and would like to reduce the amount of overhead costs being applied to your products. Which activity would you focus on first? Why?

-

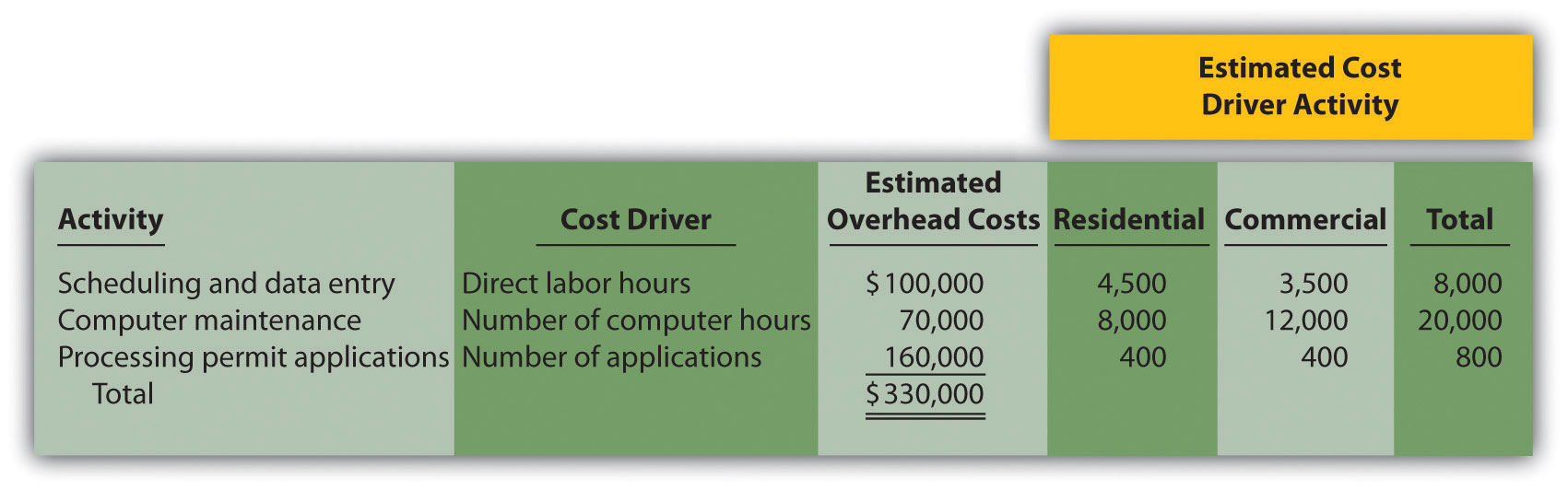

Activity-Based Costing Versus Traditional Approach: Service Company, Activity-Based Management. Hodges and Associates is a small firm that provides structural engineering services for its clients. The company performs structural engineering services for both residential and commercial buildings. Last year, total overhead costs of $330,000 were allocated based on direct labor costs. A total of $300,000 in direct labor costs were incurred in the following areas: $120,000 in the residential segment and $180,000 in the commercial segment. Direct materials used were negligible and are included in overhead costs. Sales revenue totaled $450,000 for residential services and $330,000 for commercial services.

The management of Hodges and Associates would like to use activity-based costing to allocate overhead rather than a plantwide rate based on direct labor costs. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

Required:

-

- Using the plantwide allocation method, calculate the total cost for each product. (Hint: Product costs for this company include overhead and direct labor.)

- Using the plantwide approach, calculate the profit for each product. Also calculate profit as a percent of sales revenue for each product (round to the nearest tenth of a percent).

-

- Using activity-based costing, calculate the predetermined overhead rate for each activity. (Hint: Step 1 through step 3 in the activity-based costing process have already been done for you; this is step 4.) Round results to the nearest cent.

- Using activity-based costing, calculate the amount of overhead assigned to each product. (Hint: This is step 5 in the activity-based costing process.)

- Using activity-based costing, calculate the profit for each product. Also calculate profit as a percent of sales revenue for each product (round to the nearest tenth of a percent).

- What caused the shift of overhead costs to the residential product using activity-based costing? How might management use this information to make improvements within the company?

-

-

Calculating and Recording Overhead Applied: Service Company. Assume Hodges and Associates, discussed in Problem 44, uses activity-based costing.

Required:

- Using the data presented at the beginning of Problem 44, calculate the predetermined overhead rate for each activity. Round results to the nearest cent.

-

The following activity associated with the commercial product was reported for the month of September.

Number of direct labor hours 350 Number of computer hours 960 Number of applications 50 Using the predetermined overhead rates calculated in requirement a, determine the amount of overhead applied to the commercial product for the month of September.

- Make the journal entry to record overhead applied to the commercial product for the month of September.

- Assume you are manager of the commercial product line and would like to reduce the amount of overhead costs being applied to your products. Which activity would you focus on first? Why?

-

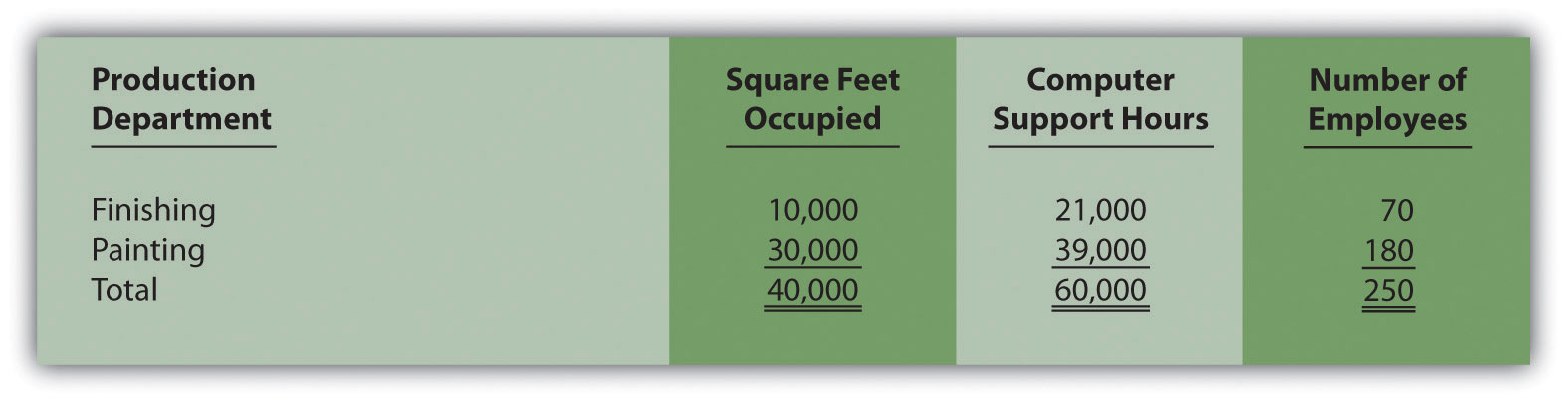

Allocating Service Department Costs. Szabo Industries has two production departments (Finishing and Painting) and three service departments (Maintenance, Computer Support, and Personnel). Service department costs are allocated to production departments using the direct method. Maintenance allocates costs totaling $3,000,000 based on the square footage of space occupied by each production department. Computer Support allocates costs totaling $4,000,000 based on hours of computer support used by each production department. Personnel allocates costs totaling $2,500,000 based on number of employees in each production department. Information for each production department follows.

Required:

- Calculate the service department costs allocated to each production department.

- Why do companies allocate service department costs to production departments?

-

Selecting an Allocation Base for Service Costs. Winstead, Inc., is looking for an appropriate allocation base to allocate personnel costs totaling $5,000,000. Service department costs are allocated to three production departments: Assembly, Sanding, and Finishing. Management is considering two allocation bases.

Possible Allocation Base Assembly Sanding Finishing Number of employees 30 20 50 Square feet of space occupied 25,000 15,000 10,000 Required:

- Calculate the amount of personnel department costs allocated to production departments using each allocation base.

- Which allocation base do you think is most reasonable? Why?

One Step Further: Skill-Building Cases

-

Overhead Allocation. Do you agree with the following statement? Explain your answer.

Total estimated overhead costs will vary depending on whether we use the plantwide method, department method, or activity-based costing to allocate overhead.

-

Cost Allocation Issues. Assume you rent a house with two friends. The total monthly rent is $1,500. Your bedroom is the smallest of the three bedrooms, and each of the others has a bathroom attached. You and your friends are trying to decide how to divide up the rent. Two possibilities are being discussed.

- Share the cost equally among the three of you.

- Determine rent based on square feet occupied (the attached bathrooms would be part of the square footage measurement).

Required:

- Which approach do you think is most fair for all involved? Why?

- Which approach is easiest? Why?

- Suggest another approach to dividing up the cost of rent.

- Activity-Based Costing and Activity-Based Management. A colleague states, “We produce one product, and our operations are relatively simple. Activity-based costing and activity-based management would be a waste of time for our company!” Do you agree with this statement? Explain.

- Product Costs. The company president makes the following statement: “Product costs are straightforward. Whatever costs are incurred to produce a product are assigned to that product.” Do you agree with this statement? Explain.

-

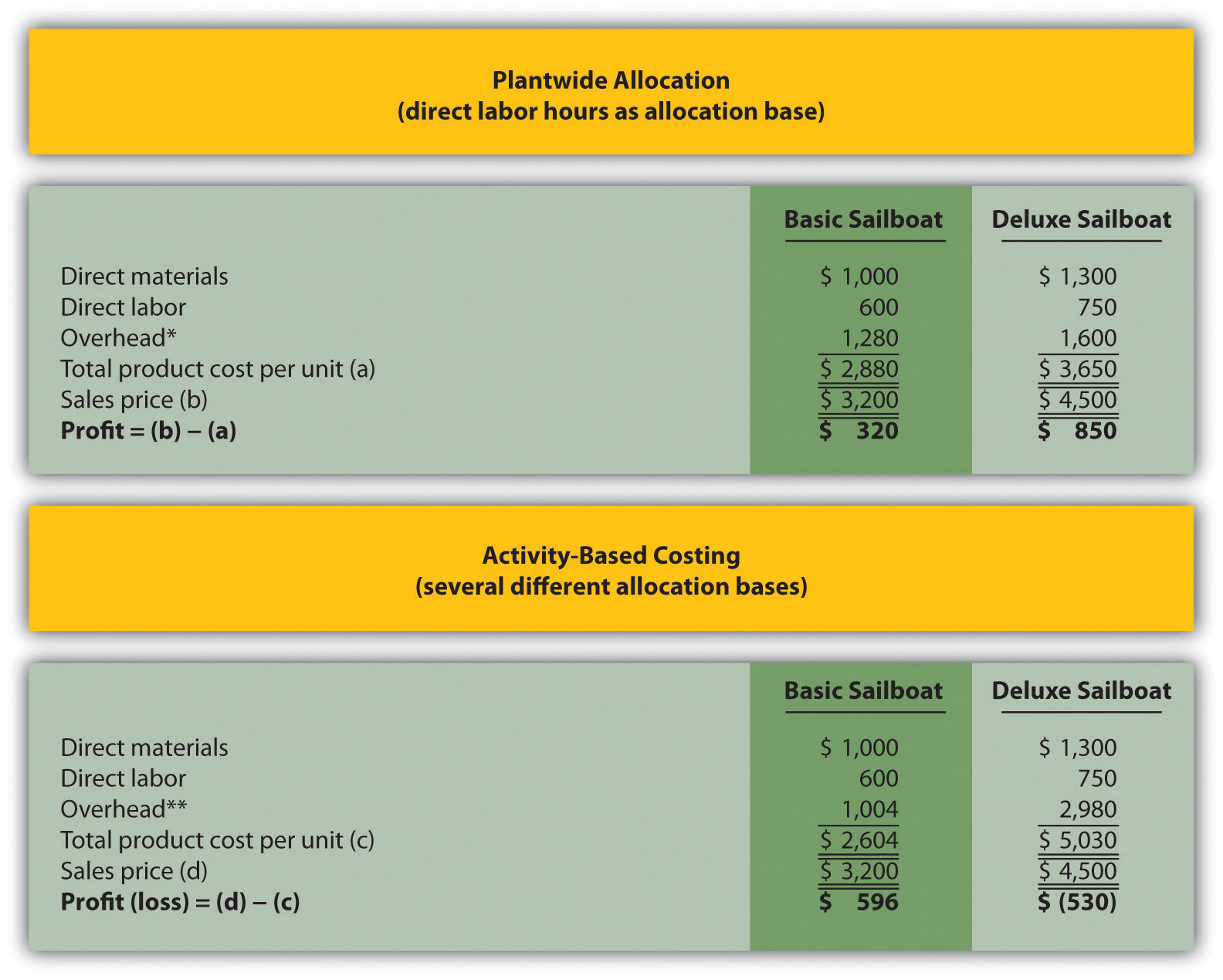

Changing Plantwide Allocation Rate at SailRite. Recall from the chapter discussion that SailRite uses one plantwide rate based on direct labor hours to allocate manufacturing overhead costs to the company’s two sailboat products—Basic and Deluxe. Management was concerned about the inaccuracy of overhead costs being assigned to each product and decided to calculate product costs using activity-based costing. Product cost and profit results are summarized in the following for the plantwide allocation approach (based on direct labor hours) and activity-based costing approach. This information was presented in the chapter in Figure 3.7 "Activity-Based Costing Versus Plantwide Costing at SailRite Company".

*Overhead taken from Figure 3.2 "SailRite Company Product Costs Using One Plantwide Rate Based on Direct Labor Hours".

**Overhead taken from Figure 3.5 "Allocation of Overhead Costs to Products at SailRite Company".

Although management of SailRite prefers the accuracy of activity-based costing, the cost of maintaining such an accounting system for the long term is prohibitive. John, the accountant, has proposed going back to using one plantwide rate, but he would like to allocate overhead costs using machine hours rather than direct labor hours.

Recall that overhead costs totaled $8,000,000. A total of 90,000 machine hours were used for the period: 50,000 for Basic sailboats and 40,000 for Deluxe sailboats. The company produced 5,000 units of the Basic model and 1,000 units of the Deluxe model. Thus the Basic model uses 10 machine hours per unit (= 50,000 machine hours ÷ 5,000 units) and the Deluxe model uses 40 machine hours per unit (= 40,000 machine hours ÷ 1,000 units).

Required:

- Calculate the predetermined overhead rate using machine hours as the allocation base, and determine the overhead cost per unit allocated to the Basic and Deluxe sailboats. Round results to the nearest cent.

- For each product, calculate the unit product cost and profit using the same format presented previously. Round results to the nearest cent.

- Compare your results in requirement b to the results using direct labor hours as the allocation base and activity-based costing.

- Provide at least two reasons why management might prefer machine hours as the overhead allocation base rather than direct labor hours or activity-based costing.

-

Service Department Cost Allocation. Biotech, Inc., recently began providing cafeteria services to its employees. Because revenue from the sale of food at the cafeteria does not fully cover cafeteria expenses, Biotech must pay for the shortfall. These costs are allocated to production departments based on employee usage. That is, the company tracks which employees use the cafeteria and allocates costs to production departments accordingly.

Sarah Kolster, manager of the quality testing department, is not happy with receiving cafeteria cost allocations. She is evaluated based on meeting a cost budget established at the beginning of the fiscal year, which does not include the cafeteria allocation, and she clearly has an incentive to minimize costs.

When Sarah met with the company’s accountant, Dan, regarding this issue, she said, “Dan, I like the idea of providing cafeteria service to our employees, but the costs allocated to my department are killing my budget. Last month alone, I was allocated $3,000 in costs related to the new cafeteria. I have no choice but to require my employees to go elsewhere for food.”

Dan responded, “I understand your concern, Sarah. Management’s intent was to provide a service to our employees that would improve productivity and reward employees for their hard work. If you tell your employees to stop using the cafeteria, more costs will be allocated to other departments, and the other departments might also stop using the cafeteria. My belief is that the cafeteria will be self-sufficient within a year if more employees are encouraged to use it. This translates into no more cost allocations to departments within a year. I’ll discuss your concerns with top management later this week.”

Required:

- Why does Biotech, Inc., allocate cafeteria costs to departments?

- What recommendations would you make to top management regarding the way cafeteria costs are allocated to departments?

Comprehensive Case

-

Activity-Based Costing, Journal Entries, T-Accounts, and Preparing an Income Statement. This problem is an adaptation of the example presented at the end of Chapter 2 "How Is Job Costing Used to Track Production Costs?" for Custom Furniture Company. The only difference is that this problem uses activity-based costing to allocate overhead costs rather than one plantwide rate. Recall that inventory beginning balances were $25,000 for raw materials inventory, $35,000 for work-in-process inventory, and $90,000 for finished goods inventory.

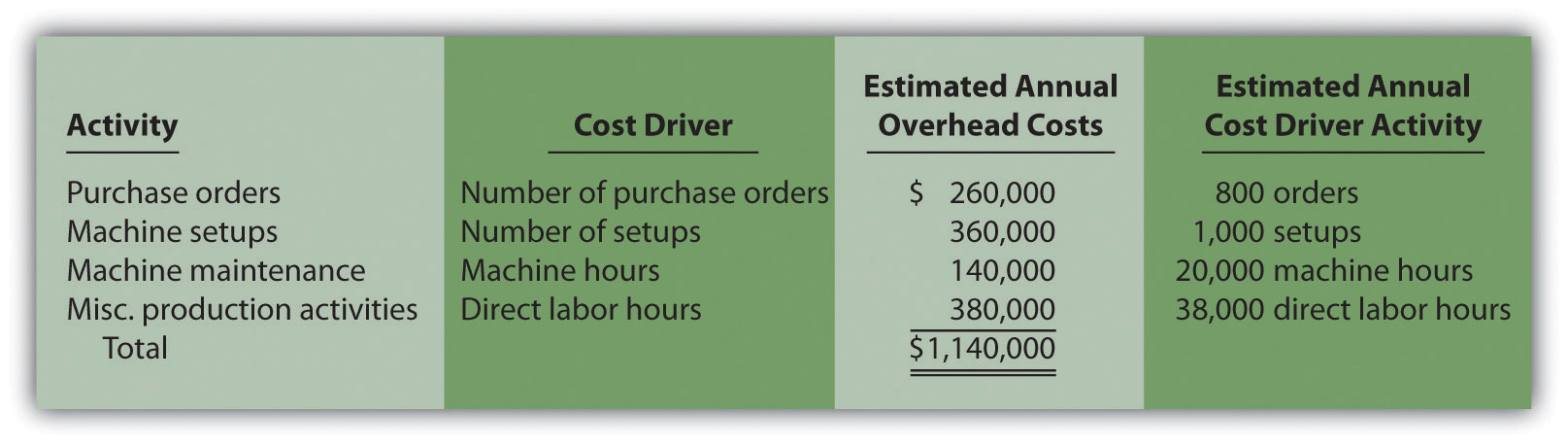

Management of Custom Furniture Company would like to use activity-based costing to allocate overhead costs totaling $1,140,000 rather than one plantwide rate based on direct labor hours. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

Transactions for the month of May are shown as follows:

- Raw materials were purchased during the month for $15,000 on account.

- Raw materials totaling $21,000 were placed in production: $3,000 for indirect materials (glue, screws, nails, and the like) and $18,000 for direct materials (wood planks, hardware, etc.).

- Timesheets from the direct labor workforce show total costs of $40,000, to be paid the next month.

- Production supervisors and other indirect labor working in the factory are owed wages totaling $27,000.

- The following costs were incurred related to the factory: building depreciation of $29,000, insurance of $11,000 (originally recorded as prepaid insurance), utilities of $4,000 (to be paid the next month), and maintenance costs of $22,000 (paid immediately).

-

Manufacturing overhead is applied to products based on the following cost driver activity for the month:

Number of purchase orders 75 Number of machine setups 120 Machine hours 1,850 Direct labor hours 3,240 - The following selling costs were incurred: wages of $5,000 (to be paid the next month), building rent of $3,000 (originally recorded as prepaid rent), and advertising totaling $10,000 (to be paid the next month).

- The following general and administrative (G&A) costs were incurred: wages of $13,000 (to be paid the next month), equipment depreciation of $6,000, and building rent of $7,000 (originally recorded as prepaid rent).

- Completed goods costing $155,000 were transferred out of work-in-process inventory.

- Sold goods for $100,000 on account and $90,000 cash.

- The goods sold in the previous transaction had a cost of $129,000.

- Closed the manufacturing overhead account to cost of goods sold.

Required:

- Calculate the predetermined overhead rate for each activity.

- Prepare T-accounts for the following accounts: cash, accounts receivable, prepaid insurance, prepaid rent, raw materials inventory, work-in-process inventory, finished goods inventory, accumulated depreciation (building and equipment), accounts payable, wages payable, manufacturing overhead, sales, cost of goods sold, advertising expense (selling), rent expense (selling), wages expense (selling), depreciation expense (G&A), rent expense (G&A), and wages expense (G&A). Enter beginning balances in T-accounts for the inventory accounts (raw materials, work in process, and finished goods).

- Prepare a journal entry for each of the transactions 1 through 11, and post each entry to the T-accounts set up in requirement b. Label each entry in the T-accounts by transaction number, and total each T-account.

- Is overhead underapplied or overapplied for the month of May? Based on the balance in the manufacturing overhead T-account prepared in requirement c, prepare a journal entry for transaction 12.

- Prepare an income statement for the month of May. (Hint: Be sure to include the adjustment made to cost of goods sold in requirement d.)