This is “Using Activity-Based Costing (ABC) and Activity-Based Management (ABM) in Service Organizations”, section 3.5 from the book Accounting for Managers (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

3.5 Using Activity-Based Costing (ABC) and Activity-Based Management (ABM) in Service Organizations

Learning Objective

- Apply activity-based costing and activity-based management to service organizations.

Question: To this point, we have presented ABC and ABM examples in a manufacturing setting. However, service organizations, such as banks, hospitals, airlines, and government agencies, also use ABC and ABM.Some specialists refer to activity-based costing and activity-based management as activity-based costing and management, or ABCM.In fact, a recent survey indicates that 75 percent of companies that use ABC are in the public sector, a service industry, or a consulting industry.Mohan Nair, “Activity-Based Costing: Who’s Using It and Why?” Management Accounting Quarterly, Spring 2000, 29–33.How can ABC help service organizations get better product cost information?

Answer: The same five steps used in manufacturing organizations can also be used in service organizations. To understand how ABC could be used in a service organization, let’s look at how ABC can be used to determine the cost of loan products at a financial institution.

Service Organization Example of ABC

Imagine you are the chief financial officer of Five Star Bank. You are interested in implementing an activity-based costing system to evaluate the cost of different loan products, such as auto loans and home equity loans, offered by the bank. The five steps of activity-based costing we presented earlier still apply. Let’s look at how these steps might work when evaluating the cost of bank loans.

Step 1. Identify costly activities.

Processing loans includes activities such as meeting with customers, reviewing customer applications, and running credit reports.

Step 2. Assign overhead costs to the activities identified in step 1.

Costs assigned to the activity of reviewing customer applications include items such as wages of personnel reviewing applications, depreciation of computer equipment used to review online applications, and supplies needed for the review process.

Step 3. Identify the cost driver for each activity.

Activity cost drivers are shown as follows:

| Activity | Cost Driver |

| Meeting with customers | Hours of meeting time |

| Reviewing customer applications | Number of applications reviewed |

| Running credit reports | Number of credit reports run |

Step 4. Calculate a predetermined overhead rate for each activity.

This is done by dividing estimated overhead costs for each activity by the estimated cost driver activity. For the activity meeting with customers, this calculation results in a rate per hour of meeting time. For the activity reviewing customer applications, the calculation results in a rate per application reviewed, and for running credit reports, a rate per credit report run.

Step 5. Allocate overhead costs to products.

Overhead is allocated, or applied, to products (auto loans and home equity loans in this example) based on the use of each activity’s cost driver. If a loan officer reviews 30 auto loan applications, an amount equal to the rate per application reviewed times 30 applications is allocated to the auto loans product.

Service Organization Example of ABM

Question: Managers at Five Star Bank are not only interested in product cost information; they would also like to scrutinize the activities involved in processing loans and make the process more efficient. How can the management of Five Star Bank use activity-based management to become more efficient?

Answer: Managers and accountants can apply the three steps of activity-based management to Five Star Bank as follows:

- Identify activities required to complete the product. This involves interviewing personnel throughout the company to capture all the activities involved in processing loans.

- Determine whether activities are value-added or non-value-added. An example of a value-added activity is the quick approval of a loan. An example of a non-value-added activity is time spent waiting for credit reports.

- Continuously improve the value-added activities and minimize, or eliminate, the non-value-added activities. Five Star Bank should continually strive to improve its ability to approve loans quickly (a value-added activity). While waiting for credit reports (a non-value-added activity), perhaps the bank can find other value-added activities that bank personnel can perform (e.g., responding to customer questions or processing other loan applications).

Business in Action 3.4

Activity-Based Costing at Blue Cross and Blue Shield of Florida (BCBSF)

Management at Blue Cross and Blue Shield of Florida realized it needed more sophisticated cost information to make better decisions. Given the highly competitive nature of the health care insurance industry and the need to minimize costs, BCBSF’s management decided to implement an activity-based costing system. Management’s primary concern was how to allocate administrative costs totaling $588,000,000 (21 percent of revenue) to the products and services the organization provides.

The benefits of implementing an activity-based costing and management system at BCBSF are as follows:

- Product pricing is improved as a result of having better cost information (prices are based on cost).

- Regional management is able to identify the cost of services provided by headquarters and make more efficient use of costly services.

- Product managers use the cost information to design products in a way that is most cost-effective.

As stated by the product director and cost accounting manager at BCBSF, “The goal is to provide the right information at the right time to the right people in a cost-efficient way.”

Source: Kenneth L. Thurston, Dennis M. Kelemen, and John B. MacArthur, “Cost for Pricing at Blue Cross and Blue Shield of Florida,” Management Accounting Quarterly, Spring 2000.

Key Takeaway

- Activity-based costing and activity-based management techniques are not limited to manufacturing companies. Virtually all organizations—including service, nonprofit, retail, and governmental—can benefit from implementing some form of ABC and ABM.

Review Problem 3.5

Menzies and Associates provides two products to its clients—tax services and audit services. Last year, total overhead costs of $1,000,000 were allocated based on direct labor hours. A total of 10,000 direct labor hours were required last year for tax clients at a cost of $350,000, and 30,000 direct labor hours were required for audit clients at a cost of $1,200,000. Direct materials used were negligible and are included in overhead costs. Sales revenue totaled $720,000 for tax services and $2,200,000 for audit services.

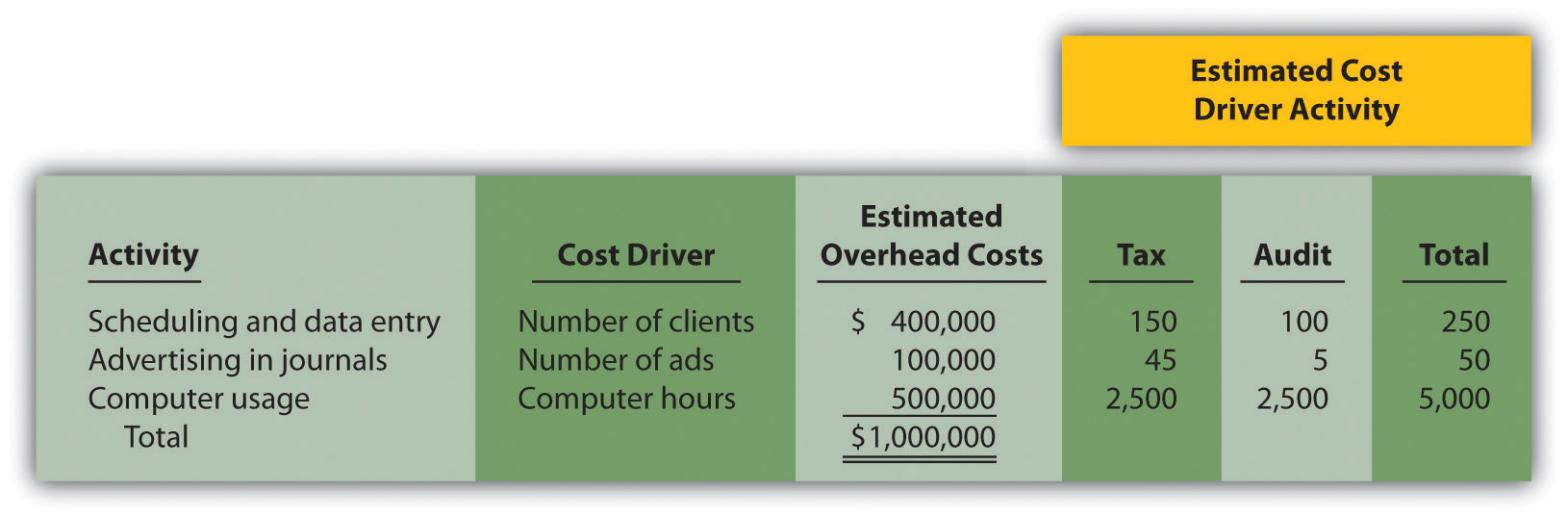

Management of Menzies and Associates would like to use activity-based costing to allocate overhead rather than use one plantwide rate based on direct labor hours (perhaps the term “officewide” rate would be more appropriate here). The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

Required:

-

- Using the plantwide allocation method, calculate the total cost for each product. (Hint: Product costs for this company include overhead and direct labor.)

- Calculate the profit for each product using this approach. Also calculate profit as a percent of sales revenue for each product.

-

- Using activity-based costing, calculate the predetermined overhead rate for each activity. (Hint: Step 1 through step 3 in the activity-based costing process have already been done for you; this is step 4.)

- Using activity-based costing, calculate the amount of overhead assigned to each product. (Hint: This is step 5 in the activity-based costing process.)

- Calculate the profit for each product using this approach. Also calculate profit as a percent of sales revenue for each product.

- Comment on the results of using activity-based costing compared to plantwide allocation.

Solutions to Review Problem 3.5

-

-

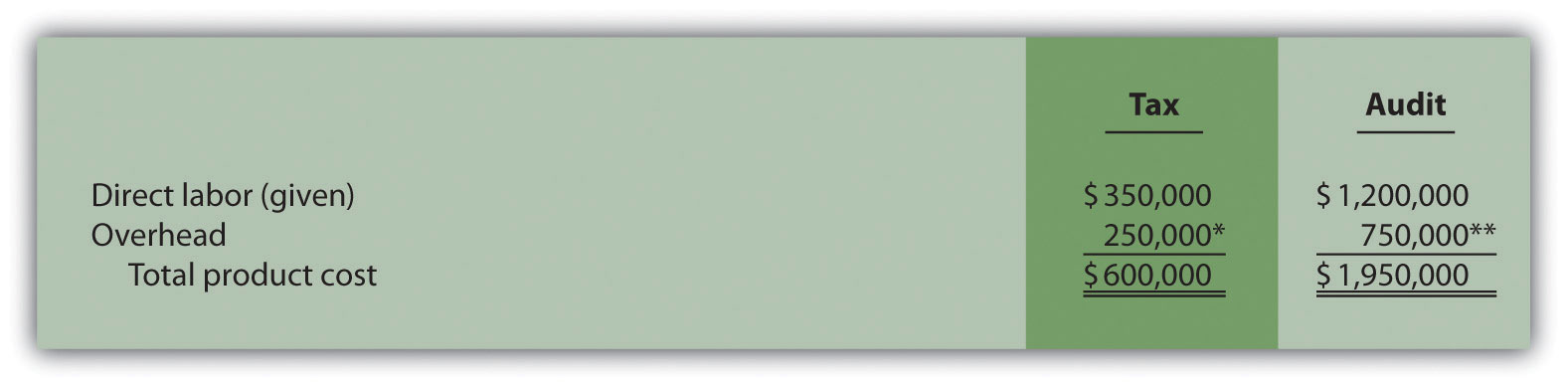

The plantwide allocation used by Menzies and Associates is based on direct labor hours. The rate is calculated as follows:

Total product costs are as follows:

*$250,000 = 10,000 direct labor hours × $25 rate.

**$750,000 = 30,000 direct labor hours per unit × $25 rate.

-

-

-

-

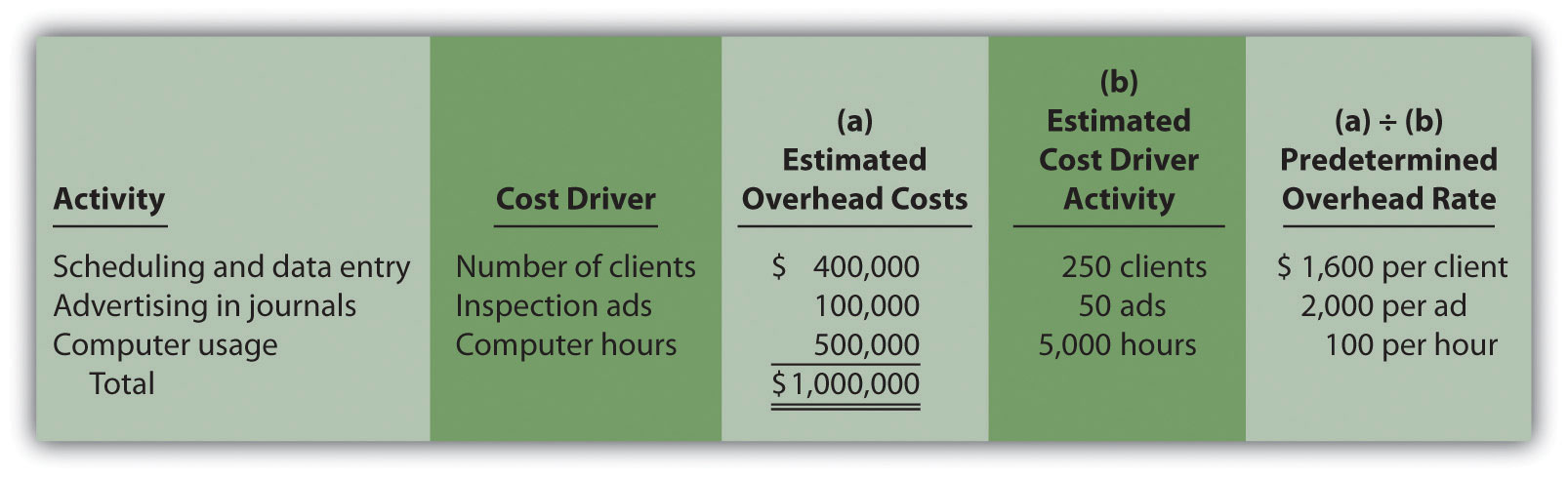

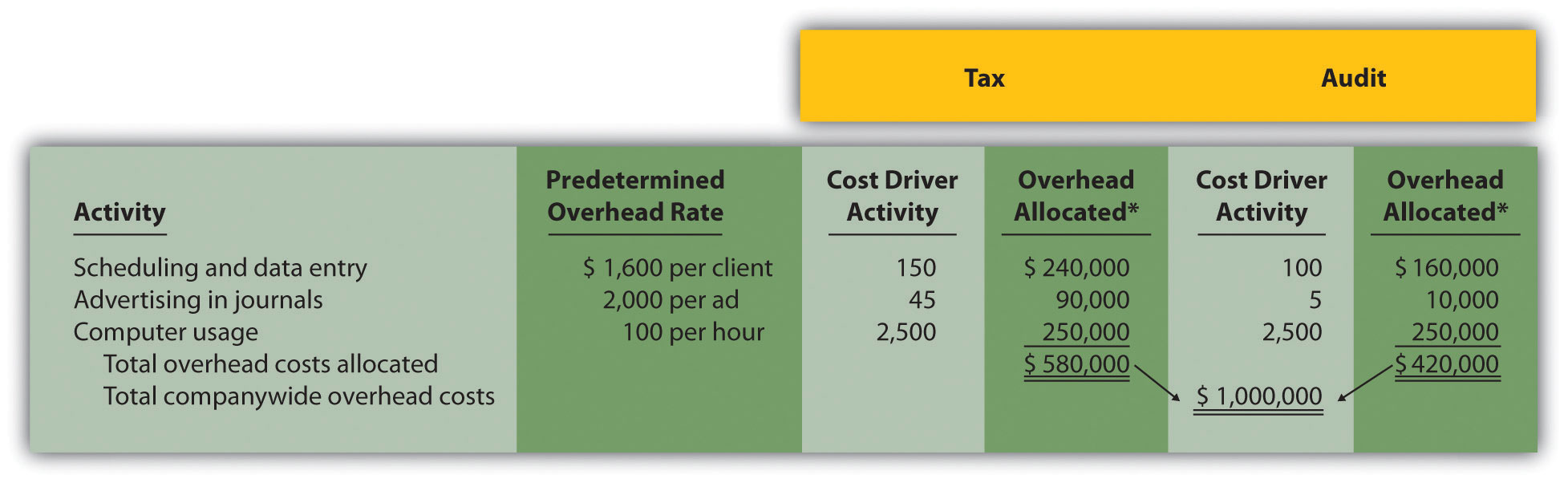

Predetermined overhead rates are calculated for each activity as follows:

-

Overhead costs are allocated as follows:

*Overhead allocated equals the predetermined overhead rate times the cost driver activity.

-

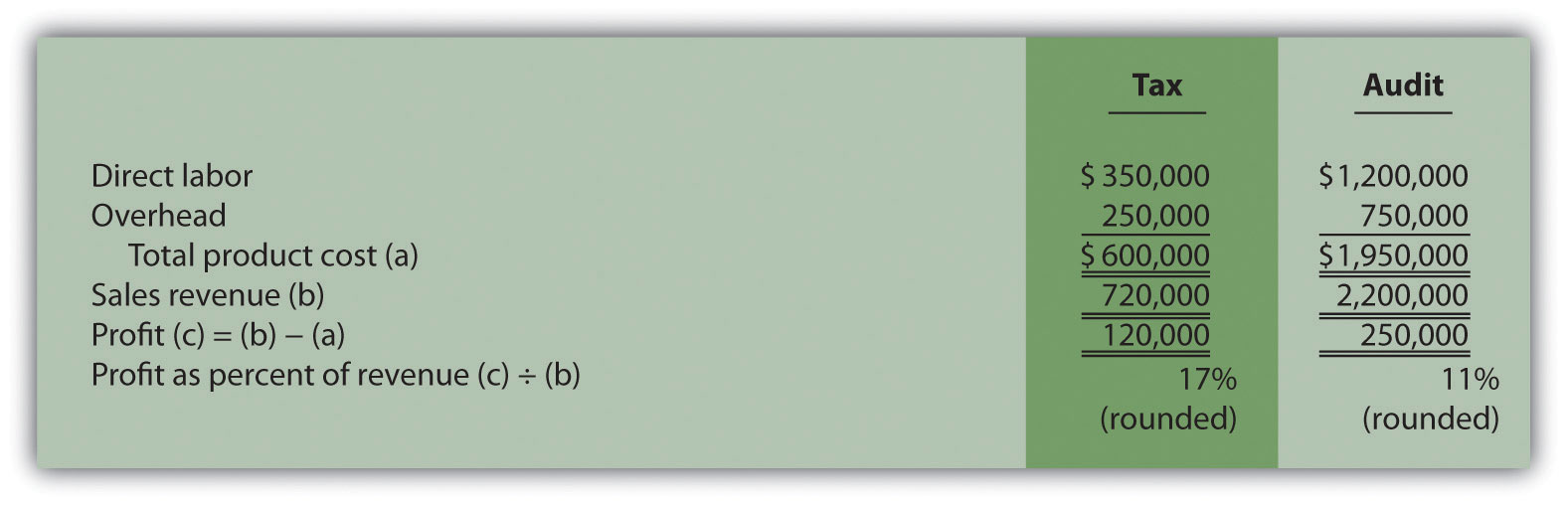

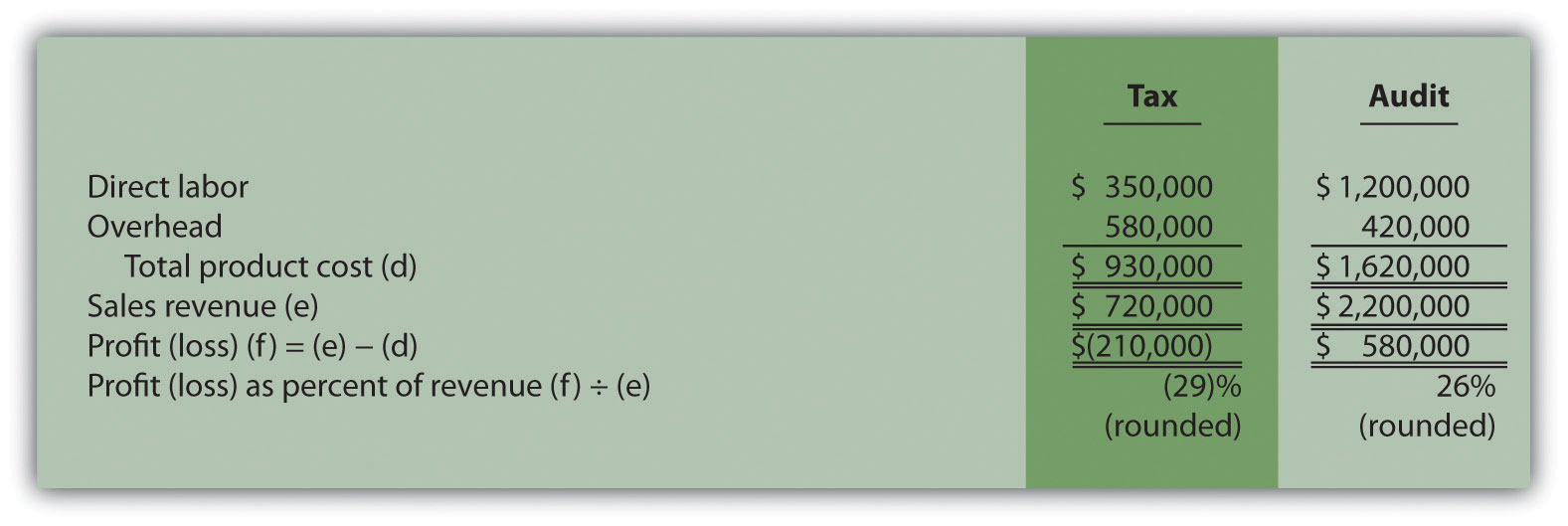

The profit and profit as a percent of sales revenue are calculated as follows:

-

-

Activity-based costing results in a significant increase of overhead costs allocated to the tax product and a decrease of overhead costs allocated to the audit product. The plantwide allocation approach allocates overhead based on direct labor hours, which results in 25 percent of all overhead costs being allocated to tax (= 10,000 direct labor hours in tax ÷ 40,000 total direct labor hours) and 75 percent to audit. However, ABC shows that tax uses 60 percent of scheduling and data entry resources (= 150 tax clients ÷ 250 total clients), 90 percent of advertising resources (= 45 tax ads ÷ 50 total ads), and 50 percent of computer resources (= 2,500 tax computer hours ÷ 5,000 total computer hours). Thus tax is allocated more overhead costs using ABC than using one plantwide rate based on direct labor hours. Note that total profit of $370,000 is the same regardless of the overhead cost allocation approach used. Using the plantwide allocation approach, $370,000 = $120,000 + $250,000. Using the ABC approach, $370,000 = ($210,000) + $580,000.

Management must use this information to make improvements to the company’s operations. It would probably be unwise to eliminate tax services because of the connection they have with audit services (i.e., audit clients may appreciate the convenience of also having tax services available to them). However, management can look for ways to make the process more efficient by focusing on costly activities identified in the ABC analysis.

Note that when calculating product costs for service organizations, it is difficult, if not impossible, to calculate a product cost per unit. Most service organizations do not have an easily defined unit of measure because services vary so much from one customer to another. One alternative is to calculate total profit as a percent of total sales revenue. This allows for a comparison of profitability between different types of services, similar to comparing the profitability for units of product.