This is “The Crash: From Decadence to Depression”, section 6.4 from the book United States History, Volume 2 (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

6.4 The Crash: From Decadence to Depression

Learning Objectives

- Explain the various causes of the Great Depression. Analyze the reasons for the stock market’s decline, the banking crisis, and the decline of consumer demand.

- Evaluate the response of the Hoover administration to the growing economic turmoil of the early 1930s. Explain how customs of limited government restrained this response, while at the same time exploring the ways that Hoover sought to expand the role of government to meet the crisis in new ways.

- Summarize the issues of the election of 1932. Explain how Roosevelt was able to win by a landslide while previous Democrats had been defeated by Republicans by equally large margins in previous elections.

Election of 1928 and the Stock Market Crash

In 1928, Republican presidential candidate Herbert Hoover declared that the United States was “nearer to the final triumph over poverty” than any nation in the history of the world. This kind of rhetoric was expected from presidents and would later be used to make it appear as though Hoover had not anticipated the challenges of the next four years. The criticism is only partially valid. Hoover, more than most political leaders of his day, understood that some of the era’s affluence was based on speculation. As secretary of commerce under Harding and Coolidge, Hoover understood these challenges as well as most Americans and had long cautioned about the dangers of stock market speculation.

As a candidate in the 1928 presidential election, however, Hoover’s strategy was to connect his leadership of the Commerce Department with the decade’s prosperity. The strategy paid dividends as Hoover easily defeated Democrat Al Smith with the support of 21 million voters to Smith’s 15 million supporters. The only consolation for the Democrats was that they were successful in mobilizing immigrant voters, although a large part of this growth was simply a reaction to the nativist rhetoric of many within the Republican Party. Smith was the first Catholic to secure the nomination of any major political party. Although the Klan and others who subscribed to anti-Catholic sentiment had declined, Smith’s campaign was still tormented by nativist detractors. These efforts backfired, at least in the long term because they brought Catholic voters into the Democratic fold. These two groups—Catholics and immigrants—would prove essential components of the future Democratic coalition that would provide large majorities for their party in future elections.

Part of Hoover’s appeal in the 1928 election was the connection in voters’ minds between the prosperity of recent years and the Republican Party. His cabinet was composed of business leaders and reflected the confidence of years of financial success. The stock market had been encouraged by nearly a decade of increasingly positive earnings results. There were certainly signs of decline within major industries and real estate, but this was true even during the most robust periods of economic growth. Some of the positive signs were unique to the US. For example, American finance and industry had gained globally in the wake of World War I. US banks and the federal government were receiving millions each year in interest payments from loans made to their Western allies during and after World War I. The United States also enjoyed a favorable balance of trade and a domestic market that was the envy of the rest of the world.

Figure 6.26

The stock market crash of October 1929 led to bank failures that caused many Americans to lose their life savings as well as their jobs. State and private charities had cared for individuals in the past, but these entities were quickly overwhelmed by the magnitude of the Great Depression.

In retrospect, at least, the global signs of economic decline were obvious. Germany was saved from delinquency in its reparation payments only by a series of temporary reprieves that delayed repayment. US banks had invested heavily in Germany both before and after the war. Had it not been for US money that was still flowing to Germany, German banks would have defaulted on their obligations to Western Europe long ago. Even worse, Western Europe’s interest payments to US banks and the federal government were dependent upon the receipt of German payments. In other words, America’s leading position in world affairs obscured the fact that it stood atop a delicate house of cards that depended on US capital to shuffle the deck. If US banks were unable to provide continued loans to their international creditors, these foreign governments and banks might default. This could start a cycle of defaults that would leave US banks to face their own precarious liquidity issues at home.

These US banks had invested their own depositor’s money, loaning money to corporations that were also low on cash reserves. Domestic consumer purchases of homes, automobiles, and appliances were declining for two important reasons. First, consumers who could afford these items had already purchased them, while others had purchased them on credit. Neither group could be expected to make the same level of discretionary purchases indefinitely. Second, the distribution of wealth in the nation was dangerously uneven. Corporations had borrowed billions to produce factories that could churn out consumer goods, but there simply were not enough middle-class consumers who could afford their products. The wealthiest 1 percent of Americans controlled over a third of the nation’s wealth, and the bottom 50 percent had almost no personal savings whatsoever. The middle class had grown slightly wealthier, but few people could truly be considered middle class. This group of consumers was simply not large enough to sustain the new economy, which was based largely upon consumer spending.

The most obvious sign of financial crisis came in October 1929 when the average valuation of every publicly traded US company dropped by nearly 40 percent. Although this decline merely returned most stocks to the prices of the mid-1920s, the Stock Market Crash of 1929Refers to a series of days in October 1929 when the aggregate value of publicly traded companies listed on the New York Stock Exchange declined by as much as 10 percent. Although similar panics had led to declines like this over the course of a few days, the stock market crash saw multiple trading sessions in a row, where prices declined rapidly despite the efforts of leading bankers to bolster the market. Because many investors had bought stock with borrowed money, these declines led many individuals, banks, and corporations to go bankrupt. By 1933, the stock market was down by over 80 percent. was not merely a setback. Hundreds of millions of shares had been purchased with borrowed money with only the stock itself as collateral. When these stock prices fell, the loans could not be repaid. As a result, thousands of banks failed, and millions of depositors lost their life savings.

Even banks that had not made risky loans or speculated in the stock market were punished because depositors did not want to take chances that their bank would be the next to fail. At this time, it is important to remember, the US government did not provide insurance for bank deposits. The result was that banks no longer had money to lend to individuals or businesses to keep the economy going. To make matters worse, banks also began to call in their loans early, which forced businesses to sell their own stock, lay off workers, or simply declare bankruptcy.

This incredibly risky strategy of buying stock with borrowed money was known as “buying on margin.” The practice remains legal in the modern era, although it is more heavily regulated. Buying on margin allowed individuals to “leverage” their money to buy more stock than they normally could by using existing stock as collateral. For example, someone with 500 shares of General Electric valued at $100 per share would have an investment valued at $50,000. The use of leverage and margin could permit the investor to use those shares as collateral for a loan of another $200,000, which he would use to purchase another 2,000 shares of GE stock. If GE stock increases in value, the individual stands to make a substantial profit. However, if the stock declines by 40 percent, as most stocks did, the individual’s 2,500 shares at $60 each would be worth only $150,000. Because he still owes the bank $200,000 and has only $150,000 in stock to pay it back, he and the bank might be in serious trouble. During the 1920s, many private citizens, corporations, investment firms, and even banks found themselves in precisely this situation. Had the investor simply bought the 500 shares with money he owned, he would still have $30,000 worth of stock even after the 40 percent decline.

It may be easy in hindsight to see the folly of such an investment strategy, but the stock market’s unprecedented rise during the 1920s enticed many investors to become gamblers. The era’s prosperity had led to dramatic increases in stock prices, partially due to genuine corporate profits but also because many other speculators were also buying stock with money they did not actually have. Eventually, there were not enough new investors to keep buying stocks, and the prices began to decline.

However, these stock price declines were not the only cause of the Great Depression. Stock prices had doubled in the final two years of the 1920s and were overdue for a correction. The greatest significance of the stock market was its effect upon the banking system. The economy’s decline had actually begun sector by sector in the mid- to late 1920s in response to declining consumer demand. It was only after the crash of Wall Street that investors started paying attention to the years of declining consumer demand. Prior to the crash of October 1929, investors were happy to purchase stock at inflated prices. Afterwards, the realization that corporate profits lagged behind stock prices led to three consecutive years of stock market declines.

These declines erased the wealth of many potential entrepreneurs and led to the near-collapse of the banking system. It also shook the confidence of credit markets in ways that would prevent economic recovery. Recovery was also prevented by the unequal distribution of wealth in an economy based on consumer spending. When consumers could no longer afford to act as consumers are expected to act, sales declined, and the downward pressure on all financial markets continued. Between bank failures, the stock market crash, massive unemployment, and the complete erosion of consumer demand, it became increasingly clear that the economy would not recover on its own as quickly as it had in the past.

Hoover’s Response

Hoover recognized that the economy risked slowing due to overproduction that had produced glutted markets, especially in agriculture. Hoover believed the solution was higher tariffs for imports and a cooperative effort between businesses and government to expand into foreign markets. The Smoot-Hawley Tariff of 1930Placed taxes on imported goods during the Depression. The tariff was intended to spur domestic production by limiting foreign imports. However, the tariff encouraged foreign countries to place reciprocal tariffs on US exports, leading many historians to argue that the tariff was counterproductive. increased tariffs to record highs in hopes of limiting foreign imports to the United States. Economists predicted that the tariffs would backfire by leading foreign governments to raise tariffs on US products sold abroad. Because the United States was a net exporter of both manufactured goods and agricultural products, the danger of damaging the export trade was greater than the possible benefit of reducing imports. Unfortunately for farmers and industry, the tariff took effect just as a global depression led other nations to place similar tariffs on foreign goods, and international trade fell by two-thirds by 1932. Many in government recognized that raising the tariff was a poor long-term strategy, yet by 1930, most politicians were simply hoping to provide a quick boost to the domestic economy.

The stock market crash led to tighter credit and a suspension of loans from US banks abroad. As a result, only a controversial deal brokered by Hoover granting a one-year suspension of payments on wartime loans prevented an immediate collapse of the international banking system. However, the instability and unlikelihood that European banks could resume payments to the United States when this temporary moratorium ended led private citizens and companies to withdraw their money from European banks. The panic soon spread to the United States where bank runs led to the failure of a few thousand banks between 1931 and 1933. Because US banks had loaned the money that had been deposited to US businesses, real estate developers, and international banks, none of whom could immediately pay back their loans, there was no money to repay all of the depositors who were presenting themselves by the hundreds at the door of US banks.

The years 1932 and 1933 were the worst of the Great DepressionA period of high unemployment and low economic development between the Wall Street Crash of 1929 and US entry into World War II. The Depression was not limited to the United States, as Europe and the rest of the industrialized world experienced severe declines in their material well-being., as bank failures wiped out life savings and discouraged those who still had money from spending or investing it. One-fourth to one-third of Americans who sought jobs were unemployed at any given moment. Private charities that had been somewhat effective at caring for America’s poor in years past found themselves in the unenviable position of trying to determine who was in the greatest danger of starvation. Diseases associated with malnutrition that had not surfaced since the leanest years of the Civil War began to reemerge. Several million families were evicted from their homes and lived in the growing shanties that surrounded most cities. That many Americans called these clusters of makeshift shelters “Hoovervilles” indicated that Americans’ expectations of the federal government had changed since the crises of the 1870s and 1890s. During those years, most Americans turned to state and local governments for assistance. However, the magnitude of the crisis appeared to be beyond the ability of these institutions and private charity to mitigate.

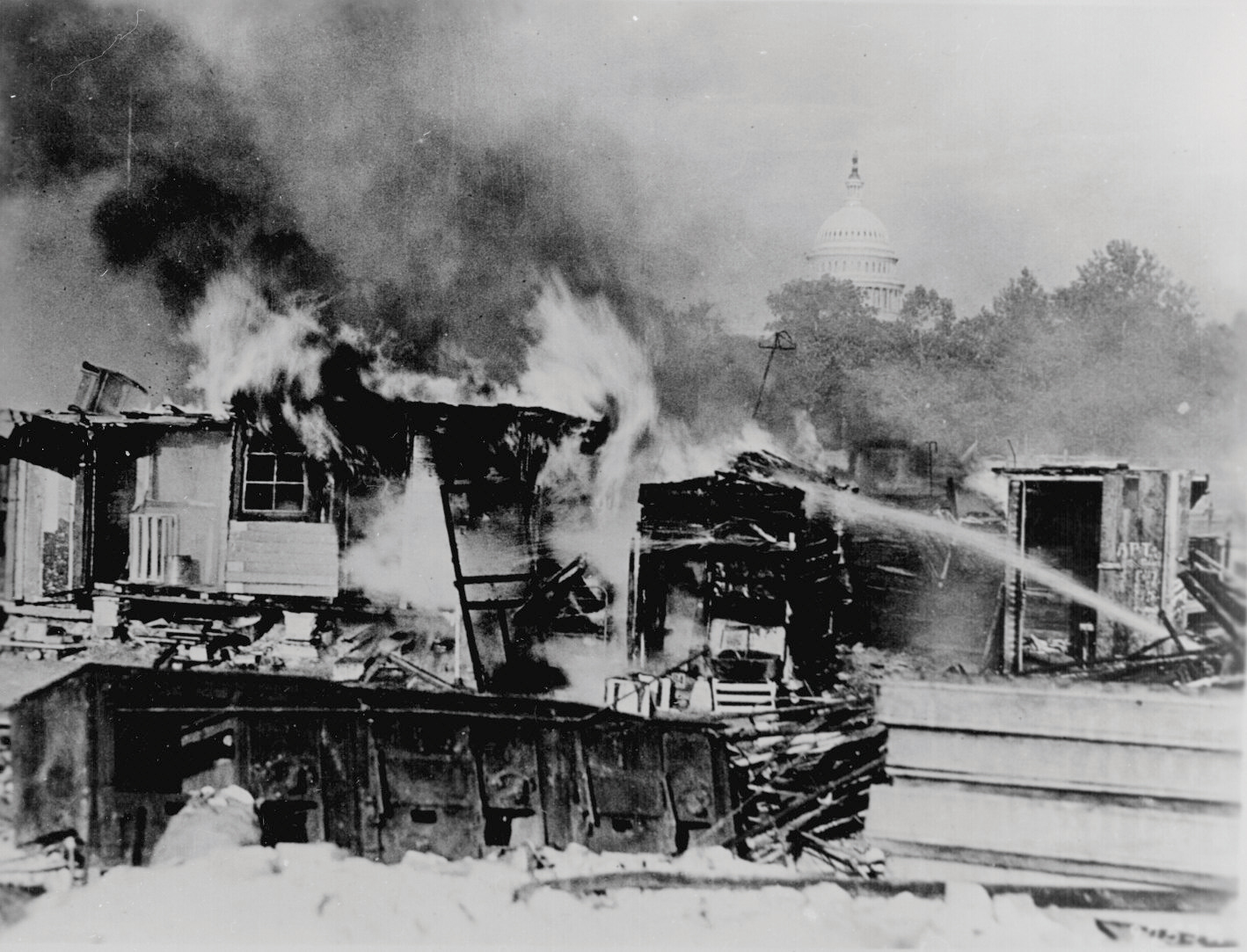

Instead of Coxey’s Army, which had demanded federal jobs during the crisis of the 1890s, more than 15,000 veterans converged on Washington in the summer of 1932. These former World War I soldiers requested early payment of their retirement bonus. Congress and President Hoover debated the matter, but determined that it was more important to maintain a balanced budget. Few of the veterans left the city after their measure was defeated. For many of these men and their families, obtaining an early payment of their bonus was their last best hope. Calling themselves the Bonus Army, these men and their families established their own Hoovervilles throughout the city and resolved to stay until the federal government reconsidered.

On July 28, an enraged President Hoover ordered the military to prevent these men from continuing their protest in front of the White House or US Capitol. Not for the last time in his career, General Douglas MacArthur exceeded a president’s orders. He sought to evict the veterans and their families from the nation’s capitol by force if necessary. Hoover likely did not fully understand the tactics that the military used on these veterans’ families, believing that he had preserved law and order from a trespassing “mob” as he called the men. The media told a different story complete with pictures of tanks under the command of MacArthur and perhaps the last cavalry charge in US military history led by a major named George S. Patton. The troops used poisonous gas that led to the death of an infant, while local police ordered the shacks set on fire. Among the dozens of injured veterans was a former private from Camden, New Jersey, who had been decorated for valor in saving Patton’s life during World War I.

Figure 6.27

The US Capitol appears in the backdrop of burning shacks, the temporary home of veterans who were part of the Bonus Army. These men had traveled to Washington, DC, in hopes of convincing Congress and President Hoover to pay World War I enlistment bonuses early due to the hardships of the Depression. As the photo indicates, that request was denied.

Following the government’s response to the Bonus Army, the public perceived Hoover as remarkably insensitive to the plight of ordinary Americans. It helped little that Hoover believed that keeping up the regal appearances of the White House might help to demonstrate his confidence in recovery. Hoover had never relished the trappings of office in the first place and might have been better served by communicating a bit of his own history instead of being photographed with white-gloved White House waiters. Hoover rose from poverty as an orphan to become a wealthy engineer. Actually, Hoover had succeeded at nearly everything he tried. He had also demonstrated a capacity for helping others in times of dire need as the head of an international agency that provided relief for Belgians during World War I. Hoover had also coordinated America’s remarkably successful humanitarian efforts throughout Europe at the war’s conclusion.

However, Hoover also viewed the creation of a large and powerful central government as the first step toward the tyranny that led to World War I. He and most other leading men of his era had come to believe that economic fluctuations were simply part of the business cycle and should be endured with stoic resolve. Hoover also believed in the importance of balanced budgets and ensuring a strong dollar based on the gold standard. While some of his critics suggested that printing more money would help to alleviate the credit crisis, limit bank failures, and perhaps encourage investment, Hoover followed orthodox economists who believed intentionally causing inflation was heresy. Hoover’s economic advisers also rejected new ideas such as raising money by selling government bonds to fund public works projects that would provide jobs. In fact, Hoover vetoed a law sponsored by his Democratic opponents that would have done this as the 1930 congressional elections approached.

Election of 1932

It is easy in hindsight to blame Congress for its failure to effectively regulate banks and financial markets. It is also tempting to blame Hoover for not embracing deficit spending, public works projects, and deliberate inflation to try to spur the economy. However, the total federal budget for non–defense-related expenditures was barely more than what some of the larger states spent each year. The expectations of the federal government were limited, and previous recessions and depressions had been dealt with by allowing the business cycle to right itself. From the perspective of history and Treasury Secretary Andrew Mellon, the role of the federal government was to stoically permit the natural workings of the market to “purge the rottenness out of the system.”

The Democrats believed that this depression was different, and they began their attack on Hoover and Republican members of Congress during the Congressional elections of 1930. Many of their allegations were less than objective and even unfair. However, partisan attacks against the party in power during times of economic decline was a time-honored strategy among both parties. Democrats used the science of marketing to brand the president and the Republicans as the architects of ruin. The empty pockets of an unemployed worker turned inside out were labeled “Hoover flags,” and the newspaper that covered him at night was referred to as a “Hoover blanket” by the Democrats.

After the Democrats gained over fifty seats in the House of Representatives during the 1930 elections, Hoover belatedly agreed to fund some public works projects. He also agreed to provide unprecedented loans to keep banks and other financial firms from going bankrupt. Despite Hoover’s activism, sincerity of purpose, and a work schedule that allowed him only a few hours for sleep, the economy continued to decline throughout the election year of 1932. The Democrats successfully branded the federal bailouts of banks—a strategy they had actually recommended to the president—as evidence to support their claims that Hoover cared more about the bankers who allegedly caused the Depression than the people who were suffering from it.

The perception was both unfair and inaccurate, as Hoover had agreed to numerous bipartisan relief efforts that would alleviate conditions in the next few years. For example, the Emergency Relief Act of July 1932 authorized up to $2 billion in loans to states to finance direct relief to those most in need and public works projects to provide jobs. These loans would pale in comparison to the massive federal programs of the next few years. However, these loans and other programs also initiated the process of using the federal government and monetary policy to steer the economy. They also provided funding for the first federal welfare program beyond the Sheppard-Towner Act which had offered limited subsidies for women’s health clinics.

In politics, as in most other fields, perception is reality and Hoover was continually branded as insensitive and unwilling to help those in need. Despite Hoover’s belated acceptance of what would later be known as Keynesian economics, he would be remembered as a president that did nothing in the face of crisis. He would also be portrayed as someone who believed in “trickle-down” theories of economic growth and recovery. This theory argues the best way to aid the economy is to secure the fortunes of the wealthy and the solvency of banks. Historians have recently argued that this comparison is inaccurate, especially when considered within the context of 1920s America. These times were about to change quickly, however, as Hoover’s successor used a variety of new strategies on such a massive scale that most Americans would forget Hoover’s limited attempts to use the power of the federal government to address the crisis.

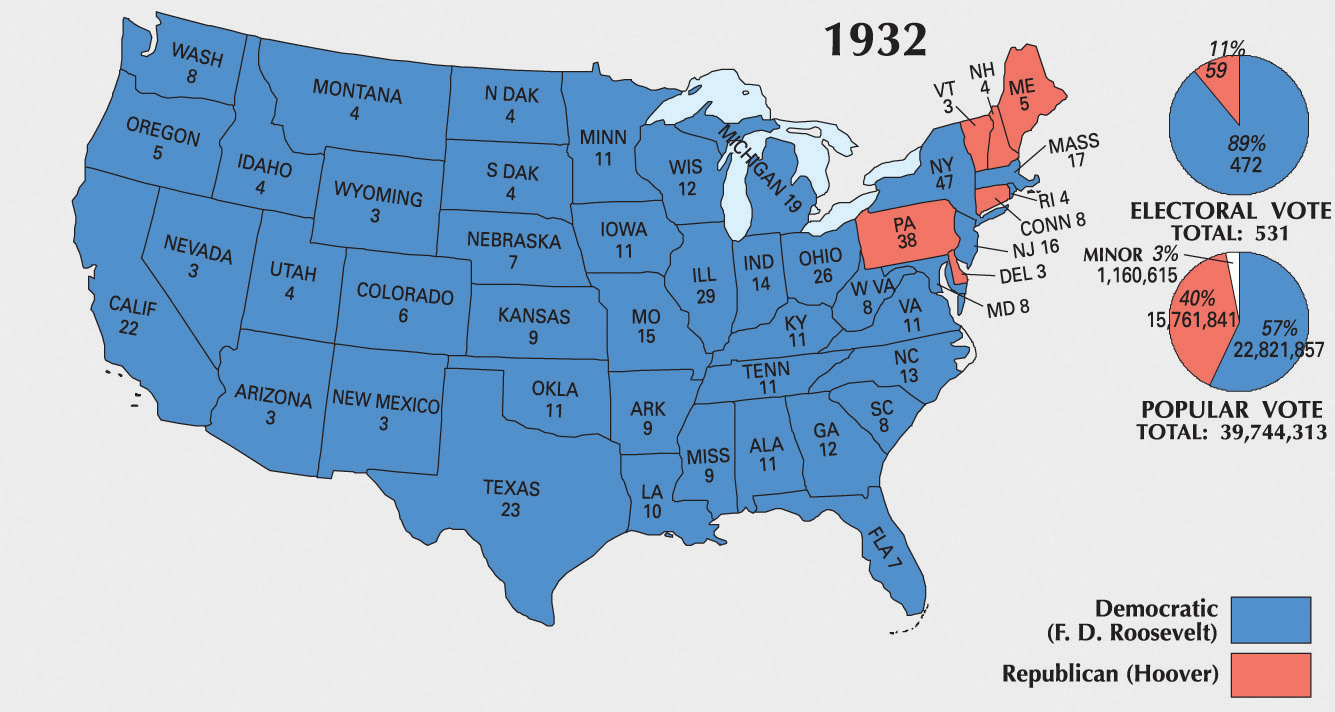

Figure 6.28

As this map indicates, the Democratic candidate Franklin Delano Roosevelt easily prevailed over the incumbent Herbert Hoover in the 1932 presidential election.

That man was Franklin Delano Roosevelt (FDR)A New York governor who became the 32nd president of the United States, Roosevelt would be elected to an unprecedented four terms between 1932 and his death in 1945. Although born and raised in affluence, Roosevelt communicated empathy for those Americans struggling through the Great Depression. As president, Roosevelt used his political power to create a number of federal programs that would later be known as the New Deal. He also sought to intervene on behalf of the Western Allies prior to the official US declaration of war against Japan and Germany in December 1941., a man of privilege who was born into an affluent family and used his connections to become governor of New York. Roosevelt was a lifelong politician who had been crippled by polio in 1921. With the aid of steel braces and his own indomitable will, he managed to “walk” by throwing his weight forward and bracing himself on the arm of a sturdy companion. For the rest of his life, that companion was his wife Eleanor. Also from a prominent family, the talented and well-educated Eleanor Roosevelt became his public face while her desk-bound husband dispatched armies of letters that kept him connected to the political world.

In the same year that New York’s Al Smith lost in a landslide to Hoover, Smith had convinced Roosevelt to enter the gubernatorial race in New York. Roosevelt’s victory and rising influence within the Democratic Party in the next four years ironically led to his selection over Al Smith during the 1932 Democratic convention. Hoover was nominated by a dispirited Republican Party but did not campaign in an election that many believed had already been decided by the state of the economy. Roosevelt spent most of 1932 campaigning for office by attempting to reconcile the various elements of his party rather than attempting to confront Hoover. By November 1932, industrial production had declined by 50 percent, and even business interests were abandoning Hoover and the Republicans. Everyone in America knew that whoever won the Democratic nomination had effectively won the presidency by default. What Roosevelt might do to halt the Depression and spur recovery, however, remained anyone’s guess.

Review and Critical Thinking

- How did speculation and debt lead to the stock market crash? Did the stock market crash cause the Great Depression? If you believe it did, why would the market partially recover in 1930?

- Explain the role of the stock market, banking, international affairs, and declining consumer demand in causing the Great Depression.

- Most Americans were angered by the Hoover administration and blamed the president for the state of the economy by the time of the 1932 election. Was this criticism fair? Answer this question in context of both the causes of the Depression and the traditions of limited government up to this time.

- Did Roosevelt unite the various competing factions of the Democratic Party in 1932, or was his landslide more a reflection of another factor?

- Socialists argued that the Depression revealed the true nature of Capitalism and its insatiable drive for maximizing profit that led to instability. What do you think? Did the Great Depression show the need for government intervention to prevent the downfall of the Capitalist system?