This is “Distributive Justice”, section 12.3 from the book Theory and Applications of Microeconomics (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

12.3 Distributive Justice

Learning Objectives

- What is the evidence from economic experiments about “fairness”?

- What are some of the leading theories about “fairness”?

So far we have described some facts about inequality in the United States and the world, and we have offered some explanations of why we observe these inequalities. In this section, we take a more philosophical perspective on the distribution of income and wealth. We ask questions of a kind that economists generally ignore, such as the following: “Is the distribution of income fair?”

As you might expect, questions like this are extremely contentious. Different people have very different ideas about what is fair and just, and this topic is highly politicized. It is not our job, nor is it our intention, to tell you what is and is not fair. What we can do is give you a (very brief) introduction to some of the ways that philosophers, economists, political scientists, and others have thought about these very hard questions. More particularly, we can give you some “thought experiments” to help you determine your own views on these topics. Hundreds of books have been written on these issues, however, so we simply scratch the surface here.

Experimental Evidence on Fairness

Noneconomists frequently speak about a “fair wage” or a “fair price” for a particular product. To economists, this language is unfamiliar, even confusing. Economics provides no theory about what is fair or unfair; it gives us no basis to ask whether particular prices in the economy are fair.

Yet ideas about fairness motivate people in many economic transactions. As one example, some people are willing to pay extra for “fair trade” goods, such as coffee or chocolate bars. The idea of these goods is that the seller makes some guarantees about payments to producers, working conditions, or other variables that are not intrinsic to the good itself. As another example, people are often willing to take part in boycotts, meaning that they voluntarily forgo a good that they like to send a message to the producer of the good.

Experimental economists have conducted many studies to try to understand some of these ideas of fairness. Sometimes they have used a dictator gameA game in which one player decides how much money to give to the other player and how much to keep.. This game has two players. Player A, the dictator, is given a sum of money and decides how much of that money to give to player B. Player B keeps the money he is given, and player A keeps the rest. From the perspective of economic reasoning, this game is completely trivial. Suppose you are the dictator, and you are given $100 to allocate. The self-interested thing to do is to keep all the money for yourself and give nothing to player B.

Yet study after study has shown that people typically give away some of their money, often dividing it up in equal shares. You may be able to think of several reasons why people behave this way. Perhaps they are worried about what the other person will think about them. Perhaps they are worried about what the experimenter will think about them. Researchers have gone to great lengths to design studies where no one except player A can possibly know her decision. Even in this case, most people do not keep all the money. It is hard to dismiss the view that people’s decisions are motivated in some way by what they think is the fair thing to do.

A related but slightly richer game is known as the ultimatum gameA game in which one player decides how much money to offer to the other player who either accepts or rejects the offer.. It also has two players. Player A is given a sum of money and then decides how much of that money to offer to player B. Player B then decides whether to accept or reject player A’s offer. If player B accepts that offer, he keeps the amount offered, and player A keeps the rest. If player B rejects the offer, then both player A and player B receive nothing.

Toolkit: Section 17.18 "Nash Equilibrium"

You can read more about these games and others in the toolkit.

The difference between the ultimatum game and the dictator game is that player B has the right to veto the offer. If he vetoes the offer, then both players get nothing. Economic theory again has a simple prediction about what completely self-interested players will do. Player B is better off accepting any positive offer than he is rejecting the offer. Suppose player A starts with $100 and offers $1 to player B. If player B accepts, he gets $1. If he rejects, he gets $0. Because $1 is better than nothing, player B should accept the offer. Knowing this, player A should offer the smallest amount possible. For example, if player A has $100 to allocate, she should offer $0.01. Player B should accept the offer ($0.01 is bigger than $0.00), and player A will then end up with $99.99. In fact, this is not what usually happens. People in the role of player A typically offer much more than the minimum amount. One reason is the risk that if player B is made a stingy offer, he will reject it out of spite. Another reason, like in the dictator game, is that people may care about fairness when making their offers. The evidence suggests that both factors seem to matter in this game.

Hundreds of studies have been conducted using different variants of these two games. The big conclusion from all these studies is that people seem to be motivated by more than just narrow self-interest when they play games such as these in the laboratory. Instead, they care about allocating the rewards from the experiment in a way that is fair. Understanding exactly what underlies these ideas of fairness is an exciting area of research in experimental and behavioral economics, as well as in psychology and other disciplines.

Meritocracy

We begin with a very simple framework. Imagine an economy in which there are two kinds of people: high ability and low ability. Half the people in the economy are high ability: they can produce 100 chocolate bars in a year. The other half are low ability: they can produce only 50 chocolate bars in a year. In this economy, productivity and ability are the same thing. High-ability people are more productive than low-ability people. We use this simple economy to think about different approaches to the allocation of society’s resources.

Libertarianism

One view of distribution is summarized by the statement “you are entitled to whatever you earn.” In this world, the distribution of income and consumption will be the same as the distribution of output. High-ability people have income of 100 chocolate bars. If our fictional economy were to last for only one year, their consumption would also be 100 chocolate bars. Similarly, low-ability people will have income and consumption of 50 chocolate bars. This economy has an unequal distribution of income and consumption.

If we were to associate this position with a particular philosophical school of thought, it would be libertarianism. Libertarians generally believe that people are entitled to whatever they can earn, the state should intervene as little as possible, and the state should not actively seek to redistribute resources. The fact that there is inequality in this society is simply a reflection of differing abilities, which is not any reason for the government to get involved. (To be clear, libertarians have no objection to people making charitable contributions. If the high-ability people in the economy wanted to voluntarily give money to the low-ability people, libertarians would have no complaint about this.)

Consumption, Saving, and Insurance

Now let us consider a slight variant on this economy. Suppose the economy lasts for two periods: in each period, every individual has a 50-50 chance of being either high or low ability. If we measured income in either period, we would see the same amount of inequality as before.

Consumption, however, is a different story. Suppose you are a high-ability person in the first period. You know that you face a risk of being low ability in the second period. Should you eat your entire 100 chocolate bars in the first period? Most people prefer to keep their consumption at least somewhat smooth, so they will “save for a rainy day.” We expect that high-income people in this economy will consume less than their income.

Similar reasoning applies to low-ability people. They earn only 50 bars in the first year but have a 50-50 chance of higher income next year. By the same consumption-smoothing argument, they would like to somewhat increase consumption today. Thus low-ability people will consume more than their income in the first period. There will be a credit market (or loan market)Where suppliers and demanders of credit meet and trade. in which high-income people lend money to low-income people in the first year, and those loans are repaid the following year.

Toolkit: Section 17.6 "The Credit Market"

You can review the idea of the credit market in the toolkit.

This example of borrowing and lending driven by the desire for smooth consumption affects the distributions of income and consumption. Economic theory tells us that consumption will be more equal than income. This is consistent with the evidence: consumption is indeed more evenly distributed than income. Again, believers in a libertarian philosophy would see no reason for any intervention in this economy.

If this economy were more sophisticated, it might even develop an insurance market. All the individuals in the first year would recognize that their future income was uncertain. If they are risk-averseBeing willing to pay more than a gamble’s expected loss in order to avoid that gamble., then they would all prefer to eliminate this uncertainty. Being risk-averse means you prefer the average of a gamble to the gamble itself. Suppose a person is faced with a choice between

- 100 chocolate bars with a probability of 0.5 and 50 chocolate bars with a probability of 0.5

- 75 chocolate bars

A risk-averse person prefers the option that delivers 75 chocolate bars with certainty. The first option also yields 75 chocolate bars on average (more technically, it has an expected value of 0.5 × 100 + 0.5 × 50 = 75), but this option has uncertainty that risk-averse people will want to avoid. In this economy, there would be some redistribution of income in the second year. However, it would be a voluntary redistribution based on the insurance contract that everybody agreed to in the first year. Again, there would be no role for government.

Toolkit: Section 17.7 "Expected Value"

You can review the concepts of probability and expected value in the toolkit.

The Rawlsian Veil of Ignorance

One of the most famous approaches to the questions of fairness and justice was pioneered by the philosopher John Rawls in his celebrated book, A Theory of Justice.John Rawls, A Theory of Justice (Cambridge: MA, Harvard University Press, 1971). Rawls’s work is rich, complicated, and much debated, and the presentation here is very simplified and stylized. For example, Rawls focused more on the institutions that people behind the veil would want, rather than on the actual distribution of income. Rawls introduced a powerful thought experiment to help people decide how they feel about different distributions of society’s resources.

It is difficult for any of us to think about redistribution without framing it in terms of our own personal circumstances and interests. Rawls’s idea was designed to help us shed those considerations. He proposed thinking about redistribution from behind a veil of ignorance. Behind this veil, you know what the distribution of resources and abilities will look like in society, but you do not know where you will be in this distribution. You might be born rich, or you might be born poor. You could end up as Bill Gates, or as a homeless person in New York. If you want to play this game globally, you might end up as a member of a royal family in Europe or as someone scavenging for food on a garbage heap in Cambodia. If we frame this in terms of our previous example, then, behind the veil of ignorance, you know that 50 percent of the people will be high ability, and 50 percent will be low ability, but you do not know which you will end up being.

Now suppose that decisions on how to allocate chocolate bars across households are made before people know whether they are high or low ability. Rawls suggested that people behind the veil would adopt a social contractAn agreement (possibly implicit) among the members of a society. in which they agree to the following.

- Once born, they will produce chocolate bars according to their ability and then put the chocolate bars they produce into a big pile.

- Each individual will take out an equal share of 75 bars.

This contract involves taxation and redistribution. The high-ability people are each taxed 25 bars, and the low-ability people receive a transfer of 25 bars. The taxes are sufficient to finance the transfers.

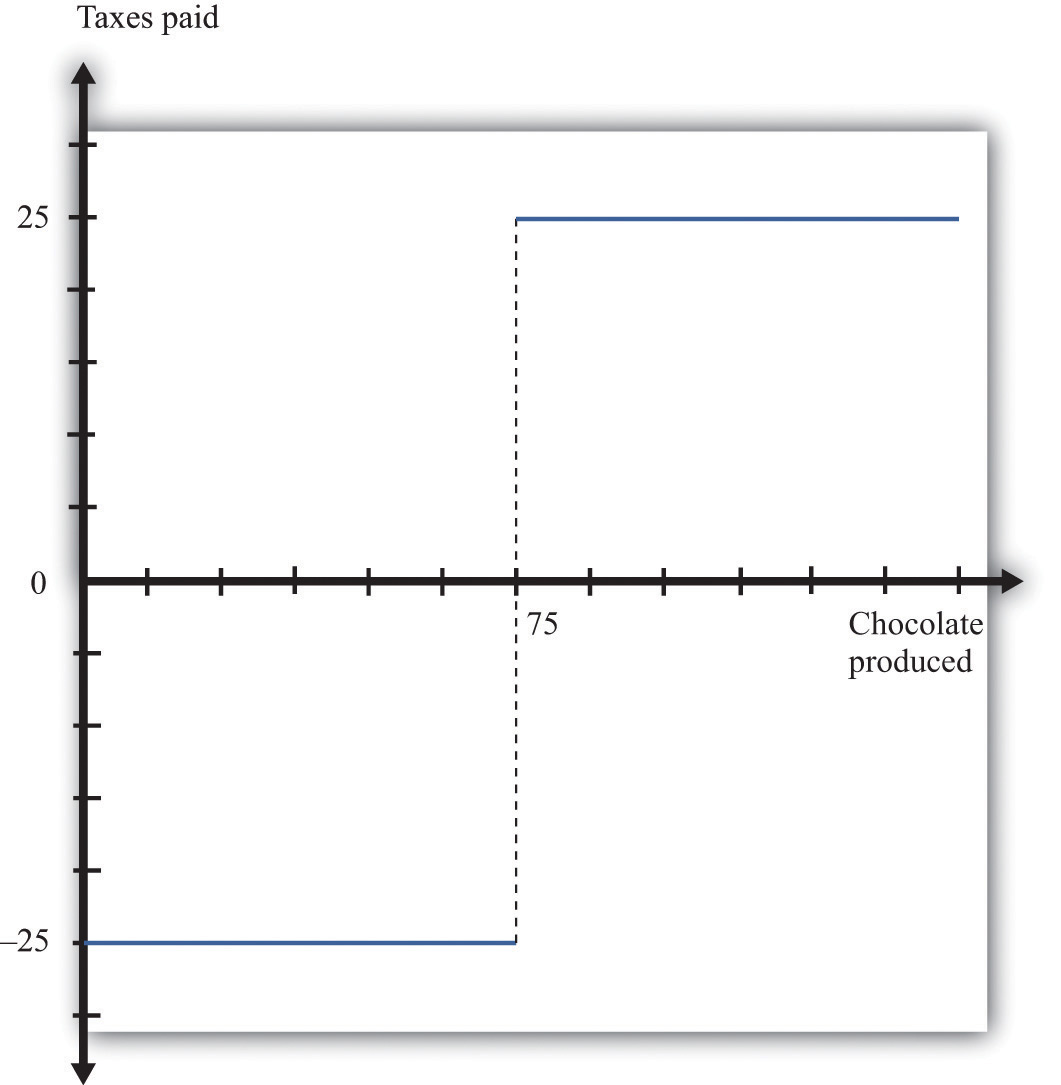

Figure 12.8 "Taxes and Transfers in a Rawlsian Social Contract" shows a taxation and transfer scheme that could be used with this social contract. On the horizontal axis is production, which is income. On the vertical axis is the tax paid by each income group. With this scheme, anyone with income above 75 bars pays a tax of 25 bars. Anyone with income below 75 bars gets a transfer of 25 bars. Because there are an equal number of high- and low-ability households, taxes collected equal transfers. The government’s budget balances.

Figure 12.8 Taxes and Transfers in a Rawlsian Social Contract

With this tax scheme, households producing more than 75 chocolate bars pay a tax of 25 bars, and those producing fewer than 75 bars receive a transfer (negative tax) of 25 bars.

Because everyone is risk-averse, all will prefer this deal to the allocation that gave the high-ability people 100 bars and the low-ability people 50 bars. Though additional chocolate bars are not produced, the redistribution of the contract is preferred to everyone before they know their ability. The key, emphasized in the previous sentence, is that the contract is agreed on before people know their ability. Because of this timing, the risk sharing through the redistribution of the chocolate bars makes everyone better off, compared to the—imaginary—initial condition.

You have almost certainly noticed that this Rawlsian social contract very closely resembles the insurance contract that we described in Section 12.3.2 "Meritocracy". In effect, Rawls suggested that people behind the veil would want to write the same kind of insurance contract that they would write in a similar situation in real life. But because we obviously can’t write contracts before we are born, Rawls thought that we should agree to government policies that would mimic these kinds of insurance contracts. Notice that, in the Rawlsian world, the distribution of income has a higher Gini coefficient than does consumption. In fact, in this example, there is no inequality in consumption.

From Each According to His Ability and to Each According to His Needs

Karl Marx, the famous philosopher and social theorist, suggested that society should distribute its resources as follows: “From each according to his ability, to each according to his needs.” Marx’s prescription recognizes that individuals differ in their ability to produce and in their consumption needs. He said that workers should produce at a rate commensurate with their ability, so high-ability individuals would be expected to produce more output than low-ability individuals.

In the Marxian view, there is a complete disconnect between production and consumption. There is no sense that those who produce more of society’s resources should be entitled to consume more of those resources. It stands in complete contrast to the libertarian view that individuals have a right to whatever they produce. The distribution of production is independent of the allocation of income and consumption.

How would the Marxian view work in our chocolate bar economy? “From each according to his ability” means simply that the high-ability individuals should produce 100 chocolate bars and the low-ability individuals should produce 50 chocolate bars. Meanwhile, “to each according to his needs” means that the total number of chocolate bars produced in the economy ought to be allocated in a way that reflects the needs of the individuals. In our simple example, individuals do not differ in their valuationThe maximum amount an individual would be willing to pay to obtain that quantity. of a chocolate bar. All individuals like chocolate bars the same amount. Therefore, the allocation that satisfies the Marxian prescription is that everyone should have the same number of chocolate bars.

In our simple example, Marx and Rawls agree on how to allocate chocolate bars. We can imagine, however, ways in which individuals might differ in terms of their needs. For example, some people are fortunate enough to be healthy and fit, while others suffer from illness or disease. A Marxian prescription would allocate more of society’s resources to the sick, on the grounds that their needs were greater. (It is also possible, of course, that people behind the Rawlsian veil of ignorance would make a similar allocation.)

Luck versus Merit

In all of our examples so far, we have supposed that people differed only in terms of their abilities, which are—by assumption—completely outside their control. In our earlier discussion of the sources of inequality, however, we listed many different possible reasons why people might have different earnings. Some of these factors were outside any individual’s control; others were not. Table 12.9 "Luck versus Merit" provides a partial listing.

Table 12.9 Luck versus Merit

| Outside an Individual’s Control | Within an Individual’s Control |

|---|---|

| Innate abilities | Effort and hours worked |

| Demand for these abilities | Education (in part) |

| Supply of these abilities by others | Experience and training |

| Discrimination | Consumption/saving decisions |

| Inherited wealth |

An individual does not control his or her basic abilities. Some are lucky, possessing the abilities that allow them to be great basketball players, pianists, authors, or scientists. Abilities that are scarce are likely to be more valuable. The value associated with a particular set of abilities is also heavily dependent on time and place—for example, being a great rock drummer would not have been worth much in the Roman Empire, and an ability to throw a spear hard and accurately is not especially valuable in modern-day San Francisco. All of these come down to luck when viewed from the perspective of any individual.

We have hinted at many other factors that are also a matter of luck. Those born of wealthy parents in wealthy countries are likely to attend high-quality schools and receive inherited wealth. They may also be able to earn higher real interest rates on their savings. Meanwhile, those who are subject to discrimination will earn lower incomes.

There are also many factors that influence the distribution of income, consumption, and wealth that are under the control of an individual. Individuals can choose how hard to work and how many hours to work. They can choose whether to sacrifice current earnings to go to college. They can decide to go back to school to earn a master’s degree. They can choose careers that allow them to develop skills and experience on the job.

Why does this distinction matter? Most people would agree that there is little or no problem with inequalities that result from people’s choices. There is nothing self-evidently unfair about one person having a higher income than another because he works harder or chose to take time off from work to pursue a graduate degree. But opinions differ much more about the fairness of inequalities that result from luck or chance. Tiger Woods is an immensely talented golfer, but is it fair that he should earn so much on the basis of his genetic luck? Is it fair that someone who struggles in school and possesses little in the way of valuable skills should earn only minimum wage? These are not questions that we can answer, but thinking about these questions should help you form your own opinions on what is a fair and just distribution of society’s resources.

Equality of Opportunity versus Equality of Outcome

The distinction between luck and merit gives us a more nuanced view of equality. It is closely related to another distinction that is often made when discussing the distribution of society’s resources: equality of opportunity versus equality of outcome. Here is an example to help make the distinction clear.

At major soccer tournaments, such as the World Cup, teams often line up behind banners proclaiming “fair play.” The international soccer association, FIFA (Fédération Internationale de Football Association), places a lot of emphasis on this idea. Fair play means that players should always play within the rules, and these rules provide equality of opportunity on the soccer field. At the start of any game, both teams line up with the same number of players, try to score in the same sized goal, and enjoy the benefits of impartial referees. This does not mean that soccer games always end in a tie: FIFA’s rules do not mean that there is equality of outcome. The outcome depends on the two teams’ abilities. So although the opportunity to win is shared equally by the teams, the outcome is not: the winner takes all.

Equality of opportunity without equality of outcome is pervasive in the economy as well. Institutions exist to enhance equality of opportunity with no guarantees about outcomes. For example, going to a public school is an option for everyone (though there are significant differences across schools in terms of their quality). But there is no guarantee that two people graduating from the same school will have the same outcome. When you apply for a job, you have an opportunity to compete along with anyone else for that job, but the outcome is different for the person who is hired compared to those who are not.

It is tempting to identify equality of opportunity with the view that merit should be rewarded but luck should not. There is certainly a connection. Both imply that discrimination should not affect the distribution of income in the economy. But equality of opportunity still allows those with high abilities to get higher rewards, even though those abilities are a matter of luck. If your college soccer team were to play Real Madrid, either team would have the chance to win the game, according to the rules. That equality of opportunity would be of little consolation to your team’s goalkeeper as he picked the ball out of the net for the 20th time.

Yet there is one very good reason why equality of opportunity is so important. Imagine what would happen if FIFA started instructing referees to ensure that every soccer game ended in a draw. To ensure equality of outcome, the referee would alter the rules of the game to help the side that was losing. Fair play would be gone, together with lots of other things: teams would have no incentive to play hard, they would have no incentive to find quality players, and fans would not enjoy the game as much. We get the best from a team because it knows that if it performs well, under the rules, it will win and receive financial and emotional rewards. These provide the incentives for team members to train and play hard, within the rules of the game. Combining equality of opportunity with the ability to compete for a prize strikes the right balance—at least for soccer—between equality and incentives. In the next section, we will examine why incentives matter so much for decisions about redistribution.

Key Takeaways

- In experimental bargaining games, players seem to be motivated by more than narrow self-interest. In many cases, they give money to the other player.

- Equality of opportunity argues that everyone should have an equal chance of succeeding without guaranteeing that success. It contrasts with the view that everyone should work as hard as they can, and goods and services should be allocated according to need.

Checking Your Understanding

- Does the grading in your economics class exhibit equality of opportunity? Why or why not?

- If you think about the allocation of resources within a household, which of the theories of distributive justice best applies?