This is “Macroeconomics Toolkit”, chapter 16 from the book Theory and Applications of Macroeconomics (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 16 Macroeconomics Toolkit

In this chapter, we present the key tools used in the macroeconomics part of this textbook. This toolkit serves two main functions:

- Because these tools appear in multiple chapters, the toolkit serves as a reference. When using a tool in one chapter, you can refer back to the toolkit to find a more concise description of the tool as well as links to other parts of the book where the tool is used.

- You can use the toolkit as a study guide. Once you have worked through the material in the chapters, you can review the tools using this toolkit.

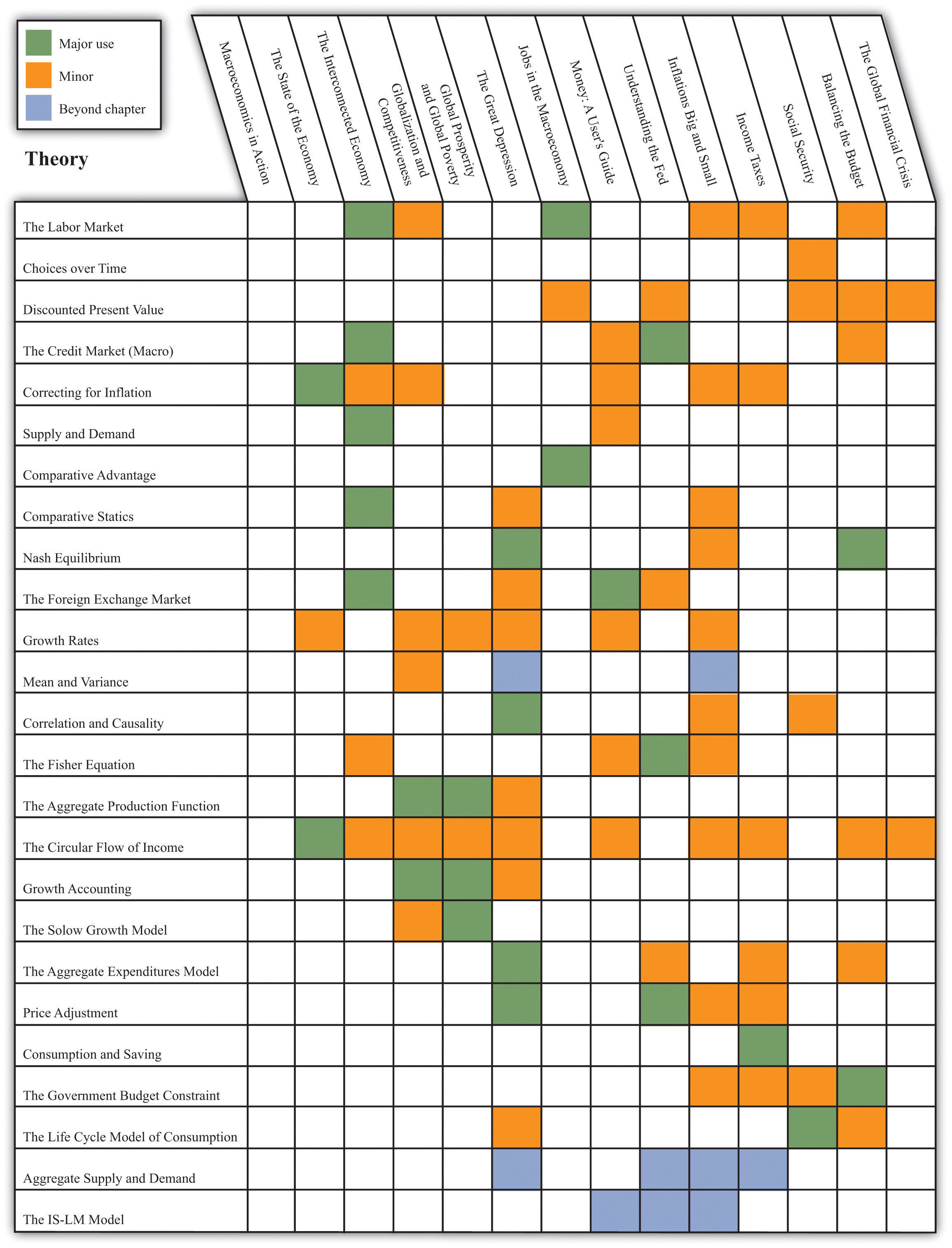

The chart below shows the main uses of each tool in green, and the secondary uses are in orange.

16.1 The Labor Market

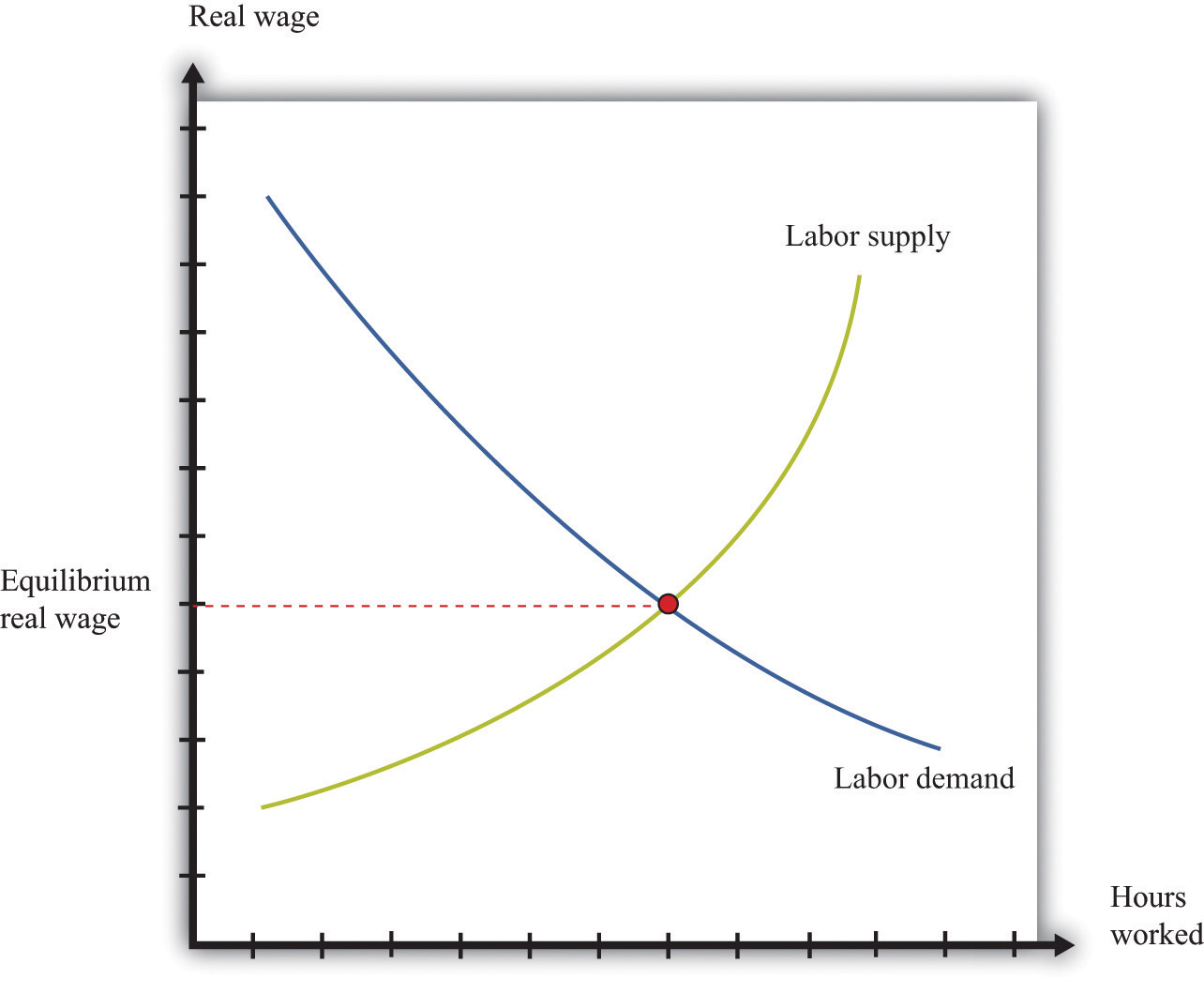

The labor market is the market in which labor services are traded. Individual labor supply comes from the choices of individuals or households about how to allocate their time. As the real wage (the nominal wage divided by the price level) increases, households supply more hours to the market, and more households decide to participate in the labor market. Thus the quantity of labor supplied increases. The labor supply curve of a household is shifted by changes in wealth. A wealthier household supplies less labor at a given real wage.

Labor demand comes from firms. As the real wage increases, the marginal cost of hiring more labor increases, so each firm demands fewer hours of labor input—that is, a firm’s labor demand curve is downward sloping. The labor demand curve of a firm is shifted by changes in productivity. If labor becomes more productive, then the labor demand curve of a firm shifts rightward: the quantity of labor demanded is higher at a given real wage.

The labor market equilibrium is shown in Figure 16.1 "Labor Market Equilibrium". The real wage and the equilibrium quantity of labor traded are determined by the intersection of labor supply and labor demand. At the equilibrium real wage, the quantity of labor supplied equals the quantity of labor demanded.

Figure 16.1 Labor Market Equilibrium

Key Insights

- Labor supply and labor demand depend on the real wage.

- Labor supply is upward sloping: as the real wage increases, households supply more hours to the market.

- Labor demand is downward sloping: as the real wage increases, firms demand fewer hours of work.

- A market equilibrium is a real wage and a quantity of hours such that the quantity demanded equals the quantity supplied.

16.2 Choices over Time

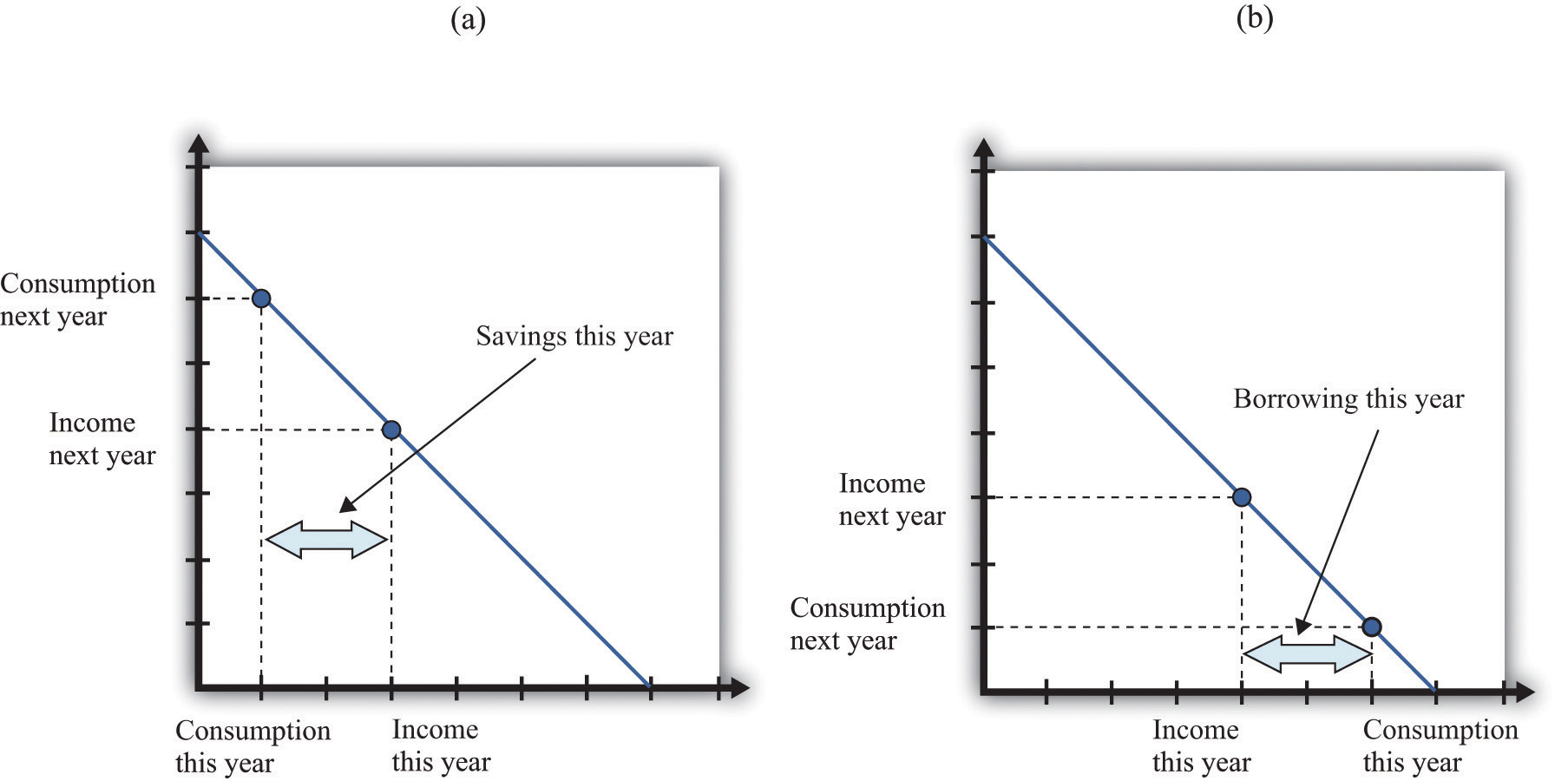

Individuals make decisions that unfold over time. Because individuals choose how to spend income earned over many periods on consumption goods over many periods, they sometimes wish to save or borrow rather than spend all their income in every period.

Figure 16.2 "Choices over Time" shows examples of these choices over a two-year horizon. The individual earns income this year and next. The combinations of consumption that are affordable and that exhaust all of an individual’s income are shown on the budget line, which in this case is called an intertemporal budget constraint. The slope of the budget line is equal to (1 + real interest rate), which is equivalent to the real interest factor. The slope is the amount of consumption that can be obtained tomorrow by giving up a unit of consumption today.

The preferred point is also indicated; it is the combination of consumption this year and consumption next year that the individual prefers to all the points on the budget line. The individual in part (a) of Figure 16.2 "Choices over Time" is consuming less this year than she is earning: she is saving. Next year she can use her savings to consume more than her income. The individual in part (b) of Figure 16.2 "Choices over Time" is consuming more this year than he is earning: he is borrowing. Next year, his consumption will be less than his income because he must repay the amount borrowed this year.

When the real interest rate increases, individuals will borrow less and (usually) save more (the effect of interest rate changes on saving is unclear as a matter of theory because income effects and substitution effects act in opposite directions). Thus individual loan supply slopes upward.

Of course, individuals live for many periods and make frequent decisions on consumption and saving. The lifetime budget constraint is obtained using the idea of discounted present value:

discounted present value of lifetime income = discounted present value of lifetime consumption.The left side is a measure of all the disposable income the individual will receive over his lifetime (disposable means after taking into account taxes paid to the government and transfers received from the government). The right side calculates the value of consumption of all goods and services over an individual’s lifetime.

Key Insights

- Over a lifetime, an individual’s discounted present value of consumption will equal the discounted present value of income.

- Individuals can borrow or lend to obtain their preferred consumption bundle over their lifetimes.

- The price of borrowing is the real interest rate.

Figure 16.2 Choices over Time

The Main Use of This Tool

16.3 Discounted Present Value

Discounted present value is a technique used to add dollar amounts over time. We need this technique because a dollar today has a different value from a dollar in the future.

The discounted present value this year of $1.00 that you will receive next year is as follows:

If the nominal interest rate is 10 percent, then the nominal interest factor is 1.1, so $1 next year is worth $1/1.1 = $0.91 this year. As the interest rate increases, the discounted present value decreases.

More generally, we can compute the value of an asset this year from the following formula:

The flow benefit depends on the asset. For a bond, the flow benefit is a coupon payment. For a stock, the flow benefit is a dividend payment. For a fruit tree, the flow benefit is the yield of a crop.

If an asset (such as a bond) yields a payment next year of $10 and has a price next year of $90, then the “flow benefit from asset + price of the asset next year” is $100. The value of the asset this year is then If the nominal interest rate is 20 percent, then the value of the asset is $100/1.2 = 83.33.

We discount nominal flows using a nominal interest factor. We discount real flows (that is, flows already corrected for inflation) using a real interest factor, which is equal to (1 + real interest rate).

Key Insights

- If the interest rate is positive, then the discounted present value is less than the direct sum of flows.

- If the interest rate increases, the discounted present value will decrease.

More Formally

Denote the dividend on an asset in period t as Dt. Define Rt as the cumulative effect of interest rates up to period t. For example, R2 = (1 + r1)(1 + r2). Then the value of an asset that yields Dt dollars in every year up to year T is given by

If the interest rate is constant (equal to r), then the one period interest factor is R = 1 + r, and Rt = Rt.

The discounted present value tool is illustrated in Table 16.1 "Discounted Present Value with Different Interest Rates". The number of years (T) is set equal to 5. The table gives the value of the dividends in each year and computes the discounted present values for two different interest rates. For this example, the annual interest rates are constant over time.

Table 16.1 Discounted Present Value with Different Interest Rates

| Year | Dividend ($) | Discounted Present Value with R = 1.05 ($) | Discounted Present Value with R = 1.10 ($) |

|---|---|---|---|

| 1 | 100 | 100 | 100 |

| 2 | 100 | 95.24 | 90.91 |

| 3 | 90 | 81.63 | 74.38 |

| 4 | 120 | 103.66 | 90.16 |

| 5 | 400 | 329.08 | 273.20 |

| Discounted present value | 709.61 | 628.65 |

16.4 The Credit (Loan) Market (Macro)

Consider a simple example of a loan. Imagine you go to your bank to inquire about a loan of $1,000, to be repaid in one year’s time. A loan is a contract that specifies three things:

- The amount being borrowed (in this example, $1,000)

- The date(s) at which repayment must be made (in this example, one year from now)

- The amount that must be repaid

What determines the amount of the repayment? The lender—the bank—is a supplier of credit, and the borrower—you—is a demander of credit. We use the terms credit and loans interchangeably. The higher the repayment amount, the more attractive this loan contract will look to the bank. Conversely, the lower the repayment amount, the more attractive this contract is to you.

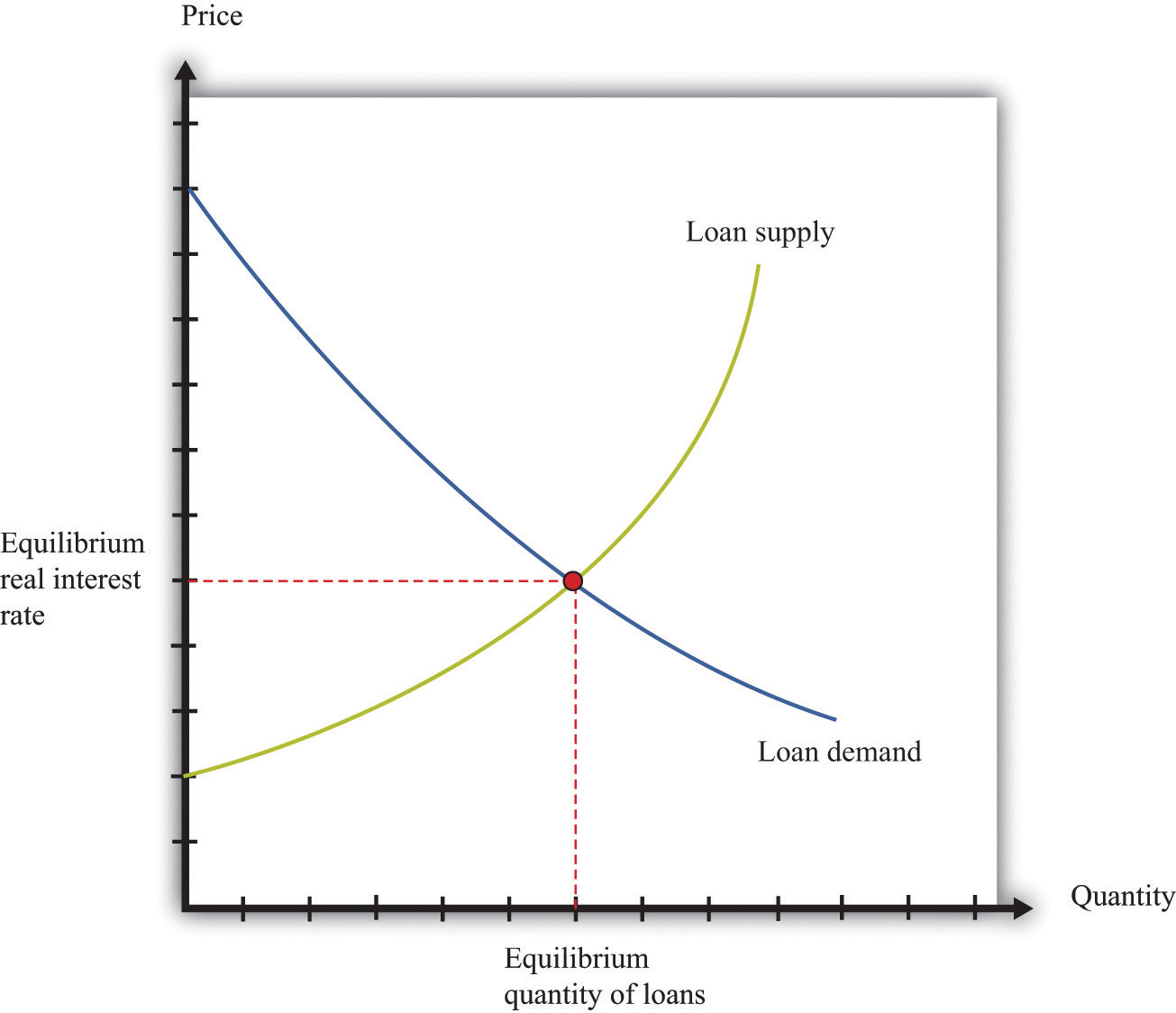

If there are lots of banks that are willing to supply such loans, and lots of people like you who demand such loans, then we can draw supply and demand curves in the credit (loan) market. The equilibrium price of this loan is the interest rate at which supply equals demand.

In macroeconomics, we look at not only individual markets like this but also the credit (loan) market for an entire economy. This market brings together suppliers of loans, such as households that are saving, and demanders of loans, such as businesses and households that need to borrow. The real interest rate is the “price” that brings demand and supply into balance.

The supply of loans in the domestic loans market comes from three different sources:

- The private saving of households and firms

- The saving of governments (in the case of a government surplus)

- The saving of foreigners (when there is a flow of capital into the domestic economy)

Households will generally respond to an increase in the real interest rate by reducing current consumption relative to future consumption. Households that are saving will save more; households that are borrowing will borrow less. Higher interest rates also encourage foreigners to send funds to the domestic economy. Government saving or borrowing is little affected by interest rates.

The demand for loans comes from three different sources:

- The borrowing of households and firms to finance purchases, such as housing, durable goods, and investment goods

- The borrowing of governments (in the case of a government deficit)

- The borrowing of foreigners (when there is a flow of capital from the domestic economy)

As the real interest rate increases, investment and durable goods spending decrease. For firms, a high interest rate represents a high cost of funding investment expenditures. This is an application of discounted present value and is evident if a firm borrows to purchase capital. It is also true if it uses internal funds (retained earnings) to finance investment because the firm could always put those funds into an interest-bearing asset instead. For households, higher interest rates likewise make it more costly to borrow to purchase housing and durable goods. The demand for credit decreases as the interest rate rises. When it is expensive to borrow, households and firms will borrow less.

Equilibrium in the market for loans is shown in Figure 16.3 "The Credit Market". On the horizontal axis is the total quantity of loans in equilibrium. The demand curve for loans is downward sloping, whereas the supply curve has a positive slope. Loan market equilibrium occurs at the real interest rate where the quantity of loans supplied equals the quantity of loans demanded. At this equilibrium real interest rate, lenders lend as much as they wish, and borrowers can borrow as much as they wish. Equilibrium in the aggregate credit market is what ensures the balance of flows into and out of the financial sector in the circular flow diagram.

Key Insights

- As the real interest rate increases, more loans are supplied, and fewer loans are demanded.

- Adjustment of the real interest rate ensures that, in the circular flow diagram, the flows into the financial sector equal the flows from the sector.

The Main Uses of This Tool

- Chapter 4 "The Interconnected Economy"

- Chapter 9 "Money: A User’s Guide"

- Chapter 10 "Understanding the Fed"

- Chapter 11 "Inflations Big and Small"

- Chapter 14 "Balancing the Budget"

Figure 16.3 The Credit Market

16.5 Correcting for Inflation

If you have some data expressed in nominal terms (for example, in dollars), and you want to convert them to real terms, you should use the following four steps.

- Select your deflator. In most cases, the Consumer Price Index (CPI) is the best deflator to use. You can find data on the CPI (for the United States) at the Bureau of Labor Statistics website (http://www.bls.gov).

- Select your base year. Find the value of the index in that base year.

- For all years (including the base year), divide the value of the index in that year by the value in the base year. The value for the base year is 1.

- For each year, divide the value in the nominal data series by the number you calculated in step 3. This gives you the value in “base year dollars.”

Table 16.2 "Correcting Nominal Sales for Inflation" shows an example. We have data on the CPI for three years, as listed in the second column. The price index is created using the year 2000 as a base year, following steps 1–3. Sales measured in millions of dollars are given in the fourth column. To correct for inflation, we divide sales in each year by the value of the price index for that year. The results are shown in the fifth column. Because there was inflation each year (the price index is increasing over time), real sales do not increase as rapidly as nominal sales.

Table 16.2 Correcting Nominal Sales for Inflation

| Year | CPI | Price Index (2000 Base) | Sales (Millions) | Real Sales (Millions of Year 2000 Dollars) |

|---|---|---|---|---|

| 2000 | 172.2 | 1.0 | 21.0 | 21.0 |

| 2001 | 177.1 | 1.03 | 22.3 | 21.7 |

| 2002 | 179.9 | 1.04 | 22.9 | 21.9 |

Source: Bureau of Labor Statistics for the Consumer Price Index

This calculation uses the CPI, which is an example of a price index. To see how a price index like the CPI is constructed, consider Table 16.3 "Constructing a Price Index", which shows a very simple economy with three goods: T-shirts, music downloads, and meals. The prices and quantities purchased in the economy in 2012 and 2013 are summarized in the table.

Table 16.3 Constructing a Price Index

| Year | T-shirts | Music Downloads | Meals | Cost of 2013 Basket | Price Index | |||

|---|---|---|---|---|---|---|---|---|

| Price ($) | Quantity | Price ($) | Quantity | Price ($) | Quantity | Price ($) | ||

| 2012 | 20 | 10 | 1 | 50 | 25 | 6 | 425 | 1.00 |

| 2013 | 22 | 12 | 0.80 | 60 | 26 | 5 | 442 | 1.04 |

To construct a price index, you must choose a fixed basket of goods. For example, we could use the goods purchased in 2013 (12 T-shirts, 60 downloads, and 5 meals). This fixed basket is then priced in different years. To construct the cost of the 2013 basket at 2013 prices, the product of the price and the quantity purchased for each good in 2013 is added together. The basket costs $442. Then we calculate the cost of the 2013 basket at 2012 prices: that is, we use the prices of each good in 2012 and the quantities purchased in 2013. The sum is $425. The price index is constructed using 2012 as a base year. The value of the price index for 2013 is the cost of the basket in 2013 divided by its cost in the base year (2012).

When the price index is based on a bundle of goods that represents total output in an economy, it is called the price level. The CPI and gross domestic product (GDP) deflator are examples of measures of the price level (they differ in terms of exactly which goods are included in the bundle). The growth rate of the price level (its percentage change from one year to the next) is called the inflation rate.

We also correct interest rates for inflation. The interest rates you typically see quoted are in nominal terms: they tell you how many dollars you will have to repay for each dollar you borrow. This is called a nominal interest rate. The real interest rate tells you how much you will get next year, in terms of goods and services, if you give up a unit of goods and services this year. To correct interest rates for inflation, we use the Fisher equation:

real interest rate ≈ nominal interest rate − inflation rate.For more details, see Section 16.14 "The Fisher Equation: Nominal and Real Interest Rates" on the Fisher equation.

Key Insights

- Divide nominal values by the price index to create real values.

- Create the price index by calculating the cost of buying a fixed basket in different years.

16.6 Supply and Demand

The supply-and-demand framework is the most fundamental framework in economics. It explains both the price of a good or a service and the quantity produced and purchased.

The market supply curve comes from adding together the individual supply curves of firms in a particular market. A competitive firm, taking prices as given, will produce at a level such that

price = marginal cost.Marginal cost usually increases as a firm produces more output. Thus an increase in the price of a product creates an incentive for firms to produce more—that is, the supply curve of a firm is upward sloping. The market supply curve slopes upward as well: if the price increases, all firms in a market will produce more output, and some new firms may also enter the market.

A firm’s supply curve shifts if there are changes in input prices or the state of technology. The market supply curve is shifted by changes in input prices and changes in technology that affect a significant number of the firms in a market.

The market demand curve comes from adding together the individual demand curves of all households in a particular market. Households, taking the prices of all goods and services as given, distribute their income in a manner that makes them as well off as possible. This means that they choose a combination of goods and services preferred to any other combination of goods and services they can afford. They choose each good or service such that

price = marginal valuation.Marginal valuation usually decreases as a household consumes more of a product. If the price of a good or a service decreases, a household will substitute away from other goods and services and toward the product that has become cheaper—that is, the demand curve of a household is downward sloping. The market demand curve slopes downward as well: if the price decreases, all households will demand more.

The household demand curve shifts if there are changes in income, prices of other goods and services, or tastes. The market demand curve is shifted by changes in these factors that are common across a significant number of households.

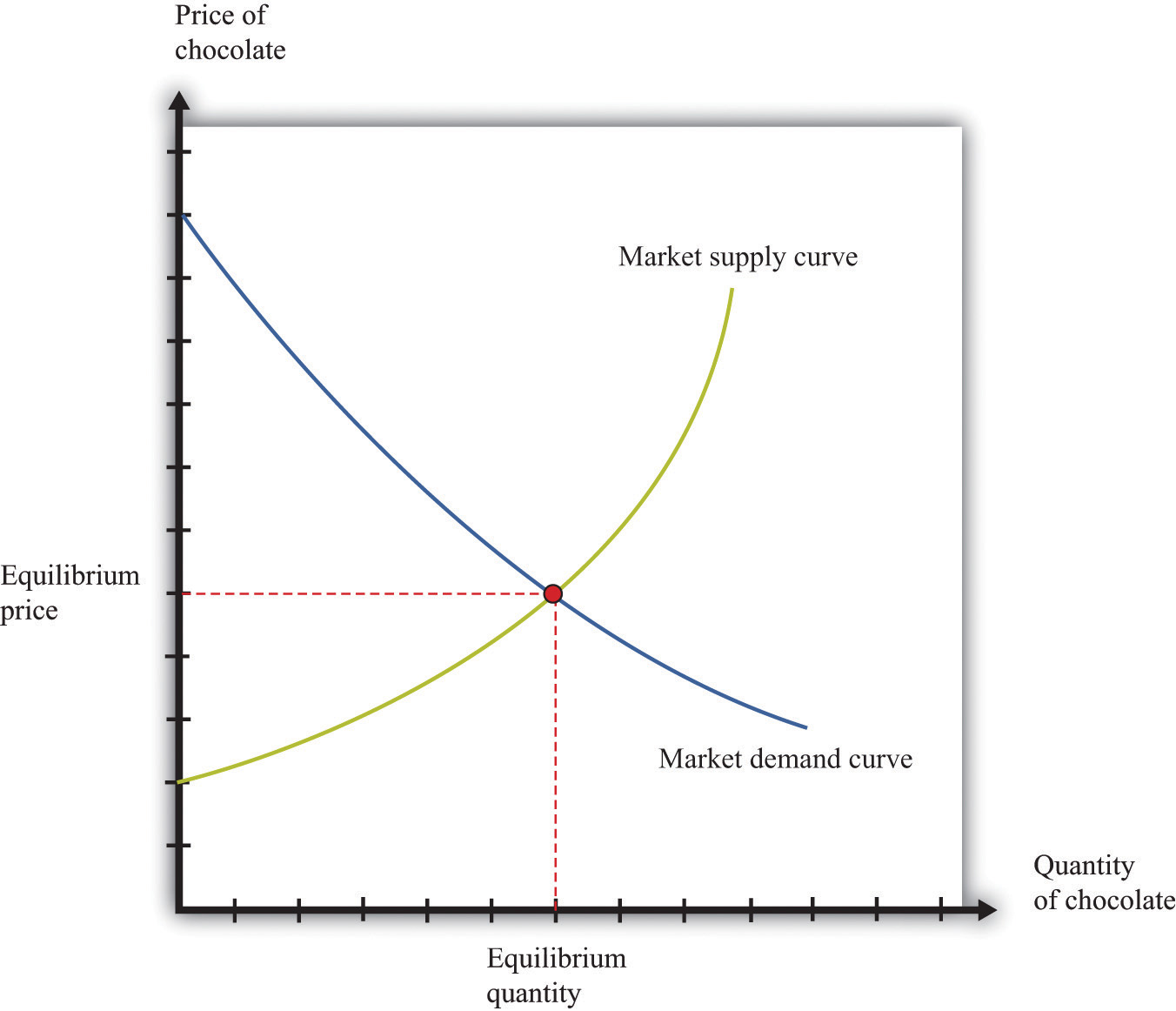

A market equilibrium is a price and a quantity such that the quantity supplied equals the quantity demanded at the equilibrium price (Figure 16.4 "Market Equilibrium"). Because market supply is upward sloping and market demand is downward sloping, there is a unique equilibrium price. We say we have a competitive market if the following are true:

- The product being sold is homogeneous.

- There are many households, each taking the price as given.

- There are many firms, each taking the price as given.

A competitive market is typically characterized by an absence of barriers to entry, so new firms can readily enter the market if it is profitable, and existing firms can easily leave the market if it is not profitable.

Key Insights

- Market supply is upward sloping: as the price increases, all firms will supply more.

- Market demand is downward sloping: as the price increases, all households will demand less.

- A market equilibrium is a price and a quantity such that the quantity demanded equals the quantity supplied.

Figure 16.4 Market Equilibrium

Figure 16.4 "Market Equilibrium" shows equilibrium in the market for chocolate bars. The equilibrium price is determined at the intersection of the market supply and market demand curves.

More Formally

If we let p denote the price, qd the quantity demanded, and I the level of income, then the market demand curve is given by

qd = a − bp + cI,where a, b, and c are constants. By the law of demand, b > 0. For a normal good, the quantity demanded increases with income: c > 0.

If we let qs denote the quantity supplied and t the level of technology, the market supply curve is given by

qs = d + ep + ft,where d, e, and f are constants. Because the supply curve slopes upward, e > 0. Because the quantity supplied increases when technology improves, f > 0.

In equilibrium, the quantity supplied equals the quantity demanded. Set qs = qd = q* and set p = p* in both equations. The market clearing price (p*) and quantity (q*) are as follows:

and

q* = d + ep* + ft.The Main Uses of This Tool

16.7 Comparative Advantage

Comparative advantage explains why individuals and countries trade with each other. Trade is at the heart of modern economies: individuals specialize in production and generalize in consumption. To consume many goods while producing relatively few, individuals must sell what they produce in exchange for the output of others. Countries likewise specialize in certain goods and services and import others. By so doing, they obtain gains from trade.

Table 16.4 "Hours of Labor Required" shows the productivity of two different countries in the production of two different goods. It shows the number of labor hours required to produce two goods—tomatoes and beer—in two countries: Guatemala and Mexico. From these data, Mexico has an absolute advantage in the production of both goods. Workers in Mexico are more productive at producing both tomatoes and beer in comparison to workers in Guatemala.

Table 16.4 Hours of Labor Required

| Tomatoes (1 Kilogram) | Beer (1 Liter) | |

|---|---|---|

| Guatemala | 6 | 3 |

| Mexico | 2 | 2 |

In Guatemala, the opportunity cost of 1 kilogram of tomatoes is 2 liters of beer. To produce an extra kilogram of tomatoes in Guatemala, 6 hours of labor time must be taken away from beer production; 6 hours of labor time is the equivalent of 2 liters of beer. In Mexico, the opportunity cost of 1 kilogram of tomatoes is 1 liter of beer. Thus the opportunity cost of producing tomatoes is lower in Mexico than in Guatemala. This means that Mexico has a comparative advantage in the production of tomatoes. By a similar logic, Guatemala has a comparative advantage in the production of beer.

Guatemala and Mexico can have higher levels of consumption of both beer and tomatoes if they trade rather than produce in isolation; each country should specialize (either partially or completely) in the good in which it has a comparative advantage. It is never efficient to have both countries produce both goods.

Key Insights

- Comparative advantage helps predict the patterns of trade between individuals and/or countries.

- A country has a comparative advantage in the production of a good if the opportunity cost of producing that good is lower in that country.

- Even if one country has an absolute advantage in all goods, it will still gain from trading with another country.

- Although this example is cast in terms of countries, the same logic is also used to explain production patterns between two individuals.

The Main Use of This Tool

16.8 Comparative Statics

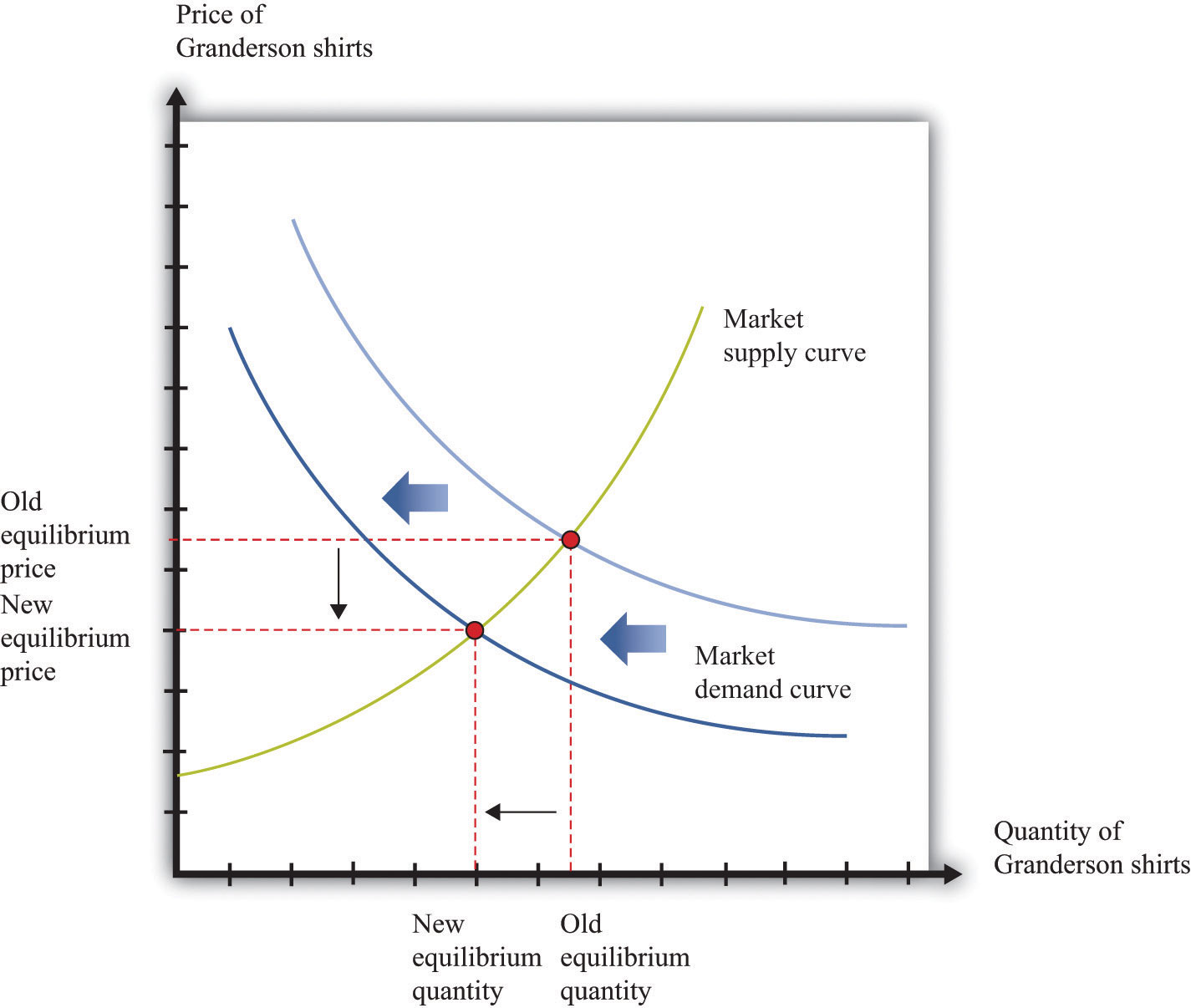

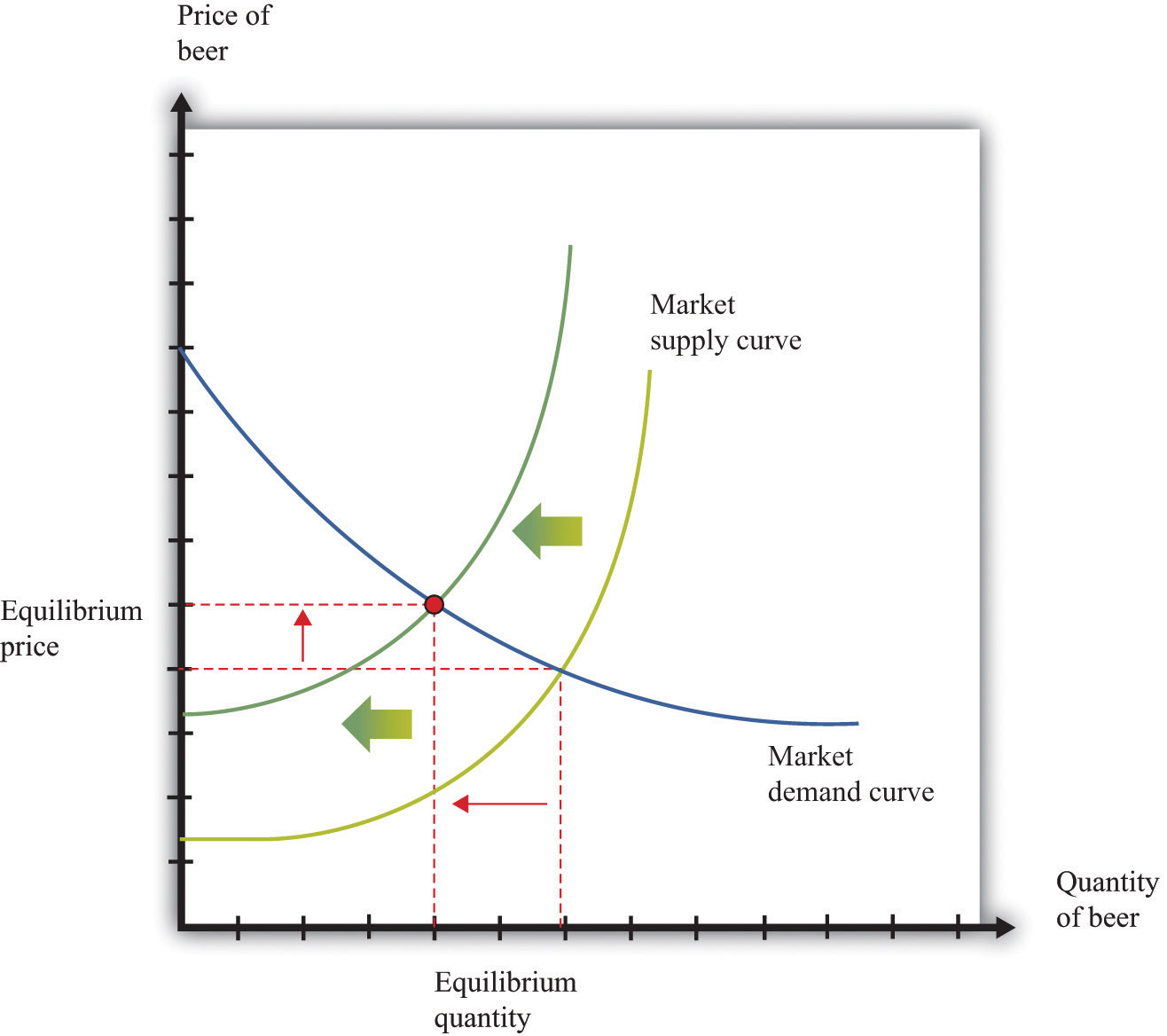

Comparative statics is a tool used to predict the effects of exogenous variables on market outcomes. Exogenous variables shift either the market demand curve (for example, news about the health effects of consuming a product) or the market supply curve (for example, weather effects on a crop). By market outcomes, we mean the equilibrium price and the equilibrium quantity in a market. Comparative statics is a comparison of the market equilibrium before and after a change in an exogenous variable.

A comparative statics exercise consists of a sequence of five steps:

- Begin at an equilibrium point where the quantity supplied equals the quantity demanded.

- Based on a description of the event, determine whether the change in the exogenous variable shifts the market supply curve or the market demand curve.

- Determine the direction of this shift.

- After shifting the curve, find the new equilibrium point.

- Compare the new and old equilibrium points to predict how the exogenous event affects the market.

Figure 16.5 "A Shift in the Demand Curve" and Figure 16.6 "A Shift in the Supply Curve" show comparative statics in action in the market for Curtis Granderson replica shirts and the market for beer. In Figure 16.5 "A Shift in the Demand Curve", the market demand curve has shifted leftward. The consequence is that the equilibrium price and the equilibrium quantity both decrease. The demand curve shifts along a fixed supply curve. In Figure 16.6 "A Shift in the Supply Curve", the market supply curve has shifted leftward. The consequence is that the equilibrium price increases and the equilibrium quantity decreases. The supply curve shifts along a fixed demand curve.

Key Insights

- Comparative statics is used to determine the market outcome when the market supply and demand curves are shifting.

- Comparative statics is a comparison of equilibrium points.

- If the market demand curve shifts, then the new and old equilibrium points lie on a fixed market supply curve.

- If the market supply curve shifts, then the new and old equilibrium points lie on a fixed market demand curve.

Figure 16.5 A Shift in the Demand Curve

Figure 16.6 A Shift in the Supply Curve

The Main Uses of This Tool

16.9 Nash Equilibrium

A Nash equilibrium is used to predict the outcome of a game. By a game, we mean the interaction of a few individuals, called players. Each player chooses an action and receives a payoff that depends on the actions chosen by everyone in the game.

A Nash equilibrium is an action for each player that satisfies two conditions:

- The action yields the highest payoff for that player given her predictions about the other players’ actions.

- The player’s predictions of others’ actions are correct.

Thus a Nash equilibrium has two dimensions. Players make decisions that are in their own self-interests, and players make accurate predictions about the actions of others.

Consider the games in Table 16.5 "Prisoners’ Dilemma", Table 16.6 "Dictator Game", Table 16.7 "Ultimatum Game", and Table 16.8 "Coordination Game". The numbers in the tables give the payoff to each player from the actions that can be taken, with the payoff of the row player listed first.

Table 16.5 Prisoners’ Dilemma

| Left | Right | |

|---|---|---|

| Up | 5, 5 | 0, 10 |

| Down | 10, 0 | 2, 2 |

Table 16.6 Dictator Game

| Number of dollars (x) | 100 − x, x |

Table 16.7 Ultimatum Game

| Accept | Reject | |

|---|---|---|

| Number of dollars (x) | 100 − x, x | 0, 0 |

Table 16.8 Coordination Game

| Left | Right | |

|---|---|---|

| Up | 5, 5 | 0, 1 |

| Down | 1, 0 | 4, 4 |

- Prisoners’ dilemma. The row player chooses between the action labeled Up and the one labeled Down. The column player chooses between the action labeled Left and the one labeled Right. For example, if row chooses Up and column chooses Right, then the row player has a payoff of 0, and the column player has a payoff of 10. If the row player predicts that the column player will choose Left, then the row player should choose Down (that is, down for the row player is her best response to left by the column player). From the column player’s perspective, if he predicts that the row player will choose Up, then the column player should choose Right. The Nash equilibrium occurs when the row player chooses Down and the column player chooses Right. Our two conditions for a Nash equilibrium of making optimal choices and predictions being right both hold.

- Social dilemma. This is a version of the prisoners’ dilemma in which there are a large number of players, all of whom face the same payoffs.

- Dictator game. The row player is called the dictator. She is given $100 and is asked to choose how many dollars (x) to give to the column player. Then the game ends. Because the column player does not move in this game, the dictator game is simple to analyze: if the dictator is interested in maximizing her payoff, she should offer nothing (x = 0).

- Ultimatum game. This is like the dictator game except there is a second stage. In the first stage, the row player is given $100 and told to choose how much to give to the column player. In the second stage, the column player accepts or rejects the offer. If the column player rejects the offer, neither player receives any money. The best choice of the row player is then to offer a penny (the smallest amount of money there is). The best choice of the column player is to accept. This is the Nash equilibrium.

- Coordination game. The coordination game has two Nash equilibria. If the column player plays Left, then the row player plays Up; if the row player plays Up, then the column player plays Left. This is an equilibrium. But Down/Right is also a Nash equilibrium. Both players prefer Up/Left, but it is possible to get stuck in a bad equilibrium.

Key Insights

- A Nash equilibrium is used to predict the outcome of games.

- In real life, payoffs may be more complicated than these games suggest. Players may be motivated by fairness or spite.

More Formally

We describe a game with three players (1, 2, 3), but the idea generalizes straightforwardly to situations with any number of players. Each player chooses a strategy (s1, s2, s3). Suppose σ1(s1, s2, s3) is the payoff to player 1 if (s1, s2, s3) is the list of strategies chosen by the players (and similarly for players 2 and 3). We put an asterisk (*) to denote the best strategy chosen by a player. Then a list of strategies (s*1, s*2, s*3) is a Nash equilibrium if the following statements are true:

σ1(s*1, s*2, s*3) ≥ σ1(s1, s*2, s*3) σ2(s*1, s*2, s*3) ≥ σ2(s*1, s2, s*3) σ3(s*1, s*2, s*3) ≥ σ3(s*1, s*2, s3)In words, the first condition says that, given that players 2 and 3 are choosing their best strategies (s*2, s*3), then player 1 can do no better than to choose strategy s*1. If a similar condition holds for every player, then we have a Nash equilibrium.

The Main Uses of This Tool

16.10 Foreign Exchange Market

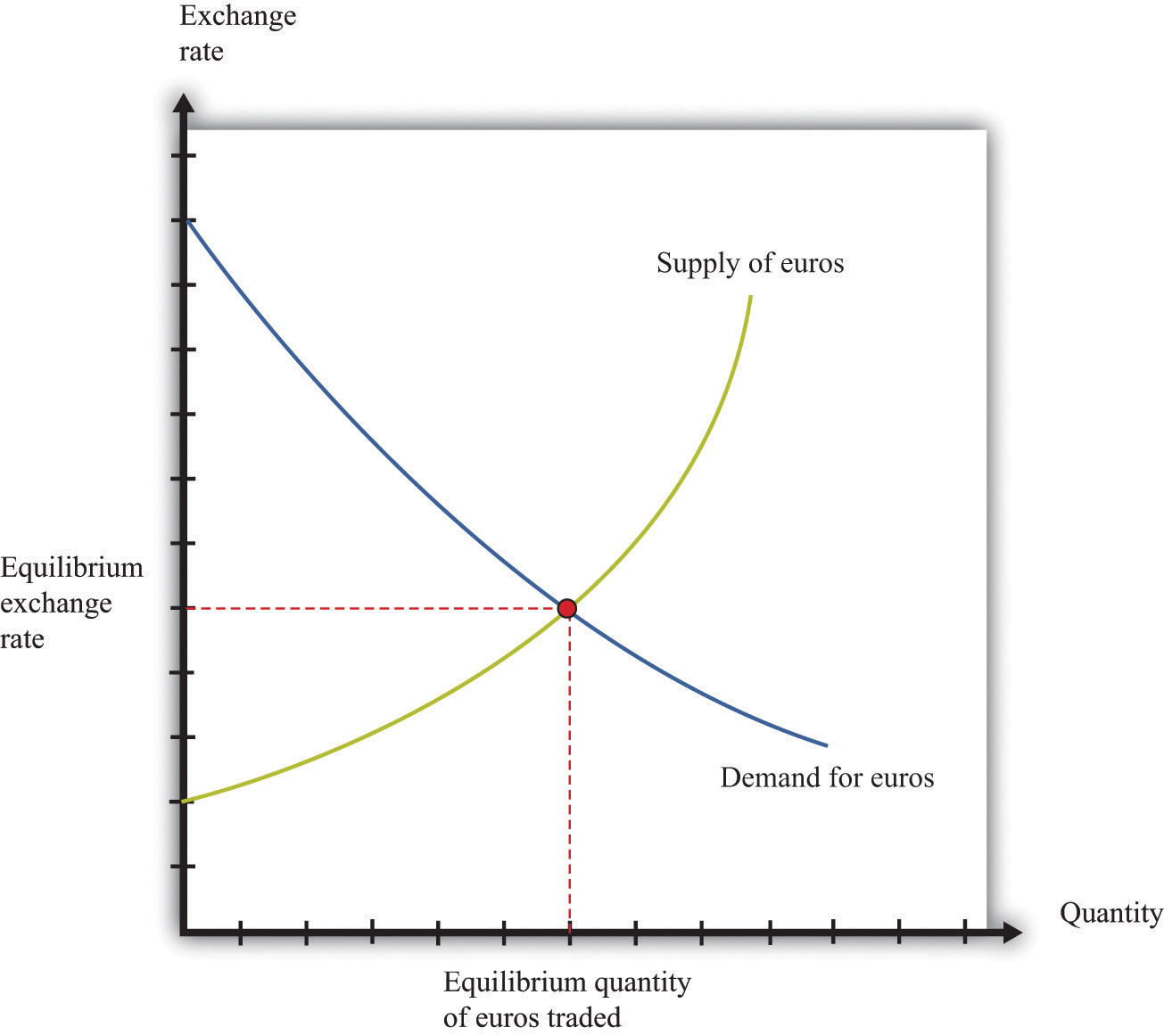

A foreign exchange market is where one currency is traded for another. There is a demand for each currency and a supply of each currency. In these markets, one currency is bought using another. The price of one currency in terms of another (for example, how many dollars it costs to buy one Mexican peso) is called the exchange rate.

Foreign currencies are demanded by domestic households, firms, and governments that wish to purchase goods, services, or financial assets denominated in the currency of another economy. For example, if a US auto importer wants to buy a German car, the importer must buy euros. The law of demand holds: as the price of a foreign currency increases, the quantity of that currency demanded will decrease.

Foreign currencies are supplied by foreign households, firms, and governments that wish to purchase goods, services, or financial assets denominated in the domestic currency. For example, if a Canadian bank wants to buy a US government bond, the bank must sell Canadian dollars. As the price of a foreign currency increases, the quantity supplied of that currency increases.

Exchange rates are determined just like other prices—by the interaction of supply and demand. At the equilibrium exchange rate, the supply and demand for a currency are equal. Shifts in the supply or the demand for a currency lead to changes in the exchange rate. Because one currency is exchanged for another in a foreign exchange market, the demand for one currency entails the supply of another. Thus the dollar market for euros (where the price is dollars per euro and the quantity is euros) is the mirror image of the euro market for dollars (where the price is euros per dollar and the quantity is dollars).

To be concrete, consider the demand for and the supply of euros. The supply of euros comes from the following:

- European households and firms that wish to buy goods and services from countries that do not have the euro as their currency

- European investors who wish to buy assets (government debt, stocks, bonds, etc.) that are denominated in currencies other than the euro

The demand for euros comes from the following:

- Households and firms in noneuro countries that wish to buy goods and services from Europe

- Investors in noneuro countries that wish to buy assets (government debt, stocks, bonds, etc.) that are denominated in euros

Figure 16.7 "The Foreign Exchange Market" shows the dollar market for euros. On the horizontal axis is the quantity of euros traded. On the vertical axis is the price in terms of dollars. The intersection of the supply and demand curves determines the equilibrium exchange rate.

Figure 16.7 The Foreign Exchange Market

The foreign exchange market can be used as a basis for comparative statics exercises. We can study how changes in an economy affect the exchange rate. For example, suppose there is an increase in the level of economic activity in the United States. This leads to an increase in the demand for European goods and services. To make these purchases, US households and firms will demand more euros. This causes an outward shift in the demand curve and an increase in the dollar price of euros.

When the dollar price of a euro increases, we say that the dollar has depreciated relative to the euro. From the perspective of the euro, the depreciation of the dollar represents an appreciation of the euro.

Key Insight

- As the exchange rate increases (so a currency becomes more valuable), a greater quantity of the currency is supplied to the market and a smaller quantity is demanded.

16.11 Growth Rates

If some variable x (for example, the number of gallons of gasoline sold in a week) changes from x1 to x2, then we can define the change in that variable as Δx = x2 − x1. But there are difficulties with this simple definition. The number that we calculate will change, depending on the units in which we measure x. If we measure in millions of gallons, x will be a much smaller number than if we measure in gallons. If we measured x in liters rather than gallons (as it is measured in most countries), it would be a bigger number. So the number we calculate depends on the units we choose. To avoid these problems, we look at percentage changes and express the change as a fraction of the individual value. In what follows, we use the notation %Δx to mean the percentage change in x and define it as follows: %Δx = (x2 − x1)/x1. A percentage change equal to 0.1 means that gasoline consumption increased by 10 percent. Why? Because 10 percent means 10 “per hundred,” so 10 percent = 10/100 = 0.1.

Very often in economics, we are interested in changes that take place over time. Thus we might want to compare gross domestic product (GDP) between 2012 and 2013. Suppose we know that GDP in the United States in 2012 was $14 trillion and that GDP in 2013 was $14.7 trillion. Using the letter Y to denote GDP measured in trillions, we write Y2012 = 14.0 and Y2013 = 14.7. If we want to talk about GDP at different points in time without specifying a particular year, we use the notation Yt. We express the change in a variable over time in the form of a growth rate, which is just an example of a percentage change. Thus the growth rate of GDP in 2013 is calculated as follows:

%ΔY2013 = (Y2013 − Y2012)/Y2012 = (14.7 − 14)/14 = 0.05.The growth rate equals 5 percent. In general, we write %ΔYt+1 = (Yt+1 − Yt)/Yt. Occasionally, we use the gross growth rate, which simply equals 1 + the growth rate. So, for example, the gross growth rate of GDP equals Y2013/Y2012, or 1.05.

There are some useful rules that describe the behavior of percentage changes and growth rates.

The Product Rule. Suppose we have three variables, x, y, and z, and suppose

x = yz.Then

%Δx = %Δy + %Δz.In other words, the growth rate of a product of two variables equals the sum of the growth rates of the individual variables.

The Quotient Rule. Now suppose we rearrange our original equation by dividing both sides by z to obtain

If we take the product rule and subtract %Δz from both sides, we get the following:

%Δy = %Δx − %Δz.The Power Rule. There is one more rule of growth rates that we make use of in some advanced topics, such as growth accounting. Suppose that

y = xa.Then

%Δy = a(%Δx).For example, if y = x2, then the growth rate of y is twice the growth rate of x. If then the growth rate of y is half the growth rate of x (remembering that a square root is the same as a power of ½).

More Formally

Growth rates compound over time: if the growth rate of a variable is constant, then the change in the variable increases over time. For example, suppose GDP in 2020 is 20.0, and it grows at 10 percent per year. Then in 2021, GDP is 22.0 (an increase of 2.0), but in 2022, GDP is 24.2 (an increase of 2.2). If this compounding takes place every instant, then we say that we have exponential growth. Formally, we write exponential growth using the number e = 2.71828.… If the value of Y at time 0 equals Y0 and if Y grows at the constant rate g (where g is an “annualized” or per year growth rate), then at time t (measured in years),

Yt = egtY0.A version of this formula can also be used to calculate the average growth rate of a variable if we know its value at two different times. We can write the formula as

egt = Yt/Y0,which also means

gt = ln(Yt/Y0),where ln() is the natural logarithm. You do not need to know exactly what this means; you can simply calculate a logarithm using a scientific calculator or a spreadsheet. Dividing by t we get the average growth rate

g = ln(Yt/Y0)/t.For example, suppose GDP in 2020 is 20.0 and GDP in 2030 is 28.0. Then Y2030/Y2020 = 28/20 = 1.4. Using a calculator, we can find ln(1.4) = 0.3364. Dividing by 10 (since the two dates are 10 years apart), we get an average growth rate of 0.034, or 3.4 percent per year.

16.12 Mean and Variance

To start our presentation of descriptive statistics, we construct a data set using a spreadsheet program. The idea is to simulate the flipping of a two-sided coin. Although you might think it would be easier just to flip a coin, doing this on a spreadsheet gives you a full range of tools embedded in that program. To generate the data set, we drew 10 random numbers using the spreadsheet program. In the program we used, the function was called RAND and this generated the choice of a number between zero and one. Those choices are listed in the second column of Table 16.9.

The third column creates the two events of heads and tails that we normally associate with a coin flip. To generate this last column, we adopted a rule: if the random number was less than 0.5, we termed this a “tail” and assigned a 0 to the draw; otherwise we termed it a “head” and assigned a 1 to the draw. The choice of 0.5 as the cutoff for heads reflects the fact that we are considering the flips of a fair coin in which each side has the same probability: 0.5.

Table 16.9

| Draw | Random Number | Heads (1) or Tails (0) |

|---|---|---|

| 1 | 0.94 | 1 |

| 2 | 0.84 | 1 |

| 3 | 0.26 | 0 |

| 4 | 0.04 | 0 |

| 5 | 0.01 | 0 |

| 6 | 0.57 | 1 |

| 7 | 0.74 | 1 |

| 8 | 0.81 | 1 |

| 9 | 0.64 | 1 |

| 10 | 0.25 | 0 |

Keep in mind that the realization of the random number in draw i is independent of the realizations of the random numbers in both past and future draws. Whether a coin comes up heads or tails on any particular flip does not depend on other outcomes.

There are many ways to summarize the information contained in a sample of data. Even before you start to compute some complicated statistics, having a way to present the data is important. One possibility is a bar graph in which the fraction of observations of each outcome is easily shown. Alternatively, a pie chart is often used to display this fraction. Both the pie chart and the bar diagram are commonly found in spreadsheet programs.

Economists and statisticians often want to describe data in terms of numbers rather than figures. We use the data from the table to define and illustrate two statistics that are commonly used in economics discussions. The first is the mean (or average) and is a measure of central tendency. Before you read any further, ask, “What do you think the average ought to be from the coin flipping exercise?” It is natural to say 0.5, since half the time the outcome will be a head and thus have a value of zero, whereas the remainder of the time the outcome will be a tail and thus have a value of one.

Whether or not that guess holds can be checked by looking at Table 16.9 and calculating the mean of the outcome. We let ki be the outcome of draw i. For example, from the table, k1 = 1 and k5 = 0. Then the formula for the mean if there are N draws is μ = Σiki/N. Here Σiki means the sum of the ki outcomes. In words, the mean, denoted by μ, is calculated by adding together the draws and dividing by the number of draws (N). In the table, N = 10, and the sum of the draws of random numbers is about 51.0. Thus the mean of the 10 draws is about 0.51.

We can also calculate the mean of the heads/tails column, which is 0.6 since heads came up 6 times in our experiment. This calculation of the mean differs from the mean of the draws since the numbers in the two columns differ with the third column being a very discrete way to represent the information in the second column.

A second commonly used statistic is a measure of dispersion of the data called the variance. The variance, denoted σ2, is calculated as σ2 = Σi(ki − μ)2/(N). From this formula, if all the draws were the same (thus equal to the mean), then the variance would be zero. As the draws spread out from the mean (both above and below), the variance increases. Since some observations are above the mean and others below, we square the difference between a single observation (ki) and the mean (μ) when calculating the variance. This means that values above and below the mean both contribute a positive amount to the variance. Squaring also means that values that are a long way away from the mean have a big effect on the variance.

For the data given in the table, the mean of the 10 draws was given as μ = 0.51. So to calculate the variance, we would subtract the mean from each draw, square the difference, and then add together the squared differences. This yields a variance of 0.118 for this draw. A closely related concept is that of the standard deviation, which is the square root of the variance. For our example, the standard deviation is 0.34. The standard deviation is greater than the variance since the variance is less than 1.

The Main Uses of This Tool

16.13 Correlation and Causality

Correlation is a statistical measure describing how two variables move together. In contrast, causality (or causation) goes deeper into the relationship between two variables by looking for cause and effect.

Correlation is a statistical property that summarizes the way in which two variables move either over time or across people (firms, governments, etc.). The concept of correlation is quite natural to us, as we often take note of how two variables interrelate. If you think back to high school, you probably have a sense of how your classmates did in terms of two measures of performance: grade point average (GPA) and the results on a standardized college entrance exam (SAT or ACT). It is likely that classmates with high GPAs also had high scores on the SAT or ACT exam. In this instance, we would say that the GPA and SAT/ACT scores were positively correlated: looking across your classmates, when a person’s GPA is higher than average, that person’s SAT or ACT score is likely to be higher than average as well.

As another example, consider the relationship between a household’s income and its expenditures on housing. If you conducted a survey across households, it is likely that you would find that richer households spend more on most goods and services, including housing. In this case, we would conclude that income and expenditures on housing are positively correlated.

When economists look at data for a whole economy, they often focus on a measure of how much is produced, which we call real gross domestic product (real GDP), and the fraction of workers without jobs, called the unemployment rate. Over long periods of time, when GDP is above average (the economy is doing well), the unemployment rate is below average. In this case, GDP and the unemployment rate are negatively correlated, as they tend to move in opposite directions.

The fact that one variable is correlated with another does not inform us about whether one variable causes the other. Imagine yourself on an airplane in a relaxed mood, reading or listening to music. Suddenly, the pilot comes on the public address system and requests that you buckle your seat belts. Usually, such a request is followed by turbulence. This is a correlation: the announcement by the pilot is positively correlated with air turbulence. The correlation is of course not perfect because sometimes you hit some bumps without warning, and sometimes the pilot’s announcement is not followed by turbulence.

But—obviously—this does not mean that we could solve the turbulence problem by turning off the public address system. The pilot’s announcement does not cause the turbulence. The turbulence is there whether the pilot announces it or not. In fact, the causality runs the other way. The turbulence causes the pilot’s announcement.

We noted earlier that real GDP and unemployment are negatively correlated. When real GDP is below average, as it is during a recession, the unemployment rate is typically above average. But what is the causality here? If unemployment caused recessions, we might be tempted to adopt a policy that makes unemployment illegal. For example, the government could fine firms if they lay off workers. This is not a good policy because we do not think that low unemployment causes high real GDP. Neither do we necessarily think that high real GDP causes low unemployment. Instead, based on economic theory, there are other influences that affect both real GDP and unemployment.

More Formally

Suppose you have N observations of two variables, x and y, where xi and yi are the values of these variables in observation i = 1, 2,…, N. The mean of x, denoted μx, is the sum over the values of x in the sample is divided by N; the scenario applies for y.

and

We can also calculate the variance and standard deviations of x and y. The calculation for the variance of x, denoted is as follows:

The standard deviation of x is the square root of

With these ingredients, the correlation of (x,y), denoted corr(x,y), is given by

The Main Uses of This Tool

16.14 The Fisher Equation: Nominal and Real Interest Rates

When you borrow or lend, you normally do so in dollar terms. If you take out a loan, the loan is denominated in dollars, and your promised payments are denominated in dollars. These dollar flows must be corrected for inflation to calculate the repayment in real terms. A similar point holds if you are a lender: you need to calculate the interest you earn on saving by correcting for inflation.

The Fisher equation provides the link between nominal and real interest rates. To convert from nominal interest rates to real interest rates, we use the following formula:

real interest rate ≈ nominal interest rate − inflation rate.To find the real interest rate, we take the nominal interest rate and subtract the inflation rate. For example, if a loan has a 12 percent interest rate and the inflation rate is 8 percent, then the real return on that loan is 4 percent.

In calculating the real interest rate, we used the actual inflation rate. This is appropriate when you wish to understand the real interest rate actually paid under a loan contract. But at the time a loan agreement is made, the inflation rate that will occur in the future is not known with certainty. Instead, the borrower and lender use their expectations of future inflation to determine the interest rate on a loan. From that perspective, we use the following formula:

contracted nominal interest rate ≈ real interest rate + expected inflation rate.We use the term contracted nominal interest rate to make clear that this is the rate set at the time of a loan agreement, not the realized real interest rate.

Key Insight

- To correct a nominal interest rate for inflation, subtract the inflation rate from the nominal interest rate.

More Formally

Imagine two individuals write a loan contract to borrow P dollars at a nominal interest rate of i. This means that next year the amount to be repaid will be P × (1 + i). This is a standard loan contract with a nominal interest rate of i.

Now imagine that the individuals decided to write a loan contract to guarantee a constant real return (in terms of goods not dollars) denoted r. So the contract provides P this year in return for being repaid (enough dollars to buy) (1 + r) units of real gross domestic product (real GDP) next year. To repay this loan, the borrower gives the lender enough money to buy (1 + r) units of real GDP for each unit of real GDP that is lent. So if the inflation rate is π, then the price level has risen to P × (1 + π), so the repayment in dollars for a loan of P dollars would be P(1 + r) × (1 + π).

Here (1 + π) is one plus the inflation rate. The inflation rate πt+1 is defined—as usual—as the percentage change in the price level from period t to period t + 1.

πt+1 = (Pt+1 − Pt)/Pt.If a period is one year, then the price level next year is equal to the price this year multiplied by (1 + π):

Pt+1 = (1 + πt) × Pt.The Fisher equation says that these two contracts should be equivalent:

(1 + i) = (1 + r) × (1 + π).As an approximation, this equation implies

i ≈ r + π.To see this, multiply out the right-hand side and subtract 1 from each side to obtain

i = r + π + rπ.If r and π are small numbers, then rπ is a very small number and can safely be ignored. For example, if r = 0.02 and π = 0.03, then rπ = 0.0006, and our approximation is about 99 percent accurate.

16.15 The Aggregate Production Function

The aggregate production function describes how total real gross domestic product (real GDP) in an economy depends on available inputs. Aggregate output (real GDP) depends on the following:

- Physical capital—machines, production facilities, and so forth that are used in production

- Labor—the number of hours that are worked in the entire economy

- Human capital—skills and education embodied in the workforce of the economy

- Knowledge—basic scientific knowledge, and blueprints that describe the available production processes

- Social infrastructure—the general business, legal and cultural environment

- The amount of natural resources available in an economy

- Anything else that we have not yet included

We group the inputs other than labor, physical, and human capital together, and call them technology.

The aggregate production function has several key properties. First, output increases when there are increases in physical capital, labor, and natural resources. In other words, the marginal products of these inputs are all positive.

Second, the increase in output from adding more inputs is lower when we have more of a factor. This is called diminishing marginal product. That is,

- The more capital we have, the less additional output we obtain from additional capital.

- The more labor we have, the less additional output we obtain from additional labor.

- The more natural resources we have, the less additional output we obtain from additional resources.

In addition, increases in output can also come from increases in human capital, knowledge, and social infrastructure. In contrast to capital and labor, we do not assume that there are diminishing returns to human capital and technology. One reason is that we do not have a natural or an obvious measure for human capital, knowledge, or social infrastructure, whereas we do for labor and capital (hours of work and hours of capital usage).

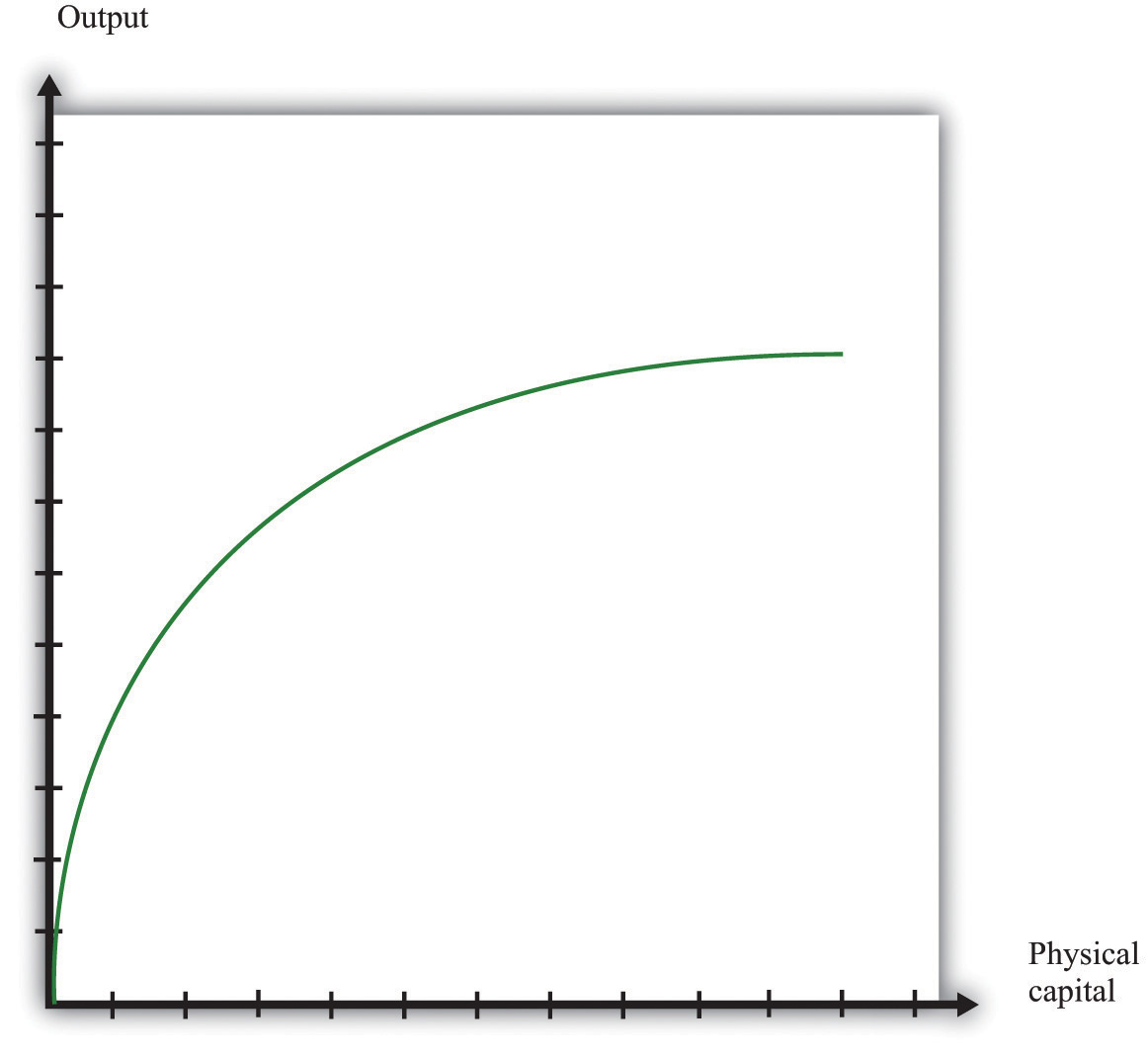

Figure 16.8 shows the relationship between output and capital, holding fixed the level of other inputs. This figure shows two properties of the aggregate production function. As capital input is increased, output increases as well. But the change in output obtained by increasing the capital stock is lower when the capital stock is higher: this is the diminishing marginal product of capital.

Figure 16.8

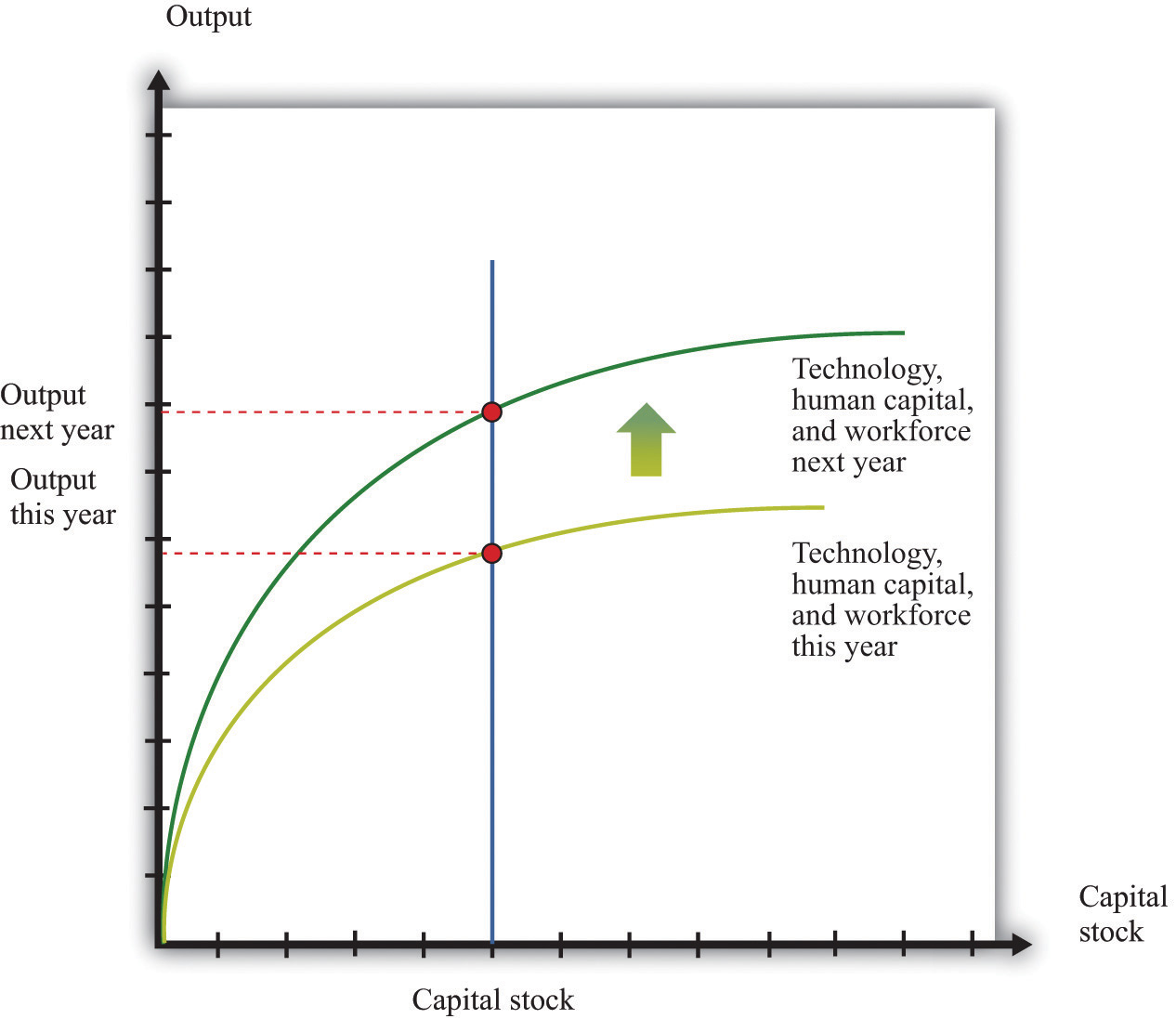

In many applications, we want to understand how the aggregate production function responds to variations in the technology or other inputs. This is illustrated in Figure 16.9. An increase in, say, technology means that for a given level of the capital stock, more output is produced: the production function shifts upward as technology increases. Further, as technology increases, the production function is steeper: the increase in technology increases the marginal product of capital.

Figure 16.9

Key Insight

- The aggregate production function allows us to determine the output of an economy given inputs of capital, labor, human capital, and technology.

More Formally

Specific Forms for the Production Function

We can write the production function in mathematical form. We use Y to represent real GDP, K to represent the physical capital stock, L to represent labor, H to represent human capital, and A to represent technology (including natural resources). If we want to speak about production completely generally, then we can write Y = F(K,L,H,A). Here F() means “some function of.”

A lot of the time, economists work with a production function that has a specific mathematical form, yet is still reasonably simple:

Y = A × Ka × (L × H)(1 − a),where a is just a number. This is called a Cobb-Douglas production function. It turns out that this production function does a remarkably good job of summarizing aggregate production in the economy. In fact, we also know that we can describe production in actual economies quite well if we suppose that a = 1/3.

16.16 The Circular Flow of Income

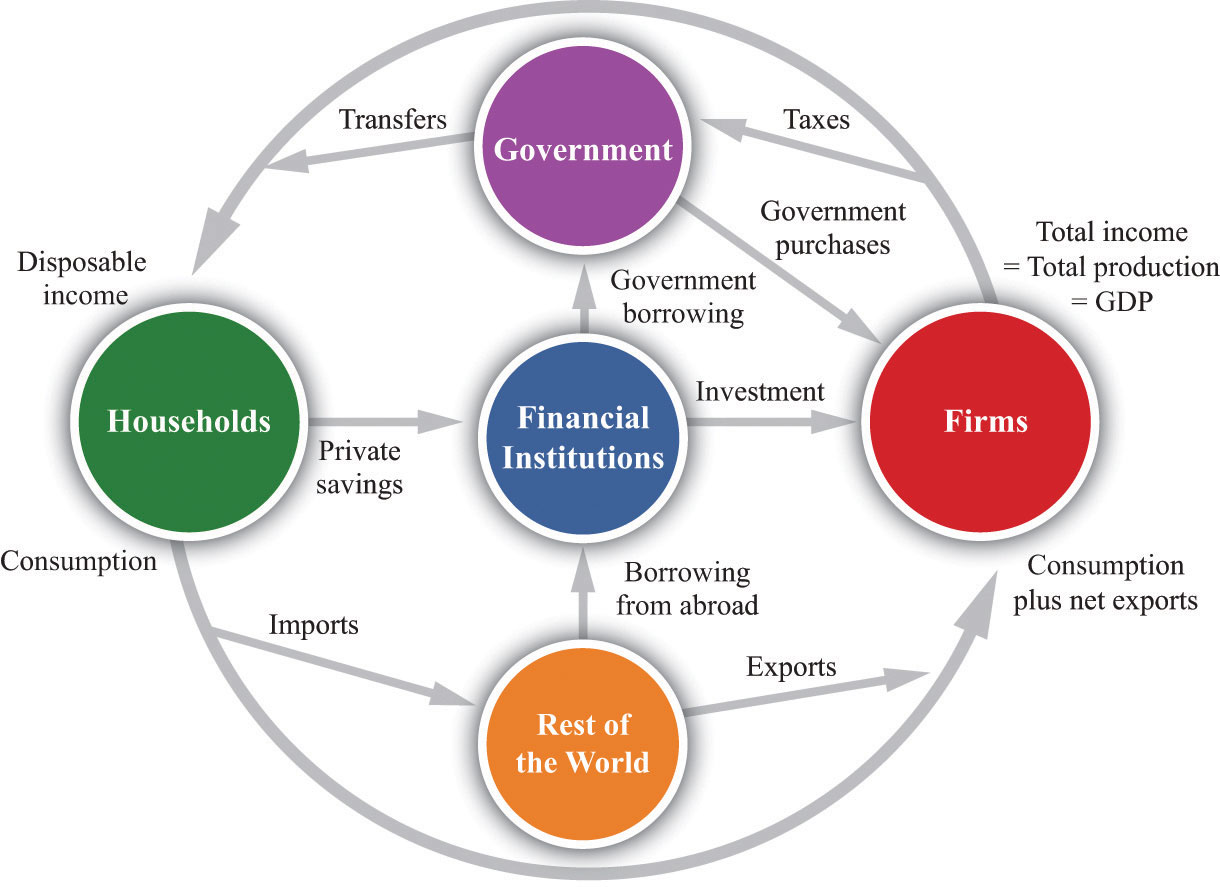

The circular flow of income describes the flows of money among the five main sectors of an economy. As individuals and firms buy and sell goods and services, money flows among the different sectors of an economy. The circular flow of income describes these flows of dollars (pesos, euros, or whatever). From a simple version of the circular flow, we learn that—as a matter of accounting—

gross domestic product (GDP) = income = production = spending.This relationship lies at the heart of macroeconomic analysis.

There are two sides to every transaction. Corresponding to the flows of money in the circular flow, there are flows of goods and services among these sectors. For example, the wage income received by consumers is in return for labor services that flow from households to firms. The consumption spending of households is in return for the goods and services that flow from firms to households.

A complete version of the circular flow is presented in Figure 16.10. (Chapter 3 "The State of the Economy" contains a discussion of a simpler version of the circular flow with only two sectors: households and firms.)

Figure 16.10

The complete circular flow has five sectors: a household sector, a firm sector, a government sector, a foreign sector, and a financial sector. Different chapters of the book emphasize different pieces of the circular flow, and Figure 16.10 shows us how everything fits together. In the following subsections, we look at the flows into and from each sector in turn. In each case, the balance of the flows into and from each sector underlies a useful economic relationship.

The Firm Sector

Figure 16.10 includes the component of the circular flow associated with the flows into and from the firm sector of an economy. We know that the total flow of dollars from the firm sector measures the total value of production in an economy. The total flow of dollars into the firm sector equals total expenditures on GDP. We therefore know that

production = consumption + investment + government purchases + net exports.This equation is called the national income identity and is the most fundamental relationship in the national accounts.

By consumption we mean total consumption expenditures by households on final goods and services. Investment refers to the purchase of goods and services that, in one way or another, help to produce more output in the future. Government purchases include all purchases of goods and services by the government. Net exports, which equal exports minus imports, measure the expenditure flows associated with the rest of the world.

The Household Sector

The household sector summarizes the behavior of private individuals in their roles as consumers/savers and suppliers of labor. The balance of flows into and from this sector is the basis of the household budget constraint. Households receive income from firms, in the form of wages and in the form of dividends resulting from their ownership of firms. The income that households have available to them after all taxes have been paid to the government and all transfers received is called disposable income. Households spend some of their disposable income and save the rest. In other words,

disposable income = consumption + household savings.This is the household budget constraint. In Figure 16.10, this equation corresponds to the fact that the flows into and from the household sector must balance.

The Government Sector

The government sector summarizes the actions of all levels of government in an economy. Governments tax their citizens, pay transfers to them, and purchase goods from the firm sector of the economy. Governments also borrow from or lend to the financial sector. The amount that the government collects in taxes need not equal the amount that it pays out for government purchases and transfers. If the government spends more than it gathers in taxes, then it must borrow from the financial markets to make up the shortfall.

The circular flow figure shows two flows into the government sector and two flows out. Since the flows into and from the government sector must balance, we know that

government purchases + transfers = tax revenues + government borrowing.Government borrowing is sometimes referred to as the government budget deficit. This equation is the government budget constraint.

Some of the flows in the circular flow can go in either direction. When the government is running a deficit, there is a flow of dollars to the government sector from the financial markets. Alternatively, the government may run a surplus, meaning that its revenues from taxation are greater than its spending on purchases and transfers. In this case, the government is saving rather than borrowing, and there is a flow of dollars to the financial markets from the government sector.

The Foreign Sector

The circular flow includes a country’s dealings with the rest of the world. These flows include exports, imports, and borrowing from other countries. Exports are goods and services produced in one country and purchased by households, firms, and governments of another country. Imports are goods and services purchased by households, firms, and governments in one country but produced in another country. Net exports are exports minus imports. When net exports are positive, a country is running a trade surplus: exports exceed imports. When net exports are negative, a country is running a trade deficit: imports exceed exports. The third flow between countries is borrowing and lending. Governments, individuals, and firms in one country may borrow from or lend to another country.

Net exports and borrowing are linked. If a country runs a trade deficit, it borrows from other countries to finance that deficit. If we look at the flows into and from the foreign sector, we see that

borrowing from other countries + exports = imports.Subtracting exports from both sides, we obtain

borrowing from other countries = imports − exports = trade deficit.Whenever our economy runs a trade deficit, we are borrowing from other countries. If our economy runs a trade surplus, then we are lending to other countries.

This analysis has omitted one detail. When we lend to other countries, we acquire their assets, so each year we get income from those assets. When we borrow from other countries, they acquire our assets, so we pay them income on those assets. Those income flows are added to the trade surplus/deficit to give the current account of the economy. It is the current account that must be matched by borrowing from or lending to other countries. A positive current account means that net exports plus net income flows from the rest of the world are positive. In this case, our economy is lending to the rest of the world and acquiring more assets.

The Financial Sector

The financial sector of an economy summarizes the behavior of banks and other financial institutions. The balance of flows into and from the financial sector tell us that investment is financed by national savings and borrowing from abroad. The financial sector is at the heart of the circular flow. The figure shows four flows into and from the financial sector.

- Households divide their after-tax income between consumption and savings. Thus any income that they receive today but wish to put aside for the future is sent to the financial markets. The household sector as a whole saves so, on net, there is a flow of dollars from the household sector into the financial markets.

- The flow of money from the financial sector into the firm sector provides the funds that are available to firms for investment purposes.

- The flow of dollars between the financial sector and the government sector reflects the borrowing (or lending) of governments. The flow can go in either direction. When government expenditures exceed government revenues, the government must borrow from the private sector, and there is a flow of dollars from the financial sector to the government. This is the case of a government deficit. When the government’s revenues are greater than its expenditures, by contrast, there is a government surplus and a flow of dollars into the financial sector.

- The flow of dollars between the financial sector and the foreign sector can also go in either direction. An economy with positive net exports is lending to other countries: there is a flow of money from an economy. An economy with negative net exports (a trade deficit) is borrowing from other countries.

The national savings of the economy is the savings carried out by the private and government sectors taken together. When the government is running a deficit, some of the savings of households and firms must be used to fund that deficit, so there is less left over to finance investment. National savings is then equal to private savings minus the government deficit—that is, private savings minus government borrowing:

national savings = private savings − government borrowing.If the government is running a surplus, then

national savings = private savings + government surplus.National savings is therefore the amount that an economy as a whole saves. It is equal to what is left over after we subtract consumption and government spending from GDP. To see this, notice that

private savings − government borrowing = income − taxes + transfers − consumption − (government purchases + transfers − taxes) = income − consumption − government purchases.This is the domestic money that is available for investment.

If we are borrowing from other countries, there is another source of funds for investment. The flows into and from the financial sector must balance, so

investment = national savings + borrowing from other countries.Conversely, if we are lending to other countries, then our national savings is divided between investment and lending to other countries:

national savings = investment + lending to other countries.The Main Uses of This Tool

- Chapter 3 "The State of the Economy"

- Chapter 4 "The Interconnected Economy"

- Chapter 6 "Global Prosperity and Global Poverty"

- Chapter 7 "The Great Depression"

- Chapter 9 "Money: A User’s Guide"

- Chapter 11 "Inflations Big and Small"

- Chapter 12 "Income Taxes"

- Chapter 14 "Balancing the Budget"

- Chapter 15 "The Global Financial Crisis"

16.17 Growth Accounting

Growth accounting is a tool that tells us how changes in real gross domestic product (real GDP) in an economy are due to changes in available capital, labor, human capital, and technology. Economists have shown that, under reasonably general circumstances, the change in output in an economy can be written as follows:

output growth rate = a × capital stock growth rate + [(1 − a) × labor hours growth rate]+ [(1 − a) × human capital growth rate] + technology growth rate.In this equation, a is just a number. For example, if a = 1/3, the growth in output is as follows:

output growth rate = (1/3 × capital stock growth rate) + (2/3 × labor hours growth rate)+ (2/3 × human capital growth rate) + technology growth rate.Growth rates can be positive or negative, so we can use this equation to analyze decreases in GDP as well as increases. This expression for the growth rate of output, by the way, is obtained by applying the rules of growth rates (discussed in Section 16.11 "Growth Rates") to the Cobb-Douglas aggregate production function (discussed in Section 16.15 "The Aggregate Production Function").

What can we measure in this expression? We can measure the growth in output, the growth in the capital stock, and the growth in labor hours. Human capital is more difficult to measure, but we can use information on schooling, literacy rates, and so forth. We cannot, however, measure the growth rate of technology. So we use the growth accounting equation to infer the growth in technology from the things we can measure. Rearranging the growth accounting equation,

technology growth rate = output growth rate − (a × capital stock growth rate)− [(1 − a) × labor hours growth rate] − [(1 − a) × human capital growth rate].So if we know the number a, we are done—we can use measures of the growth in output, labor, capital stock, and human capital to solve for the technology growth rate. In fact, we do have a way of measuring a. The technical details are not important here, but a good measure of (1 − a) is simply the total payments to labor in the economy (that is, the total of wages and other compensation) as a fraction of overall GDP. For most economies, a is in the range of about 1/3 to 1/2.

Key Insight

- The growth accounting tool allows us to determine the contributions of the various factors of economic growth.

16.18 The Solow Growth Model

The analysis in Chapter 6 "Global Prosperity and Global Poverty" is (implicitly) based on a theory of economic growth known as the Solow growth model. Here we present two formal versions of the mathematics of the model. The first takes as its focus the capital accumulation equation and explains how the capital stock evolves in the economy. This version ignores the role of human capital and ignores the long-run growth path of the economy. The second follows the exposition of the chapter and is based around the derivation of the balanced growth path. They are, however, simply two different ways of approaching the same problem.

Presentation 1

There are three components of this presentation of the model: technology, capital accumulation, and saving. The first component of the Solow growth model is the specification of technology and comes from the aggregate production function. We express output per worker (y) as a function of capital per worker (k) and technology (A). A mathematical expression of this relationship is

y = Af(k),where f(k) means that output per worker depends on capital per worker. As in our presentation of production functions, output increases with technology. We assume that f() has the properties that more capital leads to more output per capita at a diminishing rate. As an example, suppose

y = Ak1/3.In this case the marginal product of capital is positive but diminishing.

The second component is capital accumulation. If we let kt be the amount of capital per capita at the start of year t, then we know that

kt+1 = kt(1 − δ) + it.This expression shows how the capital stock changes over time. Here δ is the rate of physical depreciation so that between year t and year t +1, δkt units of capital are lost from depreciation. But during year t, there is investment (it) that yields new capital in the following year.

The final component of the Solow growth model is saving. In a closed economy, saving is the same as investment. Thus we link it in the accumulation equation to saving. Assume that saving per capita (st) is given by

st = s × yt.Here s is a constant between zero and one, so only a fraction of total output is saved.

Using the fact that savings equals investment, along with the per capita production function, we can relate investment to the level of capital:

it = sAf(kt).We can then write the equation for the evolution of the capital stock as follows:

kt+1 = kt(1 − δ) + sAf(kt).Once we have specified the function f(), we can follow the evolution of the capital stock over time. Generally, the path of the capital stock over time has two important properties:

- Steady state. There is a particular level of the capital stock such that if the economy accumulates that amount of capital, it stays at that level of capital. We call this the steady state level of capital, denoted k*.

- Stability. The economy will tend toward the per capita capital stock k*.

To be more specific, the steady state level of capital solves the following equation:

k* = k*(1 − δ) + sAf(k*).At the steady state, the amount of capital lost by depreciation is exactly offset by saving. This means that at the steady state, net investment is exactly zero. The property of stability means that if the current capital stock is below k*, the economy will accumulate capital so that kt+1 > kt. And if the current capital stock is above k*, the economy will decumulate capital so that kt+1 < kt.

If two countries share the same technology (A) and the same production function [f(k)], then over time these two countries will eventually have the same stock of capital per worker. If there are differences in the technology or the production function, then there is no reason for the two countries to converge to the same level of capital stock per worker.

Presentation 2

In this presentation, we explain the balanced-growth path of the economy and prove some of the claims made in the text. The model takes as given (exogenous) the investment rate; the depreciation rate; and the growth rates of the workforce, human capital, and technology. The endogenous variables are output and physical capital stock.

The notation for the presentation is given in Table 16.10 "Notation in the Solow Growth Model": We use the notation gx to represent the growth rate of a variable x; that is,

There are two key ingredients to the model: the aggregate production function and the equation for capital accumulation.

Table 16.10 Notation in the Solow Growth Model

| Variable | Symbol |

|---|---|

| Real gross domestic product | Y |

| Capital stock | K |

| Human capital | H |

| Workforce | L |

| Technology | A |

| Investment rate | i |

| Depreciation rate | δ |

The Production Function

The production function we use is the Cobb-Douglas production function:

Equation 16.1

Y = Ka(HL)1−aA.Growth Accounting

If we apply the rules of growth rates to Equation 16.1, we get the following expression:

Equation 16.2

gY = agK + (1 − a)(gL + gH) + gA.Balanced Growth

The condition for balanced growth is that gY = gK. When we impose this condition on our equation for the growth rate of output (Equation 16.2), we get

where the superscript “BG” indicates that we are considering the values of variables when the economy is on a balanced growth path. This equation simplifies to

Equation 16.3

The growth in output on a balanced-growth path depends on the growth rates of the workforce, human capital, and technology.

Using this, we can rewrite Equation 16.2 as follows:

Equation 16.4

The actual growth rate in output is an average of the balanced-growth rate of output and the growth rate of the capital stock.

Capital Accumulation

The second piece of our model is the capital accumulation equation. The growth rate of the capital stock is given by

Equation 16.5

Divide the numerator and denominator of the first term by Y, remembering that i = I/Y.

Equation 16.6

The growth rate of the capital stock depends positively on the investment rate and negatively on the depreciation rate. It also depends negatively on the current capital-output ratio.

The Balanced-Growth Capital-Output Ratio

Now rearrange Equation 16.6 to give the ratio of capital to gross domestic product (GDP), given the depreciation rate, the investment rate, and the growth rate of the capital stock:

When the economy is on a balanced growth path, gK = , so

We can also substitute in our balanced-growth expression for (Equation 16.3) to get an expression for the balanced-growth capital output ratio in terms of exogenous variables.

Convergence

The proof that economies will converge to the balanced-growth ratio of capital to GDP is relatively straightforward. We want to show that if K/Y < then capital grows faster than output. If capital is growing faster than output, gK − gY > 0. First, go back to Equation 16.4:

Subtract both sides from the growth rate of capital:

Now compare the general expression for ratio of capital to GDP with its balanced growth value:

and

If K/Y < then it must be the case that gK > , which implies (from the previous equation) that gK > gY.

Output per Worker Growth

If we want to examine the growth in output per worker rather than total output, we take the per-worker production function (Equation 16.2) and apply the rules of growth rates to that equation.

(1 − a)gY = a[gK − gY] + (1 − a)[gL + gH] + gA = a[gK − gY] + (1 − a)[gL + gH] + gA.We then we divide by (1 − a) to get

and subtract gL from each side to obtain

Finally, we note that gY − gL = gY/L:

With balanced growth, the first term is equal to zero, so

Endogenous Investment Rate

In this analysis, we made the assumption from the Solow model that the investment rate is constant. The essential arguments that we have made still apply if the investment rate is higher when the marginal product of capital is higher. The argument for convergence becomes stronger because a low value of K/Y implies a higher marginal product of capital and thus a higher investment rate. This increases the growth rate of capital and causes an economy to converge more quickly to its balanced-growth path.

Endogenous Growth

Take the production function

Y = Ka(HL)1−aA.Now assume A is constant and so

The Main Uses of This Tool

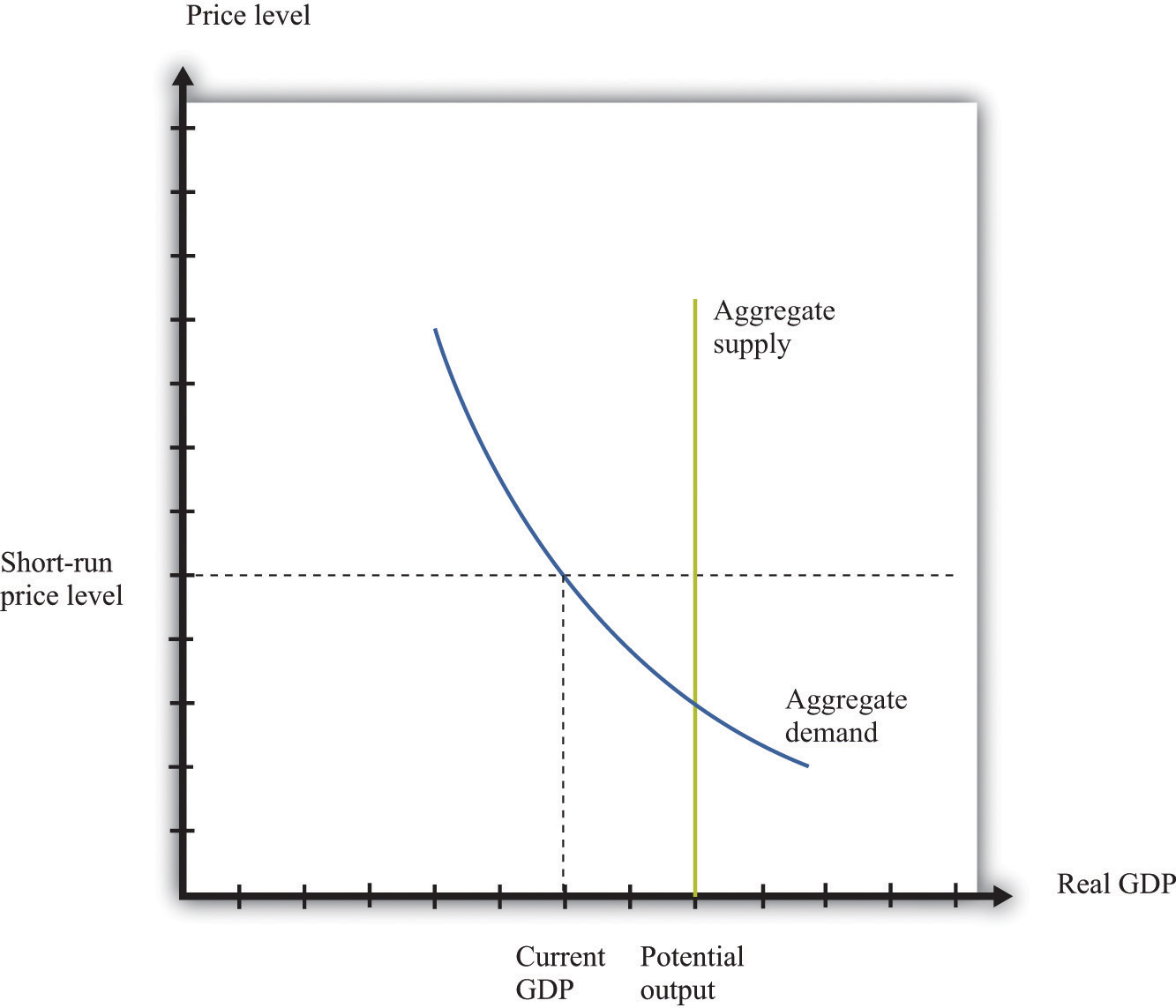

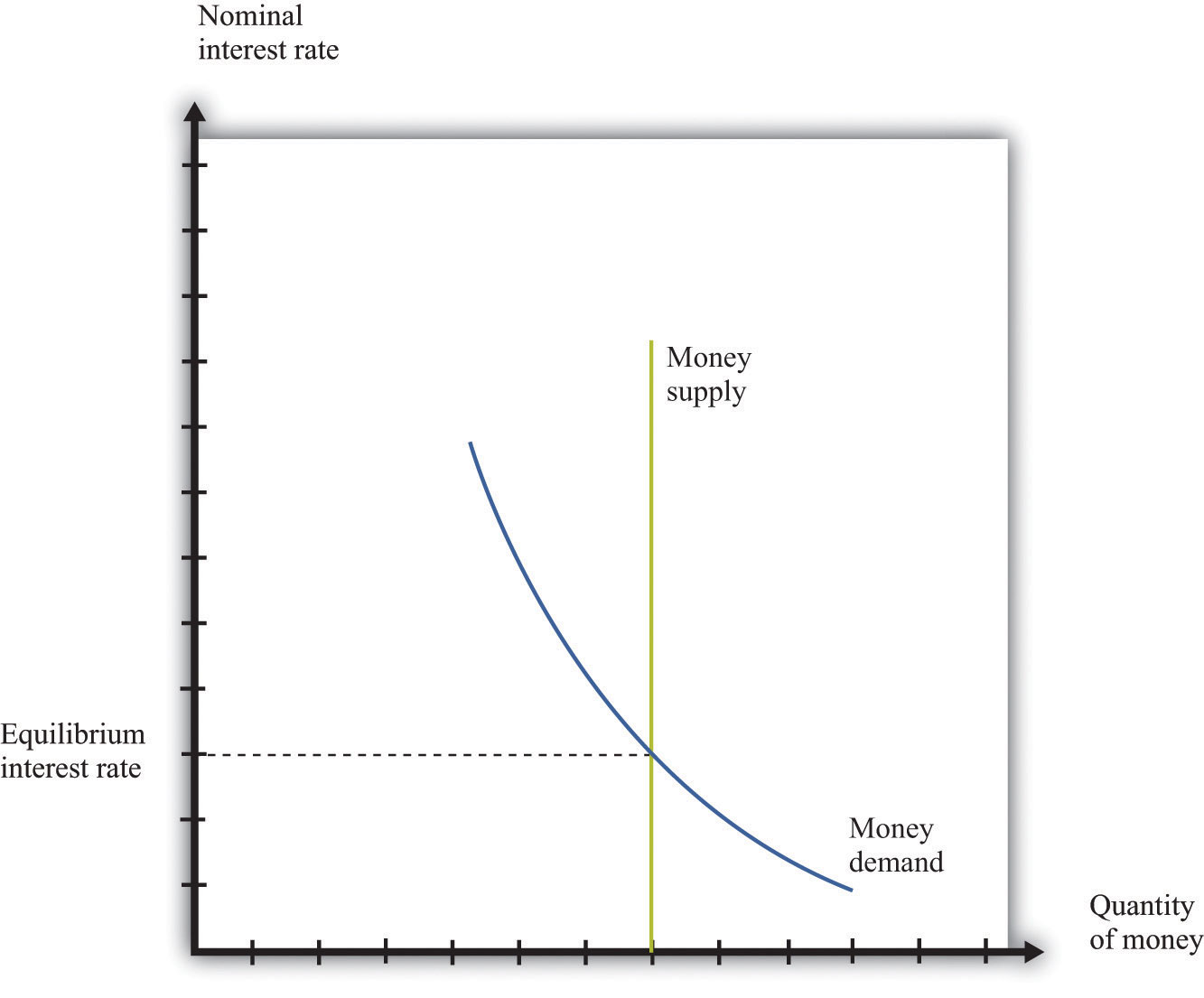

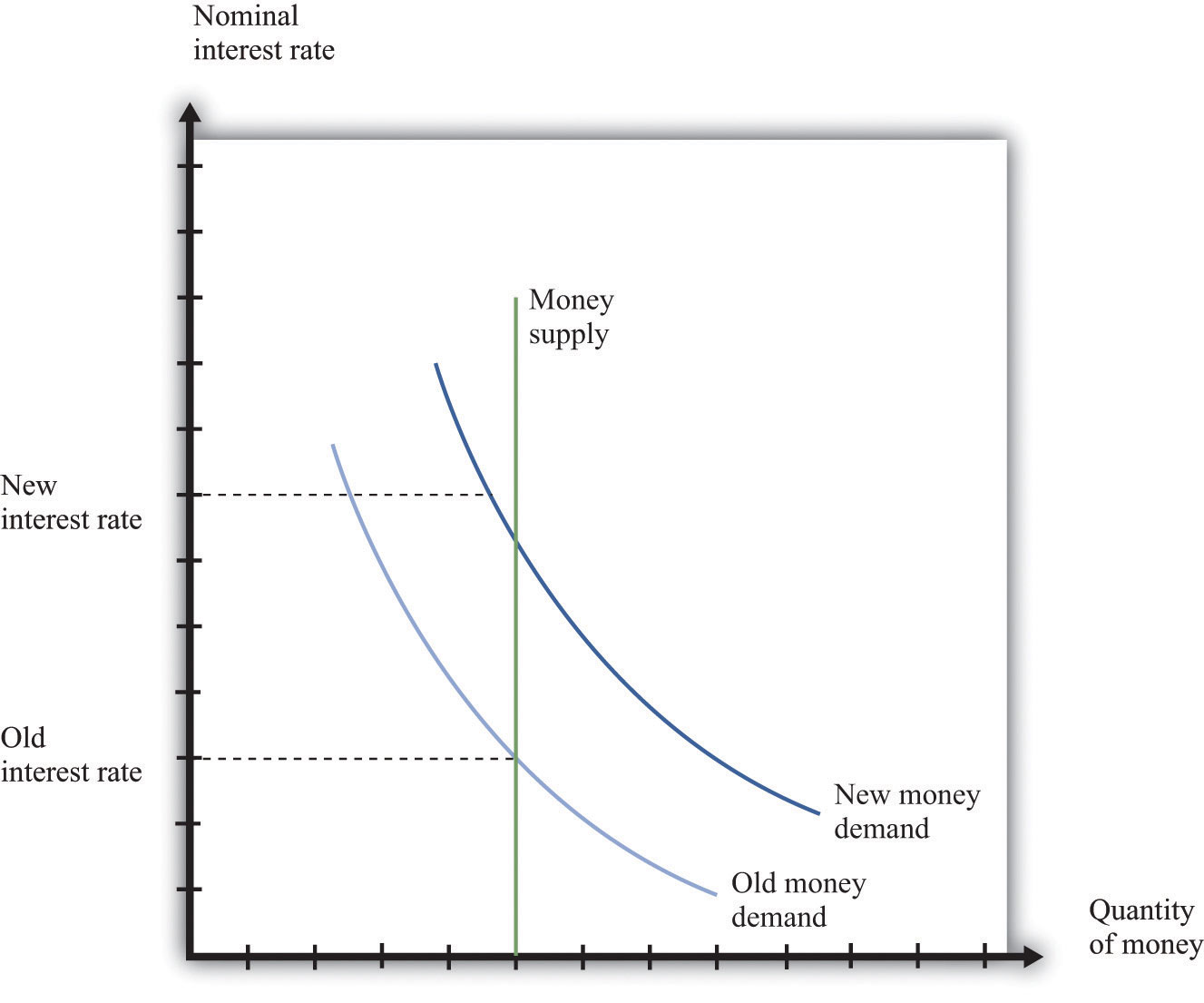

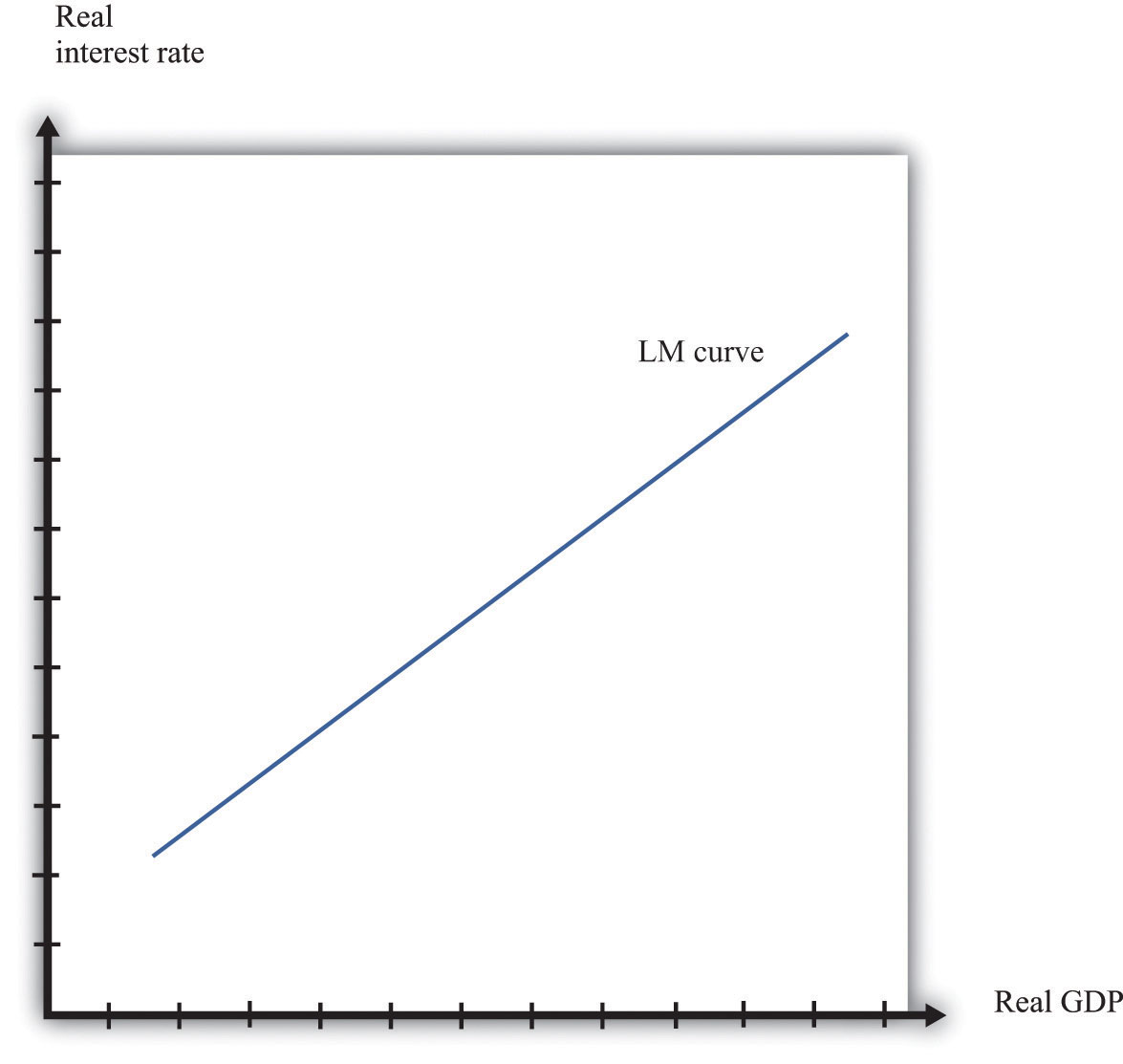

16.19 The Aggregate Expenditure Model

The aggregate expenditure model relates the components of spending (consumption, investment, government purchases, and net exports) to the level of economic activity. In the short run, taking the price level as fixed, the level of spending predicted by the aggregate expenditure model determines the level of economic activity in an economy.

An insight from the circular flow is that real gross domestic product (real GDP) measures three things: the production of firms, the income earned by households, and total spending on firms’ output. The aggregate expenditure model focuses on the relationships between production (GDP) and planned spending:

GDP = planned spending = consumption + investment + government purchases + net exports.Planned spending depends on the level of income/production in an economy, for the following reasons:

- If households have higher income, they will increase their spending. (This is captured by the consumption function.)

- Firms are likely to decide that higher levels of production—particularly if they are expected to persist—mean that they should build up their capital stock and should thus increase their investment.

- Higher income means that domestic consumers are likely to spend more on imported goods. Since net exports equal exports minus imports, higher imports means lower net exports.

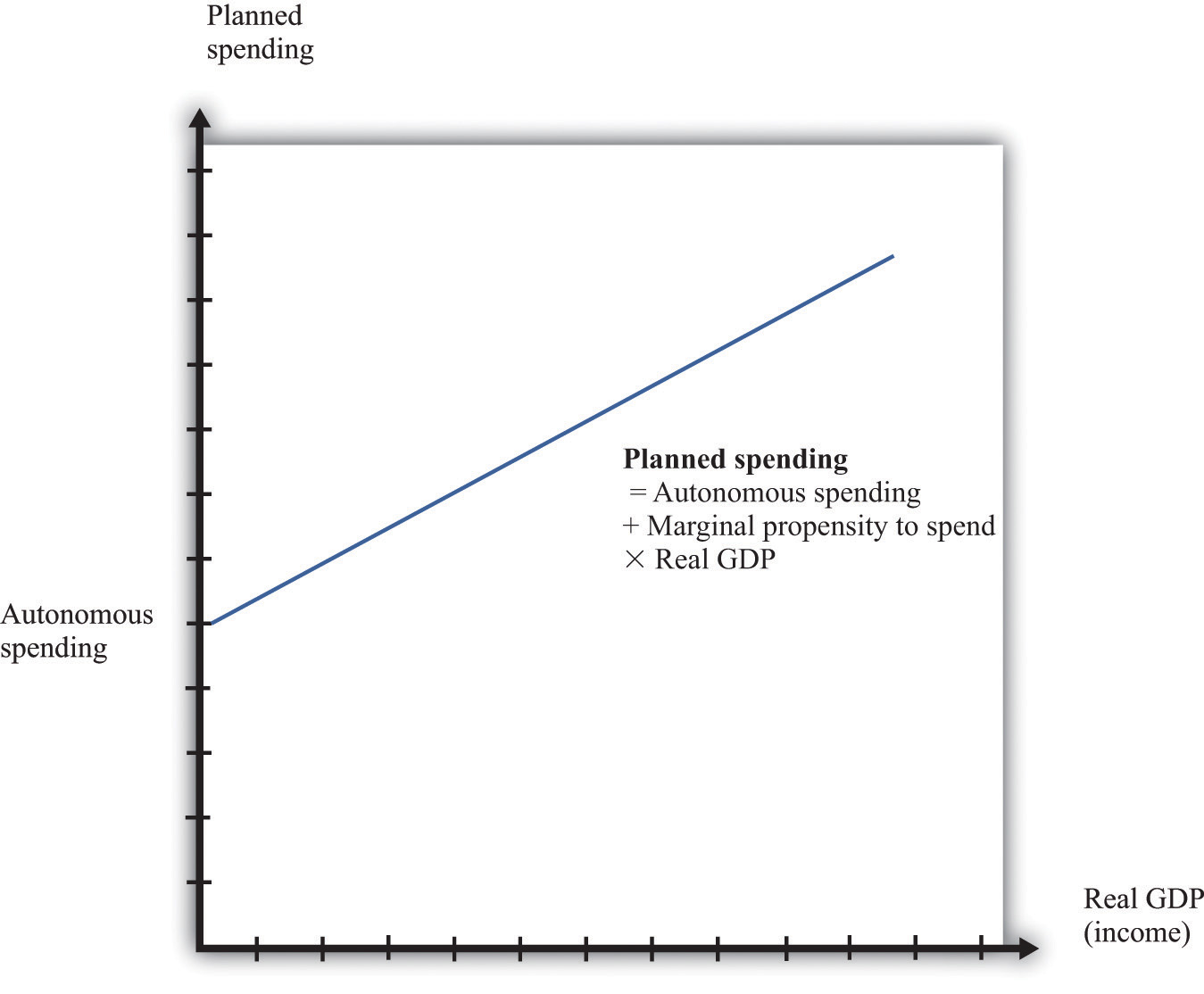

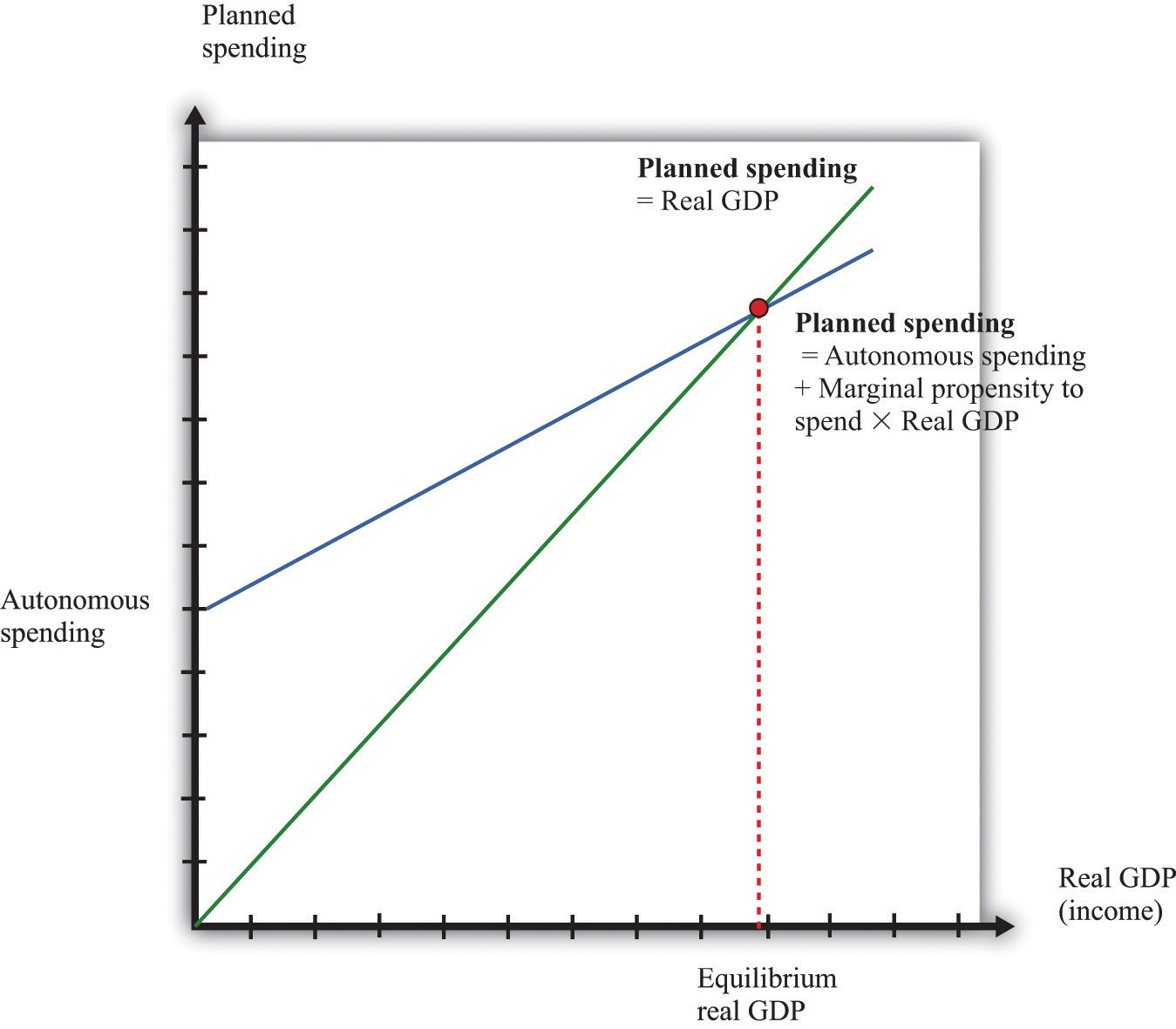

The negative net export link is not large enough to overcome the other positive links, so we conclude that when income increases, so also does planned expenditure. We illustrate this in Figure 16.11 "Planned Spending in the Aggregate Expenditure Model" where we suppose for simplicity that there is a linear relationship between spending and GDP. The equation of the line is as follows:

spending = autonomous spending + marginal propensity to spend × real GDP.Figure 16.11 Planned Spending in the Aggregate Expenditure Model