This is “Money: A User’s Guide”, chapter 9 from the book Theory and Applications of Macroeconomics (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 9 Money: A User’s Guide

The Color of Money

You wake up one morning, drag yourself out of bed, and, bleary-eyed, throw on some clothes. You stumble out of your apartment and across the road to your neighborhood coffee shop. “Coffee, please,” you say to the barista, those being the only two words that you are capable of getting out of your system before you get some caffeine into it. She pours a cup of the coffee of the day and places it on the counter in front of you. Just smelling the coffee makes you feel a little bit better already.

“That’ll be a dollar.” You reach into your pocket, pull out a crumpled twenty, hand it to her, and reach for the cup. “I’m sorry,” she says, pulling the cup away from you, “I can’t accept that.” “Why on earth not?” you ask, bemused. “It’s the wrong color,” she says. “You could have used that yesterday, but—look—this is what bills look like now.” And she reaches into her register and shows you a bright purple $20 bill, like the one in the following figure .

Figure 9.1 The New $20 Bill

Imagine if you woke up one morning and found that all money was now this color.

In this story, normal green dollar bills were accepted as money yesterday, while purple dollar bills were worthless colored pieces of paper. But today, purple dollar bills are accepted as money, and green dollar bills are just worthless pieces of paper. This sounds absurd. Yet it is not so far from what happened in a dozen different countries on January 1, 2002. If you had awakened in Italy on that day and gone down the street to a neighborhood café, you would have noticed that the simple act of buying coffee had changed from the day before. Your local café still looked as it did on December 31, 2001. But where you had previously paid with notes and coins called Italian lira, you would now pay with a completely new currency called the euro.

The same was true in France, Finland, Germany, Greece, and seven other European countries. On that day, 12 countries all officially gave up their own currencies and instead adopted a common currency—the euro. Admittedly, the transition was not quite as stark as in our story: there was a period of about 2 months in which euros and the old local currencies both circulated. But the essence is the same. At one time, euro notes were just colored pieces of paper that shopkeepers would not accept for transactions. Then, not that long afterward, those colored pieces of paper became valuable, while the old currencies turned into worthless pieces of paper.

This was an amazing event for the international economy. Familiar currencies like the French franc, the German deutschmark, the Greek drachma, and the Spanish peseta simply disappeared. The following figure shows some of these vanished currencies. Some of the world’s largest economies changed their currency.In Chapter 15 "The Global Financial Crisis", we take up another aspect of this event: what it means for a country to disband its central bank and delegate monetary policy to a centralized entity. To make sense of this event, we need to answer a disarmingly simple-looking question, which is the theme of this chapter:

Why do people want to hold apparently worthless pieces of paper?

Figure 9.2 Some Vanished Currencies

Here are some of the banknotes that disappeared from circulation in Europe upon the advent of the euro.

Road Map

Understanding what happened in Europe requires us to answer two more basic questions:

What is money? and Why is it valuable?

We begin this chapter by looking at what makes something a money. Surprisingly, this is not straightforward: we will see that money has several attributes, and many different things can act as money. Then we look at what we can do with money. We use money to buy goods and services, we use money to buy other kinds of money, and we use money to buy money in the future.

Before exploring the world of money, we need to make one clarification. In everyday language, if you bought a camera for $200 and sold it for $300, we would say that you made money from the deal. Economists, however, use the term money more precisely, in ways that we make clear in this chapter. An economist would say that your resale of the camera earned you income, and you received that income in the form of money.

9.1 What Is Money?

Learning Objectives

After you have read this section, you should be able to answer the following questions:

- What gives money value?

- What are the functions of money?

Take a look at some currency—a dollar bill, for example. It is nothing more than a piece of paper with writing on it. A very pretty piece of paper, perhaps, with fancy writing and some pictures, but it is still just a piece of paper. Yet people voluntarily give up valuable goods or services in exchange for pieces of paper. This is the mystery of money.

The question motivating this chapter—why do people want money?—is a deep one. That may seem a surprising claim because obviously we all like having money. But questions that seem trivial sometimes provide insights into how the world works. If we can understand why people want these intrinsically worthless pieces of paper, then we can understand why money is valuable. And to understand why people want these pieces of paper, we need to know what people want to do with their money.

The Characteristics of Money

A striking feature of modern developed economies is that people are typically specialists in production and generalists in consumption. By this we mean that most of us work at one or at most two jobs, producing (or, more often, helping to produce) a very small number of things—for example, a cattle farmer produces beef, a software designer produces computer code, and a nurse produces health services. However, we all purchase hundreds of goods and services.

There is no law that says that we have to buy goods and services using money. An alternative is to trade goods or services directly for one another. This is called barterThe exchange of goods and services without money.. We do see some barter in the world. A restaurant may allow its employees free meals at the end of the night, which means that some of the employees’ wages effectively takes the form of food. If a car mechanic and a caterer live next door to each other, they may have an informal arrangement whereby the mechanic repairs the caterer’s truck in exchange for food for a birthday party.

Sometimes we know exactly where to buy the goods and services that we want. At other times, we go looking—perhaps walking or driving from store to store, perhaps searching using a phone book or the Internet. We do this because we don’t know which store has the goods we want in stock; in addition, we might not know the prices that different stores are charging, and we want to hunt around for the best deal.

To understand the role that money plays in an economy, begin by imagining a world where we must search for the goods and services that we want to buy and there is no money, so all trades take place through barter. Imagine, for example, that you are a web designer, and you want to buy a used car. You must look around for someone who has a car for sale. This search takes time: it has an opportunity cost in that you would prefer to spend that time working or enjoying leisure. Eventually, you find someone who has a car that you are interested in buying. But your problems are not over. He has a car for sale, but what can you give him in exchange? You have to hope that he is interested in obtaining some web design services in exchange for the car. Successful barter requires a coincidence of wants: you must have what the other person wants, and they must have what you want.

A world of nothing but barter is hard to imagine. Each time you wanted to buy something from a seller in a store, you would have to exchange some good or service for that good. If you went to a café, you might have to wash the dishes in return for a coffee. Professors of economics wanting a meal would have to go from restaurant to restaurant trying to find a chef who wanted to hear an economics lecture. They would probably go hungry. It is easy to see why all societies find some way of making these transactions easier.

If you can carry some kind of money around with you to make purchases like these, life is much easier. You still have to hunt for the goods and services that you want, but you don’t have to worry about whether the other party in the transaction wants the product that you sell. Money, therefore, plays a key role in ensuring that trades occur. Trades, in turn, create value in our economy. People are not forced to buy or sell things; they do so only if the trade leaves them better off than they were prior to trading. Money therefore plays a critical role in value creation.

The reason that we rarely see exchange without money is that it is so inefficient. Without money, a coincidence of wants is unlikely, so desirable trades do not occur, and value is not created. With money, transactions are much easier. If you want a meal in a restaurant, the owner will always serve it to you if you have money. Likewise, you obtain money by working at your job. You don’t care what good or service your employer produces; as long as your employer pays you in money, you are happy to supply your labor time to them.

Let us think for a moment about what characteristics this money needs to have:

- Money must be portable. If you are going to walk around searching for goods and services, you want to be able to carry money with you. Sacks of coal would not make a very good money.

- Money must be divisible. Different goods have different prices, and the money we use must accommodate that. Watches would not make a very good money.

- Money must be durable. Daffodils would not make a very good money.

It is easy to list many things that are reasonably portable, divisible, and durable: chocolate chip cookies, cigarettes, and printer paper are just a few examples. These are not typically used as money, although they could be. If you went into a fast-food restaurant, asked for a burger, and then offered to pay using chocolate chip cookies, you can be confident that you would not get the food that you want. That is because there is a fourth characteristic of money that is rather different from the other three.

- Money must be acceptable.

Something can function as money only if people are willing to accept it as money. It is not impossible to imagine a world where chocolate chip cookies function as money. If everyone else is willing to accept cookies in payment for goods and services, then you will be willing to do so as well. But if other people accept only printed pieces of paper as money, then you would be foolish to accept chocolate chip cookies for the product that you sell.

Fiat Money

We know of no country, of course, that actually uses chocolate chip cookies for money. In most countries, money takes a particular form called fiat moneyIntrinsically useless pieces of paper not backed by any physical commodity that nevertheless attain value in exchange.. Fiat money is money that is not backed by any physical commodity, such as gold. Instead, the currency is intrinsically useless pieces of paper that attain value in exchange.

Fiat is a Latin word that means “let it be.” Fiat money is money just because the government says so. In a fiat money system, the government does not promise to exchange goods for money. In addition, money is not generally something that we can directly consume: most people would not enjoy eating a dollar bill. So if it doesn’t taste good and the government doesn’t promise to give you something in exchange for it, what gives fiat money value? Why are we all willing to work hard to get pieces of these—intrinsically worthless—pieces of paper?

The answer is because these pieces of paper are acceptable as money. Other people will accept them, so you and I will as well. To put it another way, fiat money has value because everyone believes it has value. Think back to the story with which we opened the chapter. The US economy uses green and white pieces of paper as money. US residents are willing to give up valuable goods and services in exchange for these green and white pieces of paper because they believe that others, in turn, will accept them. Such an arrangement sounds fragile, and it is. If everyone stopped believing that fiat money had value, this would be a self-fulfilling prophecy.Something very much like this happens in the circumstances of very high inflation rates, as explained in Chapter 11 "Inflations Big and Small".

Suppose the money in an economy changed overnight from green pieces of paper to purple pieces of paper, as we fancifully suggested at the beginning of this chapter. Everyone now works for and accepts the new purple currency. You are forced to follow. It would be foolish for you to work and accept green paper because no one would give you goods or services in exchange. Instead, you demand to be paid in purple paper because that is what you now need to buy goods and services.

Of course, we do not often observe these switches across colors of paper within an economy. People get used to one type of currency, and it is difficult to change everyone’s behavior at once. Still, Europe did, in effect, switch from green pieces of paper to purple pieces of paper. Sure enough, no one in Europe these days is willing to accept French francs, Portuguese escudos, or Finnish marks. These are the old pieces of paper. Now people will accept only the new pieces of paper.

That conversion was not truly instantaneous. Prior to the changeover to the euro, there was a switch to a dual unit of account: French bank statements in 2001 gave balances in both French francs and euros, for example. Even now, years after the changeover, bills in Europe often still appear in both the old local currency and euros. It was also possible to use the euro as a store of value before the changeover because banks started establishing accounts in euros.

Even though fiat money issued by the government is, in the end, just pieces of colored paper, it typically does have one particular property that stems from the power of the state. The US government states that it will accept dollars in settlement of government debts—most importantly, tax bills. The government also states that dollars can be used in settlement of private debts. Dollars are legal tender.There is a subtle question here about whether this aspect of money means that even intrinsically worthless currency must always have some value. If people owe debts to the government that are specified in money terms, then they will be willing to pay something for legal tender currency.

The Functions of Money

Thus far, we have thought about money in terms of its characteristics. We can also think about what makes a good or bad money in terms of the functions that it serves.

Medium of Exchange

If you walk into an electronics store and see a camera with a price tag of $500, the store is making an offer to you and other customers: if you hand over ten $50 bills, you can have the camera in exchange. Money serves as a medium of exchangeAnything that will be widely accepted in exchange for goods and services..

There are other ways to purchase a camera rather than cash. You could write a check, for example, or use a debit card (a card that immediately deducts the $500 from your bank account and pays it into the store’s account). The fact that there are different ways of paying for something is a clue that there is, in fact, no single thing that we can call money. Money is anything that does what money does.

Interestingly, one common form of purchase does not involve money at all. If you use a credit card to buy a camera, you do not pay at all at the time of purchase, so no money—by any definition—changes hands. In this case, you receive the camera in exchange for a promise to pay for the camera later. It is only when that promise to pay is fulfilled that you hand over the money for the purchase.

Store of Value

Any medium of exchange must also serve as a store of valueAnything that can reliably be expected to maintain its worth over time.. This just means that money should keep its value between the time that you receive it (in exchange for goods that you sell or work that you do) and you spend it again.

If an object lost all or most of its value over a short period, then it would not be acceptable in exchange. So something that serves as money must be a store of value. Imagine for a moment an economy in which ice played the role of money. Except on the coldest days, the ice you receive on payday would not last long enough for you to buy anything with it. It would be a terrible store of value and, as a result, would not do a good job of facilitating exchange.

Paper money and coins are not like ice. They are durable and do not dissolve with use. Because of this, you can be confident that the dollar you have in your pocket today will still be a dollar you can spend tomorrow. The fact that people are willing to hold money for long periods of time is indicative of the role of money as a store of value. If money were not a store of value, then all people would want to get rid of cash as soon as they received it. To mix our metaphors: if money were ice, it would become a hot potato.

Being a store of value is more than just a physical property of money. Currency in your pocket can remain there for a long periods of time before disintegrating. So, in a physical sense, that currency retains its worth. But, if prices are increasing, then in terms of what the currency can buy, the money in your pocket is not retaining its value. In times of inflation, money functions less well as a store of value.

Unit of Account

Almost universally, prices are quoted in terms of some currency, such as pesos, dollars, or euros. Goods and services sold in the United States have prices in terms of US dollars. The dollar serves as a unit of accountA standardized measure for economic transactions.. But when the very same goods and services are sold in Europe, they are priced in a different unit of account: euros. This role of money is so familiar as to be mundane, yet our economy simply could not function without a commonly accepted monetary measuring stick. It would be like building a house without an accepted measure of length or running an airline without an accepted measure of time.

The unit that people use to keep account of their monetary transactions varies from country to country. In Mexico, prices are quoted in pesos, in India prices are quoted in rupees, and so on. In most countries, the medium of exchange and the unit of account are the same thing, but this need not be true.

Because the US dollar is known throughout the world, it is often used as a unit of account in unexpected places. Prices of commodities in international transactions may be quoted in terms of the dollar even when the transaction does not directly involve the United States. Luxury hotels in China and elsewhere sometimes quote prices in US dollars even to guests who are not coming from the United States.In Chapter 3 "The State of the Economy", we discuss both nominal and real gross domestic product (real GDP). Nominal GDP is the value of all the goods and services produced in an economy, measured in terms of money. Money is used as a unit of account to allow us to add together different goods and services. Even the concept of real GDP uses money as a unit of account: the difference is that we use money prices from a base year to value output rather than current money prices. As another example, after the changeover to the euro, that currency became the medium of exchange and the “official” unit of account. But many people—at least in terms of their own thinking and mental accounting—continued to use the old currencies. In everyday conversation, people continued to talk in terms of the old currencies for months or even years after the change.On a bike trip in the summer of 2002, one of the authors had lunch in a French country restaurant. Though it was many months after the change to the euro, the menu was still in French francs. An elderly lady running the restaurant painstakingly produced a bill in euros: for each entry (in French francs), she multiplied by the exchange rate (euros to francs) and then added the amounts together. Even today, some bills and bank statements in Europe continue to quote the old currency along with the euro.

Meanwhile, merchants in countries who have not adopted the euro may still quote prices in that currency. In Hungary, the local currency is called the forint. Figure 9.3 "The Euro as a Unit of Account" shows a sign at a restaurant in Budapest, Hungary, advertising goods in both currencies: goulash soup, for example, is sold for 1,090 forint or 4.40 euro. If, as may well be the case, the restaurant is also willing to accept euros in payment, then the euro is also acting as a medium of exchange alongside the forint.

Figure 9.3 The Euro as a Unit of Account

A sign at a restaurant in Hungary quotes prices in euros and the local currency (forint).

Source: Image taken by the authors

Key Takeaways

- Fiat money has value because everyone believes it has value.

- The three functions of money are medium of exchange, store of value, and unit of account.

Checking Your Understanding

- In what sense are you a specialist in production and a generalist in consumption?

- Why is money less effective as a store of value when inflation is high?

- In times of inflation, money is also less effective as a unit of account. Why?

9.2 Using Money to Buy Goods and Services

Learning Objectives

After you have read this section, you should be able to answer the following questions:

- What is arbitrage?

- What is the law of one price?

Having defined money through its characteristics and functions, we now turn to the uses of money. By looking at what we can do with money, we can understand how intrinsically worthless pieces of paper acquire their value.

Let us imagine, then, that you are lucky enough to find a $100 bill on the sidewalk. You have no way of returning it to its rightful owner. What might you do with this money? The first and most obvious answer is that you can use it to buy something you want: you can take the $100 and purchase some goods and services.

The Value of Money

The observation that we use money to buy things tells us more about the value of money. Economists often make a distinction between real and nominal values; this distinction can be applied to money as well. First, what is the nominal value of money? This is almost a trick question: we are asking, “How many dollars is a dollar bill worth?” The answer, which does not require a doctorate in economics, is that a dollar bill is worth $1.

Nominal variables—those measured in dollars or other currencies—can be converted into real variables—that is, those measured in units of real gross domestic product (real GDP). To convert a nominal variable to a real variable, we simply divide by the price level. For example, if your nominal wage is $20 per hour and the price level is $10 (meaning that a typical unit of real GDP costs this amount), then your real wage is 2 units of real GDP.

Toolkit: Section 16.5 "Correcting for Inflation"

If you want to review the process of correcting for inflation, you will find more details in the toolkit.

Exactly the same principle can be applied to money itself. The real value of a dollar is obtained by dividing one by the price level. Thus

Think of an economy in which real GDP is measured in pizzas and suppose the price level—the price of a pizza—is $10. Then the value of a dollar bill is 1/10 of a pizza.

Although $1 is always worth $1, you are not guaranteed that the dollar bill in your pocket will buy the same amount of goods and services from one day to the next. If your local café increases the price of a cookie from $1.00 to $1.25, then your $1 will no longer buy you a cookie; its value, measured in cookies, has declined. If the price level increases, then the real value of money decreases. For notes and coins to be a good store of value, it must be the case that prices are not increasing too quickly.We discuss this problem in more detail in Chapter 11 "Inflations Big and Small".

Using Money to Make Money: Arbitrage

An old joke has it that the secret to getting rich is very simple: buy at a low price and sell at a high price. So another use of your $100 would be to buy goods not to consume but to resell—a process known as arbitrageThe act of buying and then selling an asset to take advantage of profit opportunities..

Suppose you discovered that a particular model of digital camera could be bought much more cheaply in Minneapolis, Minnesota, than in Flagstaff, Arizona. Then you could purchase a large number of cameras in Minneapolis, load them into a suitcase, fly to Flagstaff, and sell them for a profit. If the gap in price were large enough to compensate for your time and travel costs, then this would be a money machine. By buying cameras at a low price and selling them at a high price, you could make as much profit as you wished.

This situation would not persist. You, and other entrepreneurs as well, would start to bid up the price of cameras in Minneapolis. Meanwhile, the increased supply of cameras in Flagstaff would cause prices there to decrease. Before too long, your money machine would have dried up: the gap between the Flagstaff price and the Minneapolis price would no longer justify the effort.

Arbitrage ensures that the prices of individual goods do not vary too much across different regions of the United States. Taken to its extreme, it would imply that the price level would be the same throughout the country. Economists call this idea the law of one priceDifferent prices for the same good or service will not persist because arbitrage eliminates such differences.. The law of one price says that different prices for the same good or service cannot persist because arbitrage eliminates such differences. Arbitrageurs would buy the good at the low price and sell it at the high price. Demand would increase in the market where the price was low, causing that price to increase. Supply would increase in the market where the price was high, causing that price to decrease. This process would continue until the prices were equalized across the two markets.

There are, of course, differences in the prices of individual goods and services in different states and different cities. These differences are primarily due to the fact that some items cannot be arbitraged. If cameras are cheaper in Minneapolis than in Flagstaff, then they can be bought and sold as we described. But if apartments in Flagstaff are cheaper than in Minneapolis, it isn’t possible to ship them across the country. Likewise services typically cannot be arbitraged. Thus we do not expect the law of one price to be literally true for every good and service. Nevertheless, the law of one price does lead us to expect that the overall price level will not differ too much in different parts of the country.

It can be difficult to apply the law of one price in practice because we have to be careful about what we mean by the “same” product. An apparently identical shirt at two different retailers might not qualify as the same—perhaps one retailer allows goods to be returned, while the other does not allow returns. Identical goods are not the same if they are in different places: a Toyota on a dealership lot in Kentucky is not the same as the identical model car on a lot in Pretoria, South Africa, and so on. In such situations, the law of one price tells us that we should not expect prices of goods to be “too different,” depending on the costs of transportation and the other costs of arbitrage.

We said earlier that money makes an economy more efficient because it makes transactions easier. Money makes arbitrage easier as well. Arbitrage would be a less certain way of making money in an economy with barter. First, the lack of a clear unit of account would make arbitrage opportunities less transparent. Second, the lack of a reliable medium of exchange would make arbitrage risky: the person in Flagstaff who wants to buy a digital camera from you might not have anything you want, so you might end up giving up something you own and not getting something you want in return.

Key Takeaways

- Arbitrage is the process of making a profit by buying goods at a low price and selling them at a higher price.

- When arbitrage is possible, we expect the same good to sell at the same price. There are no arbitrage profits to be made when the law of one price holds.

Checking Your Understanding

- All else being the same, if the price level increases, what happens to the real value of money?

- Explain why the law of one price is less likely to hold for a service than for a good.

9.3 Using Money to Buy Other Monies: Exchange Rates

Learning Objectives

After you have read this section, you should be able to answer the following questions:

- What is the difference between the nominal exchange rate and the real exchange rate?

- How is the law of one price related to the nominal exchange rate?

As we all know, there are multiple currencies in the world. These are most often associated with a single country: the yen in Japan, the yuan in China, the peso in Mexico, and so on. Sometimes many countries will use the same money, with the leading example being the use of the euro by the member countries of the European Union (http://ec.europa.eu/economy_finance/euro/index_en.htm). Sometimes multiple currencies are in use in a single place: when you land at a major European airport, such as Frankfurt, Germany, or Amsterdam, the Netherlands, you will see that you can buy a cup of coffee at the airport using many different currencies. Likewise, the US dollar is freely accepted in some countries in addition to the local currency, British pounds formerly were freely accepted in Ireland, and so on.

If you happened to find your $100 right before going on a trip to another country, you might decide to use it to buy the money of that country. For example, if you were about to take a trip to Canada, you could take the bill into a bank or a foreign exchange merchant and exchange it for Canadian dollars. If you want to buy goods and services in Canada, you need Canadian dollars because they are the medium of exchange in that country.

When you make such an exchange, you buy the local currency using your home currency. If you travel from the United States to Europe, you buy euros using dollars. The price you pay is the dollar price of the euro: the amount in dollars you must pay to obtain 1 euro. This is completely analogous to using a dollar to buy a bottle of soda, when you pay the dollar price of soda.

In practice, it is often unnecessary to carry out a physical exchange of notes and coins. In most countries, you can go to an automated teller machine (ATM) and withdraw local currency directly. Your bank deducts the equivalent sum in your home currency from your bank account. You are still carrying out an exchange, of course, but it is hidden from view, and you will see it only when you look at your next statement. The same is true if you make a purchase using a credit card.

Just as a US resident traveling to Europe wishes to buy euros with dollars, a visitor to the United States from, say, Holland will need to buy dollars with euros. The price she pays is the euro price of the dollar: the number of euros needed to obtain $1. The price of one currency in terms of another is called an exchange rateThe price of one currency in terms of another..

Toolkit: Section 16.10 "Foreign Exchange Market"

If you want to review the definition of an exchange rate, you will find more details in the toolkit.

If we think of two currencies—euros and dollars, for example—then there are two exchange rates to keep in mind: the price of euros in dollars and the price of dollars in euros. (You might suspect, correctly, that these two prices are linked; we return to this shortly.) In a world of 3 currencies, each has a price in terms of the other two currencies, so there are 6 (= 3 × 2) different prices. And in a world of 100 currencies, then for each one, there are 99 prices for the other currencies. So there are 100 × 99 = 9,900 prices to quote! A Zambian traveling to Armenia wants to know about the kwacha price of drams, a Malaysian traveling to Oman is interested in the ringgit price of rials, and so on.

Foreign Exchange Markets

Imagine a series of three visitors traveling from the United States to Europe. First, we have someone arriving on vacation. Chances are that she will want to exchange dollars for euros to have money to spend on hotels, meals, and so on. She also buys souvenirs in Europe—goods that she imports back to the United States. Our second visitor spends a lot of time in Europe for work purposes. He might open a bank account in, say, Germany. If he wanted, he could use this bank account to keep some of his wealth in Europe. He would buy euros with his dollars, deposit these euros in the bank to earn interest, and then—at some point in the future—he would take his money out of the bank in Germany and exchange the euros for dollars. (Later, we will consider how you can decide if this is a good investment strategy. For now, our point is that this type of financial investment is another source of demand for euros.) Our third visitor to Europe is a professional wine buyer who wants to purchase wine to sell in a US restaurant. She travels to the wine-growing regions of Europe (France, Spain, Italy, Germany, Portugal, etc.) and must exchange dollars for euros to pay for her purchases.

Our three visitors represent a microcosm of the transactions that take place in the foreign exchange market every day. Households and firms buy euros to pay for their imports of goods and services (souvenirs, wine, etc.). Many different goods and services are produced in Europe and sold in the United States. Some are imported by retailers, others by specialist import-export firms, and still others by individuals, but in all cases there is an associated purchase of euros using dollars.

The demand for euros also arises from financial investment by households, firms, and financial institutions. For example, a wealthy private investor in the United States may purchase stock issued by a company in Europe. To buy that stock, the US investor sells dollars and buys euros. In practice, such transactions are typically carried out by financial institutions that undertake trades on behalf of households and firms.

Most exchanges of dollars for euros do not actually entail someone traveling to Europe. Think about the foreign currency needs of a large multinational firm that produces goods and services in Europe but sells its output in the United States. The company naturally needs euros to pay workers and suppliers in Europe. Since it sells goods and thus earns revenues in dollars, the company must convert from dollars to euros very frequently. But you will not see the company’s chief financial officer in an airport line to exchange money. Instead, such currency operations are conducted through financial institutions, such as commercial banks.

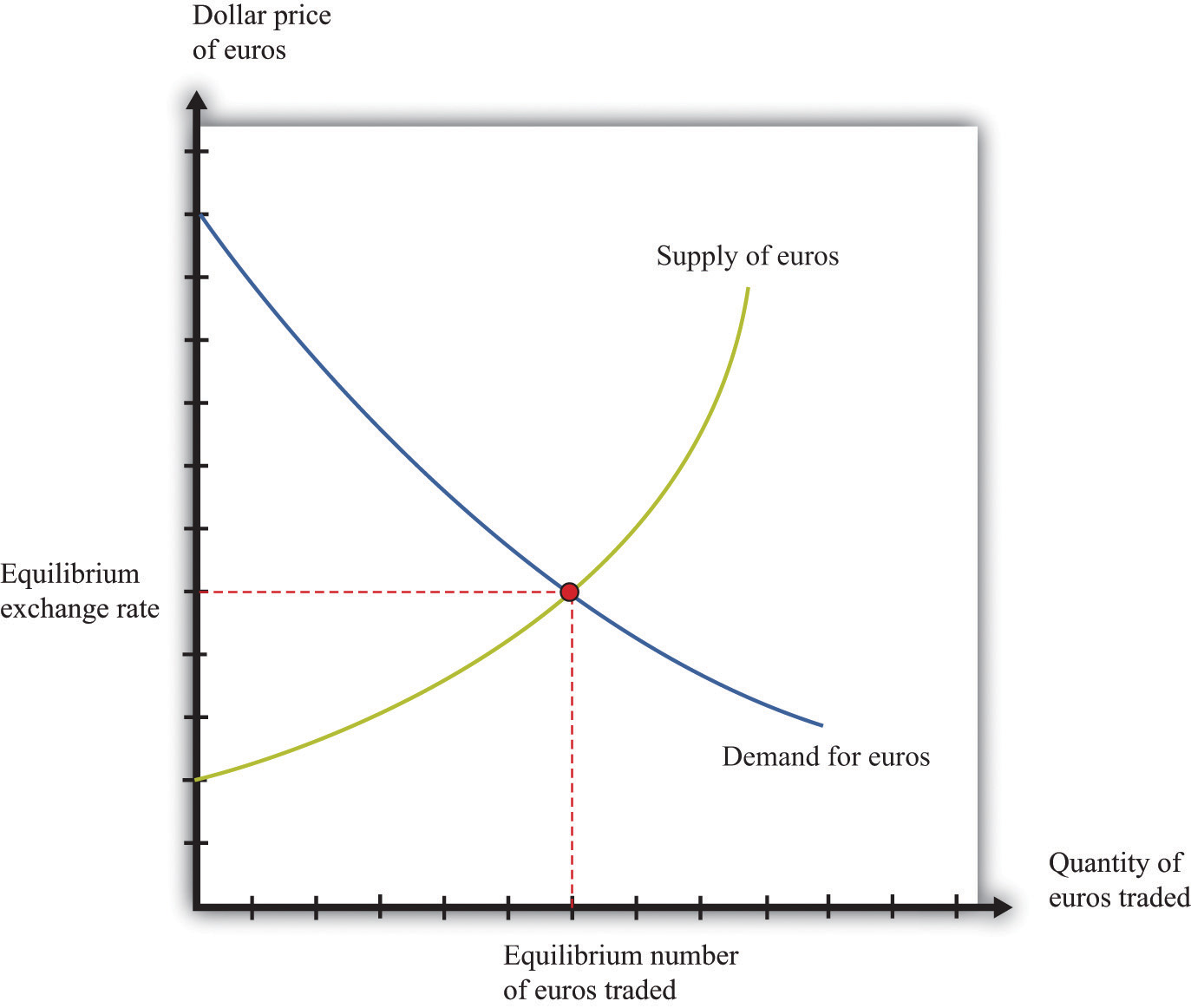

Because of all these transactions, there are very active and sophisticated markets in which currencies are traded. We can represent these markets using the familiar supply-and-demand framework. Figure 9.4 "The Market for Euros" shows a picture of the market where euros are bought and sold. Buyers from the United States buy euros with dollars, and European traders sell euros in exchange for dollars.Of course, it is not literally the case that everyone who is buying is from the United States and that everyone selling is from Europe. If you have dollars, you can buy euros; if you have euros, you can sell them for dollars. But it is simpler to explain if we think of Europeans selling euros and Americans buying them. The supply and demand curves refer to the object being traded—euros. Thus the quantity of euros is shown on the horizontal axis. The price on the vertical axis is in dollars.

This market is just like any other you encounter. The demand curve is downward sloping: as the price of euros increases, the quantity of euros demanded decreases. This is the law of demandPeople consume more of a good when its price decreases and less of a good when its price increases. at work. As the price of euros increases, people in the United States will find that goods and services produced in Europe are more expensive. For example, suppose that 1 euro costs $1, and a Mercedes automobile costs EUR 50,000.There is an established set of three-letter symbols for all the currencies in the world. Euros are denoted by EUR, US dollars are denoted by USD, Australian dollars are denoted by AUD, and so forth. In this book we use the familiar $ symbol for US dollars and the three-letter symbols otherwise. A list of the currency codes can be found at http://www.xe.com/iso4217.php. Then its cost in dollars is $50,000. Now imagine that euros become more expensive, so that EUR 1 now costs $2. You now need $100,000 to buy the same Mercedes in Europe. So an increase in the price of euros means that Americans choose to buy fewer goods and services produced in Europe. Exactly the same logic tells us that an increase in the price of the euro makes European assets look less attractive to investors. A German government bond, a piece of real estate in Slovenia, or a share in a Portuguese firm might look like good buys when the euro costs $1 yet seem like a bad idea if each euro costs $2.

The supply curve also has a familiar upward slope. As the price of euros increases, more people in Europe sell their euros in exchange for dollars. They do so because with the higher dollar price of euros, they can obtain more dollars for every euro they sell. This means that they can buy more US goods and services or dollar-denominated financial assets.

Figure 9.4 The Market for Euros

This diagram shows the foreign exchange market in which euros are bought and sold. As the price of euros (in dollars) increases, more euros are supplied to the market, but fewer euros are demanded.

The price where supply equals demand is the equilibrium exchange rate. (The market also shows us the equilibrium number of euros traded, but here we are more interested in the price of the euro.)

Toolkit: Section 16.6 "Supply and Demand"

The foreign exchange market is an example of a market that we can analyze using the tool of supply and demand. You can review the supply-and-demand framework and the meaning of equilibrium in the toolkit.

Arbitrage with Two Currencies

So far, we have talked about buying foreign currencies to purchase either assets or goods and services. Another reason to buy foreign currencies is in the hope that you could make money by trading them. Let us think about how you might try to make money in the foreign exchange market. You might start with some dollars and exchange them for euros. Then you could take those euros and exchange them for dollars again. Is it possible that, by doing this, you could end up with more money than you started with? Could you buy euros cheaply and then sell them at a high price, thus making a profit?

Begin by supposing that dollars and euros are only two currencies in the world, and there are only two economies: the United States and Europe (a shorthand for “those European countries that use the euro”). Imagine that there are two separate markets: in the euro market, the price of 1 euro is $2; in the dollar market, the price of one dollar is EUR 1. With these two prices, there is money to be made by buying and selling currencies. Start with 1 euro. Sell that euro in the market for euros and obtain $2. Use those dollars to buy euros in the market for euros and obtain 2 euros. Now we are talking business: you started with 1 euro, made some trades, and ended up with 2 euros.

There is, of course, a catch. The prices that we just suggested would not be consistent with equilibrium in the foreign exchange markets. As we have just seen, there is a simple recipe for making unlimited profit at these prices, not only for you but also for everyone else in the market. What would happen? Everyone would try to capitalize on the same opportunity that you saw. Those with euros would want either to sell them in the euro market—because euros are valuable—or to use them to buy dollars in the dollar market—because dollars are cheap. Those with dollars, however, would not want to buy expensive euros in the euro market, and they would not want to sell them in the dollar market. Hence, in the euro market, the supply of euros would shift rightward, and the demand for euros would shift leftward. The forces of supply and demand would make the dollar price of euros decrease. In the dollar market, the supply of dollars would shift leftward, and the demand for dollars would shift rightward, causing the euro price of dollars to increase.

The mechanism we just described is arbitrage at work again. The arbitrage possibility between the dollar market for euros and the euro market for dollars disappears when the following equation is satisfied:

price of euro in dollars × price in dollar in euros = 1.When this condition holds, there is no way to buy and sell currencies in the different markets and make a profit. As an example, suppose that EUR 1 costs $2 and $1 costs EUR 0.5. These prices satisfy the equation because 2 × 0.5 = 1. Imagine you start with $1. If you use it in the dollar market for euros to buy euros, then you will have EUR 0.50. If you then use these in the euro market for dollars to buy dollars, you will get $2 for each euro you supply to the market. Since you have half of a euro, you will end up with $1, which is what you started with. There is no arbitrage opportunity.

By now you have probably realized that there is a close connection between the market for euros and the market for dollars (where dollars are bought and sold using euros). Whenever someone buys euros, they are selling dollars, and whenever someone sells euros, they are buying dollars. In our two-country, two-currency world, the market for euros and the market for dollars are exactly the same market, just looked at from two different angles.

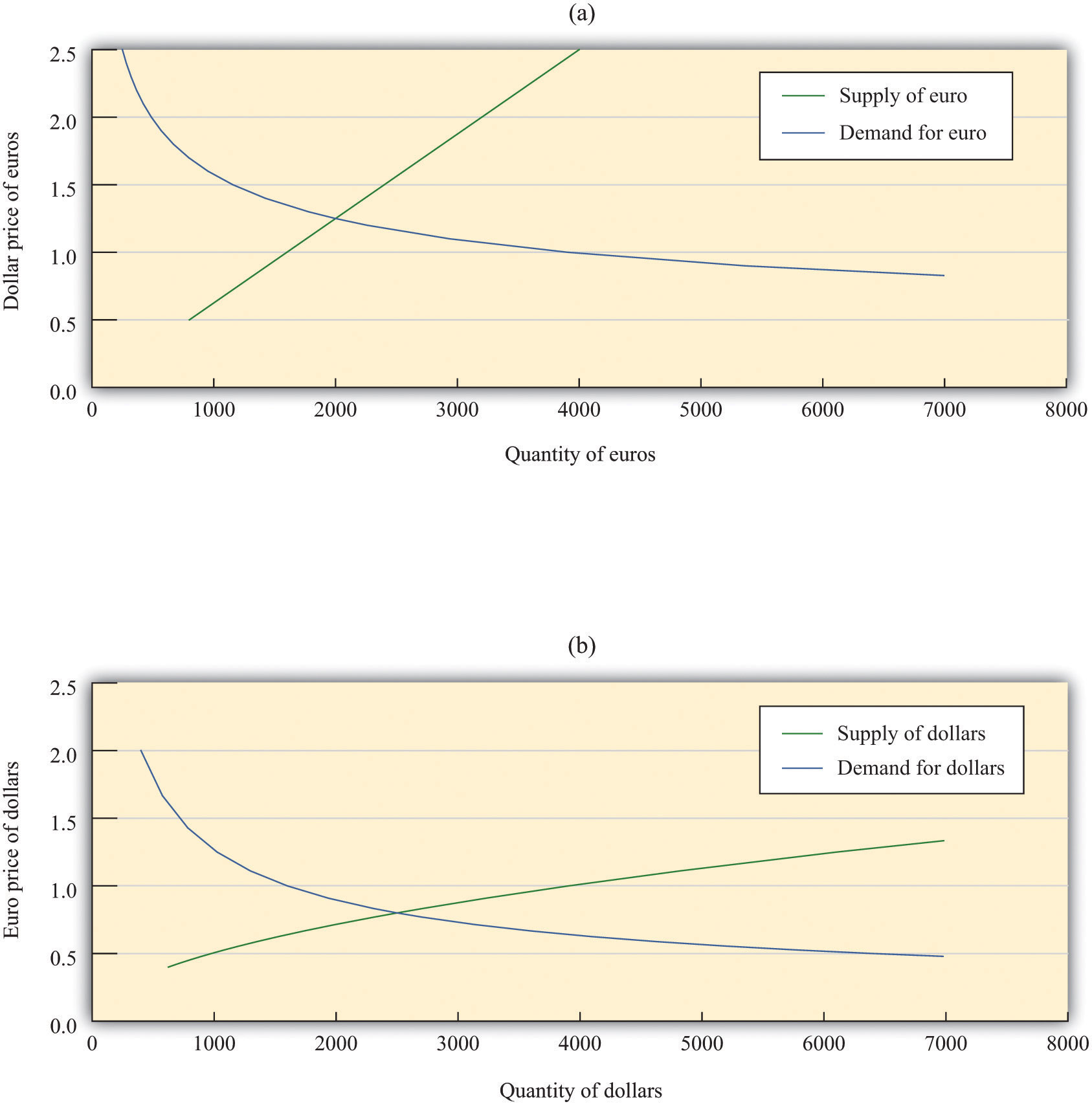

Figure 9.5 The Market for Euros and the Market for Dollars

Here we show the market where euros are bought and sold with dollars (a) and the market where dollars are bought and sold with euros (b). Because of arbitrage, these are just two different ways of looking at the same market.

We illustrate this in Figure 9.5 "The Market for Euros and the Market for Dollars". In part (a) of Figure 9.5 "The Market for Euros and the Market for Dollars", we show the market where euros are bought and sold, and in part (b) of Figure 9.5 "The Market for Euros and the Market for Dollars" the market where dollars are bought and sold. The supply curve for dollars is just the demand curve for euros, and the demand curve for dollars is the same as the supply curve for euros. For example, suppose 1 euro costs $2. From part (a), we see that, at this price, people would supply EUR 3,200. In other words, there are individuals who are willing to exchange EUR 3,200 for $6,400. If we think about this from the perspective of the market for dollars, these people would demand $6,400 in the market when $1 costs EUR 0.50—and, indeed, we see that this is a point on the demand curve in part (b). The market is in equilibrium when EUR 1.00 costs $1.25, or equivalently when $1 costs EUR 0.80. At this exchange rate, holders of dollars are willing to give up $2,500, and holders of euros are willing to give up EUR 2,000.

Arbitrage with Many Currencies

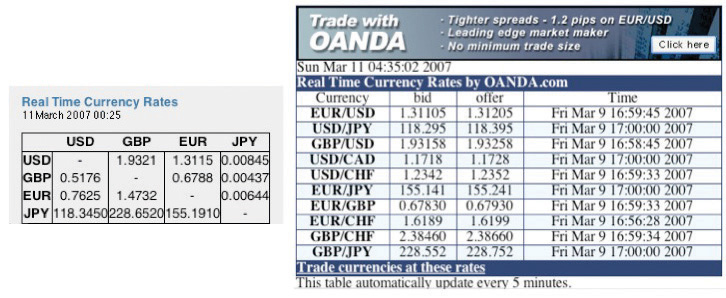

We live in a world with many different currencies, not just two. Figure 9.6 "Exchange Rates" shows some exchange rates from http://www.oanda.com, a site that provides current and historical data on exchange rates and that is also an online market where you can trade currencies. So, on March 11, 2007, just after midnight, the price of a euro in dollars was 1.3115. At the same time, the price of a dollar in British pounds was 0.5176.

Figure 9.6 Exchange Rates

These tables come from http://www.oanda.com. The table on the left shows exchange rates among four currencies and the table on the right shows the rates at which you can actually conduct trades at this site.

If you look at the table on the left side of Figure 9.6 "Exchange Rates", you see that it provides both the dollar price of the euro and the euro price of the dollar (and similarly for the other currency pairs). Tables such as this one have already built in the arbitrage condition, so you cannot keep buying and selling the same currency in exchange for dollars and make money.

When there are multiple currencies, we can imagine more complicated trading strategies. As an example, consider the following string of transactions.

- Take a dollar and use it to buy euros.

- Take the euros and buy Japanese yen.

- Take the yen and buy dollars.

If you end up with more than $1, then there are profits to be made buying and selling currencies in the manner outlined here. Can you make a profit this way? The answer, once again, is no. If you could, then the markets for foreign currency would not be in equilibrium: everyone would buy euros with dollars, sell them for yen, and then sell the yen for dollars. Once again, exchange rates would rapidly adjust to remove the arbitrage opportunity.

To verify this, let us go through this series of transactions using Figure 9.6 "Exchange Rates". One dollar will buy you EUR 0.7625. Now take these and use them to buy yen. You will get 0.7625 × 155.1910 = JPY 118.3331. Now, use these yen to buy dollars, and you will get 118.3331 × 0.00845 = $0.9999. You start with $1; you end with $1 (give or take a rounding error).

These calculations assume that there are no costs to trading foreign currencies. In practice, there are costs involved in these exchanges. A traveler arriving at an airport in need of local currency does not see rates posted as in the left-hand table in Figure 9.6 "Exchange Rates". Instead, they see something that looks like the right-hand table, where rates are posted in two columns: bid (buying) and offer (selling). The bid is a statement of how much the currency seller is willing to pay in local currency for the listed currency. The offer column is the price in local currency at which the seller is willing to sell to you. Naturally, the offer price is bigger than the bid: the seller buys currencies at a low price and sells them at a high price. The difference between the bid and offer prices is called the spread. The existence of the spread means that if you try to buy and sell currencies with the dealer, you will actually lose money. At the same time, the spread creates a profit margin for the dealer and thus pays for the service that the dealer provides.

Arbitrage with Goods and Currencies

We have talked about arbitrage with goods and arbitrage with foreign currencies. We can also put the two together to study the prices of goods that are traded across international borders. Arbitrage of goods from one country to another is a bit more complicated because it involves buying and selling currencies as well as goods. To see how this works, imagine you are going on a trip to Europe. You are allowed two suitcases filled with belongings free of charge on the airplane. What about filling a suitcase full of new blue jeans, transporting them to Europe, and then selling them there? Could you make money that way?

Suppose that the dollar price of 1 euro is $1.50. Further, suppose that the price of a pair of blue jeans is $70.00 in the United States and EUR 50.00 in Paris. Consider the following sequence of actions.

- Take $70 out of your pocket and buy a pair of blue jeans.

- Travel with these blue jeans to Paris.

- Sell the jeans for euros.

- Buy dollars with your euros.

The question is whether you can make money in this way. The answer is given by how many dollars you will have in your pocket at the end of these steps. When you sell the jeans in Paris, you will have EUR 50.00. If the dollar price of euros is $1.50, then by selling the jeans in Paris you will get 50 × $1.50 = $75. This is a profit of $5 for each pair of jeans—you are in business.

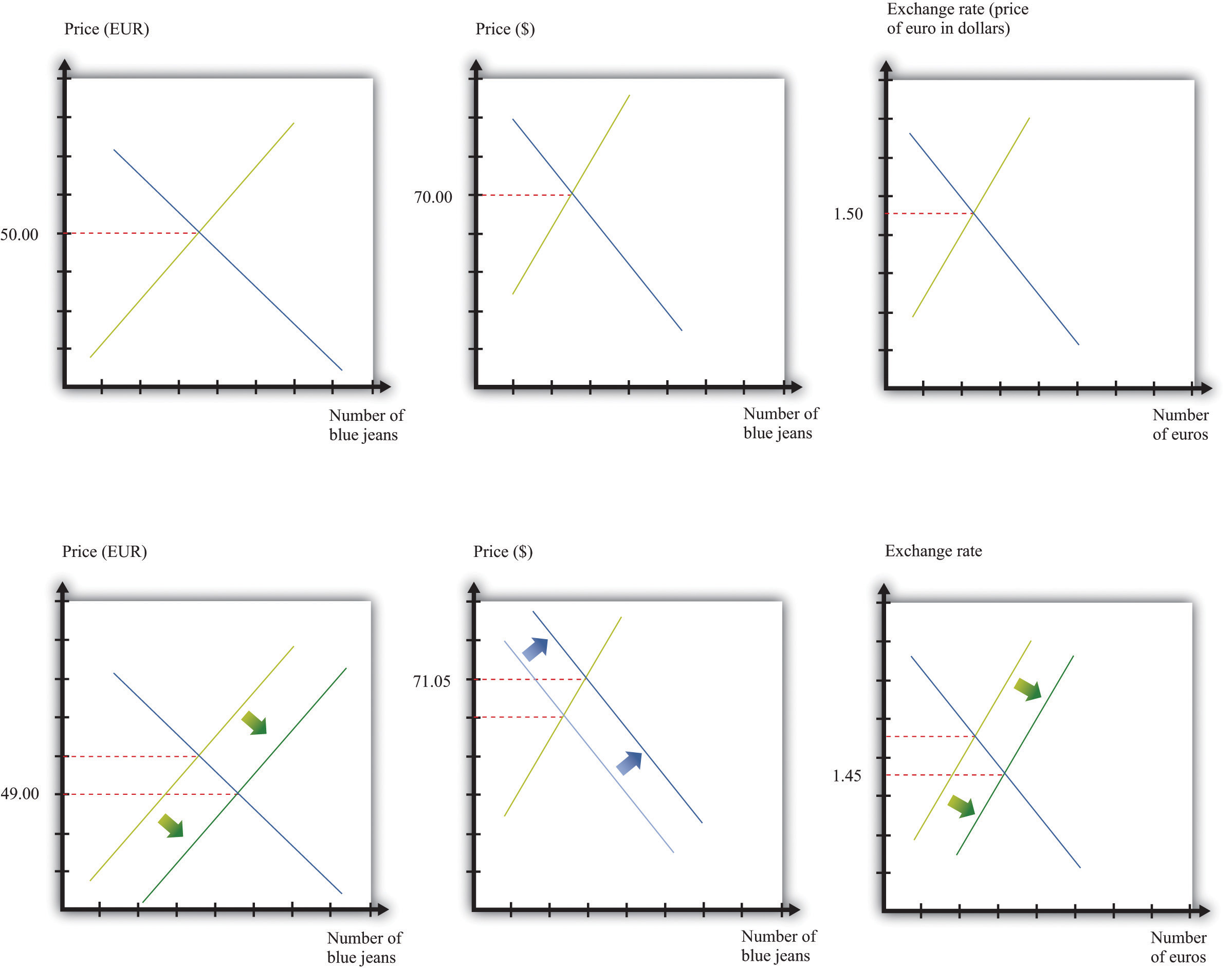

Once again, the opportunity for arbitrage suggests that this situation is unlikely to persist. Entrepreneurs will buy jeans in the United States, take them to Paris, and sell them there. Market forces in three different markets will work to eliminate the profit. First, the activity of arbitrageurs will increase the demand for jeans in the United States, causing the US price of jeans to increase. Second, the increased supply of jeans in Paris will cause the price there to decrease. And third, there will be an increased supply of euros in the foreign exchange market, which will cause the euro to depreciate. This is shown in Figure 9.7 "International Arbitrage Restores the Law of One Price".

Figure 9.7 International Arbitrage Restores the Law of One Price

When blue jeans cost $70 in the United States and EUR 50 in France, and the exchange rate is $1.50 per euro, arbitrageurs can make a profit by importing blue jeans to Europe from the United States.

These price changes continue until there are no profits to be made by arbitrage. Exactly how much of the adjustment will take place in each market depends on the slopes of the supply and demand curves. In Figure 9.7 "International Arbitrage Restores the Law of One Price", we have drawn the new equilibrium as follows: blue jeans cost EUR 49 in Europe and $71.05 in the United States; and the exchange rate is $1.45 per euro. At these prices,

price of blue jeans in dollars = price of blue jeans in euros × price of euro in dollars,and there is no longer any possibility of arbitrage. This is another illustration of the law of one price. If we were literally talking just about arbitrage in blue jeans, most of the adjustment would take place in the markets for blue jeans in the United States and Europe, and there would be a negligible effect on the exchange rate. But if the same kinds of arbitrage opportunities exist for lots of goods, then there will be an impact on the exchange rate as well.

For tradable goodsGoods that can be easily and cheaply transported from one place to another, which means they can be easily arbitraged., the law of one price says that the

dollar price of good = euro price of good × dollar price of euro.When this condition holds, there are no arbitrage profits to be gained by purchasing the good with dollars, selling it for euros, and then buying dollars with euros. Likewise, if this condition holds, there are also no arbitrage profits from purchasing the good with euros, selling it for dollars, and then buying euros with dollars. In general, we expect that such arbitrage will occur very quickly. There are no profits to be made from arbitrage when the law of one price holds.

The Economist has kept track of the price of a McDonald’s Big Mac in a number of countries for many years, creating something they call the “the Big Mac index.” Table 9.1 "The " contains some of their data. The last column of Table 9.1 "The " gives the price of a Big Mac in each selected country in July 2011, converted to US dollars at the current exchange rate. That is, the last column is calculated by dividing the local currency price (the second column) by the exchange rate (the third column). A Big Mac costs $4.07 in the United States but more than twice as much in Norway. China is a real deal at only $1.89.

Table 9.1 The Economist’s Big Mac Index, July 2011

| Country | Local Currency Price of Big Mac | Local Currency Price of a Dollar | Price in US Dollars |

|---|---|---|---|

| United States | USD 4.07 | 1 | 4.07 |

| Norway | NOK 45 | 5.41 | 8.31 |

| Euro Area | EUR 3.44 | 0.70 | 4.93 |

| Czech Republic | CZK 69.3 | 17.0 | 4.07 |

| China | CNY 14.7 | 6.45 | 1.89 |

Source: “The Big Mac Index: Currency Comparisons, to Go,” Economist online, July 28, 2011, accessed August 2, 2011, http://www.economist.com/blogs/dailychart/2011/07/big-mac-index.

The price differentials in this table violate the law of one price: there is (apparently) profit to be made by buying Big Macs at a low price and selling them at a high price. Applying the principle of arbitrage, we should all be flying to China, buying Big Macs, traveling to Norway, and selling them on the streets of Oslo. Of course, there are a few small problems with this scheme, such as the following:

- It is expensive to fly back and forth between China and Norway.

- There is a limited capacity for transporting Big Macs on the airplane.

- The quality of the Big Mac might deteriorate while it is being transported.

- You might not be permitted to import meat products from China into Norway.

- You might have to pay taxes when you bring Big Macs into Norway.

- It might be tough to open a McDonald’s in Oslo.

This long list easily explains the deviations from the law of one price for Big Macs. Similar considerations explain why the law of one price might not hold for other goods. The law also does not apply to services, such as tattoos, since these cannot be imported and exported. The law of one price is most applicable to goods that are homogeneous and easily traded at low cost. Economists use the law of one price as a guide but certainly do not expect it to hold for all products in all places.

Using the Law of One Price to Understand the Exchange Rate

There is another way to interpret the finding that Big Macs do not cost the same in each country. The Economist uses this information to draw conclusions about the values of different currencies and how these values are likely to change over time.

From this perspective, the Big Mac is more expensive in Europe than in the United States because dollars are cheap in Europe. Put differently, we say that the dollar is undervaluedThe price of a currency is too low compared to the ratio of price levels in the two countries. relative to the euro. If the price of a dollar in euros were 0.85 instead of 0.70, then a Big Mac would cost the same in the United States and Europe. Completely equivalently, we can say that that the euro is overvaluedThe price of a currency is too high compared to the ratio of price levels in the two countries. relative to the dollar. With this in mind, we might expect the undervalued dollar to increase in value relative to the euro. That is, we would expect the price of a dollar in euros to increase. Similarly, we would conclude that the Norwegian kroner is overvalued relative to the dollar, the Chinese yuan is undervalued, and the Czech Koruna is neither overvalued nor undervalued.

To see how this works more generally, look back at our arbitrage condition for blue jeans. If we divide both sides by the price of blue jeans in euros, we get

This equation says that, according to the law of one price, the dollar price of the euro should equal the dollar price of blue jeans divided by the price of blue jeans in euros. This is exactly the kind of calculation that underlies the Big Mac index, only with blue jeans instead of Big Macs. Equivalently, the law of one price says that the

Suppose we think about this equation applying (approximately) to all goods and services. We can then get a better prediction of the exchange rate by looking at a general price index in each country:

Because of all the reasons why the law of one price does not literally hold, economists certainly do not expect this equation to give an exact prediction of the exchange rate. Nevertheless, it can provide a useful indication of whether a currency is undervalued or overvalued.

A currency is undervalued if, following this equation, its price is too low compared to the ratio of price levels in the two countries. A currency is overvalued if, following this equation, its price is too high compared to the ratio of price levels in the two countries. As in our discussion of the euro, if a currency is overvalued, then we would expect its value to decrease over time. This is called a depreciationA decrease in the price of a currency. of the currency. Likewise, we would expect the price of an undervalued currency to increase over time. This is called an appreciationAn increase in the price of a currency. of the currency.

The market forces behind these currency movements come from the buying and selling of currencies for trading purposes. If the Chinese yuan is undervalued, goods produced in China will be relatively cheap in US dollars. The demand for Chinese exports will be high, and this will lead to a large demand for the yuan. Eventually the dollar price of the yuan will increase—that is, the yuan will appreciate, and the dollar will depreciate.

Changes in the Exchange Rate

Even though the law of one price does not literally hold for all goods and services, it reminds us that the value of $1 in the United States is linked to its value in the rest of the world. As a result, we expect that price level changes are likely to lead to changes in the exchange rate. We see this more clearly if we write our previous equation in terms of growth rates. Using the formula for growth rates, we find the following:

growth rate of price of dollar in euros = growth rate of price of European bundle of goods− growth rate of price of US bundle of goods.Toolkit: Section 16.11 "Growth Rates"

The formulas for using growth rates can be found in the toolkit.

If the bundle of goods in each country corresponds roughly to the goods in the Consumer Price Index (CPI)A price index that uses as the bundle of goods the typical purchases of households., then the growth rate of these prices corresponds to the inflation rateThe growth rate of the price index from one year to the next.. The growth rate of the exchange rate is just another term for the percentage appreciation of the currency. Thus we get the following:

percentage appreciation of the dollar ≈ European inflation rate − US inflation rate.So, if the inflation rate in the United States is higher than it is in Europe, we expect the euro price of the dollar to decrease. We expect depreciation of the dollar if US inflation exceeds European inflation. Inflation reduces the real value of money domestically; it will also tend to reduce the value of money in terms of what it can purchase in the rest of the world. This makes sense. If our currency is becoming less valuable at home, then we should also expect it to become less valuable in the rest of the world.

The Real Exchange Rate

The law of one price is connected to another measure of the exchange rate—the real exchange rateA measure of the price of goods and services in one country relative to another when prices are expressed in a common currency.. This exchange rate is a measure of the price of goods and services in one country relative to another when prices are expressed in a common currency. It is about exchanging goods, rather than money, across countries.

The real exchange rate between the United States and Europe is given as follows:

You can think of the real exchange rate as the number of units of European gross domestic product (GDP) you can get for one unit of US GDP.Let us check the units of the real exchange rate. The US price level over the European price level is in dollars/euros: it is the price of a unit of US real GDP divided by the price of a unit of European real GDP. The nominal exchange rate is measured in euros per dollar. Thus the units are as follows:The dollars and the euros cancel out in this expression, so the real exchange rate is just a number. For example, if the price level in the United States is $1,600, the price level in Europe is EUR 400, and the price of dollars in euros is EUR 0.5, then the real exchange rate is as follows:

One unit of US GDP will get you two units of European GDP.

The real exchange rate is intimately linked to the law of one price. The easiest way to see this is to suppose that we measure US real GDP and European GDP in the same units: that is, suppose we use the same bundle of goods in each case. We know that the law of one price should hold for tradable goods—that is, goods for which arbitrage is possible and practical. If every good that went into GDP were tradable, then the law of one price would hold for every good, and the real exchange rate would equal 1. If the real exchange rate was not 1, you could make arbitrage profits by buying and selling “units of GDP.”

As before, suppose the US price level is $1,600, the European price level is EUR 400, and the nominal exchange rate (dollars per euro) is 0.5. Imagine that US GDP and European GDP measure the same bundle of (tradable) goods. Then you could take $800 and buy EUR 400. With these euros, you could buy a basket of goods in Europe. You could sell this basket in the United States for $1,600. The law of one price is violated. We would expect the following:

- Prices in the United States would increase.

- Prices in Europe would decrease.

- The nominal exchange rate would depreciate (the dollar would become less valuable).

Because arbitrage is not possible for all goods and services, we do not expect—nor do we observe—the real exchange rate to be exactly one. But this benchmark is still useful in understanding movements in the real exchange rate.

The Real Exchange Rate in Action

The real exchange rate matters because it is the price that is relevant for import and export decisions. Suppose you are trying to decide between buying a mobile phone manufactured in the United States and one manufactured in Finland. If the dollar appreciates against the euro, then the US phone retailer needs fewer dollars to purchase euros, so Finnish phones will be cheaper in US stores. If prices decrease in Finland, the imported phone again becomes relatively cheaper. If prices increase in the United States, the US phone will be more expensive. In other words, increasing prices in the United States, decreasing prices in Finland, and appreciation of the dollar all make you more likely to buy the imported phone rather than the domestically produced phone.

More generally, anything that causes the real exchange rate to increase will make imports look more attractive compared to goods produced in the domestic economy. Examined from the point of view of Europe, the same increase in the real exchange rate makes US goods look more expensive relative to goods produced in Europe, so Europeans will be likely to import fewer goods from the United States. An increase in the real exchange rate therefore leads to an increase in US imports and a decrease in US exports—that is, it leads to a decrease in net exportsExports minus imports..

The real exchange rate can and does vary substantially over time. Argentina in the 1990s provides a nice illustration of real exchange rates in action.We discuss this in more detail in Chapter 11 "Inflations Big and Small". Argentina had a currency boardA fixed exchange rate regime in which each unit of domestic currency is backed by holding the foreign currency, valued at the fixed exchange rate. during this period. Under a currency board, a country maintains a fixed exchange rate by backing its currency completely with another currency. Although Argentina did have its own currency (the Argentine peso), each peso in circulation was backed by a US dollar held by the Argentine central bank. You could at any time exchange pesos for dollars at a nominal exchange rate of 1.

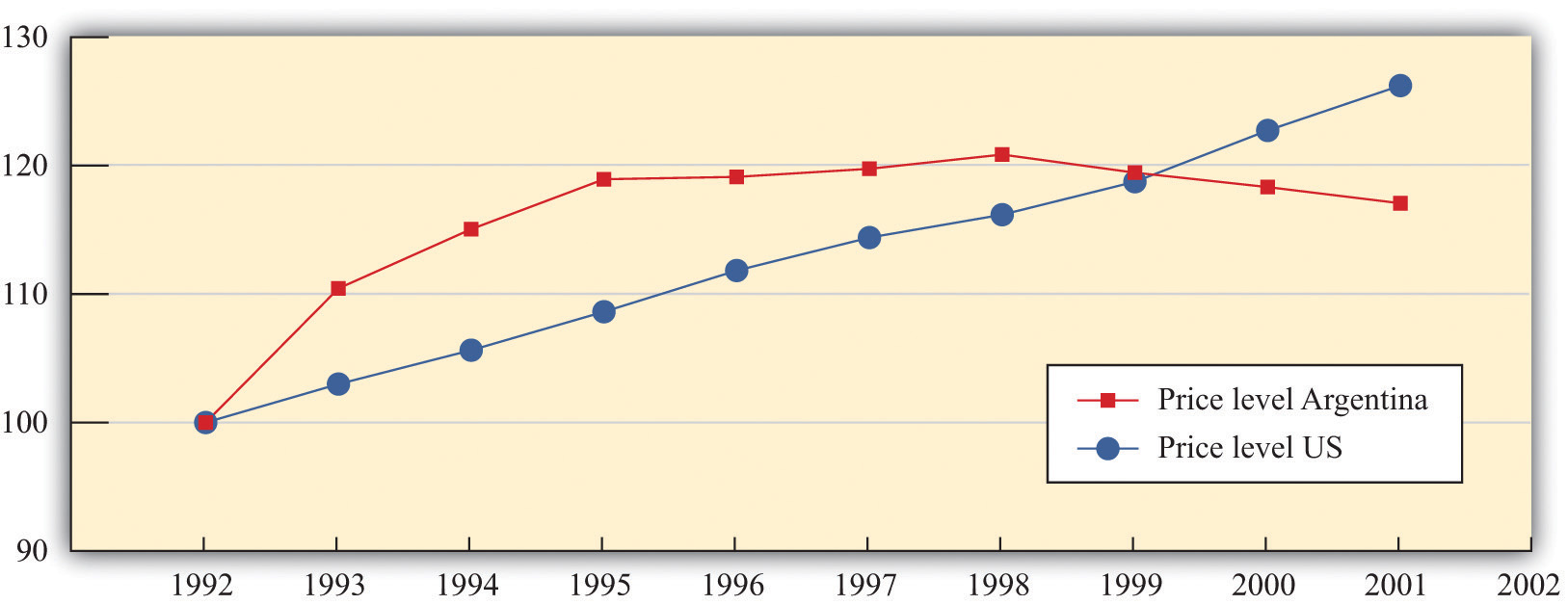

Figure 9.8 "The Real Exchange Rate in Argentina" shows what happened to prices in Argentina and the United States over this period. Look at 1992–95. Both countries had some inflation. But prices were increasing faster in Argentina than in the United States. The real exchange rate (Argentina–United States) is given by

because the price of the peso in dollars was 1. Therefore the real exchange rate appreciated as Argentine inflation outpaced US inflation.

The appreciation of the real exchange rate meant that Argentine goods became more expensive in other countries, so Argentine exports became less competitive. (The problem was compounded by the fact that the US dollar [and hence the peso] also appreciated against the currencies of neighboring countries such as Brazil.) Without the currency board, it would have been possible for the nominal exchange rate (price of the peso in dollars) to decline, offsetting the effects of the inflation rate. Instead, this appreciation of the real exchange rate ended up causing substantial economic problems in Argentina in the 1990s. In the second half of the decade, the real exchange rate began to depreciate because the inflation rate in Argentina was lower than in the United States. The appreciation at the start of the decade had been so large, however, that the real exchange rate in 1999 was still higher than it had been in 1992.

Figure 9.8 The Real Exchange Rate in Argentina

Argentina’s real exchange rate appreciated between 1992 and 1995 because the nominal (US dollar–Argentine peso) exchange rate was constant and equal to one, and the price level increased more rapidly in Argentina than in the United States.

Source: CPI inflation figures from International Monetary Fund World Economic Outlook database (http://www.imf.org/external/pubs/ft/weo/2006/01/data/dbcselm.cfm?G=205) and Bureau of Labor Statistics (http://www.bls.gov).

If countries want to have a permanently fixed exchange rate, there is an option that is more radical than a currency board. Countries can decide to adopt a common currency, like the European countries that adopted the euro. There are several reasons why countries might decide to take such a course of action. The first advantage of a common currency is that it enhances the role of money as a medium of exchange. There is no longer a need to exchange one currency for another, making it easier to trade goods and services across countries. People do not have to deal with the inconveniences of exchanging currencies: individuals do not have to exchange cash at airports, and firms do not need to manage multiple currencies to conduct international business. In the jargon of economics, a single currency removes transaction costs. These costs might be individually small, but they can add up when you consider just how many times households and firms needed to switch from one of the euro area currencies to another.According to studies supporting a common currency, these gains from reduced transactions costs were substantial. One of the key analyses was the Delors report. A summary of that report is available at “Phase 3: the Delors Report,” European Commission, October 30, 2010, accessed August 22, 2011, http://ec.europa.eu/economy_finance/euro/emu/road/delors_report_en.htm. A complete report on the history of the euro is available at “One Currency for One Europe: The Road to the Euro,” European Commission, 2007, accessed August 22, 2011, http://ec.europa.eu/economy_finance/publications/publication6730_en.pdf.

One way to picture this advantage is to imagine the reverse. Suppose, for example, that each state in the United States decided to adopt its own currency. Trade across state lines would become more complicated and more costly. Even more starkly, imagine that your hometown had its own currency, so you had to exchange money whenever you traveled anywhere else.

A second advantage of a single currency is that it makes business planning easier. A firm in Belgium can write a contract with another firm in Spain without having to worry about the implications of currency appreciation or depreciation. Thus an argument for the move to a single currency was that such a change was likely to encourage trade among countries of the European Union. Again, imagine how much more complicated business would be in the United States if each state had its own freely floating currency.

Finally, a common currency enhances capital flows. Just as it is easier for businesses to trade goods and services, it is also easier for investors to shift funds from country to country. With a common currency, investors do not have to pay the transactions costs of converting currencies, and they no longer face the uncertainty of exchange rate changes. When capital flows more easily across borders, investment activity is more productive, enhancing the growth of the countries involved.

Key Takeaways

- The nominal exchange rate is the price of one currency in terms of another. The real exchange rate compares the price of goods and services in one country to the cost of these goods and services in another country when all prices are in a common currency.

- From the law of one price, a tradable good in one country should have the same price as that same good in another country when the goods are priced in the same currency. This means that the exchange rate is equal to the ratio of the prices expressed in the two different currencies. Put differently, by the law of one price, the real exchange rate between tradable goods should be 1.

Checking Your Understanding

- If the price of a euro was $2 and the price of a dollar was 1 EUR, how would you make a profit?

- If goulash sells for either 1,090 forint or 4.40 euro, what is the price of the forint in terms of the euro? Do the two prices of cabbage quoted in Figure 9.3 "The Euro as a Unit of Account" yield a different euro price for the forint? Is there an arbitrage possibility here (or elsewhere on the menu)?

9.4 Using Money to Buy Assets: Interest Rates

Learning Objectives

After you have read this section, you should be able to answer the following questions:

- What is the difference between nominal interest rates and real interest rates?

- What is the yield curve?

- What is the Fisher equation?

We have now discussed how you could use your $100 to buy goods and services or the money of another country. You can also use your money to buy money in the future. When we say this, we are simply describing a familiar transaction in an unfamiliar way: we are talking about saving. If you put money in a bank, then you are buying money in the future with money you give up today. When you save in this way, you become a participant in the credit markets (or loan markets)A market that brings together suppliers of credit, such as households who are saving, and demanders of credit, such as businesses and households who need to borrow..

Toolkit: Section 16.4 "The Credit (Loan) Market (Macro)"

A credit market (or loan market) brings together suppliers of credit, such as households who are saving, and demanders of credit, such as businesses and households who need to borrow. You can review the credit market in the toolkit.

Arbitrage with Credit and Assets

Suppose you do not want to spend your $100 until next year. You could just put the money under your mattress, but a better option is to find some way of getting more than $100 next year. One way to do this is to lend your money to someone else. For you, this might simply mean taking it to your bank and putting it in your savings account. When you do that, you are making a loan to the bank. Of course, the bank probably will not leave the money in its vault; it will lend that money to someone else. Banks and other financial institutions act as intermediaries between those who want to save and those who want to borrow.

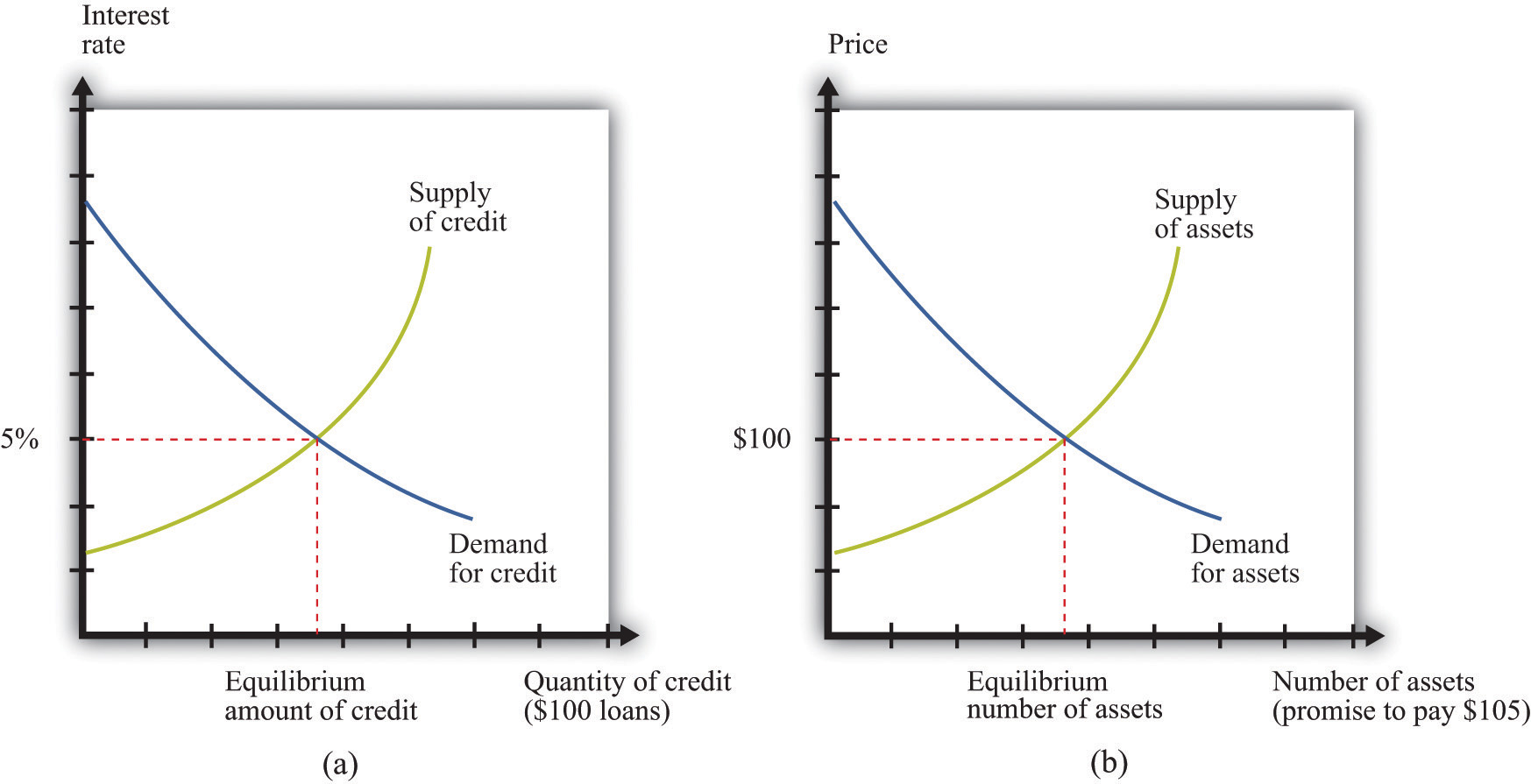

Figure 9.9 The Credit Market and the Asset Market

Credit markets and asset markets are two ways of looking at the same market: the market for $100 loans (a) with an equilibrium interest rate of 5 percent is the same as the market for an asset that promises to pay $105 in a year’s time (b).

The credit market brings together the suppliers and demanders of credit, and the nominal interest rateThe number of additional dollars that must be repaid for every dollar that is borrowed. is the price that brings demand and supply into balance. The supply of credit increases as the interest rate increases: as the return on saving increases, households will generally save more and thus supply more funds to the credit market. The demand for credit decreases as the interest rate increases: when it is expensive to borrow, households and firms will borrow less. At the equilibrium interest rate, the quantity of credit supplied and the quantity of credit demanded are equal. This is shown in part (a) of Figure 9.9 "The Credit Market and the Asset Market".

There is another way to look at credit markets. Borrowers get money today in exchange for a promise to pay money later. Lenders purchase those promises by giving up money today. Instead of asking how much the interest rate is for a given $100 loan, we could ask what people would be willing to pay today for the right to receive $105 in a year’s time.

The market for the promise to pay $105 in a year is illustrated in part (b) of Figure 9.9 "The Credit Market and the Asset Market". The units on the horizontal axis are $105 payments. These are assets: buyers are purchasing a piece of paper that is a promise to deliver $105 in a year’s time. The price on the vertical axis is the current price of that asset.

The nominal rate of return on an asset is the amount that you obtain, in percentage terms, from holding the asset for a year. In the case of the simple one-year asset we are considering, the return is given as follows:

We can also rearrange this to give us the price of the asset:

Notice what happens when we look at the market in this way. Buyers have become sellers, and sellers have become buyers. Borrowers are sellers: they sell the promise to pay. Lenders are buyers: they purchase the promise to pay. If we are looking at the same group of buyers and sellers as before, then the current equilibrium price of this asset would be $100.

The nominal interest rate and the nominal rate of return defined through these two markets must be the same. If not, there would be an arbitrage possibility. Imagine, for example, that the interest rate is 5 percent but the price of the asset is $90. In this case, the rate of the return on asset is which is 22.2 percent. So you could make a lot of money by borrowing at a 5 percent interest rate and then purchasing the promises to pay $110 at price of $90.

If you could do this, so also could many major financial institutions—except that they would operate on a much larger scale, perhaps buying millions worth of assets and borrowing a lot in credit markets. So the demand for credit would shift outward, as would the demand for assets. This would cause the interest rate to increase and the asset price to increase, so the rate of return on the asset decreases. This would continue until the arbitrage opportunity disappeared.

In summary, we would say there is no arbitrage opportunity when the

nominal rate of return on asset = nominal interest rate.The rate of return on the asset, in other words, is equivalent to the interest rate on the asset. Equivalently this means that

In the second line we replaced (1 + nominal interest rate) with the nominal interest factorA factor, equal to 1 + the nominal interest rate, used to convert dollars today into dollars next year.. The two are equivalent, but sometimes we find it more convenient to work with interest factors rather than interest rates.

The argument that we have just made should seem familiar. It is analogous to the argument for why there cannot be distinct dollar-euro and euro-dollar markets; they are just ways of looking at the same asset. Likewise, we can think of the sale of any asset as equivalent to borrowing, while for any example of credit we can also think of there being an underlying asset.

Different Assets

Very often economists and others talk about “the” interest rate, as if there were just a single asset in the economy. In fact, there are many different assets that you could buy with your $100, each with an associated interest rate. The following are various assets that you might purchase:

- Currency and coin. To begin with, your $100 is itself an asset. If you put the money under a mattress and retrieve it after a year, it is very easy to calculate the nominal interest rate on $100. If you give up $100 today, you will get exactly $100 back next year. The nominal interest rate is zero.

- Bank deposits. Bank deposits are also an asset. If you put your money in the bank, you are extending credit to the bank. Depending on the type of bank account, you may or may not earn interest on your deposits.

- Foreign exchange. The money of other countries is likewise an asset. You can take dollars today and use them to purchase, say, euros or Japanese yen (JPY). Even in this case, there is a rate of return. For example, suppose that today you can buy JPY 100 with $1. Suppose also that in a year’s time, there are JPY 90 to the dollar. Then with your JPY 100, you can buy $1.11 (100/90 = 1.11). You obtained a nominal rate of return of 11 percent.

- Gold and other precious metals. You could take your $100 and use it to buy gold. Unless you are a dentist or a jeweler, you will not have any direct use for the gold; you simply keep it and resell it at some future date. The rate of return on gold is purely a matter of what happens to the price of gold. If the price of gold (in dollars) increases by 10 percent, then you get a 10 percent rate of return.

- Government bonds. A government bond is also a loan contract; if you buy a government bond, you are extending credit to the government. The bond is a promise to pay a certain amount at some future date. Because the loan will be paid off a number of years in the future, it is slightly more complicated to calculate the interest rate.