This is “Transfer and Negotiation of Commercial Paper”, section 14.1 from the book The Legal Environment and Advanced Business Law (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

14.1 Transfer and Negotiation of Commercial Paper

Learning Objectives

- Understand what a transfer of commercial paper is.

- Recognize the rights and liabilities of transferees and the liabilities of transferors.

- Know how a transfer becomes a negotiation payable to order or to bearer.

Definitions, Rights, and Liabilities

TransferDelivery of an instrument by a person other than its issuer for the purpose of giving the transferee rights to enforce the instrument. means physical delivery of any instrument—negotiable or not—intending to pass title. Section 3-203(a) of the Uniform Commercial Code (UCC) provides that “an instrument is transferred when it is delivered by a person other than its issuer for the purpose of giving to the person receiving delivery the right to enforce the instrument.”

Negotiation and Holder

Section 3-201(a) of the UCC defines negotiationThe act of transferring commercial paper to a subsequent holder. as “a transfer of possession, whether voluntary or involuntary, of an instrument to a person who thereby becomes its holder if possession is obtained from a person other than the issuer of the instrument.” A holderPerson in possession of an instrument drawn, issued, or indorsed to him or to his order, or to bearer, or in blank. is defined in Section 1-201(2) as “a person who is in possession of an instrument drawn, issued, or indorsed to him or his order or to bearer or in blank” (“in blank” means that no indorsement is required for negotiation). The original issuing or making of an instrument is not negotiation, though a holder can be the beneficiary of either a transfer or a negotiation. The Official Comment to 3-201(a) is helpful:

A person can become holder of an instrument when the instrument is issued to that person, or the status of holder can arise as the result of an event that occurs after issuance. “Negotiation” is the term used in article 3 to describe this post-issuance event. Normally, negotiation occurs as the result of a voluntary transfer of possession of an instrument by a holder to another person who becomes the holder as a result of the transfer. Negotiation always requires a change in possession of the instrument because nobody can be a holder without possessing the instrument, either directly or through an agent. But in some cases the transfer of possession is involuntary and in some cases the person transferring possession is not a holder.…[S]ubsection (a) states that negotiation can occur by an involuntary transfer of possession. For example, if an instrument is payable to bearer and it is stolen by Thief or is found by Finder, Thief or Finder becomes the holder of the instrument when possession is obtained. In this case there is an involuntary transfer of possession that results in negotiation to Thief or Finder.Uniform Commercial Code, Section 3-201, Official Comment.

In other words, to qualify as a holder, a person must possess an instrument that runs to her. An instrument “runs” to a person if (1) it has been issued to her or (2) it has been transferred to her by negotiation (negotiation is the “post-issuance event” cited in the comment). Commercially speaking, the status of the immediate person to whom the instrument was issued (the payee) is not very interesting; the thing of interest is whether the instrument is passed on by the payee after possession, through negotiation. Yes, the payee of an instrument is a holder, and can be a holder in due course, but the crux of negotiable instruments involves taking an instrument free of defenses that might be claimed by anybody against paying on the instrument; the payee would know of defenses, usually, so—as the comment puts it—“use of the holder-in-due-course doctrine by the payee of an instrument is not the normal situation.…[r]ather, the holder in due course is an immediate or remote transferee of the payee.”Uniform Commercial Code, Section 3-302, Comment 4.

Liability of Transferors

We discuss liability in Chapter 16 "Liability and Discharge". However, a brief introduction to liability will help in understanding the types of indorsements discussed in this chapter. There are two types of liability affecting transferors: contract liability and warranty liability.

Contract Liability

Persons who sign the instrument—that is, makers, acceptors, drawers, indorsers—have signed a contract and are subject to contract liabilities. Drafts (checks) and notes are, after all, contracts. Makers and acceptors are primary parties and are unconditionally liable to pay the instrument. Drawers and indorsers are secondary parties and are conditionally liable. The conditions creating liability—that is, presentment, dishonor, and notice—are discussed in Chapter 16 "Liability and Discharge".

Warranty Liability

The transferor’s contract liability is limited. It applies only to those who sign and only if certain additional conditions are met and, as will be discussed, can even be disclaimed. Consequently, a holder who has not been paid often must resort to a suit based on one of five warranties. These warranties are implied by law; UCC, Section 3-416, details them:

(A) A person who transfers an instrument for consideration warrants all of the following to the transferee and, if the transfer is by indorsement, to any subsequent transferee:

(1) The warrantor is a person entitled to enforce the instrument.

(2) All signatures on the instrument are authentic and authorized.

(3) The instrument has not been altered.

(4) The instrument is not subject to a defense or claim in recoupment of any party which can be asserted against the warrantor.

(5) The warrantor has no knowledge of any insolvency proceeding commenced with respect to the maker or acceptor or, in the case of an unaccepted draft, the drawer.

Breach of one of these warranties must be proven at trial if there is no general contract liability.

Liability of Transferees

The transferee takes by assignment; as an assignee, the new owner of the instrument has only those rights held by the assignor. Claims that could be asserted by third parties against the assignor can be asserted against the assignee. A negotiable instrument can be transferred in this sense without being negotiated. A payee, for example, might fail to meet all the requirements of negotiation; in that event, the instrument might wind up being merely transferred (assigned). When all requirements of negotiability and negotiation have been met, the buyer is a holder and may (if a holder in due course—see Chapter 15 "Holder in Due Course and Defenses") collect on the instrument without having to prove anything more. But if the instrument was not properly negotiated, the purchaser is at most a transferee and cannot collect if defenses are available, even if the paper itself is negotiable.

How Negotiation Is Accomplished

Negotiation can occur with either bearer paper or order paper.

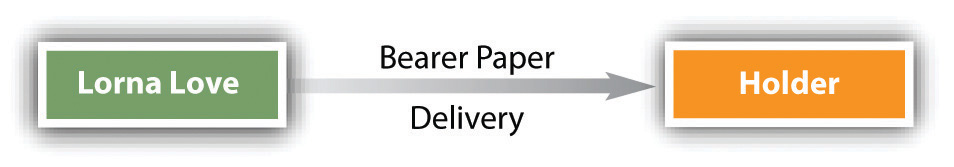

Negotiation of Instrument Payable to Bearer

An instrument payable to bearer—bearer paperA negotiable instrument payable to whoever has possession.—can be negotiated simply by delivering it to the transferee (see Figure 14.1 "Negotiation of Bearer Paper"; recall that “Lorna Love” is the proprietor of a tennis club introduced in Chapter 13 "Nature and Form of Commercial Paper"): bearer paper runs to whoever is in possession of it, even a thief. Despite this simple rule, the purchaser of the instrument may require an indorsement on some bearer paper anyway. You may have noticed that sometimes you are requested to indorse your own check when you make it out to cash. That is because the indorsement increases the liability of the indorser if the holder is unable to collect. Chung v. New York Racing Association (Section 14.4 "Cases") deals with issues involving bearer paper.

Figure 14.1 Negotiation of Bearer Paper

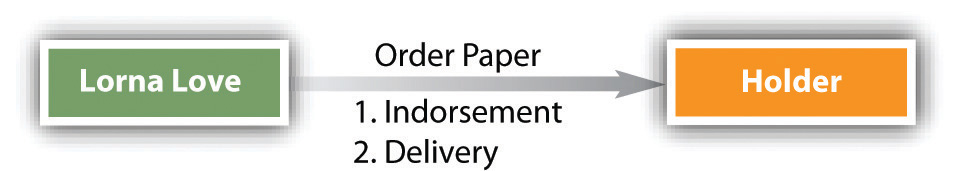

Negotiation of Instrument Payable to Order

Negotiation is usually voluntary, and the issuer usually directs payment “to order”—that is, to someone’s order, originally the payee. Order paperNegotiable instrument that by its term is payable to a specified person or his or her assignee (as opposed to bearer paper). is this negotiable instrument that by its term is payable to a specified person or his assignee. If it is to continue its course through the channels of commerce, it must be indorsed—signed, usually on the back—by the payee and passed on to the transferee. Continuing with the example used in Chapter 13 "Nature and Form of Commercial Paper", Rackets, Inc. (the payee) negotiates Lorna Love’s check (Lorna is the issuer or drawer) drawn to the order of Rackets when an agent of Rackets “signs” the company’s name on the reverse of the check and passes it to the indorsee, such as the bank or someone to whom Rackets owed money. (A company’s signature is usually a rubber stamp for mere deposit, but an agent can sign the company name and direct the instrument elsewhere.) The transferee is a holder (see Figure 14.2 "Negotiation of Order Paper"). Had Rackets neglected to indorse the check, the transferee, though in physical possession, would not be a holder. Issues regarding indorsement are discussed in Section 14.2 "Indorsements".

Figure 14.2 Negotiation of Order Paper

Key Takeaway

A transfer is the physical delivery of an instrument with the intention to pass title—the right to enforce it. A mere transferee stands in the transferor’s shoes and takes the instrument subject to all the claims and defenses against paying it that burdened it when the transferor delivered it. Negotiation is a special type of transfer—voluntary or involuntary—to a holder. A holder is a person who has an instrument drawn, issued, or indorsed to him or his order or to bearer or in blank. If the instrument is order paper, negotiation is accomplished by indorsement and delivery to the next holder; if it is bearer paper or blank paper, delivery alone accomplishes negotiation. Transferors incur two types of liability: those who sign the instrument are contractually liable; those who sign or those who do not sign are liable to the transferee in warranty.

Exercises

- What is a transfer of commercial paper, and what rights and liabilities has the transferee?

- What is a negotiation of commercial paper?

- What is a holder?

- How is bearer paper negotiated?

- How is order paper negotiated?