This is “Production Subsidies as a Reason for Trade”, section 8.3 from the book Policy and Theory of International Trade (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

8.3 Production Subsidies as a Reason for Trade

Learning Objective

- Describe the price, quantity, and trade effects of a domestic production subsidy implemented by a small open economy.

This section will show how a production subsidy can cause trade for a small, perfectly competitive, open economy. The analysis indicates that domestic policies can be a cause of trade even in the absence of other reasons for trade. In other words, even if countries were identical with respect to their resource endowments, their technology, and their preferences and even if there were no economies of scale or imperfectly competitive markets, domestic policies could induce trade between countries.

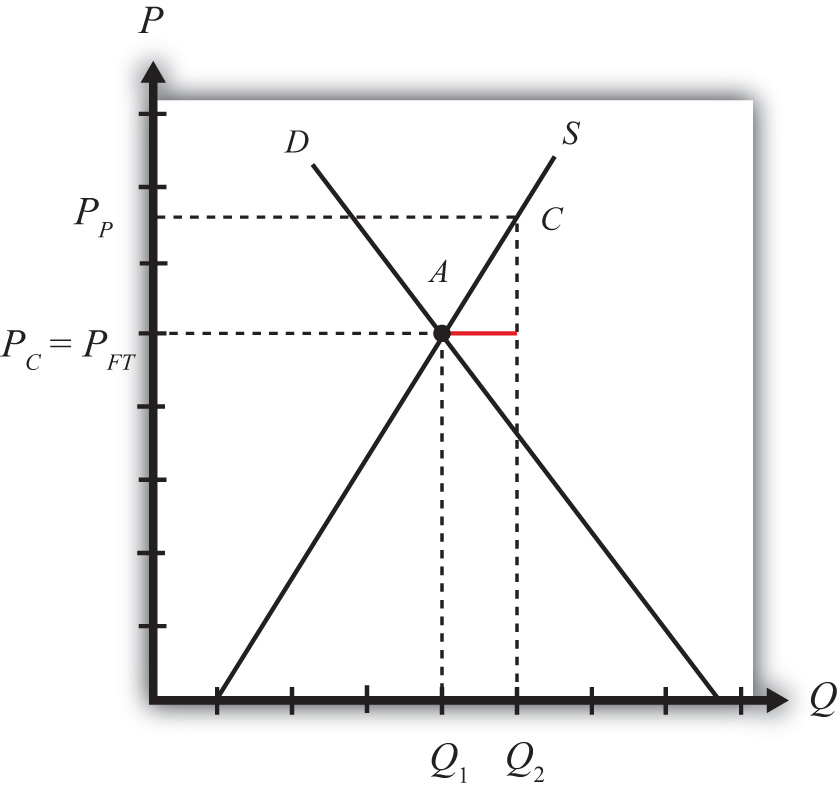

Consider a small open economy with a perfectly competitive industry. Let the domestic market be represented by the supply and demand curves in Figure 8.1 "Inducing Exports with a Domestic Production Subsidy". Suppose initially that free trade is allowed with the rest of the world, but by coincidence (actually by assumption), let the free trade price be exactly equal to the autarky price for the good. This is shown as the price, PFT. This implies that no imports or exports occur, even though there is free trade.

Figure 8.1 Inducing Exports with a Domestic Production Subsidy

Next, suppose that the government of this country offers a specific (per unit) production subsidy to the domestic firms. Let the subsidy rate be set at “s.” This means the government will pay “s” dollars for every unit the domestic firm produces, regardless of where the product is sold.

The subsidy effectively raises the price that the producer receives for each unit of the good produced and sold. At the same time, the subsidy will not affect the domestic price that consumers pay. In other words, the subsidy will cause the price received by producers (the producer price) to rise above the price paid by consumers (the consumer price). The new producer price is labeled PP in Figure 8.1 "Inducing Exports with a Domestic Production Subsidy", while the consumer price, PC, remains equal to the free trade price. Thus PP = PFT + s and PC = PFT. These price changes occur because these prices will allow domestic firms in the small country to maximize their profits in the face of free competition with firms in the rest of the world.

The subsidy will increase domestic production. At the market price PFT, domestic firms were willing to supply to Q1. Once the producer price rises to PP, domestic supply will rise to Q2. Demand would remain the same, however, since the consumer price remains fixed. The difference between domestic supply and demand, Q2 − Q1, represents the level of exports to the rest of the world. Since exports did not exist prior to the subsidy, this is an example in which a domestic policy (a production subsidy) can cause trade (i.e., exports) to occur.

Key Takeaways

- A production subsidy raises the price received by producers by the full amount of the subsidy when the country is open to international trade.

- A production subsidy has no effect on the price paid by consumers when the country is open to international trade.

- A production subsidy causes exports when implemented by a small country open to trade but not initially trading.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- Of exports or imports, the one that is likely to be increased as a result of a domestic production subsidy on that product.

- Of increase, decrease, or stay the same, the effect on the producer price if a specific production subsidy is implemented by a country open to trade.

- Of increase, decrease, or stay the same, the effect on the consumer price if a specific production subsidy is implemented by a country open to trade.