This is “Trade Policy Effects with Perfectly Competitive Markets”, chapter 7 from the book Policy and Theory of International Trade (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 7 Trade Policy Effects with Perfectly Competitive Markets

Governments have long intervened in international trade by collecting taxes, or tariffs, on imported goods. Tariffs have a long history since they are one of the easiest ways for governments to collect revenue. However, tariffs have a number of other effects besides generating government revenue; they also affect the success of business and the well-being of consumers. And because tariffs affect the volume of trade between countries, they also affect businesses and consumers abroad.

This chapter examines, in detail, the effects of a tariff. However, it also examines the impacts of the many other types of trade policies that governments have applied historically, including import quotas, export quotas, export taxes, and export subsidies.

The effects are considered under one set of standard assumptions—namely, in the case when markets are perfectly competitive.

7.1 Basic Assumptions of the Partial Equilibrium Model

Learning Objective

- Identify the basic assumptions of a simple partial equilibrium trade model.

This section analyzes the price and welfare effects of trade policies using a partial equilibrium model under the assumption that markets are perfectly competitive.

- Assume there are two countries, the United States and Mexico. The analysis can be generalized by assuming one of the countries is the rest of the world.

- Each country has producers and consumers of a tradable good, wheat. The analysis can be generalized by considering broad classes of products, like manufactured goods, or services.

- Wheat is a homogeneous good. All wheat from Mexico and the United States is perfectly substitutable in consumption.

- The markets are perfectly competitive.

- We assume that the two countries are initially trading freely. One country implements a trade policy and there is no response or retaliation by the other country.

The Meaning of Partial Equilibrium

In partial equilibriumAn economic analysis in which the effects are examined only in the markets that are directly affected. Supply and demand curves for the market of interest are typically used in a partial equilibrium analysis. analysis, the effects of policy actions are examined only in the markets that are directly affected. Supply and demand curves are used to depict the price effects of policies. Producer and consumer surplus is used to measure the welfare effects on participants in the market. A partial equilibrium analysis either ignores effects on other industries in the economy or assumes that the sector in question is very, very small and therefore has little if any impact on other sectors of the economy.

In contrast, a general equilibrium analysis incorporates the interaction of import and export sectors and then considers the effects of policies on multiple sectors in the economy. It uses offer curves to depict equilibria and measures welfare with aggregate welfare functions or trade indifference curves.

The Large versus Small Country Assumption

Two cases are considered regarding the size of the policy-setting country in international markets. The effects of policies vary significantly depending on the size of a country in international markets.

If the country is a “large countryA country is large if any change in its trade volume for a product is sufficiently large to affect the price of that product in the rest of the world.” in international markets, then the country’s imports or exports are a significant share in the world market for the product. Whenever a country is large in an international market, domestic trade policies can affect the world price of the good. This occurs if the domestic trade policy affects supply or demand on the world market sufficiently to change the world price of the product.

If the country is a “small countryA country is small if any change in its trade volume for a product is too small to have any effect on the price of that product in the rest of the world.” in international markets, then the policy-setting country has a very small share in the world market for the product—so small that domestic policies are unable to affect the world price of the good. The small country assumption is analogous to the assumption of perfect competition in a domestic goods market. Domestic firms and consumers must take international prices as given because they are too small for their actions to affect the price.

Key Takeaways

- Partial equilibrium analysis uses supply and demand curves in a particular market and ignores effects that occur beyond these markets.

- Large countries are those whose trade volume is significant enough such that large changes in trade flows can affect the world price of the good.

- Small countries are those whose trade volume is not significant enough such that any changes in its trade flows will not affect the world price of the good.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The term used to describe a country in which domestic policy changes can influence prices in international markets.

- The term used to describe a country in which domestic policy changes cannot influence prices in international markets.

- The term used to describe the substitutability of a good that is homogeneous.

- This type of economic analysis focuses on policy effects within a single market and does not address effects external to the market.

7.2 Depicting a Free Trade Equilibrium: Large and Small Country Cases

Learning Objectives

- Use supply and demand to derive import demand curves and export supply curves.

- Combine import demand and export supply curves to depict a free trade equilibrium under the assumption that the countries are large.

- Use an import demand and export supply diagram to depict a free trade equilibrium under the assumption that the import country is small.

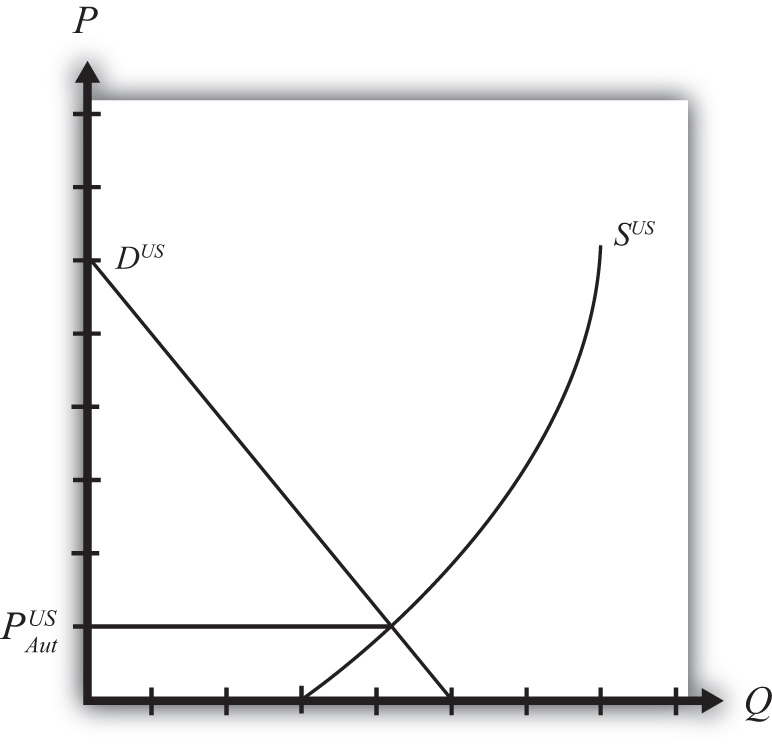

Figure 7.1 "U.S. Wheat Market: Autarky Equilibrium" depicts the supply and demand for wheat in the U.S. market. The supply curve represents the quantity of wheat that U.S. producers would be willing to supply at every potential price for wheat in the U.S. market. The demand curve represents demand by U.S. consumers at every potential price for wheat in the U.S. market. The intersection of demand and supply corresponds to the equilibrium autarky price and quantity in the United States. The price, PAutUS, is the only price that will balance domestic supply with domestic demand for wheat.

Figure 7.1 U.S. Wheat Market: Autarky Equilibrium

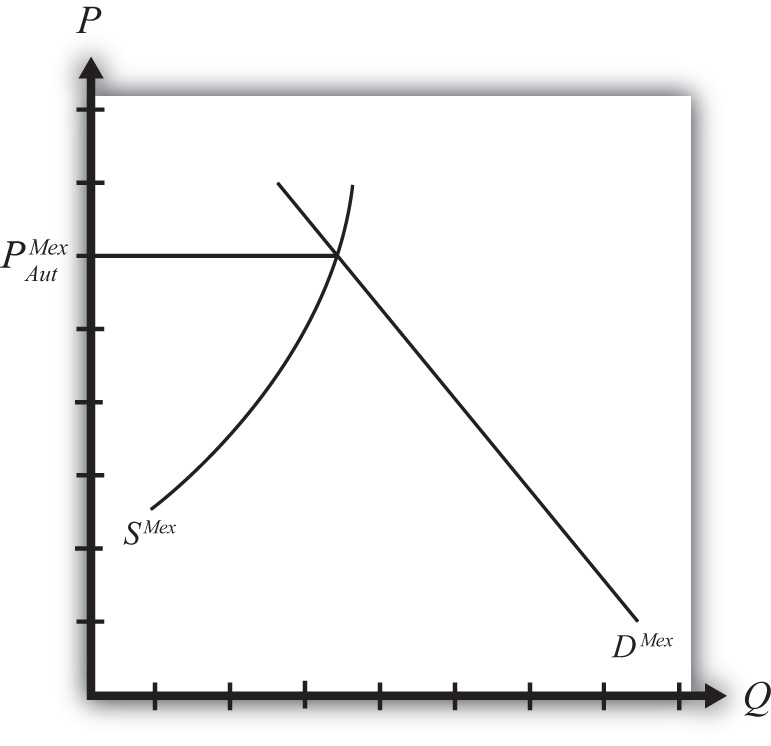

Figure 7.2 "Mexican Wheat Market: Autarky Equilibrium" shows the supply and demand for wheat in the Mexican market. The supply curve represents the quantity of wheat that Mexican producers would be willing to supply at every potential price in the Mexican market. The demand curve represents demand by Mexican consumers at every potential price for wheat in the Mexican market. The intersection of demand and supply corresponds to the equilibrium autarky price and quantity in Mexico. The price, PAutMex, is the only price that will balance Mexican supply with demand for wheat.

Figure 7.2 Mexican Wheat Market: Autarky Equilibrium

The curves are drawn such that the U.S. autarky price is lower than the Mexican autarky price. This implies that if these two countries were to move from autarky to free trade, the United States would export wheat to Mexico. Once trade is opened, the higher Mexican price will induce profit-seeking U.S. firms to sell their wheat in Mexico, where it commands a higher price initially. As wheat flows into Mexico, the total supply of wheat rises, which will cause the price to fall. In the U.S. market, wheat supply falls because of U.S. exports. The reduced supply raises the equilibrium price in the United States. These prices move together as U.S. exports rise until the prices are equalized between the two markets. The free trade price of wheat, PFT, is shared by both countries.

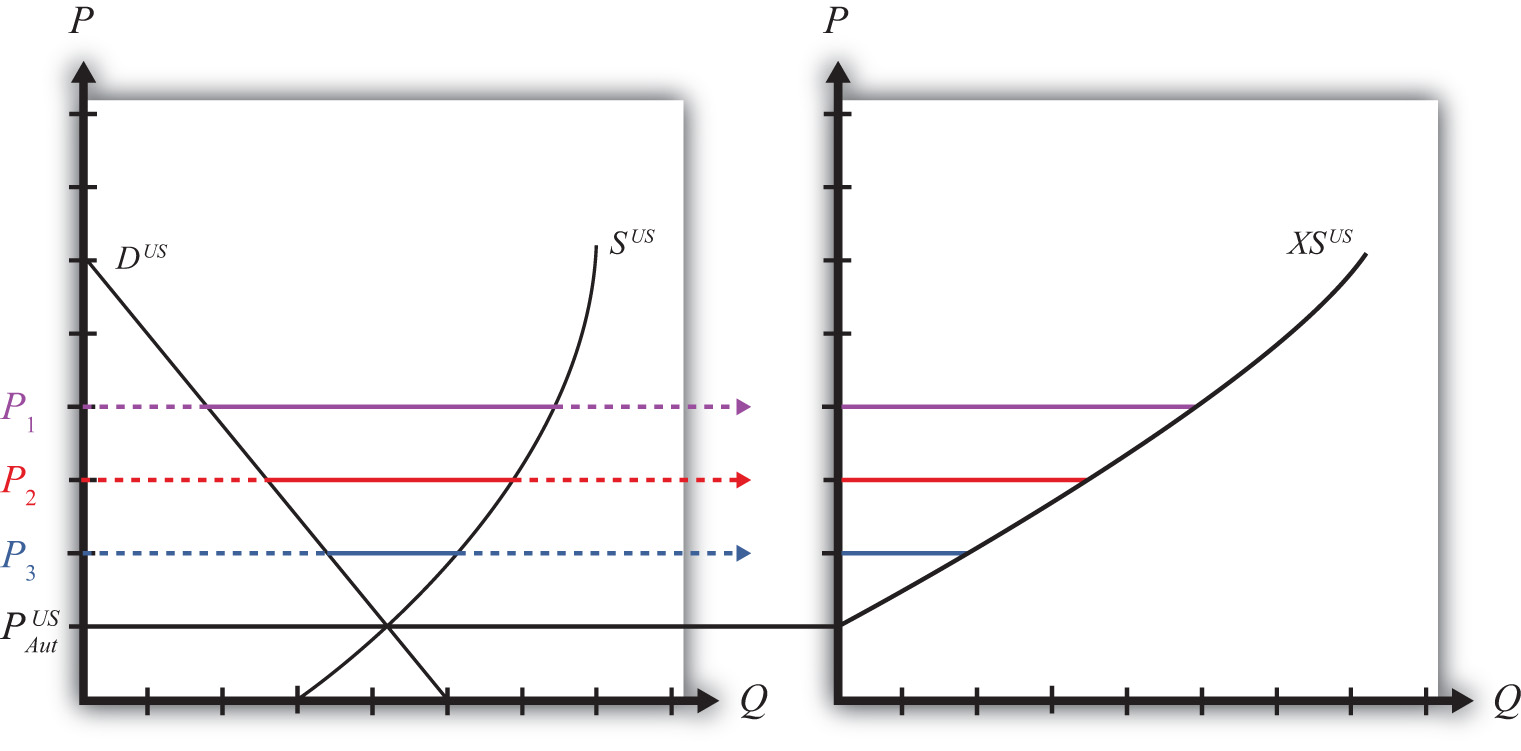

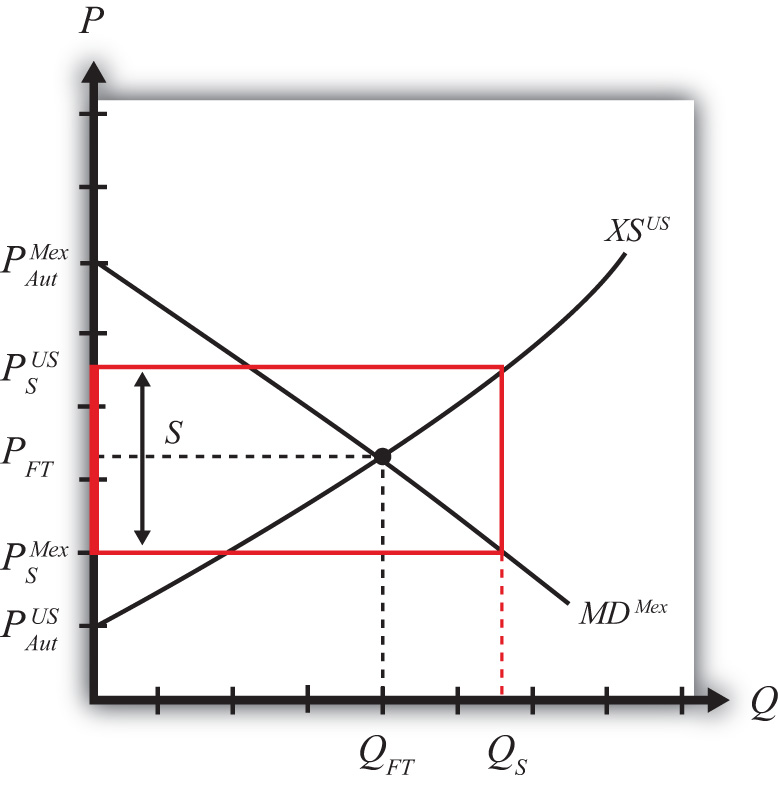

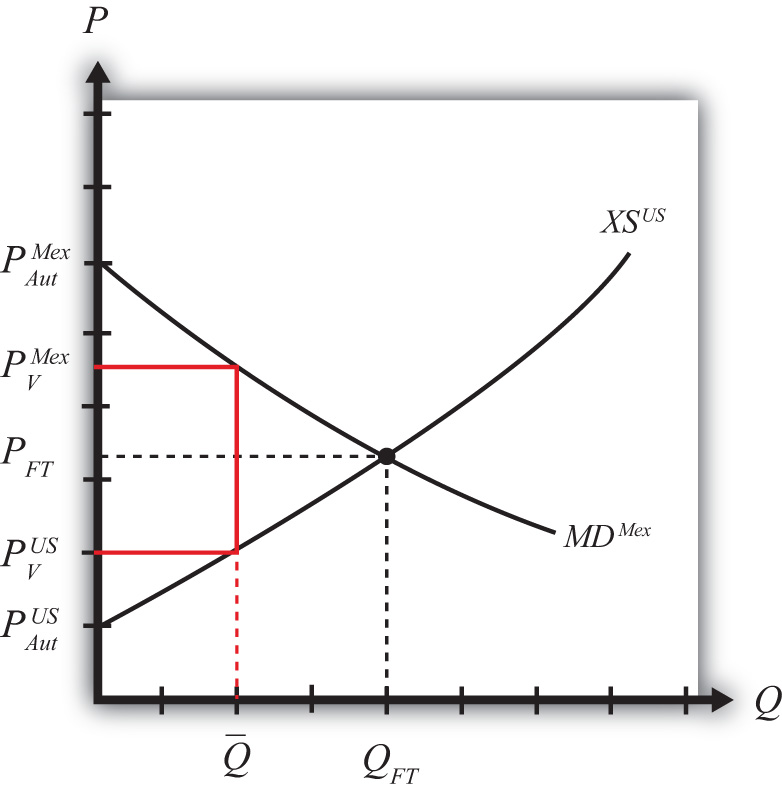

To derive the free trade price and the quantity traded, we can construct an export supply curve for the United States and an import demand curve for Mexico. Notice that at prices above the autarky price in the United States, there is excess supply of wheat—that is, supply exceeds demand. If we consider prices either at or above the autarky price, we can derive an export supply curve for the United States. The equation for export supply is given by

where XSUS(.) is the export supply function, SUS(.) is the supply function for wheat in the United States, and DUS(.) is the demand function for wheat in the United States. Each function is dependent on the U.S. price of wheat, PUS.

Figure 7.3 Deriving the U.S. Export Supply Curve

Graphically, export supplyThe quantity of a product a country would wish to export at a particular price. The export supply curve is the schedule of export supply at every potential price (usually prices above the country’s autarky price). is the horizontal difference between the supply and demand curve at every price at and above the autarky price, as shown in Figure 7.3 "Deriving the U.S. Export Supply Curve". At the autarky price, PAutUS, export supply is zero. At prices P1, P2, and P3, export supply is given by the length of the like-colored line segment. To plot the export supply curve XSUS, we transfer each line segment to a separate graph and connect the points, as shown on the right in Figure 7.3 "Deriving the U.S. Export Supply Curve". The export supply curve gives the quantities the United States would be willing to export if it faced prices above its autarky price.

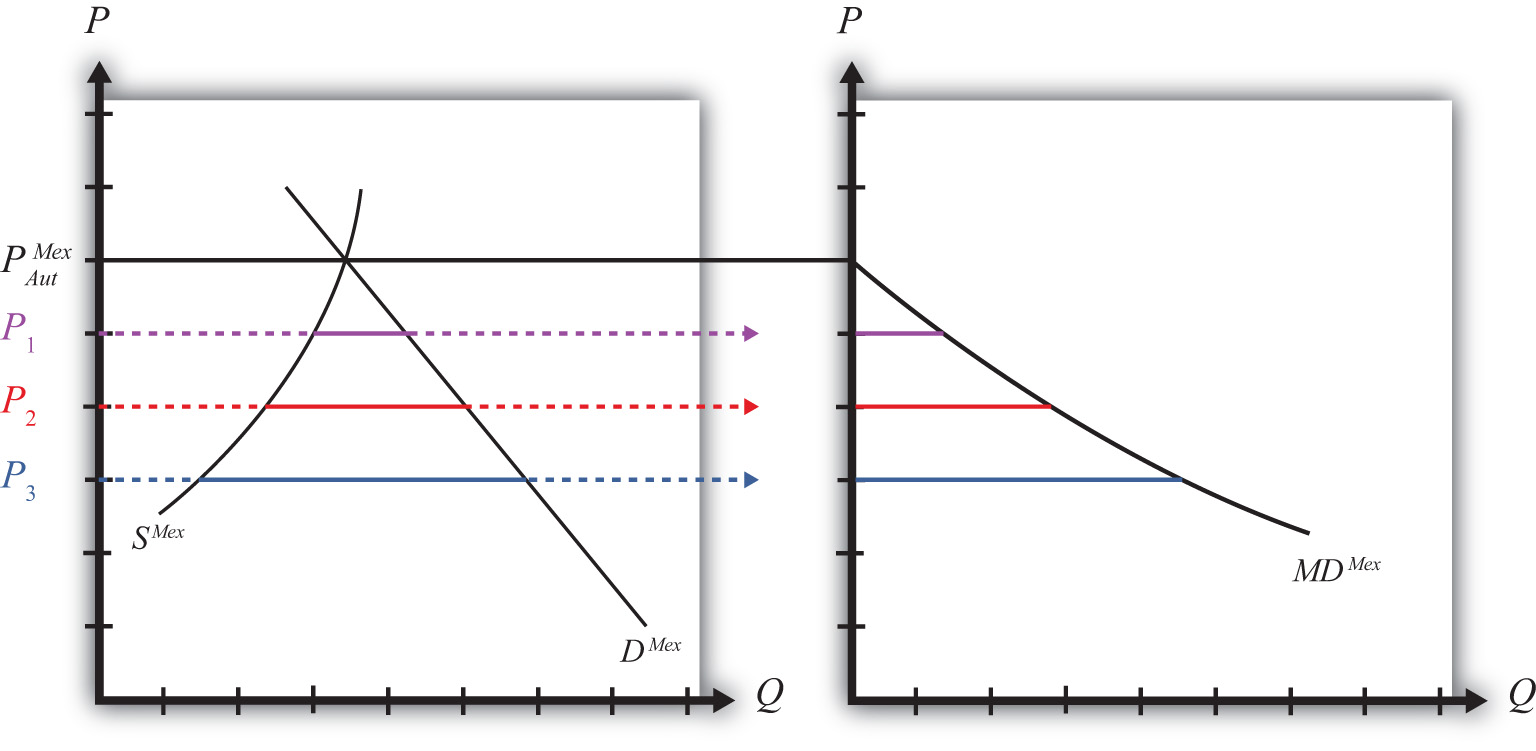

In Mexico, at prices below its autarky price there is excess demand for wheat since demand exceeds supply. If we consider prices either at or below the autarky price, we can derive an import demand curve for Mexico. The equation for import demand is given by

where MDMex(.) is the import demand function, DMex(.) is the demand function for wheat in Mexico, and SMex(.) is the supply function for wheat in Mexico. Each function is dependent on the Mexican price of wheat, PMex. Graphically, import demandThe quantity of a product a country would wish to import at a particular price. The import demand curve is the schedule of import demand at every potential price (usually prices below the country’s autarky price). is the horizontal difference between the demand and supply curve at every price at and below the autarky price, as shown in Figure 7.4 "Deriving the Mexican Import Demand Curve". At the autarky price, PAutMex, import demand is zero. At prices P1, P2, and P3, import demand is given by the length of the like-colored line segment. To plot the import demand curve MDMex, we transfer each line segment to a separate graph and connect the points, as shown on the right in Figure 7.4 "Deriving the Mexican Import Demand Curve". The import demand curve gives the quantities Mexico would be willing to import if it faced prices below its autarky price.

Figure 7.4 Deriving the Mexican Import Demand Curve

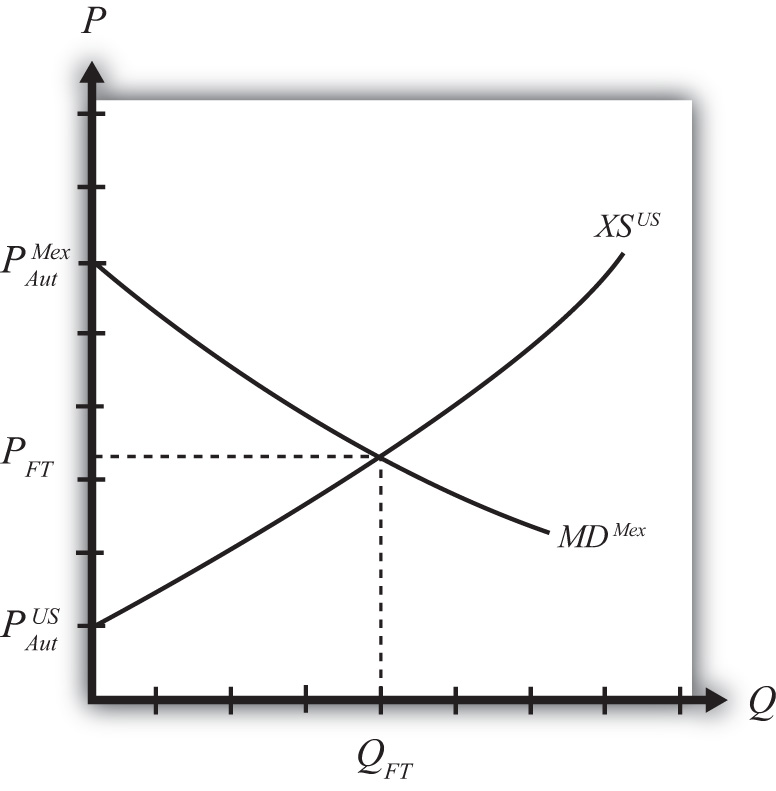

Free Trade Equilibrium: Large Country Case

The intersection of the U.S. export supply with Mexican import demand determines the equilibrium free trade price, PFT, and the quantity traded, QFT, where QFT = XSUS (PFT) = MDMex(PFT). See Figure 7.5 "Depicting a Free Trade Equilibrium". The free trade price, PFT, must be the price that equalizes the U.S. export supply with Mexican import demand. Algebraically, the free trade price is the price that solves

Figure 7.5 Depicting a Free Trade Equilibrium

This implies also that world supply is equal to world demand since

and

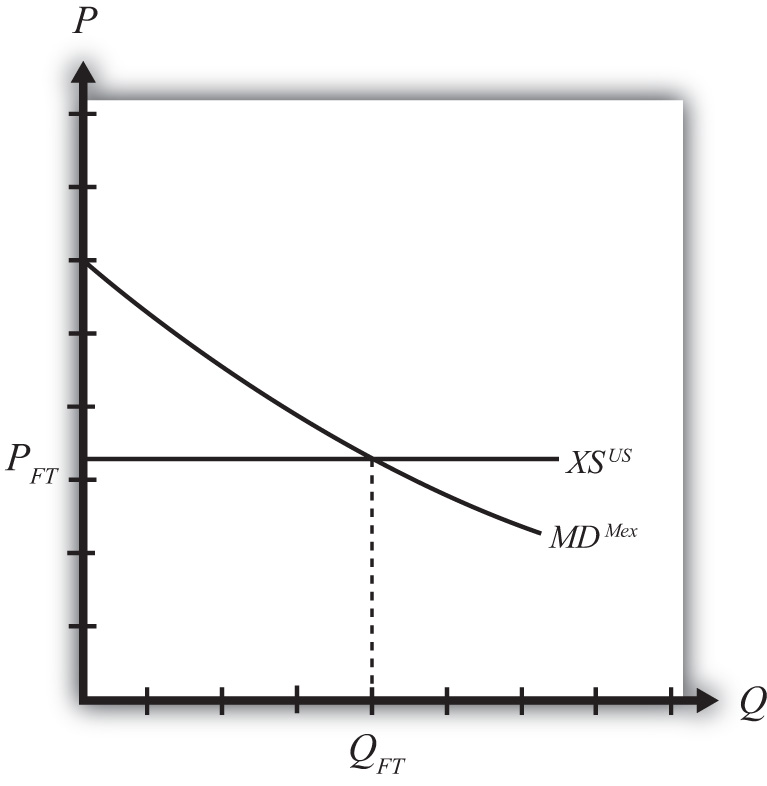

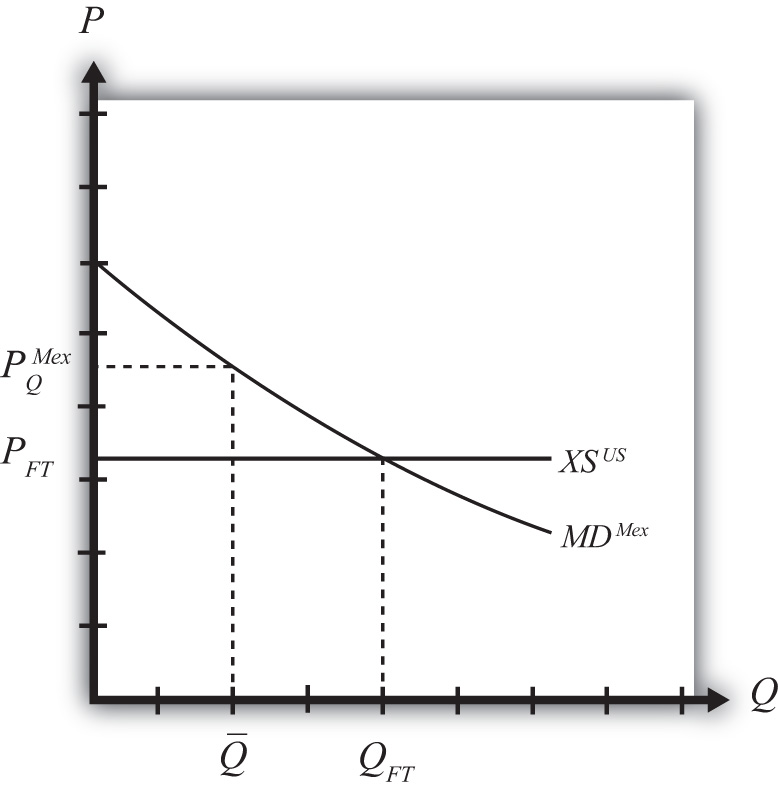

Free Trade Equilibrium: Small Country Case

The small country assumption means that the country’s imports are a very small share of the world market—so small that even a complete elimination of imports would have an imperceptible effect on world demand for the product and thus would not affect the world price.

To depict a free trade equilibrium using an export supply and import demand diagram, we must redraw the export supply curve in light of the small country assumption. The assumption implies that the export supply curve is horizontal at the level of the world price. In this case, we call the importing country small. From the perspective of the small importing country, it takes the world price as exogenous since it can have no effect on it. From the exporter’s perspective, it is willing to supply as much of the product as the importer wants at the given world price.

Figure 7.6 Free Trade Equilibrium: Small Country Case

The free trade price, PFT, is the price that prevails in the export, or world, market. The quantity imported into the small country is found as the intersection between the downward-sloping import demand curve and the horizontal export supply curve.

Key Takeaways

- Import demand is the excess demand that a country would wish to import from another country if the market price were below the price that equalizes its own supply and demand (i.e., its autarky price).

- Export supply is the excess supply that a country would wish to export to another country if the market price were above the price that equalizes its own supply and demand (i.e., its autarky price).

- When there are only two countries, the free trade price is the one that equalizes one country’s import demand with the other’s export supply.

- When export supply is equal to import demand, world supply of the product is equal to world demand at the shared free trade price.

- A large importing country faces a downward-sloping export supply curve.

- A small importing country is one that faces a perfectly elastic export supply function.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The price that equalizes one country’s import demand with the other’s export supply.

- Of higher than, lower than, or equal to the autarky price in a market, this is the range of prices that would generate positive import demand.

- Of higher than, lower than, or equal to the autarky price in a market, this is the range of prices that would generate positive export supply.

- The value of imports of wine in free trade in Country A if Country A’s autarky wine price is equal to the autarky wine price in the rest of the world.

- The term used to describe the horizontal distance between supply and demand at each price below a market autarky price.

- The term used to describe the horizontal distance between supply and demand at each price above a market autarky price.

- The shape of the export supply function faced by a small importing country.

7.3 The Welfare Effects of Trade Policies: Partial Equilibrium

Learning Objective

- Measure welfare magnitudes accruing to producers and consumers in a partial equilibrium model.

A partial equilibrium analysis distinguishes between the welfare of consumers who purchase a product and the producers who produce it. Consumer welfare is measured using consumer surplus, while producer welfare is measured using producer surplus. Revenue collected by the government is assumed to be redistributed to others. Government revenue is either spent on public goods or is redistributed to someone in the economy, thus raising someone’s welfare.

Consumer Surplus

Consumer surplus is used to measure the welfare of a group of consumers who purchase a particular product at a particular price. Consumer surplusThe difference between what consumers are willing to pay for a unit of the good and the amount consumers actually do pay for the product. is defined as the difference between what consumers are willing to pay for a unit of the good and the amount consumers actually do pay for the product. Willingness to pay can be read from a market demand curve for a product. The market demand curve shows the quantity of the good that would be demanded by all consumers at each and every price that might prevail. Read the other way, the demand curve tells us the maximum price that consumers would be willing to pay for any quantity supplied to the market.

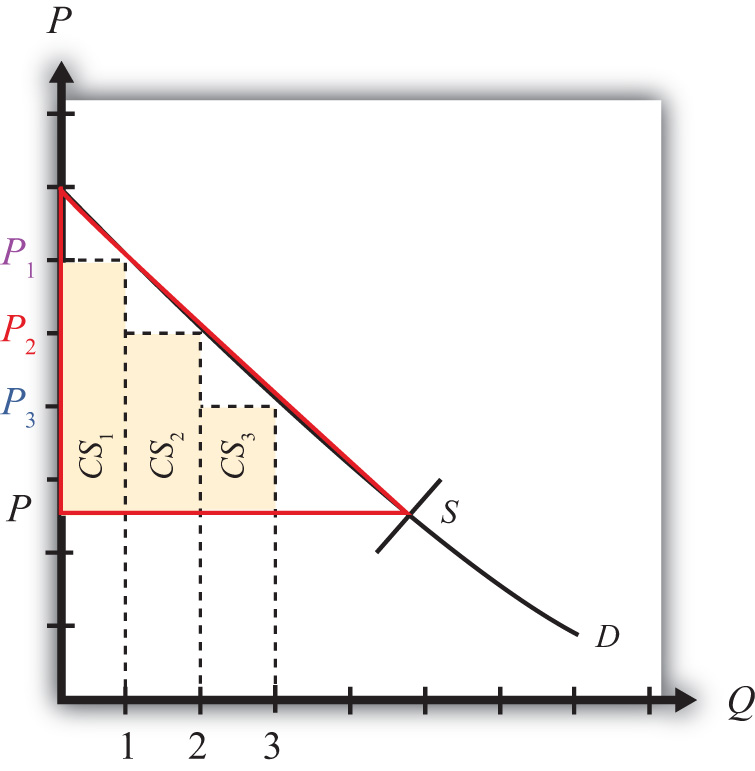

A graphical representation of consumer surplus can be derived by considering the following exercise. Suppose that only one unit of a good is available in a market. As shown in Figure 7.7 "Calculating Consumer Surplus", that first unit could be sold at the price P1. In other words, there is a consumer in the market who would be willing to pay P1. Presumably that person either has a relatively high desire or need for the product or the person has a relatively high income. To sell two units of the good, the price would have to be lowered to P2. (This assumes that the firm cannot perfectly price discriminate and charge two separate prices to two customers.) A slightly lower price might induce another customer to purchase the product or might induce the first customer to buy two units. Three units of the good could be sold if the price is lowered to P3, and so on.

Figure 7.7 Calculating Consumer Surplus

The price that ultimately prevails in a free market is that price that equalizes market supply with market demand. That price will be P in Figure 7.7 "Calculating Consumer Surplus" as long as the firms do not price discriminate. Now let’s go back to the first unit that could have been sold. The person who would have been willing to pay P1 for a unit of the good ultimately pays only P for the unit. The difference between the two prices represents the amount of consumer surplus that accrues to that person. For the second unit of the good, someone would have been willing to pay P2 but ultimately pays P. The second unit generates a smaller amount of surplus than the first unit.

We can continue this procedure until the market supply at the price P is reached. The total consumer surplus in the market is given by the sum of the areas of the rectangles. If many units of the product are sold, then a one-unit width would be much smaller than shown in Figure 7.7 "Calculating Consumer Surplus". Thus total consumer surplus can reasonably be measured as the area between the demand curve and the horizontal line drawn at the equilibrium market price. This is shown as the red triangle in the diagram. The area representing consumer surplus is measured in dollars.

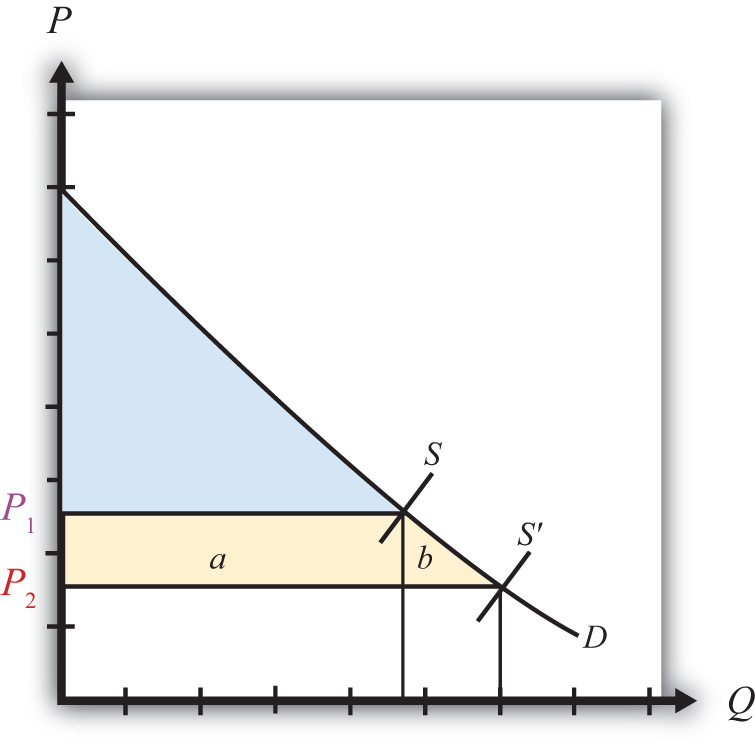

Changes in Consumer Surplus

Suppose the supply of a good rises, represented by a rightward shift in the supply curve from S to S′ in Figure 7.8 "Depicting a Change in Consumer Surplus". At the original price, P1, consumer surplus is given by the blue area in the diagram (the triangular area between the P1 price line and the demand curve). The increase in supply lowers the market price to P2. The new level of consumer surplus is now given by the sum of the blue and yellow areas in Figure 7.8 "Depicting a Change in Consumer Surplus" (the triangular area between the P2 price line and the demand curve). The change in consumer surplus, CS, is given by the yellow area in Figure 7.8 "Depicting a Change in Consumer Surplus" (the area denoted by a and b). Note that the change in consumer surplus is determined as the area between the price that prevails before, the price that prevails after, and the demand curve. In this case, consumer surplus rises because the price falls. Two groups of consumers are affected. Consumers who would have purchased the product even at the higher price, P1, now receive more surplus (P1 − P2) for each unit they purchase. These extra benefits are represented by the rectangular area a in the diagram. Also, there are additional consumers who were unwilling to purchase the product at price P1 but are now willing to purchase at the price P2. Their consumer surplus is given by the triangular area b in the diagram.

Figure 7.8 Depicting a Change in Consumer Surplus

Producer Surplus

Producer surplus is used to measure the welfare of a group of firms that sell a particular product at a particular price. Producer surplusThe difference between what producers actually receive when selling a product and the amount they would be willing to accept for a unit of the good. is defined as the difference between what producers actually receive when selling a product and the amount they would be willing to accept for a unit of the good. Firms’ willingness to accept payments can be read from a market supply curve for a product. The market supply curve shows the quantity of the good that firms would supply at each and every price that might prevail. Read the other way, the supply curve tells us the minimum price that producers would be willing to accept for any quantity demanded by the market.

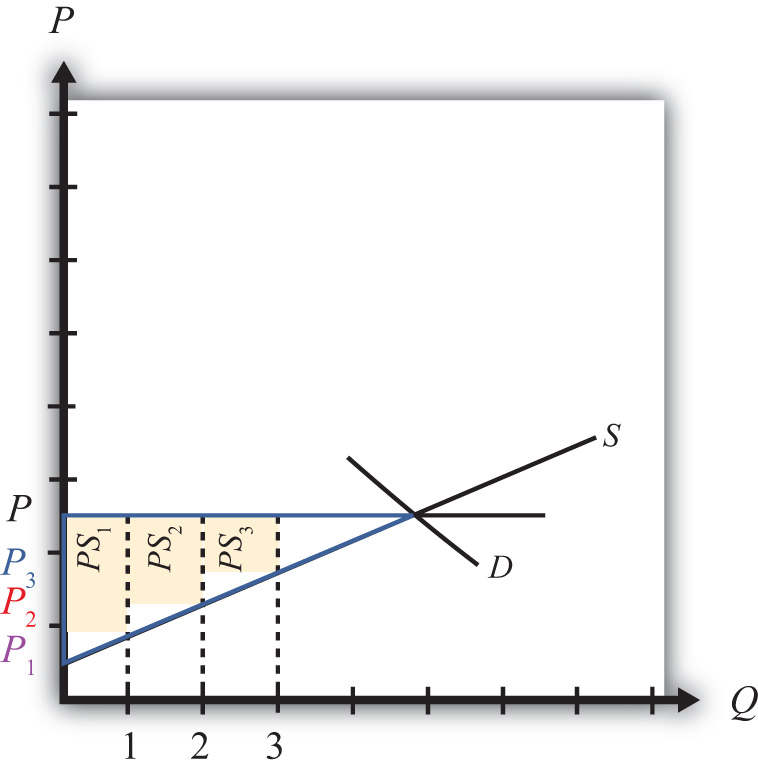

A graphical representation of producer surplus can be derived by considering the following exercise. Suppose that only one unit of a good is demanded in a market. As shown in Figure 7.9 "Calculating Producer Surplus", some firm would be willing to accept the price P1 if only one unit is produced. If two units of the good were demanded in the market, then the minimum price to induce two units to be supplied is P2. A slightly higher price would induce another firm to supply an additional unit of the good. Three units of the good would be made available if the price were raised to P3, and so on.

Figure 7.9 Calculating Producer Surplus

The price that ultimately prevails in a free market is the price that equalizes market supply with market demand. That price will be P in Figure 7.9 "Calculating Producer Surplus". Now let’s go back to the first unit demanded. Some firm would have been willing to supply one unit at the price P1 but ultimately receives P for the unit. The difference between the two prices represents the amount of producer surplus that accrues to the firm. For the second unit of the good, some firm would have been willing to supply the unit at the price P2 but ultimately receives P. The second unit generates a smaller amount of surplus than the first unit.

We can continue this procedure until the market demand at the price P is reached. The total producer surplus in the market is given by the sum of the areas of the rectangles. If many units of the product are sold, then the one-unit width would be much smaller than shown in Figure 7.9 "Calculating Producer Surplus". Thus total producer surplus can reasonably be measured as the area between the supply curve and the horizontal line drawn at the equilibrium market price. This is shown as the yellow triangle in the diagram. The area representing producer surplus is measured in dollars.

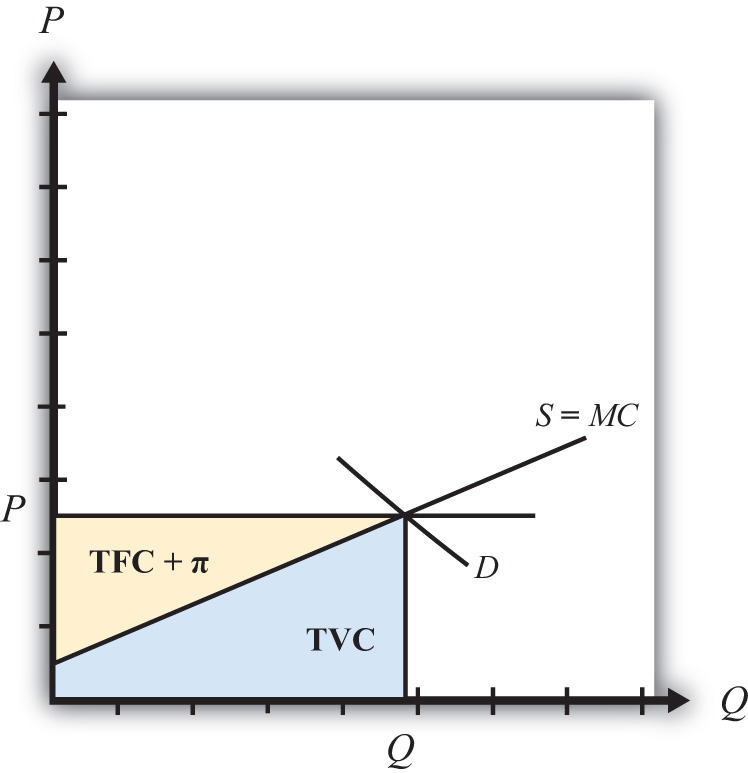

Producer surplus can be interpreted as the amount of revenue allocated to fixed costs and profit in the industry. This is because the market supply curve corresponds to industry marginal costs. Recall that firms choose output in a perfectly competitive market by setting the price equal to the marginal cost. Thus the marginal cost is equal to the price P in Figure 7.10 "Interpreting Producer Surplus" at an industry output equal to Q. The marginal cost represents the addition to cost for each additional unit of output. As such, it represents an additional variable cost for each additional unit of output. This implies that the area under the supply curve at an output level such as Q represents the total variable cost (TVC) to the industry, shown as the blue area in Figure 7.10 "Interpreting Producer Surplus".

Figure 7.10 Interpreting Producer Surplus

On the other hand, the market price multiplied by the quantity produced (P × Q) represents the total revenue received by firms in the industry. This is represented by the sum of the blue and yellow areas in the diagram. The difference between the total revenue and the total variable cost, in turn, represents payments made to fixed factors of production, or total fixed cost (TFC), and any short-run profits (Π) accruing to firms in the industry (the yellow area in the figure—that is, the area between the price line and the supply curve). This area is the same as the producer surplus.

Since fixed factors of production represent capital equipment that must be installed by the owners of the firms before any output can be produced, it is reasonable to use producer surplus to measure the well-being of the owners of the firms in the industry.

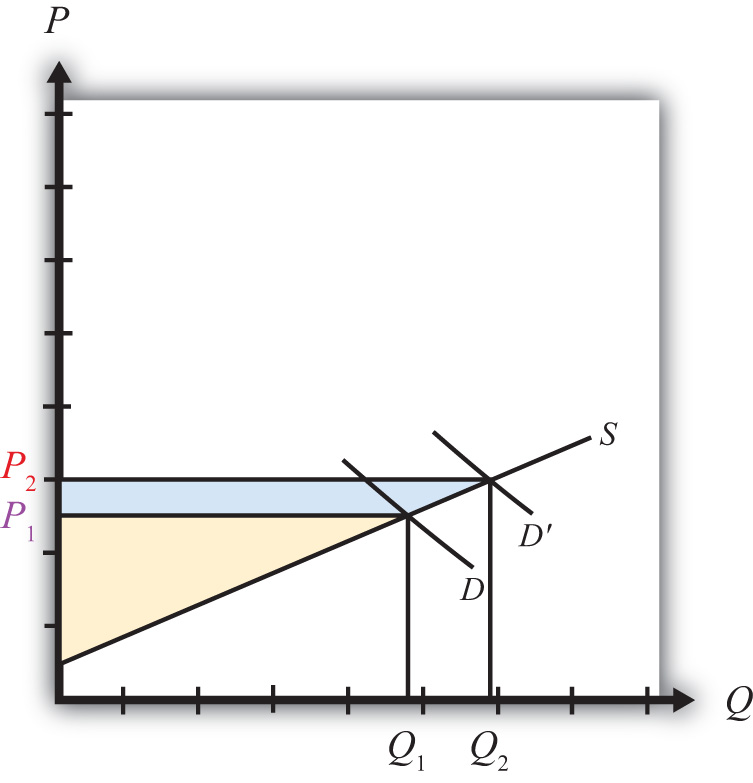

Changes in Producer Surplus

Suppose the demand for a good rises, represented by a rightward shift in the demand curve from D to D′ in Figure 7.11 "Depicting a Change in Producer Surplus". At the original price, P1, producer surplus is given by the yellow area in Figure 7.11 "Depicting a Change in Producer Surplus" (the triangular area between the P1 price and the supply curve). The increase in demand raises the market price to P2. The new level of producer surplus is now given by the sum of the blue and yellow areas in the figure (the triangular area between the price P2 and the supply curve). The change in producer surplus, PS, is given by the blue area in the figure (the area between the two prices and the supply curve). Note that the change in producer surplus is determined as the area between the price that prevails before, the price that prevails after, and the supply curve. In this case, producer surplus rises because the price increases and output rises. The increase in price and output raises the return to fixed costs and the profitability of firms in the industry. The increase in output also requires an increase in variable factors of production such as labor. Thus one additional benefit to firms not measured by the increase in producer surplus is an increase in industry employment.

Figure 7.11 Depicting a Change in Producer Surplus

Key Takeaways

- Consumer surplus and producer surplus are methods used to identify the magnitude of the welfare effects on consumers of a product and producers of a product.

- Consumer surplus measures the extra amount of money consumers would be willing to pay for a product over what they actually did pay.

- Consumer surplus is measured as the area between the demand curve, the horizontal line at the equilibrium price, and the vertical axis.

- Producer surplus is the extra amount of money producers receive when selling a product above what they would be willing to accept for it.

- Producer surplus is measured as the area between the supply curve, the horizontal line at the equilibrium price, and the vertical axis.

Exercises

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The term used to describe a measure of consumer welfare in a partial equilibrium analysis.

- The term used to describe a measure of producer welfare in a partial equilibrium analysis.

- Of increase, decrease, or stay the same, this is the effect of a price decrease on consumer surplus.

- Of increase, decrease, or stay the same, this is the effect of a price increase on producer surplus.

- Of increase, decrease, or stay the same, this is the effect of a demand increase on producer surplus.

- Of increase, decrease, or stay the same, this is the effect of a supply increase on consumer surplus.

-

Suppose the demand for baseballs is given by D = 1,000 – 20P.

- Calculate consumer surplus at a market price of $20.

- Calculate the change in consumer surplus if the price increases by $5.

-

Suppose the supply of baseballs is given by S = 30P.

- Calculate producer surplus at a market price of $20.

- Calculate the change in producer surplus if the price decreases by $5.

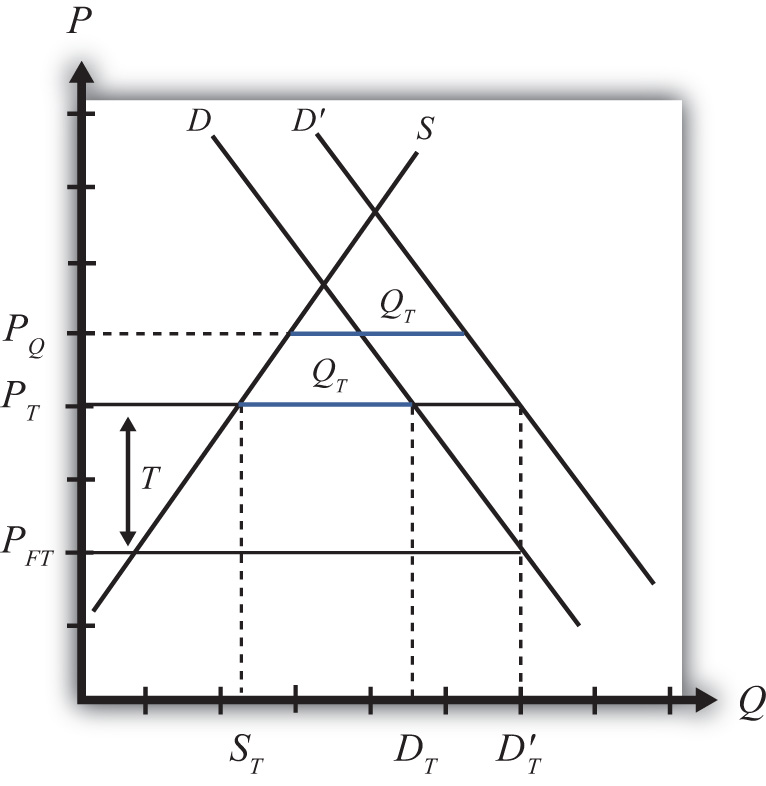

7.4 Import Tariffs: Large Country Price Effects

Learning Objectives

- Identify the effects of a specific tariff on prices in both countries and the quantity traded.

- Know the equilibrium conditions that must prevail in a tariff equilibrium.

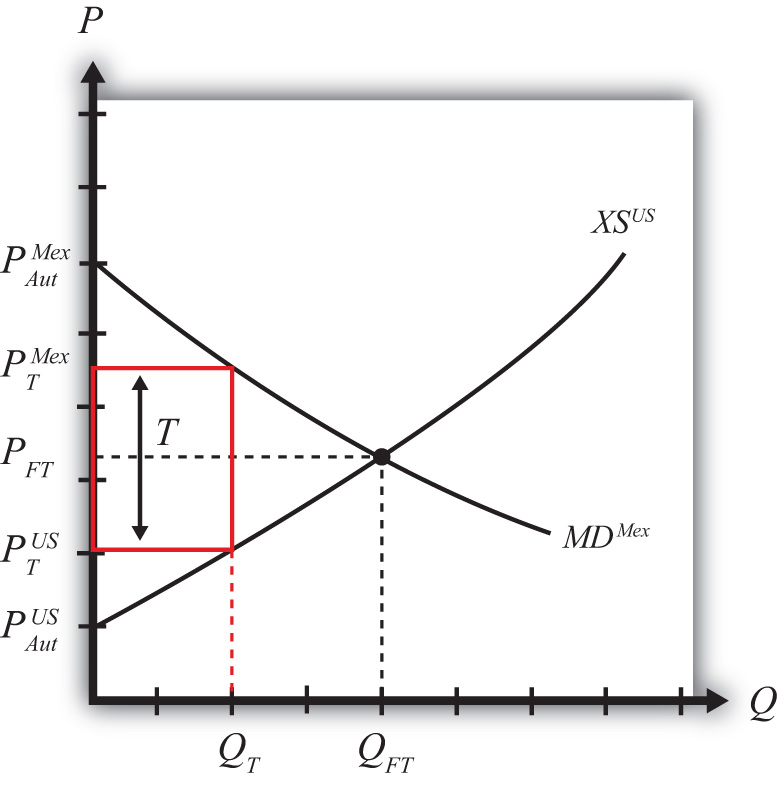

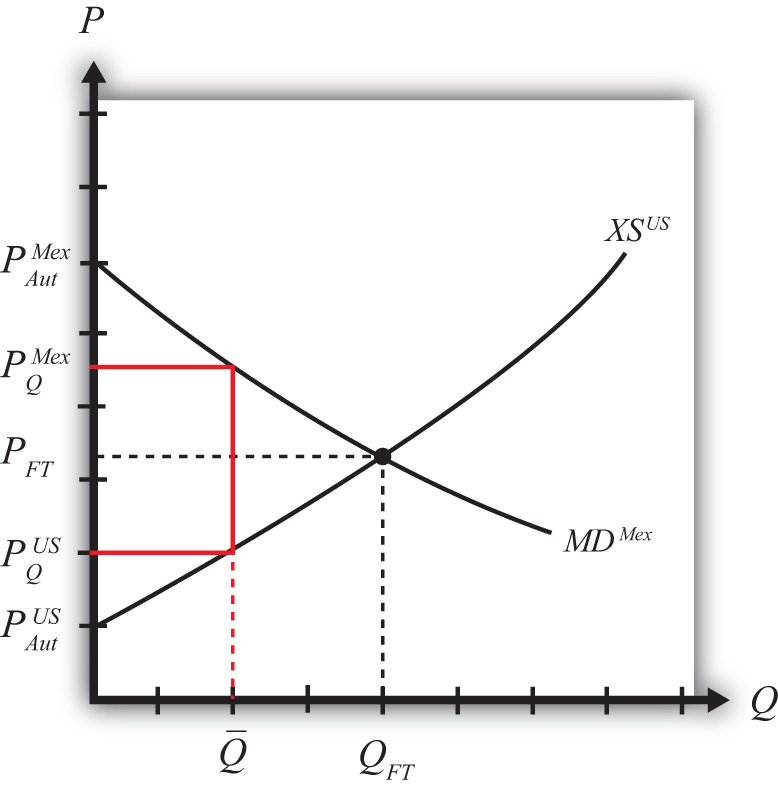

Suppose Mexico, the importing country in free trade, imposes a specific tariff on imports of wheat. As a tax on imports, the tariff will inhibit the flow of wheat across the border. It will now cost more to move the product from the United States into Mexico.

As a result, the supply of wheat to the Mexican market will fall, inducing an increase in the price of wheat. Since wheat is homogeneous and the market is perfectly competitive, the price of all wheat sold in Mexico, both Mexican wheat and U.S. imports, will rise in price. The higher price will reduce Mexico’s import demand.

The reduced wheat supply to Mexico will shift back supply to the U.S. market. Since Mexico is assumed to be a large importer, the supply shifted back to the U.S. market will be enough to induce a reduction in the U.S. price. The lower price will reduce the U.S. export supply.

For this reason, a country that is a large importer is said to have monopsony power in tradeAnother term to describe a large importing country—that is, a country whose policy actions can affect international prices.. A monopsony arises whenever there is a single buyer of a product. A monopsony can gain an advantage for itself by reducing its demand for a product in order to induce a reduction in the price. In a similar way, a country with monopsony power can reduce its demand for imports (by setting a tariff) to lower the price it pays for the imported product. Note that these price effects are identical in direction to the price effects of an import quota, a voluntary export restraint, and an export tax.

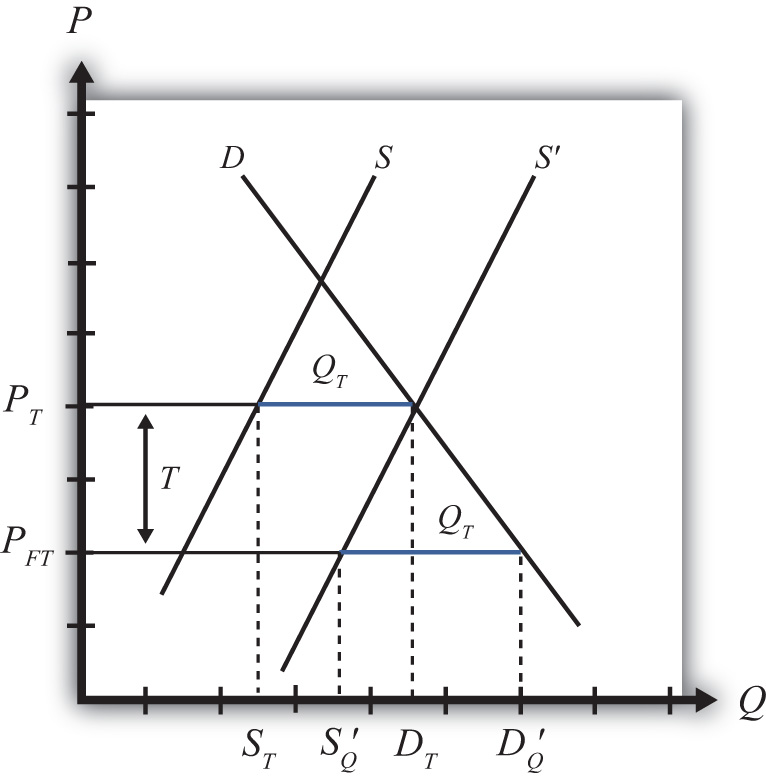

A new tariff-ridden equilibrium will be reached when the following two conditions are satisfied:

and

where T is the tariff, PTMex is the price in Mexico after the tariff, and PTUS is the price in the United States after the tariff.

The first condition represents a price wedge between the final U.S. price and the Mexican price equal to the amount of the tariff. The prices must differ by the tariff because U.S. suppliers of wheat must receive the same price for their product regardless of whether the product is sold in the United States or Mexico, and all wheat sold in Mexico must be sold at the same price. Since a tax is collected at the border, the only way for these price equalities within countries to arise is if the price differs across countries by the amount of the tax.

The second condition states that the amount the United States wants to export at its new lower price must be equal to the amount Mexico wants to import at its new higher price. This condition guarantees that world supply of wheat equals world demand for wheat.

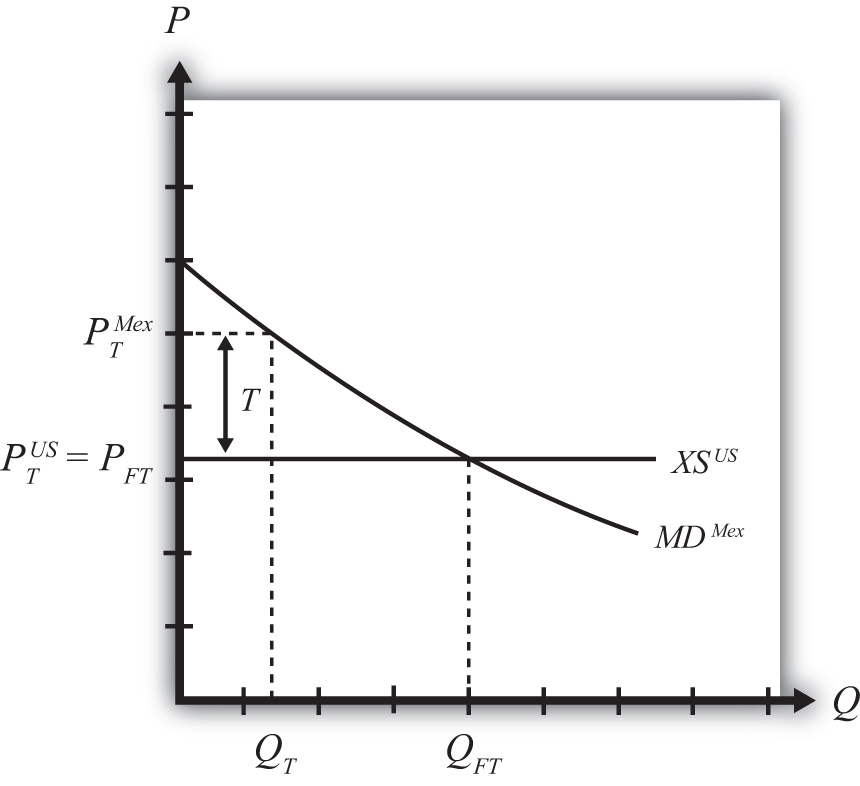

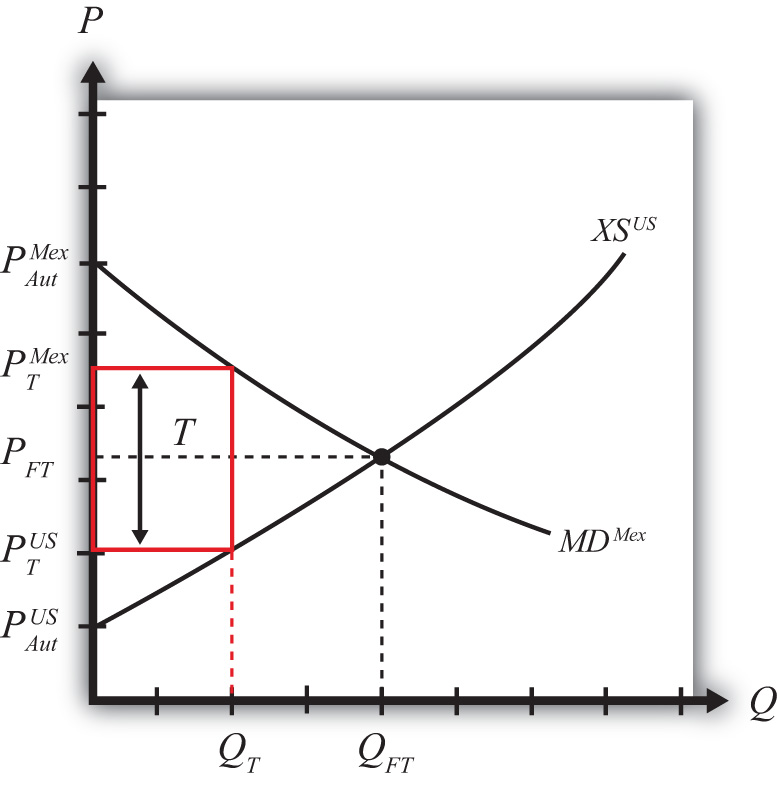

The tariff equilibrium is depicted graphically in Figure 7.12 "Depicting a Tariff Equilibrium: Large Country Case". The Mexican price of wheat rises from PFT to PTMex, which reduces its import demand from QFT to QT. The U.S. price of wheat falls from PFT to PTUS, which also reduces its export supply from QFT to QT. The difference in the prices between the two markets is equal to the specific tariff rate, T.

Figure 7.12 Depicting a Tariff Equilibrium: Large Country Case

Notice that there is a unique set of prices that satisfies the equilibrium conditions for every potential tariff that is set. If the tariff were set higher than T, the price wedge would rise, causing a further increase in the Mexican price, a further decrease in the U.S. price, and a further reduction in the quantity traded.

At the extreme, if the tariff were set equal to the difference in autarky prices (i.e., ), then the quantity traded would fall to zero. In other words, the tariff would prohibit trade. Indeed, any tariff set greater than or equal to the difference in autarky prices would eliminate trade and cause the countries to revert to autarky in that market. Thus we define a prohibitive tariff as any tariff, Tpro, such that

The Price Effects of a Tariff: A Simple Dynamic Story

For an intuitive explanation about why these price changes would likely occur in a real-world setting, read the following story about the likely dynamic adjustment process. Technically, this story is not a part of the partial equilibrium model, which is a static model that does not contain adjustment dynamics. However, it is worthwhile to think about how a real market adjusts to the equilibria described in these simple models.

Suppose the United States and Mexico are initially in a free trade equilibrium. Mexico imports wheat at the free trade price of $10 per bushel. Imagine that the market for unprocessed wheat in both the United States and Mexico is located in a warehouse in each country. Each morning, wheat arrives from the suppliers and is placed in the warehouse for sale. During the day, consumers of unprocessed wheat arrive to buy the supply. For simplicity, assume there is no service charge collected by the intermediary that runs the warehouses. Thus, for each bushel sold, $10 passes from the consumer directly to the producer.

Each day, the wheat market clears in the United States and Mexico at the price of $10. This means that the quantity of wheat supplied at the beginning of the day is equal to the quantity purchased by consumers during the day. Supply equals demand in each market at the free trade price of $10.

Now suppose that Mexico places a $2 specific tariff on imports of wheat. Let’s assume that the agents in the model react slowly and rather naively to the change. Let’s also suppose that the $2 tariff is a complete surprise.

Each day, prior to the tariff, trucks carrying U.S. wheat would cross the Mexican border in the wee hours, unencumbered, en route to the Mexican wheat market. On the day the tariff is imposed, the trucks are stopped and inspected. The drivers are informed that they must pay $2 for each bushel that crosses into Mexico.

Suppose the U.S. exporters of wheat naively pay the tax and ship the same number of bushels to the Mexican market that day. However, to recoup their losses, they raise the price by the full $2. The wheat for sale in Mexico now is separated into two groups. The imported U.S. wheat now has a price tag of $12, while the Mexican-supplied wheat retains the $10 price. Mexican consumers now face a choice. However, since Mexican and U.S. wheat are homogeneous, the choice is simple. Every Mexican consumer will want to purchase the Mexican wheat at $10. No one will want the U.S. wheat. Of course, sometime during the day, Mexican wheat will run out and consumers will either have to buy the more expensive wheat or wait till the next day. Thus some $12 U.S. wheat will sell, but not the full amount supplied. At the end of the day, a surplus will remain. This means that there will be an excess demand for Mexican wheat and an excess supply of U.S. wheat in the Mexican market.

Mexican producers of wheat will quickly realize that they can supply more to the market and raise their price. A higher price is possible because the competition is now charging $12. The higher supply and higher price will raise the profitability of the domestic wheat producers. (Note that the supply of wheat may not rise quickly since it is grown over an annual cycle. However, the supply of a different type of good could be raised rapidly. The length of this adjustment will depend on the nature of the product.) U.S. exporters will quickly realize that no one wants to buy their wheat at a price of $12. Their response will be to reduce export supply and lower their price in the Mexican market.

As time passes, in the Mexican market, the price of Mexican-supplied wheat will rise from $10 and the price of U.S. supplied wheat will fall from $12 until the two prices meet somewhere in between. The homogeneity of the goods requires that if both goods are to be sold in the Mexican market, then they must sell at the same price in equilibrium.

As these changes take place in the Mexican market, other changes occur in the U.S. market. When U.S. exporters of wheat begin to sell less in Mexico, that excess supply is shifted back to the U.S. market. The warehouse in the United States begins to fill up with more wheat than U.S. consumers are willing to buy at the initial price of $10. Thus at the end of each day, wheat supplies remain unsold. An inventory begins to pile up. Producers realize that the only way to unload the excess wheat is to cut the price. Thus the price falls in the U.S. market. At lower prices, though, U.S. producers are willing to supply less, thus production is cut back as well.

In the end, the U.S. price falls and the Mexican price rises until the two prices differ by $2, the amount of the tariff. A Mexican price of $11.50 and a U.S. price of $9.50 is one possibility. A Mexican price of $11 and a U.S. price of $9 is another. U.S. producers now receive the same lower price for wheat whether they sell in the United States or Mexico. The exported wheat is sold at the higher Mexican price, but $2 per bushel is paid to the Mexican government as tariff revenue. Thus U.S. exporters receive the U.S. price for the wheat sold in Mexico.

The higher price in Mexico raises domestic supply and reduces domestic demand, thus reducing their demand for imports. The lower price in the United States reduces U.S. supply, raises U.S. demand, and thus lowers U.S. export supply to Mexico. In a two-country world, the $2 price differential that arises must be such that U.S. export supply equals Mexican import demand.

Noteworthy Price Effects of a Tariff

Two of the effects of a tariff are worthy of emphasis. First, although a tariff represents a tax placed solely on imported goods, the domestic price of both imported and domestically produced goods will rise. In other words, a tariff will cause local producers of the product to raise their prices. Why?

In the model, it is assumed that domestic goods are perfectly substitutable for imported goods (i.e., the goods are homogeneous). When the price of imported goods rises due to the tariff, consumers will shift their demand from foreign to domestic suppliers. The extra demand will allow domestic producers an opportunity to raise output and prices to clear the market. In so doing, they will also raise their profit. Thus as long as domestic goods are substitutable for imports and as long as the domestic firms are profit seekers, the price of the domestically produced goods will rise along with the import price.

The average consumer may not recognize this rather obvious point. For example, suppose the United States places a tariff on imported automobiles. Consumers of U.S.-made automobiles may fail to realize that they are likely to be affected. After all, they might reason, the tax is placed only on imported automobiles. Surely this would raise the imports’ prices and hurt consumers of foreign cars, but why would that affect the price of U.S. cars? The reason, of course, is that the import car market and the domestic car market are interconnected. Indeed, the only way U.S.-made car prices would not be affected by the tariff is if consumers were completely unwilling to substitute U.S. cars for imported cars or if U.S. automakers were unwilling to take advantage of a profit-raising possibility. These conditions are probably unlikely in most markets around the world.

The second interesting price effect arises because the importing country is large. When a large importing country places a tariff on an imported product, it will cause the foreign price to fall. The reason? The tariff will reduce imports into the domestic country, and since its imports represent a sizeable proportion of the world market, world demand for the product will fall. The reduction in demand will force profit-seeking firms in the rest of the world to lower output and price in order to clear the market.

The effect on the foreign price is sometimes called the terms of trade effect. The terms of trade is sometimes defined as the price of a country’s export goods divided by the price of its import goods. Here, since the importing country’s import good will fall in price, the country’s terms of trade will rise. Thus a tariff implemented by a large country will cause an improvement in the country’s terms of trade.

Key Takeaways

- An import tariff will raise the domestic price and, in the case of a large country, lower the foreign price.

- An import tariff will reduce the quantity of imports.

- An import tariff will raise the price of the “untaxed” domestic import-competing good.

- The tariff will drive a price wedge, equal to the tariff value, between the foreign price and the domestic price of the product.

- With the tariff in place in a two-country model, export supply at the lower foreign price will equal import demand at the higher domestic price.

Exercises

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The kind of power a country is said to have when its imports make up a significant share of the world market.

- The direction of change of the domestic price after an import tariff is implemented by a domestic country.

- The direction of change of the foreign price after an import tariff is implemented by a large domestic country.

- The term used to describe a tariff that eliminates trade.

- Of increase, decrease, or stay the same, this is the effect on the price of U.S.-made automobiles if the United States places a tax on imported foreign automobiles.

- The price of tea in the exporting country if the importer sets a tariff of $1.50 per pound and if the importer country price is $5.50 inclusive of the tariff.

- Of increase, decrease, or stay the same, this is the effect on imports of wheat if a wheat tariff is implemented.

- Of increase, decrease, or stay the same, this is the effect on foreign exports of wheat if a wheat tariff is implemented by an importing country.

-

Complete the following descriptions of the equilibrium conditions with a tariff in place.

- _____________________________________________________ is equal to the price in the exporting market with the foreign tariff plus the tariff.

- Import demand, at the price that prevails in the importing country after the tariff, is equal to _____________________________________________________ at the price that prevails _____________________________________________________.

7.5 Import Tariffs: Large Country Welfare Effects

Learning Objectives

- Use a partial equilibrium diagram to identify the welfare effects of an import tariff on producer and consumer groups and the government in the importing and exporting countries.

- Calculate the national and world welfare effects of an import tariff.

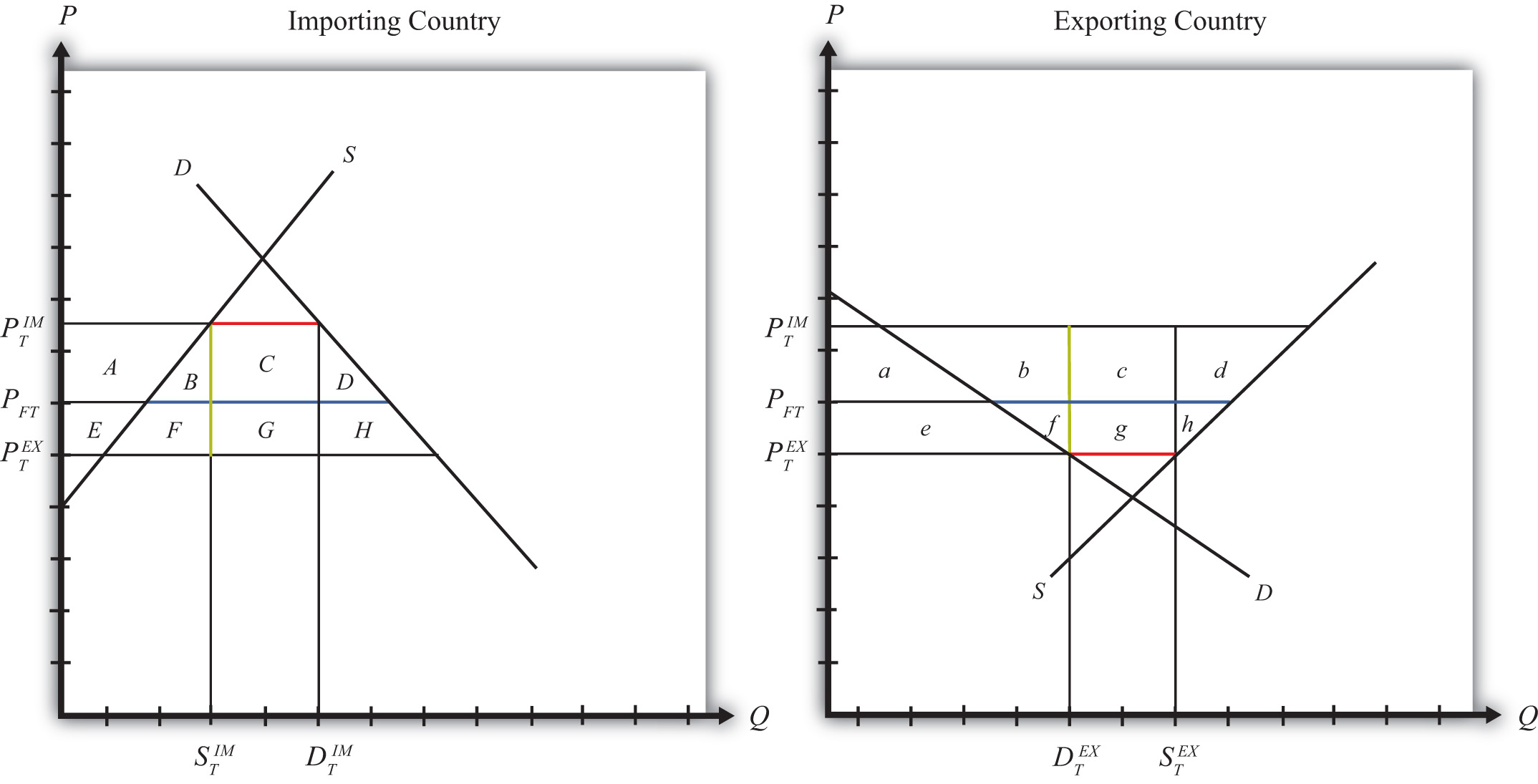

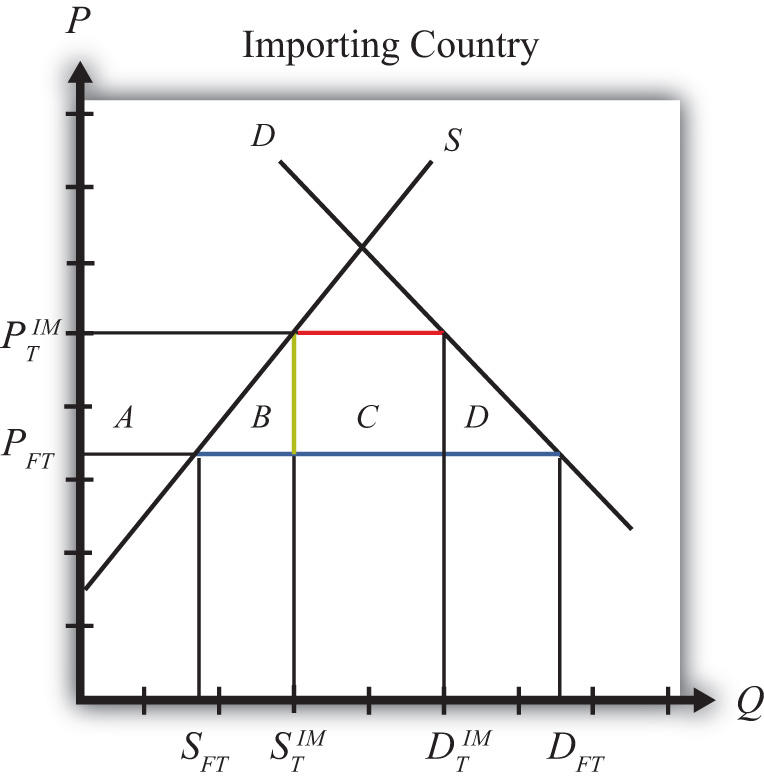

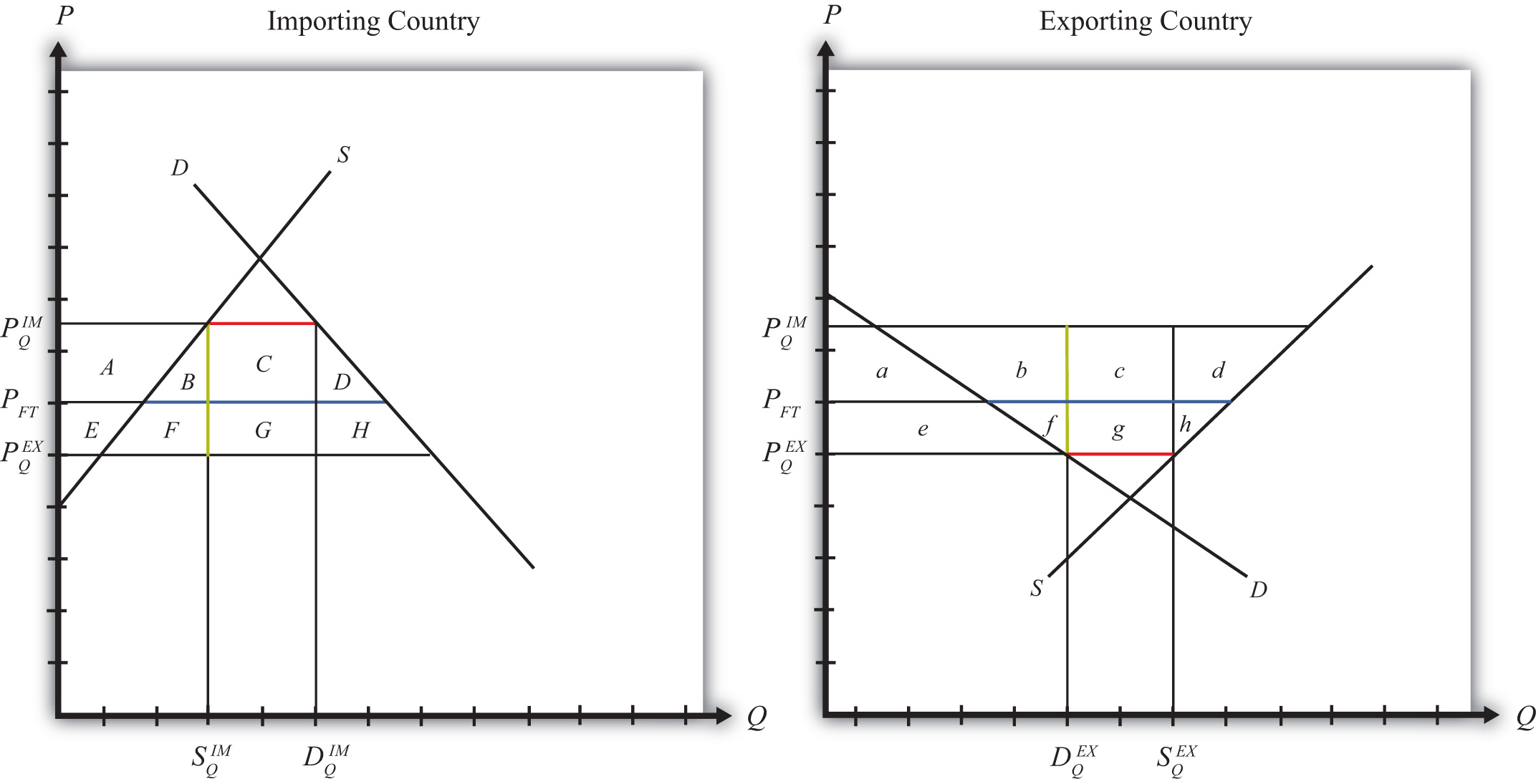

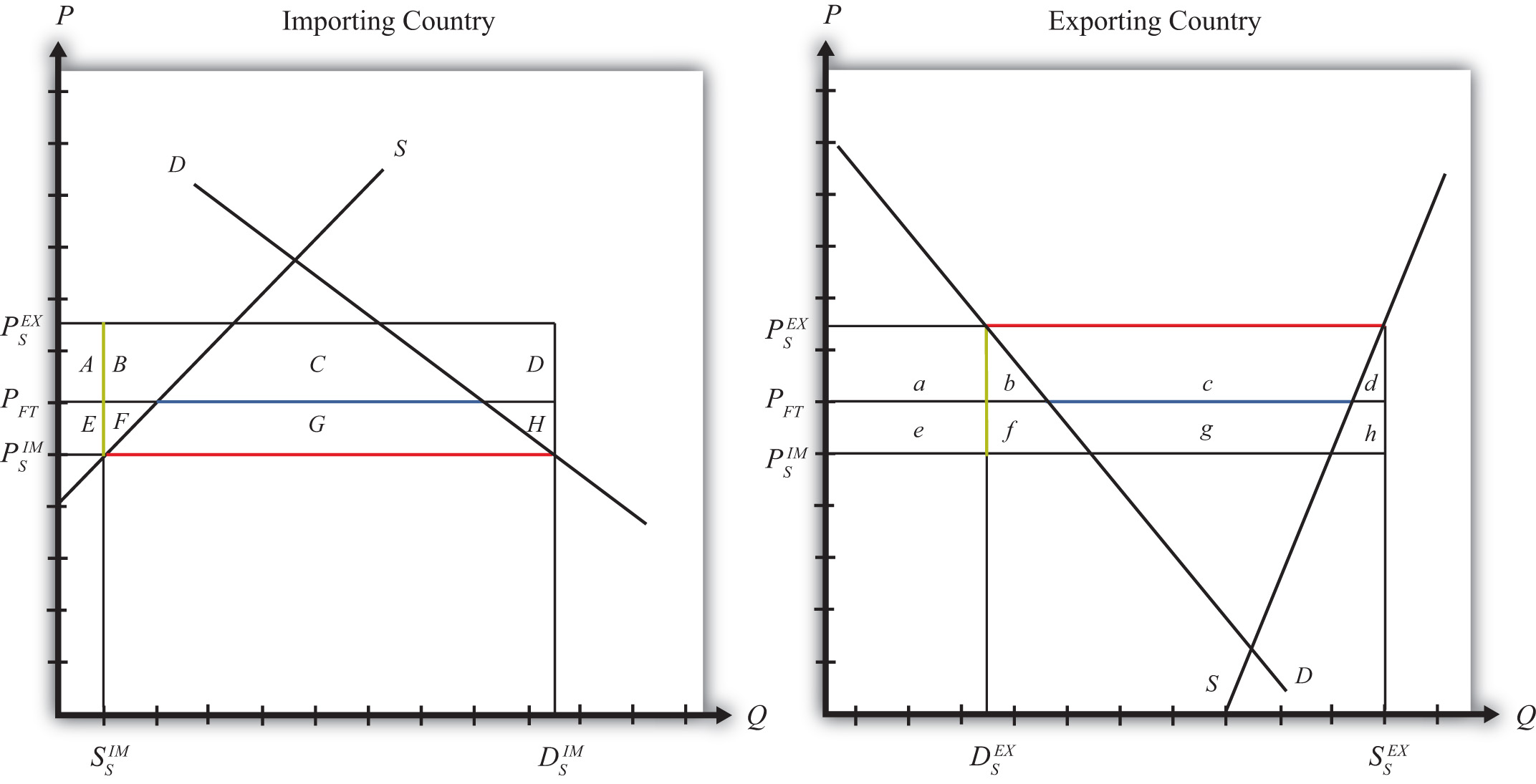

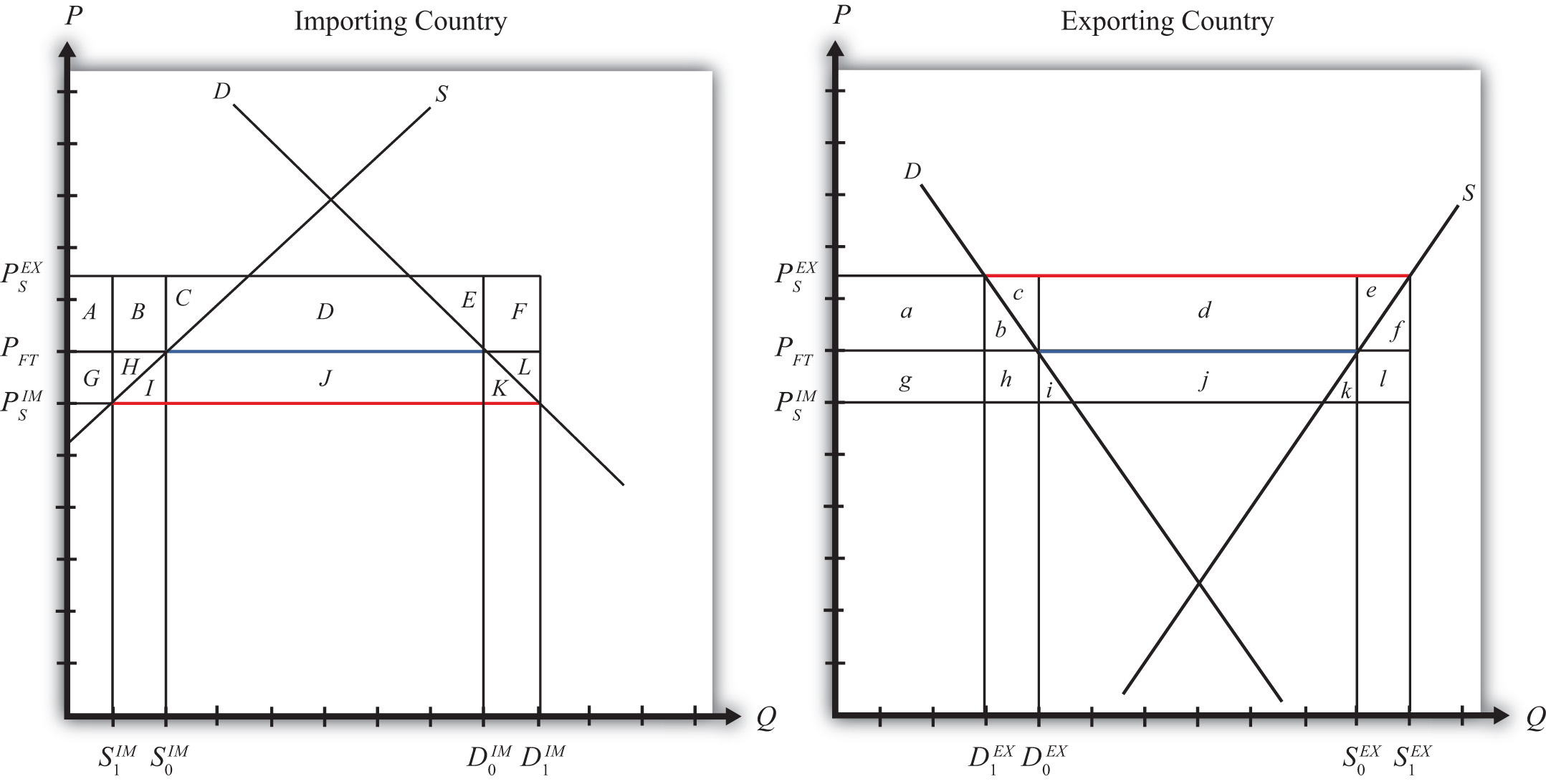

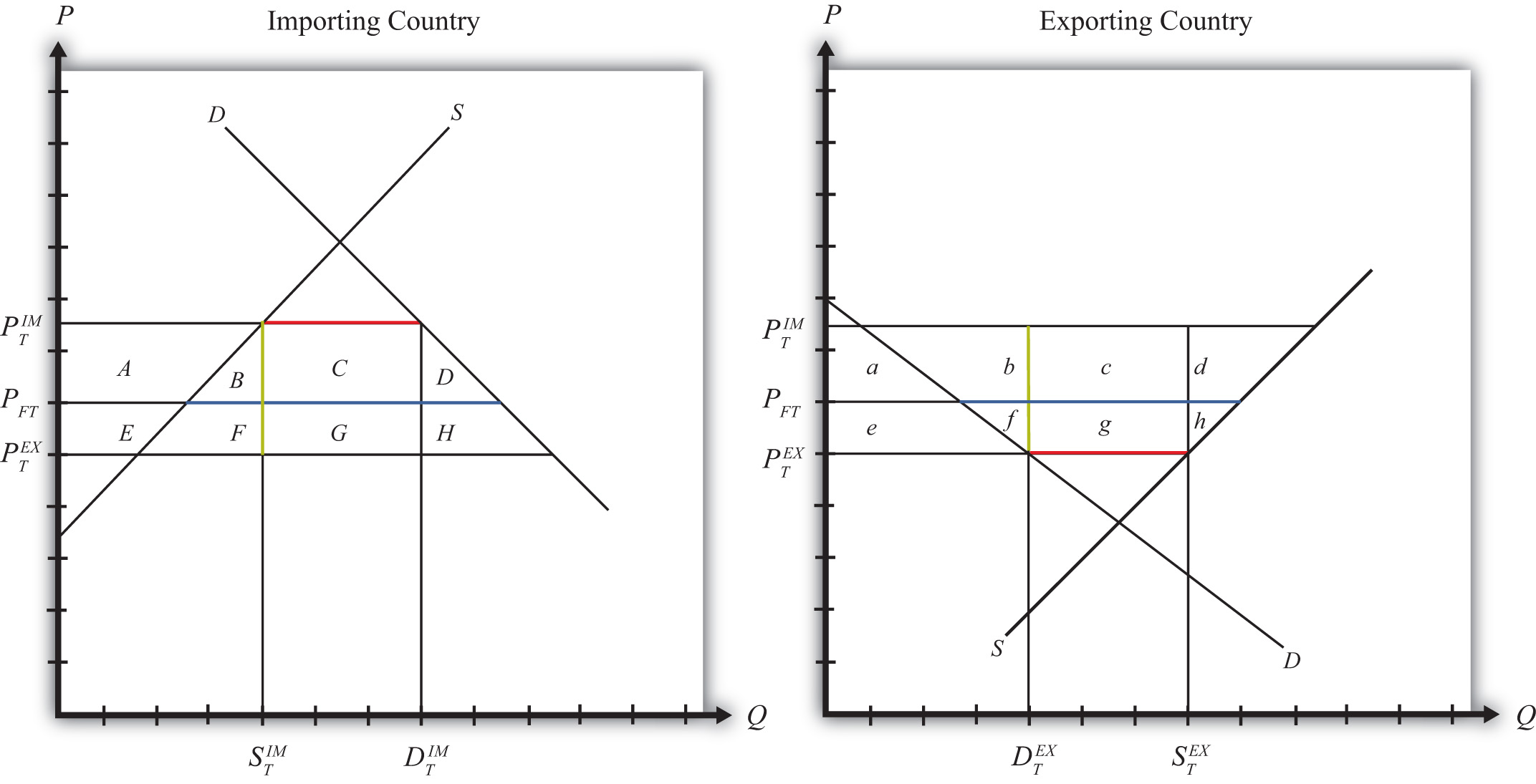

Suppose that there are only two trading countries: one importing country and one exporting country. The supply and demand curves for the two countries are shown in Figure 7.13 "Welfare Effects of a Tariff: Large Country Case". PFT is the free trade equilibrium price. At that price, the excess demand by the importing country equals excess supply by the exporter.

Figure 7.13 Welfare Effects of a Tariff: Large Country Case

The quantity of imports and exports is shown as the blue line segment on each country’s graph. (That’s the horizontal distance between the supply and demand curves at the free trade price.) When a large importing country implements a tariff it will cause an increase in the price of the good on the domestic market and a decrease in the price in the rest of the world (RoW). Suppose after the tariff the price in the importing country rises to and the price in the exporting country falls to . If the tariff is a specific tax, then the tariff rate would be , equal to the length of the green line segment in the diagram. If the tariff were an ad valorem tax, then the tariff rate would be given by .

Table 7.1 "Welfare Effects of an Import Tariff" provides a summary of the direction and magnitude of the welfare effects to producers, consumers, and the governments in the importing and exporting countries. The aggregate national welfare effects and the world welfare effects are also shown.

Table 7.1 Welfare Effects of an Import Tariff

| Importing Country | Exporting Country | |

|---|---|---|

| Consumer Surplus | − (A + B + C + D) | + e |

| Producer Surplus | + A | − (e + f + g + h) |

| Govt. Revenue | + (C + G) | 0 |

| National Welfare | + G − (B + D) | − (f + g + h) |

| World Welfare | −; (B + D) − (f + h) |

Refer to Table 7.1 "Welfare Effects of an Import Tariff" and Figure 7.13 "Welfare Effects of a Tariff: Large Country Case" to see how the magnitudes of the changes are represented.

Tariff effects on the importing country’s consumers. Consumers of the product in the importing country suffer a reduction in well-being as a result of the tariff. The increase in the domestic price of both imported goods and the domestic substitutes reduces the amount of consumer surplus in the market.

Tariff effects on the importing country’s producers. Producers in the importing country experience an increase in well-being as a result of the tariff. The increase in the price of their product on the domestic market increases producer surplus in the industry. The price increases also induce an increase in the output of existing firms (and perhaps the addition of new firms); an increase in employment; and an increase in profit, payments, or both to fixed costs.

Tariff effects on the importing country’s government. The government receives tariff revenue as a result of the tariff. Who benefits from the revenue depends on how the government spends it. Typically, the revenue is simply included as part of the general funds collected by the government from various sources. In this case, it is impossible to identify precisely who benefits. However, these funds help support many government spending programs, which presumably help either most people in the country, as is the case with public goods, or certain worthy groups. Thus someone within the country is the likely recipient of these benefits.

Tariff effects on the importing country. The aggregate welfare effect for the country is found by summing the gains and losses to consumers, producers, and the government. The net effect consists of three components: a positive terms of trade effect (G), a negative production distortion (B), and a negative consumption distortion (D).

Because there are both positive and negative elements, the net national welfare effect can be either positive or negative. The interesting result, however, is that it can be positive. This means that a tariff implemented by a large importing country may raise national welfare.

Generally speaking, the following are true:

- Whenever a large country implements a small tariff, it will raise national welfare.

- If the tariff is set too high, national welfare will fall.

- There will be a positive optimal tariff that will maximize national welfare.

However, it is also important to note that not everyone’s welfare rises when there is an increase in national welfare. Instead, there is a redistribution of income. Producers of the product and recipients of government spending will benefit, but consumers will lose. A national welfare increase, then, means that the sum of the gains exceeds the sum of the losses across all individuals in the economy. Economists generally argue that, in this case, compensation from winners to losers can potentially alleviate the redistribution problem.

Tariff effects on the exporting country’s consumers. Consumers of the product in the exporting country experience an increase in well-being as a result of the tariff. The decrease in their domestic price raises the amount of consumer surplus in the market.

Tariff effects on the exporting country’s producers. Producers in the exporting country experience a decrease in well-being as a result of the tariff. The decrease in the price of their product in their own market decreases producer surplus in the industry. The price decline also induces a decrease in output, a decrease in employment, and a decrease in profit, payments, or both to fixed costs.

Tariff effects on the exporting country’s government. There is no effect on the exporting country’s government revenue as a result of the importer’s tariff.

Tariff effects on the exporting country. The aggregate welfare effect for the country is found by summing the gains and losses to consumers and producers. The net effect consists of three components: a negative terms of trade effect (g), a negative consumption distortion (f), and a negative production distortion (h).

Since all three components are negative, the importer’s tariff must result in a reduction in national welfare for the exporting country. However, it is important to note that a redistribution of income occurs—that is, some groups gain while others lose. In this case, the sum of the losses exceeds the sum of the gains.

Tariff effects on world welfare. The effect on world welfare is found by summing the national welfare effects on the importing and exporting countries. By noting that the terms of trade gain to the importer is equal to the terms of trade loss to the exporter, the world welfare effect reduces to four components: the importer’s negative production distortion (B), the importer’s negative consumption distortion (D), the exporter’s negative consumption distortion (f), and the exporter’s negative production distortion (h). Since each of these is negative, the world welfare effect of the import tariff is negative. The sum of the losses in the world exceeds the sum of the gains. In other words, we can say that an import tariff results in a reduction in world production and consumption efficiency.

Key Takeaways

- An import tariff lowers consumer surplus in the import market and raises it in the export country market.

- An import tariff raises producer surplus in the import market and lowers it in the export country market.

- The national welfare effect of an import tariff is evaluated as the sum of the producer and consumer surplus and government revenue effects.

- National welfare may rise or fall when a large country implements an import tariff.

- National welfare in the exporting country falls when an importing country implements an import tariff.

- An import tariff of any size will reduce world production and consumption efficiency and thus cause world welfare to fall.

Exercises

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The product of the specific tariff rate and the quantity of imports.

- Of increase, decrease, or stay the same, this is the effect of a tariff on the welfare of consumers of the product in the large importing country.

- Of increase, decrease, or stay the same, this is the effect of a tariff on the welfare of producers of the product in the large importing country.

- Of increase, decrease, or stay the same, this is the effect of a tariff on the welfare of the recipients of government benefits in the large importing country.

- Of increase, decrease, or stay the same, this is the effect of a tariff on the welfare of consumers of the product in the large exporting country.

- Of increase, decrease, or stay the same, this is the effect of a tariff on the welfare of producers of the product in the exporting country.

- Of increase, decrease, or stay the same, this is the effect of a tariff on the world welfare.

- Of larger, smaller, or the same, this is how the magnitude of the consumer losses compares with the magnitude of the producer gains in an importing country implementing a tariff.

- Of larger, smaller, or the same, this is how the magnitude of the consumer gains compares with the magnitude of the producer losses in an exporting country affected by a foreign tariff.

-

Consider the following trade policy actions (each applied by the domestic country) listed along the top row of the table below. In the empty boxes, use the following notation to indicate the effect of each policy on the variables listed in the first column. Use a partial equilibrium model to determine the answers and assume that the shapes of the supply and demand curves are “normal.” Assume that none of the policies begin with or result in prohibitive trade policies. Also assume that none of the policies correct for market imperfections or distortions. Use the following notation:

+ the variable increases

− the variable decreases

0 the variable does not change

A the variable change is ambiguous (i.e., it may rise, it may fall)

For example, an import tariff applied by a large country will cause an increase in the domestic price of the import good; therefore, a + is placed in the first box of the table.

Table 7.2 Trade Policy Effects

I II Import Tariff by a Large Country—Initial Tariff Is Zero Import Tariff Reduction by a Large Country Domestic Market Price + Domestic Industry Employment Domestic Consumer Welfare Domestic Producer Welfare Domestic Government Revenue Domestic National Welfare Foreign Price Foreign Consumer Welfare Foreign Producer Welfare Foreign National Welfare -

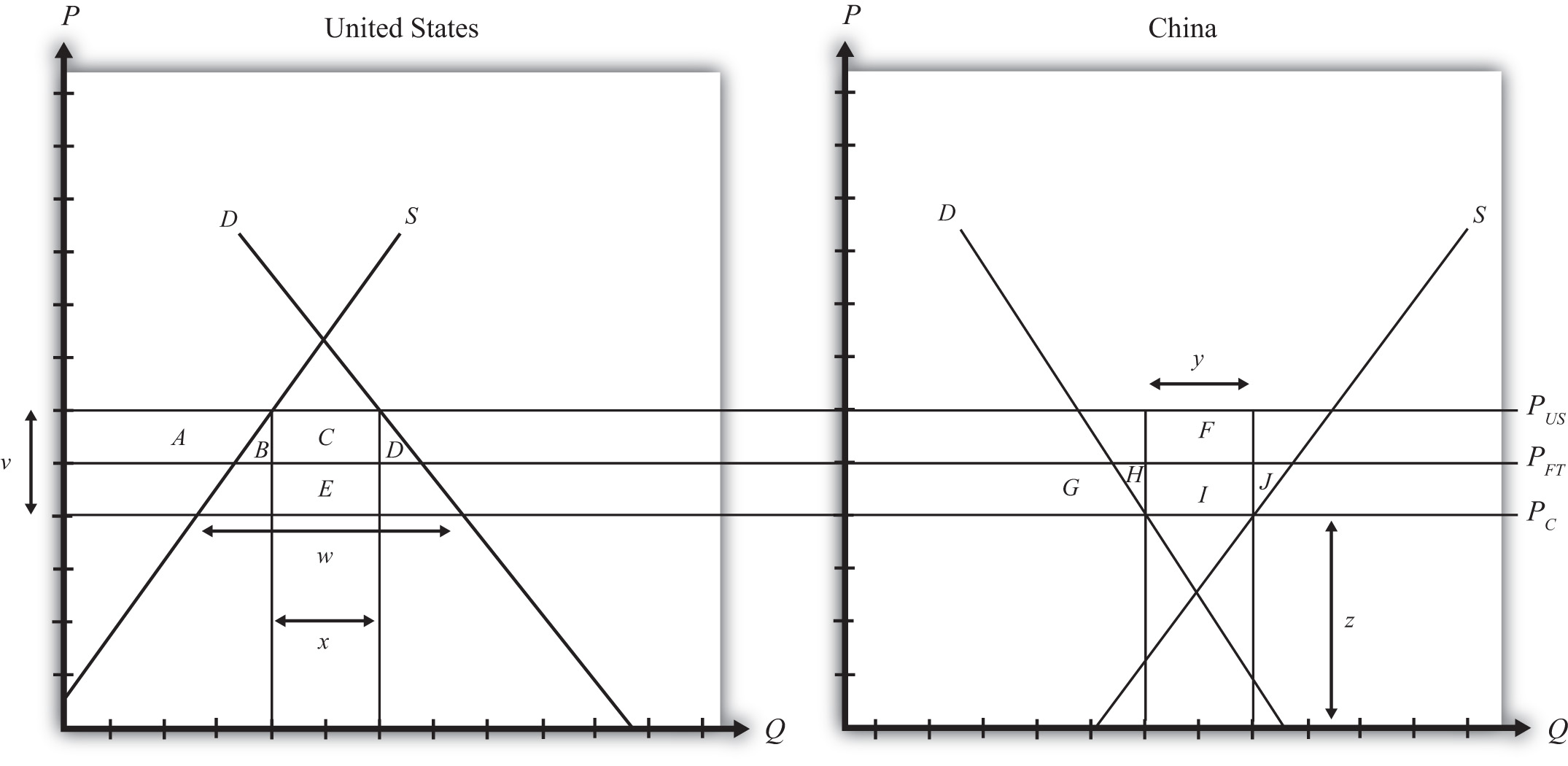

Consider the following partial equilibrium diagram depicting two countries, China and the United States, trading a product with each other. Suppose PFT is the free trade price, PUS is the price in the United States when a tariff is in place, and PC is the price in China when a tariff is in place. Answer the following questions by referring to the figure below. Assume the letters, A, B, C, D, E, F, G, H, I, and J refer to areas on the graph. The letters v, w, x, y, and z refer to lengths.

Figure 7.14 Two Large Trading Countries

- Which country is the exporter of the product?

- Where on the graph is the level of imports depicted with the tariff in place?

- Which areas on the graph represent the change in consumer surplus for the importing country if the tariff is removed? (Include the sign.)

- Which areas represent the tariff revenue lost by the importing government?

- Which areas represent the net national welfare effect of the tariff elimination by the importing country?

- Which areas represent the net national welfare effect of the tariff elimination in the exporting country?

- Which areas represent the world welfare effects of the tariff elimination?

7.6 The Optimal Tariff

Learning Objectives

- Plot the impact of an import tariff in a large country on consumer surplus, producer surplus, government revenue, and national welfare as the tariff is raised from zero.

- Describe how tariff changes will affect national welfare in different circumstances.

The possibility that a tariff could improve national welfare for a large country in international markets was first noted by Robert Torrens. Since the welfare improvement occurs only if the terms of trade gain exceeds the total deadweight losses, the argument is commonly known as the terms of trade argument for protection.

Economists have studied the conditions under which a tariff will improve welfare in a variety of perfectly competitive models. This section describes the general results that come from that analysis.

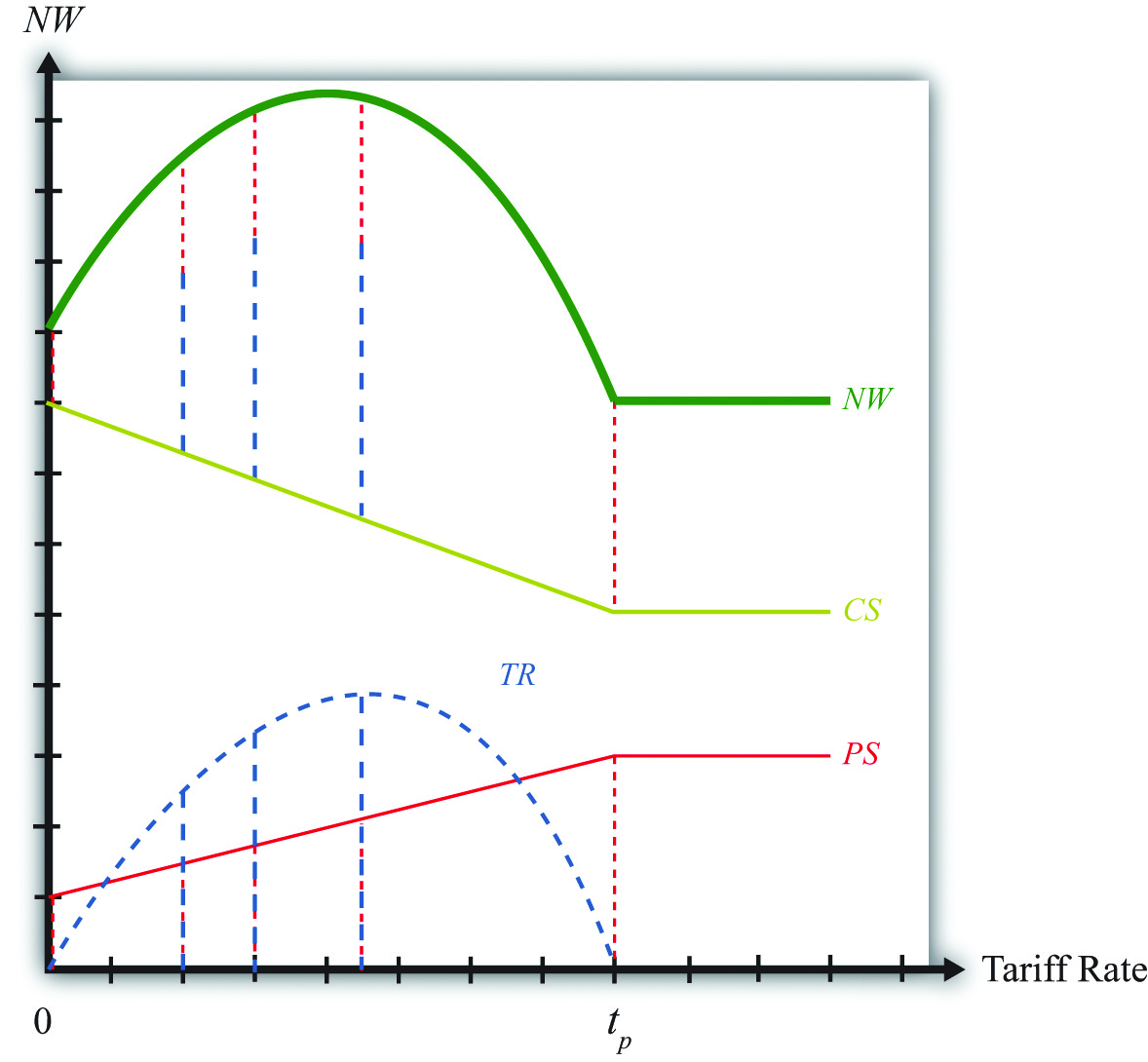

Consider Figure 7.15 "Derivation of the Optimal Tariff: Large Country", which plots the levels of consumer surplus (CS), producer surplus (PS), and tariff revenue (TR) at different tariff rates. The origin corresponds to a zero tariff rate, or free trade. As the tariff is increased from zero, consumer surplus falls since the domestic price rises. This is shown by the solid declining (green) CS line. When the tariff becomes prohibitive at tp, the price settles at the autarky price, and any further increases in the tariff have no effect on consumer surplus. Hence the CS line becomes flat above tp.

Figure 7.15 Derivation of the Optimal Tariff: Large Country

Producer surplus (PS), the red dotted line, rises as the tariff is increased from zero; however, it rises at a lower rate than consumer surplus falls. This occurs because, for an importing country, producer surplus increases are less than the change in consumer surplus for any increase in the tariff. When the prohibitive tariff is reached, again the price settles at the autarky price, and any further increases in the tariff rate have no effect on producer surplus.

Tariff revenue (TR), the blue dashed line, first increases with the increase in the tariff and then decreases for higher tariff rates. This occurs because tariff revenue equals the tariff rate multiplied by imports. As the tariff is increased from zero, imports fall at a slower rate than the increase in the tariff rate, hence revenue rises. Eventually, imports begin to fall faster than the tariff rate rises, and tariff revenue declines. The tariff rate that generates the highest tariff revenue is called the maximum revenue tariffThe tariff that achieves the highest government revenue..

Another way to see that tariff revenue must rise and then fall with increasing tariffs is to note that when the tariff rate is zero, tariff revenue has to be zero for any level of imports. Also, when the tariff rate is at or above tp, the prohibitive tariff, imports are zero, thus whatever the tariff rate, tariff revenue again must be zero. Somewhere between a zero tariff and the prohibitive tariff, tariff revenue has to be positive. Thus tariff revenue must rise from zero and then fall back to zero when it reaches tp.

The national welfare level at each tariff rate is defined as the sum of consumer surplus, producer surplus, and tariff revenue. The vertical summation of these three curves generates the national welfare (NW) curve given by the thick, solid blue-green line. In Figure 7.15 "Derivation of the Optimal Tariff: Large Country", the vertical summation is displayed for five different levels of the tariff rate.

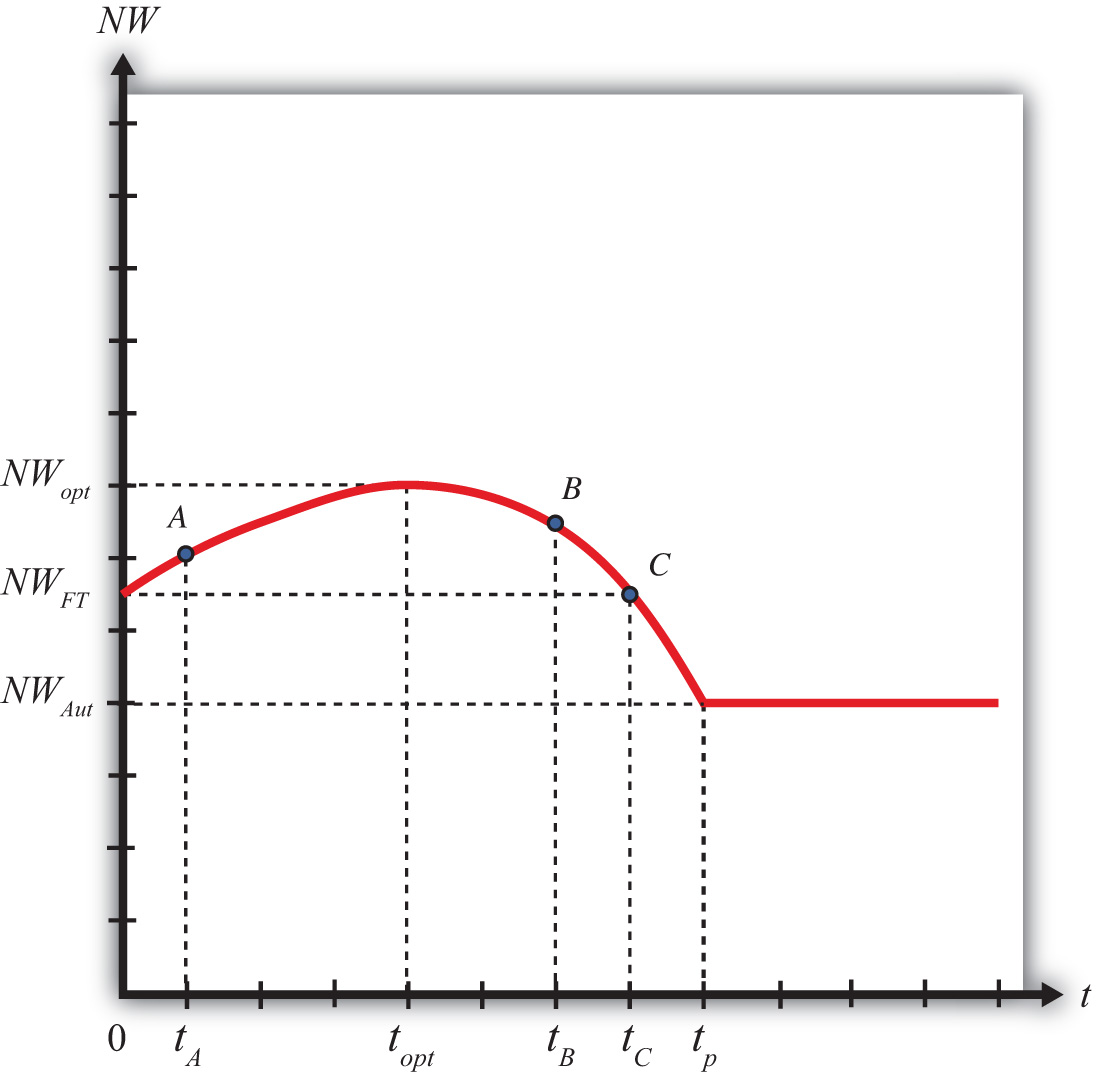

The basic shape of the national welfare line is redrawn in Figure 7.16 "Optimal Tariff: Large Country Case". Note that national welfare first rises and then falls as the tariff is increased from zero. For one tariff rate (topt), the country can realize the highest level of national welfare (NWopt), one that is higher than that achievable in free trade. We call that tariff rate the “optimal tariff.” One regularity that results is that the optimal tariff is always less than the maximum revenue tariff.

Figure 7.16 Optimal Tariff: Large Country Case

If the tariff is raised above the optimal rate, as with an increase from topt to tB, then national welfare will fall. The terms of trade gain, which rises as low tariffs are increased, will begin to fall at a higher tariff rate. Since the deadweight losses continue to rise, both effects contribute to the decline in national welfare. Note, however, that at a tariff level like tB, national welfare still exceeds the free trade level.

Eventually, at even higher tariff rates, national welfare will fall below the free trade level. In Figure 7.16 "Optimal Tariff: Large Country Case", this occurs at tariff rates greater than tC. The higher the tariff is raised, the lower will be the level of imports. At a sufficiently high tariff, imports will be eliminated entirely. The tariff will prohibit trade. At the prohibitive tariff (tp), there is no tariff revenue, which implies that the previously positive terms of trade gain is now zero. The only effect of the tariff is the deadweight loss. The economy is effectively in autarky, at least with respect to this one market, hence national welfare is at NWAut. Note that any additional increases in the tariff above tp will maintain national welfare at NWAut since the market remains at the autarky equilibrium.

The National Welfare Effects of Trade Liberalization for a Large Country

Trade liberalization can be represented by a decrease in the tariff rate on imports into a country. If the country is large in international markets, then the analysis in this chapter suggests that the effect on national welfare will depend on the values of the original tariff rate and the liberalized tariff rate.

For example, if the tariff is reduced from topt to tA, then national welfare will fall when the country liberalizes trade in this market. However, if the tariff is reduced from tB to topt, then national welfare will rise when trade liberalization occurs. This implies that trade liberalization does not necessarily improve welfare for a large importing country.

Key Takeaways

- The optimal tariff is positive for a large importing country.

- National welfare with a zero tariff (free trade) is always higher than national welfare with a prohibitive tariff.

- The maximum revenue tariff is larger than the optimal tariff.

- The reduction of a tariff by a large importing country will lower national welfare if the initial tariff is less than the optimal tariff.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- A term used to describe a tariff that will raise national welfare to the greatest extent for a large importing country.

- The term used to describe the tariff rate that generates the largest amount of government revenue.

- The tariff rate that corresponds to free trade.

- The tariff rate that is just sufficient to eliminate trade with the rest of the world.

- Of higher, lower, or the same, this is how national welfare in free trade compares with national welfare in autarky.

- Of higher, lower, or the same, this is how national welfare at the optimal tariff compares with national welfare in autarky.

- Of higher, lower, or the same, this is how national welfare at the maximum revenue tariff compares with national welfare at the optimal tariff.

- Of higher, lower, or the same, this is how producer welfare in free trade compares with producer welfare in autarky.

- Of higher, lower, or the same, this is how consumer welfare in free trade compares with consumer welfare in autarky.

7.7 Import Tariffs: Small Country Price Effects

Learning Objectives

- Identify the effects of a specific tariff on prices in both countries and the quantity traded.

- Know the equilibrium conditions that must prevail in a tariff equilibrium.

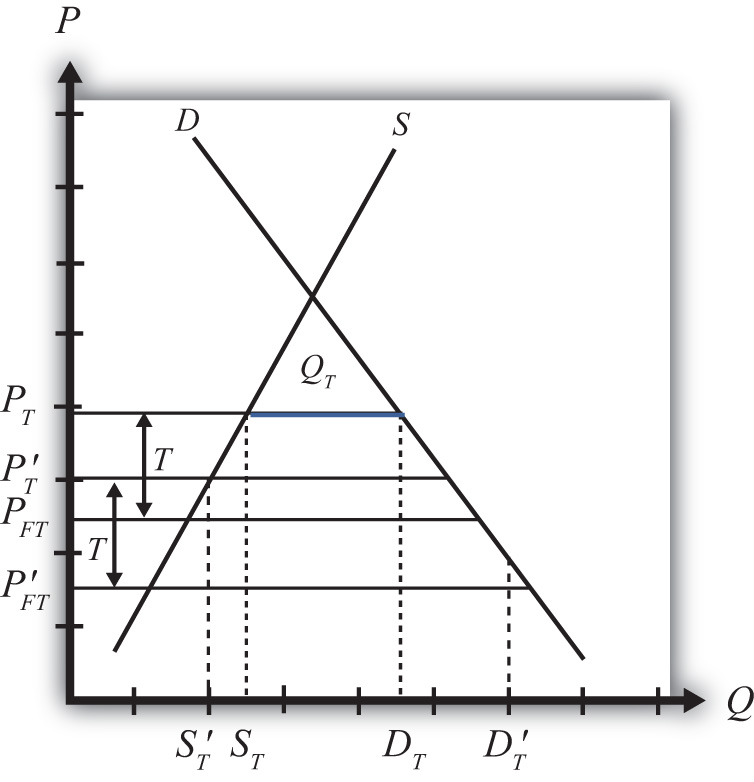

The small country assumption means that the country’s imports are a very small share of the world market—so small that even a complete elimination of imports would have an imperceptible effect on world demand for the product and thus would not affect the world price. Thus when a tariff is implemented by a small country, there is no effect on the world price.

The small country assumption implies that the export supply curve is horizontal at the level of the world price. The small importing country takes the world price as exogenous since it can have no effect on it. The exporter is willing to supply as much of the product as the importer wants at the given world price.

When the tariff is placed on imports, two conditions must hold in the final equilibrium—the same two conditions as in the case of a large country—namely,

and

However, now PTUS remains at the free trade price. This implies that, in the case of a small country, the price of the import good in the importing country will rise by the amount of the tariff, or in other words . As seen in Figure 7.17 "Depicting a Tariff Equilibrium: Small Country Case", the higher domestic price reduces import demand and export supply to QT.

Figure 7.17 Depicting a Tariff Equilibrium: Small Country Case

Key Takeaways

- An import tariff will raise the domestic price and, in the case of a small country, leave the foreign price unchanged.

- An import tariff will reduce the quantity of imports.

- An import tariff will raise the domestic price of imports and import-competing goods by the full amount of the tariff.

- With the tariff in place in a two-country model, export supply at the unchanged foreign price will equal import demand at the higher domestic price.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The world price of butter if a small country has a tariff of $0.50 per pound in place and butter sells for $4.50 per pound.

- The amount the domestic auto price rises if a small country places a $100 tariff on auto imports.

- Of increase, decrease, or stay the same, the effect on the world price when a small importing country implements a tariff.

- Of increase, decrease, or stay the same, the effect on the import volume of a product when a small importing country implements a tariff.

- Of increase, decrease, or stay the same, the effect on the exports from the rest of the world when a small importing country implements a tariff on the product.

7.8 Import Tariffs: Small Country Welfare Effects

Learning Objectives

- Use a partial equilibrium diagram to identify the welfare effects of an import tariff on producer and consumer groups and the government in the importing country.

- Calculate the national welfare effects of an import tariff.

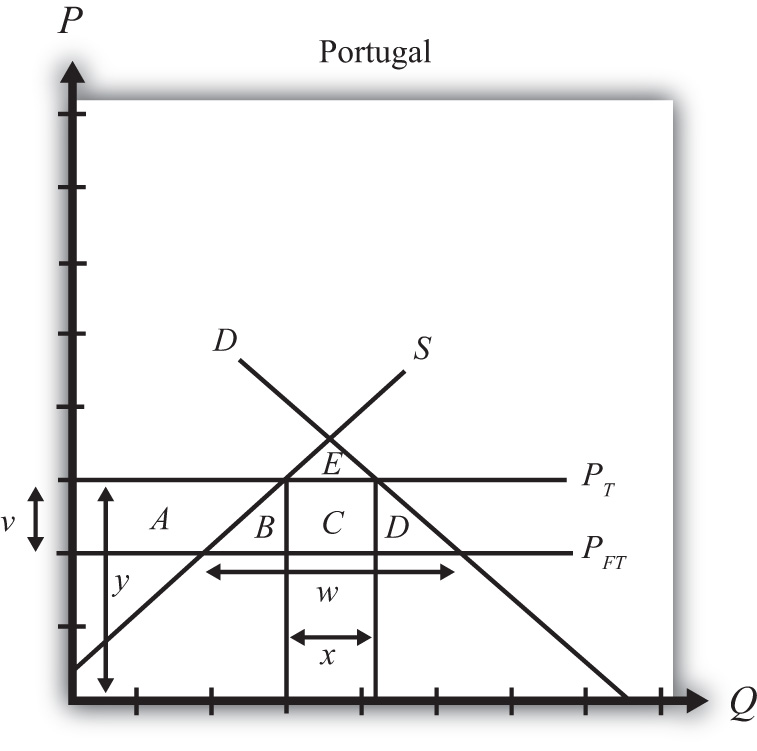

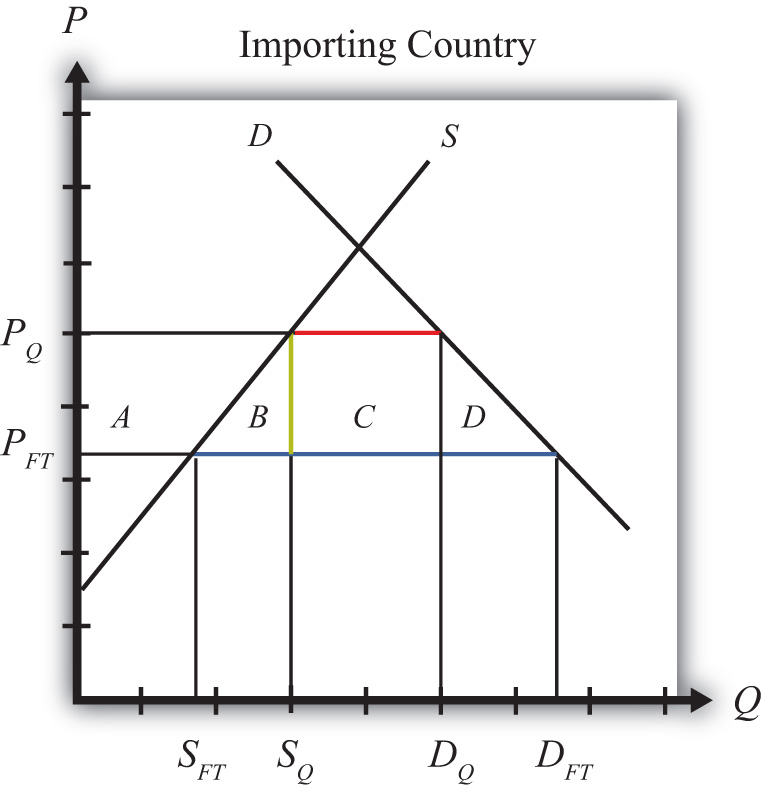

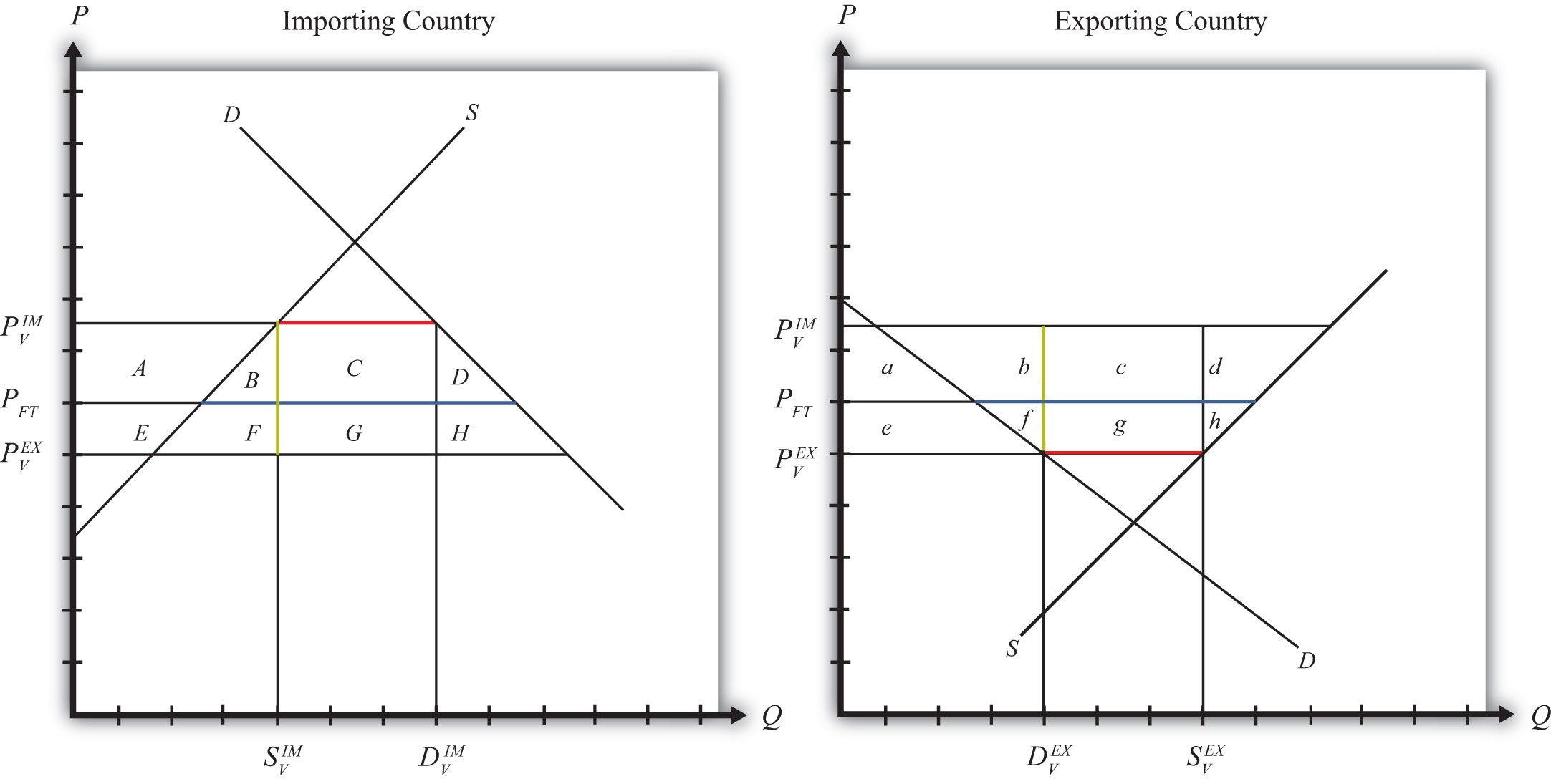

Consider a market in a small importing country that faces an international or world price of PFT in free trade. The free trade equilibrium is depicted in Figure 7.18 "Welfare Effects of a Tariff: Small Country Case", where PFT is the free trade equilibrium price. At that price, domestic demand is given by DFT, domestic supply by SFT, and imports by the difference DFT − SFT (the blue line in the figure).

Figure 7.18 Welfare Effects of a Tariff: Small Country Case

When a specific tariff is implemented by a small country, it will raise the domestic price by the full value of the tariff. Suppose the price in the importing country rises to because of the tariff. In this case, the tariff rate would be , equal to the length of the green line segment in the figure.

Table 7.3 "Welfare Effects of an Import Tariff" provides a summary of the direction and magnitude of the welfare effects to producers, consumers, and the governments in the importing country. The aggregate national welfare effect is also shown.

Table 7.3 Welfare Effects of an Import Tariff

| Importing Country | |

|---|---|

| Consumer Surplus | − (A + B + C + D) |

| Producer Surplus | + A |

| Govt. Revenue | + C |

| National Welfare | − B − D |

Refer to Table 7.3 "Welfare Effects of an Import Tariff" and Figure 7.18 "Welfare Effects of a Tariff: Small Country Case" to see how the magnitudes of the changes are represented.

Tariff effects on the importing country’s consumers. Consumers of the product in the importing country are worse off as a result of the tariff. The increase in the domestic price of both imported goods and the domestic substitutes reduces consumer surplus in the market.

Tariff effects on the importing country’s producers. Producers in the importing country are better off as a result of the tariff. The increase in the price of their product increases producer surplus in the industry. The price increases also induce an increase in the output of existing firms (and perhaps the addition of new firms), an increase in employment, and an increase in profit, payments, or both to fixed costs.

Tariff effects on the importing country’s government. The government receives tariff revenue as a result of the tariff. Who will benefit from the revenue depends on how the government spends it. These funds help support diverse government spending programs; therefore, someone within the country will be the likely recipient of these benefits.

Tariff effects on the importing country. The aggregate welfare effect for the country is found by summing the gains and losses to consumers, producers, and the government. The net effect consists of two components: a negative production efficiency loss (B) and a negative consumption efficiency loss (D). The two losses together are typically referred to as “deadweight losses.”

Because there are only negative elements in the national welfare change, the net national welfare effect of a tariff must be negative. This means that a tariff implemented by a small importing country must reduce national welfare.

In summary, the following are true:

- Whenever a small country implements a tariff, national welfare falls.

- The higher the tariff is set, the larger will be the loss in national welfare.

- The tariff causes a redistribution of income. Producers and the recipients of government spending gain, while consumers lose.

- Because the country is assumed to be small, the tariff has no effect on the price in the rest of the world; therefore, there are no welfare changes for producers or consumers there. Even though imports are reduced, the related reduction in exports by the rest of the world is assumed to be too small to have a noticeable impact.

Key Takeaways

- An import tariff lowers consumer surplus and raises producer surplus in the import market.

- An import tariff by a small country has no effect on consumers, producers, or national welfare in the foreign country.

- The national welfare effect of an import tariff is evaluated as the sum of the producer and consumer surplus and government revenue effects.

- An import tariff of any size will result in deadweight losses and reduce production and consumption efficiency.

- National welfare falls when a small country implements an import tariff.

Exercises

-

Consider the following trade policy action (applied by the domestic country) listed along the top row of the table below. In the empty boxes, use the following notation to indicate the effect of the policy on the variables listed in the first column. Use a partial equilibrium model to determine the answers, and assume that the shapes of the supply and demand curves are “normal.” Assume that the policy does not begin with, or result in, prohibitive trade policies. Also assume that the policy does not correct for market imperfections or distortions. Use the following notation:

+ the variable increases

− the variable decreases

0 the variable does not change

A the variable change is ambiguous (i.e., it may rise, it may fall)

Table 7.4 Trade Policy Effects

Import Tariff Reduction by a Small Country Domestic Market Price Domestic Industry Employment Domestic Consumer Welfare Domestic Producer Welfare Domestic Government Revenue Domestic National Welfare Foreign Price Foreign Consumer Welfare Foreign Producer Welfare Foreign National Welfare -

Consider the following partial equilibrium diagram depicting the market for radios in Portugal, a small importing country. Suppose PFT is the free trade price and PT is the price in Portugal when a tariff is in place. Answer the following questions by referring to the diagram. Assume the letters, A, B, C, D, and E refer to areas on the graph. The letters v, w, x, and y refer to lengths. (Be sure to include the direction of changes by indicating “+” or “−.”)

Figure 7.19 A Small Trading Country

- Where on the graph is the level of imports in free trade?

- Which area or areas represent the level of consumer surplus in free trade?

- Which area or areas represent the level of producer surplus in free trade?

- Where on the graph is the size of the tariff depicted?

- Where on the graph is the level of imports after the tariff depicted?

- Which area or areas represent the tariff revenue collected by the importing government with the tariff in place?

- Which area or areas represent the change (+/−) in consumer surplus when the tariff is applied?

- Which area or areas represent the change (+/−) in producer surplus when the tariff is applied?

- Which area or areas represent the change (+/−) in national welfare when the tariff is applied?

- Which area or areas represent the efficiency losses that arise with the tariff?

7.9 Retaliation and Trade Wars

Learning Objectives

- Identify the key components to describe an economic game, including players, strategies, objectives, and equilibrium concepts.

- Determine both noncooperative and cooperative equilibria in an economic game.

The analysis of tariffs in a perfectly competitive market demonstrates that if a large country imposes a relatively small tariff, or if it imposes an optimal tariff, then domestic national welfare will rise but foreign national welfare will fall. The partial equilibrium analysis shows further that national welfare losses to the exporting nation exceed the national welfare gains to the importing nation. The reason is that any tariff set by a large country also reduces world welfare.

If we assume that nations are concerned about the national welfare effects of trade policies, then the tariff analysis provides a rationale for protectionism on the part of large importing nations. However, if large importing nations set optimal tariffs on all or many of their imported goods, the effect internationally will be to reduce the national welfare of its trading partners. If the trade partners are also concerned about their own national welfare, then they would likely find the optimal tariffs objectionable and would look for ways to mitigate the negative effects.

One effective way to mitigate the loss in national welfare, if the trade partners are also large countries, is to retaliate with optimal tariffs on your own imported goods. Thus if country A imports wine, cheese, and wheat from country B, and A places optimal tariffs on imports of these products, then country B could retaliate by imposing optimal tariffs on its imports of, say, lumber, televisions, and machine tools from country A. By doing so, country B could offset its national welfare losses in one set of markets with national welfare gains in another set.

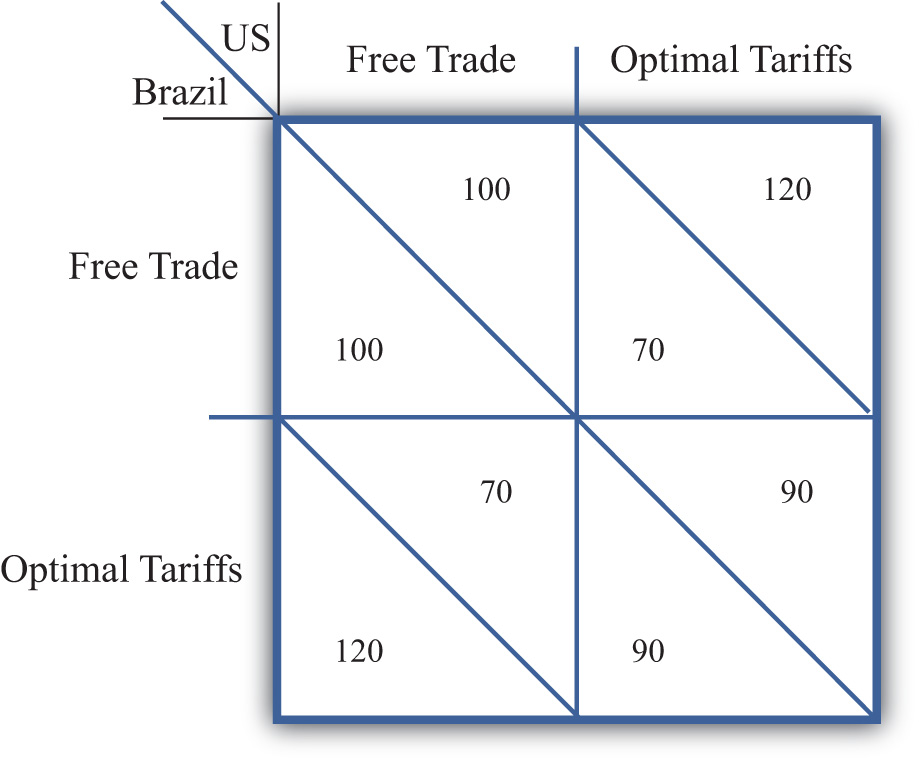

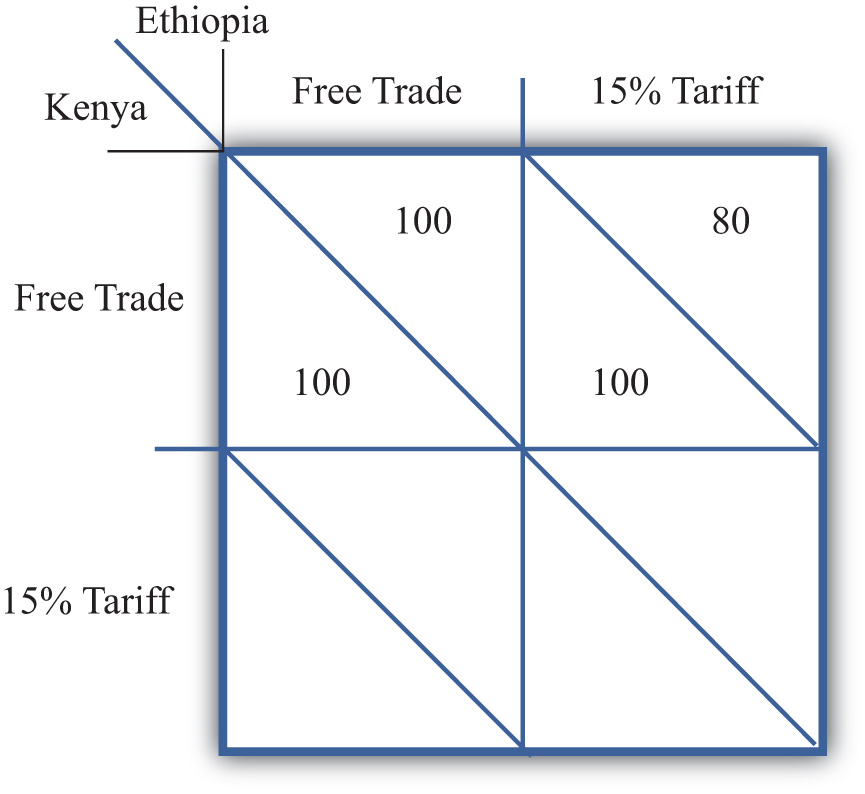

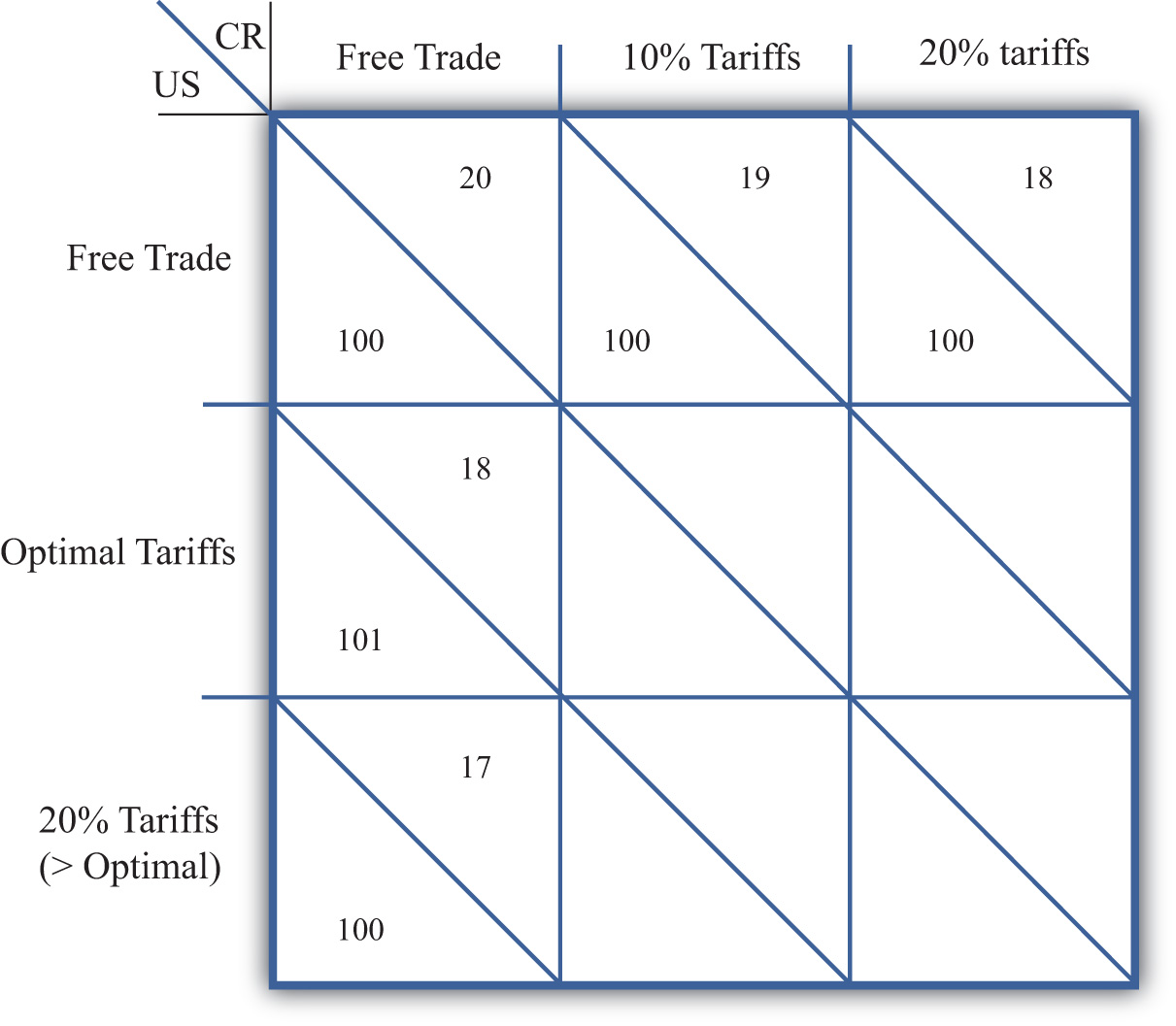

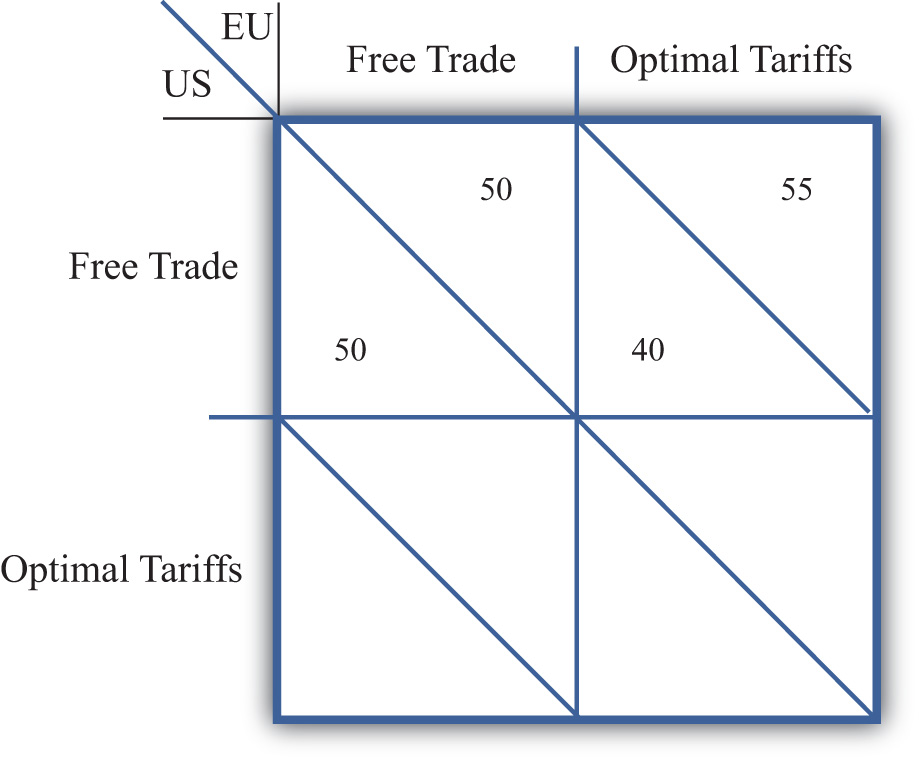

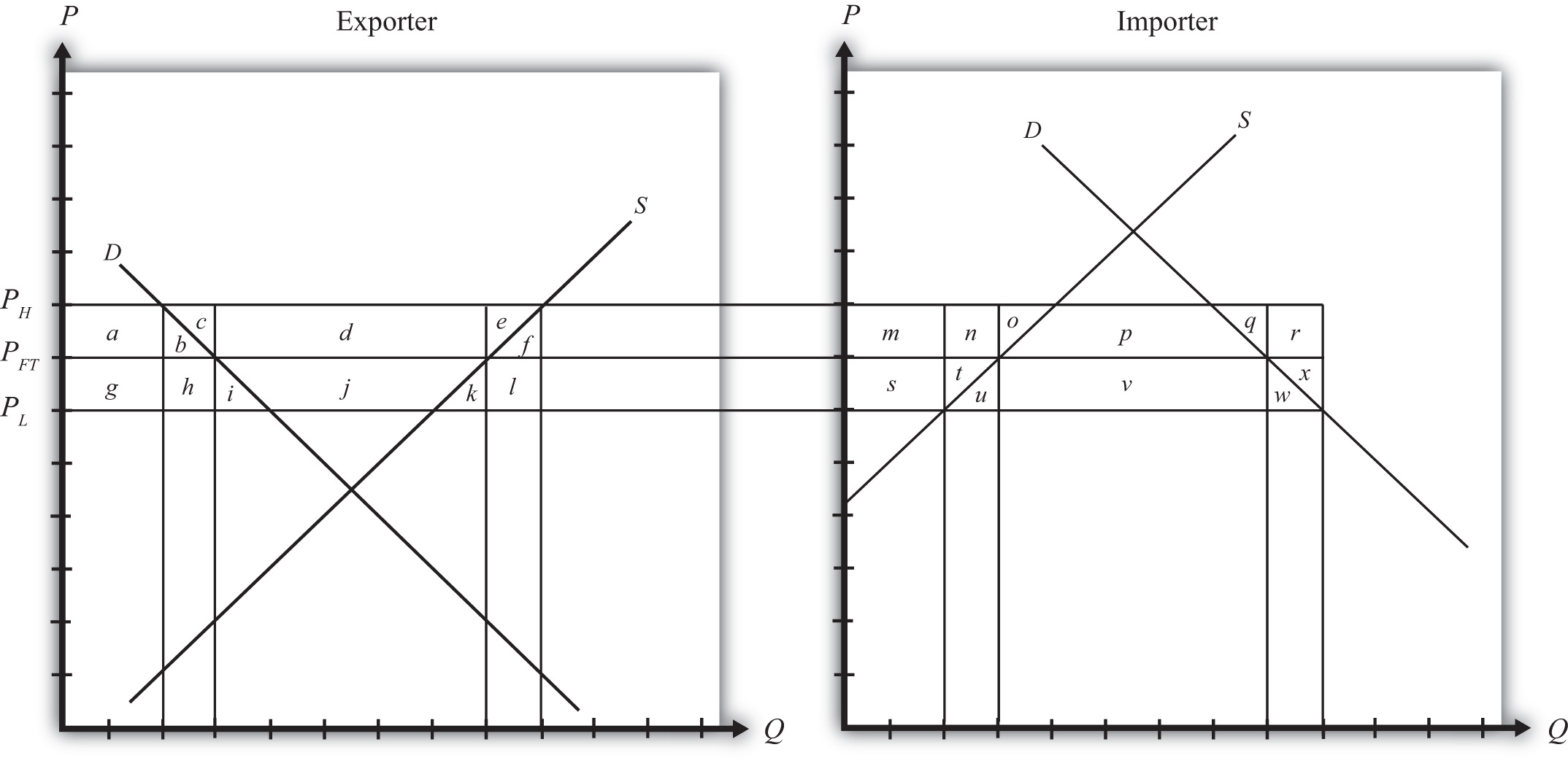

Figure 7.20 A Trade Policy Game

We examine the effects of optimal tariffs and retaliation more formally by using a simple game theory setup. Suppose the players in the game are the governments of two large countries, the United States and Brazil. Suppose the United States imports a set of products (A, B, C, etc.) from Brazil, while Brazil imports a different set of products (X, Y, Z, etc.) from the United States. We imagine that each country’s government must choose between two distinct trade policies, free trade and optimal tariffs. Each policy choice represents a game strategy. If the United States chooses free trade, then it imposes no tariffs on imports of goods A, B, C, and so on. If the United States chooses optimal tariffs, then it determines the optimal tariff in each import market and sets the tariff accordingly. Brazil is assumed to have the same set of policy choices available.

In Figure 7.20 "A Trade Policy Game", U.S. strategies are represented by the two columns; Brazilian strategies correspond to the two rows. The numbers represent the payoffs to the countries, measured as the level of national welfare realized in each country in each of the four possible scenarios. For example, if the United States chooses a free trade policy and Brazil chooses to impose optimal tariffs, then the payoffs are shown in the lower left-hand box. The Brazilian payoff is below the diagonal, while the U.S. payoff is above the diagonal. Thus Brazil gets 120 units of welfare, while the United States gets 70 units.

Note that the size of the numbers used in the example is immaterial, but how they relate to the numbers in alternate boxes is not. We will use the results from the tariff analysis section to inform us about the relationship between the numbers.

To begin, let’s assume that each country receives 100 units of national welfare when both the United States and Brazil choose free trade. If Brazil decides to impose optimal tariffs on all of its imports and the United States maintains its free trade position, then a partial equilibrium welfare analysis suggests the following:

- Brazilian welfare will rise (we’ll assume from 100 to 120 units).

- U.S. welfare will fall (we’ll assume from 100 to 70 units).

- World welfare will fall (thus the sum of the U.S. and Brazilian welfare initially is 200 units but falls to 120 + 70 = 190 afterward).

Similarly, if the United States imposes optimal tariffs on all of its imports while Brazil maintains free trade, then the countries will realize the payoffs in the upper right-hand box. The United States would get 120 units of welfare, while Brazil would get 70. To keep the example simple, we are assuming that the effects of tariffs are symmetric. In other words, the effect of U.S. optimal tariffs on the two countries is of the same magnitude as the effects of Brazilian tariffs.

Finally, if both countries set optimal tariffs against each other, then we can simply sum up the total effects. Since each country’s actions raise its own welfare by 20 units and lower its trade partner’s welfare by 30 units, when both countries impose tariffs, national welfare falls to 90 units in each country.

To determine which strategy the two governments would choose in this game, we need to identify the objectives of the players and the degree of cooperation. Initially, we will assume that each government is interested in maximizing its own national welfare and that the governments do not cooperate with each other. Afterward, we will consider the outcome when the governments do cooperate.