This is “Import Tariffs: Small Country Price Effects”, section 7.7 from the book Policy and Theory of International Trade (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

7.7 Import Tariffs: Small Country Price Effects

Learning Objectives

- Identify the effects of a specific tariff on prices in both countries and the quantity traded.

- Know the equilibrium conditions that must prevail in a tariff equilibrium.

The small country assumption means that the country’s imports are a very small share of the world market—so small that even a complete elimination of imports would have an imperceptible effect on world demand for the product and thus would not affect the world price. Thus when a tariff is implemented by a small country, there is no effect on the world price.

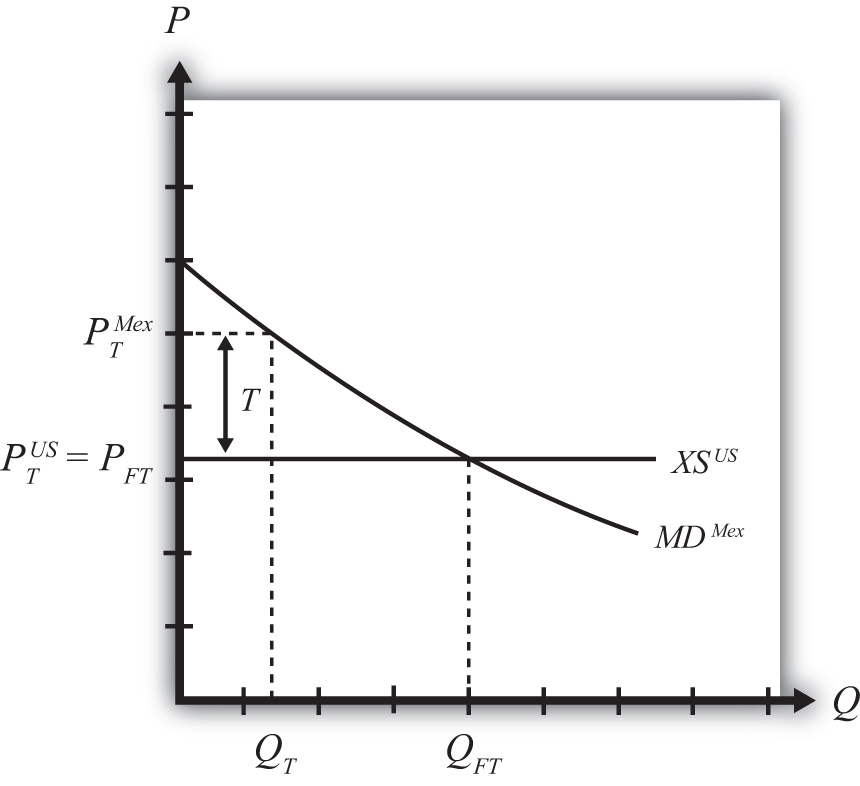

The small country assumption implies that the export supply curve is horizontal at the level of the world price. The small importing country takes the world price as exogenous since it can have no effect on it. The exporter is willing to supply as much of the product as the importer wants at the given world price.

When the tariff is placed on imports, two conditions must hold in the final equilibrium—the same two conditions as in the case of a large country—namely,

and

However, now PTUS remains at the free trade price. This implies that, in the case of a small country, the price of the import good in the importing country will rise by the amount of the tariff, or in other words . As seen in Figure 7.17 "Depicting a Tariff Equilibrium: Small Country Case", the higher domestic price reduces import demand and export supply to QT.

Figure 7.17 Depicting a Tariff Equilibrium: Small Country Case

Key Takeaways

- An import tariff will raise the domestic price and, in the case of a small country, leave the foreign price unchanged.

- An import tariff will reduce the quantity of imports.

- An import tariff will raise the domestic price of imports and import-competing goods by the full amount of the tariff.

- With the tariff in place in a two-country model, export supply at the unchanged foreign price will equal import demand at the higher domestic price.

Exercise

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- The world price of butter if a small country has a tariff of $0.50 per pound in place and butter sells for $4.50 per pound.

- The amount the domestic auto price rises if a small country places a $100 tariff on auto imports.

- Of increase, decrease, or stay the same, the effect on the world price when a small importing country implements a tariff.

- Of increase, decrease, or stay the same, the effect on the import volume of a product when a small importing country implements a tariff.

- Of increase, decrease, or stay the same, the effect on the exports from the rest of the world when a small importing country implements a tariff on the product.