This is “Effect of an Increase in the U.S. Dollar Value on Real GNP”, section 8.11 from the book Policy and Theory of International Finance (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

8.11 Effect of an Increase in the U.S. Dollar Value on Real GNP

Learning Objective

- Learn how a change in the U.S. dollar value affects equilibrium GNP.

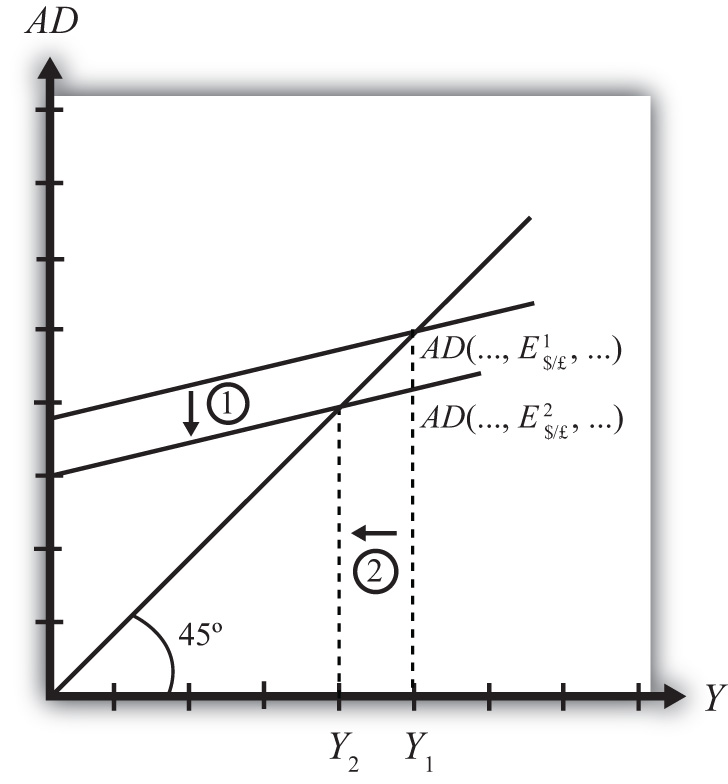

Suppose the economy is initially in equilibrium in the G&S market with the exchange rate at level E$/£1 and real GNP at Y1 as shown in Figure 8.5 "Effect of an Increase in the U.S. Dollar Value in the G&S Market". The initial AD function is written as AD(…, E$/£1, …) to signify the level of the exchange rate and to denote that other variables affect AD and are at some initial and unspecified values.

Figure 8.5 Effect of an Increase in the U.S. Dollar Value in the G&S Market

Next, suppose the U.S. dollar value rises, corresponding to a decrease in the exchange rate from E$/£1 to E$/£2, ceteris paribus. As explained in Chapter 8 "National Output Determination", Section 8.6 "Export and Import Demand", the increase in the spot dollar value also increases the real dollar value, causing foreign G&S to become relatively cheaper and U.S. G&S to become more expensive. This change reduces demand for U.S. exports and increases import demand, resulting in a reduction in aggregate demand. The ceteris paribus assumption means that all other exogenous variables are assumed to remain fixed.

Since the higher dollar value lowers aggregate demand, the AD function shifts down from AD(…, E$/£1, …) to AD(…, E$/£2, …) (step 1), and equilibrium GNP in turn falls to Y2 (step 2). Thus the increase in the U.S. dollar value causes a decrease in real GNP.

The adjustment process follows the “GNP too high” story. When the dollar value rises but before GNP falls to adjust, Y1 > AD. The excess supply of G&S raises inventories, causing merchants to decrease order size. This leads firms to decrease output, lowering GNP.

Key Takeaway

- In the G&S model, an increase (decrease) in the U.S. dollar value causes a decrease (increase) in real GNP.

Exercises

-

Jeopardy Questions. As in the popular television game show, you are given an answer to a question and you must respond with the question. For example, if the answer is “a tax on imports,” then the correct question is “What is a tariff?”

- Of increase, decrease, or stay the same, the effect on equilibrium real U.S. GNP from a decrease in the value of the U.S. dollar in the G&S model.

- Of increase, decrease, or stay the same, the effect on equilibrium real GNP caused by an increase in the value of the U.S. dollar in the G&S model.

- Of GNP too low or GNP too high, the equilibrium story that must be told following an increase in the value of the U.S. dollar in the G&S model.

- Of GNP too low or GNP too high, the equilibrium story that must be told following a decrease in the value of the U.S. dollar in the G&S model.

-

In the text, the effect of a change in the currency value is analyzed. Use the G&S model (diagram) to individually assess the effect on equilibrium GNP caused by the following changes. Assume ceteris paribus.

- A decrease in the real currency value.

- An increase in the domestic price level.

- An increase in the foreign price level.