This is “Review and Practice”, section 17.4 from the book Microeconomics Principles (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

17.4 Review and Practice

Summary

In this chapter we have seen how international trade makes it possible for countries to improve on their domestic production possibilities.

A country that is operating on its production possibilities curve can obtain more of all goods by opening its markets to free international trade. Free trade allows nations to consume goods beyond their domestic production possibilities curves. If nations specialize in the production of goods and services in which they have a comparative advantage, total output increases. Free trade enhances production possibilities on a worldwide scale. It does not benefit everyone, however. Some workers and owners of other factors of production will be hurt by free trade, at least in the short run.

Contrary to the implication of the model of specialization based on comparative advantage, not all trade is one-way trade. Two-way trade in the same goods may arise from variations in transportation costs and seasonal influences. Two-way trade in similar goods is often the result of imperfect competition. Much trade among high-income countries is two-way trade.

The imposition of trade barriers such as tariffs, antidumping proceedings, quotas, or voluntary export restrictions raises the equilibrium price and reduces the equilibrium quantity of the restricted good. Although there are many arguments in favor of such restrictions on free trade, economists generally are against protectionist measures and supportive of free trade.

Concept Problems

- Explain how through trade a country can consume at levels beyond the reach of its production possibilities.

- Why do countries place restrictions on international trade?

- What is the difference between a tariff and a quota?

- The Case in Point on America’s shifting comparative advantage suggests that the United States may have a comparative advantage over other countries in the production of high-tech capital goods. What do you think might be the sources of this advantage?

- “I know a lawyer who can type 100 words per minute but pays a secretary $10 per hour to type court briefs. But the secretary can only type 50 words per minute. I have told my lawyer friend a hundred times she would be better off doing the typing herself, but she just will not listen.” Who has the better part of this disagreement, the lawyer or the friend? Explain.

- Which individuals in the United States might benefit from a tariff placed on the importation of shoes? Who might lose?

- Explain why economists argue that protectionist policies lead to the misallocation of resources in the domestic economy.

- Tomatoes grow well in Kansas. Why do the people of Kansas buy most of their tomatoes from Florida, Mexico, and California?

- Under what circumstances will a country both export and import the products of the same industry?

- Suppose the United States imposes a quota on copper imports. Who might be helped? Who might be hurt?

- Some people argue that international trade is fine, but that firms in different countries should play on a “level playing field.” They argue that if a good can be produced more cheaply abroad than at home, tariffs should be imposed on the good so that the costs of producing it are the same everywhere. What do you think of this argument?

- Suppose wages in the Philippines are one-tenth of wages in the United States. Why do all U.S. firms not just move production to the Philippines?

Numerical Problems

-

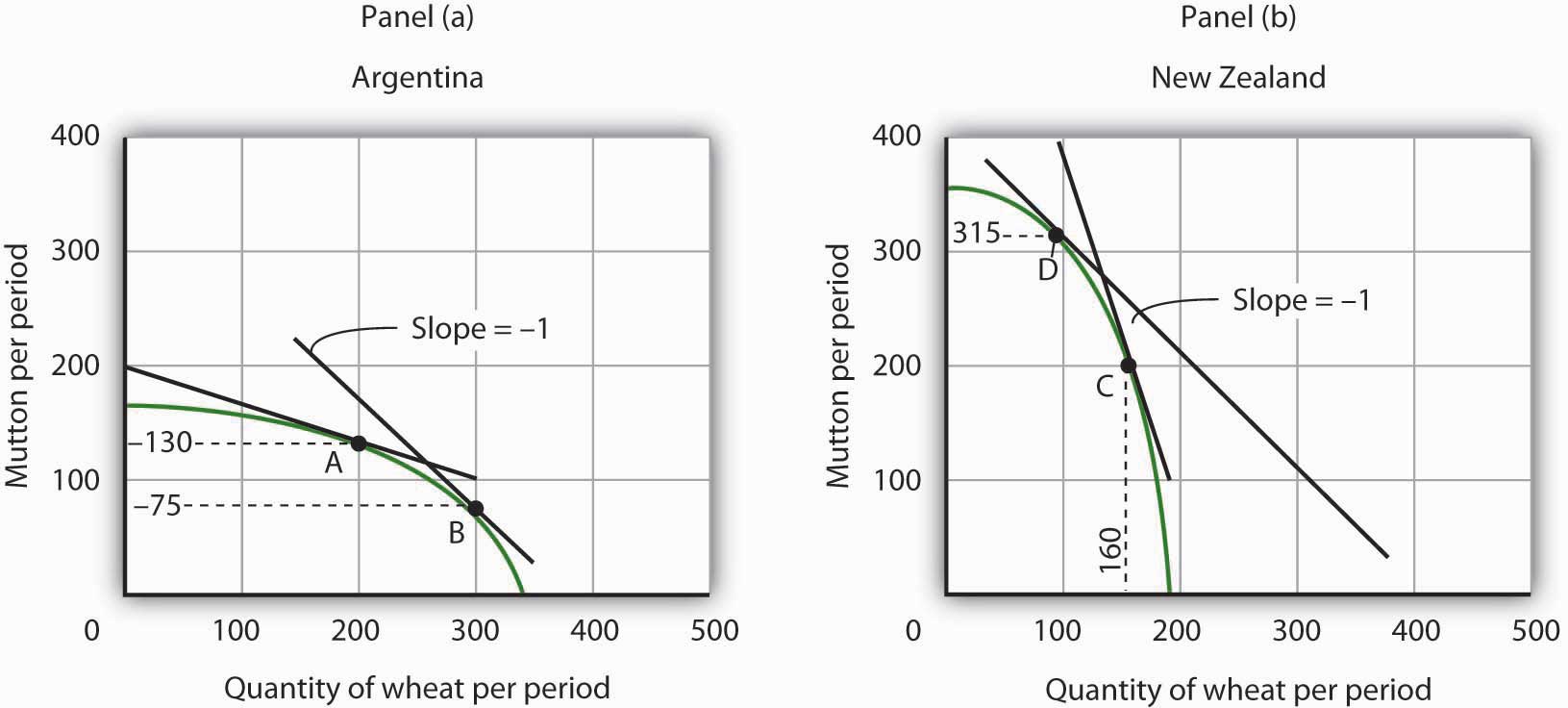

Argentina and New Zealand each produce wheat and mutton under conditions of perfect competition, as shown on the accompanying production possibilities curves. Assume that there is no trade between the two countries and that Argentina is now producing at point A and New Zealand at point C.

- What is the opportunity cost of producing each good in Argentina?

- What is the opportunity cost of producing each good in New Zealand?

- Which country has a comparative advantage in which good? Explain.

- Explain how international trade would affect wheat production in Argentina.

- How would international trade affect mutton production?

- Explain how international trade would affect wheat production in New Zealand. How would it affect mutton production?

- How would trade between the two countries affect consumption of wheat and mutton in each country?

- Assume that trade opens between Argentina and New Zealand and that, with trade, a pound of mutton exchanges for a bushel of wheat. Before trade, Argentina produced at point A and New Zealand produced at point C. Argentina moves to point B, while New Zealand moves to point D. Calculate and illustrate graphically an exchange between Argentina and New Zealand that would leave both countries with more of both goods than they had before trade.

-

Assume that the world market for producing radios is monopolistically competitive. Suppose that the price of a typical radio is $25.

- Why is this market likely to be characterized by two-way trade?

- Suppose that Country A levies a tax of $5 on each radio produced within its borders. Will radios continue to be produced in Country A? If they are, what will happen to their price? If they are not, who will produce them?

- If you concluded that radios will continue to be produced in Country A, explain what will happen to their price in the short run. Illustrate your answer graphically.

- What will happen to their price in the long run?

-

Suppose radio producers in Country A file a successful anti-dumping complaint against their competitors, and that the result is the imposition of a $10 per radio tariff on imported radios.

- Illustrate and explain how the $10 tariff will affect radio producers in Country A in the short run.

- Illustrate and explain how the $10 tariff will affect radio producers in Country A in the long run.

- How will the level of employment be affected in Country A?

- Explain how the tariff will affect consumers in Country A. Who will benefit from the anti-dumping action? Who will bear the burden of the action?