This is “Interest Rates and the Markets for Capital and Natural Resources”, chapter 13 from the book Microeconomics Principles (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 13 Interest Rates and the Markets for Capital and Natural Resources

Start Up: Building the “Internet in the Sky”

The race to build the “Internet in the Sky” started in the early 1990s. One plan was to build 840 low earth-orbiting (LEO) satellites that would allow information to be sent and received instantaneously anywhere on the face of the globe. At least that was the plan.

A number of telecommunication industry giants, as well as some large manufacturing companies, were impressed with the possibilities. They saw what they thought was a profitable opportunity and decided to put up some financial capital. Craig McCaw, who made a fortune developing and then selling to AT&T, the world’s largest cellular phone network, became chair of Teledesic, the company he formed to build the LEO satellite system. McCaw put up millions of dollars to fund the project, as did Microsoft’s Bill Gates and Prince Alwaleed Bin Talal Bin Abdulaziz of Saudi Arabia. Boeing, Motorola, and Matra Marconi Space, Europe’s leading satellite manufacturer, became corporate partners. Altogether, the company raised almost a billion dollars. The entire project was estimated to cost $9 billion.

But, alas, a decade later the company had shifted into very low gear. From the initial plan for 840 satellites, the project was scaled back to 300 satellites and then to a mere 30. Then, in 2003 in a letter to the U.S. Federal Communications commission, it announced that it was giving up its license to use a large part of the radio spectrum.Peter B. De Selding, “Teledesic Plays Its Last Card, Leaves the Game,” Space News Business Report online, July 7, 2005.

What happened to this dream? The development of cellular networks to handle data and video transmissions may have made the satellite system seem unnecessary. In contrast to a satellite system that has to be built in total in order to bring in a single customer, wireless companies were able to build their customer base city by city.

Even if the project had become successful, the rewards to the companies and to the individuals that put their financial capital into the venture would have been a long time in coming. Service was initially scheduled to begin in 2001, but Teledesic did not even sign a contract to build its first two satellites until February 2002, and six months later the company announced that work on those had been suspended.

Teledesic’s proposed venture was bigger than most capital projects, but it shares some basic characteristics with any acquisition of capital by firms. The production of capital—the goods used in producing other goods and services—requires sacrificing consumption. The returns to capital will be spread over the period in which the capital is used. The choice to acquire capital is thus a choice to give up consumption today in hopes of returns in the future. Because those returns are far from certain, the choice to acquire capital is inevitably a risky one.

For all its special characteristics, however, capital is a factor of production. As we investigate the market for capital, the concepts of marginal revenue product, marginal factor cost, and the marginal decision rule that we have developed will continue to serve us. The big difference is that the benefits and costs of holding capital are distributed over time.

We will also examine markets for natural resources in this chapter. Like decisions involving capital, choices in the allocation of natural resources have lasting effects. For potentially exhaustible natural resources such as oil, the effects of those choices last forever.

For the analysis of capital and natural resources, we shift from the examination of outcomes in the current period to the analysis of outcomes distributed over many periods. Interest rates, which link the values of payments that occur at different times, will be central to our analysis.

13.1 Time and Interest Rates

Learning Objectives

- Define interest and the interest rate.

- Describe and show algebraically how to compute present value.

- List and explain the factors that affect what the present value of some future payment will be.

Time, the saying goes, is nature’s way of keeping everything from happening all at once. And the fact that everything does not happen at once introduces an important complication in economic analysis.

When a company decides to use funds to install capital that will not begin to produce income for several years, it needs a way to compare the significance of funds spent now to income earned later. It must find a way to compensate financial investors who give up the use of their funds for several years, until the project begins to pay off. How can payments that are distributed across time be linked to one another? Interest rates are the linkage mechanism; we shall investigate how they achieve that linkage in this section.

The Nature of Interest Rates

Consider a delightful problem of choice. Your Aunt Carmen offers to give you $10,000 now or $10,000 in one year. Which would you pick?

Most people would choose to take the payment now. One reason for that choice is that the average level of prices is likely to rise over the next year. The purchasing power of $10,000 today is thus greater than the purchasing power of $10,000 a year hence. There is also a question of whether you can count on receiving the payment. If you take it now, you have it. It is risky to wait a year; who knows what will happen?

Let us eliminate both of these problems. Suppose that you are confident that the average level of prices will not change during the year, and you are absolutely certain that if you choose to wait for the payment, you and it will both be available. Will you take the payment now or wait?

Chances are you would still want to take the payment now. Perhaps there are some things you would like to purchase with it, and you would like them sooner rather than later. Moreover, if you wait a year to get the payment, you will not be able to use it while you are waiting. If you take it now, you can choose to spend it now or wait.

Now suppose Aunt Carmen wants to induce you to wait and changes the terms of her gift. She offers you $10,000 now or $11,000 in one year. In effect, she is offering you a $1,000 bonus if you will wait a year. If you agree to wait a year to receive Aunt Carmen’s payment, you will be accepting her promise to provide funds instead of the funds themselves. Either will increase your wealthThe sum of assets less liabilities., which is the sum of all your assets less all your liabilities. AssetsAnything of value. are anything you have that is of value; liabilitiesObligations to make future payments. are obligations to make future payments. Both a $10,000 payment from Aunt Carmen now and her promise of $11,000 in a year are examples of assets. The alternative to holding wealth is to consume it. You could, for example, take Aunt Carmen’s $10,000 and spend it for a trip to Europe, thus reducing your wealth. By making a better offer—$11,000 instead of $10,000—Aunt Carmen is trying to induce you to accept an asset you will not be able to consume during the year.

The $1,000 bonus Aunt Carmen is offering if you will wait a year for her payment is interest. In general, interestA payment made to people who agree to postpone their use of wealth. is a payment made to people who agree to postpone their use of wealth. The interest rateThe opportunity cost of using wealth today, expressed as a percentage of the amount of wealth whose use is postponed. represents the opportunity cost of using wealth today, expressed as a percentage of the amount of wealth whose use is postponed. Aunt Carmen is offering you $1,000 if you will pass up the $10,000 today. She is thus offering you an interest rate of 10% ( ).

Suppose you tell Aunt Carmen that, given the two options, you would still rather have the $10,000 today. She now offers you $11,500 if you will wait a year for the payment—an interest rate of 15% ( ). The more she pays for waiting, the higher the interest rate.

You are probably familiar with the role of interest rates in loans. In a loan, the borrower obtains a payment now in exchange for promising to repay the loan in the future. The lender thus must postpone his or her use of wealth until the time of repayment. To induce lenders to postpone their use of their wealth, borrowers offer interest. Borrowers are willing to pay interest because it allows them to acquire the sum now rather than having to wait for it. And lenders require interest payments to compensate them for postponing their own use of their wealth.

Interest Rates and Present Value

We saw in the previous section that people generally prefer to receive a payment of some amount today rather than wait to receive that same amount later. We may conclude that the value today of a payment in the future is less than the dollar value of the future payment. An important application of interest rates is to show the relationship between the current and future values of a particular payment.

To see how we can calculate the current value of a future payment, let us consider an example similar to Aunt Carmen’s offer. This time you have $1,000 and you deposit it in a bank, where it earns interest at the rate of 10% per year.

How much will you have in your bank account at the end of one year? You will have the original $1,000 plus 10% of $1,000, or $1,100:

More generally, if we let P0 equal the amount you deposit today, r the percentage rate of interest, and P1 the balance of your deposit at the end of 1 year, then we can write:

Equation 13.1

Factoring out the P0 term on the left-hand side of Equation 13.1, we have:

Equation 13.2

Equation 13.2 shows how to determine the future value of a payment or deposit made today. Now let us turn the question around. We can ask what P1, an amount that will be available 1 year from now, is worth today. We solve for this by dividing both sides of Equation 13.2 by (1 + r) to obtain:

Equation 13.3

Equation 13.3 suggests how we can compute the value today, P0, of an amount P1 that will be paid a year hence. An amount that would equal a particular future value if deposited today at a specific interest rate is called the present valueAn amount that would equal a particular future value if deposited today at a specific interest rate. of that future value.

More generally, the present value of any payment to be received n periods from now =

Equation 13.4

Suppose, for example, that your Aunt Carmen offers you the option of $1,000 now or $15,000 in 30 years. We can use Equation 13.4 to help you decide which sum to take. The present value of $15,000 to be received in 30 years, assuming an interest rate of 10%, is:

Assuming that you could earn that 10% return with certainty, you would be better off taking Aunt Carmen’s $1,000 now; it is greater than the present value, at an interest rate of 10%, of the $15,000 she would give you in 30 years. The $1,000 she gives you now, assuming an interest rate of 10%, in 30 years will grow to:

The present value of some future payment depends on three things.

- The Size of the Payment Itself. The bigger the future payment, the greater its present value.

- The Length of the Period Until Payment. The present value depends on how long a period will elapse before the payment is made. The present value of $15,000 in 30 years, at an interest rate of 10%, is $859.63. But that same sum, if paid in 20 years, has a present value of $2,229.65. And if paid in 10 years, its present value is more than twice as great: $5,783.15. The longer the time period before a payment is to be made, the lower its present value.

- The Rate of Interest. The present value of a payment of $15,000 to be made in 20 years is $2,229.65 if the interest rate is 10%; it rises to $5,653.34 at an interest rate of 5%. The lower the interest rate, the higher the present value of a future payment. Table 13.1 "Time, Interest Rates, and Present Value" gives present values of a payment of $15,000 at various interest rates and for various time periods.

Table 13.1 Time, Interest Rates, and Present Value

| Present Value of $15,000 | ||||

|---|---|---|---|---|

| Interest rate (%) | Time until payment | |||

| 5 years | 10 years | 15 years | 20 years | |

| 5 | $11,752.89 | $9,208.70 | $7,215.26 | $5,653.34 |

| 10 | 9,313.82 | 5,783.15 | 3,590.88 | 2,229.65 |

| 15 | 7,457.65 | 3,707.77 | 1,843.42 | 916.50 |

| 20 | 6,028.16 | 2,422.58 | 973.58 | 391.26 |

The higher the interest rate and the longer the time until payment is made, the lower the present value of a future payment. The table below shows the present value of a future payment of $15,000 under different conditions. The present value of $15,000 to be paid in five years is $11,752.89 if the interest rate is 5%. Its present value is just $391.26 if it is to be paid in 20 years and the interest rate is 20%.

The concept of present value can also be applied to a series of future payments. Suppose you have been promised $1,000 at the end of each of the next 5 years. Because each payment will occur at a different time, we calculate the present value of the series of payments by taking the value of each payment separately and adding them together. At an interest rate of 10%, the present value P0 is:

Interest rates can thus be used to compare the values of payments that will occur at different times. Choices concerning capital and natural resources require such comparisons, so you will find applications of the concept of present value throughout this chapter, but the concept of present value applies whenever costs and benefits do not all take place in the current period.

State lottery winners often have a choice between a single large payment now or smaller payments paid out over a 25- or 30-year period. Comparing the single payment now to the present value of the future payments allows winners to make informed decisions. For example, in June 2005 Brad Duke, of Boise, Idaho, became the winner of one of the largest lottery prizes ever. Given the alternative of claiming the $220.3 million jackpot in 30 annual payments of $7.4 million or taking $125.3 million in a lump sum, he chose the latter. Holding unchanged all other considerations that must have been going through his mind, he must have thought his best rate of return would be greater than 4.17%. Why 4.17%? Using an interest rate of 4.17%, $125.3 million is equal to slightly less than the present value of the 30-year stream of payments. At all interest rates greater than 4.17%, the present value of the stream of benefits would be less than $125.3 million. At all interest rates less than 4.17%, the present value of the stream of payments would be more than $125.3 million. Our present value analysis suggests that if he thought the interest rate he could earn was more than 4.17%, he should take the lump sum payment, which he did.

Key Takeaways

- People generally prefer to receive a specific payment now rather than to wait and receive it later.

- Interest is a payment made to people who agree to postpone their use of wealth.

-

We compute the present value, P0, of a sum to be received in n years, Pn, as:

- The present value of a future payment will be greater the larger the payment, the sooner it is due, and the lower the rate of interest.

Try It!

Suppose your friend Sara asks you to lend her $5,000 so she can buy a used car. She tells you she can pay you back $5,200 in a year. Reliable Sara always keeps her word. Suppose the interest rate you could earn by putting the $5,000 in a savings account is 5%. What is the present value of her offer? Is it a good deal for you or not? What if the interest rate on your savings account is only 3%?

Case in Point: Waiting for Death and Life Insurance

Figure 13.1

© 2010 Jupiterimages Corporation

It is a tale that has become all too familiar.

Call him Roger Johnson. He has just learned that his cancer is not treatable and that he has only a year or two to live. Mr. Johnson is unable to work, and his financial burdens compound his tragic medical situation. He has mortgaged his house and sold his other assets in a desperate effort to get his hands on the cash he needs for care, for food, and for shelter. He has a life insurance policy, but it will pay off only when he dies. If only he could get some of that money sooner…

The problem facing Mr. Johnson has spawned a market solution—companies and individuals that buy the life insurance policies of the terminally ill. Mr. Johnson could sell his policy to one of these companies or individuals and collect the purchase price. The buyer takes over his premium payments. When he dies, the company will collect the proceeds of the policy.

The industry is called the viatical industry (the term viatical comes from viaticum, a Christian sacrament given to a dying person). It provides the terminally ill with access to money while they are alive; it provides financial investors a healthy interest premium on their funds.

It is a chilling business. Potential buyers pore over patient’s medical histories, studying T-cell counts and other indicators of a patient’s health. From the buyer’s point of view, a speedy death is desirable, because it means the investor will collect quickly on the purchase of a patient’s policy.

A patient with a life expectancy of less than six months might be able to sell his or her life insurance policy for 80% of the face value. A $200,000 policy would thus sell for $160,000. A person with a better prognosis will collect less. Patients expected to live two years, for example, might get only 60% of the face value of their policies.

Are investors profiting from the misery of others? Of course they are. But, suppose that investors refused to take advantage of the misfortune of the terminally ill. That would deny dying people the chance to acquire funds that they desperately need. As is the case with all voluntary exchange, the viatical market creates win-win situations. Investors “win” by earning high rates of return on their investment. And the dying patient? He or she is in a terrible situation, but the opportunity to obtain funds makes that person a “winner” as well.

Kim D. Orr, a former agent with Life Partners Inc. (www.lifepartnersinc.com), one of the leading firms in the viatical industry, recalled a case in his own family. “Some years ago, I had a cousin who died of AIDS. He was, at the end, destitute and had to rely totally on his family for support. Today, there is a broad market with lots of participants, and a patient can realize a high fraction of the face value of a policy on selling it. The market helps buyers and patients alike.”

In recent years, this industry has been renamed the life settlements industry, with policy transfers being offered to healthier, often elderly, policyholders. These healthier individuals are sometimes turning over their policies for a payment to third parties who pay the premiums and then collect the benefit when the policyholders die. Expansion of this practice has begun to raise costs for life insurers, who assumed that individuals would sometimes let their policies lapse, with the result that the insurance company does not have to pay claims on them. Businesses buying life insurance policies are not likely to let them lapse.

Sources: Personal Interview and Liam Pleven and Rachel Emma Silverman, “Investors Seek Profit in Strangers’ Deaths”, The Wall Street Journal Online, 2 May 2006, p. C1.

Answer to Try It! Problem

The present value of $5,200 payable in a year with an interest rate of 5% is:

Since the present value of $5,200 is less than the $5,000 Sara has asked you to lend her, you would be better off refusing to make the loan. Another way of evaluating the loan is that Sara is offering a return on your $5,000 of 200/5,000 = 4%, while the bank is offering you a 5% return. On the other hand, if the interest rate that your bank is paying is 3%, then the present value of what Sara will pay you in a year is:

With your bank only paying a 3% return, Sara’s offer looks like a good deal.

13.2 Interest Rates and Capital

Learning Objectives

- Define investment, explain how to determine the net present value of an investment project, and explain how the net present value calculation aids the decision maker in determining whether or not to pursue an investment project.

- Explain the demand curve for capital and the factors that can cause it to shift.

- Explain and illustrate the loanable funds market and explain how changes in the demand for capital affect that market and vice versa.

The quantity of capital that firms employ in their production of goods and services has enormously important implications for economic activity and for the standard of living people in the economy enjoy. Increases in capital increase the marginal product of labor and boost wages at the same time they boost total output. An increase in the stock of capital therefore tends to raise incomes and improve the standard of living in the economy.

Capital is often a fixed factor of production in the short run. A firm cannot quickly retool an assembly line or add a new office building. Determining the quantity of capital a firm will use is likely to involve long-run choices.

The Demand for Capital

A firm uses additional units of a factor until marginal revenue product equals marginal factor cost. Capital is no different from other factors of production, save for the fact that the revenues and costs it generates are distributed over time. As the first step in assessing a firm’s demand for capital, we determine the present value of marginal revenue products and marginal factor costs.

Capital and Net Present Value

Suppose Carol Stein is considering the purchase of a new $95,000 tractor for her farm. Ms. Stein expects to use the tractor for five years and then sell it; she expects that it will sell for $22,000 at the end of the five-year period. She has the $95,000 on hand now; her alternative to purchasing the tractor could be to put $95,000 in a bond account earning 7% annual interest.

Ms. Stein expects that the tractor will bring in additional annual revenue of $50,000 but will cost $30,000 per year to operate, for net revenue of $20,000 annually. For simplicity, we shall suppose that this net revenue accrues at the end of each year.

Should she buy the tractor? We can answer this question by computing the tractor’s net present value (NPV)The value equal to the present value of all the revenues expected from an asset minus the present value of all the costs associated with it., which is equal to the present value of all the revenues expected from an asset minus the present value of all the costs associated with it. We thus measure the difference between the present value of marginal revenue products and the present value of marginal factor costs. If NPV is greater than zero, purchase of the asset will increase the profitability of the firm. A negative NPV implies that the funds for the asset would yield a higher return if used to purchase an interest-bearing asset. A firm will maximize profits by acquiring additional capital up to the point that the present value of capital’s marginal revenue product equals the present value of marginal factor cost.

If the revenues generated by an asset in period n equal Rn and the costs in period n equal Cn, then the net present value NPV0 of an asset expected to last for n years is:

Equation 13.5

To purchase the tractor, Ms. Stein pays $95,000. She will receive additional revenues of $50,000 per year from increased planting and more efficient harvesting, less the operating cost per year of $30,000, plus the $22,000 she expects to get by selling the tractor at the end of five years. The net present value of the tractor, NPV0 is thus given by:

Given the cost of the tractor, the net returns Ms. Stein projects, and an interest rate of 7%, Ms. Stein will increase her profits by purchasing the tractor. The tractor will yield a return whose present value is $2,690 greater than the return that could be obtained by the alternative of putting the $95,000 in a bond account yielding 7%.

Ms. Stein’s acquisition of the tractor is called investment. Economists define investmentAn addition to capital stock. as an addition to capital stock. Any acquisition of new capital goods therefore qualifies as investment.

The Demand Curve for Capital

Our analysis of Carol Stein’s decision regarding the purchase of a new tractor suggests the forces at work in determining the economy’s demand for capital. In deciding to purchase the tractor, Ms. Stein considered the price she would have to pay to obtain the tractor, the costs of operating it, the marginal revenue product she would receive by owning it, and the price she could get by selling the tractor when she expects to be done with it. Notice that with the exception of the purchase price of the tractor, all those figures were projections. Her decision to purchase the tractor depends almost entirely on the costs and benefits she expects will be associated with its use.

Finally, Ms. Stein converted all those figures to a net present value based on the interest rate prevailing at the time she made her choice. A positive NPV means that her profits will be increased by purchasing the tractor. That result, of course, depends on the prevailing interest rate. At an interest rate of 7%, the NPV is positive. At an interest rate of 8%, the NPV would be negative. At that interest rate, Ms. Stein would do better to put her funds elsewhere.

At any one time, millions of choices like that of Ms. Stein concerning the acquisition of capital will be under consideration. Each decision will hinge on the price of a particular piece of capital, the expected cost of its use, its expected marginal revenue product, its expected scrap value, and the interest rate. Not only will firms be considering the acquisition of new capital, they will be considering retaining existing capital as well. Ms. Stein, for example, may have other tractors. Should she continue to use them, or should she sell them? If she keeps them, she will experience a stream of revenues and costs over the next several periods; if she sells them, she will have funds now that she could use for something else. To decide whether a firm should keep the capital it already has, we need an estimate of the NPV of each unit of capital. Such decisions are always affected by the interest rate. At higher rates of interest, it makes sense to sell some capital rather than hold it. At lower rates of interest, the NPV of holding capital will rise.

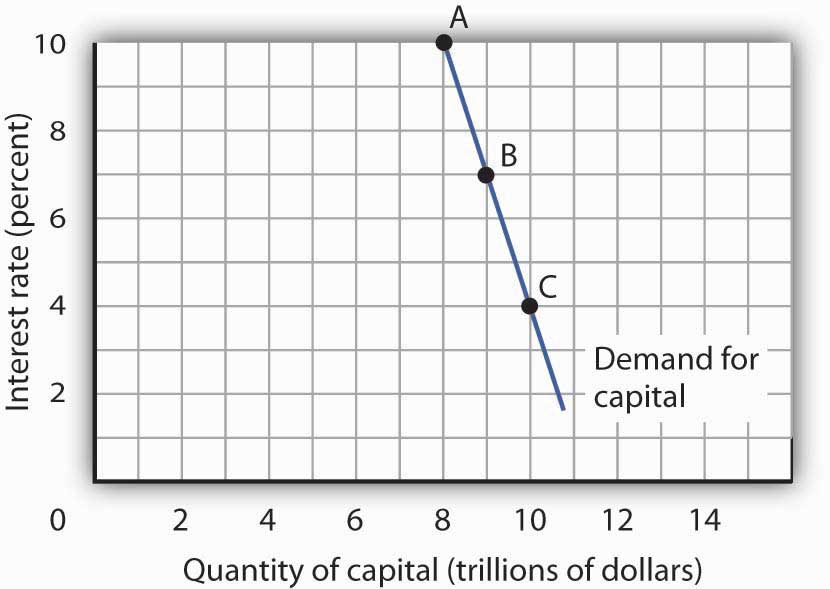

Because firms’ choices to acquire new capital and to hold existing capital depend on the interest rate, the demand curve for capitalShows the quantity of capital firms intend to hold at each interest rate. in Figure 13.2 "The Demand Curve for Capital", which shows the quantity of capital firms intend to hold at each interest rate, is downward-sloping. At point A, we see that at an interest rate of 10%, $8 trillion worth of capital is demanded in the economy. At point B, a reduction in the interest rate to 7% increases the quantity of capital demanded to $9 trillion. At point C, at an interest rate of 4%, the quantity of capital demanded is $10 trillion. A reduction in the interest rate increases the quantity of capital demanded.

Figure 13.2 The Demand Curve for Capital

The quantity of capital firms will want to hold depends on the interest rate. The higher the interest rate, the less capital firms will want to hold.

The demand curve for capital for the economy is found by summing the demand curves of all holders of capital. Ms. Stein’s demand curve, for example, might show that at an interest rate of 8%, she will demand the capital she already has—suppose it is $600,000 worth of equipment. If the interest rate drops to 7%, she will add the tractor; the quantity of capital she demands rises to $695,000. At interest rates greater than 8%, she might decide to reduce her maintenance efforts for some of the capital she already has; the quantity of capital she demands would fall below $600,000. As with the demand for capital in the economy, we can expect individual firms to demand a smaller quantity of capital when the interest rate is higher.

Shifts in the Demand for Capital

Why might the demand for capital change? Because the demand for capital reflects the marginal revenue product of capital, anything that changes the marginal revenue product of capital will shift the demand for capital. Our search for demand shifters must thus focus on factors that change the marginal product of capital, the prices of the goods capital produces, and the costs of acquiring and holding capital. Let us discuss some factors that could affect these variables and thus shift the demand for capital.

Changes in Expectations

Choices concerning capital are always based on expectations. Net present value is computed from the expected revenues and costs over the expected life of an asset. If firms’ expectations change, their demand for capital will change. If something causes firms to revise their sales expectations upward (such as stronger than expected sales in the recent past), it is likely to increase their demand for capital. Similarly, an event that dampens firms’ expectations (such as recent weak sales) is likely to reduce their demand for capital.

Technological Change

Technological changes can increase the marginal product of capital and thus boost the demand for capital. The discovery of new ways to integrate computers into production processes, for example, has dramatically increased the demand for capital in the last few years. Many universities are adding new classroom buildings or renovating old ones so they can better use computers in instruction, and businesses use computers in nearly every facet of operations.

Changing Demand for Goods and Services

Ultimately, the source of demand for factors of production is the demand for the goods and services produced by those factors. Economists say that the demand for a factor is a “derived” demand—derived, that is, from the demand for what the factor produces. As population and incomes expand, we can expect greater demand for goods and services, a change that will increase the demand for capital.

Changes in Relative Factor Prices

Firms achieve the greatest possible output for a given total cost by operating where the ratios of marginal product to factor price are equal for all factors of production. For a firm that uses labor (L) and capital (K), for example, this requires that MPL/PL = MPK/PK, where MPL and MPK are the marginal products of labor and capital, respectively, and PL and PK are the prices of labor and capital, respectively. Suppose these equalities hold and the price of labor rises. The ratio of the marginal product of labor to its price goes down, and the firm substitutes capital for labor. Similarly, an increase in the price of capital, all other things unchanged, would cause firms to substitute other factors of production for capital. The demand for capital, therefore, would fall.

Changes in Tax Policy

Government can indirectly affect the price of capital through changes in tax policy. For example, suppose the government enacts an investment tax credit for businesses, that is, a deduction of a certain percentage of their spending on capital from their profits before paying taxes. Such a policy would effectively lower the price of capital, causing firms to substitute capital for other factors of production and increasing the demand for capital. The repeal of an investment tax credit would lead to a decrease in the demand for capital.

The Market for Loanable Funds

When a firm decides to expand its capital stock, it can finance its purchase of capital in several ways. It might already have the funds on hand. It can also raise funds by selling shares of stock, as we discussed in a previous chapter. When a firm sells stock, it is selling shares of ownership of the firm. It can borrow the funds for the capital from a bank. Another option is to issue and sell its own bonds. A bondA promise to pay back a certain amount at a certain time. is a promise to pay back a certain amount at a certain time. When a firm borrows from a bank or sells bonds, of course, it accepts a liability—it must make interest payments to the bank or the owners of its bonds as they come due.

Regardless of the method of financing chosen, a critical factor in the firm’s decision on whether to acquire and hold capital and on how to finance the capital is the interest rate. The role of the interest rate is obvious when the firm issues its own bonds or borrows from a bank. But even when the firm uses its own funds to purchase the capital, it is forgoing the option of lending those funds directly to other firms by buying their bonds or indirectly by putting the funds in bank accounts, thereby allowing the banks to lend the funds. The interest rate gives the opportunity cost of using funds to acquire capital rather than putting the funds to the best alternative use available to the firm.

The interest rate is determined in a market in the same way that the price of potatoes is determined in a market: by the forces of demand and supply. The market in which borrowers (demanders of funds) and lenders (suppliers of funds) meet is the loanable funds marketThe market in which borrowers (demanders of funds) and lenders (suppliers of funds) meet..

We will simplify our model of the role that the interest rate plays in the demand for capital by ignoring differences in actual interest rates that specific consumers and firms face in the economy. For example, the interest rate on credit cards is higher than the mortgage rate of interest, and large, established companies can borrow funds or issue bonds at lower interest rates than new, start-up companies can. Interest rates that firms face depend on a variety of factors, such as riskiness of the loan, the duration of the loan, and the costs of administering the loan. However, since we will focus on general tendencies that cause interest rates to rise or fall and since the various interest rates in the economy tend to move up and down together, the conclusions we reach about the market for loanable funds and how firms and consumers respond to interest rate changes will still be valid.

The Demand for Loanable Funds

In the previous section we learned that a firm’s decision to acquire and keep capital depends on the net present value of the capital in question, which in turn depends on the interest rate. The lower the interest rate, the greater the amount of capital that firms will want to acquire and hold, since lower interest rates translate into more capital with positive net present values. The desire for more capital means, in turn, a desire for more loanable funds. Similarly, at higher interest rates, less capital will be demanded, because more of the capital in question will have negative net present values. Higher interest rates therefore mean less funding demanded.

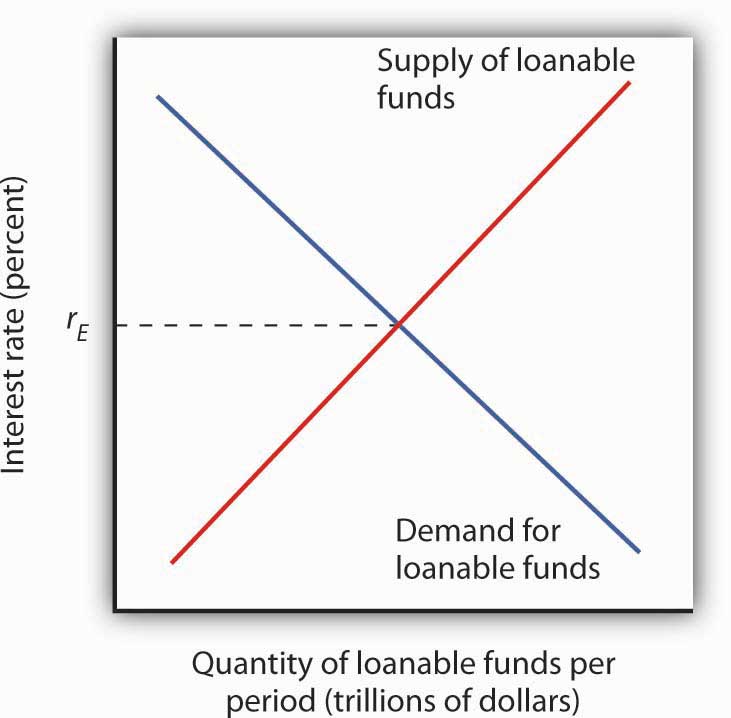

Figure 13.3 The Demand and Supply of Loanable Funds

At lower interest rates, firms demand more capital and therefore more loanable funds. The demand for loanable funds is downward-sloping. The supply of loanable funds is generally upward-sloping. The equilibrium interest rate, rE, will be found where the two curves intersect.

Thus the demand for loanable funds is downward-sloping, like the demand for virtually everything else, as shown in Figure 13.3 "The Demand and Supply of Loanable Funds". The lower the interest rate, the more capital firms will demand. The more capital that firms demand, the greater the funding that is required to finance it.

The Supply of Loanable Funds

Lenders are consumers or firms that decide that they are willing to forgo some current use of their funds in order to have more available in the future. Lenders supply funds to the loanable funds market. In general, higher interest rates make the lending option more attractive.

For consumers, however, the decision is a bit more complicated than it is for firms. In examining consumption choices across time, economists think of consumers as having an expected stream of income over their lifetimes. It is that expected income that defines their consumption possibilities. The problem for consumers is to determine when to consume this income. They can spend less of their projected income now and thus have more available in the future. Alternatively, they can boost their current spending by borrowing against their future income.

SavingIncome not spent on consumption. is income not spent on consumption. (We shall ignore taxes in this analysis.) DissavingConsumption that exceeds income during a given period. occurs when consumption exceeds income during a period. Dissaving means that the individual’s saving is negative. Dissaving can be financed either by borrowing or by using past savings. Many people, for example, save in preparation for retirement and then dissave during their retirement years.

Saving adds to a household’s wealth. Dissaving reduces it. Indeed, a household’s wealth is the sum of the value of all past saving less all past dissaving.

We can think of saving as a choice to postpone consumption. Because interest rates are a payment paid to people who postpone their use of wealth, interest rates are a kind of reward paid to savers. Will higher interest rates encourage the behavior they reward? The answer is a resounding “maybe.” Just as higher wages might not increase the quantity of labor supplied, higher interest rates might not increase the quantity of saving. The problem, once again, lies in the fact that the income and substitution effects of a change in interest rates will pull in opposite directions.

Consider a hypothetical consumer, Tom Smith. Let us simplify the analysis of Mr. Smith’s choices concerning the timing of consumption by assuming that there are only two periods: the present period is period 0, and the next is period 1. Suppose the interest rate is 8% and his income in both periods is expected to be $30,000.

Mr. Smith could, of course, spend $30,000 in period 0 and $30,000 in period 1. In that case, his saving equals zero in both periods. But he has alternatives. He could, for example, spend more than $30,000 in period 0 by borrowing against his income for period 1. Alternatively, he could spend less than $30,000 in period 0 and use his saving—and the interest he earns on that saving—to boost his consumption in period 1. If, for example, he spends $20,000 in period 0, his saving in period 0 equals $10,000. He will earn $800 interest on that saving, so he will have $40,800 to spend in the next period.

Suppose the interest rate rises to 10%. The increase in the interest rate has boosted the price of current consumption. Now for every $1 he spends in period 0 he gives up $1.10 in consumption in period 1, instead of $1.08, which was the amount that would have been given up in consumption in period 1 when the interest rate was 8%. A higher price produces a substitution effect that reduces an activity—Mr. Smith will spend less in the current period due to the substitution effect. The substitution effect of a higher interest rate thus boosts saving. But the higher interest rate also means that he earns more income on his saving. Consumption in the current period is a normal good, so an increase in income can be expected to increase current consumption. But an increase in current consumption implies a reduction in saving. The income effect of a higher interest rate thus tends to reduce saving. Whether Mr. Smith’s saving will rise or fall in response to a higher interest rate depends on the relative strengths of the substitution and income effects.

To see how an increase in interest rates might reduce saving, imagine that Mr. Smith has decided that his goal is to have $40,800 to spend in period 1. At an interest rate of 10%, he can reduce his saving below $10,000 and still achieve his goal of having $40,800 to spend in the next period. The income effect of the increase in the interest rate has reduced his saving, and consequently his desire to supply funds to the loanable funds market.

Because changes in interest rates produce substitution and income effects that pull saving in opposite directions, we cannot be sure what will happen to saving if interest rates change. The combined effect of all consumers’ and firms’ decisions, however, generally leads to an upward-sloping supply curve for loanable funds, as shown in Figure 13.3 "The Demand and Supply of Loanable Funds". That is, the substitution effect usually dominates the income effect.

The equilibrium interest rate is determined by the intersection of the demand and supply curves in the market for loanable funds.

Capital and the Loanable Funds Market

If the quantity of capital demanded varies inversely with the interest rate, and if the interest rate is determined in the loanable funds market, then it follows that the demand for capital and the loanable funds market are interrelated. Because the acquisition of new capital is generally financed in the loanable funds market, a change in the demand for capital leads to a change in the demand for loanable funds—and that affects the interest rate. A change in the interest rate, in turn, affects the quantity of capital demanded on any demand curve.

The relationship between the demand for capital and the loanable funds market thus goes both ways. Changes in the demand for capital affect the loanable funds market, and changes in the loanable funds market can affect the quantity of capital demanded.

Changes in the Demand for Capital and the Loanable Funds Market

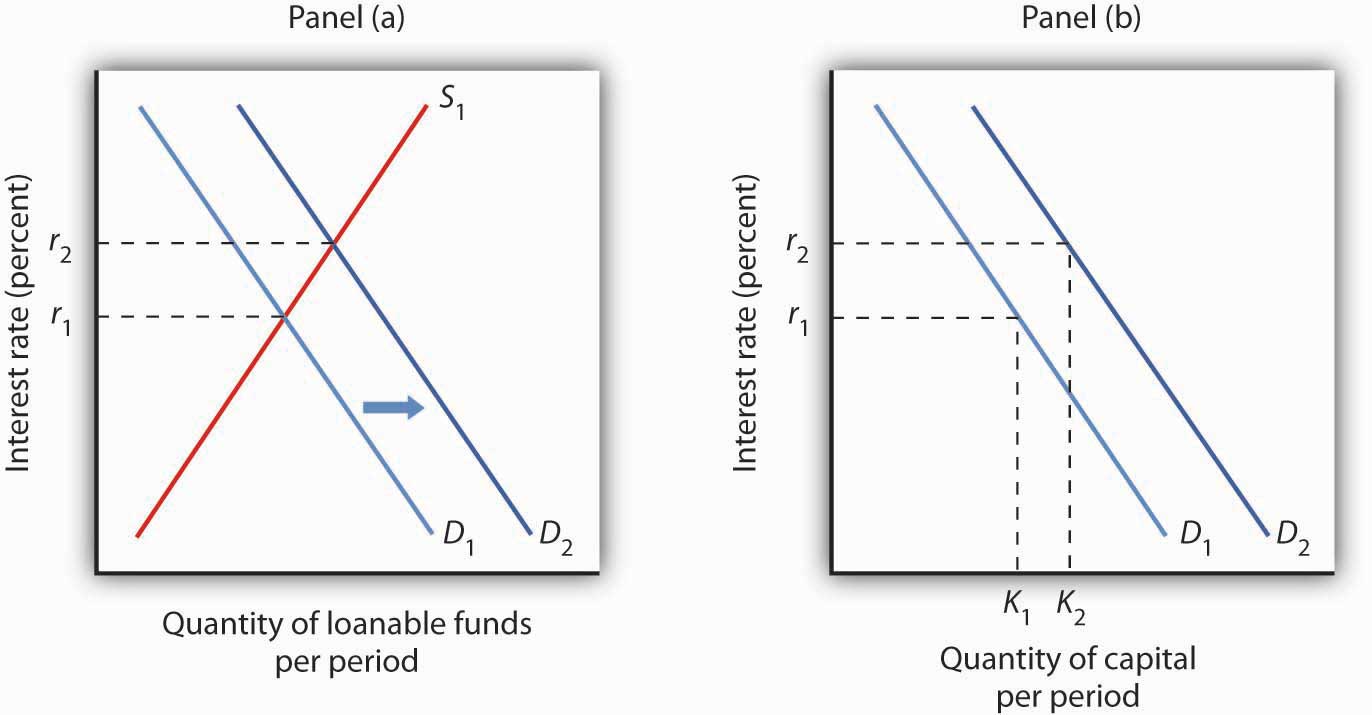

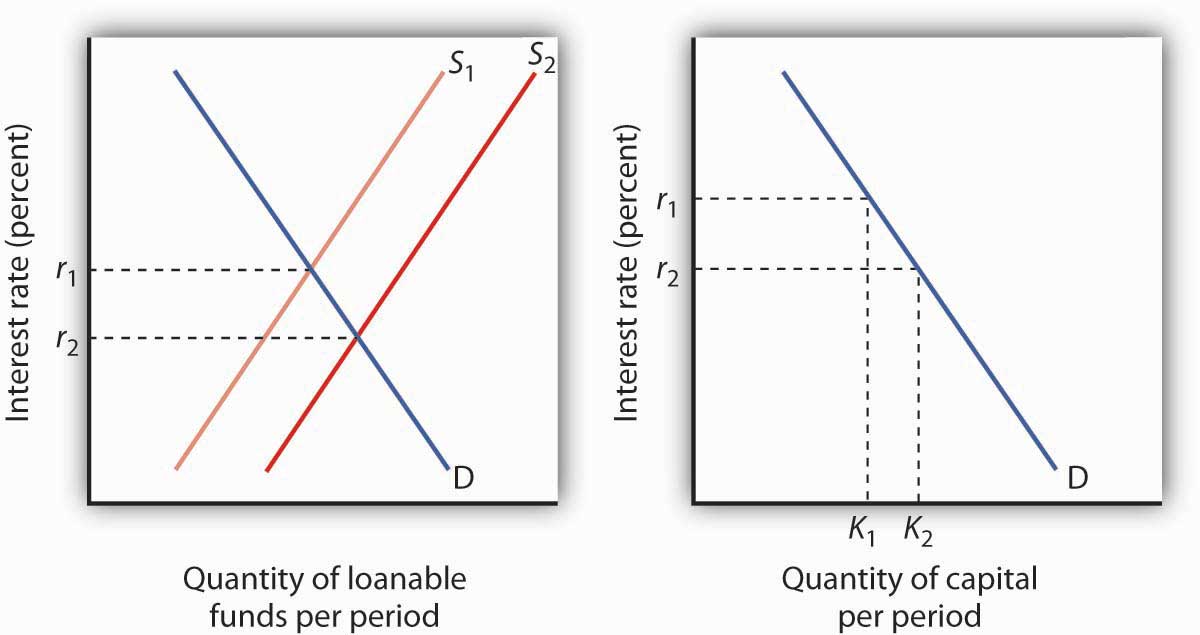

Figure 13.4 "Loanable Funds and the Demand for Capital" suggests how an increased demand for capital by firms will affect the loanable funds market, and thus the quantity of capital firms will demand. In Panel (a) the initial interest rate is r1. At r1 in Panel (b) K1 units of capital are demanded (on curve D1). Now suppose an improvement in technology increases the marginal product of capital, shifting the demand curve for capital in Panel (b) to the right to D2. Firms can be expected to finance the increased acquisition of capital by demanding more loanable funds, shifting the demand curve for loanable funds to D2 in Panel (a). The interest rate thus rises to r2. Consequently, in the market for capital the demand for capital is greater and the interest rate is higher. The new quantity of capital demanded is K2 on demand curve D2.

Figure 13.4 Loanable Funds and the Demand for Capital

The interest rate is determined in the loanable funds market, and the quantity of capital demanded varies with the interest rate. Thus, events in the loanable funds market and the demand for capital are interrelated. If the demand for capital increases to D2 in Panel (b), the demand for loanable funds is likely to increase as well. Panel (a) shows the result in the loanable funds market—a shift in the demand curve for loanable funds from D1 to D2 and an increase in the interest rate from r1 to r2. At r2, the quantity of capital demanded will be K2, as shown in Panel (b).

Changes in the Loanable Funds Market and the Demand for Capital

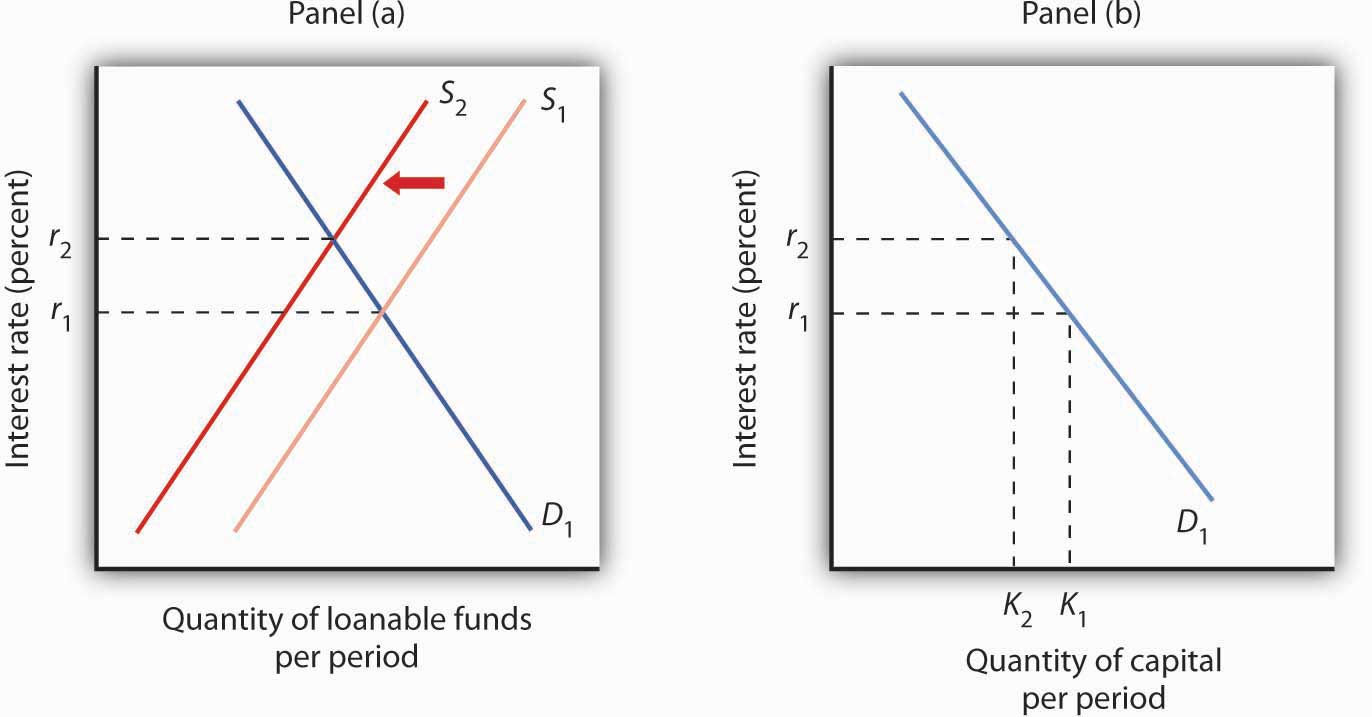

Events in the loanable funds market can also affect the quantity of capital firms will hold. Suppose, for example, that consumers decide to increase current consumption and thus to supply fewer funds to the loanable funds market at any interest rate. This change in consumer preferences shifts the supply curve for loanable funds in Panel (a) of Figure 13.5 "A Change in the Loanable Funds Market and the Quantity of Capital Demanded" from S1 to S2 and raises the interest rate to r2. If there is no change in the demand for capital D1, the quantity of capital firms demand falls to K2 in Panel (b).

Figure 13.5 A Change in the Loanable Funds Market and the Quantity of Capital Demanded

A change that begins in the loanable funds market can affect the quantity of capital firms demand. Here, a decrease in consumer saving causes a shift in the supply of loanable funds from S1 to S2 in Panel (a). Assuming there is no change in the demand for capital, the quantity of capital demanded falls from K1 to K2 in Panel (b).

Our model of the relationship between the demand for capital and the loanable funds market thus assumes that the interest rate is determined in the market for loanable funds. Given the demand curve for capital, that interest rate then determines the quantity of capital firms demand.

Table 13.2 "Two Routes to Changes in the Quantity of Capital Demanded" shows that a change in the quantity of capital that firms demand can begin with a change in the demand for capital or with a change in the demand for or supply of loanable funds. A change in the demand for capital affects the demand for loanable funds and hence the interest rate in the loanable funds market. The change in the interest rate leads to a change in the quantity of capital demanded. Alternatively, a change in the loanable funds market, which leads to a change in the interest rate, causes a change in quantity of capital demanded.

Table 13.2 Two Routes to Changes in the Quantity of Capital Demanded

| A change originating in the capital market | A change originating in the loanable funds market |

|---|---|

| 1. A change in the demand for capital leads to… | 1. A change in the demand for or supply of loanable funds leads to … |

| 2.…a change in the demand for loanable funds, which leads to… | 2.…a change in the interest rate, which leads to… |

| 3.…a change in the interest rate, which leads to… | 3.…a change in the quantity of capital demanded. |

| 4.…a change in the quantity of captial demanded. |

A change in the quantity of capital that firms demand can begin with a change in the demand for capital or with a change in the demand or supply of loanable funds.

Key Takeaways

- The net present value (NPV) of an investment project is equal to the present value of its expected revenues minus the present value of its expected costs. Firms will want to undertake those investments for which the NPV is greater than or equal to zero.

- The demand curve for capital shows that firms demand a greater quantity of capital at lower interest rates. Among the forces that can shift the demand curve for capital are changes in expectations, changes in technology, changes in the demands for goods and services, changes in relative factor prices, and changes in tax policy.

- The interest rate is determined in the market for loanable funds. The demand curve for loanable funds has a negative slope; the supply curve has a positive slope.

- Changes in the demand for capital affect the loanable funds market, and changes in the loanable funds market affect the quantity of capital demanded.

Try It!

Suppose that baby boomers become increasingly concerned about whether or not the government will really have the funds to make Social Security payments to them over their retirement years. As a result, they boost saving now. How would their decisions affect the market for loanable funds and the demand curve for capital?

Case in Point: The Net Present Value of an MBA

Figure 13.6

© 2010 Jupiterimages Corporation

An investment in human capital differs little from an investment in capital—one acquires an asset that will produce additional income over the life of the asset. One’s education produces—or it can be expected to produce—additional income over one’s working career.

Ronald Yeaple, a professor at the University of Rochester business school, has estimated the net present value (NPV) of an MBA obtained from each of 20 top business schools. The costs of attending each school included tuition and forgone income. To estimate the marginal revenue product of a degree, Mr. Yeaple started with survey data showing what graduates of each school were earning five years after obtaining their MBAs. He then estimated what students with the ability to attend those schools would have been earning without an MBA. The estimated marginal revenue product for each year is the difference between the salaries students earned with a degree versus what they would have earned without it. The NPV is then computed using Equation 13.5.

The estimates given here show the NPV of an MBA over the first seven years of work after receiving the degree. They suggest that an MBA from 15 of the schools ranked is a good investment—but that a degree at the other schools might not be. Mr. Yeaple says that extending income projections beyond seven years would not significantly affect the analysis, because present values of projected income differentials with and without an MBA become very small.

While the Yeaple study is somewhat dated, a 2002 study by Stanford University Graduate School of Business professor Jeffrey Pfeffer and Stanford Ph.D. candidate Christina T. Fong reviewed 40 years of research on this topic and reached the conclusion that, “For the most part, there is scant evidence that the MBA credential, particularly from non-elite schools…are related to either salary or the attainment of higher level positions in organizations.”

Of course, these studies only include financial aspects of the investment and did not cover any psychic benefits that MBA recipients may incur from more interesting work or prestige.

| School | Net present value, first 7 years of work | School | Net present value, first 7 years of work |

|---|---|---|---|

| Harvard | $148,378 | Virginia | $30,046 |

| Chicago | 106,847 | Dartmouth | 22,509 |

| Stanford | 97,462 | Michigan | 21,502 |

| MIT | 85,736 | Carnegie-Mellon | 18,679 |

| Yale | 83,775 | Texas | 17,459 |

| Wharton | 59,486 | Rochester | −307 |

| UCLA | 55,088 | Indiana | −3,315 |

| Berkeley | 54,101 | NYU | −3,749 |

| Northwestern | 53,562 | South Carolina | −4,565 |

| Cornell | 30,874 | Duke | −17,631 |

Sources: “The MBA Cost-Benefit Analysis,” The Economist, August 6 1994, p. 58. Table reprinted with permission. Further reproduction prohibited. (We need to obtain permission to use this table again.) Jeffrey Pfeffer and Christina T. Fong, “The End of Business Schools? Less Success Than Meets the Eye,” Academy of Management Learning and Education 1:1 (September 2002): 78–95.

Answer to Try It! Problem

An increase in saving at each interest rate implies a rightward shift in the supply curve of loanable funds. As a result, the equilibrium interest rate falls. With the lower interest rate, there is movement downward to the right along the demand-for-capital curve, as shown.

Figure 13.7

13.3 Natural Resources and Conservation

Learning Objectives

- Distinguish between exhaustible and renewable natural resources.

- Discuss the market for exhaustible natural resources in terms of factors that influence both demand and supply.

- Discuss the market for renewable natural resources and relate the market outcome to carrying capacity.

- Explain and illustrate the concept of economic rent.

Natural resources are the gifts of nature. They include everything from oil to fish in the sea to magnificent scenic vistas. The stock of a natural resource is the quantity of the resource with which the earth is endowed. For example, a certain amount of oil lies in the earth, a certain population of fish live in the sea, and a certain number of acres make up an area such as Yellowstone National Park or Manhattan. These stocks of natural resources, in turn, can be used to produce a flow of goods and services. Each year, we can extract a certain quantity of oil, harvest a certain quantity of fish, and enjoy a certain number of visits to Yellowstone.

As with capital, we examine the allocation of natural resources among alternative uses across time. By definition, natural resources cannot be produced. Our consumption of the services of natural resources in one period can affect their availability in future periods. We must thus consider the extent to which the expected demands of future generations should be taken into account when we allocate natural resources.

Natural resources often present problems of property rights in their allocation. A resource for which exclusive property rights have not been defined will be allocated as a common property resource. In such a case, we expect that the marketplace will not generate incentives to use the resource efficiently. In the absence of government intervention, natural resources that are common property may be destroyed. In this section, we shall consider natural resources for which exclusive property rights have been defined. The public sector’s role in the allocation of common property resources is investigated in the chapter on the environment.

We can distinguish two categories of natural resources, those that are renewable and those that are not. A renewable natural resourceA resource whose services can be used in one period without necessarily reducing the stock of the resource that will be available in subsequent periods. is one whose services can be used in one period without necessarily reducing the stock of the resource that will be available in subsequent periods. The fact that they can be used in such a manner does not mean that they will be; renewable natural resources can be depleted. Wilderness areas, land, and water are renewable natural resources. The consumption of the services of an exhaustible natural resourceA resource whose services cannot be used in one period without reducing the stock of the resource that will be available in subsequent periods., on the other hand, necessarily reduces the stock of the resource. Oil and coal are exhaustible natural resources.

Exhaustible Natural Resources

Owners of exhaustible natural resources can be expected to take the interests of future as well as current consumers into account in their extraction decisions. The greater the expected future demand for an exhaustible natural resource, the greater will be the quantity preserved for future use.

Expectations and Resource Extraction

Suppose you are the exclusive owner of a deposit of oil in Wyoming. You know that any oil you pump from this deposit and sell cannot be replaced. You are aware that this is true of all the world’s oil; the consumption of oil inevitably reduces the stock of this resource.

If the quantity of oil in the earth is declining and the demand for this oil is increasing, then it is likely that the price of oil will rise in the future. Suppose you expect the price of oil to increase at an annual rate of 15%.

Given your expectation, should you pump some of your oil out of the ground and sell it? To answer that question, you need to know the interest rate. If the interest rate is 10%, then your best alternative is to leave your oil in the ground. With oil prices expected to rise 15% per year, the dollar value of your oil will increase faster if you leave it in the ground than if you pump it out, sell it, and purchase an interest-earning asset. If the market interest rate were greater than 15%, however, it would make sense to pump the oil and sell it now and use the revenue to purchase an interest-bearing asset. The return from the interest-earning asset, say 16%, would exceed the 15% rate at which you expect the value of your oil to increase. Higher interest rates thus reduce the willingness of resource owners to preserve these resources for future use.

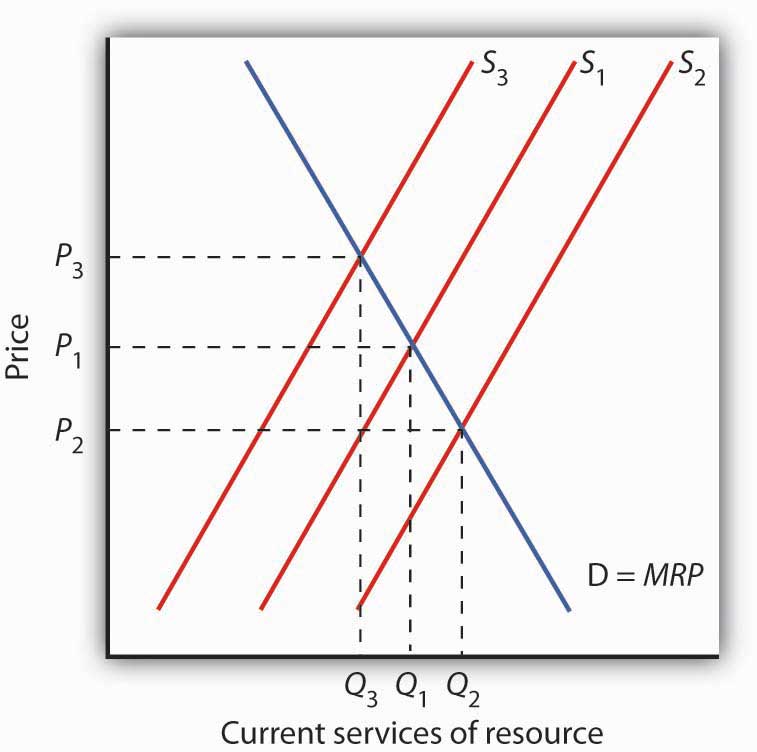

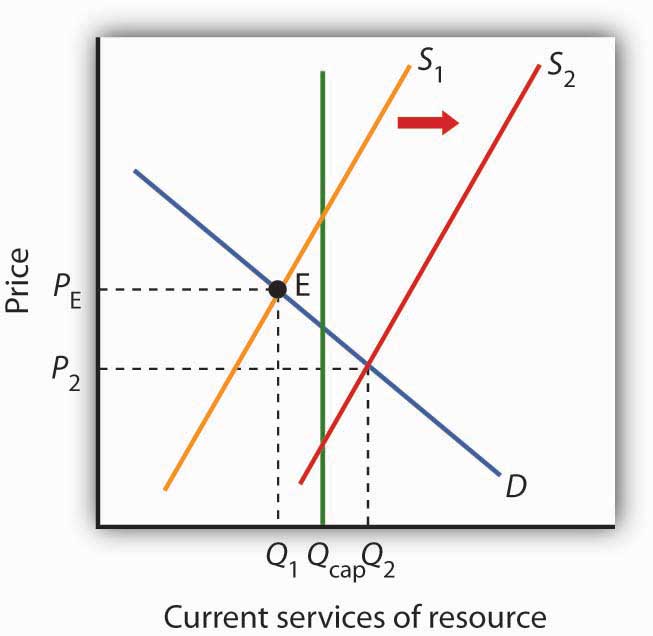

Figure 13.8 Future Generations and Exhaustible Natural Resources

The current demand D for services of an exhaustible resource is given by the marginal revenue product (MRP). S1 reflects the current marginal cost of extracting the resource, the prevailing interest rate, and expectations of future demand for the resource. The level of current consumption is thus at Q1. If the interest rate rises, the supply curve shifts to S2, causing the price of the resource to fall to P2 and the quantity consumed to rise to Q2. A drop in the interest rate shifts the supply curve to S3, leading to an increase in price to P3 and a decrease in consumption to Q3.

The supply of an exhaustible resource such as oil is thus governed by its current price, its expected future price, and the interest rate. An increase in the expected future price—or a reduction in the interest rate—reduces the supply of oil today, preserving more for future use. If owners of oil expect lower prices in the future, or if the interest rate rises, they will supply more oil today and conserve less for future use. This relationship is illustrated in Figure 13.8 "Future Generations and Exhaustible Natural Resources". The current demand D for these services is given by their marginal revenue product (MRP). Suppose S1 reflects the current marginal cost of extracting the resource, the prevailing interest rate, and expectations of future demand for the resource. If the interest rate increases, owners will be willing to supply more of the natural resource at each price, thereby shifting the supply curve to the right to S2. The current price of the resource will fall. If the interest rate falls, the supply curve for the resource will shift to the left to S3 as more owners of the resource decide to leave more of the resource in the earth. As a result, the current price rises.

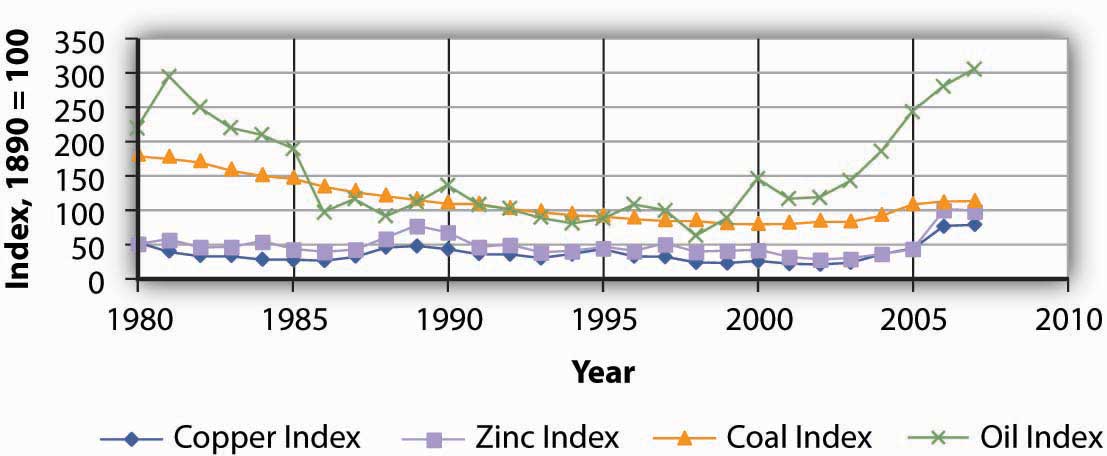

Resource Prices Over Time

Since using nonrenewable resources would seem to mean exhausting a fixed supply, then one would expect the prices of exhaustible natural resources to rise over time as the resources become more and more scarce. Over time, however, the prices of most exhaustible natural resources have fluctuated considerably relative to the prices of all other goods and services. Figure 13.9 "Natural Resource Prices, 1980–2007" shows the prices of four major exhaustible natural resources from 1980 to 2007. Prices have been adjusted for inflation to reflect the prices of these resources relative to other prices.

During the final two decades of the twentieth century, exhaustible natural resource prices were generally falling or stable. With the start of the current century, their prices have been rising. In short, why do prices of natural resources fluctuate as they do? Should the process of continuing to “exhaust” them just drive their prices up over time?

Figure 13.9 Natural Resource Prices, 1980–2007

The chart shows changes in the prices of five exhaustible resources—chromium, copper, nickel, tin, and tungsten (relative to the prices of other goods and services)—from 1890–2003.

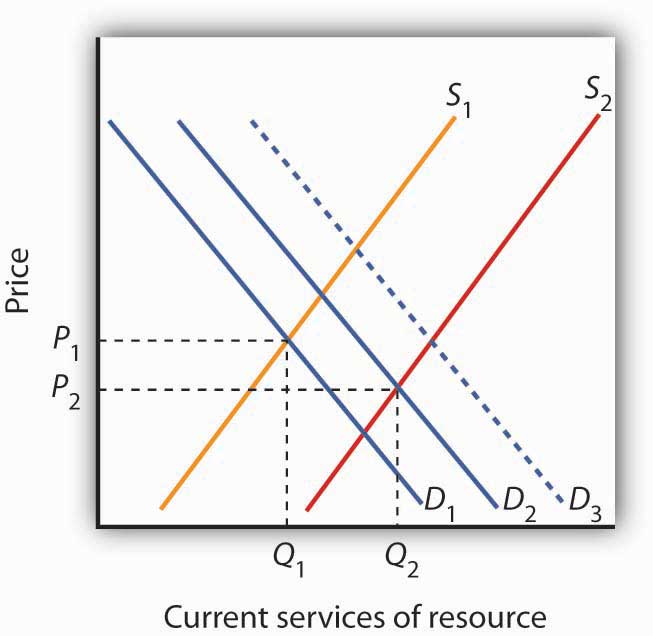

Sources: U.S. Bureau of the Census, Statistical Abstract of the United States, online; U.S. Energy Information Administration, Annual Energy Review, online.

In setting their expectations, people in the marketplace must anticipate not only future demand but future supply as well. Demand in future periods could fall short of expectations if new technologies produce goods and services using less of a natural resource. That has clearly happened. The quantity of energy—which is generally produced using exhaustible fossil fuels—used to produce a unit of output has fallen by more than half in the last three decades. At the same time, rising income levels around the world, particularly in China and India over the last two decades, have led to increased demand for energy. Supply increases when previously unknown deposits of natural resources are discovered and when technologies are developed to extract and refine resources more cheaply. Figure 13.10 "An Explanation for Falling Resource Prices" shows that discoveries that reduce the demand below expectations and increase the supply of natural resources can push prices down in a way that people in previous periods might not have anticipated. This scenario explains the fall in some prices of natural resources in the latter part of the twentieth century. To explain the recent rise in exhaustible natural resources prices, we can say that the factors contributing to increased demand for energy and some other exhaustible natural resources were outweighing the factors contributing to increased supply, resulting in higher prices—a scenario opposite to what is shown in Figure 13.10 "An Explanation for Falling Resource Prices". This upward trend began to reverse itself again in late 2008, as the world economies began to slump.

Figure 13.10 An Explanation for Falling Resource Prices

Demand for resources has increased over time from D1 to D2, but this shift in demand is less than it would have been (D3) if technologies for producing goods and services using less resource per unit of output had not been developed. Supply of resources has increased from S1 to S2 as a result of the discovery of deposits of natural resources and/or development of new technologies for extracting and refining resources. As a result, the prices of many natural resources have fallen.

Will we ever run out of exhaustible natural resources? Past experience suggests that we will not. If no new technologies or discoveries that reduce demand or increase supply occur, then resource prices will rise. As they rise, consumers of these resources will demand lower quantities of these resources. Eventually, the price of a particular resource could rise so high that the quantity demanded would fall to zero. At that point, no more of the resource would be used. There would still be some of the resource in the earth—it simply would not be practical to use more of it. The market simply will not allow us to “run out” of exhaustible natural resources.

Renewable Natural Resources

As is the case with exhaustible natural resources, our consumption of the services of renewable natural resources can affect future generations. Unlike exhaustible resources, however, renewable resources can be consumed in a way that does not diminish their stocks.

Carrying Capacity and Future Generations

The quantity of a renewable natural resource that can be consumed in any period without reducing the stock of the resource available in the next period is its carrying capacityThe quantity of a renewable natural resource that can be consumed in any period without reducing the stock of the resource available in the next period.. Suppose, for example, that a school of 10 million fish increases by 1 million fish each year. The carrying capacity of the school is therefore 1 million fish per year—the harvest of 1 million fish each year will leave the size of the population unchanged. Harvests that exceed a resource’s carrying capacity reduce the stock of the resource; harvests that fall short of it increase that stock.

As is the case with exhaustible natural resources, future generations have a stake in current consumption of a renewable resource. Figure 13.11 "Future Generations and Renewable Resources" shows the efficient level of consumption of such a resource. Suppose Qcap is the carrying capacity of a particular resource and S1 is the supply curve that reflects the current marginal cost of utilizing the resource, including costs for the labor and capital required to make its services available, given the interest rate and expected future demand. The efficient level of consumption in the current period is found at point E, at the intersection of the current period’s demand and supply curves. Notice that in the case shown, current consumption at Q1 is less than the carrying capacity of the resource. A larger stock of this resource will be available in subsequent periods than is available now.

Figure 13.11 Future Generations and Renewable Resources

The efficient quantity of services to consume is determined by the intersection S1 and the demand curve D. This intersection occurs at point E at a quantity of Q1. This lies below the carrying capacity Qcap. An increase in interest rates, however, shifts the supply curve to S2. The efficient level of current consumption rises to Q2, which now exceeds the carrying capacity of the resource.

Now suppose interest rates increase. As with nonrenewable resources, higher interest rates shift the supply curve to the right, as shown by S2. The result is an increase in current consumption to Q2. Now consumption exceeds the carrying capacity, and the stock of the resource available to future generations will be reduced. While this solution may be efficient, the resource will not be sustained over time at current levels.

If society is concerned about a reduction in the amount of the resource available in the future, further steps may be required to preserve it. For example, if trees are being cut down faster than they are being replenished in a particular location, such as the Amazon in Brazil, a desire to maintain biological diversity might lead to conservation efforts.

Economic Rent and The Market for Land

We turn finally to the case of land that is used solely for the space it affords for other activities—parks, buildings, golf courses, and so forth. We shall assume that the carrying capacity of such land equals its quantity.

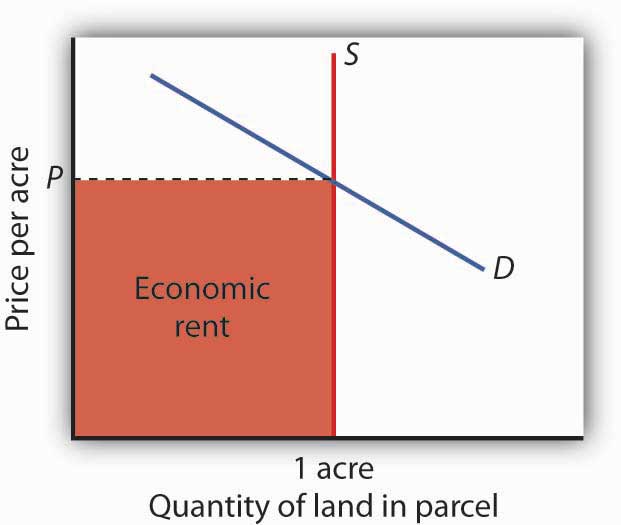

Figure 13.12 The Market for Land

The price of a one-acre parcel of land is determined by the intersection of a vertical supply curve and the demand curve for the parcel. The sum paid for the parcel, shown by the shaded area, is economic rent.

The supply of land is a vertical line. The quantity of land in a particular location is fixed. Suppose, for example, that the price of a one-acre parcel of land is zero. At a price of zero, there is still one acre of land; quantity is unaffected by price. If the price were to rise, there would still be only one acre in the parcel. That means that the price of the parcel exceeds the minimum price—zero—at which the land would be available. The amount by which any price exceeds the minimum price necessary to make a resource available is called economic rentThe amount by which any price exceeds the minimum price necessary to make a resource available..

The concept of economic rent can be applied to any factor of production that is in fixed supply above a certain price. In this sense, much of the salary received by Brad Pitt constitutes economic rent. At a low enough salary, he might choose to leave the entertainment industry. How low would depend on what he could earn in a best alternative occupation. If he earns $30 million per year now but could earn $100,000 in a best alternative occupation, then $29.9 million of his salary is economic rent. Most of his current earnings are in the form of economic rent, because his salary substantially exceeds the minimum price necessary to keep him supplying his resources to current purposes.

Key Takeaways

- Natural resources are either exhaustible or renewable.

- The demand for the services of a natural resource in any period is given by the marginal revenue product of those services.

- Owners of natural resources have an incentive to take into account the current price, the expected future demand for them, and the interest rate when making choices about resource supply.

- The services of a renewable natural resource may be consumed at levels that are below or greater than the carrying capacity of the resource.

- The payment for a resource above the minimum price necessary to make the resource available is economic rent.

Try It!

You have just been given an oil well in Texas by Aunt Carmen. The current price of oil is $45 per barrel, and it is estimated that your oil deposit contains about 10,000 barrels of oil. For simplicity, assume that it does not cost anything to extract the oil and get it to market and that you must decide whether to empty the well now or wait until next year. Suppose the interest rate is 10% and that you expect that the price of oil next year will rise to $54 per barrel. What should you do? Would your decision change if the choice were to empty the well now or in two years?

Case in Point: World Oil Dilemma

Figure 13.13

© 2010 Jupiterimages Corporation

The world is going to need a great deal more oil. Perhaps soon.

The International Energy Agency, regarded as one of the world’s most reliable in assessing the global energy market, says that world oil production must increase from 87 million barrels per day in 2008 to 99 million barrels per day by 2015. Looking farther ahead, the situation gets scarier. Jad Mouawad reported in The New York Times that the number of cars and trucks in the world is expected to double—to 2 billion—in 30 years. The number of passenger jetliners in the world will double in 20 years. The IEA says that the demand for oil will increase by 35% by 2030. Meeting that demand would, according to the Times, require pumping an additional 11 billion barrels of oil each year—an increase of 13%.

Certainly some in Saudi Arabia, which holds a quarter of the world’s oil reserves, were sure it would be capable of meeting the world’s demand for oil, at least in the short term. In the summer of 2005, Peter Maass of The New York Times reported that Saudi Arabia’s oil minister, Ali al-Naimi, gave an upbeat report in Washington, D.C. to a group of world oil officials. With oil prices then around $55 a barrel, he said, “I want to assure you here today that Saudi Arabia’s reserves are plentiful, and we stand ready to increase output as the market dictates.” The minister may well have been speaking in earnest. But, according to the U. S. Energy Information Administration, Saudi Arabia’s oil production was 9.6 million barrels per day in 2005. It fell to 8.7 million barrels per day in 2006 and to 8.7 million barrels per day in 2007. The agency reports that world output also fell in each of those years. World oil prices soared to $147 per barrel in June of 2008. What happened?

Much of the explanation for the reduction in Saudi Arabia’s output in 2006 and 2007 can be found in one field. More than half of the country’s oil production comes from the Ghawar field, the most productive oil field in the world. Ghawar was discovered in 1948 and has provided the bulk of Saudi Arabia’s oil. It has given the kingdom and the world more than 5 million barrels of oil per day for well over 50 years. It is, however, beginning to lose pressure. To continue getting oil from it, the Saudis have begun injecting the field with seawater. That creates new pressure and allows continued, albeit somewhat reduced, production. Falling production at Ghawar has been at the heart of Saudi Arabia’s declining output.

The Saudi’s next big hope is an area known as the Khurais complex. An area about half the size of Connecticut, the Saudis are counting on Khurais to produce 1.2 million barrels per day beginning in 2009. If it does, it will be the world’s fourth largest oil field, behind Ghawar and fields in Mexico and Kuwait. Khurais, however, is no Ghawar. Not only is its expected yield much smaller, but it is going to be far more difficult to exploit. Khurais has no pressure of its own. To extract any oil from it, the Saudis will have to pump a massive amount of seawater from the Persian Gulf, which is 120 miles from Khurais. Injecting the water involves an extraordinary complex of pipes, filters, and more than 100 injection wells for the seawater. The whole project will cost a total of $15 billion. The Saudis told The Wall Street Journal that the development of the Khurais complex is the biggest industrial project underway in the world. The Saudis have used seismic technology to take more than 2.8 million 3-dimensional pictures of the deposit, trying to gain as complete an understanding of what lies beneath the surface as possible. The massive injection of seawater is risky. Done incorrectly, the introduction of the seawater could make the oil unusable.

Khurais illustrates a fundamental problem that the world faces as it contemplates its energy future. The field requires massive investment for an extraordinarily uncertain outcome, one that will only increase Saudi capacity from about 11.3 million barrels per day to 12.5.

Sadad al-Husseini, who until 2004 was the second in command at Aramco and is now a private energy consultant, doubts that Saudi Arabia will be able to achieve even that increase in output. He says that is true of the world in general, that the globe has already reached the maximum production it will ever achieve—the so-called “peak production” theory. What we face, he told The Wall Street Journal in 2008, is a grim future of depleting oil resources and rising prices.

Rising oil prices, of course, lead to greater conservation efforts, and the economic slump that took hold in the latter part of 2008 has led to a sharp reversal in oil prices. But, if “peak production” theory is valid, lower oil prices will not persist after world growth returns to normal. This idea is certainly one to consider as we watch the path of oil prices over the next few years.

Sources: Peter Maass, “The Breaking Point,” The New York Times Magazine Online, August 21, 2005; Jad Mouawad, “The Big Thirst,” The New York Times Online, April 20, 2008; US. Energy Information Administration, International Controlling a Monthly, May 2008, Table 4.1c; Neil King, Jr. “Saudis Face Hurdles in New Oil Drilling,” The Wall Street Journal, April 22, 2008, A1, Neil King, Jr. “Global Oil-Supply Worries Fuel Debate in Saudi Arabia,” The Wall Street Journal, June 27, 2008, A1.

Answer to Try It! Problem

Since you expect oil prices to rise ($54 − 45)/$45 = 20% and the interest rate is only 10%, you would be better off waiting a year before emptying the well. Another way of seeing this is to compute the present value of the oil a year from now:

Po = ($54 * 10,000)/(1 + 0.10)1 = $490,909.09Since $490,909 is greater than the $45*10,000 = $450,000 you could earn by emptying the well now, the present value calculation shows the rewards of waiting a year.

If the choice is to empty the well now or in 2 years, however, you would be better off emptying it now, since the present value is only $446,280.99:

Po = ($54 * 10,000)/(1 + 0.10)2 = $446,280.9913.4 Review and Practice

Summary

Time is the complicating factor when we analyze capital and natural resources. Because current choices affect the future stocks of both resources, we must take those future consequences into account. And because a payment in the future is worth less than an equal payment today, we need to convert the dollar value of future consequences to present value. We determine the present value of a future payment by dividing the amount of that payment by (1 + r)n, where r is the interest rate and n is the number of years until the payment will occur. The present value of a given future value is smaller at higher values of n and at higher interest rates.

Interest rates are determined in the market for loanable funds. The demand for loanable funds is derived from the demand for capital. At lower interest rates, the quantity of capital demanded increases. This, in turn, leads to an increase in the demand for loanable funds. In the aggregate, the supply curve of loanable funds is likely to be upward-sloping.

We assume that firms determine whether to acquire an additional unit of capital by (NPV) of the asset. When NPV equals zero, the present value of capital’s marginal revenue product equals the present value of its marginal factor cost. The demand curve for capital shows the quantity of capital demanded at each interest rate. Among the factors that shift the demand curve for capital are changes in expectations, new technology, change in demands for goods and services, and change in relative factor prices.

Markets for natural resources are distinguished according to whether the resources are exhaustible or renewable. Owners of natural resources have an incentive to consider future as well as present demands for these resources. Land, when it has a vertical supply curve, generates a return that consists entirely of rent. In general, economic rent is return to a resource in excess of the minimum price necessary to make that resource available.

Concept Problems

- The charging of interest rates is often viewed with contempt. Do interest rates serve any useful purpose?

- How does an increase in interest rates affect the present value of a future payment?

- How does an increase in the size of a future payment affect the present value of the future payment?

- Two payments of $1,000 are to be made. One of them will be paid one year from today and the other will be paid two years from today. Which has the greater present value? Why?

- The essay on the viatical settlements industry suggests that investors pay only 80% of the face value of a life insurance policy that is expected to be paid off in six months. Why? Would it not be fairer if investors paid the full value?

-

How would each of the following events affect the demand curve for capital?

- A prospective cut in taxes imposed on business firms

- A reduction in the price of labor

- An improvement in technology that increases capital’s marginal product

- An increase in interest rates

- If developed and made practical, fusion technology would allow the production of virtually unlimited quantities of cheap, pollution-free energy. Some scientists predict that the technology for fusion will be developed within the next few decades. How does an expectation that fusion will be developed affect the market for oil today?

- Is the rent paid for an apartment economic rent? Explain.

- Film director Brett Ratner (Rush Hour, After the Sunset, and others) commented to a New York Times (November 13, 2004, p. A19) reporter that, “If he weren’t a director, Mr. Ratner said he would surely be taking orders at McDonald’s.” How much economic rent is Mr. Ratner likely earning?

- Suppose you own a ranch, and that commercial and residential development start to take place around your ranch. How will this affect the value of your property? What will happen to the quantity of land? What kind of return will you earn?

- Explain why higher interest rates tend to increase the current use of natural resources.

Numerical Problems