This is “Price, the Only Revenue Generator”, chapter 15 from the book Marketing Principles (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 15 Price, the Only Revenue Generator

Many people will stand in line for something free, even if it takes hours. When Chick-fil-A opens new locations, they offer the first one hundred customers a free meal every week for a year. Customers camp out to get the free meals. When KFC introduced its grilled chicken, they put coupons good for a free piece of chicken in many Sunday newspaper magazines. So how do sellers make any money if they always offer goods and services on sale or for a special deal? Many sellers give customers something for free hoping they’ll buy other products, but a careful balance is needed to make sure a profit is made. Are free products a good pricing strategy?

Figure 15.1

Some of shoppers’ favorite four-letter words include FREE, SALE, and BOGO (Buy One Get One Free).

© 2010 Jupiterimages Corporation

In previous chapters, we looked at the offering (products and services), communication (promotion), and place (the other marketing mix variables), all of which cost firms money. Price is the only marketing mix variable or part of the offering that generates revenue. Buyers relate the price to value. They must feel they are getting value for the price paid. Pricing decisions are extremely important. So how do organizations decide how to price their goods and services?

15.1 The Pricing Framework and a Firm’s Pricing Objectives

Learning Objectives

- Understand the factors in the pricing framework.

- Explain the different pricing objectives organizations have to choose from.

Prices can be easily changed and easily matched by your competitors. Consequently, your product’s price alone might not provide your company with a sustainable competitive advantage. Nonetheless, prices can attract consumers to different retailers and businesses to different suppliers.

Organizations must remember that the prices they charge should be consistent with their offerings, promotions, and distribution strategies. In other words, it wouldn’t make sense for an organization to promote a high-end, prestige product, make it available in only a limited number of stores, and then sell it for an extremely low price. The price, product, promotion (communication), and placement (distribution) of a good or service should convey a consistent image. If you’ve ever watched the television show The Price Is Right, you may wonder how people guess the exact price of the products. Watch the video clip below to see some of the price guessing on The Price Is Right.

Video Clip

Perfect Bid on The Price Is Right

(click to see video)Contestant guesses exact price of prizes.

Video Clip

Trying to Figure Out When The Price Is Right

(click to see video)How do consumers get so close when guessing the prices of products?

The Pricing Framework

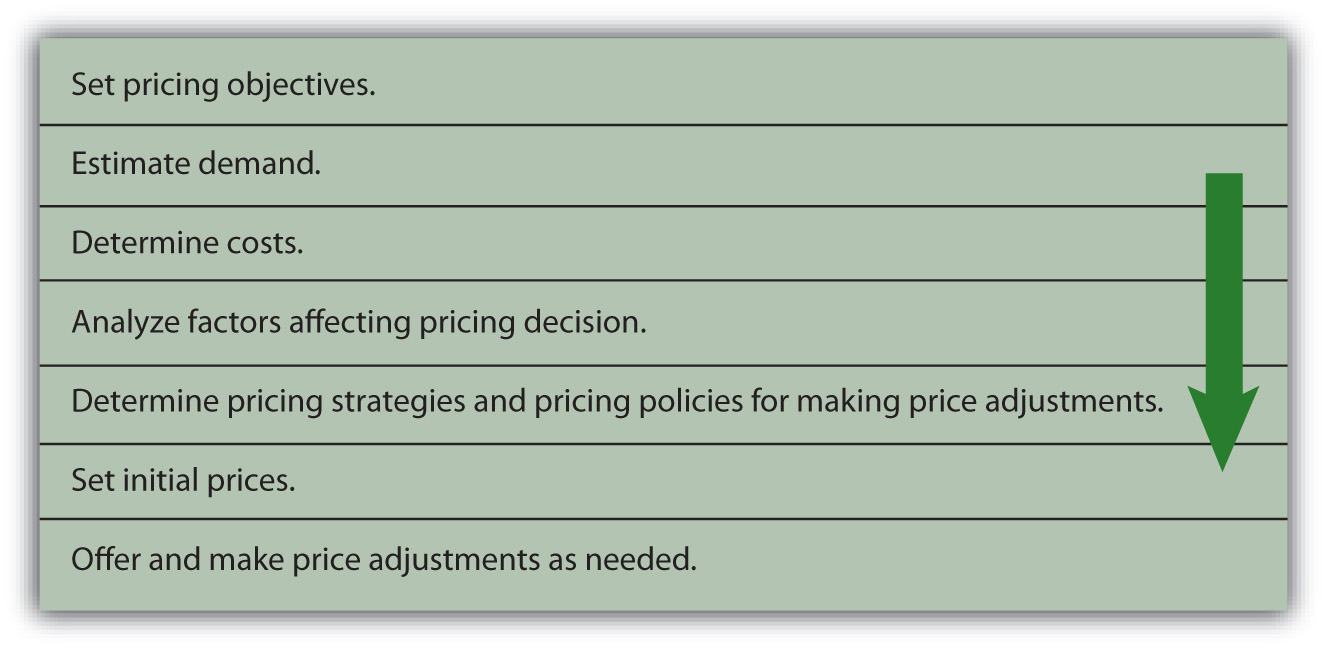

Before pricing a product, an organization must determine its pricing objectivesWhat an organization wants to accomplish with its pricing.. In other words, what does the company want to accomplish with its pricing? Companies must also estimate demand for the product or service, determine the costs, and analyze all factors (e.g., competition, regulations, and economy) affecting price decisions. Then, to convey a consistent image, the organization should choose the most appropriate pricing strategy and determine policies and conditions regarding price adjustments. The basic steps in the pricing framework are shown in Figure 15.2 "The Pricing Framework".

Figure 15.2 The Pricing Framework

The Firm’s Pricing Objectives

Different firms want to accomplish different things with their pricing strategies. For example, one firm may want to capture market share, another may be solely focused on maximizing its profits, and another may want to be perceived as having products with prestige. Some examples of different pricing objectives companies may set include profit-oriented objectives, sales-oriented objectives, and status quo objectives.

Earning a Targeted Return on Investment (ROI)

ROI, or return on investment, is the amount of profit an organization hopes to make given the amount of assets, or money, it has tied up in a product. ROI is a common pricing objective for many firms. Companies typically set a certain percentage, such as 10 percent, for ROI in a product’s first year following its launch. So, for example, if a company has $100,000 invested in a product and is expecting a 10 percent ROI, it would want the product’s profit to be $10,000.

Maximizing Profits

Many companies set their prices to increase their revenues as much as possible relative to their costs. However, large revenues do not necessarily translate into higher profits. To maximize its profits, a company must also focus on cutting costs or implementing programs to encourage customer loyalty.

In weak economic markets, many companies manage to cut costs and increase their profits, even though their sales are lower. How do they do this? The Gap cut costs by doing a better job of controlling its inventory. The retailer also reduced its real estate holdings to increase its profits when its sales were down during the latest economic recession. Other firms such as Dell, Inc., cut jobs to increase their profits. Meanwhile, Walmart tried to lower its prices so as to undercut its competitors’ prices to attract more customers. After it discovered that wealthier consumers who didn’t usually shop at Walmart before the recession were frequenting its stores, Walmart decided to upgrade some of its offerings, improve the checkout process, and improve the appearance of some of its stores to keep these high-end customers happy and enlarge its customer base. Other firms increased their prices or cut back on their marketing and advertising expenses. A firm has to remember, however, that prices signal value. If consumers do not perceive that a product has a high degree of value, they probably will not pay a high price for it. Furthermore, cutting costs cannot be a long-term strategy if a company wants to maintain its image and position in the marketplace.

Maximizing Sales

Maximizing sales involves pricing products to generate as much revenue as possible, regardless of what it does to a firm’s profits. When companies are struggling financially, they sometimes try to generate cash quickly to pay their debts. They do so by selling off inventory or cutting prices temporarily. Such cash may be necessary to pay short-term bills, such as payroll. Maximizing sales is typically a short-term objective since profitability is not considered.

Maximizing Market Share

Some organizations try to set their prices in a way that allows them to capture a larger share of the sales in their industries. Capturing more market share doesn’t necessarily mean a firm will earn higher profits, though. Nonetheless, many companies believe capturing a maximum amount of market share is downright necessary for their survival. In other words, they believe if they remain a small competitor they will fail. Firms in the cellular phone industry are an example. The race to be the biggest cell phone provider has hurt companies like Motorola. Motorola holds only 10 percent of the cell phone market, and its profits on their product lines are negative.

Maintaining the Status Quo

Sometimes a firm’s objective may be to maintain the status quoAn objective a firm sets to maintain its current prices and/or its competitors’ prices. or simply meet, or equal, its competitors’ prices or keep its current prices. Airline companies are a good example. Have you ever noticed that when one airline raises or lowers its prices, the others all do the same? If consumers don’t accept an airline’s increased prices (and extra fees) such as the charge for checking in with a representative at the airport rather than checking in online, other airlines may decide not to implement the extra charge and the airline charging the fee may drop it. Companies, of course, monitor their competitors’ prices closely when they adopt a status quo pricing objective.

Key Takeaway

Price is the only marketing variable that generates money for a company. All the other variables (product, communication, distribution) cost organizations money. A product’s price is the easiest marketing variable to change and also the easiest to copy. Before pricing a product, an organization must determine its pricing objective(s). A company can choose from pricing objectives such as maximizing profits, maximizing sales, capturing market share, achieving a target return on investment (ROI) from a product, and maintaining the status quo in terms of the price of a product relative to competing products.

Review Questions

- What are the steps in the pricing framework?

- In addition to profit-oriented objectives, what other types of pricing objectives do firms utilize?

We want to hear your feedback

At Flat World Knowledge, we always want to improve our books. Have a comment or suggestion? Send it along! http://bit.ly/wUJmef

15.2 Factors That Affect Pricing Decisions

Learning Objectives

- Understand the factors that affect a firm’s pricing decisions.

- Understand why companies must conduct research before setting prices in international markets.

- Learn how to calculate the breakeven point.

Having a pricing objective isn’t enough. A firm also has to look at a myriad of other factors before setting its prices. Those factors include the offering’s costs, the demand, the customers whose needs it is designed to meet, the external environment—such as the competition, the economy, and government regulations—and other aspects of the marketing mix, such as the nature of the offering, the current stage of its product life cycle, and its promotion and distribution. If a company plans to sell its products or services in international markets, research on the factors for each market must be analyzed before setting prices. Organizations must understand buyers, competitors, the economic conditions, and political regulations in other markets before they can compete successfully. Next we look at each of the factors and what they entail.

Customers

How will buyers respond? Three important factors are whether the buyers perceive the product offers value, how many buyers there are, and how sensitive they are to changes in price. In addition to gathering data on the size of markets, companies must try to determine how price sensitive customers are. Will customers buy the product, given its price? Or will they believe the value is not equal to the cost and choose an alternative or decide they can do without the product or service? Equally important is how much buyers are willing to pay for the offering. Figuring out how consumers will respond to prices involves judgment as well as research.

Price elasticityThe amount of sensitivity to price changes, which affects the demand for a product., or people’s sensitivity to price changes, affects the demand for products. Think about a pair of sweatpants with an elastic waist. You can stretch an elastic waistband like the one in sweatpants, but it’s much more difficult to stretch the waistband of a pair of dress slacks. Elasticity refers to the amount of stretch or change. For example, the waistband of sweatpants may stretch if you pull on it. Similarly, the demand for a product may change if the price changes. Imagine the price of a twelve-pack of sodas changing to $1.50 a pack. People are likely to buy a lot more soda at $1.50 per twelve-pack than they are at $4.50 per twelve-pack. Conversely, the waistband on a pair of dress slacks remains the same (doesn’t change) whether you pull on it or not. Likewise, demand for some products won’t change even if the price changes. The formula for calculating the price elasticity of demand is as follows.

Price elasticity = percentage change in quantity demanded ÷ percentage change in priceWhen consumers are very sensitive to the price change of a product—that is, they buy more of it at low prices and less of it at high prices—the demand for it is price elasticConsumers are very sensitive to price changes and buy more at low prices and less at high prices.. Durable goods such as TVs, stereos, and freezers are more price elastic than necessities. People are more likely to buy them when their prices drop and less likely to buy them when their prices rise. By contrast, when the demand for a product stays relatively the same and buyers are not sensitive to changes in its price, the demand is price inelasticBuyers are not sensitive to price changes and demand is relatively unchanged.. Demand for essential products such as many basic food and first-aid products is not as affected by price changes as demand for many nonessential goods.

The number of competing products and substitutes available affects the elasticity of demand. Whether a person considers a product a necessity or a luxury and the percentage of a person’s budget allocated to different products and services also affect price elasticity. Some products, such as cigarettes, tend to be relatively price inelastic since most smokers keep purchasing them regardless of price increases and the fact that other people see cigarettes as unnecessary. Service providers, such as utility companies in markets in which they have a monopoly (only one provider), face more inelastic demand since no substitutes are available.

Competitors

How competitors price and sell their products will have a tremendous effect on a firm’s pricing decisions. If you wanted to buy a certain pair of shoes, but the price was 30 percent less at one store than another, what would you do? Because companies want to establish and maintain loyal customers, they will often match their competitors’ prices. Some retailers, such as Home Depot, will give you an extra discount if you find the same product for less somewhere else. Similarly, if one company offers you free shipping, you might discover other companies will, too. With so many products sold online, consumers can compare the prices of many merchants before making a purchase decision.

The availability of substitute products affects a company’s pricing decisions as well. If you can find a similar pair of shoes selling for 50 percent less at a third store, would you buy them? There’s a good chance you might. Recall from the five forces model discussed in Chapter 2 "Strategic Planning" that merchants must look at substitutes and potential entrants as well as direct competitors.

The Economy and Government Laws and Regulations

The economy also has a tremendous effect on pricing decisions. In Chapter 2 "Strategic Planning" we noted that factors in the economic environment include interest rates and unemployment levels. When the economy is weak and many people are unemployed, companies often lower their prices. In international markets, currency exchange rates also affect pricing decisions.

Pricing decisions are affected by federal and state regulations. Regulations are designed to protect consumers, promote competition, and encourage ethical and fair behavior by businesses. For example, the Robinson-Patman ActA U.S. act that limits price discrimination (charging different customers different prices for the same product and quantities of it purchased). limits a seller’s ability to charge different customers different prices for the same products. The intent of the act is to protect small businesses from larger businesses that try to extract special discounts and deals for themselves in order to eliminate their competitors. However, cost differences, market conditions, and competitive pricing by other suppliers can justify price differences in some situations. In other words, the practice isn’t illegal under all circumstances. You have probably noticed that restaurants offer senior citizens and children discounted menus. The movies also charge different people different prices based on their ages and charge different amounts based on the time of day, with matinees usually less expensive than evening shows. These price differences are legal. We will discuss more about price differences later in the chapter.

Price fixingWhen firms get together and agree to charge the same prices., which occurs when firms get together and agree to charge the same prices, is illegal. Usually, price fixing involves setting high prices so consumers must pay a high price regardless of where they purchase a good or service. Video systems, LCD (liquid crystal display) manufacturers, auction houses, and airlines are examples of offerings in which price fixing existed. When a company is charged with price fixing, it is usually ordered to take some type of action to reach a settlement with buyers.

Price fixing isn’t uncommon. Nintendo and its distributors in the European Union were charged with price fixing and increasing the prices of hardware and software. Sharp, LG, and Chungwa collaborated and fixed the prices of the LCDs used in computers, cell phones, and other electronics. Virgin Atlantic Airways and British Airways were also involved in price fixing for their flights. Sotheby’s and Christie’s, two large auction houses, used price fixing to set their commissions.

One of the most famous price-fixing schemes involved Robert Crandall, the CEO of American Airlines in the early 1990s. Crandall called Howard Putnam, the CEO of Braniff Airlines, since the two airlines were fierce competitors in the Dallas market. Unfortunately for Crandall, Putnam taped the conversation and turned it over to the U.S. Department of Justice. Their conversation went like this:

Crandall: “I think it’s dumb—to pound—each other and neither one of us making a [expletive] dime.”

Putnam: “Well…”

Crandall: “I have a suggestion for you. Raise your—fares twenty percent. I’ll raise mine the next morning.”

Putnam: “Robert, we—”

Crandall: “You’ll make more money and I will too.”

Putnam: “We can’t talk about pricing.”

Crandall: “Oh, [expletive] Howard. We can talk about any [expletive] thing we want to talk about.”David S. Jackson, John S. Demott, and Allen Pusey, “Dirty Tricks in Dallas,” Time, March 7, 1983, http://www.time.com/time/magazine/article/0,9171,953755,00.html (accessed December 15, 2009).

By requiring sellers to keep a minimum price level for similar products, unfair trade lawsState laws requiring sellers to keep a minimum price level for similar products. protect smaller businesses. Unfair trade laws are state laws preventing large businesses from selling products below cost (as loss leaders) to attract customers to the store. When companies act in a predatory manner by setting low prices to drive competitors out of business, it is a predatory pricingWhen companies act in a predatory manner by setting low prices to drive competitors out of business. strategy.

Similarly, bait-and-switch pricing is illegal in many states. Bait and switchA pricing tactic a seller uses to lure in, or “bait,” customers with a low-priced product. The seller then attempts to persuade the buyer to purchase higher-priced products, perhaps by telling him or her that the low-priced product is no longer available., or bait advertising, occurs when a business tries to “bait,” or lure in, customers with an incredibly low-priced product. Once customers take the bait, sales personnel attempt to sell them more expensive products. Sometimes the customers are told the cheaper product is no longer available.

You perhaps have seen bait-and-switch pricing tactics used to sell different electronic products or small household appliances. While bait-and-switch pricing is illegal in many states, stores can add disclaimers to their ads stating that there are no rain checks or that limited quantities are available to justify trying to get you to buy a different product. However, the advertiser must offer at least a limited quantity of the advertised product, even if it sells out quickly.

Product Costs

The costs of the product—its inputs—including the amount spent on product development, testing, and packaging required have to be taken into account when a pricing decision is made. So do the costs related to promotion and distribution. For example, when a new offering is launched, its promotion costs can be very high because people need to be made aware that it exists. Thus, the offering’s stage in the product life cycle can affect its price. Keep in mind that a product may be in a different stage of its life cycle in other markets. For example, while sales of the iPhone remain fairly constant in the United States, the Koreans felt the phone was not as good as their current phones and was somewhat obsolete. Similarly, if a company has to open brick-and-mortar storefronts to distribute and sell the offering, this too will have to be built into the price the firm must charge for it.

The point at which total costs equal total revenue is known as the breakeven point (BEP)The amount (in units or dollars) where total revenue equals total costs.. For a company to be profitable, a company’s revenue must be greater than its total costs. If total costs exceed total revenue, the company suffers a loss.

Total costsFixed costs plus variable costs. include both fixed costs and variable costs. Fixed costsOverhead or costs that remain the same regardless of the level of production or the level of sales., or overhead expenses, are costs that a company must pay regardless of its level of production or level of sales. A company’s fixed costs include items such as rent, leasing fees for equipment, contracted advertising costs, and insurance. As a student, you may also incur fixed costs such as the rent you pay for an apartment. You must pay your rent whether you stay there for the weekend or not. Variable costsCosts that change with the level of production or service delivery. are costs that change with a company’s level of production and sales. Raw materials, labor, and commissions on units sold are examples of variable costs. You, too, have variable costs, such as the cost of gasoline for your car or your utility bills, which vary depending on how much you use.

Consider a small company that manufactures specialty DVDs and sells them through different retail stores. The manufacturer’s selling price (MSP) is $15, which is what the retailers pay for the DVDs. The retailers then sell the DVDs to consumers for an additional charge. The manufacturer has the following charges:

| Copyright and distribution charges for the titles | $150,000 |

| Package and label designs for the DVDs | $10,000 |

| Advertising and promotion costs | $40,000 |

| Reproduction of DVDs | $5 per unit |

| Labels and packaging | $1 per unit |

| Royalties | $1 per unit |

In order to determine the breakeven point, you must first calculate the fixed and variable costs. To make sure all costs are included, you may want to highlight the fixed costs in one color (e.g., green) and the variable costs in another color (e.g., blue). Then, using the formulas below, calculate how many units the manufacturer must sell to break even.

The formula for BEP is as follows:

BEP = total fixed costs (FC) ÷ contribution per unit (CU) contribution per unit = MSP – variable costs (VC) BEP = $200,000 ÷ ($15 – $7) = $200,000 ÷ $8 = 25,000 units to break evenTo determine the breakeven point in dollars, you simply multiply the number of units to break even by the MSP. In this case, the BEP in dollars would be 25,000 units times $15, or $375,000.

Key Takeaway

In addition to setting a pricing objective, a firm has to look at a number of factors before setting its prices. These factors include the offering’s costs, the customers whose needs it is designed to meet, the external environment—such as the competition, the economy, and government regulations—and other aspects of the marketing mix, such as the nature of the offering, the stage of its product life cycle, and its promotion and distribution. In international markets, firms must look at environmental factors and customers’ buying behavior in each market. For a company to be profitable, revenues must exceed total costs.

Review Questions

- What factors do organizations consider when making price decisions?

- How do a company’s competitors affect the pricing decisions the firm will make?

- What is the difference between fixed costs and variable costs?

We want to hear your feedback

At Flat World Knowledge, we always want to improve our books. Have a comment or suggestion? Send it along! http://bit.ly/wUJmef

15.3 Pricing Strategies

Learning Objectives

- Understand introductory pricing strategies.

- Understand the different pricing approaches that businesses use.

Once a firm has established its pricing objectives and analyzed the factors that affect how it should price a product, the company must determine the pricing strategy (or strategies) that will help it achieve those objectives. As we have indicated, firms use different pricing strategies for their offerings. And oftentimes, the strategy depends on the stage of life cycle the offerings are in currently. Products may be in different stages of their life cycle in various international markets. Next, we’ll examine three strategies businesses often consider when a product is first introduced and then look at several different pricing approaches that companies utilize during the product life cycle.

Introductory Pricing Strategies

Think of products that have been introduced in the last decade and how products were priced when they first entered the market. Remember when the iPhone was first introduced, its price was almost $700. Since then, the price has dropped considerably even for new models. The same is true for DVD players, LCD televisions, digital cameras, and many high-tech products. As mentioned in Chapter 7 "Developing and Managing Offerings", a skimming price strategyA strategy whereby a company sets a high initial price for a product. The idea is to target buyers who are willing to pay a high price (top of the market) and buy products early. is when a company sets a high initial price for a product. The idea is to go after consumers who are willing to pay a high price (top of the market) and buy products early. This way, a company recoups its investment in the product faster.

The easy way to remember a skimming approach is to think of the turkey gravy at Thanksgiving. When the gravy is chilled, the fat rises to the top and is often “skimmed” off before serving. Price skimming is a pricing approach designed to skim that top part of the gravy, or the top of the market. Over time, the price of the product goes down as competitors enter the market and more consumers are willing to purchase the offering.

In contrast to a skimming approach, a penetration pricing strategyA strategy in which an organization offers a low initial price on a product so that it captures as much market share as possible. is one in which a low initial price is set. Often, many competitive products are already in the market. The goal is to get as much of the market as possible to try the product. Penetration pricing is used on many new food products, health and beauty supplies, and paper products sold in grocery stores and mass merchandise stores such as Walmart, Target, and Kmart.

Another approach companies use when they introduce a new product is everyday low pricesThe practice of charging a low initial price for an offering and maintaining that price throughout the offering’s product life cycle.. That is, the price initially set is the price the seller expects to charge throughout the product’s life cycle. Companies like Walmart and Lowe’s use everyday low pricing. Lowe’s emphasizes their everyday low pricing strategy with the letters in their name plus the letter “t” (Lowest).

Figure 15.3

New flavors of snacks, candy, cereal, and shampoo sold in grocery stores and by mass merchandisers similar to the one in this picture are priced using a penetration pricing strategy to get consumers to try the products.

© 2010 Jupiterimages Corporation

Pricing Approaches

Companies can choose many ways to set their prices. We’ll examine some common methods you often see. Many stores use cost-plus pricingA pricing strategy where a certain amount of profit is added to the total cost of a product in order to determine its price., in which they take the cost of the product and then add a profit to determine a price. Cost-plus pricing is very common. The strategy helps ensure that a company’s products’ costs are covered and the firm earns a certain amount of profit. When companies add a markupA certain amount of money added to the cost of a product to set the final price., or an amount added to the cost of a product, they are using a form of cost-plus pricing. When products go on sale, companies mark down the prices, but they usually still make a profit. Potential markdownsThe amount (in dollars or percent) taken off the price. or price reductions should be considered when deciding on a starting price.

Many pricing approaches have a psychological appeal. Odd-even pricingA strategy in which a company prices products a few cents below the next dollar amount or a few dollars (for high-cost products such as automobiles) below the next hundred- or thousand-dollar value. occurs when a company prices a product a few cents or a few dollars below the next dollar amount. For example, instead of being priced $10.00, a product will be priced at $9.99. Likewise, a $20,000 automobile might be priced at $19,998, although the product will cost more once taxes and other fees are added. See Figure 15.4 for an example of odd-even pricing.

Figure 15.4

The charcoal shown in the photo is priced at $5.99 a bag, which is an example of odd-even pricing, or pricing a product slightly below the next dollar amount.

Source: Photo courtesy of Stubb’s Legendary Kitchen.

Prestige pricingThe practice of pricing a product higher to signal that it is of high quality. occurs when a higher price is utilized to give an offering a high-quality image. Some stores have a quality image, and people perceive that perhaps the products from those stores are of higher quality. Many times, two different stores carry the same product, but one store prices it higher because of the store’s perceived higher image. Neckties are often priced using a strategy known as price liningPricing a group of similar products (e.g., neckties) at a few different price levels (e.g., $25, $50, and $75)., or price levels. In other words, there may be only a few price levels ($25, $50, and $75) for the ties, but a large assortment of them at each level. Movies and music often use price lining. You may see a lot of movies and CDs for $15.99, $9.99, and perhaps $4.99, but you won’t see a lot of different price levels.

Remember when you were in elementary school and many students bought teachers little gifts before the holidays or on the last day of school. Typically, parents set an amount such as $5 or $10 for a teacher’s gift. Knowing that people have certain maximum levels that they are willing to pay for gifts, some companies use demand backward pricingPricing a product based on what customers are willing to pay for it and then creating the offering based on that price.. They start with the price demanded by consumers (what they want to pay) and create offerings at that price. If you shop before the holidays, you might see a table of different products being sold for $5 (mugs, picture frames, ornaments) and another table of products being sold for $10 (mugs with chocolate, decorative trays, and so forth). Similarly, people have certain prices they are willing to pay for wedding gifts—say, $25, $50, $75, or $100—so stores set up displays of gifts sold at these different price levels. IKEA also sets a price for a product—which is what the company believes consumers want to pay for it—and then, working backward from the price, designs the product.

Leader pricingA strategy of offering low prices on one or more items as “lead” items in advertisements to attract customers. involves pricing one or more items low to get people into a store. The products with low prices are often on the front page of store ads and “lead” the promotion. For example, prior to Thanksgiving, grocery stores advertise turkeys and cranberry sauce at very low prices. The goal is to get shoppers to buy many more items in addition to the low-priced items. Leader or low prices are legal; however, as you learned earlier, loss leadersProducts priced below cost; this is illegal in some states., or items priced below cost in an effort to get people into stores, are illegal in many states.

Sealed bid pricingThe process of offering to buy or sell products at prices designated in sealed bids. is the process of offering to buy or sell products at prices designated in sealed bids. Companies must submit their bids by a certain time. The bids are later reviewed all at once, and the most desirable one is chosen. Sealed bids can occur on either the supplier or the buyer side. Via sealed bids, oil companies bid on tracts of land for potential drilling purposes, and the highest bidder is awarded the right to drill on the land. Similarly, consumers sometimes bid on lots to build houses. The highest bidder gets the lot. On the supplier side, contractors often bid on different jobs and the lowest bidder is awarded the job. The government often makes purchases based on sealed bids. Projects funded by stimulus money were awarded based on sealed bids.

Figure 15.5

When people think of auctions, they may think of the words, “Going, going, gone.” Online auctions use a similar bidding process.

© 2010 Jupiterimages Corporation

Bids are also being used online. Online auctionBidding and negotiating prices online with buyers and sellers on sites such as eBay.com until an acceptable price is agreed upon. sites such as eBay give customers the chance to bid and negotiate prices with sellers until an acceptable price is agreed upon. When a buyer lists what he or she wants to buy, sellers may submit bids. This process is known as a forward auctionThe process that occurs when a buyer lists what he or she wants to buy and sellers may submit bids.. If the buyer not only lists what he or she wants to buy but also states how much he or she is willing to pay, a reverse auctionWhen the buyer lists what he or she wants to buy and also states how much he or she is willing to pay. The reverse auction is finished when at least one firm is willing to accept the buyer’s price. occurs. The reverse auction is finished when at least one firm is willing to accept the buyer’s price.

Going-rate pricingPricing whereby purchasers pay the same price for a product regardless of where they buy it or from whom. occurs when buyers pay the same price regardless of where they buy the product or from whom. Going-rate pricing is often used on commodity products such as wheat, gold, or silver. People perceive the individual products in markets such as these to be largely the same. Consequently, there’s a “going” price for the product that all sellers receive.

Price bundlingA strategy of selling different products or services together, typically at a lower price than if each product or service is sold separately. occurs when different offerings are sold together at a price that’s typically lower than the total price a customer would pay by buying each offering separately. Combo meals and value meals sold at restaurants are an example. Companies such as McDonald’s have promoted value meals for a long time in many different markets. See the following video clips for promotions of value meals in the United States, Greece, and Japan. Other products such as shampoo and conditioner are sometimes bundled together. Automobile companies bundle product options. For example, power locks and windows are often sold together, regardless of whether customers want only one or the other. The idea behind bundling is to increase an organization’s revenues.

Video Clip

McDonald’s Introduced Value Meals in 1985

(click to see video)Look at the cost and the amount of food in the original value meal.

Captive pricingA strategy firms use to price products when they know customers must buy specific replacement parts, such as razor blades, because there are no alternatives. is a strategy firms use when consumers must buy a given product because they are at a certain event or location or they need a particular product because no substitutes will work. Concessions at a sporting event or a movie provide examples of how captive pricing is used. Maybe you didn’t pay much to attend the game, but the snacks and drinks were extremely expensive. Similarly, if you buy a razor and must purchase specific razor blades for it, you have experienced captive pricing. The blades are often more expensive than the razor because customers do not have the option of choosing blades from another manufacturer.

Pricing products consumers use together (such as blades and razors) with different profit margins is also part of product mix pricingDeciding how to price a firm’s products and services that go together, such as power options (locks, windows) on a car.. Recall from Chapter 6 "Creating Offerings" that a product mix includes all the products a company offers. If you want to buy an automobile, the base price might seem reasonable, but the options such as floor mats might earn the seller a much higher profit margin. While consumers can buy floor mats at stores like Walmart for $30, many people pay almost $200 to get the floor mats that go with the car from the dealer.

Most students and young people have cell phones. Are you aware of how many minutes you spend talking or texting and what it costs if you go over the limits of your phone plan? Maybe not if your plan involves two-part pricing. Two-part pricingA pricing strategy in which providers have two different charges for a product, such as the base monthly rate for cell phone coverage and additional charges for extra minutes or texting. means there are two different charges customers pay. In the case of a cell phone, a customer might pay a charge for one service such as a thousand minutes, and then pay a separate charge for each minute over one thousand. Get out your cell phone and look at how many minutes you have used. Many people are shocked at how many minutes they have used or the number of messages they have sent in the last month.

Have you ever seen an ad for a special item only to find out it is much more expensive than what you recalled seeing in the ad? A company might advertise a price such as $25*, but when you read the fine print, the price is really five payments of $25 for a total cost of $125. Payment pricingA pricing strategy in which customers are allowed to break down product payments into smaller amounts they pay incrementally., or allowing customers to pay for products in installments, is a strategy that helps customers break up their payments into smaller amounts, which can make them more inclined to buy higher-priced products.

Promotional pricingA short-term tactic to get people to purchase a product or more of it. is a short-term tactic designed to get people into a store or to purchase more of a product. Examples of promotional pricing include back-to-school sales, rebates, extended warranties, and going-out-of-business sales. Rebates are a great strategy for companies because consumers think they’re getting a great deal. But as you learned in Chapter 12 "Public Relations, Social Media, and Sponsorships", many consumers forget to request the rebate. Extended warranties have become popular for all types of products, including automobiles, appliances, electronics, and even athletic shoes. If you buy a vacuum for $35, and it has a one-year warranty from the manufacturer, does it really make sense to spend an additional $15 to get another year’s warranty? However, when it comes to automobiles, repairs can be expensive, so an extended warranty often pays for itself following one repair. Buyers must look at the costs and benefits and determine if the extended warranty provides value.

We discussed price discriminationThe process of charging different customers different prices for the same product and quantities of it purchased., or charging different customers different prices for the same product, earlier in the chapter. In some situations, price discrimination is legal. As we explained, you have probably noticed that certain customer groups (students, children, and senior citizens, for example) are sometimes offered discounts at restaurants and events. However, the discounts must be offered to all senior citizens or all children within a certain age range, not just a few. Price discrimination is used to get more people to use a product or service. Similarly, a company might lower its prices in order to get more customers to buy an offering when business is slow. Matinees are often cheaper than movies at night; bowling might be less expensive during nonleague times, and so forth.

Price Adjustments

Organizations must also decide what their policies are when it comes to making price adjustmentsA change to the listed price of a product., or changing the listed prices of their products. Some common price adjustments include quantity discountsDiscounts buyers get for making large purchases., which involves giving customers discounts for larger purchases. Discounts for paying cash for large purchases and seasonal discounts to get rid of inventory and holiday items are other examples of price adjustments.

A company’s price adjustment policies also need to outline the firm’s shipping charges. Many online merchants offer free shipping on certain products, orders over a certain amount, or purchases made in a given time frame. FOB (free on board) origin and FOB delivered are two common pricing adjustments businesses use to show when the title to a product changes along with who pays the shipping charges. FOB (free on board) originA pricing arrangement that designates that a product’s title changes at its origin (the place it’s purchased), and the buyer pays the shipping charges. means the title changes at the origin—that is, when the product is purchased—and the buyer pays the shipping charges. FOB (free on board) destinationA pricing arrangement that designates that a product’s title changes at its destination (the place to which it’s transported), and the seller pays the shipping charges. means the title changes at the destination—that is, after the product is transported—and the seller pays the shipping charges.

Uniform-delivered pricingA pricing strategy in which buyers pays the same shipping charges regardless of their locations., also called postage-stamp pricing, means buyers pay the same shipping charges regardless of where they are located. If you mail a letter across town, the postage is the same as when you mail a letter to a different state.

Recall that we discussed trade allowancesDiscounts an organization gives its channel partners for performing different functions. in Chapter 12 "Public Relations, Social Media, and Sponsorships". For example, a manufacturer might give a retail store an advertising allowance to advertise the manufacturer’s products in local newspapers. Similarly, a manufacturer might offer a store a discount to restock the manufacturer’s products on store shelves rather than having its own representatives restock the items.

Reciprocal agreementsAgreements whereby merchants agree to promote one another’s offerings to customers. are agreements in which merchants agree to promote each other to customers. Customers who patronize a particular retailer might get a discount card to use at a certain restaurant, and customers who go to a restaurant might get a discount card to use at a specific retailer. For example, when customers make a purchase at Diesel, Inc., they get a discount coupon good to use at a certain resort. When customers are at the resort, they get a discount coupon to use at Diesel. Old Navy and Great Clips implemented similar reciprocal agreements.

Figure 15.6

When customers made a purchase at the clothing chain Diesel, they were given a bounce back card to be used during certain dates as shown in this photo. The bounce back card gets customers back in the store for additional purchases.

Source: Photo courtesy of Diesel, Inc.

A promotion that’s popular during weak economic times is called a bounce back. A bounce backA discount card or coupon purchasers can use on their next shopping visits during set dates. is a promotion in which a seller gives customers discount cards or coupons (see Figure 15.6) after purchasing. Consumers can then use the cards and coupons on their next shopping visits. The idea is to get the customers to return to the store or online outlets later and purchase additional items. Some stores set minimum amounts that consumers have to spend to use the bounce back card.

Key Takeaway

Both external and internal factors affect pricing decisions. Companies use many different pricing strategies and price adjustments. However, the price must generate enough revenues to cover costs in order for the product to be profitable. Cost-plus pricing, odd-even pricing, prestige pricing, price bundling, sealed bid pricing, going-rate pricing, and captive pricing are just a few of the strategies used. Organizations must also decide what their policies are when it comes to making price adjustments, or changing the listed prices of their products. Some companies use price adjustments as a short-term tactic to increase sales.

Review Questions

- Explain the difference between a penetration and a skimming pricing strategy.

- Describe how both buyers and sellers use sealed bid pricing.

- Identify an example of each of the following: odd-even pricing, prestige pricing, price bundling, and captive pricing.

- What is the difference between FOB origin and FOB destination when paying for shipping charges?

- Explain how trade allowances work.

We want to hear your feedback

At Flat World Knowledge, we always want to improve our books. Have a comment or suggestion? Send it along! http://bit.ly/wUJmef

15.4 Discussion Questions and Activities

Discussion Questions

- What is the difference between leader pricing and a loss leader?

- Which pricing approaches do you feel work best long term?

- When is price discrimination legal?

- Which pricing strategies have you noticed when you shop?

- What new products have you purchased in the last two years that were priced using either a penetration or a skimming approach?

Activities

- In order to understand revenues and costs, get a two-liter bottle of soda, ten to twenty cups, and a bucket of ice. Fill each cup with ice and then fill it with soda. Assume each cup of soda sells for at least $1 and you paid $1 for the soda and $1 for the cups. How much profit can you make?

- Go to a fast-food restaurant for lunch. Figure out how much the price of a bundled meal is versus buying the items separately. Then decide if you think many consumers add a soda or fries because they feel like they’re getting a deal.

We want to hear your feedback

At Flat World Knowledge, we always want to improve our books. Have a comment or suggestion? Send it along! http://bit.ly/wUJmef