This is “Strategic Portfolio Planning Approaches”, section 2.5 from the book Marketing Principles (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

2.5 Strategic Portfolio Planning Approaches

Learning Objectives

- Explain how SBUs are evaluated using the Boston Consulting Group matrix.

- Explain how businesses and the attractiveness of industries are evaluated using the General Electric approach.

When a firm has multiple strategic business units like PepsiCo does, it must decide what the objectives and strategies for each business are and how to allocate resources among them. A group of businesses can be considered a portfolioA group of business units owned by a single firm., just as a collection of artwork or investments compose a portfolio. In order to evaluate each business, companies sometimes utilize what’s called a portfolio planning approach. A portfolio planning approachAn approach to analyzing various businesses relative to one another. involves analyzing a firm’s entire collection of businesses relative to one another. Two of the most widely used portfolio planning approaches include the Boston Consulting Group (BCG) matrix and the General Electric (GE) approach.

The Boston Consulting Group Matrix

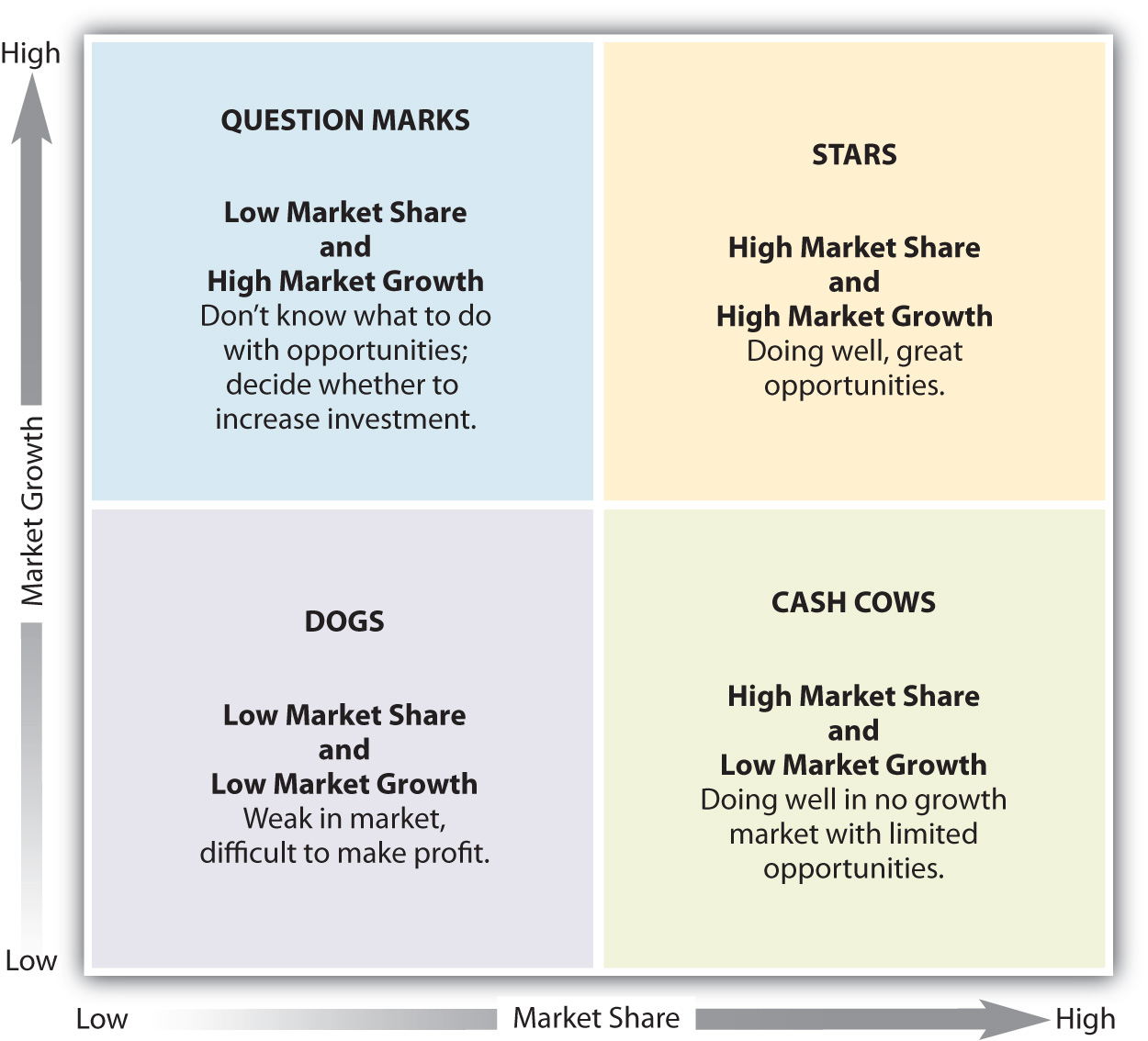

Figure 2.15 The Boston Consulting Group (BCG) Matrix

The Boston Consulting Group (BCG) matrixA portfolio planning approach that examines strategic business units based on their relative market shares and growth rates. Businesses are classified as stars, cash cows, question marks (problem children), or dogs. helps companies evaluate each of its strategic business units based on two factors: (1) the SBU’s market growth rate (i.e., how fast the unit is growing compared to the industry in which it competes) and (2) the SBU’s relative market share (i.e., how the unit’s share of the market compares to the market share of its competitors). Because the BCG matrix assumes that profitability and market share are highly related, it is a useful approach for making business and investment decisions. However, the BCG matrix is subjective and managers should also use their judgment and other planning approaches before making decisions. Using the BCG matrix, managers can categorize their SBUs (products) into one of four categories, as shown in Figure 2.15 "The Boston Consulting Group (BCG) Matrix".

Stars

Everyone wants to be a star. A starBusiness or offering with high growth and a high market share. is a product with high growth and a high market share. To maintain the growth of their star products, a company may have to invest money to improve them and how they are distributed as well as promote them. The iPod, when it was first released, was an example of a star product.

Cash Cows

A cash cowBusiness or offering with a large share of a shrinking market. is a product with low growth and a high market share. Cash cows have a large share of a shrinking market. Although they generate a lot of cash, they do not have a long-term future. For example, DVD players are a cash cow for Sony. Eventually, DVDs are likely to be replaced by digital downloads, just like MP3s replaced CDs. Companies with cash cows need to manage them so that they continue to generate revenue to fund star products.

Questions Marks or Problem Children

Did you ever hear an adult say they didn’t know what to do with a child? The same question or problem arises when a product has a low share of a high-growth market. Managers classify these products as question marks or problem childrenBusinesses or offerings with a low share of a high-growth market.. They must decide whether to invest in them and hope they become stars or gradually eliminate or sell them. For example, as the price of gasoline soared in 2008, many consumers purchased motorcycles and mopeds, which get better gas mileage. However, some manufacturers have a very low share of this market. These manufacturers now have to decide what they should do with these products.

Dogs

In business, it is not good to be considered a dog. A dogBusiness or offering with low growth and a low market share. is a product with low growth and low market share. Dogs do not make much money and do not have a promising future. Companies often get rid of dogs. However, some companies are hesitant to classify any of their products as dogs. As a result, they keep producing products and services they shouldn’t or invest in dogs in hopes they’ll succeed.

The BCG matrix helps managers make resource allocation decisions once different products are classified. Depending on the product, a firm might decide on a number of different strategies for it. One strategy is to build market share for a business or product, especially a product that might become a star. Many companies invest in question marks because market share is available for them to capture. The success sequence is often used as a means to help question marks become stars. With the success sequence, money is taken from cash cows (if available) and invested into question marks in hopes of them becoming stars.

Holding market share means the company wants to keep the product’s share at the same level. When a firm pursues this strategy, it only invests what it has to in order to maintain the product’s market share. When a company decides to harvestWhen a firm lowers investment in a product or business. a product, the firm lowers its investment in it. The goal is to try to generate short-term profits from the product regardless of the long-term impact on its survival. If a company decides to divestWhen a firm drops or sells a product or business. a product, the firm drops or sells it. That’s what Procter & Gamble did in 2008 when it sold its Folgers coffee brand to Smuckers. Proctor & Gamble also sold Jif peanut butter brand to Smuckers. Many dogs are divested, but companies may also divest products because they want to focus on other brands they have in their portfolio.

As competitors enter the market, technology advances, and consumer preferences change, the position of a company’s products in the BCG matrix is also likely to change. The company has to continually evaluate the situation and adjust its investments and product promotion strategies accordingly. The firm must also keep in mind that the BCG matrix is just one planning approach and that other variables can affect the success of products.

The General Electric Approach

Another portfolio planning approach that helps a business determine whether to invest in opportunities is the General Electric (GE) approachA portfolio planning approach that examines a business’ strengths and the attractiveness of industries.. The GE approach examines a business’s strengths and the attractiveness of the industry in which it competes. As we have indicated, a business’ strengths are factors internal to the company, including strong human resources capabilities (talented personnel), strong technical capabilities, and the fact that the firm holds a large share of the market. The attractiveness of an industry can include aspects such as whether or not there is a great deal of growth in the industry, whether the profits earned by the firms competing within it are high or low, and whether or not it is difficult to enter the market. For example, the automobile industry is not attractive in times of economic downturn such as the recession in 2009, so many automobile manufacturers don’t want to invest more in production. They want to cut or stop spending as much as possible to improve their profitability. Hotels and airlines face similar situations.

Companies evaluate their strengths and the attractiveness of industries as high, medium, and low. The firms then determine their investment strategies based on how well the two correlate with one another. As Figure 2.16 "The General Electric (GE) Approach" shows, the investment options outlined in the GE approach can be compared to a traffic light. For example, if a company feels that it does not have the business strengths to compete in an industry and that the industry is not attractive, this will result in a low rating, which is comparable to a red light. In that case, the company should harvest the business (slowly reduce the investments made in it), divest the business (drop or sell it), or stop investing in it, which is what happened with many automotive manufacturers.

Figure 2.16 The General Electric (GE) Approach

Although many people may think a yellow light means “speed up,” it actually means caution. Companies with a medium rating on industry attractiveness and business strengths should be cautious when investing and attempt to hold the market share they have. If a company rates itself high on business strengths and the industry is very attractive (also rated high), this is comparable to a green light. In this case, the firm should invest in the business and build market share. During bad economic times, many industries are not attractive. However, when the economy improves businesses must reevaluate opportunities.

Key Takeaway

A group of businesses is called a portfolio. Organizations that have multiple business units must decide how to allocate resources to them and decide what objectives and strategies are feasible for them. Portfolio planning approaches help firms analyze the businesses relative to each other. The BCG and GE approaches are two or the most common portfolio planning methods.

Review Questions

- How would you classify a product that has a low market share in a growing market?

- What does it mean to hold market share?

- What factors are used as the basis for analyzing businesses and brands using the BCG and the GE approaches?