This is “Introduction”, section 5.1 from the book Getting the Most Out of Information Systems (v. 1.3). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

5.1 Introduction

Learning Objectives

- Define Moore’s Law and understand the approximate rate of advancement for other technologies, including magnetic storage (disk drives) and telecommunications (fiber-optic transmission).

- Understand how the price elasticity associated with faster and cheaper technologies opens new markets, creates new opportunities for firms and society, and can catalyze industry disruption.

- Recognize and define various terms for measuring data capacity.

- Consider the managerial implication of faster and cheaper computing on areas such as strategic planning, inventory, and accounting.

Faster and cheaper—those two words have driven the computer industry for decades, and the rest of the economy has been along for the ride. Today it’s tough to imagine a single industry not impacted by more powerful, less expensive computing. Faster and cheaper puts mobile phones in the hands of peasant farmers, puts a free video game in your Happy Meal, and drives the drug discovery that may very well extend your life.

Some Definitions

This phenomenon of “faster, cheaper” computing is often referred to as Moore’s LawChip performance per dollar doubles every eighteen months., after Intel cofounder, Gordon Moore. Moore didn’t show up one day, stance wide, hands on hips, and declare “behold my law,” but he did write a four-page paper for Electronics Magazine in which he described how the process of chip making enabled more powerful chips to be manufactured at cheaper prices.G. Moore, “Cramming More Components onto Integrated Circuits,” Electronics Magazine, April 19, 1965.

Moore’s friend, legendary chip entrepreneur and CalTech professor Carver Mead, later coined the “Moore’s Law” moniker. That name sounded snappy, plus as one of the founders of Intel, Moore had enough geek cred for the name to stick. Moore’s original paper offered language only a chip designer would love, so we’ll rely on the more popular definition: chip performance per dollar doubles every eighteen months. (Moore’s original paper stated transistors per chip, a proxy for power, would double every two years, but many sources today refer to the eighteen-month figure, so we’ll stick with that—either way, we’re still talking about ridiculously accelerating power and plummeting costs.)

Moore’s Law applies to chips—broadly speaking, to processors, or the electronics stuff that’s made out of silicon.Although other materials besides silicon are increasingly being used. The microprocessorThe part of the computer that executes the instructions of a computer program. is the brain of a computing device. It’s the part of the computer that executes the instructions of a computer program, allowing it to run a Web browser, word processor, video game, or virus. For processors, Moore’s Law means that next generation chips should be twice as fast in eighteen months, but cost the same as today’s models (or from another perspective, in a year and a half, chips that are same speed as today’s models should be available for half the price).

Random-access memory (RAM)The fast, chip-based volatile storage in a computing device. is chip-based memory. The RAM inside your personal computer is volatile memoryStorage (such as RAM chips) that is wiped clean when power is cut off from a device., meaning that when the power goes out, all is lost that wasn’t saved to nonvolatile memoryStorage that retains data even when powered down (such as flash memory, hard disk, or DVD storage). (i.e., a more permanent storage media like a hard disk or flash memory). Think of RAM as temporary storage that provides fast access for executing computer programs and files. When you “load” or “launch” a program, it usually moves from your hard drive to those RAM chips, where it can be more quickly executed by the processor.

Cameras, MP3 players, USB drives, and mobile phones often use flash memoryNonvolatile, chip-based storage, often used in mobile phones, cameras, and MP3 players. Sometimes called flash RAM, flash memory is slower than conventional RAM, but holds its charge even when the power goes out. (sometimes called flash RAM). It’s not as fast as the RAM used in most traditional PCs, but holds data even when the power is off (so flash memory is also nonvolatile memory). You can think of flash memory as the chip-based equivalent of a hard drive. In fact, flash memory prices are falling so rapidly that several manufactures including Apple and the One Laptop per Child initiative (see the “Tech for the Poor” sidebar later in this section) have begun offering chip-based, nonvolatile memory as an alternative to laptop hard drives. The big advantage? Chips are solid state electronicsSemiconductor-based devices. Solid state components often suffer fewer failures and require less energy than mechanical counterparts because they have no moving parts. RAM, flash memory and microprocessors are solid state devices. Hard drives are not. (meaning no moving parts), so they’re less likely to fail, and they draw less power. The solid state advantage also means that chip-based MP3 players like the iPod nano make better jogging companions than hard drive players, which can skip if jostled. For RAM chips and flash memory, Moore’s Law means that in eighteen months you’ll pay the same price as today for twice as much storage.

Computer chips are sometimes also referred to as semiconductorsA substance such as silicon dioxide used inside most computer chips that is capable of enabling as well as inhibiting the flow of electricity. From a managerial perspective, when someone refers to semiconductors, they are talking about computer chips, and the semiconductor industry is the chip business. (a substance such as silicon dioxide used inside most computer chips that is capable of enabling as well as inhibiting the flow of electricity). So if someone refers to the semiconductor industry, they’re talking about the chip business.Semiconductor materials, like the silicon dioxide used inside most computer chips, are capable of enabling as well as inhibiting the flow of electricity. These properties enable chips to perform math or store data.

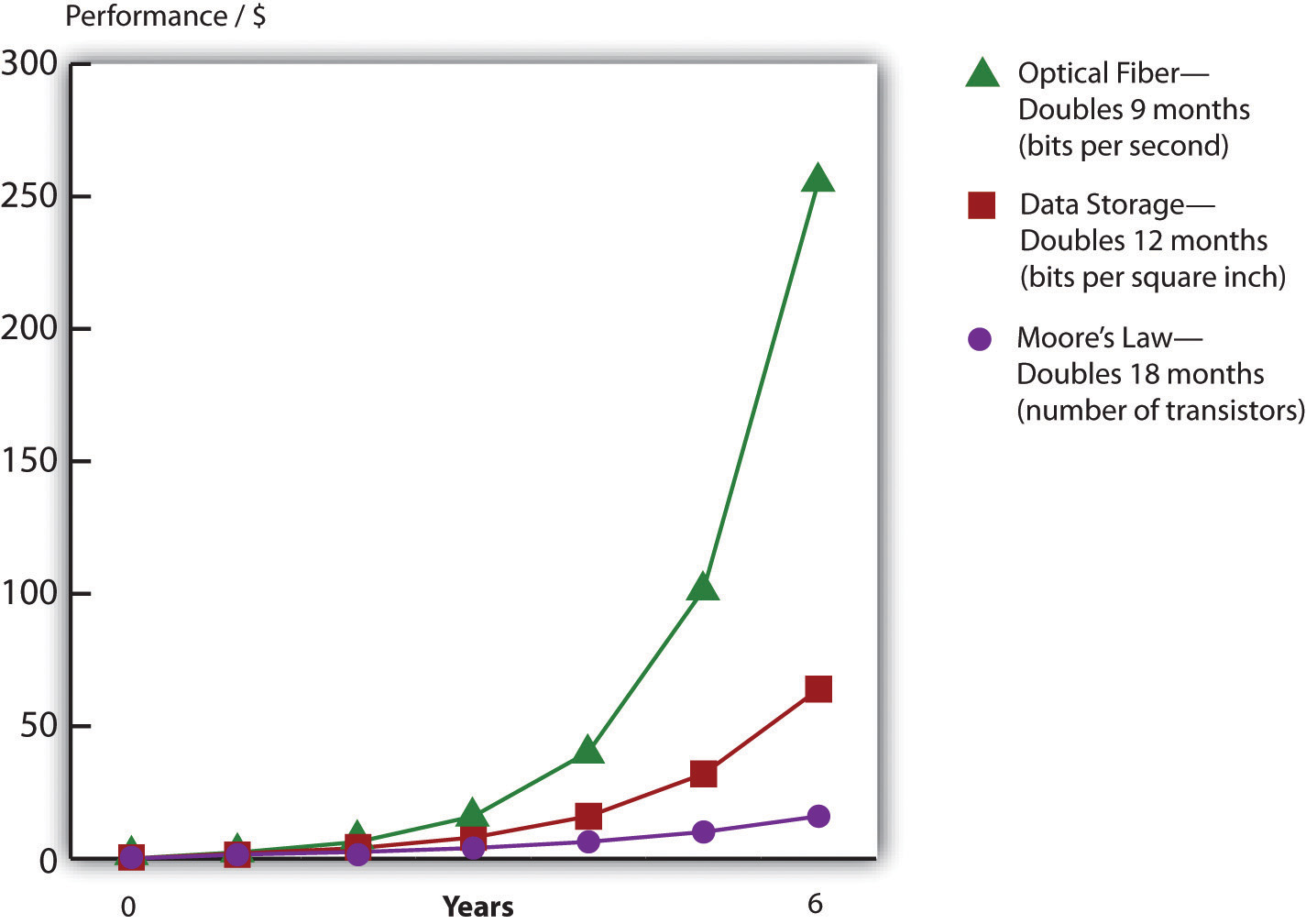

Strictly speaking, Moore’s Law does not apply to other technology components. But other computing components are also seeing their price versus performance curves skyrocket exponentially. Data storage doubles every twelve months. Networking speed is on a tear, too. With an equipment change at the ends of the cables, the amount of data that can be squirted over an optical fiber lineA high-speed glass or plastic-lined networking cable used in telecommunications. can double every nine months.Fiber-optic lines are glass or plastic data transmission cables that carry light. These cables offer higher transmission speeds over longer distances than copper cables that transmit electricity. These numbers should be taken as rough approximations and shouldn’t be expected to be strictly precise over time. However, they are useful as rough guides regarding future computing price/performance trends. Despite any fluctuation, it’s clear that the price/performance curve for many technologies is exponential, offering astonishing improvement over time.

Figure 5.1 Advancing Rates of Technology (Silicon, Storage, Telecom)

Source: Adopted from Shareholder Presentation by Jeff Bezos, Amazon.com, 2006.

Get Out Your Crystal Ball

Faster and cheaper makes possible the once impossible. As a manager, your job will be about predicting the future. First, consider how the economics of Moore’s Law opens new markets. When technology gets cheap, price elasticityThe rate at which the demand for a product or service fluctuates with price change. Goods and services that are highly price elastic (e.g., most consumer electronics) see demand spike as prices drop, whereas goods and services that are less price elastic are less responsive to price change (think heart surgery). kicks in. Tech products are highly price elastic, meaning consumers buy more products as they become cheaper.As opposed to goods and services that are price inelastic (like health care and housing), which consumers will try their best to buy even if prices go up. And it’s not just that existing customers load up on more tech; entire new markets open up as firms find new uses for these new chips.

Just look at the five waves of computing we’ve seen over the previous five decades.M. Copeland, “How to Ride the Fifth Wave,” Business 2.0, July 1, 2005. In the first wave in the 1960s, computing was limited to large, room-sized mainframe computers that only governments and big corporations could afford. Moore’s Law kicked in during the 1970s for the second wave, and minicomputers were a hit. These were refrigerator-sized computers that were as speedy as or speedier than the prior generation of mainframes, yet were affordable by work groups, factories, and smaller organizations. The 1980s brought wave three in the form of PCs, and by the end of the decade nearly every white-collar worker in America had a fast and cheap computer on their desk. In the 1990s wave four came in the form of Internet computing—cheap servers and networks made it possible to scatter data around the world, and with more power, personal computers displayed graphical interfaces that replaced complex commands with easy-to-understand menus accessible by a mouse click. At the close of the last century, the majority of the population in many developed countries had home PCs, as did most libraries and schools.

Now we’re in wave five, where computers are so fast and so inexpensive that they have become ubiquitous—woven into products in ways few imagined years before. Silicon is everywhere! It’s in the throwaway radio frequency identification (RFID) tags that track your luggage at the airport. It provides the smarts in the world’s billion-plus mobile phones. It’s the brains inside robot vacuum cleaners, next generation Legos, and the table lamps that change color when the stock market moves up or down. These digital shifts can rearrange entire industries. Consider that today the firm that sells more cameras than any other is Nokia, a firm that offers increasingly sophisticated chip-based digital cameras as a giveaway as part of its primary product, mobile phones. This shift has occurred with such sweeping impact that former photography giants Pentax, Konica, and Minolta have all exited the camera business.

Ambient Devices and the Fifth Wave

Pritesh Gandhi almost never gets caught in the rain without his umbrella. That’s because Gandhi’s umbrella regularly and wirelessly checks weather reports on its own. If the umbrella gets word it will rain in the next few hours, the handle blinks with increasing urgency, warning its owner with a signal that seems to declare, “You will soon require my services.” Gandhi is CEO of “fifth wave” firm Ambient Devices, a Massachusetts start-up that’s embedding computing and communications technology into everyday devices in an attempt to make them “smarter” and more useful (the weather-sensing umbrella was developed while he helmed the firm).

Ambient’s ability to pull off this little miracle is evidence of how quickly innovative thinkers are able to take advantage of new opportunities and pioneer new markets enabled by Moore’s Law. The firm’s first product, the Orb, is a lamp that can be set up to change color in real time in reaction to factors such as the performance of your stock portfolio or the intensity of the local pollen count. In just six months, the ten refugees from MIT’s Media Lab that founded Ambient Devices took the idea for the Orb, designed the device and its software, licensed wireless spectrum from a pager firm that had both excess capacity and a footprint to cover over 90 percent of the United States, arranged for manufacturing, and began selling the gizmo through Brookstone and Nieman Marcus.M. Copeland, “How to Ride the Fifth Wave,” Business 2.0, July 1, 2005; and J. Miller, “Goodbye G.U.I? Ambient Orb a Computer ‘Mood Ring,’” Mass High Tech, February 10, 2003.

Ambient has since expanded the product line to several low-cost appliances designed to provide information at a glance. These include the Ambient Umbrella, as well as useful little devices that grab and display data ranging from sports scores to fluctuating energy prices (so you’ll put off running the dishwasher until evening during a daytime price spike). The firm even partnered with LG on a refrigerator that can remind you of an upcoming anniversary as you reach for the milk.

Figure 5.2

Products developed by “fifth wave” firm Ambient Devices include the weather-reading Ambient Umbrella, the Energy Joule, a seven-day forecaster, and the Orb lamp.

Source: Used with permission from Ambient Devices.

Moore’s Law inside Your Medicine Cabinet

Moore’s Law is about to hit your medicine cabinet. The GlowCap from Vitality, Inc., is a “smart” pill bottle that will flash when you’re supposed to take your medicine. It will play a little tune if you’re an hour late for your dose and will also squirt a signal to a night-light that flashes as a reminder (in case you’re out of view of the cap). GlowCaps can also be set to call or send a text if you haven’t responded past a set period of time. And the device will send a report to you, your doc, or whomever else you approve. The GlowCap can even alert your pharmacy when it’s time for refills. Amazon sells the device for $99, but we know how Moore’s Law works—it’ll soon likely be free. The business case for that? The World Health Organization estimates drug adherence at just 50 percent, and analysts estimate that up to $290 billion in increased medical costs are due to patients missing their meds. Vitality CEO David Rose (who incidentally also cofounded Ambient Devices) recently cited a test in which GlowCap users reported a 98 percent medication adherence rate.D. Rose, presentation as part of “From Disruption to Innovation” at the MIT Enterprise Forum, Cambridge, MA, June 23, 2010.

Figure 5.3

The GlowCap from Vitality, Inc., will flash, beep, call, and text you if you’ve skipped your meds. It can also send reports to you, your doctor, and your loved ones and even notify your pharmacy when it’s time for a refill.

Source: Used with permission from Vitality, Inc.

And there might also be a chip inside the pills, too! Proteus, a Novartis-backed venture, has developed a sensor made of food and vitamin materials that can be swallowed in medicine. The sensor is activated and powered by the body’s digestive acids (think of your stomach as a battery). Once inside you, the chip sends out a signal with vitals such as heart rate, body angle, temperature, sleep, and more. A waterproof skin patch picks up the signal and can wirelessly relay the pill’s findings when the patient walks within twenty feet of their phone. Proteus will then compile a report from the data and send it to their mobile device or e-mail account. The gizmo’s already in clinical trials for heart disease, hypertension, and tuberculosis and for monitoring psychiatric illnesses.E. Landau, “Tattletale Pills, Bottles Remind You to Take Your Meds,” CNN, February 2, 2010. And a pill with built-in smarts can identify itself to help guard against taking counterfeit drugs, a serious worldwide concern. Pills that chat with mobile phones could help promote telemedicine, bringing health care to hard-to-reach rural populations. And games and social apps based on this information can provide motivating, fun ways to nudge patients into healthy habits. The CEO of Proteus Health says that soon you may be able to think of your body as “the ultimate game controller.”K. Rozendal, “The Democratic, Digital Future of Healthcare,” Scope, May 13, 2011.

One of the most agile surfers of this fifth wave is Apple, Inc.—a firm with a product line that is now so broad that in January 2007, it dropped the word “Computer” from its name. Apple’s breakout resurgence owes a great deal to the iPod. At launch, the original iPod sported a 5 GB hard drive that Steve Jobs declared would “put 1,000 songs in your pocket.” Cost? $399. Less than six years later, Apple’s highest-capacity iPod sold for fifty dollars less than the original, yet held forty times the songs. By that time the firm had sold over one hundred fifty million iPods—an adoption rate faster than the original Sony Walkman. Apple’s high-end models have morphed into Internet browsing devices capable of showing maps, playing videos, and gulping down songs from Starbucks’ Wi-Fi while waiting in line for a latte.

The original iPod has also become the jumping-off point for new business lines including the iPhone, Apple TV, iPad, and iTunes. As an online store, iTunes is always open. ITunes regularly sells tens of millions of songs on Christmas Day alone, a date when virtually all of its offline competition is closed for the holiday. In a short five years after its introduction, iTunes has sold over 4 billion songs and has vaulted past retail giants Wal-Mart, Best Buy, and Target to become the number one music retailer in the world. Today’s iTunes is a digital media powerhouse, selling movies, TV shows, games, and other applications. And with podcasting, Apple’s iTunes University even lets students at participating schools put their professors’ lectures on their gym playlist for free. Surfing the fifth wave has increased the value of Apple stock sixteenfold six years after the iPod’s launch. Ride these waves to riches, but miss the power and promise of Moore’s Law and you risk getting swept away in its riptide. Apple’s rise occurred while Sony, a firm once synonymous with portable music, sat on the sidelines unwilling to get on the surfboard. Sony’s stock stagnated, barely moving in six years. The firm has laid off thousands of workers while ceding leadership in digital music (and video) to Apple.

Table 5.1 Top U.S. Music Retailers

| 1992 | 2005 | 2006 | 2008 |

|---|---|---|---|

| 1. Musicland | 1. Wal-Mart | 1. Wal-Mart | 1. iTunes |

| 2. The Handleman | 2. Best Buy | 2. Best Buy | 2. Wal-Mart |

| 3. Tower Records | 3. Target | 3. Target | 3. Best Buy |

| 4. Trans World Music

|

… 7. iTunes |

4. iTunes, Amazon tie

|

4. Amazon, Target tie

|

| Moore’s Law restructures industries. The firms that dominated music sales when you were born are now bankrupt, while one that had never sold a physical music CD now sells more than anyone else. | |||

Source: Michelle Quinn and Dawn C. Chmielewski, “Top Music Seller’s Store Has No Door,” Los Angeles Times, April 4, 2008.

Table 5.2 Tech’s Price/Performance Trends in Action: Amazon Kindle and Apple Music Storage

| Amazon Kindle | Apple | ||

|---|---|---|---|

| First Generation | Fourth Generation | iPod | iCloud |

| 250 MB | 2 GB | 5 GB | 5 GB |

| November 2007 | September 2011 | October 2001 | October 2011 |

| $399 | $79 | $399 | Free |

Amazon’s first Kindle sold for nearly $400. Less than four years later, Amazon was selling an updated version of the Kindle for one-fifth that price. Similarly, Apple offered 5 GB of music storage in the original iPod (also priced at roughly $400). By the iPod’s tenth birthday, Apple was giving away 5 GB of storage (for music or other media) for free via its iCloud service. Other factors influence price drops, such as being able to produce products and their components at scale, but Moore’s Law and related price/performance trends are clearly behind the price decreases we see across a wide variety of tech products and services.

While the change in hard drive prices isn’t directly part of Moore’s Law (hard drives are magnetic storage, not silicon chips), as noted earlier, the faster and cheaper phenomenon applies to storage, too. Look to Amazon as another example of jumping onto a once-impossible opportunity courtesy of the price/performance curve. When Amazon.com was founded in 1995, the largest corporate database was one terabyte, or TB (see Note 5.14 "Bits and Bytes") in size. In 2003, the firm offered its “Search Inside the Book” feature, digitizing the images and text from thousands of books in its catalog. “Search Inside the Book” lets customers peer into a book’s contents in a way that’s both faster and more accurate than browsing a physical bookstore. Most importantly for Amazon and its suppliers, titles featured in “Search Inside the Book” enjoyed a 7 percent sales increase over nonsearchable books. When “Search Inside the Book” launched, the database to support this effort was 20 TB in size. In just eight years, the firm found that it made good business sense to launch an effort that was a full twenty times larger than anything used by any firm less than a decade earlier. And of course, all of these capacities seem laughably small by today’s standards. (See Chapter 11 "The Data Asset: Databases, Business Intelligence, and Competitive Advantage".) For Amazon, the impossible had not just become possible; it became good business. By 2009, digital books weren’t just for search; they were for sale. Amazon’s Kindle reader (a Moore’s Law marvel sporting a microprocessor and flash storage) became the firm’s top-selling product in terms of both unit sales and dollar volume. The real business opportunity for Amazon isn’t Kindle as a consumer electronics device but as an ever-present, never-closing store, which also provides the firm with a migration path from atoms to bits. (For more on that topic, see Chapter 4 "Netflix in Two Acts: The Making of an E-commerce Giant and the Uncertain Future of Atoms to Bits".) By 2011, Amazon (by then the largest book retailer in North America) reported that it was selling more electronic books than print ones.M. Hamblen, “Amazon: E-Books Now Outsell Print Books,” ComputerWorld, May 19, 2011. Apple’s introduction of the iPad, complete with an iBook store, shows how Moore’s Law rewrites the boundaries of competition—bringing a firm that started as a computer retailer and a firm that started as an online bookstore in direct competition with one another.

Bits and Bytes

Computers express data as bits that are either one or zero. Eight bits form a byte (think of a byte as being a single character you can type from a keyboard). A kilobyte refers to roughly a thousand bytes, or a thousand characters, megabyte = 1 million, gigabyte = 1 billion, terabyte = 1 trillion, petabyte = 1 quadrillion, and exabyte = 1 quintillion bytes.

While storage is most often listed in bytes, telecommunication capacity (bandwidth) is often listed in bits per second (bps). The same prefixes apply (Kbps = kilobits, or one thousand bits, per second, Mbps = megabits per second, Gbps = gigabits per second, and Tbps = terabits per second).

These are managerial definitions, but technically, a kilobyte is 210 or 1,024 bytes, mega = 220, giga = 230, tera = 240, peta = 250, and exa = 260. To get a sense for how much data we’re talking about, see the table below.E. Schuman, “At Wal-Mart, World’s Largest Retail Data Warehouse Gets Even Larger,” eWeek, October 13, 2004; and J. Huggins, “How Much Data Is That?” Refrigerator Door, August 19, 2008.

Table 5.3 Bytes Defined

| Managerial Definition | Exact Amount | To Put It in Perspective | |

|---|---|---|---|

| 1 Byte | One keyboard character | 8 bits | 1 letter or number = 1 byte |

| 1 Kilobyte (KB) | One thousand bytes | 210 bytes | 1 typewritten page = 2 KB |

| 1 digital book (Kindle) = approx. 500—800 KB | |||

| 1 Megabyte (MB) | One million bytes | 220 bytes | 1 digital photo (7 megapixels) = 1.3 MB |

| 1 MP3 song = approx. 3 MB | |||

| 1 CD = approx. 700 MB | |||

| 1 Gigabyte (GB) | One billion bytes | 230 bytes | 1 DVD movie = approx. 4.7 GB |

| 1 Blu-ray movie = approx. 25 GB | |||

| 1 Terabyte (TB) | One trillion bytes | 240 bytes | Printed collection of the Library of Congress = 20 TB |

| 1 Petabyte (PB) | One quadrillion bytes | 250 bytes | eBay data warehouse (2010) = 10 PBC. Monash, “eBay Followup—Greenplum Out, Teradata > 10 Petabytes, Hadoop Has Some Value, and More,” October 6, 2010. Note eBay plans to increase this value 2.5 times by the end of 2011. |

| 1 Exabyte (EB) | One quintillion bytes | 260 bytes | |

| 1 Zettabyte (ZB) | One sextillion bytes | 270 bytes | Amount of data consumed by U.S. households in 2008 = 3.6 ZB |

Here’s another key implication—if you are producing products with a significant chip-based component, the chips inside that product rapidly fall in value. That’s great when it makes your product cheaper and opens up new markets for your firm, but it can be deadly if you overproduce and have excess inventory sitting on shelves for long periods of time. Dell claims its inventory depreciates as much as a single percentage point in value each week.B. Breen, “Living in Dell Time,” Fast Company, November 24, 2004. That’s a big incentive to carry as little inventory as possible, and to unload it, fast!

While the strategic side of tech may be the most glamorous, Moore’s Law impacts mundane management tasks, as well. From an accounting and budgeting perspective, as a manager you’ll need to consider a number of questions: How long will your computing equipment remain useful? If you keep upgrading computing and software, what does this mean for your capital expense budget? Your training budget? Your ability to make well-reasoned predictions regarding tech’s direction will be key to answering these questions.

Tech for the Poor

Nicholas Negroponte, the former head of MIT’s Media Lab, is on a mission. His OLPC (One Laptop per Child) project aims to deliver education to children in the world’s poorest communities via ultralow-cost computing devices that the firm has developed. The first offering, the XO laptop, costs roughly $175, although a sub-$100 tablet is in the works. The XO sports a rubberized keyboard and entirely solid-state design (flash RAM rather than hard drive) that helps make the machine durable. The XO’s ultrabright screen is readable in daylight and can be flipped to convert into an e-book reader. And a host of open source software and wiki tools for courseware development all aim to keep the costs low. Mesh networking allows laptops within a hundred feet or so to communicate with each other, relaying a single Internet connection for use by all. And since the XO is targeted at the world’s poorest kids in communities where power generation is unreliable or nonexistent, several battery-charging power generation schemes are offered, including a hand crank and foldout flexible solar panels. The OLPC Foundation delivered over 2.4 million laptops to children in twenty-four countries.C. Lawton, “The X.O. Laptop Two Years Later,” Wired, June 19, 2009, http://laptop.org/map. The XO is a product made possible by the rapidly falling price of computing.

Figure 5.4 The XO PC

Source: Used with permission from fuseproject.

While the success of the OLPC effort will reveal itself over time, another tech product containing a microprocessor is already transforming the lives of some of the world’s most desperate poor—the cell phone. There are three billion people worldwide that don’t yet have a phone, but they will, soon. In the ultimate play of Moore’s Law opening up new markets, mobiles from Vodafone and Indian telecom provider Spice sell for $25 or less. While it took roughly twenty years to sell a billion mobile phones worldwide, the second billion sold in four years, and the third billion took just two years. Today, some 80 percent of the world’s population lives within cellular network range (double the 2000 level), and the vast majority of mobile subscriptions are in developing countries.S. Corbett, “Can the Cellphone Help End Global Poverty?” New York Times Magazine, April 13, 2008.

Why such demand? Mobiles change lives for the better. According to Columbia economist Jeffrey Sachs, “The cell phone is the single most transformative technology for world economic development.”J. Ewing, “Upwardly Mobile in Africa,” BusinessWeek, September 24, 2007, 64–71. Think about the farmer who can verify prices and locate buyers before harvesting and transporting perishable crops to market; the laborer who was mostly unemployed but with a mobile is now reachable by those who have day-to-day work; the mother who can find out if a doctor is in and has medicine before taking off work to make the costly trek to a remote clinic with her sick child; or the immigrant laborer serving as a housekeeper who was “more or less an indentured servant until she got a cell phone” enabling new customers to call and book her services.S. Corbett, “Can the Cellphone Help End Global Poverty?” New York Times Magazine, April 13, 2008.

As an example of impact, look to poor fishermen in the Indian state of Kerala. By using mobile phones to find the best local marketplace prices for sardines, these fishermen were able to increase their profits by an average of 8 percent even though consumer prices for fish dropped 4 percent. The trends benefiting both buyer and seller occurred because the fishermen no longer had to throw away unsold catch previously lost by sailing into a port after all the buyers had left. The phone-equipped fleet now see more consistent pricing, spreading their catch more evenly whereas previous fisherman often inefficiently clustered in one market, overserving one population while underserving another. A London Business School study found that for every ten mobile phones per one hundred people, a country’s GDP bumps up 0.5 percent.J. Ewing, “Upwardly Mobile in Africa,” BusinessWeek, September 24, 2007, 64–71.

Bangladeshi economist Mohammed Yunus won the Nobel Peace Prize based on his work in the microfinance movement, an effort that provides very small loans to the world’s poorest entrepreneurs. Microfinance loans grew the market for Grameen Phone Ltd., a firm that has empowered over two hundred and fifty thousand Bangladeshi “phone ladies” to start businesses that helped their communities become more productive. Phone ladies buy a phone and special antenna on microcredit for about $150 each. These special long-life battery phones allow them to become a sort of village operator, charging a small commission for sending and receiving calls. Through phone ladies, the power of the mobile reaches even those too poor to afford buying one outright. Grameen Phone now has annual revenues of over $1 billion and is Bangladesh’s largest telecom provider.

In another ingenious scheme, phone minutes become a proxy for currency. The New York Times reports that a person “working in Kampala, for instance, who wishes to send the equivalent of five dollars back to his mother in a village will buy a five-dollar prepaid airtime card, but rather than entering the code into his own phone, he will call the village phone operator and read the code to her. [The operator] then uses the airtime for her phone and completes the transaction by giving the man’s mother the money, minus a small commission.”S. Corbett, “Can the Cellphone Help End Global Poverty?” New York Times Magazine, April 13, 2008.

South Africa’s WIZZIT and GCASH in the Philippines allow customers to use mobile phones to store cash credits sent from another phone or purchased through a post office or kiosk operator. When phones can be used as currency for purchases or payments, who needs Visa? Vodafone’s Kenyan-based M-PESA mobile banking program landed 200,000 new customers in a month—they’d expected it would take a year to hit that mark. With 1.6 million customers by that time, the service is spreading throughout Africa. The “mobile phone as bank” may bring banking to a billion unserved customers in a few years.

Key Takeaways

- Moore’s Law applies to the semiconductor industry. The widely accepted managerial interpretation of Moore’s Law states that for the same money, roughly eighteen months from now you should be able to purchase computer chips that are twice as fast or store twice as much information. Or over that same time period, chips with the speed or storage of today’s chips should cost half as much as they do now.

- Nonchip-based technology also advances rapidly. Disk drive storage doubles roughly every twelve months, while equipment to speed transmissions over fiber-optic lines has doubled every nine months. While these numbers are rough approximations, the price/performance curve of these technologies continues to advance exponentially.

- These trends influence inventory value, depreciation accounting, employee training, and other managerial functions. They also help improve productivity and keep interest rates low.

- From a strategic perspective, these trends suggest that what is impossible from a cost or performance perspective today may be possible in the future. This fact provides an opportunity to those who recognize and can capitalize on the capabilities of new technology. As technology advances, new industries, business models, and products are created, while established firms and ways of doing business can be destroyed.

- Managers must regularly study trends and trajectory in technology to recognize opportunity and avoid disruption.

Questions and Exercises

- What is Moore’s Law? What does it apply to?

- Are other aspects of computing advancing as well? At what rates?

- What is a microprocessor? What devices do you or your family own that contain microprocessors (and hence are impacted by Moore’s Law)?

- What is a semiconductor? What is the substance from which most semiconductors are made?

- How does flash memory differ from the memory in a PC? Are both solid state?

- Which of the following are solid state devices: an iPod shuffle, a TiVo DVR, a typical laptop PC?

- Why is Moore’s Law important for managers? How does it influence managerial thinking?

- What is price elasticity? How does Moore’s Law relate to this concept? What’s special about falling chip prices compared to price drops for products like clothing or food?

- Give examples of firms that have effectively leveraged the advancement of processing, storage, and networking technology.

- What are the five waves of computing? Give examples of firms and industries impacted by the fifth wave.

- As Moore’s Law advances, technology becomes increasingly accessible to the poor. Give examples of how tech has benefited those who likely would not have been able to afford the technology of a prior generation.

- How have cheaper, faster chips impacted the camera industry? Give an example of the leadership shifts that have occurred in this industry.

- What has been the impact of “faster, cheaper” on Apple’s business lines?

- How did Amazon utilize the steep decline in magnetic storage costs to its advantage?

- How does Moore’s Law impact production and inventory decisions?