This is “Introduction”, section 4.1 from the book Getting the Most Out of Information Systems (v. 1.3). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

4.1 Introduction

Learning Objectives

- Understand the basics of the two services operating under the Netflix business model.

- Recognize the downside the firm may have experienced from an early IPO.

- Appreciate why other firms found Netflix’s market attractive, and why many analysts incorrectly suspected Netflix was doomed.

- Understand the factors that led to customer exodus and stock market collapse, and identify mistakes Netflix made in rebranding the firm and splitting its offerings.

In 2011 Netflix co-founder and CEO Reed Hastings went from tech industry pinnacle to business press punching bag. For years, Netflix was known for best-in-class service, regularly and repeatedly ranking atop multiple customer satisfaction surveys. Hastings had been appointed to the Board of Directors of two of the tech industry’s most influential firms—Microsoft and Facebook. The prior year closed with Fortune featuring Hastings on its cover as the “Businessperson of the Year.” By July 2011, Netflix’s profits, customer base, and stock had each hit an all time high. But a poorly-communicated repricing scheme, followed by a failed attempt to split the firm into two websites, led to an exodus of nearly a million customers in three months, a collapse of the firm’s share price, and calls for Hastings’ resignation.J. Poggi, “3 Reasons Netflix Reed Hastings Shouldn’t Be Fired… Yet,” TheStreet.com, Oct. 24, 2011.

The problems in the second half of 2011 were particularly shocking since Netflix had spent several years defying the predictions of naysayers. Analysts had spent years underestimating Netflix, assuming it would be vanquished by larger, deep-pocketed rivals. One analyst referred to the firm’s impending competition as “The Last Picture Show” for Netflix,M. Conlin, “Netflix: Flex to the Max,” BusinessWeek, September 24, 2007. another called the firm a "worthless piece of crap,” setting a $3 target on a stock then trading at $11 a share.M. Copeland, “Reed Hastings: The Leader of the Pack,” Fortune, Nov. 18, 2010.

Doubters were concerned because Netflix was a dot-com, an Internet pure play without a storefront and with a miniscule customer base when compared with its new competition—Blockbuster and Wal-Mart. Hastings told Fortune that if he could change one strategic decision, it would have been to delay the firm’s initial public stock offering (IPO), claiming that the financial disclosure required by public companies tipped off others that the firm was on a money-making growth tear. “If we had stayed private for another two to four years, not as many people would have understood how big a business this could be.”M. Boyle, “Questions for…Reed Hastings,” Fortune, May 23, 2007. Once the secret was out, Blockbuster showed up, bringing with it 40 million card-carrying customers, and a promise to link DVD-by-mail with the nation’s largest network of video stores. Following close behind was Wal-Mart—not just a big Fortune 500 company but the largest firm in the United States ranked by sales. A price war ensued, Netflix was forced to increase advertising, and the outlook for Hastings’ baby seemed bleak.

Fast-forward and we see that the stellar rise of Netflix throughly trounced the doomsday predictions of the naysayers. Within a year of launch Wal-Mart had cut and run, dumping their experiment in DVD-by-mail. Blockbuster spent the next several years hemorrhaging billions of dollars, eventually declaring bankruptcy and selling out to satelite pay-TV provider, Dish Network. And that stock that was predicted to drop to $3 a share? It had instead skyrocketed past $300. Like the triumphant final scene in the movies, the dot-com did it. David knocked off not one, but two Goliaths.

Victory, right? Not so fast. At a time when Hastings seems to have achieved the pinnacle of success, Netflix was sent reeling from a sequence of gaffes that caused a customer exodus and share price collapse. The damage started when the single fee for the $10 base Netflix service was unbundled into two separate $8 plans for DVD-by-mail and streaming over the Internet. The move amounted to a 60 percent price hike for subscribers wanting to continue with both offerings, and customers rebelled. The firm’s Facebook page quickly amassed over 44,000 negative comments, “Dear Netflix” complaints became a trending topic on Twitter, and customers began referring to the firm’s CEO as “Greed Hastings.”D. Pogue, “Why Netflix Raised Prices,” The New York Times, July 14, 2011. E. Mack, “'Dear Netflix': Price hike ignites social-media fire,” CNet, July 12, 2011. And G. Sandoval, “Don't call Netflix's CEO 'Greed' Hastings just yet,” CNet, July 25, 2011. Despite the outcry Netflix doubled-down in September 2011, announcing it would further split into two distinct services with two separate websites. The switch reads as a primer on what not to do when transitioning a business. The unpopular price hikes were followed by changes that actually made the firm’s products harder to use by forcing customers to access two different websites, each with a separate database of offerings. Adding to the pain was the embarrassment of a botched rebranding of the DVD-by-mail service under the new name Qwikster. At the time of the rebranding announcement, Netflix had secured the domain Qwikster.com, but not the Twitter handle @Qwikster. The latter was owned by a guy whose drug referencing, foul-mouthed tweets were accompanied by a profile picture of a pot smoking Elmo from Sesame Street. Hastings, who stood at the peak of industry just a few weeks earlier, had become both a target of customer vitriol and an industry laughing stock, the subject of Saturday Night Live skits and comedian punch lines. Netflix quickly dropped plans for the Qwikster split, but it chose to hold firm with the price increase that started the slide. Over the course of 90 nightmarish days, Netflix lost over 800,000 customers, its stock tumbled from $304 a share to below $75, and its market value shed over $12 billion, including $2.3 billion in a single day.

When announcing Qwikster, Hastings wrote in a blog post that “…my greatest fear at Netflix has been that we wouldn't make the leap from success in DVDs to success in streaming. Most companies that are great at something—like AOL dialup or Borders bookstores—do not become great at new things people want (streaming for us) because they are afraid to hurt their initial business... Companies rarely die from moving too fast, and they frequently die from moving too slowly.” But in this case, the poorly handled transition might just have been too much, too soon. It is true that while the DVD business built Netflix into a sector-dominating powerhouse, digital streaming is where the industry is headed. But this business is radically different from DVD-by-mail in several key ways, including content costs, content availability, revenue opportunities, rivals and their motivation, and more. If, and how, Netflix makes the transition from the certain-to-wither DVD-by-mail business to a profitable and dominant future in streaming remains to be seen.

Why Study Netflix?

Studying Netflix gives us a chance to examine how technology helps firms craft and reinforce a competitive advantage. In the next section we’ll pick apart the components of the firm’s DVD-by-mail strategy and learn how technology played a starring role in developing assets such as scale, brand, and switching costs that combined to place the firm atop its industry. This will also give us a chance to introduce concepts such as the long tail, collaborative filtering, crowdsourcing, and the value of the data asset. In the second part of this case, we recognize that while Netflix emerged the victorious underdog at the end of the first show, there will be at least one sequel, with the final scene yet to be determined. Act II looks at the very significant challenges the firm faces as its primary business shifts from competing in shipping the atoms of DVDs to one focused on sending bits over the Internet. We’ll see that a highly successful firm can still be challenged by technical shifts, giving us an oportunity to examine issues that include digital goods, licensing, platform competition, and supplier power.

How Netflix Works: A Model in Transition

Here’s how it started out: Reed Hastings, a former Peace Corps volunteer with a master’s in computer science, got the idea for Netflix when he was late in returning the movie Apollo 13 to his local video store. The forty-dollar late fee was enough to have bought the video outright with money left over. Hastings felt ripped off, and out of this outrage, Netflix was born. The firm’s initial model for success was a DVD-by-mail service that charged a flat-rate monthly subscription rather than a per-disc rental fee. Under this model, customers don’t pay a cent in mailing expenses, and there are no late fees. Videos arrive in red Mylar envelopes that are addressed and postage-paid for reuse in disc returns. When done watching videos, consumers just slip the DVD back into the envelope, reseal it with a peel-back sticky strip, and drop the disc in the mail. Users make their video choices in their “request queue” at Netflix.com. If a title isn’t available, Netflix simply moves to the next title in the queue. Consumers use the Web site to rate videos they’ve seen, specify their viewing preferences, get video recommendations, check out title details, and even share their viewing habits and reviews.

Figure 4.1 The Netflix DVD-by-Mail Model

Source: Graphic from the Netflix PR Kit at http://www.netflix.com. Reproduced by permission of Netflix, Inc. Copyright © 2009, Netflix, Inc. All rights reserved.

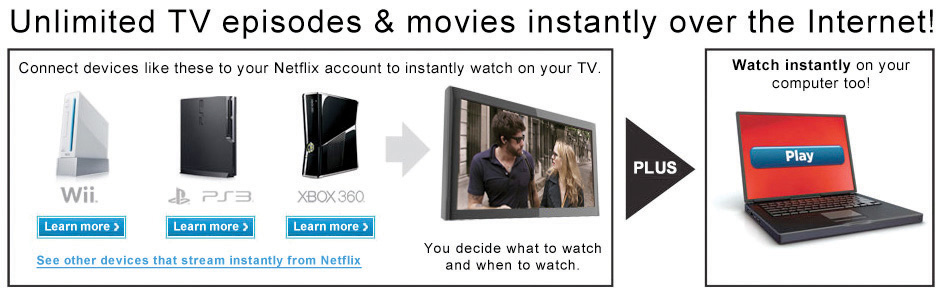

This model helped Netflix grow into a giant, but technology continues to radically change the firm. Hastings knew that if his firm was successful it would one day transition from reliance on mailed DVDs and introduce streaming video. Says Hastings, “We named the company Netflix for a reason; we didn’t name it DVDs-by-mail.”M. Boyle, “Questions for…Reed Hastings,” Fortune, May 23, 2007. In 2007, the firm added a “Watch Now” button next to those videos that could be automatically streamed over the Internet, and offered unlimited streaming as part of the firm’s base subscription price. By 2011, the firm was so focused on digital distribution that it made a streaming-only plan the default option for consumers (the first page at Netflix.com didn’t even mention DVDs or discs). The still-popular DVD-by-Mail was no longer offered in the firm’s base-price product—the disc subscription service that Netflix built its user-base with had become ‘an optional add-on’.

Figure 4.2 The Netflix Streaming Model

Source: Graphic from the Netflix PR Kit at http://www.netflix.com. Reproduced by permission of Netflix, Inc. Copyright © 2009, Netflix, Inc. All rights reserved.

Key Takeaways

- Analysts and managers have struggled to realize that dot-com start-up Netflix could actually create sustainable competitive advantage, beating back challenges from Wal-Mart and Blockbuster, among others.

- Data disclosure required by public companies may have attracted these larger rivals to the firm’s market.

- Netflix operates via a DVD subscription and video-streaming model. These started as a single subscription, but are now viewed as two separate services. Although sometimes referred to as “rental,” the model is really a substitute good for conventional use-based media rental.

- Fear of clinging to a sure-to-shrink DVD-by-mail business model prompted Netflix management to split and reprice its services. However, the price increase, a poorly handled rebranding effort, and a process that would have made the firm’s services more difficult to use all contributed to the firm’s first major customer contraction and satisfaction decrease.

Questions and Exercises

- Describe the two separate Netflix offerings.

- Which firms are or have been Netflix’s most significant competitors in the DVD-by-mail business? How do their financial results or performance of their efforts compare to Netflix’s efforts?

- What appointments have Reed Hastings accepted in addition to his job as Netflix CEO? Why are these appointments potentially important for Netflix?

- Why did Wal-Mart and Blockbuster managers, as well as Wall Street analysts, underestimate Netflix? What issues might you advise analysts and managers to consider so that they avoid making these sorts of mistakes in the future?

- Why did Netflix split its business into two separately billed services, and why did it attempt to split the business in two? What did the firm do wrong?

- Do you think Netflix is right to try to hasten the transition to streaming? Why or why not? What are the risks in waiting? What are the risks in moving too quickly?