This is “Evidence of Market Efficiency”, section 7.4 from the book Finance, Banking, and Money (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

7.4 Evidence of Market Efficiency

Learning Objective

- How efficient are our markets?

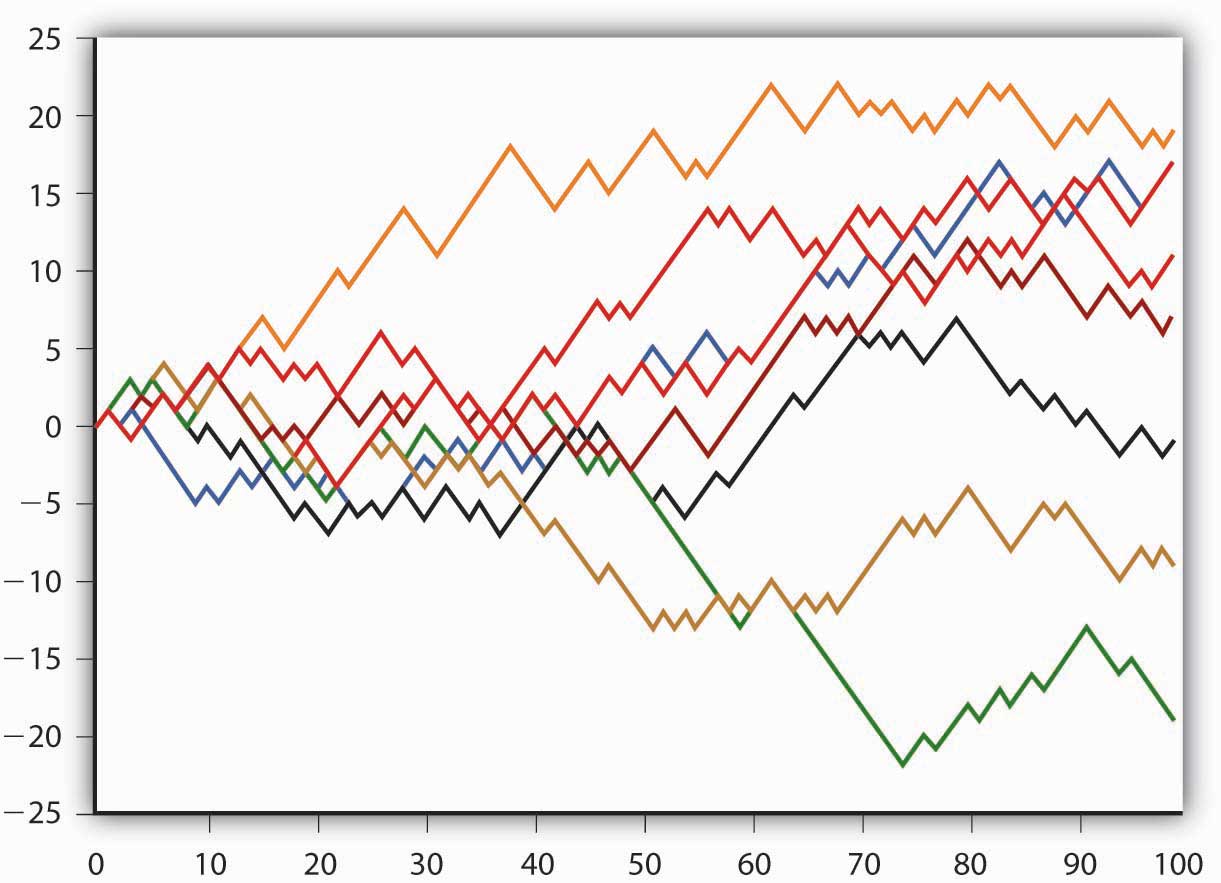

Sophisticated statistical analyses of stock and other securities prices indicate that they follow a “random walk.” That is why stock charts often look like the path of a drunk staggering home after a party, just as in Figure 7.1 "Sample random series". As noted at the beginning of this chapter, securities prices in efficient markets are not random. They are determined by fundamentals, particularly interest rate, inflation, and profit expectations. What is random is their direction, up or down, in the next period. That’s because relevant news cannot be systematically predicted. (If it could, it wouldn’t be news.) So-called technical analysis, the attempt to predict future stock prices based on their past behavior, is therefore largely a chimera. On average, technical analysts do not outperform the market. Some technical analysts do, but others do not. The differences are largely a function of luck. (The fact that technical analysts and actively managed funds persist, however, suggests that financial markets are still far short of perfect efficiency.)

Figure 7.1 Sample random series

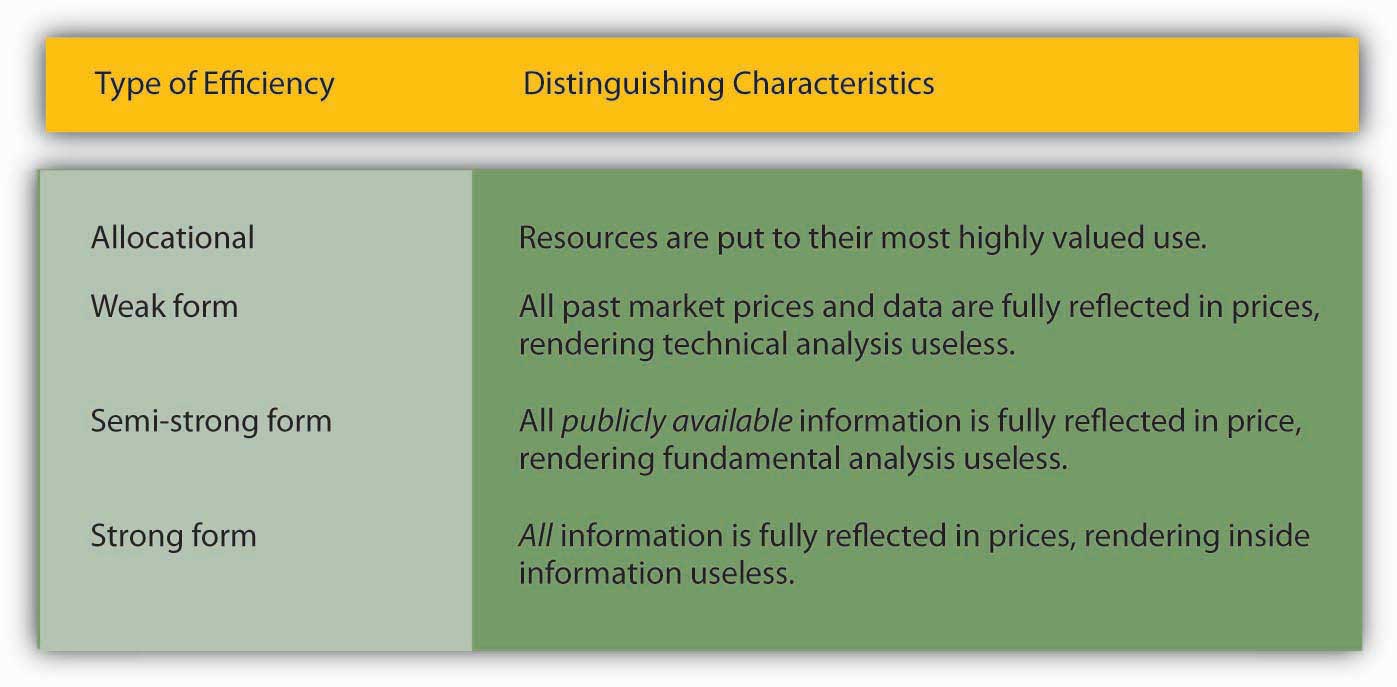

In fact, in addition to allocational efficiency, economists talk about three types of market efficiency: weak, semistrong, and strong. These terms are described in Figure 7.2 "Types of efficiency". Today, most financial markets appear to be semistrong at best. As it turns out, that’s pretty good.

Figure 7.2 Types of efficiency

Some markets are more efficient than others. Thanks to technology improvements, today’s financial markets are more efficient (though not necessarily more rational) than those of yore. In every age, financial markets tend to be more efficient than real estate markets, which in turn tend to be more efficient than commodities markets and labor and many services markets. That’s because financial instruments tend to have a very high value compared to their weight (indeed they have no weight whatsoever today), are of uniform quality (a given share of Microsoft is the same as any other shareAny share of the same class, that is. As noted above, some corporations issue preferred shares, which differ from the common shares discussed in this chapter. Other corporations issue shares, usually denominated Class A or Class B, that have different voting rights.), and are little subject to wastage (you could lose bearer bonds or cash, but most other financial instruments are registered, meaning a record of your ownership is kept apart from physical possession of the instruments themselves). Most commodities are relatively bulky, are not always uniform in quality, and deteriorate over time. In fact, futures markets have arisen to make commodities markets (for gold, wheat, orange juice, and many others)www2.barchart.com/futures.asp more efficient. Financial markets, particularly mortgage markets, also help to improve the efficiency of real estate markets. Nevertheless, considerable inefficiencies persist. As the Wall Street Journal reported in March 2007, it was possible to make outsized profits by purchasing homes sold at foreclosure, tax, and other auctions, then selling them at a hefty profit, accounting for transaction costs, without even going through the trouble or expense of fixing them up. That is nothing short of real estate arbitrage!James R. Hagerty, “Foreclosure Rise Brings Business to One Investor,” Wall Street Journal, March 14, 2007, A1.

Labor and services markets are the least efficient of all. People won’t or can’t move to their highest valued uses; they adapt very slowly to technology changes; and myriad regulations, some imposed by government and others by labor unions, limit their flexibility on the job. Some improvements have been made in recent years thanks to global outsourcing, but it is clear that the number of unexploited profit opportunities in labor markets far exceeds those in the financial markets. Finally, markets for education,www.forbes.com/columnists/2005/12/29/higher-education-partnerships-cx_rw_1230college.html health care,www.amazon.com/Fubarnomics-Lighthearted-Serious-Americas-Economic/dp/1616141913/ref=ntt_at_ep_dpi_3 and custom construction serviceswww.amazon.com/Broken-Buildings-Busted-Budgets-Trillion-Dollar/dp/0226472671/ref=sr_1_1/002-2618567-2654432?ie are also highly inefficient, probably due to high levels of asymmetric information.

Stop and Think Box

A friend urges you to subscribe to a certain reputable investment report. Should you buy? Another friend brags about the huge returns she has made by buying and selling stocks frequently. Should you emulate her trading strategies?

Buying an investment report makes more sense than following the unsolicited hot stock tip discussed above, but it still may not be a good idea. Many legitimate companies try to sell information and advice to investors. The value of that information and advice, however, may be limited. The information may be tainted by conflicts of interest. Even if the research is unbiased and good, by the time the newsletter reaches you, even if it is electronic, the market has probably already priced the information, so there will be no above-market profit opportunities remaining to exploit. In fact, only one investment advice newsletter, Value Line Survey (VLS), has consistently provided advice that leads to abnormally high risk-adjusted returns. It isn’t clear if VLS has deeper insights into the market, if it has simply gotten lucky, or if its mystique has made its predictions a self-fulfilling prophecy: investors believe that it picks super stocks, so they buy its recommendations, driving prices up, just as it predicted! The three explanations are not, in fact, mutually exclusive. Luck and skill may have created the mystique underlying VLS’s continued success.

As far as emulating your friend’s trading strategies, you should investigate the matter more thoroughly first. For starters, people tend to brag about their gains and forget about their losses. Even if your friend is genuinely successful at picking stocks, she is likely just getting lucky. Her luck could turn just as your money gets in the game. To the extent that markets are efficient, investors are better off choosing the level of risk they are comfortable with and earning the market return. That usually entails buying and holding a diverse portfolio via an indexed mutual fund, which minimizes taxes and brokerage fees, both of which can add up. Long-term index investors also waste less time tracking stocks and worrying about market gyrations.

As noted above, none of this should be taken to mean that financial markets are perfectly efficient. Researchers have uncovered certain anomalies, situations where it is or was possible to outperform the market, holding risk and liquidity constant. I say was because exposing an anomaly will often induce investors to exploit it until it is eliminated. One such anomaly was the so-called January Effect, a predictable rise in stock prices that for many years occurred each January until its existence was recognized and publicized. Similarly, stock prices in the past tended to display mean reversion. In other words, stocks with low returns in one period tended to have high returns in the next, and vice versa. The phenomenon appears to have disappeared, however, with the advent of trading strategies like the Dogs of the Dow, where investors buy beaten-down stocks in the knowledge that they can only go up (though a few will go to zero and stay there).www.dogsofthedow.com

Other anomalies, though, appear to persist. The prices of many financial securities, including stocks, tend to overshoot when there is unexpected bad news. After a huge initial drop, the price often meanders back upward over a period of several weeks. This suggests that investors should buy soon after bad news hits, then sell at a higher price a few weeks later. Sometimes, prices seem to adjust only slowly to news, even highly specific announcements about corporate profit expectations. That suggests that investors could earn above-market returns by buying immediately on good news and selling after a few weeks when the price catches up to the news.

Some anomalies may be due to deficiencies in our understanding of risk and liquidity rather than market inefficiency. One of these is the small-firm effect. Returns on smaller companies, apparently holding risk and liquidity constant, are abnormally large. Why then don’t investors flock to such companies, driving their stock prices up until the outsized returns disappear? Some suspect that the companies are riskier, or at least appear riskier to investors, than researchers believe. Others believe the root issues are asymmetric information, the fact that the quality and quantity of information about smaller firms is inferior to that of larger ones, and inaccurate measurement of liquidity. Similarly, some researchers believe that stock prices are more volatile than they should be given changes in underlying fundamentals. That finding too might stem from the fact that researchers aren’t as prescient as the market.

The most important example of financial market inefficiencies are so-called asset bubbles or manias. Periodically, market prices soar far beyond what the fundamentals suggest they should. During stock market manias, like the dot-com bubble of the late 1990s, investors apparently popped sanguine values for g into models like the Gordon growth model or, given the large run-up in prices, large P1 values into the one-period valuation model. In any event, starting in March 2000, the valuations for most of the shares were discovered to be too high, so share prices rapidly dropped. Bubbles are not necessarily irrational, but they are certainly inefficient to the extent that they lead to the misallocation of resources when prices are rising and unexploited profit opportunities when prices head south.

Asset bubbles are very common affairs. Literally thousands of bubbles have arisen throughout human history, typically when assets

- can be purchased with cheap, borrowed money;

- attract the attention of numerous, inexperienced traders;

- cannot be easily “sold shortThe process of short selling, of profiting from the decline of an asset’s price.” (when nobody can profit from a declining price);

- are subject to high levels of moral hazard due to the expectation of a bailout (rescue funds provided by the government or other entity);

- are subject to high agency costs (e.g., poorly aligned incentives between investors and intermediaries or market facilitators).

Agricultural commodities (e.g., tulips, tea, sheep, and sugar beets) have experienced bubbles most frequently but the precious metals (gold and silver), real estate, equities, bonds, and derivatives have also witnessed bubble activity. Most bubbles caused relatively little economic damage, but a real estate bubble in the early 1760s helped to foment the American Revolution, one in Treasury bonds helped to form the two party system in the 1790s, and one in stocks exacerbated the Great Depression. Since the tech bubble burst in 2000, we’ve already experienced another, in housing and home mortgages. Recurrent investor euphoria may be rooted in the deepest recesses of the human mind. Whether we evolved from the great apes or were created by some Divine Being, one thing is clear: our brains are pretty scrambled, especially when it comes to probabilities and percentages. For example, a recent studyMarkus Glaser, Thomas Langer, Jens Reynders, and Martin Weber, “Framing Effects in Stock Market Forecasts: The Differences Between Asking for Prices and Asking for Returns,” Review of Finance (2007) 11:325–357. published in Review of Finance showed that investors, even sophisticated ones, expect less change in future stock prices when asked to state their forecasts in currency (so many dollars or euros per share) than when asked to state them as returns (a percentage gain or loss).This is a new example of the well-known framing effect. Predict the future stock price of a stock that goes from $35 to $37 to $39 to $41 to $43 to $45. Now predict the future stock price of a stock whose returns are +$2, +$2, +$2, +$2, +$2, and +$2. If you are like most people, your answer to the first will be less than $45 but your answer to the second will be +$2 even though both series provide precisely the same information. In other words, the way a problem is set up or framed influences the way people respond to it.

Behavioral financeA new interdisciplinary subject matter that tries to understand the limits of human rationality, especially as it applies to financial markets. uses insights from evolutionary psychology, anthropology, sociology, the neurosciences, and psychology to try to unravel how the human brain functions in areas related to finance.www.behaviouralfinance.net For example, many people are averse to short sellingSelling a stock or other asset at a high price and buying it back later at a lower price. It is the logical equivalent of buying low and selling high, but many investors don’t attempt it., selling (or borrowing and then selling) a stock that appears overvalued with the expectation of buying it back later at a lower price. (Short sellers profit by owning more shares of the stock, or the same number of shares and a sum of cash, depending on how they go about it.) A dearth of short selling may allow stock prices to spiral too high, leading to asset bubbles. Another human foible is that we tend to be overly confident in our own judgments. Many actually believe that they are smarter than the markets in which they trade! (As noted above, many researchers appear to fall into the same trap.) People also tend to herd. They will, like the common misconception about lemmings, run with the crowd, seemingly oblivious to the cliff looming just ahead.

Many people also fail the so-called Linda Problem. When asked if a twenty-seven-year-old philosophy major concerned about social issues is more likely to be either (a) a bank teller or (b) a bank teller active in a local community activist organization, most choose the latter. The former, however, is the logical choice because b is a subset of a. The St. Petersburg Paradox also points to humanity’s less-than-logical brain: most people will pay $1 for a one-in-a-million chance to win $1 million dollars but they will not receive $1 for a one-in-a-million chance of losing $1 million dollars, although the two transactions, as opposite sides of the same bet, are mathematically equivalent.Not even lottery or raffle organizations make such a bet. Instead, they promise to pay the winner only a percentage of total ticket sales and pocket the rest. That is a major reason why lotteries and other forms of gambling are closely regulated. Most people, it seems, are naturally but irrationally risk averse.

Finally, as noted above, another source of inefficiency in financial (and nonfinancial) markets is asymmetric information, when one party to a transaction has better information than the other. Usually, the asymmetry arises due to inside information as when the seller, for instance, knows the company is weak but the buyer does not. Regulators try to reduce information asymmetries by outlawing outright fraud and by encouraging timely and full disclosure of pertinent information to the public. In short, they try to promote what economists call transparencyIn general, the opposite of opacity. In this context, transparency means a relatively low degree of asymmetric information.. Some markets, however, remain quite opaque.www.sec.gov/news/press/2011/2011-83.htm

In short, our financial markets appear to be semistrong form efficient. Greater transparency and more fervent attempts to overcome the natural limitations of human rationality would help to move the markets closer to strong form efficiency.

Key Takeaways

- Beyond allocational efficiency, markets may be classed as weak, semistrong, or strong form efficient.

- If the market is weak form efficient, technical analysis is useless because securities prices already reflect past prices.

- If the market is semistrong form efficient, fundamental analysis is also useless because prices reflect all publicly available information.

- If the market is strong form efficient, inside information is useless too because prices reflect all information.

- Securities prices tend to track each other closely over time and in fact usually display random walk behavior, moving up and down unpredictably.

- Neither technical analysis nor fundamental analysis outperforms the market on average, but inside information apparently does, so most financial markets today are at best semistrong form efficient.

- Although more efficient than commodities, labor, and services markets, financial markets are not completely efficient.

- Various anomalies, like the January and small-firm effects, market overreaction and volatility, mean reversion, and asset bubbles, suggest that securities markets sometimes yield outsized gains to the quick and the smart, people who overcome the mushy, often illogical brains all humans are apparently born with. But the quest is a never-ending one; no strategy works for long.