This is “The Trilemma, or Impossible Trinity”, section 19.1 from the book Finance, Banking, and Money (v. 1.1). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

19.1 The Trilemma, or Impossible Trinity

Learning Objectives

- What is the impossible trinity, or trilemma, and why is it important?

- What are the four major types of international monetary regimes and how do they differ?

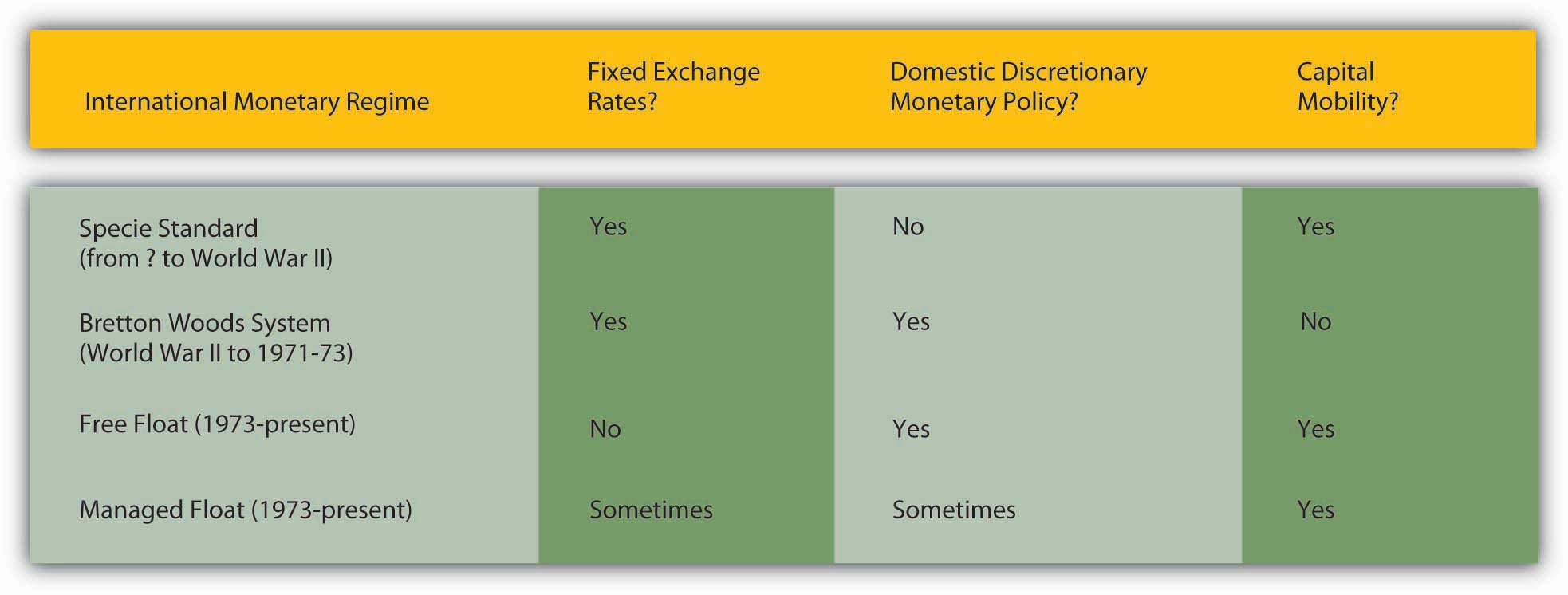

The foreign exchange (forex, or FXThe price of one currency in terms of another.) market described in Chapter 18 "Foreign Exchange" is called the free floating regime because monetary authorities allow world markets (via interest rates, and expectations about relative price, productivity, and trade levels) to determine the prices of different currencies in terms of one another. The free float, as we learned, was characterized by tremendous exchange rate volatility and unfettered international capital mobility. As we learned in Chapter 13 "Central Bank Form and Function" through Chapter 17 "Monetary Policy Targets and Goals", it is also characterized by national central banks with tremendous discretion over domestic monetary policy. The free float is not, however, the only possible international monetary regime. In fact, it has pervaded the world economy only since the early 1970s, and many nations even today do not embrace it. Between World War II and the early 1970s, much of the world (the so-called first, or free, world) was on a managed, fixed-FX regime called the Bretton Woods SystemA system of fixed exchange rates based on gold and the USD used by most of the world’s free (noncommunist) countries in the quarter century after World War II. (BWS). Before that, many nations were on the gold standardA fixed exchange rate regime based on gold. (GS), as summarized in Figure 19.1 "The trilemma, or impossible trinity, of international monetary regimes".

Figure 19.1 The trilemma, or impossible trinity, of international monetary regimes

Note that those were the prevailing regimes. Because nations determine their monetary relationship with the rest of the world individually, some countries have always remained outside the prevailing system, often for strategic reasons. In the nineteenth century, for example, some countries chose a silver rather than a gold standard. Some allowed their currencies to float in wartime. Today, some countries maintain fixed exchange rates (usually against USD) or manage their currencies so their exchange rates stay within a band or range. But just as no country can do away with scarcity or asymmetric information, none can escape the trilemma (a dilemma with three components), also known as the impossible trinity.

Figure 19.2 Strengths and weaknesses of international monetary regimes

As Figure 19.1 "The trilemma, or impossible trinity, of international monetary regimes" shows, only two of the three holy grails of international monetary policy, fixed exchanged rates, international financial capital mobility, and domestic monetary policy discretion, can be satisfied at once. Countries can adroitly change regimes when it suits them, but they cannot enjoy capital mobility, fixed exchange rates, and discretionary monetary policy all at once. That is because, to maintain a fixed exchange rate, a monetary authority (like a central bank) has to make that rate its sole consideration (thus giving up on domestic goals like inflation or employment/gross domestic product [GDP]), or it has to seal off the nation from the international financial system by cutting off capital flows. Each component of the trilemma comes laden with costs and benefits, so each major international policy regime has strengths and weaknesses, as outlined in Figure 19.2 "Strengths and weaknesses of international monetary regimes".

Stop and Think Box

From 1797 until 1820 or so, Great Britain abandoned the specie standardA fixed exchange rate regime based on specie, i.e., gold and/or silver. it had maintained for as long as anyone could remember and allowed the pound sterling to float quite freely. That was a period of almost nonstop warfare known as the Napoleonic Wars. The United States also abandoned its specie standard from 1775 until 1781, from 1814 until 1817, and from 1862 until essentially 1873. Why?

Those were also periods of warfare and their immediate aftermath in the United States—the Revolution, War of 1812, and Civil War, respectively. Apparently during wartime, both countries found the specie standard costly and preferred instead to float with free mobility of financial capital. That allowed them to borrow abroad while simultaneously gaining discretion over domestic monetary policy, essentially allowing them to fund part of the cost of the wars with a currency tax, which is to say, inflation.

Key Takeaways

- The impossible trinity, or trilemma, is one of those aspects of the nature of things, like scarcity and asymmetric information, that makes life difficult.

- Specifically, the trilemma means that a country can follow only two of three policies at once: international capital mobility, fixed exchange rates, and discretionary domestic monetary policy.

- To keep exchange rates fixed, the central bank must either restrict capital flows or give up its control over the domestic money supply, interest rates, and price level.

- This means that a country must make difficult decisions about which variables it wants to control and which it wants to give up to outside forces.

- The four major types of international monetary regime are specie standard, managed fixed exchange rate, free float, and managed float.

- They differ in their solution, so to speak, of the impossible trinity.

- Specie standards, like the classical GS, maintained fixed exchange rates and allowed the free flow of financial capital internationally, rendering it impossible to alter domestic money supplies, interest rates, or inflation rates.

- Managed fixed exchange rate regimes like BWS allowed central banks discretion and fixed exchange rates at the cost of restricting international capital flows.

- Under a free float, free capital flows are again allowed, as is domestic discretionary monetary policy, but at the expense of the security and stability of fixed exchange rates.

- With a managed float, that same solution prevails until the FX rate moves to the top or bottom of the desired band, at which point the central bank gives up its domestic discretion so it can concentrate on appreciating or depreciating its currency.