This is “NatureWorks: Green Chemistry’s Contribution to Biotechnology Innovation, Commercialization, and Strategic Positioning”, section 8.1 from the book Entrepreneurship and Sustainability (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

8.1 NatureWorks: Green Chemistry’s Contribution to Biotechnology Innovation, Commercialization, and Strategic Positioning

Learning Objectives

- Become familiar with some key innovations and entrepreneurial opportunities in the biomaterials arena.

- Analyze the possibilities of biomaterials as an alternative feedstock platform to fossil fuels.

- Examine the barriers and opportunities in producing biomass feedstock through a venture inside a large corporation.

- Compare the innovative venture inside a big firm with a subsequent stand-alone start-up.

In the NatureWorksAndrea Larson, Alia Anderson, and Karen O’Brien, Natureworks: Green Chemistry’s Contribution to Biotechnology Innovation, Commercialization, and Strategic Positioning, UVA-ENT-0089, 2006 (Charlottesville: Darden Business Publishing, University of Virginia, 2006). All quotations and references are from this source unless otherwise indicated. case, students examine challenges of commercializing polylactic acid (PLA), a disruptive technology innovation that substitutes corn-based biomass for oil-based feedstock. NatureWorks was the first US firm to create—and bring to commercial scale—biomass feedstock for a wide variety of applications including plastic components, thin film, and fabrics.

In 2002 a ten-year joint venture between US agricultural giant Cargill Inc. and Dow Chemical received the prestigious Presidential Green Chemistry Challenge Award from the American Chemical Society’s (ACS) Green Chemistry Institute for its development of the first synthetic polymer class to be produced from renewable resources, specifically from corn grown in the American Midwest. The product was biomass material and held the potential to substitute a renewable feedstock (raw material) for petroleum-based polymers. Presented at the Green Chemistry and Engineering conference and awards ceremony in Washington, DC, attended by the president of the US National Academy of Sciences, the White House science advisor, and other dignitaries from the National Academies and the American Chemical Society, the award recognized the venture’s innovative direction. In January 2005, Cargill chose to acquire Dow’s share of the venture. Now the fledgling company had to learn to fly.

NatureWorks’ bio-based plastic resins were named and trademarked NatureWorks PLA for the polylactic acid that composed the base plant sugars. In addition to replacing petroleum as the material feedstock, PLA resins had the added benefit of being compostable (safely biodegraded) or even infinitely recyclable, which meant they could be reprocessed into the same product again and again. That feature provided a distinct environmental advantage over recycling, or “downcycling,” postconsumer or postindustrial materials into lower-quality products, which merely slowed material flow to landfills by one or two product life cycles. Additional life-cycle environmental and health benefits had been identified by a thorough life-cycle analysis (LCA) from corn to pellets. PLA resins, virgin or postconsumer, could then be processed into a variety of end uses.

By early 2005, CEO Kathleen Bader and Chief Technical Officer Pat Gruber were wrestling with a number of questions. NatureWorks’ challenges were both operational and strategic:

- How to take the successful product to high-volume production

- How to market the unique resin in a mature plastics market

With Cargill’s January 2005 decision to acquire Dow’s share of the venture, there were also questions about the structure of NatureWorks going forward.

Kathleen Bader had been at Dow for thirty years before joining NatureWorks in 2004. She had managed Dow’s Styrenics and Engineered Products, a $4 billion business, between 1999 and 2003. She led Dow’s Six Sigma program implementation. As a NatureWorks board member who had long championed the technology, Bader had confidence in its future and supported it from her budget at Dow. She was a logical fit at the helm. One of her first decisions involved selecting a retail alliance partner and narrowing a list of prospective customers. Limited resources constrained her choices.

There were other issues, including application challenges when converting PLA resins to different plastic forms, the controversy over genetically modified organisms (GMOs)Life forms, typically bacteria, yeasts, or plants, the genomes of which have been directly changed by humans to yield desired properties not found in nature, often by inserting genes from a foreign species., and appropriate market positioning for a “sustainable” product, still a vague concept to many. Many executives in the company knew all too well that positioning their new product would take far more than simply getting the technology right.

In spring 2005 NatureWorks employed 230 people, split almost equally among headquarters (labs and management offices), the plant, and the international division. International consisted primarily of the European Union; the Hong Kong representative who had worked with the Japanese market had been brought back to headquarters in early 2004. As a joint venture the enterprise had consumed close to $750 million dollars in capital, was not yet profitable, but held the promise of tremendous growth that could transform a wide range of markets worldwide. In 2005 NatureWorks was still the only company in the world capable of producing on a large-scale bio-based resins that exhibited standard performance traits such as durability, flexibility, and strength—all at a competitive market price.

The Plastics Industry

The plastics industry was the fourth-largest manufacturing segment in the United States behind motor vehicles, electronics, and petroleum refining. In 2001, the United States produced 101.1 million pounds of resins from oil and shipped $45.5 billion in plastic products.Encyclopedia of Business, 2nd ed., s.v. “SIC 2821: Plastic Materials and Resins,” accessed January 31, 2011, http://www.referenceforbusiness.com/industries/Chemicals-Allied/Plastic-Materials-Resins.html. Both the oil and chemical industries were mature and relied on commodities sold on thin margins. The combined efforts of a large-scale chemical company in Dow and an agricultural processor giant in Cargill suggested Cargill Dow—now NatureWorks—was in some ways well suited for the mammoth task of challenging oil feedstock. However, could the small company grow beyond the market share that usually limited environmental products, considered somewhere between 2 and 5 percent of the market? And for that matter, should PLA be considered an “environmental product”?

Wave of Change

The rising wave of interest and activity in biomaterials had pushed industrial biotechnology into the economic mainstream by 2005. Projects to convert renewable resources into industrial chemicals proliferated, funded by government, corporate, and private capital. Major agricultural companies and chemical giants had teamed up to produce carpeting, paint, inks, solvents, automobile panels, and roofing material made from plants. Production of plant-derived fuels, such as ethanol and biodiesel, was growing. Advocates described those as better and lower-cost products: less polluting, equally dependable, lower-cost feedstock; more environmentally friendly products and processes with fewer toxic by-products; a reduced reliance on imported oil; and a smaller environmental footprint.

McKinsey & Company (Zurich) estimated the 5 percent market share represented by biotechnology products in 2004 could jump to 10–20 percent by 2010, with the biggest shift occurring in biotech processes to make bulk chemicals, polymers, and specialty chemicals. Developments in enzymatic biocatalysis were already allowing for the production of new materials with improved properties compared to existing products. Bioprocesses enabled production of existing chemicals at lower cost. The textiles, energy, chemical, and pharmaceuticals industries were all transforming in the face of biotechnology advances. Within this larger dynamic, PLA was just one of many “platform” materials available to be converted into a range of derivative products.

NatureWorks was contributing to creating, and being carried forward by, this wave of biotechnology innovation. Factors were converging to create new markets worldwide. According to Fortune magazine (July 2003), “Sales that large [$280 billion by 2012] would displace a notable quantity of oil, freeing it up for other uses and helping keep prices down—though no one can yet estimate by how much. It would also shift the source of industrial chemicals from foreign countries to farm fields nearer the markets where the end products will be consumed. That would cut transportation costs and conceivably reduce dependence on foreign oil.”Stuart F. Brown, “Bioplastic Fantastic Bugs That Eat Sugar and Poop Polymers Could Transform Industry—and Cut Oil Use Too,” Fortune, July 21, 2003, accessed March 8, 2011, http://money.cnn.com/magazines/fortune/fortune_archive/2003/07/21/346098/index.htm.

Pat Gruber, chief technology officer for NatureWorks LLC, had known of biotechnology innovation’s potential since his graduate school days in biochemistry. Gruber’s interest in environmental issues had a long history, going back to high school, where he had enjoyed and shown an aptitude for biology and chemistry. He had always liked crossing between the systems perspective of biology and the molecular building-block orientation of chemistry.

In the same year that NatureWorks’ achievements had been recognized by the Green Chemistry Challenge Award for innovation, the company brought online a plant with a capacity of 300 million pounds (140,000 metric tons) that promised to turn his team’s breakthroughs into a viable and very large business. In 2003 the business went on to win the United Kingdom’s Chemical Engineering prestigious Kirkpatrick Award for Chemical Engineering Achievement for “bringing to market a technology that allows abundant, annually renewable resources to replace finite petroleum, to make consumer goods without sacrificing performance or price.”

NatureWorks Pre-2005: The Cargill Dow Joint Venture (CD)

Cargill, the largest privately held company in the United States, was also the largest agricultural processor in the country, with 2004 revenues of $63 billion. The company served the food processing, food service, and retail food industries. The origins of NatureWorks went back to 1988, when Pat Gruber joined Cargill after graduate school. Sponsorship by Cargill’s corn milling division launched what was then a small research project. During the 1990s Gruber and his team had acquired considerable biomaterials and bioprocessing expertise, but Cargill sought a polymer partner that would bring plastic processing and application knowledge as well as market know-how. Cargill processed and sold high-volume meats, corn, and other agricultural products to large customers such as Walmart and McDonald’s but knew little about resin converters, thermomolding lines, or polymer science applications, traditional domains of the plastics industry. As a Cargill employee summed it up in the early 1990s, “We know food, we don’t know chemicals.” On the chemicals side, in the early 1990s, experts in the chemical industry generally did not believe it was possible to create carbohydrate feedstock (plant-based starches and sugars) that would perform the same as and be cost competitive with petroleum-originated plastics.

Biography

Patrick Gruber, PhD

Vice President and Chief Technology Officer

Cargill Dow LLC

At the time this case was written, Patrick Gruber was vice president and chief technology officer of Cargill Dow LLC, which he cofounded in 1997. A decade earlier, Gruber had become interested in the use of renewable resources to develop and produce industrial chemicals. Products derived from industrial biotechnology, he argued, could equal or surpass petrochemical products and reduce our environmental footprint on a global scale.

The holder of forty-eight US patents, Gruber was highly recognized for his contribution to both sustainability and business, to science and commerce. His achievement included the 2002 Presidential Green Chemistry Challenge Award, the 2001 Discover Award for Environmental Innovation from the Christopher Columbus Fellowship Foundation, the 2003 Lee W. Rivers Innovation Award from the Commercial Market Development Association, the 2002 Julius Stieglitz Award presented by the ACS and the University of Chicago, the 2003 Society of Plastics Engineers’ Emerging Technology Award, and Chemical Engineering’s Kirkpatrick Award. He also received Popular Mechanics Design and Engineering Award, Industry Week’s Technology of the Year Award, Finance and Commerce’s Innovator of the Year Award, the US Department of Energy OIT Technology of the Year Award, Frost and Sullivan’s Technology of the Year Award, and the Industrial Energy Technology Conference Energy Award.

In addition to a BS in chemistry and biology and a PhD in chemistry from the University of Minnesota, he earned an MBA from the University of Minnesota’s Carlson School of Management.

Gruber held a number of positions at Cargill Inc. before cofounding Cargill Dow, including the bioproducts area’s technology director (1995 to 1998) and bioscience technical director (1998 through 1999). Gruber headed the company’s renewable bioplastics project in 1988, during which time he and his team developed the lactic acid polymer now known as NatureWorks PLA and Ingeo fibers. It was this invention that led to the formation of Cargill Dow LLC.

Ultimately Cargill found an interested partner in Dow Chemical, a $40 billion commodity chemical and plastics manufacturer. Dow was active in oil-based raw materials, plastics, additives, processing aids, and solvents applied across multiple industries. In 2004, Dow’s commitment to its oil-based plastics businesses was expressed in plans to site large-scale plastics feedstock production facilities next to oil wells in the Arabian Peninsula. Dow also had major commitments to polypropylene (made from natural gas released in oil drilling) and polyethylene. Although Dow had considerable plastics science expertise, at the time Dow did not make polyethylene terephthalate (PET), the material PLA most likely would replace.

In 1995 the working partnership officially became a joint venture, a fifty-fifty undertaking between the two parent companies, Cargill and Dow. Though small, the enterprise was monitored closely because costs would show in red on the budgets of units within both companies. The initial $100 million investment carried with it the assumption that Cargill, primarily an agricultural commodity trading company, would contribute its corn and biological process expertise, while Dow brought polymer science, process control methods, and plastic supply-chain marketing knowledge from its commodity plastic polymer businesses. Dow also had a large biotech effort in its pharmaceutical intermediates business that could provide complementary knowledge for chemical production. The agreement between the two industry giants seemed ideal. Furthermore, the structure of the plastics industry, dominated by large companies generating high-volume, low-margin mature commodity plastics through established supply chains, virtually ensured that small players with limited capital would not last.

Board communications issues and the turnover of three CEOs, as well as four marketing VPs, between 1997 and 2004 had reduced the joint venture’s effectiveness over its short life. Some thought the parent companies did not focus on the details of the business’s unique challenges. Others believed the joint venture had served its useful life and a new ownership structure was necessary to move forward.

The assumption by many outside the company was that PLA would be adopted quickly. However, the complexity of differentiating the corn-based plastic pellets that left the Nebraska PLA plant, selling a sufficient volume to downstream buyers to increase plant capacity to greater than 70 percent, and selling the plastic as part of a buyer’s sustainability strategy proved to be a tough challenge.

By 2005, when Cargill Dow became NatureWorks, it could claim more than fifteen years’ experience in biopolymer technology and applications. However, some believed that Cargill still viewed Dow as the polymer company that provided the “technology.” Managing under two different parent organizations created its own set of issues. Two accounting books had to be kept. Fiscal calendars and IT software systems were different. Dow required its process methods and proprietary software be purchased and incorporated by the joint venture. The plant was located on Cargill’s property, thus Cargill was paid by NatureWorks for site management services in addition to the corn raw material, and the business tapped into Cargill’s steam and electric infrastructure.

A member of the top management team commented in 2004 that until recently there had been no meaningful discussion between Cargill and Dow about what each of the investing parent companies wanted from its investment. Complicating matters was Cargill’s historical unwillingness to discuss GMOs and its general reluctance to engage in the public dialogue regarding environmental concerns, and sustainability in particular. Dow, on the other hand, understood the growing interest in the sustainability agenda and was experienced, although not necessarily successful with, environmental groups and the growing regulatory activity.

Making Plastic

The Cargill Dow undertaking was an industrial biotech project as opposed to molecular or gene-focused biotechnology that had evolved from Cargill’s corn-milling business director’s interest in finding new product opportunities for corn sugars. Among the key questions when the duo was considering the project in the 1990s were the following:

- Was it possible to create a cost- and performance-comparable plastic product using corn sugar instead of petroleum as the primary feedstock?

- And was there a business in bioplastics?

PLA innovation held the potential to revolutionize the plastics and agricultural industries by offering benign bio-based biopolymers to substitute for conventional petroleum-based plastics. In those days, however, plastics industry experts repeatedly told Pat Gruber and his small team that he would never find a low-cost biological supply for lactic acid production. They were informed that polymers from that source could never work in the variety of applications they had in mind. Yet the team of scientists Pat Gruber formed around the PLA project kept at their work, believing the technology could be developed and that markets would favor environmentally preferable and renewable resource–based materials. Using Cargill’s corn-milling facility and a 34,000-ton-per-year prototype lactic acid pilot plant built in 1994, the small and expensive project moved determinedly forward.

PLA was not new. Wallace Corothers, the DuPont scientist who invented nylon, first discovered the lactic acid polymer in the 1920s and DuPont research continued through the 1930s. Plant sugars were processed into polymers in small volumes in the laboratory producing very similar characteristics to petroleum-based polymers, the traditional building blocks of commodity plastics. However, costs were orders-of-magnitude too high and the material’s technical performance was not acceptable for large-scale plastics and fibers applications. While research continued on PLA and polylactides, the DuPont-ConAgra joint venture “Ecochem” in the early 1990s ultimately failed. Subsequently, only small volumes of PLA plastic were produced for specialized applications in which the safe dissolution of the material was valued (implants and controlled drug release applications, for example). In the first decade of the twenty-first century, medical sutures made from PLA were sold by DuPont for $1,000 per kilo. Cost and technology constraints had prohibited PLA production in large volumes or for alternative uses.

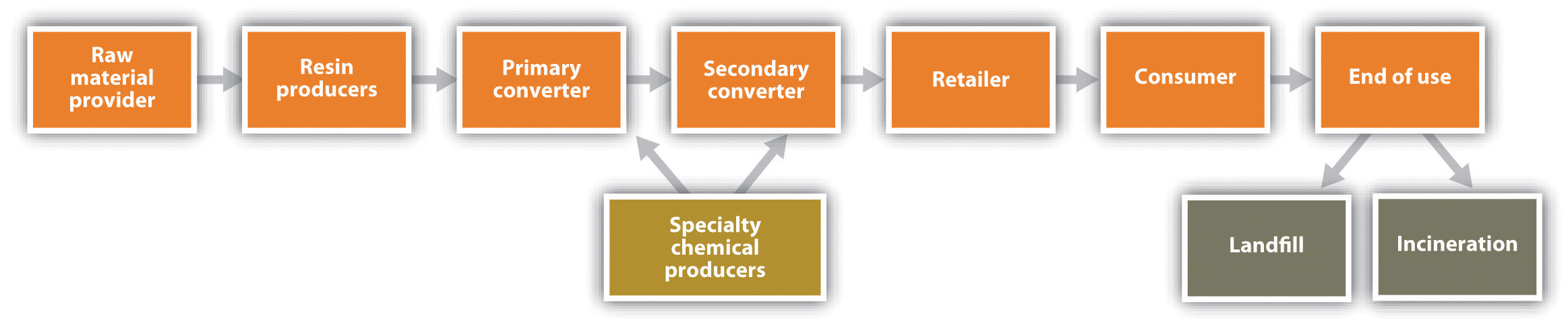

Conventional plastic is made by cracking petroleum through heating and pressure. Long chains of hydrocarbons are extracted and combined with various additives to produce polymers that can be shaped and molded. The polymer material, called resin, comes in the form of pellets, powder, or granules and is sold by the chemical manufacturer to a processor. The processor, also called a converter, blends resins and additives to produce a buyer’s desired product characteristics. For example, an automobile dashboard part needs to be flexible. The processor blends in plasticizer additives to make the resin more flexible and moldable. Plasticizers, often supplied by specialty chemical providers, are the most commonly used additives. Other additives include flame retardants, colorants, antioxidants, antifungal ingredients, impact modifiers (to increase materials’ resistance to stress), heat or light stabilizers (to resist ultraviolet rays), and lubricants. In addition to those additives, some plastics also include fillers such as glass or particulate materials. First-tier processing companies typically sold resins with specific qualities in the form of rolled sheets or pellets. Additional converters along the supply chain melted the sheets or resin pellets and converted them by processes such as injection molding (for storage tubs such as yogurt containers or waste bins), blow molding (for plastic drink bottles), and extrusion (for films).Encyclopedia of Business, 2nd ed., s.v. “SIC 2821: Plastic Materials and Resins,” accessed January 31, 2011, http://www.referenceforbusiness.com/industries/Chemicals-Allied/Plastic-Materials-Resins.html.

Figure 8.1 Simple Value Chain for Polymer Transformation into Plastic Consumer Products

Source: Created by author.

In contrast, NatureWorks’ process for creating a proprietary polylactide, trade named NatureWorks PLA (for plastics) and Ingeo (for fibers), was based on the fermentation, distillation, and polymerization of a simple plant sugar, corn dextrose. The process harvested the carbon stored in plant sugar and made a PLA polymer with characteristics similar to those of traditional thermoplastics. The production steps were as follows:

- Starch was separated from corn kernels.

- Enzymes converted starch to dextrose (a simple sugar).

- Bacterial culture fermented the dextrose into lactic acid in a biorefinery.

- A second plant used a solvent-free melt process to manufacture lactide polymers.

- Polymer emerged from the plant in the form of resin pellets.

- Pellets had the design flexibility to be made into fibers, coatings, films, foams, and molded containers.

NatureWorks’ manufacturing sequence reduced consumption of fossil fuel by 30–50 percent compared with oil-based conventional plastic resins. PLA plastic waste safely composted in about forty-five days if kept moist and warm (above 140 degrees Fahrenheit) or, once used, could be burned like paper, producing few by-products. PLA offered a renewable resource replacement material for PET and polyester, both used widely in common products such as packaging and clothing.

Field corn was the most abundant and cheapest source of fermentable sugar in the world, and the standard variety used by NatureWorks (yellow dent number 2) was commonly used to feed livestock.Erwin T. H. Vink, Karl R. Rábago, David A. Glassner, and Patrick R. Gruber, “Applications of Life Cycle Assessment to NatureWorksTM Polylactide (PLA) Production,” Polymer Degradation and Stability, 80 (2003): 403–19, accessed April 19, 2011, http://www.natureworksllc.com/the-ingeo-journey/eco-profile-and-lca/~/media/the_ingeo_journey/ecoprofile_lca/ecoprofile/ntr_completelca_ecoprofile _1102_pdf. The corn was sent to a mill, where it was ground and processed to isolate the sugar molecules (dextrose). Dextrose was purchased from Cargill and fermented using a process similar to that used in beer and wine production. That fermentation yielded lactic acid. The lactic acid was processed, purified, melted, cooled, and chopped into pellets. It was then ready for sale and to be made by processing companies along the supply chain into cups, plates, take-home containers, polyester-like fabrics, or laptop computer covers. Once the product was used, it could be either composted (meaning it would biodegrade) or melted down and recycled into equal quality products.Erwin T. H. Vink, Karl R. Rábago, David A. Glassner, and Patrick R. Gruber, “Applications of Life Cycle Assessment to NatureWorksTM Polylactide (PLA) Production,” Polymer Degradation and Stability, 80 (2003), 403–19, accessed April 19, 2011, http://www.natureworksllc.com/the-ingeo-journey/eco-profile-and-lca/~/media/the_ingeo_journey/ecoprofile_lca/ecoprofile/ntr_completelca_ecoprofile _1102_pdf. Though NatureWorks had the technical capacity to combine postconsumer PLA products with virgin corn feedstock to make new products, large-scale collection required a reverse logistics system. Bader and Gruber hoped that capability would someday exist, allowing them to close the loop of their industrial process and practice fully renewable, “cradle-to-cradle”Robert A. Frosch and Nicholas E. Gallopoulos, “Strategies for Manufacturing,” Scientific American 261, no. 3 (September 1989): 144–52; see also William McDonough and Stanley Braungart, Cradle to Cradle: Remaking the Way We Make Things (New York: North Point Press, 2002). manufacturing, a new model then gaining credence as a substitute for the linear, cradle-to-grave industrial process that had traditionally characterized Western industrial economies.

A key breakthrough resulted in a dramatic cost reduction to manufacture the lactic acid for making PLA polymers. A new fermentation and distillation process enabled cheaper purification, better optical composition control, and significant yield increases over existing practice. In contrast, two-thirds of the material inputs in conventional PLA processing were lost to waste streams. The company’s patented new process permitted the inexpensive production of different PLA grades for multiple markets in a flexible manufacturing system within the single plant, while adhering to environmentally sound practices throughout.

Buyers

Typically buyers such as food service companies (Cisco, Guest Services), restaurant chains, and supermarkets needing hundreds of thousands of drinking cups would contract with cup producers that had relationships with materials converters that had in turn purchased either plastic resins or previously fabricated plastic sheets, foams, or coatings. Some supply chains were simple, with only three steps from NatureWorks feedstock resins to the ultimate user. Other supply chains could be much longer and more complex. Long-established and preferential working relationships with plastic resins producers were standard, as were multiyear contracts and lines optimized for conventional materials. But converters could be persuaded to source differently and to change molds and even line equipment if customers demanded. Fortunately PLA could be dropped into PET molds and lines with only minor changes. It was harder to drop PLA into polystyrene lines, and optimizing for PLA might mean cutting new tools, new mold designs, or even new lines, depending on the application. For example, PLA thickness might be less than that of the conventional plastic sheets it replaced, requiring retooling to thinner sheets. Conversion to PLA could mean significant additional throughput or faster line times (cost savings), but it might also require expenditures of time and money. That could yield financial gains to converters, but few were interested in making changes when profit margins already were slim.

The Market

NatureWorks brought its new product to market in the late 1990s and early 2000s at a time of economic recession, uncertain market dynamics, and rapidly intersecting health, environmental, national security, and energy independence concerns. While the economy seemed to settle by 2005, oil supplies and dependency concerns loomed large, with oil prices exceeding $65 per barrel. Volatile oil prices and political instability in oil-producing countries argued for the US and other oil-dependent economies to decrease their oil dependence. European countries were moving more quickly than the United States, however.

Yet plastics were a visible reminder of societies’ heavy reliance on petroleum-based materials. The US food industry and demographic trends were creating rapidly growing markets for convenient prepared foods, and clear plastic packaging helped get customers’ attention at retail. Consumers had become increasingly well informed about chemicals in products and were becoming more aware that few had been tested for health impacts. Certain plastics known to leach contaminants even under normal use conditions were facing government and health nonprofits’ scrutiny. Health concerns, in particular those related to infants, children, and pregnant women, had put plastics under the microscope in the United States, but nowhere near the microscopic focus plastics had received in the European Union and Japan, where materials bans and regulatory frameworks received significant citizen support. Strong interest in green building in China and Taiwan along with strong government motivations and incentives to reduce oil dependency (true also for Europe) drove international market buyers to find alternative feedstock for plastic.

The volatility of petroleum prices between 1995 and 2005 wreaked havoc on the plastics industry. From 1998 to 2001, natural gas prices (which typically tracked oil prices) doubled, then quintupled, then returned to 1998 levels. The year 2003 was again a roller-coaster of unpredictable fluctuations, causing a Huntsman Chemical Corp. official to lament, “The problem facing the polymers and petrochemicals industry in the United States is unprecedented. Rome is burning.”Robert A. Frosch and Nicholas E. Gallopoulos, “Strategies for Manufacturing,” Scientific American 261, no. 3 (September 1989): 144–52. Others were assured that oil supplies, then central to plastics production, would be secured one way or another.

In contrast to petroleum-based plastics and fabrics, PLA, made from a renewable resource, offered performance, price, environmental compatibility, and high visibility, and therefore significant value to certain buyers and consumers for whom this configuration of product characteristics was important. But there was an information gap. Most late supply-chain buyers and individual consumers had to be reminded that plastics came from oil.

Competition

Several companies throughout the world had perfected and marketed corn-based plastic materials on a small scale. Japan was an early player in PLA technology. By the 1990s Shimadzu and MitsuiTuatsu in Japan were producing limited quantities of PLA and exploring commodity plastics applications. Their leadership reflected Japanese technological skills, greater public and government concern for environmental and related health issues, and greater waste disposal concerns given limited territory and a dense population. By 2004, Japanese companies were buying NatureWorks PLA and transporting the pellets to Chinese subsidiaries for research and production. Japan had already safely incinerated and composted PLA.

Larger companies were taking stabs at bio-based materials, but none was as far along or as targeted as NatureWorks. For example, Toyota had entered a joint venture with trading house Mitsui & Co. Ltd., which produced PLA from sweet potatoes. Toyota reportedly used PLA resins in its Prius hybrid car. Toyota announced plans in 2004 to construct a pilot plant to produce bioplastics made from vegetable matter. A new facility—to be built within an existing manufacturing plant in Japan—was expected to generate one thousand tons of the PLA plastics annually. Operations began in August 2004. Competitors and critics called these claims “greenwash”: they were skeptical of Toyota’s real intention to become a producer of its own plastic resins, a vertical integration step atypical of the auto company. But Toyota’s Biogreen Division recently had purchased a biopolymer feedstock company.

DuPont had a seven-year research program with biotechnology company Genencor using its enzyme to create a predominantly corn-based fiber called SoronaPeter Mapleston, “Automakers Work on Sustainable Platforms,” Modern Plastics 80, no. 3 (March 2003): 45, accessed January 31, 2011, http://plasticstoday.com/articles/automakers-work-sustainable-platforms. through a joint venture with Tate & Lyle. The Sorona polymer, expected to replace the company’s more expensive petrochemical-based product, was to emerge from a new, 100-million-pound-capacity plant in 2005. Sorona was only half bio-based, however, still relying on petroleum for half its feedstock. DuPont’s goal was to have 25 percent of its revenues derived from products made using renewable materials by 2015. Eastman Chemical Company’s new product called “Eastar Bio GP & Ultra Copolyester” was designed to biodegrade to biomass, water, and carbon dioxide in a commercial composting environment in 180 days.

Metabolix (Cambridge, Massachusetts) was awarded $1.6 million from the Department of Commerce’s Advanced Technology Program to help fund a project to improve the efficiency of a bioprocess to make polyhydroxyalkanoate (PHA) biodegradable plastics from corn-based sugars. Metabolix said it was engineering bacteria to make production of PHA cost competitive with petrochemical-based plastics. A report on Metabolix in 2002 stated,

Genetically engineered microbes that produce thermoplastic polymers by fermenting cornstarch or sugar are going to start nibbling away at hydrocarbon-based resins more quickly than is generally expected. That is the view of James Barber, president of Metabolix Inc., whose company operates a pilot plant for polyhydroxyalkanoate (PHA) fermentation at its headquarters in Cambridge, Massachusetts. Metabolix was created in 1992 to develop PHA technology. In 2001, the company acquired Biopol technology from Monsanto. Biopol was originally developed by ICI in the 1980s. A recent $7.4 million grant to Metabolix by the U.S. Dept. of Energy will help develop a new route to bioproduction of PHA. Instead of fermentation, Metabolix will investigate making PHA through photosynthesis in the leaves or roots of the switchgrass plant. This is a fast-growing, native American grass that grows relatively well even on marginal farmland. “Direct plant-grown PHA could allow us to challenge volume resins in lower-cost packaging and other markets,” Barber says.“Low-Cost Biopolymers May Be Coming Soon,” Plastics Technology, April 1, 2002, accessed January 31, 2011, http://www.thefreelibrary.com/Low-cost+biopolymers+ may+be+coming+soon.+%28Your+Business+in+Brief%29.-a084944193.

Germany’s BASF began R&D collaboration with Metabolix in 2003 to investigate PHA’s materials and processing properties. However, much of that competitive activity was intended to forge “platform” technical capacities to use biomaterials and processing for wide varieties of pharmaceutical and industrial applications, was in its infancy stages, and was not necessarily seen as a threat to NatureWorks. In late 2004, agriculture giant Archer Daniels formed a fifty-fifty joint venture with Metabolix to make alternatives to petrochemical plastics.

In terms of its stage and scale of technology, NatureWorks was alone among companies in the emerging industry, a situation which caused it some additional challenges. Buyers preferred comparing the cost and performance of two products rather than having to choose the only product available. In addition, NatureWorks could hardly lobby for government subsidies or regulations for its industry, since it was the sole representative of that industry.

Yet factors continued to line up favorably. The chemically tough nature of oil-based plastic polymers was both their most desirable and most problematic trait. Plastic polymers can take hundreds and even thousands of years to break down. With steadily increasing consumption rates of plastics (predicted to be 2.58 billion tons between 2004 and 2015“Global Plastic Companies Plan to Make Biodegradable Products,” Financial Express (Delhi), October 4, 2004, accessed January 31, 2011, http://www.financialexpress.com/news/global-plastic-companies-plan-to-make -biodegradable-products/57219/0.) and short product life spans (approximately 30 percent of plastic is used in packaging; this material is thrown away immediately), communities faced a significant solid waste problem. In 2004, plastic represented almost 40 percent of the municipal waste stream by tonnage.“Global Plastic Companies Plan to Make Biodegradable Products,” Financial Express (Delhi), October 4, 2004, accessed January 31, 2011, http://www.financialexpress.com/news/global-plastic-companies-plan-to-make -biodegradable-products/57219/0. The disposal issue had caused several countries to create a requirement for recyclability in plastic products. In 1994, the European Union passed the Packaging Recovery and Recycling Act, which required member nations to set targets for recovery and recycling of plastic wastes. By 2005, manufacturers had to take packaging back. The European Union also set a precedent with the Directive on End-of-Life Vehicles, which established a goal of 85 percent reuse and recycling (by weight of vehicle parts) by 2006. NatureWorks set up its EU office in 1996.

Similar laws followed in 1997 in Japan. One stated that the manufacturer was responsible for the cost of disposal of plastic packaging. Japan added to its waste regulations in 2001 by mandating that all electronics must contain 50–60 percent recyclable materials and that the manufacturers must take the electronic device back at the end of its useful life. This spurred the Japanese GreenPla designation (so named for green plastics, not PLA). This was a strict labeling program that identified products that met all government regulations for recyclability. The first product to receive the GreenPla designation was NatureWorks PLA resins.

In 2003, Taiwan initiated a phaseout of polystyrene foam and shopping bags. These regulations used the “polluter pays” approach, which made manufacturers responsible for the disposal and reuse of their products. The efforts were designed to inspire a movement toward the development of “readily recyclable” products, and two of three implementation phases were complete. The last phase would fine people for using nonbiodegradable materials. Whether termed sustainable business, triple bottom line (economic, social, and environmental performance), 3E’s (economy, equity, ecology), or simply good business, drivers of change were growing.

Additives

No discussion of plastics can leave out the issue of additives and related health concerns. Chemical specialty companies provided packages of additives that converters incorporated into melted resins to achieve the customer’s desired look and performance. One physical characteristic of plastic molecules is that the additives are not chemically bound in the polymers but rather physically bound (envision the additive molecule “sitting” inside a web of plastic molecules, rather than being molecularly “glued” in place). That means that as plastics undergo stress under normal use, such as heat or light, or pressure in a landfill, additive molecules are released into the environment. These “free-ranging” additives were causing scientists to raise questions about health impacts. Alarming data were accumulating from sources such as the American National Academy of Sciences and the US Centers for Disease Control. A 2005 Oakland Biomonitoring Project found evidence of the following chemicals in the blood of a twenty-month-old child in California: dichloro-diphenyl-trichloroethane (DDT), polychlorinated biphenyl (PCBs), mercury, cadmium, plasticizers, and flame retardants (polybrominated diphenyl ethers, or PBDEs); PBDEs, known to cause behavioral changes in rats at 300 parts per billion (ppb), registered at 838 ppb in the child.

Plasticizers, such as phthalates, were the most commonly used additives and had been labeled in studies as potential carcinogens and endocrine disruptors. Several common flame retardants regularly cause developmental disorders in laboratory mice. Possibly most startling were studies that found significant levels of phthalates, PDBEs, and other plastic additives in mothers’ breast milk. Those findings were confirmed for women in several industrially developed economies including the United Kingdom, Germany, and the United States.

Science trends had led to a series of regulations that plastic producers and other companies active in the international market could not ignore. In 1999, the EU banned the use of phthalates in children’s toys and teething rings and, in 2003, banned some phthalates for use in beauty products. California took steps to warn consumers of the suspected risk of some phthalates. The EU, California, and Maine banned the production or sale of products using certain PDBE flame retardants.

Attempting to address the fact that the majority of the thousands of chemical additives used in plastics have never been tested for health impacts, in 2005 the EU was in the final phases of legislative directives that required registration and testing of nearly ten thousand chemicals of concern. The act, called Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), was expected to become law in 2006. Imports into Europe would need to conform to REACH requirements for toxicity and health impacts. Europe used the precautionary principle in its decisions about chemicals use: unwilling to wait until conclusive scientific data proved causation, member countries decided that precautionary limits on, and monitoring of, chemicals would best protect human and ecological health.

Sales in Europe

NatureWorks’ innovation had received more attention in the international market than in the United States. In 2004, IPER, an Italian food market, sold “natural food in natural packaging” (made with PLA) and attributed a 4 percent increase in deli sales to the green packaging.Carol Radice, “Packaging Prowess,” Grocery Headquarters, August 2, 2010, accessed January 10, 2011, http://www.groceryheadquarters.com/articles/2010-08-02/Packaging-prowess. NatureWorks established a strategic partnership with Amprica SpA in Castelbelforte, Italy, a major European manufacturer of thermoformed packaging for the bakery and convenience food markets. Amprica was moving ahead with plans to replace the plastics it used, including PET, polyvinyl chloride (PVC), and polystyrene with the PLA polymer. In response to the national phaseout and ultimate ban of petroleum-based shopping bags and disposable tableware, Taiwan-based Wei-Mon Industry signed an exclusive agreement with NatureWorks to promote and distribute packaging articles made with PLA.World Business Council for Sustainable Development, “NatureWorks™ by Cargill Dow LLC: Capturing Consumer Attention and Loyalty,” accessed April 19, 2011, http://www.wbcsd.org/web/publications/case/marketing_natureworks _full_case_web.pdf. In other markets, high-end clothing designer Giorgio Armani released men’s dress suits made completely of PLA fiber; Sony sold PLA Discman and Walkman stereos in Japan; and, due to growing concerns about the health impacts of some flame retardant additives, NEC Corp. of Tokyo had combined PLA with a natural fiber called kenaf to make an ecologically and biologically neutral flame-resistant bioplastic.“NEC Develops Flame-Resistant Bio-Plastic,” GreenBiz, January 26, 2004, accessed January 27, 2011, http://www.greenbiz.com/news/2004/01/26/nec-develops-flame-resistant-bio-plastic.

Though the US market had not embraced PLA, there were signals that a market would evolve. In its eleven “green” grocery stores, Wild Oats Markets Inc.—a growing supermarket chain based in Portland, Oregon—switched to PLA packaging in its deli and salad bar. The stores advertised the corn-based material and had special recycling collection bins for the plastic tubs, which looked identical to petroleum-based containers. Wild Oats collected used PLA containers and sent them to a composting facility. The chain planned to expand that usage nationally to all seventy-seven Wild Oats stores,World Business Council for Sustainable Development, “NatureWorks™ by Cargill Dow LLC: Capturing Consumer Attention and Loyalty,” accessed April 19, 2011, http://www.wbcsd.org/web/publications/case/marketing_natureworks _full_case_web.pdf. scooping its larger rival, Whole Foods. Smaller businesses such as Mudhouse, a chain of homegrown coffee shops in Charlottesville, Virginia, had changed over to NatureWorks’ PLA plastic clear containers for cold drinks, sourced from Plastics Place in Kalamazoo, Michigan, a company that stated its mission as “making things right.”

NatureWorks marketing head Dennis McGrew noted that the more experimental companies and the firms trying to catch competitors were moving more quickly to explore PLA applications. It was significant that both smaller early adopter purchasers as well as large companies were interested. Soon, mainstream companies entered the mix. In 2004, Del Monte aced its rival Dole at the southern California food show with PLA fresh fruit packaging. Also that year, Marsh Supermarkets in Indianapolis agreed to use PLA packaging at its stores, representing an important new retail channel: the traditional supermarket.Carol Radice, “Packaging Prowess,” Grocery Headquarters, August 2, 2010, accessed January 10, 2011, http://www.groceryheadquarters.com/articles/2010-08-02/Packaging-prowess.

Clothing Fiber from PLA

Opportunities for fiber applications were growing. NatureWorks launched the Ingeo brand of PLA in January 2002, targeting fiber markets then dominated by PET, polyamide, and polypropylene fibers. Ingeo could be used for clothing, upholstery, carpets, and nonwoven furnishings as well as fiberfill for comforters and for industrial applications. By 2004 the company FIT had developed a range of man-made fibers derived from PLA polymers following the signing of a master license agreement between the Tennessee-based fiber maker and NatureWorks to produce and sell the fibers under the brand name Ingeo in North America and in select Asian markets. The agreement included technology licenses, brand rights, and raw material supply to manufacture and sell Ingeo. The US supply chain for apparel fiber had moved to Asia in the 1990s, making India and China the fabric markets to watch.

In 2004, Faribault Woolen Mill Company sold blankets and throws made with 100 percent PLA and a PLA/wool blend. Biocorp North America Inc., based in Louisiana, was one of a handful of companies producing compostable PLA cutlery and was able to offer the new product at a price competitive with conventional disposable knives, forks, and spoons. Biocorp had success selling its corn-based cutlery to sizable buyers such as Aramark and the US Environmental Protection Agency. In 2003, Ford introduced its Model U SUV, which boasted a range of “green” features such as a hydrogen engine; soy-based foam seating; and tires, roofing, and carpet mats all made with NatureWorks’ PLA.Joann Muller, “Lean Green Machine,” Forbes, February 3, 2003, accessed January 31, 2011, http://www.forbes.com/global/2003/0203/023.html. Though the new model was only a “concept vehicle,” Ford claimed that it was using the same cradle-to-cradle approach to design a market-ready vehicle.

Genetically Modified Organisms (GMOs)

A significant obstacle to marketing NatureWorks PLA in the United States was that the corn feedstock included genetically modified (called GM or GMO) corn. That PLA was certified to be free of any detectible genetic material by GeneScan Inc. and that the base sugar source (GMO or not) had no impact on PLA performance did not persuade the naysayers. Furthermore, the business was not in a position to control the corn sources coming to the mill and GMO and non-GMO were typically intermixed.

When the revolutionary NatureWorks PLA product was initially released in 2002, outdoor clothing company Patagonia jumped at the chance to use it. After approving the suitability of PLA fibers for its products and moving toward a sizable partnership, Patagonia realized that the corn feedstock, like nearly all the corn produced in the United States, had been genetically modified to be more pest resistant. Patagonia shared the concerns of many environmental nongovernmental organizations throughout the world that GMO products had not received sufficient testing for full ecological and social impact. The uncertainty that still surrounded GMO products caused such groups to lobby for a total ban on GMOs until more sound investigations were conducted. Patagonia abandoned the NatureWorks partnership and launched a publicity campaign against PLA. Environmental groups also questioned the use of food material (the corn) as feedstock when hunger remained a seemingly intractable problem internationally. NatureWorks expected to spend about $2 billion on commercial development and production technology development to enable the conversion of other agriculturally based materials, such as corn stalks and other postharvest field waste, wheat straw, and grasses, into PLA.

Though NatureWorks would have preferred to produce GMO-free products, it was challenging to purchase separate quantities of non-GMO corn at a comparable price. In 2002 the company quantified the proportion of GMO/non-GMO corn in its final resin and designed a system of offsets to support customer choice regarding non-GMO sourcing. In this system, any PLA customer could pay $.10 more per pound of PLA. NatureWorks would use this money to buy an equivalent offset amount of non-GMO corn (per one pound of PLA) for the processing plant’s primary feedstock. Though resin purchasers (under the direction of their buyers) could not guarantee that the product was 100 percent non-GMO, they could voice their preference for non-GMO corn. NatureWorks experts pointed out that since the genetically modified DNA was no longer present in the corn after it had been fermented, hydrolyzed, and distilled to make PLA, this system was the only way to work proactively on this customer issue. However, parent company Cargill had reservations about the program. Public Affairs and Communications Director Ann Tucker was working on reconfiguring the program on a more customer-directed and focused platform in early 2005. Sensitivity to the issues and the use of terms like genetically modified was not limited to Cargill. Dow had preferred that the company not say “from renewable resources.”

In 2005 the plant was operating at a lower capacity than projected. Bader was hearing the refrain repeatedly: “You cost a lot of money, make the bleeding stop” and “Your product doesn’t work because it does not offer a ‘drop-in’ (easily adopted) substitute for PET and polystyrene.” It was hard to determine and stay focused on priorities. There was so much to be done simultaneously. The top management team had to constantly ask themselves what core issues should be tackled first and what strategy would generate essential sales volumes.

Marketing

After successfully overcoming the scientific and technological barriers of producing PLA on a large scale, the team now faced the challenge of creating and managing a new market, a challenge that had not been attempted for thirty years. Manufacturers did not understand how to reconfigure their machinery to handle this new polymer, and many customers needed convincing that sustainable products were worth the investment. The pilot plant in Nebraska had the capacity to produce only 300,000 million pounds of plastic per year, hardly a contribution to the three billion oil-based pounds produced in the world annually.

Dennis McGrew, chief marketing officer, joined NatureWorks in April 2004 after twenty-one years at Dow in the plastics side of the business. McGrew was solutions oriented and brought with him considerable experience working on new business models for materials markets. The challenge as he described it was “taking PLA from niche to a broad market play.” NatureWorks had a solution for companies that wanted to move in the direction of more sustainably designed corporate strategies. For McGrew the company was selling resin pellets, but really what it had to sell was environmental responsibility. McGrew had realigned commercialization to global markets where environmental concerns were more familiar concepts.

Formerly a marginal topic, by 2005 sustainable business practices had entered the mainstream. Although the definition of sustainability depended somewhat on one’s perspective, it was clear insurers, investors, banks, end consumers, and governments worldwide were placing increasing emphasis on corporate accountability for the impact of their activities on communities, health, and the natural environment. Large companies were publishing social and environmental reports in response to investor demand, and there was a significant movement toward uniform international corporate reporting standards on what was called triple-bottom-line performance (economic, social, and environmental). The Dow Jones Sustainability Index tracked high performers in sustainable management practices. In April 2005, JPMorgan, the third-largest bank in the United States, announced a new policy of guidelines restricting lending and underwriting when projects harm the environment, following European financial institutions’ strategies. As the first US financial institution to incorporate environmental risk management into the due diligence process of its private equity divisions, the signal sent a message far beyond financial markets. A negative reputation for a company going forward could result in more expensive capital, higher insurance premiums, costlier bank credit, lower stock price, and even consumer boycotts.

These larger trends might support initiatives by firms such as NatureWorks but seemed remote to Bader and her senior management team. To go from niche to mainstream with PLA, it was essential that NatureWorks create an ongoing profitable business. This meant going from tens of millions of pounds of PLA produced to hundreds of millions of pounds.

Key Takeaways

- There are ways to decouple economic growth from fossil fuels through materials innovation based on sustainability principles.

- Entrepreneurs manage significant strategic and operating barriers that are further complicated when working with disruptive technology that must move from development to commercialization.

- Ventures within large companies face their own set of challenges due to the parent organization’s scale, vested interests, and culture.

- Sustainability, a new branding and marketing category, faces challenges throughout the supply chain.

Exercises

- What is this product in its markets? Is this a good opportunity? What is the potential for this product? Be specific about volume, markets, and applications.

- What particular difficulties arise when working with innovative products such as PLA?

- What does PLA displace; what does PLA complement? What are the implications of being a complement or a displacement?

- What are the major marketing and sales (commercialization) challenges for NatureWorks?

- What are the supply-chain issues? How might they be resolved?

- How would you have managed the commercialization process differently?