This is “Case 3: Nontraditional Insurance Programs and Application to the Hypothetical Loco Corporation”, section 23.3 from the book Enterprise and Individual Risk Management (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

23.3 Case 3: Nontraditional Insurance Programs and Application to the Hypothetical Loco Corporation

Learning Objectives

In this section we elaborate on alternative risk-financing techniques using real-world case studies and a hypothetical example:

- The evolution of sophisticated, nontraditional insurance arrangements

- Integrated risk management programs

- Finite risk management techniques

- Actual applications of alternative risk financing

- Utilization of alternative risk financing by hypothetical LOCO Corporation

From Academy of Insurance Education

Written by Phyllis S. Myers, Ph.D., and Etti G. Baranoff, Ph.D.

Edited by Gail A. Grollman

Formerly a video education program of the National Association of Insurance Brokers

Copyright: The Council of Insurance Agents and BrokersThe Council of Insurance Agents and Brokers assumed all National Association of Insurance Brokers (NAIB) copyrights when the two organizations merged. The Council gave permission to use the material. The Council of Insurance Agents and Brokers is located in Washington, D.C. This case is based on the video education series created for continuing education of brokers in 1996 and 1997. Five video education modules were created. The material used in this case is from video number 5. Some modifications to the original material were necessary when making the transition to a print format.

Preface

Case 3, unlike Cases 1 and 2, is designed for risk management students who are interested in the more complex types of insurance coverage designed for large businesses. It is provided here to enhance Chapter 6 "The Insurance Solution and Institutions" and the material provided in the textbook relating to different types of commercial coverage.

Introduction

Alternative risk financingRisk-funding arrangements that typically apply to losses above a firm’s primary self-insurance retentions or losses above the primary insurance layer. (sometimes referred to as alternative risk transfer) are risk-funding arrangements that typically apply to losses that are above the primary self-insurance retentions or losses above the primary insurance layer. Because of the complexities in designing these programs, they are utilized for solving the problems of large clients, and they merit substantial premiums.

Alternative risk transfer is an evolving area of risk finance where programs are often tailored for the individual company. Insurers have been expanding their offerings and creativity in designing methods of financing corporate risk. This new generation of financing risk is becoming more and more mainstream as more experience is gained by insurers, brokers, and risk managers.

An analogy between alternative medicine and alternative risk financing is made to demonstrate the importance of such insurance programs. The evolution of alternative risk transfer holds a striking parallel to that of alternative medicine. Individuals and the medical community began turning to alternative medicine when conventional methods failed. Alternative risk transfer is not much different. Risk managers looked for alternatives when the conventional insurance markets failed to satisfy their needs. When availability and affordability issues became prevalent in the insurance markets,Recall the explanation of the underwriting cycles described in Chapter 8 "Insurance Markets and Regulation" of the text. Also, remember that this case was prepared in 1996–1997 during the end tail of a long soft market condition. risk managers resorted to higher retention levels and creative methods of risk financing. In this process, corporations’ risk tolerance levels increased, as did the expertise and comfort level of risk managers in managing risk. Consequently, they did not rush back into the market when it softened. Many of today’s risk managers are protecting themselves from being at the mercy of the insurance industry. A long period of softness in the 1990s also put the buyers in the driver’s seat and the buyers have been demanding products that align more closely with their company’s needs. No longer was alternative risk financing created to heal availability and affordability problems. It has also been adopted to improve cash flows and effectively handle all risks in the organization. As in alternative medicine, the new methods have been seen as viable options for the improved (financial) health of the organization.

Risk managers began taking and maintaining long-term control of the process. They have been looking for cost, accounting, and tax efficiencies. Thus, in addition to using captives and risk retention groups (discussed in Chapter 6 "The Insurance Solution and Institutions" and Chapter 8 "Insurance Markets and Regulation"), they have been establishing customized finite risk programs, multiyear, multiline integrated risk programs, and they have been insuring risks that previously were once considered uninsurable. We will first delve into explaining these new-generation products before working on the LOCO case. The explanation of each program includes examples from real companies.

Nontraditional Insurance Products: The New Generation

New-generation risk-financing programs have emerged in response to the needs of large and complex organizations. These new-generation products blend with an orchestrated structure of self-insurance, captives, conventional insurance, and excess limits for selected individual lines. These more sophisticated methods of financing risk are being driven by a new breed of strategic-thinking risk managers who have an increased knowledge of risk management theory. They come to the table with a good understanding of their company’s exposures and the financial resources available to handle risk. They are seeking risk-handling solutions that will improve efficiency, be cost-effective, and stabilize earnings.

Increasingly, today’s risk managers are practicing a holistic approach to risk management in which all of the corporation’s risks—business, financial, and operational—are being assessed (as noted in Chapter 6 "The Insurance Solution and Institutions"). This concept, sometimes referred to as integrated risk managementCoordinated alternative risk-financing approach of identifying, measuring, and monitoring diverse and multiple risks that require effective and rapid response to changing circumstances., is a coordinated alternative risk-financing approach of identifying, measuring, and monitoring diverse and multiple risks that require effective and rapid response to changing circumstances.Lucy Nottingham, “Integrated Risk Management,” Canadian Business Review 23, no. 2 (1996): 26. Nontraditional risk transfer programs, combined with traditional coverages, are being used to meet the needs of this holistic and strategic risk management approach.Carolyn Aldred, “Alternative Financing of Primary Interest: Risk Managers Expected to Become More Familiar with Nontraditional Products,” Business Insurance, September 3, 1997. Two of the nontraditional transfer programs available to risk managers that are covered in this case are integrated risk and finite insurance programs.

Integrated Risk Programs

The discussion of integrated risk programs includes responses to the following questions:

- What attracts corporations to the new integrated program?

- What is the response of the insurance industry and the brokerage community?

- How do you determine the coverages to include in an integrated program?

- What limits are appropriate?

- How do deductibles operate?

- Why do you need a reinstatement provision?

- What are three overall advantages to the integrated risk concept?

What Attracts Corporations to the New Integrated Programs?

The traditional approach of a tower of monoline coverages, each with a separate policy limit, has not been meeting the needs and operations of many corporations. Companies have been looking to integrated programs that combine lines of coverages in one aggregate policy—generally for a multiyear term. These integrated programs also go by names such as concentric risk and basket aggregates. The features that are attracting corporations to these programs include the following:

- Less administration time and cost

- Less time and cost for negotiations with brokers and underwriters

- Elimination of the need to build a tower of coverages

- One loss triggers just one policy

- Elimination of gaps in coverage (seamless coverage)

- Elimination of the need to buy separate limits for each type of coverage

Judy Lindenmayer’sJudy Lindenmayer was one of the experts contributing to the creation of this video education segment. program for FMR (Fidelity Investments) was one of the earliest integrated programs. She referred to it as concentric risk. She explained how she lowered her cost through the use of an aggregate limit. Under traditional coverage, an insured may be purchasing limits that are $50 million per year, but it is unlikely that there would be a major loss every year; thus, the full limit would not be used. Therefore, there is a waste of large limits in many of the years while the insured continues to pay for them. The solution to the redundancy and the extra cost is “the integrated program, with one aggregate limit over the three-year period. You buy one $50 million limit.” Obviously, this is going to cost the insured less money. Judy Lindenmayer claimed that cost reductions could be as much as 30 or 40 percent.

Norwest, a bank with assets of $71.4 billion and 43,000 staff members in 3,000 locations (in 1997) across the United States, Canada, the Caribbean, Central and South America, and Asia was another company that could provide an example of what attracts corporations to the new concept. Until 1994, Norwest had traditional coverages. Each class of risk had an individual limit of self-insurance, a layer of commercial insurance, and an excess coverage. There were many risks that were not covered by insurance because of lack of availability.

K. C. Kidder, Norwest’s risk manager, established a new integrated risk-financing program for simplicity and efficiency. In addition, she opted for the multiyear integrated approach. Kidder’s other objectives for the major restructuring included the following:

- Provide aggregate retentions applicable to all risks

- Develop a long-term relationship with the insurer

- Stabilize price and coverage

- Provide catastrophe protection

- Reduce third-party costs significantly

- Use the company’s captive insurer

- Maximize cash flow and investment yields

- Include previously uninsured risks.

Coca-Cola was another major company that was motivated to use an integrated program.David G. May, “The Real Thing,” Financial Executive 13, no. 3 (1997): 42. Allison O’Sullivan, Coca-Cola’s director of risk management, was looking for a program that would do the following:

- Provide long-term stability

- Recognize the company’s financial ability to retain risk

- Create value through attaining the lowest sustainable cost

- Increase administrative efficiencies

- Provide relevant coverage enhancements

- Strengthen market relationships

- Enhance options for hard-to-insure business risks worldwide

Another attractive integrated product of limited use is the multitrigger contract. A multitrigger contractInsurance in which coverage is triggered by the occurrence of more than one event happening within the same time period. is insurance in which claims are triggered by the occurrence of more than one event happening within the same time period. The time period is defined in the contract and could be periods such as calendar year, fiscal year, season, or even a day. In a traditional single-trigger policy, a claim is based on the occurrence of any one covered loss, such as an earthquake or a fire. In the multitrigger contract, a claim can be made only if two or more covered incidents occur within that defined contract period. This coverage costs less than individual coverages because the probability of the two (or more) losses happening within the contract time period is lower than the probability of a single loss occurring. In the multitrigger policy, the insurer recognizes this lower probability in the pricing of the product. Thus, it would cost more to buy the earthquake insurance on a stand-alone basis than it would cost to buy earthquake insurance contingent on some other event taking place within that contract time period, such as a shift in foreign exchange or a shift in the cost of a key raw material to the client. Insureds who are concerned only with two very bad losses happening at the same time are those who would be interested in a multitrigger program.

What Is the Response of the Insurance Industry and the Brokerage Community?

Market conditions are contributing to insurers’ responsiveness to risk managers. The insurance industry and brokerage community have created a new concept of bundling risks into one basket, under one limit, for multiple years. David May of J&H Marsh and McLennan, Inc.,Today, the company name is simply Marsh. During the period of the case, many brokerage houses merged. The large mergers and the decrease in the number of brokerage houses prompted the consolidation of the brokers and agents organizations into the Council of Insurance Agents and Brokers. reported that “many insurance markets have lined up behind this new approach, offering close to $1 billion in capacity.”David G. May, “All-in-One Insurance,” Financial Executive 13, no. 3 (1997): 41. The industry provides large capacity for these types of programs. Two observations of their use include the following: (1) the corporations that use them are large with substantial financial strength and (2) the multiyear term of the programs promotes long-term relationships.

The U.S., European, and Bermuda markets all have been actively participating in various program combinations. XL and CIGNA were among the first players when they teamed up to combine property and casualty lines of coverage. The market demanded broader coverage, and the two insurers, in a very short time, have expanded their offerings. Another active player is Swiss Re with its BETA program. AIG, Chubb, and Liberty Mutual are active in the U.S. market.

Most of this capacity is not dependent on reinsurance. Some insurers offer one-stop shopping, while in other cases the structure uses a number of insurers. Coca-Cola’s program, for example, was provided ultimately by several carriers.

How Do You Determine What Coverages to Include in an Integrated Program? What Limits Are Appropriate?

Integrated programs may include different combinations of coverages and may be designed for different lengths of time and different limits. Insurers provide many choices in their offerings. Programs are put together based on each corporation’s own risk profile. These products are individualized and require intensive study to respond to the client’s needs.

The typical corporations looking into these types of programs are Fortune 200 corporations—companies needing $100 million to $200 million or more in coverage.John P. Mello, Jr., “Paradise, or Pipe Dream?” CFO: The Magazine for Chief Financial Officers 13, no. 2 (1997): 73. These are corporations that have much larger and complex risks and need to work with a few carriers.

Judy Lindenmayer of Fidelity Investments explained the process of determining which coverages to combine the following:

- Review loss history

- Consider predictability of losses

- Review annual cost of coverage and coverage amount by line

- Consider risk tolerance level

- Select an aggregate limit that exceeds expected annual losses for all coverages

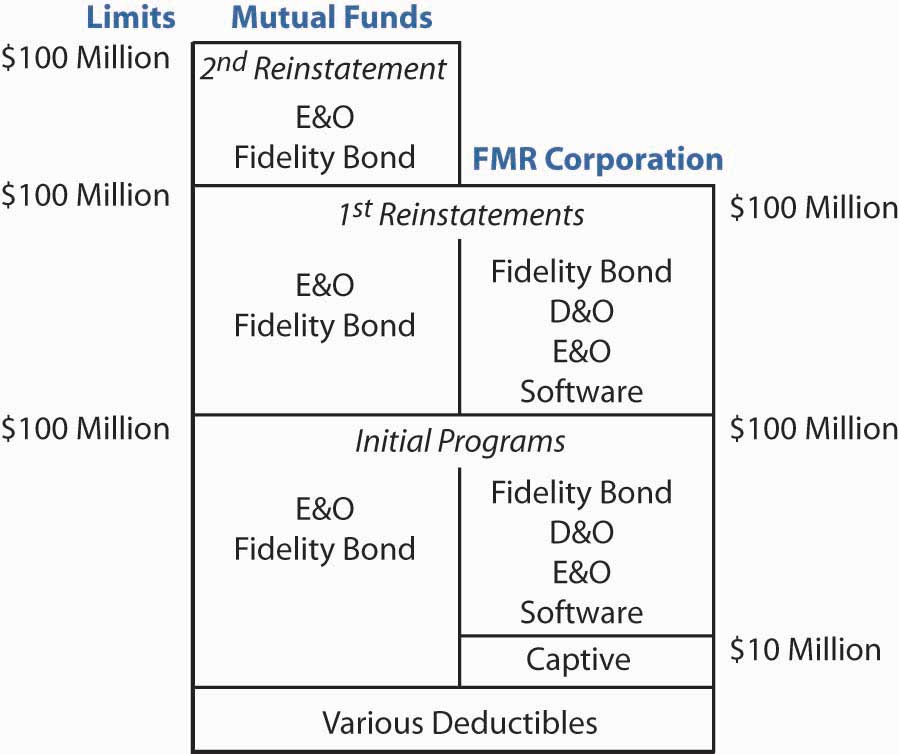

FMR had two separate integrated programs, as shown in Figure 23.5 "Fidelity Investments Integrated Risk Program".Dave Lenckus, “Concentric Risk Programs Means Big Saving—Innovative Programs to Save FMR Time, Money,” Business Insurance, April 14, 1997, 98. FMR’s program for its mutual funds combines the government mandated fidelity bonds and E&O liability insurance. FMR took a very conservative approach, with a separate program to protect its mutual funds clients from employees’ dishonesty or mistakes. For the other part of the company, the corporate side, the coverage included consolidated financial institutions bond coverage, which protects the employee benefits plans and protects against employees’ dishonesty. The other coverages were Directors & Officers (D&O), stockbrokers Errors & Omissions (E&O), corporate E&O, E&O liability for charitable gifts, partnership liability, and electronic and computer crime. The corporate program was designed to respond to the risk management needs of the corporate side, which was “on the cutting edge on a lot of things” and therefore less conservative than the mutual funds’ concentric program.

Figure 23.5 Fidelity Investments Integrated Risk Program

Integrated programs include coverages such as D&O, fiduciary liability, crime, E&O, and employment practices liability. The following are examples of the coverages that may be included in an integrated program under one aggregate limit:

- Property

- Business interruption

- General, products, and automobile liabilities

- Workers’ compensation

- Marine liabilities and cargo

- Crime

- D&O liability

- E&O liability

For specific companies, it may also include the following:

- Product recalls

- Product tampering

- Political risks

- Environmental liabilities

Both Coca-Cola’s and Norwest’s programs combined a very broad array of coverages. Coca-Cola’s program combines over thirty different risks in one contract. Although Coca-Cola did not do so in 1997, Allison O’Sullivan, then-director of risk management for Coca-Cola, said that she was open to the idea of blending financial risks like interest rate and currency exchange fluctuations. Norwest’s program had a layer of true integrated insurance, with an aggregate of $100 million limit over a five-year period. It combined the following coverages in its program:

- Aircraft liability (nonowned)

- Automobile liability

- D&O (corporate reimbursement)

- Employers’ liability

- Fiduciary liability

- Foreign liability

- Foreign property

- General liability

- Mail and transit

- Mortgagee E&O

- Professional liability

- Property

- Repossessed property

- Safe deposit

- Workers’ compensation

Understanding the loss history of each line of coverage is very important to selecting the appropriate limits. The aggregate limit must be adequate to cover losses of all combined lines for the entire multiyear period.

How Do Deductibles Operate?

Programs may be structured with one aggregate deductible for the term of the policy or with separate, per occurrence deductibles. Norwest’s integrated program had a $25 million aggregate retention over a five-year term. They had another five-year aggregate retention that was covered by its Vermont-based captive, Superior Guaranty Insurance Company. Above their retention, they had a finite risk layer (explained in the next section of this case) of $50 million. Fifty percent of this layer was covered by the captive. The other 50 percent was covered by American International Group (AIG).

The FMR aggregate programs are also structured over retentions. As discussed previously, FMR had two separate programs. The mutual funds program had multiple deductibles and the captive was not used.Dave Lenckus, “Reinsurance Program Strives to Find the Right Blend of Risks,” Business Insurance, April 14, 1997, 100. For the corporate concentric program, FMR’s captive, Fidvest Ltd., wrote up to $10 million in aggregate limits, as shown in Figure 23.5 "Fidelity Investments Integrated Risk Program". Fidvest’s retention included most of the risks except for the trustees’ E&O. The captive retained only $5 million of this risk.

The decision about the appropriate retention levels forces the risk manager to look at risks and risk tolerance.

Why Do You Need a Reinstatement Provision?

As noted previously, selecting the limit that will cover all included losses over the entire multiyear period is an estimate based on a number of factors. But that estimate can prove to be wrong. The insured could use up his or her entire aggregate limit before the end of the term. For that reason, it is important to include one or more reinstatement provisions. Negotiating a reinstatement provision on the front end is critical to provide the following:

- Additional limits if the initial limits are exhausted

- A guarantee of coverage when needed

- Coverage at the right price

The FMR program contained reinstatement provisions in the event its aggregated limits were exhausted. Figure 23.5 "Fidelity Investments Integrated Risk Program" illustrates that FMR had one reinstatement on the corporate program and an option to purchase two additional reinstatements for the funds’ program.

What Are the Overall Advantages of the Integrated Risk Concept for Insureds?

The integrated risk programs are reported to produce in excess of 25 percent savings. This savings results from the following:

- Large premium decreases as a result of utilizing fewer carriers

- Flexibility of mixing the most appropriate risks (i.e., customized plans)

- Comprehensive coverage

- More efficient operation of the captives and retentions

- Reduced administrative costs and greater efficiency regarding renewals

The risk manager does not need to shop every year and prepare for renewals. The worry about the volatility of the traditional, cyclical insurance market is also reduced. These programs are expected to increase in prevalence. They have been combined with other new-generation products, such as finite risk, which is discussed next.

Finite Risk Programs

Finite risk programs are a way to finance risk assumptions that have their origins in arrangements between insurers and reinsurers. Premiums paid by the corporation to finance potential losses are placed in an experience fund that is held by the insurer. The insured is paying for its own losses through a systematic payment plan over time. Thus, it not subjected to the earnings volatility that can occur through self-insuring. Finite risk programsAllow insureds to share in the underwriting profit and investment income that accrues on premiums if loss experience is favorable and recognize firms’ individual risk transfer needs. allow the insured to share in the underwriting profit and investment income that accrues on its premiums if loss experience is favorable and to recognize the individual risk transfer needs of each corporation. Consequently, each contract is unique. Generally, finite programs have the following characteristics in common:

- Multiyear term—at least three years, but may be five or even ten years

- Overall aggregate limit—often one limit applies; thus all losses of any type and line will be paid until they reach the aggregate limit

- Experience fund is established for the insured’s losses—monies are paid into the fund and held by the insurer over the time period

- Interest earned on funds—a negotiated interest is earned on the funds that the insured has on deposit with the insurer

- Element of risk transfer—often includes some traditional risk transfer for the program to be recognized as insurance by the IRS

- Designed for each insured individually using manuscripted policy forms

Differences between Finite Protection and Traditional Insurance

The key difference between the finite risk program and traditional insurance coverage is that the funds paid to the insurer

- earn interest, which is credited to the insured, and

- are refundable to the insured.

An Example of How the Finite Risk Program Can Be Structured

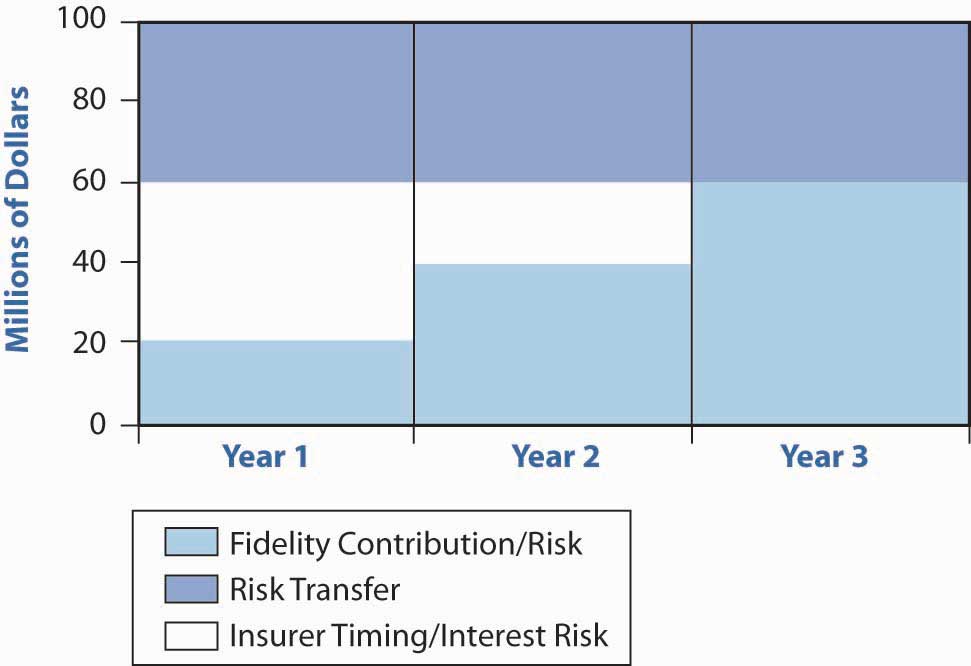

Figure 23.6 "Finite Risk Program of Fidelity Investments, $100 Million Coverage Limit" shows an example of how a finite risk program operates. In this example, the insured has implemented a three-year program with a $100 million aggregate coverage limit for the entire period, with annual premium payments of $20 million. Thus, the insured has promised to pay $60 million over the three-year period, as denoted by increasing increments for each year on the graph. Actual risk transfer—that is, the conventional insurance layer of the finit eprogram—exists between the $60 million that the insured pays in and the $100 million limit. Thus, there is $40 million in risk transfer. This risk transfer layer is shown in dark blue on the graph.

At the end of the three-year period, the deposits may be returned to the insured with interest, less any losses. As will be discussed later, a return of funds constitutes a taxable event and the insured may choose to roll the funds over to the next term.

Figure 23.6 Finite Risk Program of Fidelity Investments, $100 Million Coverage Limit

What If Losses Exceed the Funds Paid to Date?

In the example in Figure 23.6 "Finite Risk Program of Fidelity Investments, $100 Million Coverage Limit", the insured has paid in $20 million in the first year. But what if losses exceed $20 million in the first year? This is the timing risk that the insurer takes—the risk that losses will exceed the insured’s deposit—in which case, the insurer has to pay for them prior to having received the funds from the insured. The graph shows the timing risk in white. It is the difference between the insured’s accumulated payments into the fund and the total amount the insured promises to pay into the fund over the entire time period (in this example, $60 million over a three-year period). The timing layer is similar to a line of credit for the insured. The insured must still pay the insurer for the losses that were paid out in advance, or “loaned” to the insured.

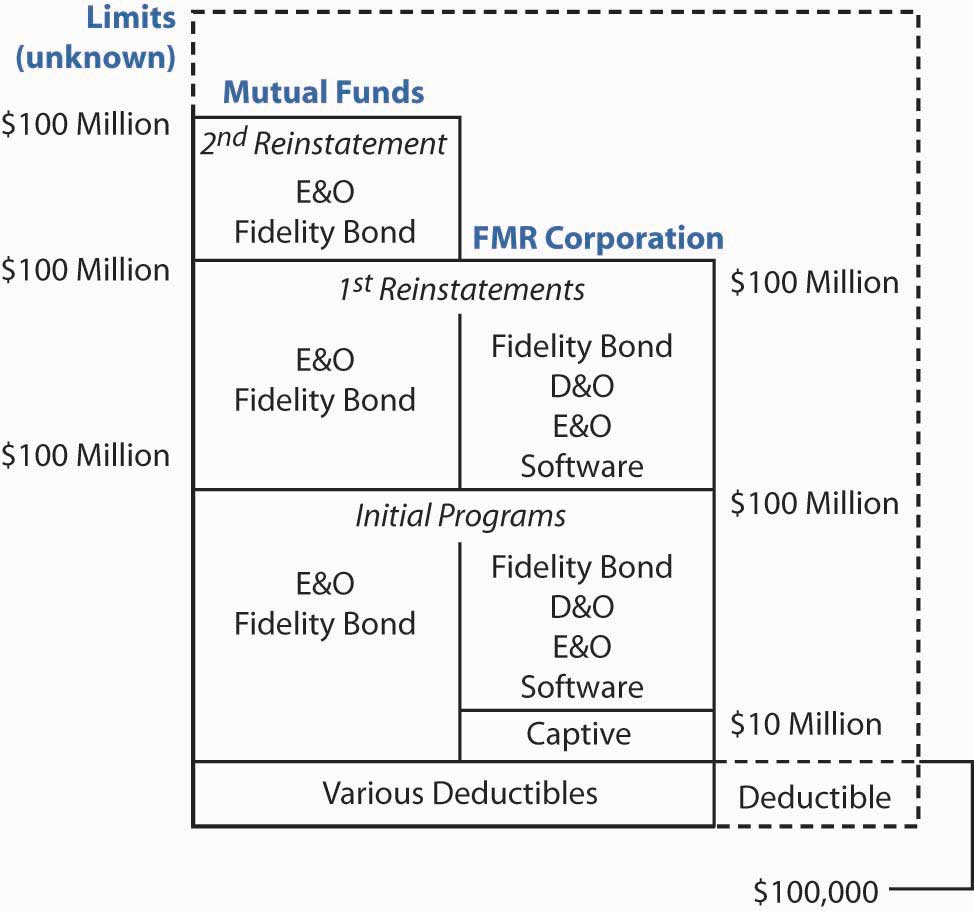

The FMR Corporation structured its finite program around its integrated risk program. Figure 23.7 "Structure of Fidelity Investments’ Finite Risk and Integrated Risk Programs" displays how FMR’s finite program fits around the two integrated programs described previously. The finite program is outlined with dotted lines. An important part of its program was the inclusion of risks that are traditionally uninsurable. If a loss occurs under the finite program that is also covered by its underlying integrated coverage, the finite program acts as a layer above the integrated limit. Thus, the finite risk protection is pierced when the integrated limit is exhausted—no deductible is incurred under the finite program. If a loss occurs under the finite program and it is not covered by the integrated program, a $100,000 aggregate deductible applies. Such losses are paid if and when aggregate losses under the finite program reach $100,000.

A finite program can fit into a corporation’s risk-financing structure in other ways as well. It can be used to fund primary losses. It can also be used in intermediate layers to stabilize infrequent but periodic losses.Gregory K. Myers, “Alternative Risk Financing in the Traditional Insurance Marketplace,” John Liner Review 10, no. 3 (1996): 13.

Figure 23.7 Structure of Fidelity Investments’ Finite Risk and Integrated Risk Programs

An Example of How the Experience Fund Operates

Now, let us show an example of how the experience fund works. Table 23.25 "Finite Risk Experience Fund" displays a chart of an experience fund with annual deposits of $20 million for a three-year term. Assume an annual interest rate of 6 percent is credited quarterly to the fund. Also assume that the interest accrues on a tax-free basis, as would be the case if the fund is placed with an offshore insurer where investment income is not subject to taxation. In this example, the insured incurs a $5 million loss in year two. At the end of the term, the insured’s balance is $62,120,260. The funds may be returned to the insured or rolled over to another contract term.

Table 23.25 Finite Risk Experience Fund

| Date | Credit/Debit to Fund | Fund Balance at Beginning of the Period | Interest Earned |

|---|---|---|---|

| Jan. 1, 1997 | $20,000,000 | $20,000,000 | |

| March 31, 1997 | $20,300,000 | $300,000 | |

| June 30, 1997 | $20,604,500 | $304,500 | |

| Sept. 30, 1997 | $20,913,568 | $309,068 | |

| Dec. 31, 1997 | $21,227,271 | $313,704 | |

| Jan. 1, 1998 | $20,000,000 | $41,227,271 | |

| March 31, 1998 | $41,845,680 | $618,409 | |

| March 31, 1998 | ($5,000,000) | $36,845,680 | |

| June 30, 1998 | $37,398,365 | $552,685 | |

| Sept. 30, 1998 | $37,959,340 | $560,975 | |

| Dec. 31, 1998 | $38,528,730 | $569,390 | |

| Jan. 1, 1999 | $20,000,000 | $58,528,730 | |

| March 31, 1999 | $59,406,661 | $877,931 | |

| June 30, 1999 | $60,297,761 | $891,100 | |

| Sept. 30, 1999 | $61,202,227 | $904,466 | |

| Dec. 31, 1999 | $62,120,260 | $918,033 |

Pricing

Pricing of the product will vary. There can be an additional premium to pay for the risk transfer and timing risk elements. Alternatively, the insurer’s risk can be paid for by the spread between the interest it expects to earn on the funds and the interest credited to the insured.

Suitability of Finite Risk

Finite programs typically are used by large corporations with one or more of the following characteristics:

- High retention levels

- Unique or difficult to insure risks

- Risks where adequate limits are not available

- Ability to make large cash outlays

Advantages of a Finite Risk Program

Finite risk programs offer a number of benefits to corporations:

- Improves the balance sheet—by including risks for which noninsurance reserves had been established, it allows the company to remove these reserves from its balance sheet.

- Reduces volatility in earnings—instead of paying unpredictable losses out of current earnings, the insured is paying equal payments to the insurer to cover losses; if losses exceed the payments, the insurer pays them and the insured can work out an arrangement to pay them back up to the agreed-on amount that should be paid into the fund.

- Allows for profit sharing if the loss experience is favorable—the insured earns interest on the payments that it pays to the insurer. In addition, these payments can be structured as tax deductible, whereas reserves on the balance sheet are not deductible until losses are paid.

- Helps secure insurance for uninsurable risks—because the losses are paid by the insured, a program can be structured without limitations on what types of risk can be included.

- Accesses new capacity for catastrophic risks—finite programs can be structured so they are layered over a very large retention level, a captive, or other insurance program, such as integrated risk programs or conventional insurance.

Determining the Risks to Include in a Finite Program

Finite risk programs can be structured to include any type of risk, contingent on approval by the company’s auditors.Types of risks included in the program may be restricted by the corporation’s external auditors. They are touted as a means of financing traditionally uninsurable risks. Thus, a corporation looks at its own risk profile to determine the appropriate risks to include in the program. A corporation can do this in one or more of the following ways:

- Examine the balance sheet for reserves—reserves are established for risks on which there is no insurance coverage. The size of these reserves reflects the potential impact of the risk.

- Examine insurance policies for existing exclusions—this exercise reveals important risks that currently are uninsured.

- Ask senior managers what keeps them awake at night—in addition to potentially identifying previously unidentified risks, the process reveals the firm’s tolerance for risk by determining what is important to senior managers.

Potential Disadvantages of a Finite Risk Program

Finite risk programs are becoming increasingly popular. But they are not without disadvantages:

- Tax and accounting questions—accounting and tax rules say that there must be more than timing and interest rate risk for the insurer in order for the insured’s payments to be tax deductible. The tax code requires that the finite financing arrangement involve real underwriting risk transfer with a reasonable expectation of loss. Transactions that do not meet tax and accounting rules regarding risk transfer will be treated as deposits. The main requirement is that the insurer (or reinsurer) must stand to realize a significant loss from the transaction. Judy Lindenmayer mentions a general rule of thumb that has developed, whereby 10 to 15 percent of the estimated exposure should be transferred to the insurer, and the risk so transferred must have a 10 to 20 percent chance of loss. Actuaries, however, caution against specifying probability thresholds because they do not allow for the differences in frequency and severity of various exposures.“What is ‘Risk Transfer’ in Reinsurance? Comments on Financial Accounting Standard 113,” Contingencies, September/October 1997, 50–53. (Based on a report of the American Academy of Actuaries Committee on Property and Liability Issues.) Evaluation of the risk transfer element is a complex process that requires a complete understanding of the transaction, the details of which are beyond the scope of this course.

- The premiums should not be construed as a deposit for accounting purposes. The risk transfer element must be verified by outside auditors. It is permissible to base the tax and accounting for the finite program on two different foundations. However, doing so may draw the attention of income tax auditors.

- Any monies that are returned to the insured at the end of the period constitute taxable income. To avoid a taxable event, the insured can roll the funds over to the next term.

- Time-consuming and complex to develop—although finite programs can save considerable time once they are in place, they can take up to a year to develop.

- Frictional costs may be greater than perceived benefits—these costs are estimated to range from 5 to 10 percent. A fee is paid to the insurer, and a federal excise tax applies to premiums paid for programs that are domiciled offshore.

- Opportunity cost of committed funds—the programs entail large outlays of cash each year of the term. These large outlays, and the fact that they tie up the funds, can overshadow the net cost efficiencies that might have been obtained. Generally, these cash outlays require the involvement of the company’s CFO or other senior manager. Often, the cash outlays form the obstacle to obtaining senior management approval of the program.

Loco Corporation Case Study: Part I

Background Information

Since its formation in 1945, LOCO Corporation has been a leader in the investment banking field. Its largest and best known subsidiary is Loyalty Investment, an investment advisory and management company for a family of one hundred funds. Through a network of thirty-two principal offices in twenty-two countries, LOCO and Loyalty Investment offer a complete range of financial services, including online trading and research assistance to corporations, institutions, and individuals throughout the world. LOCO, through another subsidiary called Loyalty Brokerage Group, engages in sales and trading on a discounted fee basis. It uses the most advanced technologies available in the market. Approximately 50 percent of trades (for both the direct funds and through the brokerage firm) are handled online, another 40 percent are handled over the telephone, and 10 percent are handled in person at sales offices around the world.

LOCO also provides financial underwriting services and advice to corporations and governments around the world regarding their capital structures. Its products and services include corporate finance, real estate, project finance and leasing, debt and equity capital markets, mergers and acquisitions, and restructuring.

Under Loyalty Investment are three subsidiaries:

- The Loyalty Brokerage Group (formerly the Kendu Financial Group acquired in 1994)—a stock brokerage firm that handles $4 billion annually in trades for retail and institutional clients on a discounted fee basis.

- The Loyalty Financial Services Group—an insurance, estate planning, and investment advisory organization for high net worth individuals operating only in the United States and the United Kingdom. The nonsupport staff is licensed to sell insurance and securities.

- Loyalware—a financial services software producer.

LOCO has offices in Europe, the Middle East, the Far East, South Africa, Australia, and South America and is expanding into Russia and China. LOCO’s financial highlights are shown in Table 23.26 "LOCO Corporation Financial Highlights", which provides information on LOCO’s size, liquidity, and debt positions in 1995 and 1996. Although LOCO has been enjoying increased revenues, LOCO’s profit margins have decreased from 1995 to 1996. Return on equity has remained stagnant for the last two years.

Table 23.26 LOCO Corporation Financial Highlights

| For the Years Ended September 30 (in Millions) | 1996 | 1995 |

|---|---|---|

| Cash and marketable securities | $ 73,259 | $ 93,325 |

| Real estate | $ 45,464 | $ 35,217 |

| Other assets | $ 20,000 | $ 18,000 |

| Total assets | $138,723 | $146,542 |

| Liabilities | $115,050 | $116,046 |

| Reserves for losses | $ 300 | $ 250 |

| Long-term borrowing | $ 9,114 | $ 8,891 |

| Stockholders’ equity | $ 23,259 | $ 21,355 |

| Total liabilities and equity | $138,723 | $146,542 |

| Net revenue | $ 4,356 | $ 3,480 |

| Net income | $ 696 | $ 634 |

| Net profit margin (net income/net revenue) | 15.98% | 18.2% |

| Return on equity (net income/stockholder’s equity) | 2.99% | 2.97% |

| Shares outstanding | 173,924,100 | 163,239,829 |

| Number of employees | 14,987 | 14,321 |

Recently, Dan Button, director of risk management, was appointed director of global risk management, a newly created position to reflect the integration of domestic and international risk management operations. LOCO has a separate operating officer both for its domestic operations and its international operations. Most likely, the separation of operations was the reason that the risk management operations were handled separately as well. Dan and his chief financial officer (CFO), Elaine Matthews, were instrumental in effecting a change. They knew that economies of scale could be realized by consolidating the risk management function on a global basis. Elaine believes in the holistic approach to risk management and involves Dan in the management of all the risks facing the corporation, be they financial, business, or event-type risks that were traditionally under the authority of the risk manager.

LOCO has a rather large amount of reserves on its balance sheet. A considerable portion of the reserves are attributable to the expected E&O losses that were assumed from Kendu Financial Group when it was acquired in 1994. Another big chunk of the reserve amount is attributable to self-insured workers’ compensation losses. LOCO has self-insured its domestic and international workers’ compensation risk since the early 1980s. Even though claims were handled by a third-party administrator, two individuals on Dan’s staff have devoted their full-time work to workers’ compensation issues. Prompted by soft market conditions, Dan decided to insure the risk. He secured Foreign Voluntary Workers’ Compensation coverage for U.S. workers abroad and for foreign nationals, as well as workers’ compensation coverage for the domestic employees. The company has built up fairly significant loss obligations from self-insuring.

LOCO’s business has been changing rapidly over the last several years. It has become more global, more dependent on technology, and more diversified in its operations. This changing risk environment, along with the corporation’s cost-cutting efforts, has compelled Dan to embark on a comprehensive assessment of his risk management department and the corporate risk profile.

Loco Corporation Case Study: Part II

Background Information

The following are some of the actions taken by Dan’s team:

- Restructuring of all coverages to save money on administration and to provide streamlined and sufficient coverage for all the risks faced by LOCO and its subsidiaries

- Finding ways to take the 1991 losses of the Gulf War off the balance sheet and insure risks that previously were uninsured

The hypothetical LOCO Corporation was created to help you apply the concepts of alternative risk financing that you studied in this chapter. Familiarize yourself with the features of LOCO Corporation, then answer the discussion questions that follow the Key Takeaways section below.

Key Takeaways

In this section you studied integrated risk management and finite risk management programs, two types of alternative risk-financing arrangements:

- Alternative risk-financing arrangements are complex arrangements used by large commercial clients that apply to losses above the primary self-insurance retentions or losses above the primary insurance layer.

- Alternative risk-financing arrangements are tailored to clients’ diverse needs and blend self-insurance, captives, conventional insurance, and excess limits.

-

Integrated risk management identifies, measures, and monitors multiple business, financial, and operational risks to satisfy holistic risk management objectives.

- An integrated risk program combines lines of insurance coverage into an aggregate, multitrigger contract for a multiyear term for improved efficiency and cost savings.

- A company’s loss history, predictability of losses, costs of coverage, and risk tolerance influences the determination of coverages to combine in integrated programs.

- Integrated programs may be structured with one aggregate deductible for the term of the policy or with separate per occurrence deductibles.

- Savings from integrated risk programs result from premium decreases, customization, comprehensive coverage, more efficient operations, and reduced administrative costs.

-

In a finite risk program, the insured pays for its own losses through premiums placed in an experience fund held by an insurer

- Finite risk programs allow insureds to share in the underwriting profit and investment income that accrues on premiums, if loss experience is favorable.

- Finite risk programs are associated with multiyear terms, overall aggregate limits, risk transfer elements, and so forth.

- The insurer assumes timing risk because losses can exceed funds paid to date by the insured, resulting in liability for the insurer.

- Finite risk programs can be used in conjunction with integrated risk management.

- Companies suited for finite programs have high retention levels, unique and/or difficult to insure risks, inadequate availability of traditional coverage, and high liquidity.

- Finite programs can improve the balance sheet, reduce earnings volatility, secure insurance for previously uninsurable risks, and access new capacity for catastrophic risks.

- Fidelity Investments, Norwest, and Coca-Cola have successfully implemented integrated risk and/or finite risk management programs

Discussion Questions

- What is alternative risk financing? How has it evolved over time?

- What attracts corporations to integrated risk management products?

- How does integrated risk management improve efficiencies and reduce costs?

- Why is the cost of coverage in multitrigger contracts less than in single-trigger contracts?

- What are two reasons that the insurance industry provides large capacity for insurance products designed for integrated risk management?

- What is the main difference between finite risk programs and traditional insurance coverage?

- What is meant by timing risk in finite risk programs? How is this like a line of credit for the insured?

- Assume you are LOCO Corporation’s major insurance broker. Assist director of global risk management Dan Button in identifying the risks that LOCO faces. Use your knowledge from this chapter as well as the risk-mapping concepts of Chapter 4 "Evolving Risk Management: Fundamental Tools" and Chapter 5 "The Evolution of Risk Management: Enterprise Risk Management".

- Take each risk that you identified in question 8 and discuss whether you expect aggregate frequency and severity of losses to be low, medium, or high.

- Current consolidation and diversification in the industry has resulted in an across-the-board corporate mandate to cut costs. Like other department heads, Dan is under pressure to increase efficiency. Dan wants to investigate the feasibility of an integrated risk management approach. What advantages would an integrated program have for LOCO? What characteristics about LOCO make it conducive to starting an integrated program?