This is “Employment-Based Risk Management (General)”, chapter 20 from the book Enterprise and Individual Risk Management (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 20 Employment-Based Risk Management (General)

The mandatory benefits that employees obtain through the workplace—worker’s compensation, unemployment compensation, and Social Security—were discussed in earlier chapters. In this chapter we move into the voluntary benefits area of group insurance coverages offered by employers. We begin with an overall explanation of the employee benefits field and group insurance in this chapter. Our first step is to delve into the specific group benefits provided by employers through insurance or self-insurance. In addition to being regulated by the states as insurance products, employee benefits are also regulated by the federal government (under the Employee Retirement Income Security Act of 1974), especially when the employer self-insures and is not subject to state insurance regulation. Because many tax incentives are available to employers that provide employee benefits, there are many nondiscrimination laws and specific limitations on the tax advantages. Employee benefits are regulated by the Department of Labor and the Internal Revenue Service (IRS).

To ensure your clear understanding of the main features of employee benefits, this chapter includes a general discussion of group insurance. The second part of the chapter includes a discussion of group life, group disability, and cafeteria plans. Some federal laws affecting employee benefits, such as the Americans with Disabilities Act, the Age Discrimination in Employment Act, and the Pregnancy Discrimination Act, are also covered. Chapter 22 "Employment and Individual Health Risk Management" delves into the most expensive noncash benefit, health care coverage. All types of managed care plans will be discussed along with the newest program of defined contribution health care plans, the health savings accounts. Relating to health insurance are long-term care and dental care, also discussed in Chapter 22 "Employment and Individual Health Risk Management". Two important federal laws, the Health Insurance Portability and Accountability Act (HIPAA) of 1996 and the Consolidated Omnibus Budget Reconciliation Act (COBRA) of 1986, will also be explained in Chapter 22 "Employment and Individual Health Risk Management". Chapter 21 "Employment-Based and Individual Longevity Risk Management" is devoted to employer-provided qualified pension plans under the Employee Retirement Income Security Act (ERISA) of 1974 and subsequent reforms such as the Tax Reform Act of 1986 and the most recent Economic Growth Tax Reform and Reconciliation Act (EGTRRA) of 2001 (EGTRRA). Chapter 21 "Employment-Based and Individual Longevity Risk Management" also describes deferred compensation plans such as 403(b), 457, the individual retirement account (IRA), and the Roth IRA. We will focus on qualified retirement plans, in which the employer contributes on the employee’s behalf and receives tax benefits, while the employee is not taxed until retirement.

The field of employee benefits is a topic of more than one full course. Therefore, your study in this and the following two chapters, along with the employee benefits Case 2 of Chapter 23 "Cases in Holistic Risk Management", is just a short introduction to the field. This chapter covers the following:

- Links

- Overview of employee benefits and employer objectives

- Nature of group insurance

- The flexibility issue, cafeteria plans, and flexible spending accounts

- Federal regulation compliance, benefits continuity and portability, and multinational employee benefit plans

Links

At this point in our study, we are ready to discuss what the employer is doing for us in the overall process of our holistic risk management. Employers became involved in securing benefits for their employees during the industrial era, when employees left the security of their homes and families and moved to the cities. The employer became the caretaker for health needs, burial, disability, and retirement. As the years passed, the government began giving employers tax incentives to continue to provide these so-called fringe benefits. Today, these benefits are called noncash compensation and are very significant in the completeness of our risk management puzzle.

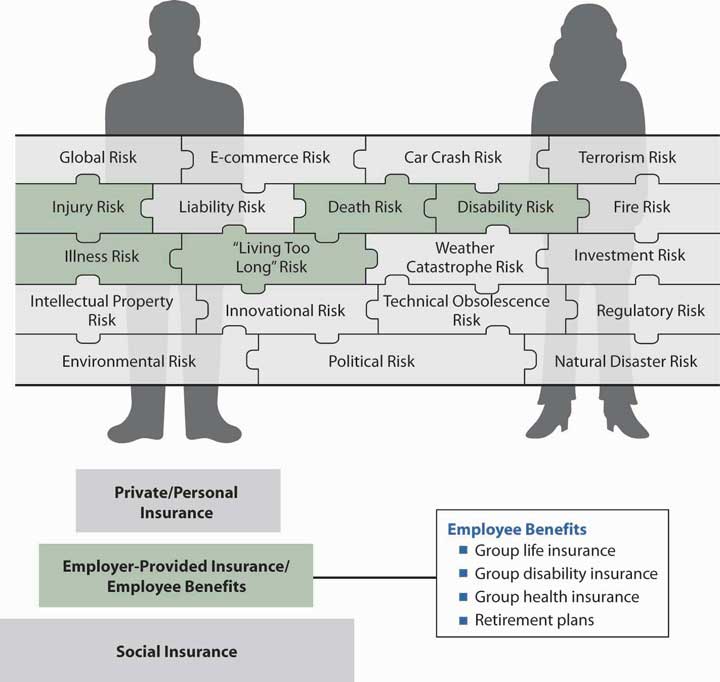

As noted in our complete risk management puzzle of Figure 20.1 "Links between Holistic Risk Pieces and Employee Benefits", we need to have coverage for the risks of health, premature death, disability, and living too long. These benefits and more are provided by most employers to their full-time employees. These types of coverage are the second step in the pyramid structure in the figure. Benefits offered by employers are critical in the buildup of our insurance coverages. As you will see in the next section of this chapter, there is no individual underwriting when we are covered in the group contract of our employer. As such, for some employees with health issues, the group life, disability, and health coverages are irreplaceable.

Two important federal laws will be discussed later in this chapter. COBRA provides for continuing health care coverage when an employee leaves a job or a breadwinner dies, and HIPAA enforces coverage for preexisting conditions when a person changes jobs. The reader can realize the enormous importance of this coverage in the holistic picture of risk management.

In our drill down into the specific pieces of the puzzle, we will again learn in this chapter that each risk is covered separately and that coverages from many sources protect each risk. It is up to us to pull together these separate pieces to provide a complete risk management portfolio. Whether the employer pays all or requires us to participate in the cost of the different types of coverage, the different coverages are important to consider and do not allow us a complete understanding of the holistic risk management process if they are not. Better yet, some of the benefits provide wonderful tax breaks that should be clearly recognized.

Figure 20.1 Links between Holistic Risk Pieces and Employee Benefits