This is “Global Trends and Their Impact on Demography and the Life Cycle Risks”, section 17.5 from the book Enterprise and Individual Risk Management (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

17.5 Global Trends and Their Impact on Demography and the Life Cycle Risks

Learning Objectives

In this section we elaborate on the following:

- International demographic features as presented by population pyramids

- The effects of technology on populations and what this means for life cycle risks

- The implications of the ranking of countries by size and analysis of demographic growth for the future of retirement systems and the management of life cycle risks

- The implications of dependency ratios

Demographic Changes Affecting Life Cycle Risks

In this section we focus on the impact of the technological waves described in the Links on demography, the social structure, and our health.This section is based on Yehuda Kahane, “Technological Changes, the Reversal of Age Pyramids and the Future of Retirement Systems,” European Papers on the New Welfare, February 2006, no. 4, pp. 17–47. These waves are responsible for the growing cost of the age-related processes that mainly affect well-being during the retirement period and the need to countermeasure them by early preventive treatment. They will also affect the future retirement systems. The current retirement systems (in the form of nationalized social insurance programs and union pension funds, discussed in Chapter 18 "Social Security" and Chapter 19 "Mortality Risk Management: Individual Life Insurance and Group Life Insurance") are becoming products of the past in urgent need of major revisions. Popular solutions to the retirement problems are expected to become unsuitable to the populations they serve (as expressed by the rapid erosion of the value of saving plans around the globe at the end of 2008).

Although retirement may not seem to be the most pressing of issues in developing economies, it needs to be addressed without delay. Retirement systems are key to financing the other, more immediately imminent problems of these economies. The future retirement system will likely take the form of mandatory privatized plans, to be supported by some form of governmental social security system that will take care of special cases that cannot be handled by the private sector. This approach has already been successfully adopted by some nations (see “Does Privatization Provide a More Equitable Solution” and “The Future of Social Security” in Chapter 18 "Social Security").

Changing Mortality and Birth Patterns

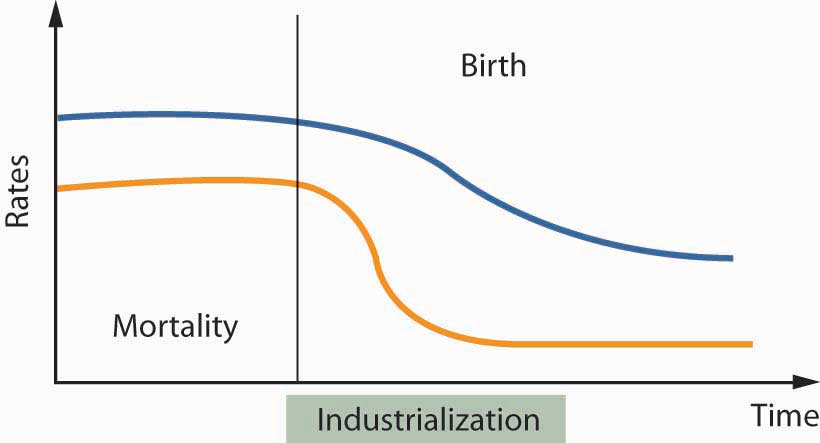

The development of a country triggers major changes in birth and mortality patterns, which, in turn, results in dramatic changes in life expectancy, the age structure of the population, and dependency ratios. Developed countries enjoy declines in both mortality and birth rates, better sanitation and health, improved nutrition, increased use of hospitals, greater accessibility to doctors, and more. During the development phase of a country, birth rates and fertility rates decline as well, but at a much slower pace than mortality. It often takes a few decades for the number of births per mother to reach a significantly lower level. This outcome is not just a technical matter of faster spread and wider use of contraceptives, but a deeper cultural (and religious) issue. The World Health Organization (WHO) statistics show that in many less-developed countries, the use of contraceptives is limited to just 5 to 15 percent of the population, compared to about three-quarters of the population in the developed countries. The interaction with declining mortality means that the number of births declines slowly, but the number of surviving children per mother grows rapidly. The average number of births per woman can be around five to six in the least-developed countries, and this fertility rate slowly declines to around two births per woman. At fertility rates around two per mother, the natural growth of a population stops (or even turns into a slow decline). The fertility ratio continues to drop to around 1.5 and lower—meaning that these populations are shrinking, unless there is a significant inflow of immigrants in a country.

The immediate result of these trends of mortality and birth patterns is the experiences of “baby booms.” This is expressed by growth in the number of surviving children. In the absence of major migration, the population structure is quite predictable for several decades (almost a century, in fact). During the first few years, there is remarkable growth in the number of school-aged children, and two decades later, a substantial increase in the figures for university students, then another four decades of a large work force, followed by a few decades with a large population of retired people. The baby boom turns into a geriatric boom! Together with the decreasing mortality of adults, there is drastic growth in the number of people needing some old age services. Concurrently, by the time the baby boomers get old, the gradually declining birth rates would reach the point of lowest proportion (and often also the absolute number) of young children. Figure 17.3 "Changing Birth and Mortality Patterns in Developed Economies" offers a schematic explanation for the baby boom phenomenon.

Figure 17.3 Changing Birth and Mortality Patterns in Developed Economies

Population Pyramids

The mortality and birth patterns described above affect the age structure of the population. This is best perceived through a population pyramid, a graphical presentation of the age structure (distributions) of the population (in percentages or in absolute numbers). Because the age structure of a population is typically quite similar for males and females, the graph is almost symmetrical and looks like a pyramid. The population pyramid is essential for the understanding of dependency ratios and retirement policy problems. We will discuss these issues after describing at some length the changing patterns of population pyramids in countries that are experiencing rapid technological changes.

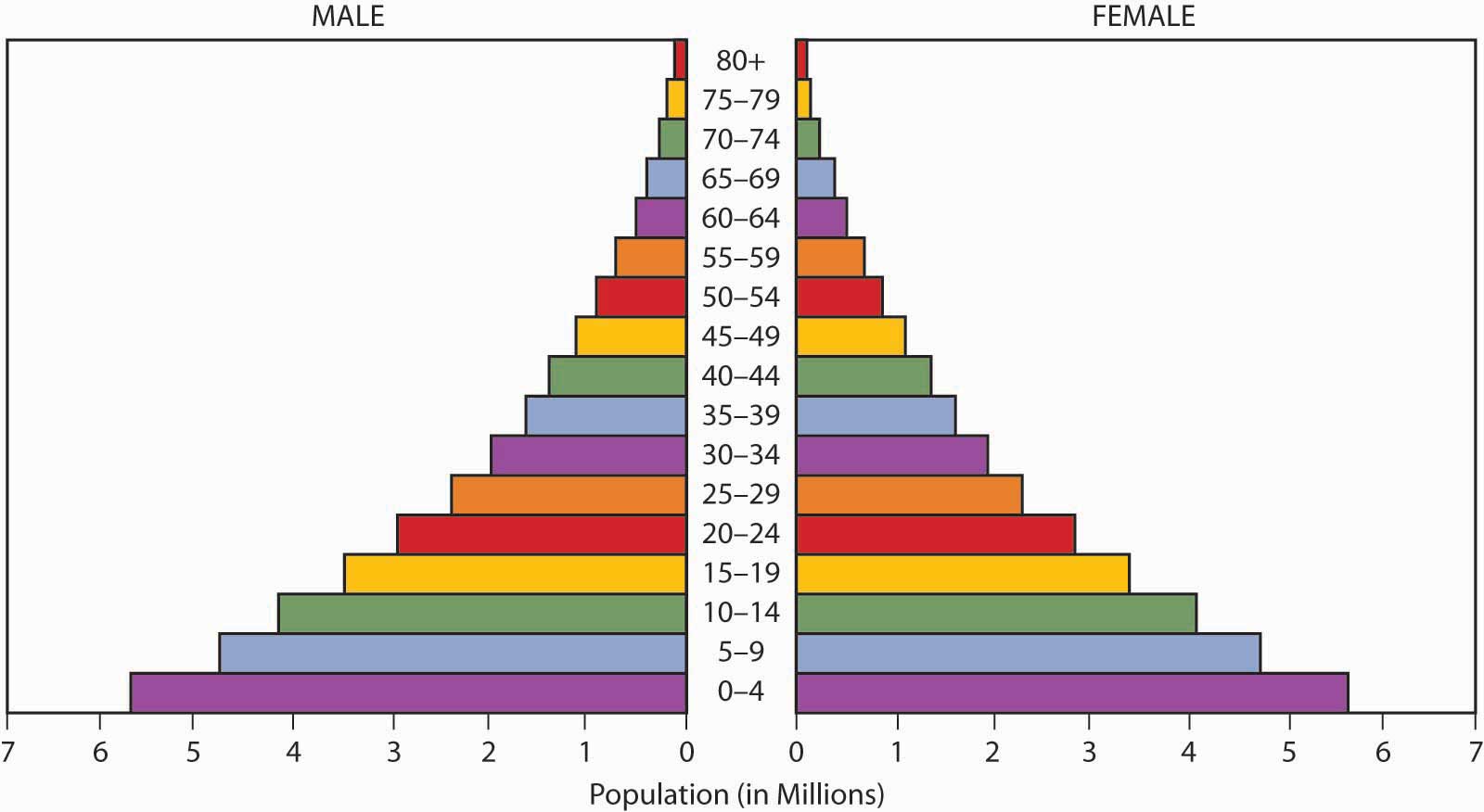

An examination of almost any agrarian economy typically shows a pyramid with a very large base (many young children) and a very pointed top (a very small number of old people). In such populations, the older people (over age sixty) are typically less than 5 percent of the population, whereas children below the age of fifteen can constitute around 40 percent. High mortality rates are also the main reason for the fast shortening of the bars at the higher age groups. These patterns characterize the pyramids of some of the countries that are expected to be among the top twenty largest countries by population within the first half of the twenty-first century. The pyramid for Ethiopia, with its very wide base, in Figure 17.4 "Age Pyramid for Ethiopia, 2000" serves as example of this general pattern. Those for Congo (Kinshasa), Nigeria, Pakistan, and the Philippines are quite similar.

Figure 17.4 Age Pyramid for Ethiopia, 2000

Source: U.S. Census Bureau, International Data Base.

Observing the development of the population pyramid of a country undergoing an industrial revolution immediately reveals the changing pattern. During the first years, the youngest age group (the base of the pyramid) gets wider due to the sudden reduction in mortality rates, which is not accompanied by an immediate decline in birth rates. The U.S. Bureau of the Census forecasts for Ethiopia in 2025 are presented in Figure 17.5 "Age Pyramid for Ethiopia, 2025". A comparison to the diagram in Figure 17.4 "Age Pyramid for Ethiopia, 2000" demonstrates the differences. Note the widening of the base of the pyramid due to the increased number of surviving children. The next age groups do not decline as fast as before due to the drastic reduction in infant mortality. Thus, the length of the bars does not decline as time passes. Note also the widening of the bars at the older ages at the top of the pyramid due to the generally declining mortality.

Figure 17.5 Age Pyramid for Ethiopia, 2025

Source: U.S. Census Bureau, International Data Base.

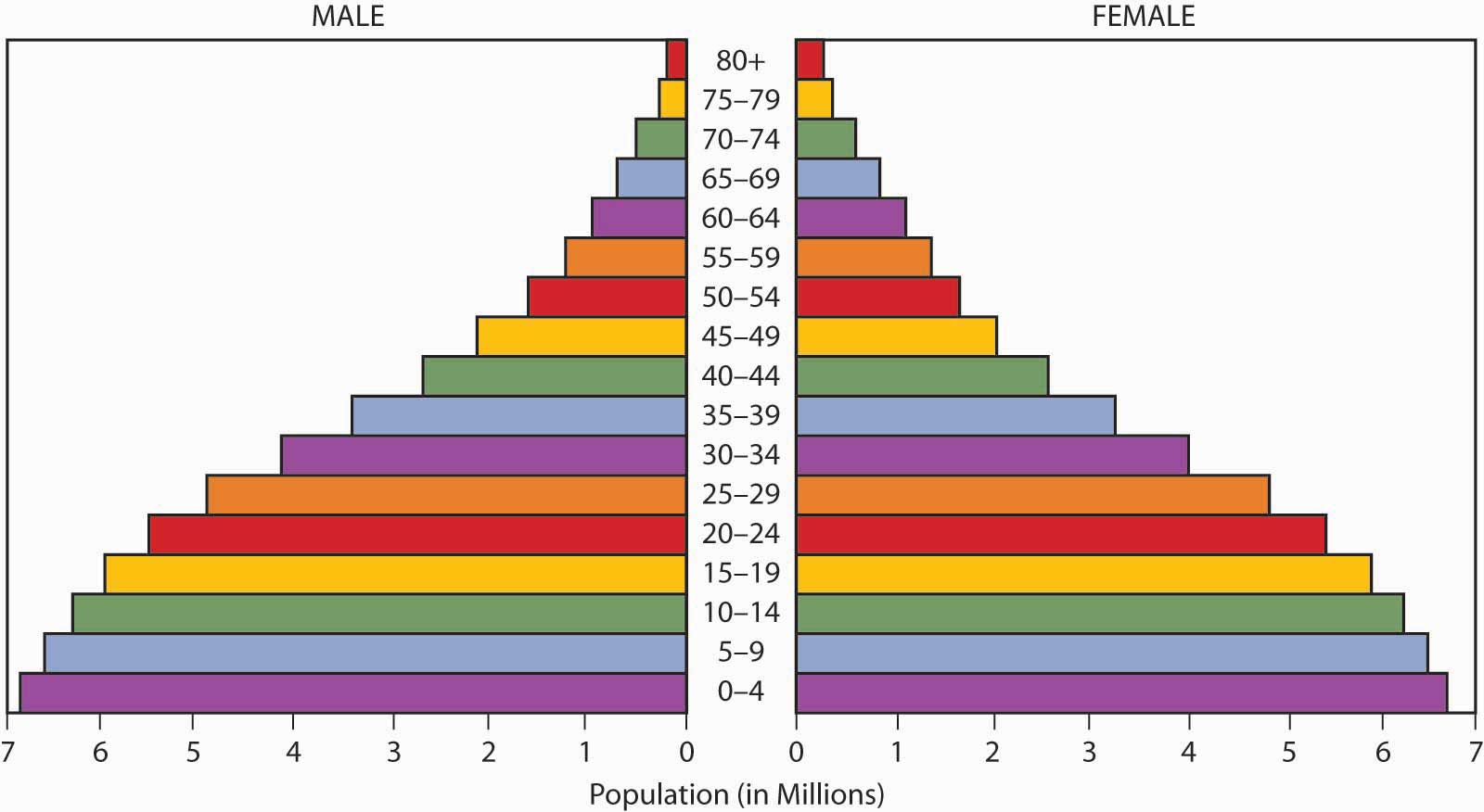

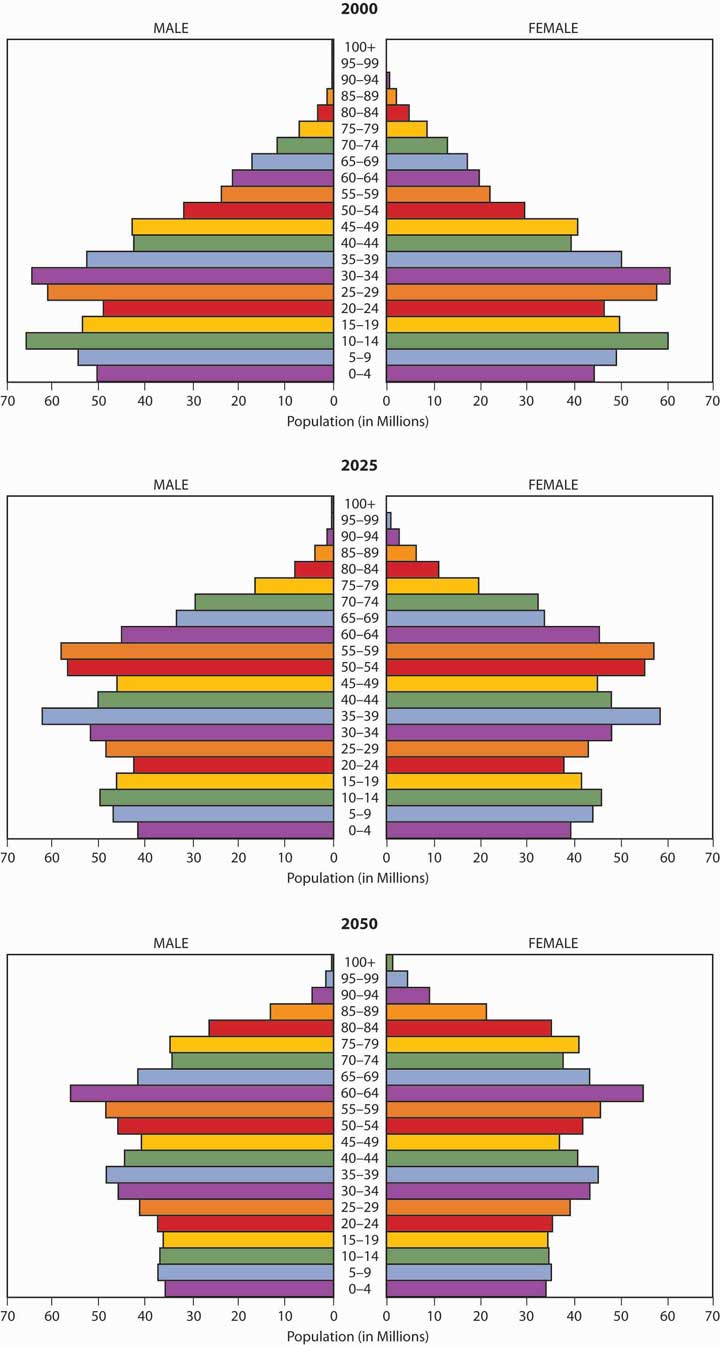

Figure 17.6 Population Pyramid Summary for India, 2000–2050

Source: U.S. Census Bureau, International Data Base.

A few decades later, as birth rates start to decline, the baby boom comes to an end, and the base of the pyramid gets narrower. Some of the developing countries are already showing this pattern, as demonstrated by India in Figure 17.6 "Population Pyramid Summary for India, 2000–2050", from 2000 to 2025, and to 2050. Figure 17.6 "Population Pyramid Summary for India, 2000–2050" shows how declining mortality rates quickly lead to a situation where most people who survived the early years continue to live for many years thereafter. Therefore, at any future point in time, the bars describing young age groups move upward (as the group gets older), but the length of the bar remains fairly constant. This makes the pyramid less and less pointed in appearance. After a few decades, when birth rates are significantly lower, the lower part of the pyramid becomes rectangular, or pillar-shaped.

The drastic decrease of births creates a situation in which we see a fully reversed age pyramid. Japan serves as an excellent example of this point. Similar patterns can be seen in western European countries. The pyramid of Germany serves as a good example of a country in which older people (above age sixty) are typically more than one-fifth, and sometimes even one-quarter of the entire population. The populations in France, Italy, and the United Kingdom follow similar patterns.

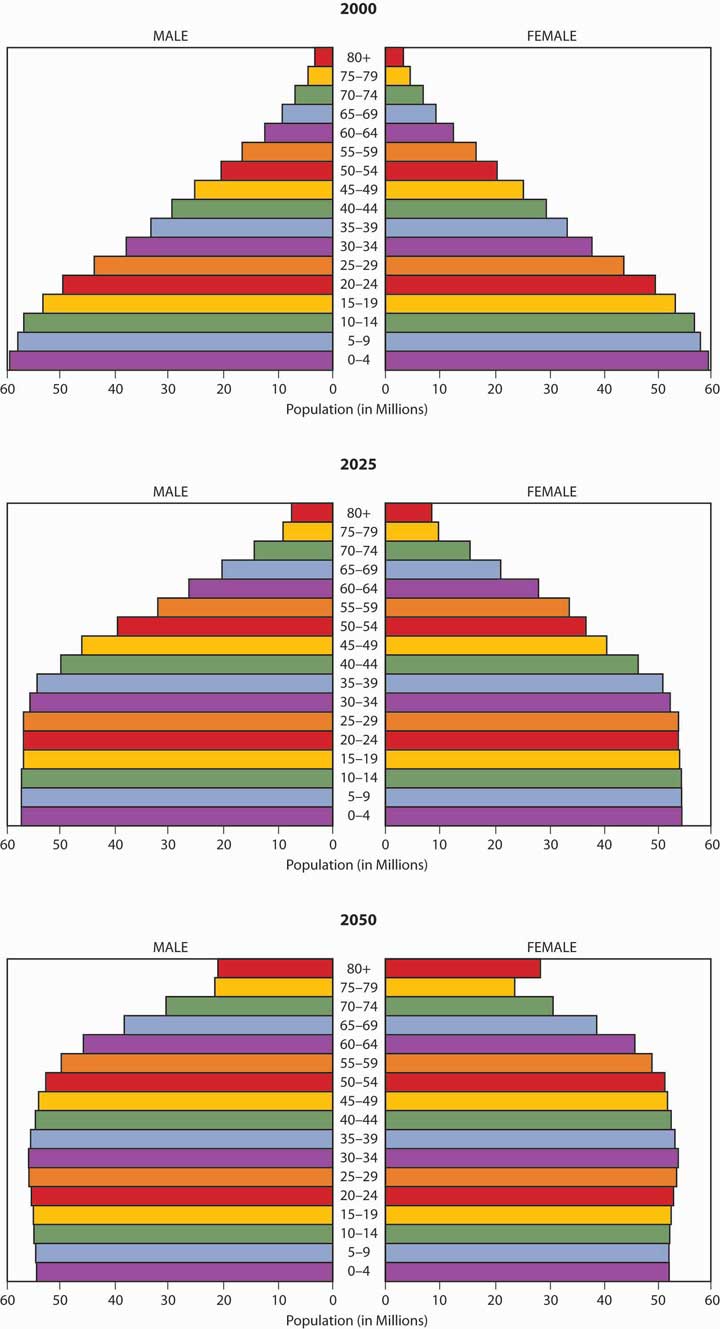

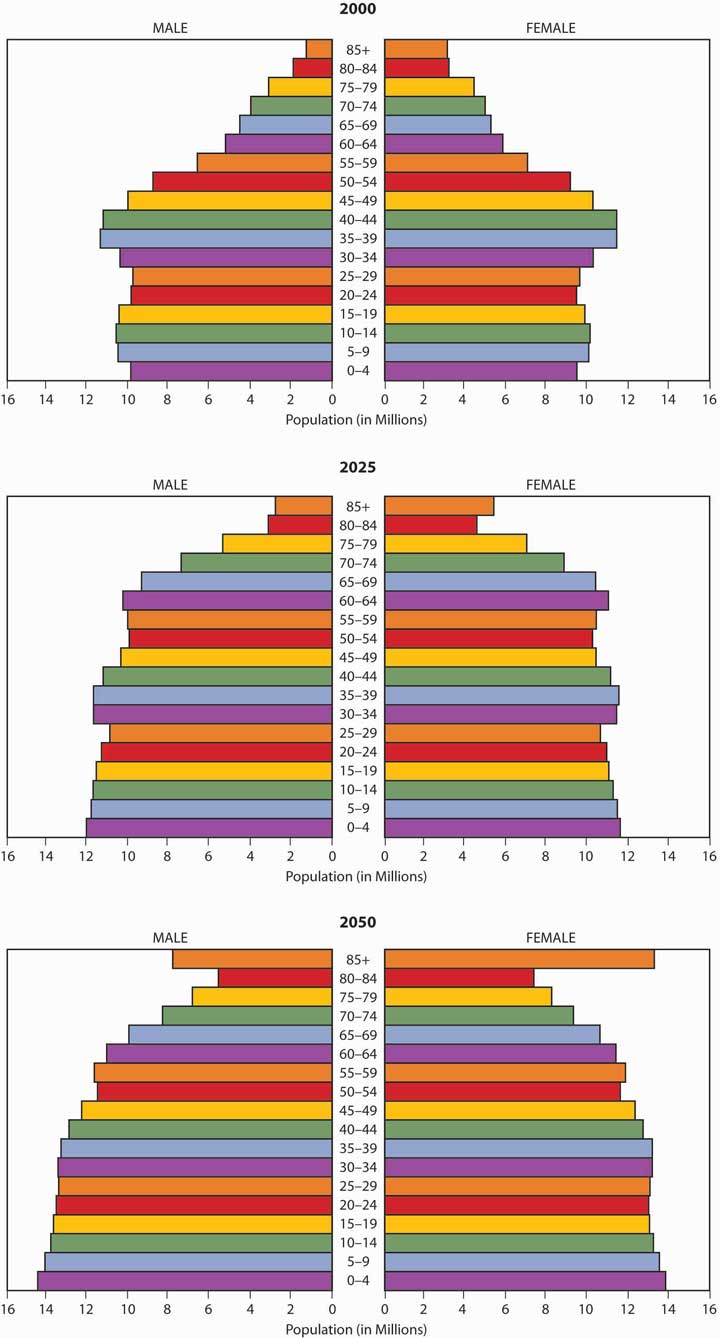

Two large countries deserve special mention. China has an age structure similar to that of a matured, developed country, but it has not experienced the natural evolutionary baby boom (see Figure 17.7 "Population Pyramid Summary for China, 2000–2050"). This is the result of the very strictly enforced birth control introduced by the Chinese government in recent decades. On the other hand, the United States, still has a rectangular-shaped population pyramid rather than an inverted pyramid (see Figure 17.8 "Population Pyramid Summary for the United States, 2000–2050"). The main reason for this anomaly is the absorption of many new immigrants into the population of the United States.

Figure 17.7 Population Pyramid Summary for China, 2000–2050

Source: U.S. Census Bureau, International Data Base.

Figure 17.8 Population Pyramid Summary for the United States, 2000–2050

Source: U.S. Census Bureau, International Data Base.

Population and Dependency Ratios

The population structure is often translated into dependency ratios; that is, the ratios of dependents (children and people beyond working age) to the number of people in the working-age group. These ratios are quite stable over time, despite the drastically changing population structure. People in the working-age groups are typically one-half to two-thirds of the population, as you can see in the U.S. population pyramid of Figure 17.8 "Population Pyramid Summary for the United States, 2000–2050". In agricultural countries, the number of children is large, but the number of elderly people is small. Dependency ratios tend to be around 75 to 100 percent. Countries in the middle have even lower dependency ratios (around 50 percent and sometimes even less). This is the result of complex trends: the birth rate and number of children has already declined, the number of elderly people has not yet increased substantially, and the baby boomers are already working adults.

The ratio between the older people and the younger ones is a more sensitive measure of the developmental stage. It changes dramatically: the ratio of people aged sixty-five or over to children below age five, for example, can be 3.5 to 4.0 in developed countries, compared to only 0.3 to 0.5 in the least-developed countries. This ratio gives a better idea of the future retirement problems: because most children are expected to survive until retirement, it shows how many retired people will have to be supported by one person in the working-age groups. It has been suggested that, in China, one child will eventually have to take care of two parents, four grandparents, and eight great-grandparents!

Effects on Employment Patterns

The 2007–2008 global economic recession and increased unemployment rates may be symptomatic to the changes driven by the technological changes of our time. One can no longer expect to be engaged in the same occupation throughout one’s lifetime. Most people will have to change their occupations and professions several times during their careers and will change workplaces quite frequently throughout their lives. In such an environment, a traditional retirement arrangement based on a particular work place, with limited mobility, becomes inappropriate. Firms will be created, experience mergers and acquisitions, go through major reorganization, and sometimes collapse within fairly short periods if they are not capable of continuously adapting to the new markets, new competitors, new products, and new methods. The dramatic changes throughout the world’s financial markets are the signs of a transition that will completely reshape the retirement systems of the world and handling of life cycle risks.

In this mobile and volatile work world, we will probably have to get used to continuously high unemployment rates, and may therefore need to structure a new system that enables unemployed people to survive during periods of joblessness at working age. Furthermore, the design of optimal retirement systems that will meet our needs in later years requires a good understanding of social, economic, and demographic trends that are by-products of profound technological changes with the power to completely reshape our environment, our needs, and our way of thinking.

Today, we recognize single-parent families, zero-parent families, same-sex families, blended families, virtual families, families of convenience, and more. A large proportion of women are being attracted to employment outside of their homes. The old concept that a man must be the primary bread-winner of the family, while the spouse is supposed to take care of the home, is dying. Both men and women work and take turns taking care of the home and family. A traditional retirement system, based mainly on the husband financing his wife’s old age, is no longer relevant or valid.

In the heated public debates of recent years on the problems of Social Security (the topic of our next chapter), pension plans (the topic of Chapter 21 "Employment-Based and Individual Longevity Risk Management"), retirement systems, and the aging population, the financial viability of social insurance programs in modern economies (and especially in the United States) has been the focus of particular attention. Whatever the arguments in the debate, our environment is clearly changing rapidly and dramatically, and current popular solutions to retirement problems are expected to become obsolete very soon. If we are to prepare for completely new challenges, we have to ensure that the solutions are feasible for people over a relatively long period. This requires a good understanding of future economic and social trends.

Key Takeaways

In this section you studied the following global demographic trends in relation to life cycle risks:

- Population distributions across different age ranges are changing in relation to technological changes in a country.

- Population pyramids can be used to represent the age structure of a population in any country.

- Older age groups increase in number and the youngest age groups decrease in number with the maturation of countries, when mortality rates improve and the adoption of technology becomes more widespread.

- The ranking of countries by size and the analysis of demographic growth has implications for the future of retirement systems and the management of life cycle risks.

- Dependency ratios express the ratio of dependents (children and people beyond working age) to the number of people in the working-age group.

Discussion Questions

- What effects are contributing to the inversion of population pyramids?

- What are dependency ratios? What is their significance with respect to life cycle risks?

- Describe briefly some of the population figures. What implication does this hold for future income needs?

- Do you agree that the demographic changes across different countries are a response to predictable trends? Why or why not?