This is “How Benefits Are Provided”, section 16.2 from the book Enterprise and Individual Risk Management (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

16.2 How Benefits Are Provided

Learning Objectives

In this section we elaborate on the following ways that workers’ compensation benefits are distributed:

- Private insurance

- Residual markets

- State funds

- Self-insurance

- Second-injury funds

Workers’ compensation laws hold the employer responsible for providing benefits to injured employees. Employees do not contribute directly to this cost. In most states, employers may insure with a private insurance company or qualify as self-insurers. In some states, state funds act as insurers. Following is a discussion of coverage through insurance programs and through the residual markets (part of insurance programs for difficult-to-insure employers), self-insurance, and state funds.

Workers’ Compensation Insurance

Employers’ risks can be transferred to an insurer by purchasing a workers’ compensation and employers’ liability policy.

Coverage

The workers’ compensation and employers’ liability policy has three parts. Under part I, Workers’ Compensation, the insurer agrees

to pay promptly when due all compensation and other benefits required of the insured by the workers’ compensation law.

The policy defines “workers’ compensation law” as the law of any state designated in the declarations and specifically includes any occupational disease law of that state. The workers’ compensation portion of the policy is directly for the benefit of employees covered by the law. The insurer assumes the obligations of the insured (that is, the employer) under the law and is bound by the terms of the law as well as the actions of the workers’ compensation commission or other governmental body having jurisdiction. Any changes in the workers’ compensation law are automatically covered by the policy.

Four limitations, or “exclusions,” apply to part 1. These limitations include any payments in excess of the benefits regularly required by workers’ compensation statutes due to (1) serious and willful misconduct by the insured; (2) the knowing employment of a person in violation of the law; (3) failure to comply with health or safety laws or regulations; or (4) the discharge, coercion, or other discrimination against employees in violation of the workers’ compensation law. In addition, the policy refers only to state laws and that of the District of Columbia; thus, coverage under any of the federal programs requires special provisions.

Part 2 of the workers’ compensation policy, Employers’ LiabilityPortion of a worker’s compensation policy that protects against potential liabilities not within the scope of the workers’ compensation law, yet arising out of employee injuries., protects against potential liabilities not within the scope of the workers’ compensation law, yet arising out of employee injuries. The insurer agrees to pay damages for which the employer becomes legally obligated because of

bodily injury by accident or disease, including death at any time resulting there from … by any employee of the insured arising out of and in the course of his employment by the insured either in operations in a state designated in … the declarations or in operations necessary or incidental thereto.

Examples of liabilities covered under part 2 are those to employees excluded from the law, such as domestic and farm laborers. Part 2 might also be applicable if the injury is not considered work-related, even if it occurs on the job.

Part 3 of the workers’ compensation policy provides Other States Insurance. Previously, this protection was available by endorsement. Part 1 applies only if the state imposing responsibility is listed in the declarations. To account for the case of an employee injured while working out of state who may be covered by that state’s compensation law, the Other States InsurancePortion of a worker’s compensation policy that allows the insured to list states (perhaps all) where the employees may have potential exposure. part of the workers’ compensation policy allows the insured to list states (perhaps all) where the employees may have potential exposure. Coverage is extended to these named locales.

Cost

Based on Payroll

The premium for workers’ compensation insurance typically is based on the payroll paid by the employer. A charge is made for each $100 of payroll for each classification of employee. This rate varies with the degree of hazard of the occupation.Rates are made for each state and depend on the experience under the law in that state. Thus, the rate for the same occupational classification may differ from state to state. Large employers can elect to have experience rating, which takes a company’s prior losses into account in determining its current rates.

Factors Affecting Rate

The rate for workers’ compensation insurance is influenced not only by the degree of hazard of the occupational classification but also by the nature of the law and its administration and, of course, by prior losses. If the benefits of the law are high, rates will tend to be high. If they are low, rates will tend to be low. Moreover, given any law, no matter its benefits level, its administration will affect premium rates. If those who administer the law are conservative in their evaluation of borderline cases, premium rates will be lower than in instances where administrators are less circumspect in parceling out employers’ and insurers’ money. Most laws provide that either the claimant or the insurer may appeal a decision of the administrative board in court on questions of law, but if both the board and the courts are inclined toward generosity, the effect is to increase workers’ compensation costs.

Workers’ compensation may be a significant expense for the employer. Given any particular law and its administration, costs for the firm are influenced by the frequency and severity of injuries suffered by workers covered. The more injuries, the more workers will be receiving benefits. The more severe such injuries are, the longer such benefits must be paid. It is not unusual to find firms in hazardous industries having workers’ compensation costs running from 10 to 30 percent of payroll. This can be a significant component of labor costs. Whatever their size, however, these costs are only part of the total cost of occupational injury and disease. The premium paid is the firm’s direct cost, but indirect costs of industrial accidents, such as lost time, spoiled materials, and impairment of worker morale, can be just as significant. These costs can be reduced by loss prevention and reduction, and by self-insuring the risk.

Loss Prevention and Reduction

Most industrial accidents are caused by a combination of physical hazard and faulty behavior. Once an accident begins to occur, the ultimate severity is largely a matter of chance. Total loss costs are a function of accident frequency and severity as explained in prior chapters. Frequency is a better indicator of safety performance than severity because chance plays a greater part in determining the seriousness of an injury than it does in determining frequency.

Accident Prevention

The first consideration is to reduce frequency by preventing accidents. Safety must be part of your thinking, along with planning and supervising. Any safety program should be designed to accomplish two goals: (1) reduce hazards to a minimum, and (2) develop safe behavior in every employee. A safety engineer from the workers’ compensation insurer (or a consultant for the self-insured employer) can give expert advice and help the program. He or she can identify hazards so they can be corrected. This involves plant inspection, job safety analysis, and accident investigation.

The safety engineer can inspect the plant to observe housekeeping, machinery guarding, maintenance, and safety equipment. He or she can help the employer organize and implement a safety training program to develop employee awareness and safe practices. He or she can analyze job safety to determine safe work methods and can set job standards that promote safety. The insurer usually provides employers with accident report forms and instructions on accident investigation. This is essential because every accident demonstrates a hazardous condition or an unsafe practice, or both. The causes of accidents must be discovered so that the information can assist in future prevention efforts. Inspections, job safety analysis, and accident investigations that lead consistently to corrective action are the foundations of accident prevention. The box “Should Ergonomic Standards Be Mandatory?” discusses the issues of job safety in the area of posture and position in the workplace.

Loss Reduction

Accident frequency cannot be reduced to zero because not all losses can be prevented. After an employee has suffered an injury, however, action may reduce the loss. First, immediate medical attention may save a life. Moreover, recovery will be expedited. This is why many large plants have their own medical staff. It is also why an employer should provide first-aid instruction for its employees. Second, the insurer along with the employer should manage the care of the injured worker, including referrals to low-cost, high-quality medical providers. Third, injured workers should take advantage of rehabilitation. Rehabilitation is not always successful, but experience has shown that remarkable progress is possible, especially if it is started soon enough after an injury. The effort is worthwhile from both the economic and humanitarian points of view. All of society benefits from such effort.

Residual Market

Various residual market mechanisms, such as assigned risk pools and reinsurance facilities, allow employers that are considered uninsurable access to workers’ compensation insurance. This is similar to the structure discussed earlier for automobile insurance. Usually employers with large losses, as depicted by high experience ratings, are considered high risk. These employers encounter difficulty in finding workers’ compensation coverage. The way to obtain coverage is through the residual or involuntary market (a market where insurers are required to provide coverage on an involuntary basis). Insurers are required to participate, and insureds are assigned to an insurer in various ways.

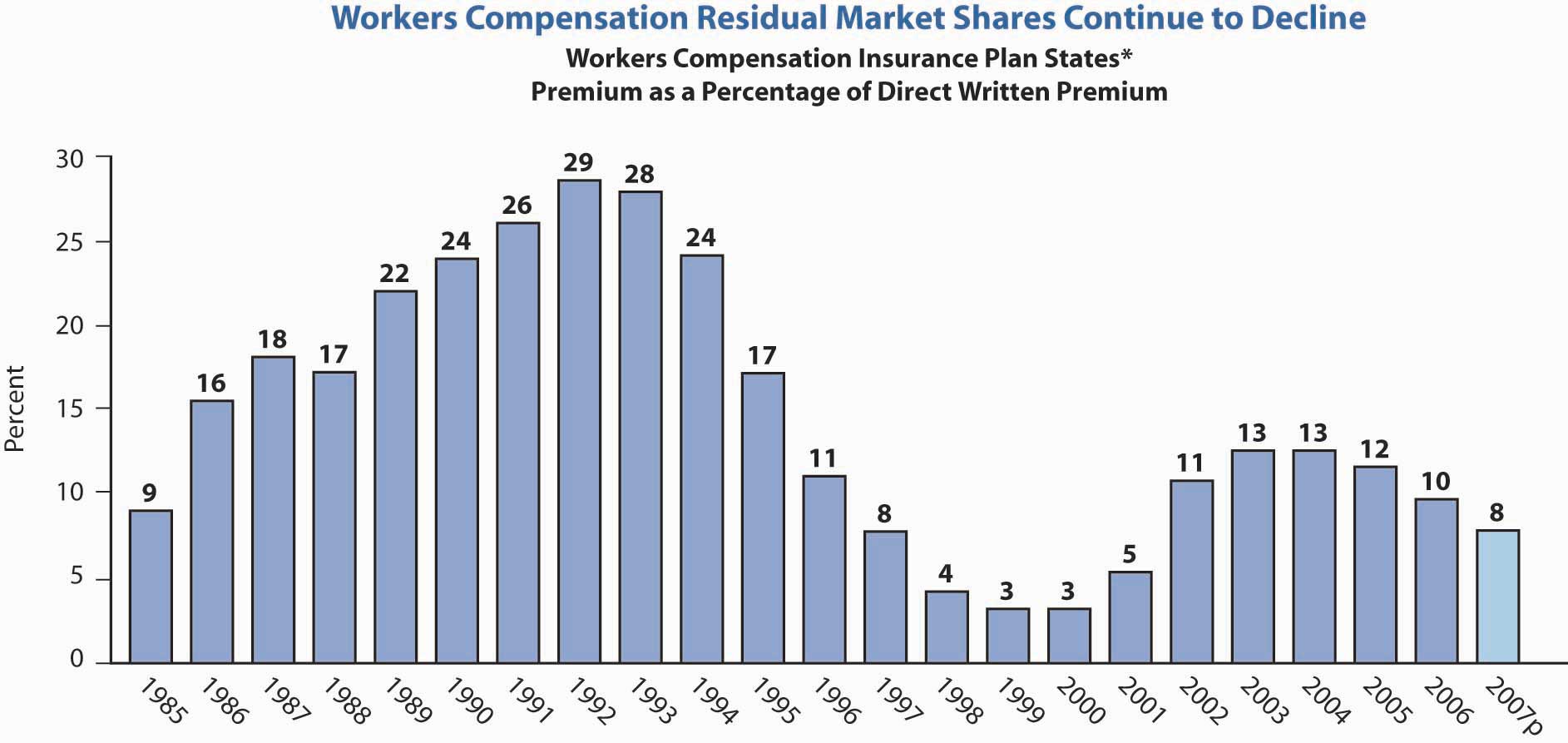

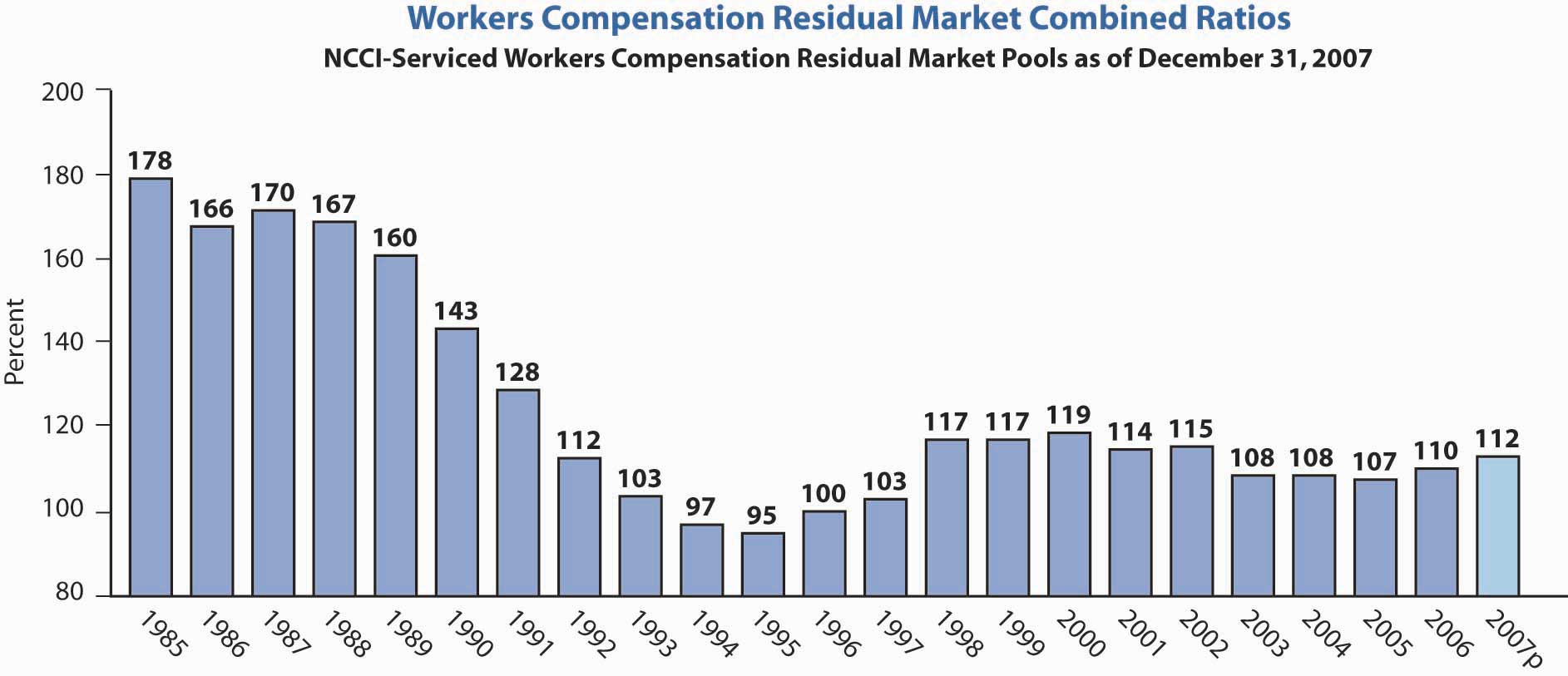

As reported in the NCCI “State of the Line” report, Figure 16.4 "Residual Market Premiums as of December 31, 2007" provides the workers’ compensation residual market premiums from 1985 to 2006; Figure 16.5 "Residual Market Combined Ratio as of December 31, 2007" provides the residual market combined ratio for the same period.

Eighteen jurisdictions have state-operated workers’ compensation fundsState government agencies responsible for collecting workers’ compensation founds and distributing benefits. in which the state government is responsible for collecting workers’ compensation founds and distributing benefits. In six of these, the state fund is exclusive; that is, employers are not permitted to buy compensation insurance from a private insurance company but must insure with the state fund or self-insure.Three of the six permit self-insurance exclusive funds are called monopolistic state funds. Where the state fund is competitive (that is, optional), employers may choose to self-insure or to insure through either the state fund or a private insurer.

Employer’s Risk

Industrial accidents create two possible losses for employers. First, employers are responsible to employees covered by the workers’ compensation law for the benefits required by law. Second, they may become liable for injuries to employees not covered by the law.For example, many workers’ compensation laws exclude workers hired for temporary jobs, known as casual workers. Injured employees who are classified as casual workers are not entitled to benefits under the law but may recover damages from the employer if they can prove that their injuries were caused by the employer’s negligence. The employer’s liability risk with regard to excluded employees is the same as it would be if there was no workers’ compensation law. The risks associated with these exposures cannot be avoided without suspending operations—hardly a practical alternative.

Where permitted, self-insurance of this exposure is common. Self-insurance is desirable, in part because of the predictability afforded by legislated benefits. In addition, employers can buy coverage (called excess loss insurance) for very large losses similar to the commercial umbrella liability policy discussed in Chapter 15 "Multirisk Management Contracts: Business" .

Figure 16.4 Residual Market Premiums as of December 31, 2007

* NCCI Plan states plus DE, IN, MA, MI, NJ, NC

Source: Dennis C. Mealy, FCAS, MAAA, National Council on Compensation Insurance (NCCI), Inc. Chief Actuary, “State of the Line” Annul Issues Symposium (AIS), May 8, 2008, Accessed March 28, 2009, https://www.ncci.com/documents/AIS-2008-SOL-Complete.pdf. © 2008 NCCI Holdings, Inc. Reproduced with permission.

Figure 16.5 Residual Market Combined Ratio as of December 31, 2007

Source: Dennis C. Mealy, FCAS, MAAA, National Council on Compensation Insurance (NCCI), Inc. Chief Actuary, “State of the Line” Annul Issues Symposium (AIS), May 8, 2008, Accessed March 28, 2009, https://www.ncci.com/documents/AIS-2008-SOL-Complete.pdf. © 2008 NCCI Holdings, Inc. Reproduced with permission.

Self-Insurance

Most state workers’ compensation laws permit an employer to retain the workers’ compensation risk if it can be proven that the employer is financially able to pay claims. Some states permit the risk to be retained only by employers who furnish a bond guaranteeing payment of benefits.

The major question for the self-insurance of the workers’ compensation risk is whether the firm has a large enough number of exposure units (employees) that its losses are reasonably stable and can be predicted with some accuracy. Clearly, an employer with ten employees cannot make an accurate prediction of workers’ compensation benefit costs for next year. Such costs may be zero one year and several thousand dollars another year. On the other hand, as the number of employees of the firm increases, workers’ compensation losses become more stable and predictable. Just how stable losses must be in order for self-insurance to be feasible depends on the employer’s ability and willingness to pay for losses that exceed expectations. The employer’s ability to pay for loss is a second important factor considered by regulators in determining whether or not to permit self-insurance. Captives are also used by many employers for this coverage. Of course, all types of self-insurance require the use of stop-loss coverage through reinsurance. The reinsurance is best for use with captives, as explained in Chapter 6 "The Insurance Solution and Institutions". Smaller employers can join together with others, usually from the same industry, and create a group self-insurance program. Under these programs, each employer is responsible for paying the losses of the group when necessary—such as in the case of a member’s insolvency. The employer’s risk is not transferred; only the payment of losses is shared through the pooling mechanism discussed in Chapter 6 "The Insurance Solution and Institutions". Group self-insurance members buy stop-loss coverage and are required to obtain regulatory approval for their existence.

Insurance or Self-Insurance?

Is your firm large enough to self-insure, and if it is, can you save money by doing so? Unless you have at least several hundred employees and your workers’ compensation losses have a low correlation with other types of retained exposures, self-insurance is not feasible. The low correlation implies diversification of the retained risk exposures. Unless self-insurance will save money, it is not worthwhile. Most employers who decide to self-insure use third-party administrators to administer the claims or contract with an insurer to provide administrative services only.

What are the possible sources for saving money? Ask yourself the following questions about your present arrangement:

- Does your insurer pay benefits too liberally?

- Does it bear the risk of excessive losses?

- Does it bear the risk of employers’ liability?

- Does it administer the program?

- How large is the premium tax paid by the insurer?

- How large is the insurer’s profit on your business?

- What is your share of losses in the assigned risk plan that the insurer pays into?

- Can the third-party administrator be a good buffer in disputes with angry employees?

As a self-insured firm, you will still provide the benefits specified by the workers’ compensation law(s) in the state(s) where you operate. Therefore, self-insuring reduces benefits only if you or your outside self-insurance administrator will settle claims more efficiently than your insurer.

Unless your firm is very large, you probably would decide to buy stop-loss insurance for excessive losses, and you would buy insurance for your employer’s liability (part B of a workers’ compensation insurance policy). Would you administer the self-insured program? Most likely, you would hire an outside administrator. In either case, the administrative expenses might be similar to those of your insurer. As a self-insurer, you would save the typical premium tax of between 2 and 3 percent that your insurer is required to pay to the state(s) where you do business. Profits are difficult to calculate because the insurer’s investment income must be factored in along with premiums, benefit payments, expenses, and your own opportunity cost of funds. If you do not pay premiums ahead, you can use the cash flow for other activities until they are used to pay for losses. While the workers’ compensation line of business produces losses in some years and profits in others, over a period of several years, you would expect the insurer to make a profit on your business. You could retain this profit by self-insuring.

Firms that do not qualify for insurance based on normal underwriting guidelines and premiums can buy insurance through an assigned risk plan, that is, the residual market. Because of inadequate rates and other problems, large operating losses are often realized in the residual market. These losses become an additional cost to be borne by insurers and passed on to insureds in the form of higher premiums. Assigned risk pool losses are allocated to insurers on the basis of their share of the voluntary (nonassigned risk) market by state and year. These losses can be 15 to 30 percent or more of premiums for employers insured in the voluntary market. This burden can be avoided by self-insuring. Many firms have self-insured for this reason, resulting in a smaller base over which to spread the residual market burden.

If your firm is large enough to self-insure, your workers’ compensation premium is experience ratedWhen a group’s own claims experience affects the cost of coverage for group insurance.. What you pay this year is influenced by your loss experience during the past three years. The extent to which your rate goes up or down to reflect bad or good experience depends on the credibility assigned by the insurer. This statistical credibility is primarily determined by the size of your firm. The larger your firm, the more your experience influences the rate you pay during succeeding years.

If an employer wants the current year’s experience rating to influence what it pays for workers’ compensation coverage this year, you can insure on a retrospective planWorker’s compensation policy that involves payment of a premium between a minimum and a maximum, depending on the insured’s loss experience.. It involves payment of a premium between a minimum and a maximum, depending on your loss experience. Regardless of how favorable your experience is, you must pay at least the minimum premium. On the other hand, regardless of how bad your experience is, you pay no more than the maximum. Between the minimum and the maximum, your actual cost for the year depends on your experience that year.

Several plans with various minimum and maximum premium stipulations are available. If you are conservative with respect to risk, you will prefer a low minimum and a low maximum, but that is the most expensive. Low minimum and high maximum is cheaper, but this puts most of the burden of your experience on you. If you have an effective loss prevention and reduction program, you may choose the high maximum and save money on your workers’ compensation insurance.

In choosing between insurance and self-insurance, you should consider the experience rating plans provided by insurers, as well as the advantages and disadvantages of self-insurance. The process of making this comparison will undoubtedly be worthwhile.

State Funds

A third method of ensuring benefit payments to injured workers is the state fund. State funds are similar to private insurers except that they are operated by an agency of the state government, and most are concerned only with benefit payments under the workers’ compensation law and do not assume the employers’ liability risk. This usually must be insured privately. The employer pays a premium (or tax) to the state fund and the fund, in turn, provides the benefits to which injured employees are entitled. Some state funds decrease rates for certain employers or classes of employers if their experience warrants it.

Cost comparisons between commercial insurers and state funds are difficult because the state fund may be subsidized. In some states, the fund may exist primarily to provide insurance to employers in high-risk industries—for example, coal mining—that are not acceptable to commercial insurers. In any case, employers who have access to a state fund should consider it part of the market and compare its rates with those of private insurers.

Second-Injury Funds

Nature and Purpose

If two employees with the same income each lost one eye in an industrial accident, the cost in workers’ compensation benefits for each would be equal. If one of these employees had previously lost an eye, however, the cost of benefits for him or her would be much greater than for the other worker (probably more than double the cost). Obviously, the loss of both eyes is a much greater handicap than the loss of one. To encourage employment in these situations, second-injury funds are part of most workers’ compensation laws. When an employee suffers a second injury, the employee is compensated for the disability resulting from the combined injuries; the insurer (or employer) who pays the benefit is then reimbursed by a second-injury fundFund that reimburses an insurer (or employer) that pays a workman’s compensation benefit to an employee who suffers more than one job-related injury. for the amount by which the combined disability benefits exceed the benefit that would have been paid only for the last injury.

Financing

Second-injury funds are financed in a variety of ways. Some receive appropriations from the state. Others receive money from a charge made against an employer or an insurer when a worker who has been killed on the job does not leave any dependents. Some states finance the fund by annual assessments on insurers and self-insurers. These assessments can be burdensome.

Key Takeaways

In this section you studied the ways workers’ compensation benefits are provided through insurance programs, residual markets, self-insurance, and state funds:

- Employers’ risks can be transferred to a workers’ compensation and employers’ liability policy, which pays for the benefits injured workers are entitled to under workers’ compensation law and for expenses incurred as a result of liability on the part of the employer.

- Workers’ compensation insurance premiums are based on payroll and experience (which is in turn influenced by loss prevention and reduction efforts).

- Employers considered uninsurable can obtain workers’ compensation insurance through the residual market, made of assigned risk pools and reinsurance facilities.

- Some jurisdictions have state-operated workers’ compensation funds as either the only source of workers’ compensation coverage or as an alternative to the private market.

- Large employers with sufficient financial resources may be able to self-insure and thus pay for workers’ compensation.

- Second-injury funds are set up to reimburse employers for payment to injured workers who suffer subsequent injuries that more than double the cost of providing them with compensation.

Discussion Questions

- How are workers’ compensation rates influenced?

- Under what circumstances should an employer retain workers’ compensation risk?

- How does a retrospective premium plan work?

- What is the purpose of second-injury funds?