This is “Identifying Potential Investors”, section 12.7 from the book Creating Services and Products (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

12.7 Identifying Potential Investors

Investors invest in people and then they investigate the idea.Sahlman (1997, July-August). This is true even when your investors are your family and friends and when economic times are challenging. Superstars in music, cinema, and in baseball garner the accolades and ultimately the money because of their above-average expertise. Music and movie publishers and baseball general managers go to the superstars because they are a known commodity and have a track record for delivering hits. This is also true for start-ups. The investors look at the management team, the CIO, the VP’s of marketing, operations, and finance, and the lawyers in terms of their reputation, education, job history, and previous experiences with start-ups.

Many start-ups have difficulty in getting funds.See the following Web sites for an overview of funding issues and general entrepreneurial concepts: http://www.sba.gov/, http://www.entrepreneur.com/, http://www.nvca.org/ There are a variety of avenues for generating additional funds that do not involve the professional investors. The first search for funds usually includes savings, credit cards, home equity loans, bank loans, and selling equity to family, friends, and selling personal assets. Bootstrapping is the process of starting a business from scratch with little or no outside capital. The goal of bootstrapping is to minimize expenditures and to reinvest the cash flow generated by the start-up back into the business.

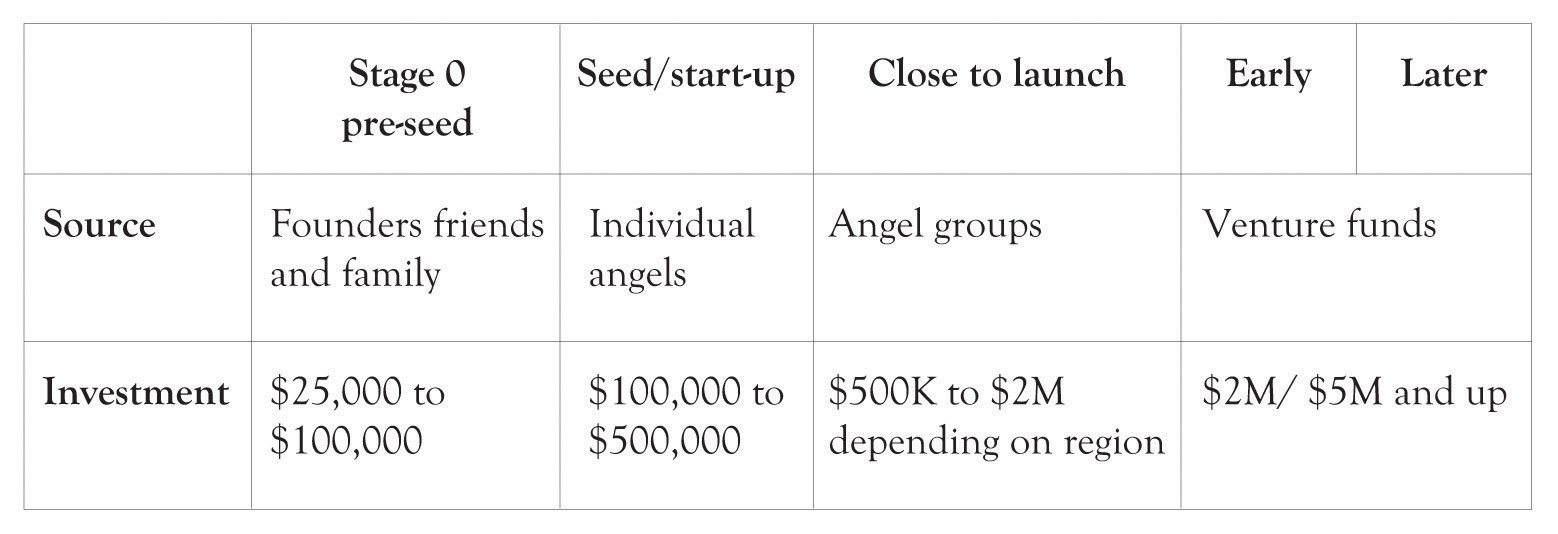

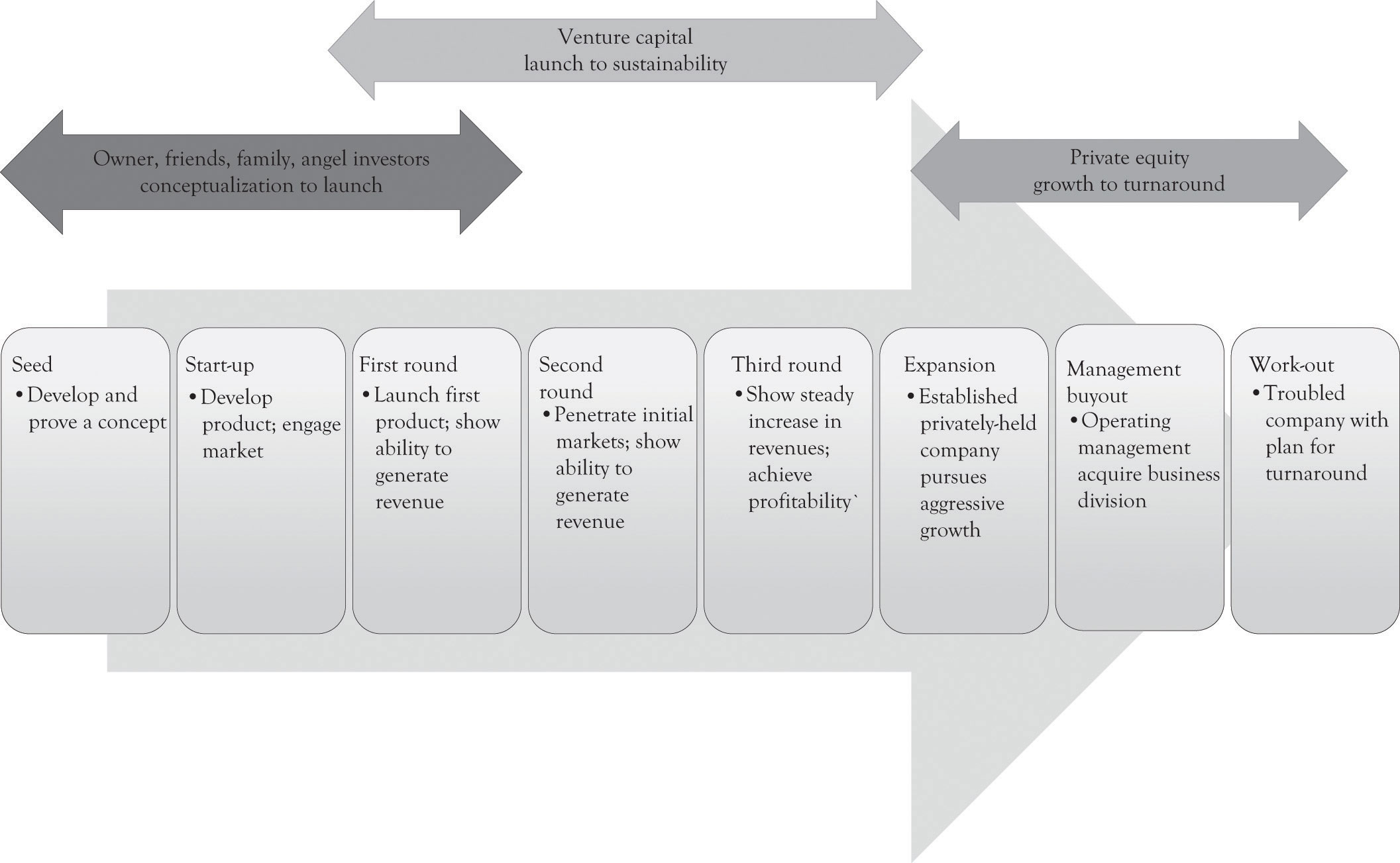

Figure 12.1 "Typical Amount of Funds Generated During Business Development" illustrates the typical level of funds that can be generated as the business grows.Applegate, Simpson, White, and McDonald (2010). Figure 12.2 "Funds Generation as Firm Grows" presents additional detail on where funds are generated as the business grows.Applegate et al. (2010).

Figure 12.1 Typical Amount of Funds Generated During Business Development

Figure 12.2 Funds Generation as Firm Grows

Here is a list of additional sources of funding to keep the business going as it grows and that the entrepreneur can turn to in lieu of professionally managed funds.

- Trade creditWhere a business sets up an account with another business and does not have to pay for the goods and services until a certain time period has elapsed.: Where a business sets up an account with another business and does not have to pay for the goods and services until a certain time period has elapsed (e.g., 30–90 days. Lumber and hardware companies often set up such accounts for contractors.

- Asset-based loanA business will use its equipment, inventory, or facilities as collateral for a loan.: A business will use its equipment, inventory, or facilities as collateral for a loan.

- Factoring of accounts receivablesA business sells its accounts receivables to the lender or factor. The lender usually handles most of the transactions that occur after the sale, such as sending out invoices and collecting funds that are owed.: A business sells its accounts receivables to the lender or factor. The lender usually handles most of the transactions that occur after the sale, such as sending out invoices and collecting the funds that are owed.

- LoanGiven after the financial statements have been analyzed, a small business credit score is obtained, or both.: Loan is given after the financial statements have been analyzed, a small business credit score is obtained, or both. Could be a bank or some other financial institution or individual. Sometimes involves collateral or assets such as inventory, facilities, equipment or personal assets of the borrower.

- LeasingThe lender purchases the asset and then charges a monthly or some periodic fee for the lessor to use it (purchase of fixed assets by lessor).: The lender purchases the asset and then charges a monthly or some periodic fee for the lessor to use it (purchase of fixed assets by lessor).

- Relationship lendingThis is the good buddy loan. The lender has dealt with the borrower in the past and grants a loan because of past success. There is often an ongoing advisory and guidance relationship between the lender and borrower.: This is the good buddy loan. The lender has dealt with the borrower in the past and grants a loan because of past success. There is often an ongoing advisory and guidance relationship between the lender and borrower. Could be a bank or some other financial institution or individual.

Sources of funds and their timing depend on the economic context, the type of business, and the capabilities and attitudes of the founders, and these figures reflect averages and processes that are forever changing.