This is “Step 3: Sorting Value”, section 9.3 from the book Competitive Strategies for Growth (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

9.3 Step 3: Sorting Value

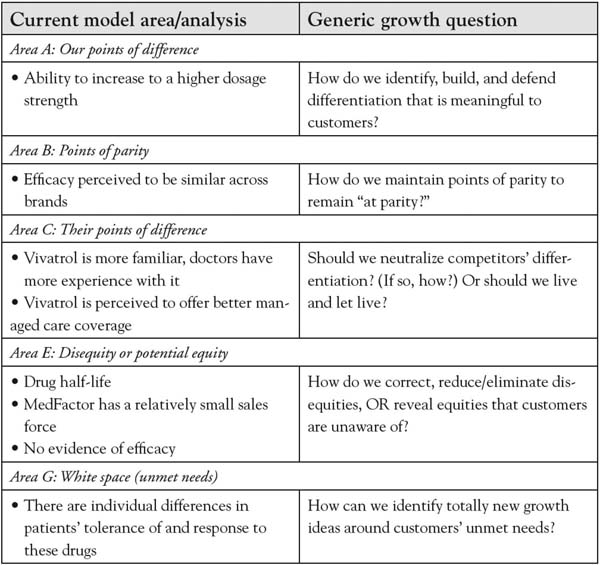

Step 3 involves the actual sorting of value into the seven categories defined by the 3-Circle model. As we have emphasized throughout the book, each of these categories has implications for growth strategies. Together, they summarize most of the core concepts of current work on growth strategy. For MedFactor’s drug OptiMod, Annie’s analysis based on interviews with several specialist physicians revealed a number of important insights (see Figure 9.2 "Three-Circle Analysis for MedFactor’s New Drug" for a summary). The analysis illustrates a classic case of a new brand facing an entrenched existing brand with whom physicians are quite familiar. Annie’s drug OptiMod gets unique credit from physicians only for its flexibility in dosage levels (Area A). In contrast, the competitor’s Vivatrol is a very familiar drug with which physicians have a great deal of experience. It is also perceived by physicians to have an advantage on the managed-care side, meaning that they believe the patient will pay less and be better served by insurance coverage for Vivatrol compared to OptiMod.

Figure 9.2 Three-Circle Analysis for MedFactor’s New Drug

Surprise Insights

The Figure 9.2 "Three-Circle Analysis for MedFactor’s New Drug" analysis captures physician perceptions as Annie identified them in the interviews. However, two critical points came as a complete surprise:

- Area B: While the two brands were perceived by doctors to be equivalent in efficacy, a head-to-head trial showed statistically significant improvement symptom relief for Annie’s brand OptiMod over Vivatrol.

- Area C: Vivatrol was perceived by the doctors to have an advantage in managed-care coverage in spite of the fact there is objectively no difference between OptiMod and Vivatrol on this dimension.

These two insights were quite significant but there was more. In addition to the earlier findings of important customer attributes that the executive team had not included in their original list, the physicians volunteered that two other factors were influential in their assessments of the two companies and their drugs: laboratory evidence and sales-force experience.

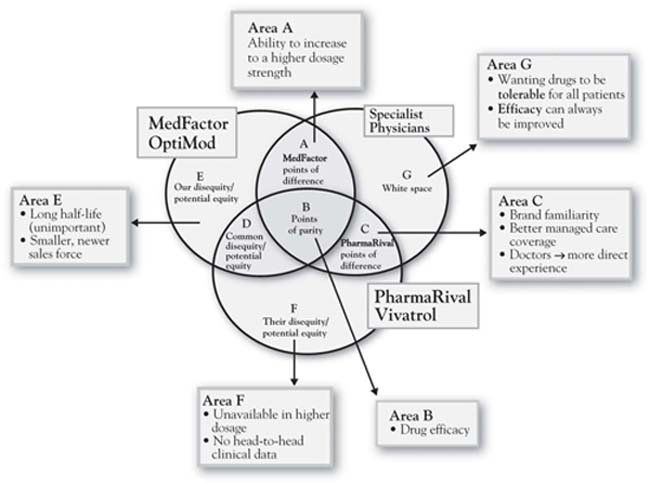

Figure 9.3 3-Circle Model Areas and Generic Growth Questions