This is “Dynamic Aspects of Markets”, chapter 8 from the book Competitive Strategies for Growth (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 8 Dynamic Aspects of Markets

Youngme Moon’s new work, entitled Different, is an essay on differentiation in a competitive marketplace.Moon (2010). In the book, Moon recounts how, in her early teaching experience, she provided detailed feedback to students on their work on specific dimensions of performance relative to the class average. She identified an interesting and very natural tendency for students to stop developing areas in which they exceeded the class average and to instead focus on improving the areas in which they were below the class average. Moon notes, “The most creative thinkers in the room were intent on improving their analytical skills, while the most analytical thinkers in the room were intent on improving their creative contributions.” The interesting outcome of these rational instincts is that the students in the class all tended to regress to the mean. That is, those who initially had unique advantages in certain areas did not develop those advantages but instead sought to become more like others on the dimensions in which they lagged.

Now consider this in extension to the competitive marketplace. Moon recounts, in simple fashion, the distinctive positions of Jeep and Nissan in the off-road vehicle market 20 years ago, when Jeep’s point of difference was its reputation as a rugged sport utility vehicle, while Nissan’s reputation was linked more to the quality of its engineering. The way of the competitive market, though, is reflected in what happens in the intervening two decades. In the next 20 years Jeep has improved its quality, Nissan has improved its ruggedness and the two brands have become similar on several other dimensions.

Moon’s work identifies a natural dynamic in the marketplace. Good people, working hard to improve their products and services by offsetting deficiencies, have a natural tendency to become more like their rivals. But in spite of this natural tendency toward sameness, why do some firms still rise above the pack? In his widely cited work on competitive rationality,Dickson (1992, 1997). Peter Dickson suggests that there are three innate drivers of entrepreneurial behavior in a competitive marketplace: the drive to improve customer satisfaction, to reduce process costs, and to improve process efficiency. The energy that fuels these drivers is the desire to learn. People and organizations who can learn the most quickly about variation in demand and supply will tend to be the most competitive. Leveraging these drives along with the natural differences that exist among customers (demand heterogeneity), some firms essentially experiment by introducing new product or service variations. The “improve my deficiency” tendency that Moon identifies is nested in the innovation-imitation process, that is, successful experiments are copied by competitors. At the same time, though, customers in such markets become more sensitive to, and come to seek, new variations that better meet demand. Drawing on classic work in economics, Dickson builds into his model the notion that luck favors prepared and alert firms, for example, innovators who have a deep understanding of how customer expectations are changing and imitators who watch and think about market reactions before blindly mimicking competitors’ actions. The most competitive firms are those that have the strongest drive to learn and improve.

Market dynamics are about a constant search for differentiation that can, paradoxically, lead to “sameness.” Yet Dickson’s work reminds us that there are firms who continuously lead the way out of commoditization by having greater perceptual acuity—by understanding their markets in a manner superior to the competition. Here in Chapter 8 "Dynamic Aspects of Markets", we consider both how the 3-Circle model describes and reveals market dynamics, and then how the model can help in anticipating likely actions of customers and how competitors can improve growth strategy. The market does not stand still—it is dynamic. To that end, this chapter explains how value moves through the 3-Circle model by demonstrating how markets and competitors change and how competitive advantage shifts over time. Building upon the research of D’Aveni, Mintzberg, Miller and Friesen, and others we demonstrate how customer values and needs, competitors market positioning, and a company’s own resource bundling may change the market landscape.A number of scholars have examined value migration and industry change, including D’Aveni (1994), Mintzberg (1994), and Miller and Friesen (1982). We begin with an important and dramatic illustration of market dynamics.

8.1 Johnson & Johnson Stent: The Perfect Market-Dynamics Storm

Johnson & Johnson (J&J) developed the first working “stent,” a small medical implement that could be used for patients with artery blockages in lieu of open heart surgery. A tiny metal “scaffold” that is inserted into an artery during a balloon angioplasty procedure, the stent significantly cuts down the rates of the artery collapsing after angioplasty and, as a result, reduces the probability of follow-up emergency surgery.This case is based upon media accounts and personal discussions with physicians and other health care professionals. Key resources include Winslow (1998), Tully (2004, May 31), Gurel (2006, July 24), Johannes (2004, September 1), Burton (2004), and Kamp (2010, February 10).

Over 7 years in the late 1980s and early 1990s, J&J invested in the research and development of the stent and compiled the research necessary to gain regulatory approval. The product was an immediate success, quickly building a $1-billion market, even though the stent was too new to be covered by health insurance. Having pioneered the development effort, J&J held a well-deserved 90% of that market in 1996. This product alone accounted for a significant proportion of the consumer-products giant’s operating income. Cleveland Clinic physician Eric Topal described the J&J Palmaz-Schatz stent as “changing cardiology and the treatment of coronary-artery disease forever.” Despite all this success, by the end of 1998, J&J lost all but 8% of its market share.

J&J faced several challenges after introducing the stent to the market. First, the J&J Palmaz-Schatz stent was initially so successful that demand substantially exceeded supply. As a result, one of the company’s initial challenges was making enough stents to meet demand. On top of that, two other initiatives were consuming significant company attention and resources. To facilitate its move into medical devices, J&J had acquired angioplasty balloon-maker Cordis, a merger made particularly challenging by Cordis’s entrepreneurial culture that conflicted with J&J’s top-down culture. In addition, J&J was allocating significant resources to lobbying the insurance industry to obtain insurance coverage for the stent. At introduction, the company had priced the stent at $1,595, a significant new expense for hospitals that was not covered by existing reimbursement levels for angioplasty procedures.

Customer Response

While doctors (and, by extension, their patients) were happy with the stent’s initial performance, hospital administrators had difficulty with its cost. Despite pressure from hospitals for price breaks, J&J stood by its price of $1,595. The company would not give quantity discounts, requiring many hospitals to carry new, significant budget expenses for the stent. Many hospitals felt gouged by J&J, perceived to be a consumer-products firm (the “baby shampoo” company) and a newcomer to the medical implements market. They felt that J&J was holding hospitals hostage by flexing its pricing power.

Market Learning

As J&J focused on building capacity, lobbying the insurance industry, and integrating a new firm with a very different culture, the company was unable to respond to feedback from doctors for improving on the first-generation stent. The original J&J stent came in only one size (about 5/8 of an inch) and was made of relatively inflexible, bare metal. The doctors learned quickly and expressed a very clear need for stents of different sizes and flexibilities to improve ease of use.

Competitor Response

J&J had built an honest advantage in pioneering the stent market, but the company also paid the price often paid by a first-mover innovator. The company carried the product through research, development, and regulatory approval, creating both a knowledge base and market opportunity for other fast followers. Paying close attention to market reaction to the one-size, bare-metal J&J stent, competitor Guidant’s subsequent success in this market was built upon J&J’s early research and market development investments and learning: (a) Guidant was able to develop the more flexible stents that physicians were demanding, (b) Guidant and other rivals benefited from both J&J’s groundwork and physicians’ pushing the FDA to speed up the approval process for new stents, and (c) J&J was successful in achieving a $2,600 increase in insurance coverage for angioplasty procedures to cover the cost of a stent exactly one day before Guidant introduced its new stent product on the U.S. market.

Understanding Market Needs

J&J’s subsequent dramatic loss of market share resulted from a significant store of resentment that had built up through its holding the line on its $1,595 price point and its inability to adequately address physician concerns about flexibility and ease of use. J&J’s behavior was driven by a solid belief in its pricing (which was later validated by rivals’ entry pricing) and the allocation of resources to other tasks. Doctors and hospitals interpreted the company’s apparent lack of responsiveness to a failure to understand the needs of this new market. While J&J was in some ways a victim of awful luck, ultimately, the customer’s perception of how a firm responds to its circumstances is the real determinant of its market share.

The J&J story is told neither to lament the company’s situation in the stent market (they have since continued to innovate and to effectively compete in this market) nor to focus on a great idea gone awry. It is instead told to illustrate an extreme example of the innovation-imitation cycles that Dickson describes in his model of competitive rationality, as well as the fact that the fastest learner in a market often gets an advantage. In addition, it allows us to consider how the 3-Circle model captures such dynamics.

8.2 Market Dynamics in 3 Circles

In previous chapters, there has been a strong theme of value dynamics. Beginning in Chapter 2 "Introduction to 3-Circle Analysis", we showed how movement of the circles could illustrate commoditization. Integral to Chapter 4 "The Meaning of Value" was a discussion of key lessons about attributes and benefits that can evolve from differentiators to parity to nonvalue, while Chapter 6 "Growth Strategy" presented a way to think about growth strategy as value shifting between different areas of the model. Here, we review the two general types of dynamics that provide some diagnostic value for anticipating future behavior in the market.

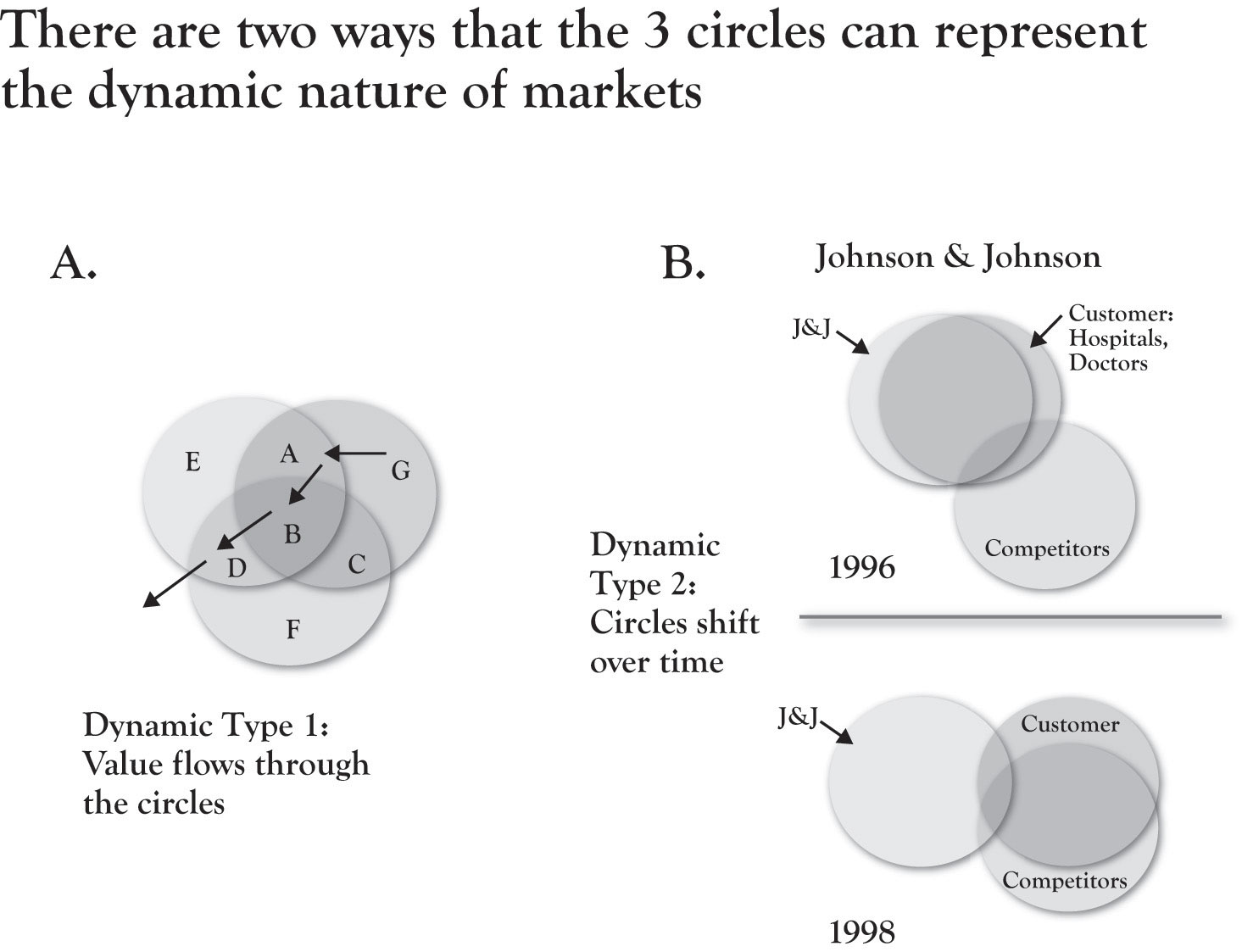

Dynamic Type 1: Value Flows Through the Circles

A key point throughout the earlier chapters is that one can think of attributes and benefits as having different roles over time. While this is not a new idea it is embedded in the work of Kano (1995) and Gale (1994), it is an idea that is not really captured in a life-cycle flow in other models. Figure 8.1 "Market Dynamics in 3 Circles" (part A) shows what we might expect to be a typical flow of value in a market. New ideas or innovations, like the stent, emerge by providing new technology or methods for better resolving unmet needs. Once developed and commercialized, such innovative attributes become a firm’s Area A. So J&J initially had a near monopoly on stent sales with a distinctive Area A. Yet competitive imitation pushes once-distinctive attributes and benefits into Area B, where they become, at best, points of parity. In fact, continuing the path, one can see that for many patients, doctors would prefer new, flexible stents, suggesting that the bare-metal stent (although still on the market) may, for many situations, fall into Area D or even out of the model, that is, not even in the consideration set for certain procedures.

If we think of an attribute life cycle, we might consider that attributes or benefits similarly pass through different phases of introduction, growth, maturity, and decline, as reflected in the classic product life cycle theory. As noted, the original one-size, inflexible, bare-metal stents quickly lost favor and gave way to more flexible stents. But the market kept moving quickly from there. When it was discovered that there could be a build-up of scar tissue around an implanted stent over time, J&J once again innovated in creating a drug-eluting stent that provided for the timed-release of blood-thinning drugs to prevent clotting. However, Boston Scientific has fought J&J for this business, with market share going back and forth, along with lawsuits over patent challenges. Different types of drugs (e.g., transplant drugs vs. cancer drugs) have been used for drug-eluting stents, further increasing the variation in offerings. Stent manufacturers and vascular specialists have discovered other stent applications as the category has evolved. Fighting 700,000 strokes a year, stents for the carotid artery have been developed, credited with significant improvement in stroke prevention and reducing the need for surgery. Nonvascular stents have been developed for clearing blockages in kidneys, intestines, and lungs. Each of these value-added variations occupies a different place in the 3-Circle model for a given manufacturer, depending on the relative uniqueness of its offering relative to competitors.

Figure 8.1 Market Dynamics in 3 Circles

Dynamic Type 2: Circles Shift Over Time

One of the most useful and powerful ways the 3-Circle graphics can convey the implications of thoughtful customer and competitor research (and subsequent action) is in the conceptual meaning behind the movement of the circles. There are three basic types of movements:

- One of the firms moves closer to the customer circle. A competitor who has improved its value delivery on dimensions important to the customer will find an increase in overlap between its circle and the customer’s circle. This can be identified conceptually and is based on measurement of customer value, as the firm’s scores on dimensions more important to customers improve. The service firm who improves its speed of service delivery, the educational institution that more effectively connects its students to opportunities, the technology product that improves the user’s efficiency to get a greater sense of control—all move the firm’s circle closer, creating greater overlap with fundamental customer needs. Depending on various product failures or recalls in the stent market, J&J and Boston Scientific continue to go back and forth in terms of market share. In 3-Circle terms this is like a moving picture over time in which the two firms alternate in their degree of overlap with the customer circle.

- The circles for both competitors move closer to the customer’s circle. When innovation-imitation cycles kick in, the net effect is that both competitors converge on the customer’s circle. From a societal allocation of resources perspective, this is a positive—the customer gets more value. From a competitive strategy perspective, it may be less desired if the follower is simply matching the value added by the innovator, creating a commodity market.

- The customer’s circle shifts away from both competitors’ circles. As substitute technologies emerge, it is frequently the case that customers find value in new sources. This may be a transition that happens very quickly (e.g., the MP3 player over portable CD players) or it may be slower. In either case, the firm’s ability to pick up on changes in customer purchasing behavior and attitudes is critical.

Referring back to Figure 8.1 "Market Dynamics in 3 Circles", part B demonstrates the shift in circles capturing J&J’s decline in the stent market in 1996 through 1998. Our post-hoc interpretation of this unusual situation is straightforward. The combination of new competitive offerings that effectively met customers’ developing needs and built up resentment toward J&J for perceived price gouging and nonresponse on new product development led to a situation in which the competitor’s circle essentially took over the customer’s circle while pushing J&J nearly out of the picture.

8.3 Anticipating Market Dynamics

In earlier chapters, we have discussed analysis of customer value in a way that prompts growth strategy development. Ultimately, though, the growth strategies you propose need to be vetted. Our vetting process here first requires you to look closely at whether you have, or could get, the resources needed to effectively execute the growth strategy (Chapter 7 "Implementation: An Inside View of the Organization"). Next, though, is to think through how your growth strategies will fit as market conditions change and how those strategies may change the market.

The term dynamics is about change—how is the market likely to change in the future in part as a function of implementing a new growth strategy? Thinking “dynamically” is difficult. It means evaluating a decision as a game theorist might: anticipating decision options the firm might have, thinking about how different players in the market (customers, competitors) will react over time to each decision option by stepping into the shoes of those players, then working back from these anticipated outcomes to select the best option. It turns out that such predictions are often so uncertain and complex, that we just avoid the issue!The challenges that people have in estimating the likely reactions of others to their own actions have been discussed widely. One paper on competitive decision making found that only a minority of managers considered competitors’ future reactions in either describing past decisions or making future decisions. Across two studies—one examining actual managerial decisions and a second examining decision making in a simulated business gain—they were most likely to discuss current internal factors (e.g., sales/revenue goals, costs, capacity constraints), which are known and can be controlled with much greater certainty (see Montgomery et al. 2005). For discussion of the evidence and explanations of a low incidence of considering competitor reactions, see Urbany and Montgomery (1998) and Moore and Urbany (1994). Such dynamics can only be estimated with great uncertainty.

Our goal in concluding the chapter is to provoke some thinking about how to get your hands around the likely dynamics that your new growth strategies will face. It is beyond the scope of this chapter to provide a detailed analysis of market dynamics to cover all types of growth strategies, but we will plant a few seeds here for analysis and subsequent study. We will address anticipation of the dynamic aspects of customer, competitors, and capabilities.

Anticipating Customer Dynamics

A variety of theories—from the product life cycle to competitive rationality—help us understand that customer preferences will change over time. There are two primary reasons for this. First, there may be a natural change in customer preferences and demand to external environmental events. The rapid increase in fuel costs in the past few years has significantly affected customer value and associated attributes that they began to demand from the producers of automobiles. Toyota introduced the first widely accepted hybrid technology in the Prius and enjoyed a significant Area A around the hybrid technology. Since then, a number of other auto manufacturers have developed hybrid versions of their vehicles. A second driver of changes in customer preferences is the rate of innovation-imitation cycles themselves. Dickson (1997) noted in his book Marketing Management that between 1987 and 1992, the mountain bike market share grew from 12% to 58% of the overall bicycle market. This remarkable jump was not due to consumers waking up one morning with visions that they must have a mountain bike. Instead, it resulted from the experimentation of one bike manufacturer that was quickly imitated by others, creating a spike in the amount and variation of supply, which unearthed significant customer demand.

While there is no precise science of customer value dynamics we can summarize some important principles as follows:

- Over time, as products become more alike, customers will become more price driven and tougher negotiators. This is the first thing business people tend to think about as markets mature. In the pioneering work that introduced the concept of cocreation in the business press, C. K. Prahalad and Venkat Ramaswamy describe today’s marketplace as one in which customers are increasingly powerful:

It’s perfectly feasible for a customer to approach a bank and say, “I will always leave a $5,000 balance in the bank. These are the services I want free in return for this commitment.”…A customer at one telecom provider, a heavy user of long-distance services, even obtained preferential long-distance rates in exchange for a commitment to that provider.Prahalad and Ramaswamy (2000).

- This tendency is a natural outcome of more and better information for customers today, particularly via the Internet. Yet it is more significantly a function of the similarity in products that emerge as markets mature. As we have emphasized throughout this book, striving to deeply understand the value customers seek and producing unique solutions is an important strategic priority. As markets evolve, though, it is equally important to understand how to give customers an additional hand in this process.

- Over time, customers will learn how features of a product or service link to their consumption problems and benefits desired. We once conducted an exploratory study of consumers who had recently purchased computers for their homes. We preselected half of those interviewed to be novices (first-time purchasers) and half to be experts (very experienced with purchasing and using computers). The difference between them was straightforward. The experts spoke in terms of how different types of computer features could be used for particular applications and what attribute levels were needed to accomplish particular goals. In short, they understood how to translate benefits into the task that needed to be done. In contrast, the novices’ basic approach was to take a newspaper ad for a computer to a retail salesperson or to an expert at work and to ask, “Are these the features I need?” In sum, the novices needed a translator! Essentially, experience leads to an ability to speak two languages: the language of features and the language of desired outcomes and results, and to be able to translate one to another.

- Over time, as customers learn, they will add value if you let them. A still-developing, yet very important paradigm in the business press today is “cocreation.” In purest form, cocreation refers to a scenario in which firm and customer together define the product or service experience. An extreme form of cocreation is when users “take over” a brand, as Alex Wipperfurth describes in his book Brand Hijack.There are a variety of excellent case studies in Wipperfurth (2005). For example, the author describes the original music-sharing website as the prototype of a brand takeover by users. The founder developed a means of sharing music among users online with no intent of financial gain. Users stood to gain only in that the more people who participated, the more music that was available. A community spirit emerged because users were on the front end of helping build the idea from its inception and in having a joint sense of control—and a sense of rebellion. There is a more basic research tradition around lead users that was pioneered by Eric von Hippel of MIT, which explores how to leverage the ideas of innovative customers in product and service development.Von Hippel (1988). Von Hippel’s work has been seminal in helping firms understanding the role of customers in leading innovation. Cocreation, though, formalizes discussion of a new layer of value that emerges from the customer’s ownership in the ideas that emerge. An interesting example is the secret menu that customers codeveloped at In-N-Out Burger, a restaurant with a cult following and a very simple 4-item menu: burgers, fries, shakes, and soft drinks. The secret menu developed in response to customers’ special requests for variations of the menu (e.g., the “wish burger” is a vegetarian option not on the menu and named by customers). There is significant potential here for Area-G thinking as the product or service matures, and it exists in the thinking of the very people using the product.

The key question as you develop strategy should be, is your growth idea subject to these dynamics in a way that will reduce its probability of success? Or, can you leverage these forces to enhance your Area A?

Anticipating Competitor Dynamics

Customer learning and evolving participation can certainly have a significant impact on growth strategy as it develops. However, it is also important to note that the reactions of competitors can have an enormous impact on the success or failure of a new growth strategy. Northwest Airlines, for example, cut its prices on a route critical to a smaller regional competitor when that competitor slashed its prices on one of Northwest’s key routes, completely neutralizing the smaller rival’s strategy. But as we have noted, there is a fair amount of evidence suggesting that managers may not often take the time to anticipate competitor reactions. Interestingly, this may not be harmful, as there may be many circumstances in which competitors actually may not respond to particular moves. However, the likelihood of a competitive response to your new growth strategy will be a function of the degree of threat as perceived by the competitor. In a recent Harvard Business Review article, McKinsey consultants Kevin Coyne and John Horn provide a very practical template for thinking through the odds that competitors will react to your actions, organized around the following questions:Coyne and Horn (2009).

- Will your rival see your actions? Coyne and Horn’s empirical research suggests that firms often do not observe rivals’ actions until it is too late to respond.

- Will the competitor feel threatened? Here, it is important to get a sense of the rival’s goals for the product or service lines that might be affected.

- Will mounting a response be a priority for the competitor? Of everything on the competitor’s plate, will reacting to your new strategy be a priority?

- Can your rival overcome organizational inertia? Coyne and Horn point out the very real organizational barrier that reactions will require resource allocations and external commitments that the rival may find too cumbersome to overcome.

The first four questions all speak to gauging the probability that a competitor will even respond to your new growth strategy. This leads to another set of questions under the assumption that a reaction will be forthcoming:

-

If the competitor is likely to respond,

- what options will the competitor actively consider;

- which option will the competitor most likely choose?

The authors’ research suggests that competitors are likely to consider two to three options. Further, they suggest that much insight can be gained into predicting the competitor’s likely reaction if our team can put themselves in the rivals shoes by thinking through (a) the number of moves the rival is likely to look ahead and (b) the particular metrics the competitor is likely to use.

In all, Coyne and Horn’s framework provides an excellent series of prompts for considering whether competitor reactions to your new growth strategy are forthcoming and what actions are likely to be considered. But if the competitor is probably going to react to our new growth strategy, the question is, what is our next move? Here, we need to return to capabilities, which are themselves dynamic.

Capability Dynamics

Despite decades of industry leadership and a large Area A, in the early 1990s, IBM’s stock price plummeted, 60,000 employees were dismissed, and Wall Street had written the company off.Harreld et al. (2007). Like a driver stuck in the sand, IBM executives thought that if they spun their tires just a little bit longer, using the same tried and true strategies and resources, they could regain market leadership and move forward again. Louis Gerstner, who became IBM CEO in 1993, said that the company lost its market in the early 1990s because “all of [IBM’s] capabilities were of a business model that had fallen wildly out of step with marketplace realities.”Gerstner (2002), p. 123. In Chapter 7 "Implementation: An Inside View of the Organization", we described how successful companies become entrenched with the resources, capabilities, and assets that made them successful and become out of touch with changing customer values. This view was supported by Chandler’s research, where he found that successful companies typically pursue the same strategies and competencies that brought them success, and yet, they are fatal in the long run.Chandler (1990).

Harreld et al. described how IBM’s leadership used dynamic capabilities to redefine itself and regain and sustain market leadership. Dynamic capabilities require company executives to first “sense” or anticipate opportunities in the market. For IBM, this meant sensing new market opportunities through exploration and learning. Gerstner, IBM’s new CEO, forecasted that, over the next decade, “customers would increasingly value companies that could provide solutions-solutions that integrated technology from various suppliers and, more importantly integrated technology into the processes of the enterprise.”Gersnter (2002).

While anticipating new customer value propositions is necessary to firm positioning, execution is the key to delivering the value and capturing the market. An organization with dynamic capability is able to quickly and effectively adjust and restructure its internal resources, capabilities, and assets to capture the anticipated opportunities. Gerstner’s internal analysis of the firm’s capabilities found that IBM had intelligent and talented employees and that its problems were not with its technology. The primary problem was that IBM failed to build and configure bundles of resources, capabilities, and assets necessary to meet the needs of the changing market. IBM leveraged and reconfigured its resources and, in the process, provided the type of value desired by customers—value that was rare in the market and could not be easily imitated by the competition. Among other things, they created internal computer software technology with “open architecture, integrated processes and self-managing systems” to help IBM employees communicate better within the company and to quickly respond to customer needs. The change in the way information is managed within IBM has modified the internal capabilities and assets of the company, transforming the market brand from a computer-hardware to a computer-services business.Harreld et al. (2007). In short, IBM created a strong Area A, a competitive advantage.

Companies that anticipate or “sense” changes in customer value and have dynamic rather than static internal capabilities gain and sustain Area A advantages. In short, the 3-Circle model shifts as organizations anticipate external customer value by dynamically altering their internal competencies.

8.4 Chapter Summary

The effective development of growth strategy not only needs to account for the current and future state of customer value and competitive behavior, it also needs to consider how those states of nature will change. Here, we have reviewed some basic tendencies in competitive markets that tend to evolve toward commoditization until a perceptive, fast-learning firm can move it in a different direction. We have also seen how such dynamics can be captured in the 3-Circle framework. Dynamics bring to mind that life and marketplace competitions have some circular elements to them—patterns repeat, influence one another, and the folks who get the quickest understanding of the value sought in the system often end up winning. It is not an endless cycle, however. We have defined a series of 10 discrete steps that will help form the basis for a productive growth strategy project. Our next chapter brings the discussion of growth strategy full circle by summarizing the overall process for strategy development that integrates the core concepts of the first eight chapters.