This is “Chapter Summary”, section 2.5 from the book Competitive Strategies for Growth (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

2.5 Chapter Summary

Pastor Buss and the GNCS team are still working on implementing the strategic directions that emerged from the 3-Circle project. They have built an impressive staff and communicated their credentials, implemented standardized testing processes, and are in the process of hiring new leadership. While the development of the school will take time, and the development of new teaching paradigms like differentiated instruction will be up to the new school leaders, Pastor Buss reports being “sold on the 3-Circle model” and process that led to the current growth strategy for the school.

The simple truth is that your business is more profitable when you lead it with a careful view to customer value. However, there is much lip service given to customer value and customer satisfaction these days because we have few disciplined ways to think about and evaluate it. The 3-Circle model provides such discipline in asking the right questions and providing guidance on the right answers for growth. The key benefits of the framework are the following:

- Understanding the customer’s perspective with a focus on competitive assessment and the deeper values underlying customer decision making

- Straightforward illustration of principles of competitive strategy and actionable implications for how to improve competitive position

- An explicit focus on building competitive advantage through both capability development and communications strategy

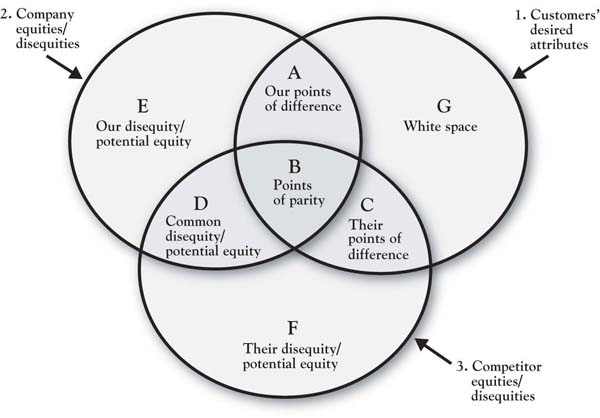

The outside view of the framework captures the front office—that is, it focuses explicitly on customer perception of the firm and its competitor. The analysis of the outside view produces a categorization of value in 7 categories, as summarized in Figure 2.14 "Summary: Outside View". The key competitive concepts reflected in this figure, and the associated growth strategy implications, are as follows:

- Area A: Our competitive points of difference. Build and defend.

- Area B: Points of parity. This is the common value that customers may come to expect from all competitors. These attributes and benefits should generally be monitored and maintained at competitive levels.

- Area C: Their (the competitor’s) points of difference. If there are absolutely critical dimensions that can be matched in cost-effective ways, there is a high priority on matching the competitor’s advantages. The exception is when the competitor’s strategy is built upon a fundamentally different positioning strategy. For example, it would not be prudent for GNCS to pursue a broad curriculum in the same way that it would be foolish for Apple to get into a price war with Dell. So “live and let live” is another potential strategic implication for Area C.

- Area D: This is nonvalue or disequity common to both competitors in the analysis. The goal here is to fix disequities if this action can contribute to your competitive advantage, reduce or eliminate attributes and benefits that customers find have little value, or potentially unearth value that has not been clearly developed or articulated to customers. Palm was the first to figure out that customers desired PDAs with a very simple set of functions, and so stripped out much of the complexity of its first generation product—to great success.

- Area E: Similar to Area D, except that this nonvalue or disequity is specific to our company, so there may be some very high priority fixes here. In addition, study of Area E might even emphasize the search for potential equities and unique capabilities the organization has that might be clarified and leveraged.

- Area F: This is the competitor’s nonvalue or disequity. If chosen, the strategy of overcoming competitors’ deficiencies involves making better products and services than the competition and distributing them more effectively. In addition, communications strategy can point out the problems with the competitor’s offering.

- Area G: The white space represents areas of unmet need that neither competitor has touched. It is important to seek growth potential in unmet needs but in a structured and disciplined manner. Identify the deeper reasons underlying customer complaints and problems, and search for potential differentiating sources of new value for which we have a capability advantage.

Figure 2.14 Summary: Outside View

The inside view of the 3-Circle model captures the back office: the work, processes, capabilities, assets, and resources that are utilized in creating customer value. In the end, the most powerful competitive advantage emerges when your distinctive Area A, as perceived by customers, is a function of real, substantive, and distinctive capabilities and assets. Finally, the framework identifies a variety of actionable, high-impact ways in which a firm can enhance its growth prospects by building customer value that is superior to that of the competitors.

Chapter 1 "The Challenges of Growth" and Chapter 2 "Introduction to 3-Circle Analysis" have provided an overview of the framework and an introduction to the key concepts within it. Now it is time to get busy with an exploration of the core concepts in the model. Chapter 3 "Defining the Context" starts with the start—defining the context for your growth strategy analysis.