This is “Exporting, Importing, and Global Sourcing”, chapter 9 from the book Challenges and Opportunities in International Business (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 9 Exporting, Importing, and Global Sourcing

© 2003–2011, Atma Global Inc. Reprinted with permission.

What’s in It for Me?

- What are importing and exporting?

- What is countertrade?

- What is global sourcing?

- How do companies manage importing and exporting?

- What options do companies have to finance their importing and exporting?

A major part of international business is, of course, importing and exporting. An increase in the level of exports and imports is, after all, one of the symptoms of a flattening world. In a flat world, goods and services can flow fluidly from one part of the globe to another. In Section 9.1 "What is Importing and Exporting?" you’ll take a quick look back in time to see importing and exporting in their historical context. Then, you’ll discover the reasons why companies export, as well as the pitfalls and risks associated with exporting. Next, you’ll venture into more specialized modes of entry into an international market, moving progressively from the least expensive to the most expensive options.

Section 9.2 "Countertrade" focuses on what countertrade is and why companies engage in it. You’ll learn about countertrade structures, such as barter and counterpurchase, and the role they play in the modern economy.

In Section 9.3 "Global Sourcing and Its Role in Business", you’ll explore global sourcing and study the best practices to manage sourcing, to judge quality from afar, and to improve sustainability through well-planned sourcing that’s beneficial to the environment. You’ll understand what outsourcing is, why companies outsource, and what the hidden costs of outsourcing are. Some of these costs are related to the fact that the world is not all that flat! You’ll see tips for managing outsourced services and look at the opportunities that outsourcing offers entrepreneurs.

Section 9.4 "Managing Export and Import" reviews the mechanics of import and export—from the main players involved, to the intermediaries, to the important documentation needed for import and export transactions.

Section 9.5 "What Options Do Companies Have for Export and Import Financing?" concludes the chapter with a look at the options companies have for financing their import/export activities.

Opening Case: Q-Cells

Q-Cells exemplifies the successes and challenges of global importing and exporting. Founded in Germany in 1999, the company became the largest manufacturer of solar cells worldwide.LDK Solar, “Q-Cells and LDK Solar Announce Formation of Joint Venture for Development of PV Systems in Europe and China,” news release, April 8, 2009, accessed October 27, 2010, http://www.ldksolar.com/med_press_list.php?news_id=100. By 2010, however, it was experiencing losses due, in part, to mistiming some of the entry strategies that are covered in Section 9.1 "What is Importing and Exporting?".

First, it’s important to know that Germany is a high-cost manufacturing country compared to China or Southeast Asia. On the other hand, Germany is known for its engineering prowess. Q-Cells gambled that customers would be willing to pay a premium for German-made solar panels. (You’ll learn more about this “country of origin” factor in Chapter 14 "Competing Effectively through Global Marketing, Distribution, and Supply-Chain Management".) The trouble was that solar cells aren’t that sophisticated or complex to manufacture, and Asian competitors were able to provide reliable products at 30 percent less cost than Q-Cells.

The Cost Advantage

Q-Cells recognized the Asian cost advantage—not only are labor and utility costs lower in Asia, but so are the selling, general, and administrative (SG&A) costs. What’s more, governments like China provide significant tax breaks to attract solar companies to their countries. So, Q-Cells opened a manufacturing plant in Malaysia. Once the Malaysian plant is fully ramped up, the costs to manufacture solar cells there will be 30 percent less than at the Q-Cells plant in Germany.

© 2011, Q-Cells SE

Then, Q-Cells entered into a joint venture with China-based LDK, in which Q-Cells used LDK silicon wafers to make its solar cells. The two companies also used each other’s respective expertise to market their products in China and Europe.Richard A. Kessler, “Q-Cells, China’s LDK Solar Form Joint Venture for Export Push,” Recharge, April 8, 2009, accessed September 9, 2010, http://www.rechargenews.com/regions/north_america/article175506.ece?print=true. Although the joint venture gave Q-Cells local knowledge of the Chinese market, it also locked Q-Cells into buying wafers from LDK. These wafers were priced higher than those Q-Cells could source on the spot market. As a result, Q-Cells was paying about 20 cents more for its wafers than competitors were paying. Thus, in the short term, the joint venture hurt Q-Cells. However, the company was able to renegotiate the price it would pay for LDK wafers.

To stay cost competitive, Q-Cells has decided to outsource its solar-panel production to contract manufacturer Flextronics International. Q-Cells’ competitors, SunPower Corp. and BP’s solar unit, also have outsourced production to contract manufacturers. The outsourcing has not only saved manufacturing costs but also brought the products physically closer to the Asian market where the greatest demand is currently. This has reduced the costs of shipping, breakage, and inventory carrying.Leonora Walet, “Sun Shines Through for Clean Tech Outsourcing,” Reuters, May 3, 2010, accessed September 9, 2010, http://www.reuters.com/article/idUSTRE6421KL20100503.

Opening Case Exercises

(AACSB: Ethical Reasoning, Multiculturalism, Reflective Thinking, Analytical Skills)

- Do you think Q-Cells could have avoided its current financial troubles? What could they have done differently?

- Do you see import or export opportunities for entrepreneurs or small businesses in the solar industry? What advice would you give them?

9.1 What is Importing and Exporting?

Learning Objectives

- Understand what importing and exporting are.

- Learn why companies export.

- Explain the main contractual and investment entry modes.

What Do We Mean by Exporting and Importing?

The history of importing and exporting dates back to the Roman Empire, when European and Asian traders imported and exported goods across the vast lands of Eurasia. Trading along the Silk RoadThe land and water trade routes that covered more than four thousand miles and connected the Mediterranean with Asia. flourished during the thirteenth and fourteenth centuries.Jack Goldstone, Why Europe? The Rise of the West in World History 1500–1850 (New York: McGraw-Hill, 2008). Caravans laden with imports from China and India came over the desert to Constantinople and Alexandria. From there, Italian ships transported the goods to European ports.J. O. Swahn, The Lore of Spices (Gothenburg, Sweden: Nordbok, 1991), 15–17.

For centuries, importing and exporting has often involved intermediaries, due in part to the long distances traveled and different native languages spoken. The spice trade of the 1400s was no exception. Spices were very much in demand because Europeans had no refrigeration, which meant they had to preserve meat using large amounts of salt or risk eating half-rotten flesh. Spices disguised the otherwise poor flavor of the meat. Europeans also used spices as medicines. The European demand for spices gave rise to the spice trade.Antony Wild, The East India Company: Trade and Conquest from 1600 (Guilford, CT: Lyons Press, 2000). The trouble was that spices were difficult to obtain because they grew in jungles half a world away from Europe. The overland journey to the spice-rich lands was arduous and involved many middlemen along the way. Each middleman charged a fee and thus raised the price of the spice at each point. By the end of the journey, the price of the spice was inflated 1,000 percent.Jack Turner, Spice: The History of a Temptation (Westminster, MD: Alfred A. Knopf, 2004), 5.

As explained in Chapter 8 "International Expansion and Global Market Opportunity Assessment", exportingThe sale of products and services in foreign countries that are sourced or made in the home country. is defined as the sale of products and services in foreign countries that are sourced or made in the home country. Importing is the flipside of exporting. ImportingBuying goods and services from foreign sources and bringing them back into the home country. Importing is also known as global sourcing. refers to buying goods and services from foreign sources and bringing them back into the home country. Importing is also known as global sourcing, which will be examined in depth in Section 9.4 "Managing Export and Import".

An Entrepreneur’s Import Success Story

Selena Cuffe started her wine import company, Heritage Link Brands, in 2005. Importing wine isn’t new, but Cuffe did it with a twist: she focused on importing wine produced by black South Africans. Cuffe got the idea after attending a wine festival in Soweto, where she saw more than five hundred wines from eighty-six producers showcased.Selena Cuffe’s bio, African-American Chamber of Greater Cincinnati / Greater Kentucky, accessed September 4, 2010, http://african-americanchamber.com/view-user-profile/selena-cuffe.html. Cuffe did some market research and learned of the $3 billion wine industry in Africa. She also saw a gap in the existing market related to wine produced by indigenous African vintners and decided to fill it. She started her company with $70,000, financed through her savings and credit cards. (In Section 9.5 "What Options Do Companies Have for Export and Import Financing?", you’ll learn about other sources of financing available to entrepreneurs and small businesses as well as to larger enterprises.) In the first year, sales were only $100,000 but then jumped to $1 million in the second year, when Cuffe sold to more than one thousand restaurants, retailers, and grocery stores.South African Chamber of Commerce in America, “Heritage Link Brands, Connecting U.S. Palates to African Wines,” profile, May 4, 2010, accessed September 4, 2010, http://www.sacca.biz/?m=5&idkey=637. Even better, American Airlines began carrying Cuffe’s imported wines on flights, thus providing a steady flow of business amid the more uncertain restaurant market.American Airlines, “Serving Up Wines That Invest in Our Communities,” American Airlines Corporate Responsibility page, accessed September 4, 2010, http://www.aa.com/i18n/aboutUs/corporateResponsibility/caseLibrary/supporting-our-communities.jsp. Cuffe has attributed her success to passion as well as to patience for meeting the multiple regulations required when running an import business.Maritza Manresa, How to Open and Operate a Financially Successful Import Export Business (Ocala, FL: Atlantic Publishing, 2010), 101. (You’ll learn more about these regulations in Section 9.4 "Managing Export and Import").

Exporting is an effective entry strategy for companies that are just beginning to enter a new foreign market. It’s a low-cost, low-risk option compared to the other strategies. These same reasons make exporting a good strategy for small and midsize companies that can’t or won’t make significant financial investment in the international market.

Companies can sell into a foreign country either through a local distributor or through their own salespeople. Many government export-trade offices can help a company find a local distributor. Increasingly, the Internet has provided a more efficient way for foreign companies to find local distributors and enter into commercial transactions.

DistributorsExport intermediaries who represent the company in the foreign market. are export intermediaries who represent the company in the foreign market. Often, distributors represent many companies, acting as the “face” of the company in that country, selling products, providing customer service, and receiving payments. In many cases, the distributors take title to the goods and then resell them. Companies use distributors because distributors know the local market and are a cost-effective way to enter that market.

However, using distributors to help with export can have its own challenges. For example, some companies find that if they have a dedicated salesperson who travels frequently to the country, they’re likely to get more sales than by relying solely on the distributor. Often, that’s because distributors sell multiple products and sometimes even competing ones. Making sure that the distributor favors one firm’s product over another product can be hard to monitor. In countries like China, some companies find that—culturally—Chinese consumers may be more likely to buy a product from a foreign company than from a local distributor, particularly in the case of a complicated, high-tech product. Simply put, the Chinese are more likely to trust that the overseas salesperson knows their product better.

Why Do Companies Export?

Companies export because it’s the easiest way to participate in global trade, it’s a less costly investment than the other entry strategies, and it’s much easier to simply stop exporting than it is to extricate oneself from the other entry modes. An export partner in the form of either a distributor or an export management company can facilitate this process. An export management company (EMC)An independent company that performs for a fee or commission the duties a firm’s own export department would execute such as handling the necessary documentation, finding buyers for the export, and taking title of the goods for direct export. is an independent company that performs the duties that a firm’s own export department would execute. The EMC handles the necessary documentation, finds buyers for the export, and takes title of the goods for direct export. In return, the EMC charges a fee or commission for its services. Because an EMC performs all the functions that a firm’s export department would, the firm doesn’t have to develop these internal capabilities. Most of all, exporting gives a company quick access to new markets.

Benefits of Exporting: Vitrac

Egyptian company Vitrac was founded by Mounir Fakhry Abdel Nour to take advantage of Egypt’s surplus fruit products. At its inception, Vitrac sourced local fruit, made it into jam, and exported it worldwide. Vitrac has acquired money, market, and manufacturing advantages from exporting:Japan External Trade Organization, “Big in Japan,” case study, accessed August 27, 2010, http://www.jetro.go.jp/en/reports/.

- Market. The company has access to a new market, which has brought added revenues.

- Money. Not only has Vitrac earned more revenue, but it has also gained access to foreign currency, which benefits companies located in certain regions of the world, such as in Vitrac’s home country of Egypt.

- Manufacturing. The cost to manufacture a given unit decreased because Vitrac has been able to manufacture at higher volumes and buy source materials in higher volumes, thus benefitting from volume discounts.

Risks of Exporting

There are risks in relying on the export option. If you merely export to a country, the distributor or buyer might switch to or at least threaten to switch to a cheaper supplier in order to get a better price. Or someone might start making the product locally and take the market from you. Also, local buyers sometimes believe that a company which only exports to them isn’t very committed to providing long-term service and support once a sale is complete. Thus, they may prefer to buy from someone who’s producing directly within the country. At this point, many companies begin to reconsider having a local presence, which moves them toward one of the other entry options.

Ethics in Action

Different Countries, Different Food and Drug Rules

Particular products, especially foods and drugs, are often subject to local laws regarding safety, purity, packaging, labeling, and so on. Companies that want to make a product that can be sold in multiple countries will have to comply with the highest common denominator of all the laws of all the target markets. Complying with the highest standard could increase the overall cost of the product. As a result, some companies opt to stay out of markets where compliance with the regulation would be more costly. Is it ethical to be selling a product in one country that another country deems substandard?

Specialized Entry Modes: Contractual

Exporting is a easy way to enter an international market. In addition to exporting, companies can choose to pursue more specialized modes of entry—namely, contracutal modes or investment modes. Contractual modes involve the use of contracts rather than investment. Let’s look at the two main contractual entry modes, licensing and franchsing.

Licensing

LicensingThe granting of permission by the licenser to the licensee to use intellectual property rights, such as trademarks, patents, brand names, or technology, under defined conditions. is defined as the granting of permission by the licenser to the licensee to use intellectual property rights, such as trademarks, patents, brand names, or technology, under defined conditions. The possibility of licensing makes for a flatter world, because it creates a legal vehicle for taking a product or service delivered in one country and providing a nearly identical version of that product or service in another country. Under a licensing agreement, the multinational firm grants rights on its intangible property to a foreign company for a specified period of time. The licenser is normally paid a royalty on each unit produced and sold. Although the multinational firm usually has no ownership interests, it often provides ongoing support and advice. Most companies consider this market-entry option of licensing to be a low-risk option because there’s typically no up-front investment.

For a multinational firm, the advantage of licensing is that the company’s products will be manufactured and made available for sale in the foreign country (or countries) where the product or service is licensed. The multinational firm doesn’t have to expend its own resources to manufacture, market, or distribute the goods. This low cost, of course, is coupled with lower potential returns, because the revenues are shared between the parties.

Franchising

Similar to a licensing agreement, under a franchisingGranting rights on an intangible property, like technology or a brand name, to a foreign company for a specified period of time and receiving a royalty in return. agreement, the multinational firm grants rights on its intangible property, like technology or a brand name, to a foreign company for a specified period of time and receives a royalty in return. The difference is that the franchiser provides a bundle of services and products to the franchisee. For example, McDonald’s expands overseas through franchises. Each franchise pays McDonald’s a franchisee fee and a percentage of its sales and is required to purchase certain products from the franchiser. In return, the franchisee gets access to all of McDonald’s products, systems, services, and management expertise.

Specialized Entry Modes: Investment

Beyond contractual relationships, firms can also enter a foreign market through one of two investment strategies: a joint venture or a wholly owned subsidiary.

Joint Ventures

An equity joint ventureA contractual strategic partnership between two or more separate business entities to pursue a business opportunity together; each partner contributes capital and resources in exchange for an equity stake and share in any resulting profits. is a contractual, strategic partnership between two or more separate business entities to pursue a business opportunity together. The partners in an equity joint venture each contribute capital and resources in exchange for an equity stake and share in any resulting profits. (In a nonentity joint venture, there is no contribution of capital to form a new entity.)

To see how an equity joint venture works, let’s return to the example of Egyptian company, Vitrac. Mounir Fakhry Abdel Nour founded his jam company to take advantage of Egypt’s surplus fruit products. Abdel Nour initially approached the French jam company, Vitrac, to enter into a joint venture with his newly founded company, VitracEgypt. Abdel Nour supplied the fruit and the markets, while his French partner supplied the technology and know-how for producing jams.

In addition to exporting to Australia, the United States, and the Middle East, Vitrac began exporting to Japan. Sales results from Japan indicated a high demand for blueberry jam. To meet this demand—in an interesting twist, given Vitrac’s origin—Vitrac had to import blueberries from Canada. Vitrac thus was importing blueberries from Canada, manufacturing the jam in Egypt, and exporting it to Japan.Japan External Trade Organization, “Big in Japan,” case study, accessed August 27, 2010, http://www.jetro.go.jp/en/reports/.

Using French Vitrac’s manufacturing know-how, Abdel Nour had found a new supply and the opportunity to enter new markets with it, thus expanding his partner’s reach. The partnership fit was good. The two companies’ joint venture continued for three years, until the French company sold its shares to Abdel Nour, making Vitrac a 100 percent owned and operated Egyptian company. Abdel Nour’s company reached $22 million in sales and was the Egyptian jam-market leader before being bought by a larger Swiss company, Hero.“Egypt/Switzerland: Hero Acquires Egyptian Jam Market Leader,” Just-Food, October 8, 2002, accessed September 5, 2010, http://www.just-food.com/news/hero-acquires-egyptian-jam-market-leader_id69297.aspx.

Risks of Joint Ventures

Equity joint ventures pose both opportunities and challenges for the companies involved. First and foremost is the challenge of finding the right partner—not just in terms of business focus but also in terms of compatible cultural perspectives and management practices.

Second, the local partner may gain the know-how to produce its own competitive product or service to rival the multinational firm. This is what’s currently happening in China. To manufacture cars in China, non-Chinese companies must set up joint ventures with Chinese automakers and share technology with them. Once the contract ends, however, the local company may take the knowledge it gained from the joint venture to compete with its former partner. For example, Shanghai Automotive Industry (Group) Corporation, which worked with General Motors (GM) to build Chevrolets, has plans to increase sales of its own vehicles tenfold to 300,000 in five years and to compete directly with its former partner.Ian Rowley, “Chinese Carmakers Are Gaining at Home,” BusinessWeek, June 8, 2009, 30–31.

Did You Know?

In the past, joint ventures were the only relationship foreign companies could form with Chinese companies. In fact, prior to 1986, foreign companies could not wholly own a local subsidiary. The Chinese government began to allow equity joint ventures in 1979, which marked the beginning of the Open Door Policy, an economic liberalization initiative. The Chinese government strongly encouraged equity joint ventures as a way to gain access to the technology, capital, equipment, and know-how of foreign companies. The risk to the foreign company was that if the venture soured, the Chinese company could end up keeping all of these assets. Often, Chinese companies only contributed things like land or tax concessions that foreign companies couldn’t keep if the venture ended. As of 2010, equity joint ventures between a Chinese company and a foreign partner require a minimum equity investment by the foreign partner of at least 33 to 70 percent of the equity, but there’s no minimum investment set for the Chinese partner.Atma Global Knowledge Media, “Entry Models into the Chinese Market,” CultureQuest 2003.

Wholly Owned Subsidiaries

Firms may want to have a direct operating presence in the foreign country, completely under their control. To achieve this, the company can establish a new, wholly owned subsidiary (i.e., a greenfield venture) from scratch, or it can purchase an existing company in that country. Some companies purchase their resellers or early partners (as VitracEgypt did when it bought out the shares that its partner, Vitrac, owned in the equity joint venture). Other companies may purchase a local supplier for direct control of the supply. This is known as vertical integration.

Establishing or purchasing a wholly owned subsidiary requires the highest commitment on the part of the international firm, because the firm must assume all of the risk—financial, currency, economic, and political.

Did You Know?

McDonald’s has a plant in Italy that supplies all the buns for McDonald’s restaurants in Italy, Greece, and Malta. International sales has accounted for as much as 60 percent of McDonald’s annual revenue.Annual revenue in 2008 was $23.5 billion, of which 60 percent was international. See Suzanne Kapner, “Making Dough,” Fortune, August 17, 2009, 14.

Cautions When Purchasing an Existing Foreign Enterprise

As we’ve seen, some companies opt to purchase an existing company in the foreign country outright as a way to get into a foreign market quickly. When making an acquisition, due diligence is important—not only on the financial side but also on the side of the country’s culture and business practices. The annual disposable income in Russia, for example, exceeds that of all the other BRIC countries (i.e., Brazil, India, and China). For many major companies, Russia is too big and too rich to ignore as a market. However, Russia also has a reputation for corruption and red tape that even its highest-ranking officials admit. Presidential economic advisor Arkady Dvorkovich (whose office in the Kremlin was once occupied by Soviet leader Leonid Brezhnev), for example, advises, “Investors should choose wisely” which regions of Russia they locate their business in, warning that some areas are more corrupt than others.Carol Matlack, “The Peril and Promise of Investing in Russia,” BusinessWeek, October 5, 2009, 48–51. Corruption makes the world less flat precisely because it undermines the viability of legal vehicles, such as licensing, which otherwise lead to a flatter world.

The culture of corruption is even embedded into some Russian company structures. In the 1990s, laws inadvertently encouraged Russian firms to establish legal headquarters in offshore tax havens, like Cyprus. A tax havenA country that has very advantageous (low) corporate income taxes. is a country that has very advantageous (low) corporate income taxes.

Businesses registered in these offshore tax havens to avoid certain Russian taxes. Even though companies could obtain a refund on these taxes from the Russian government, “the procedure is so complicated you never actually get a refund,” said Andrey Pozdnyakov, cofounder of Siberian-based Elecard.Carol Matlack, “The Peril and Promise of Investing in Russia,” BusinessWeek, October 5, 2009, 48–51.

This offshore registration, unfortunately, is a danger sign to potential investors like Intel. “We can’t invest in companies that have even a slight shadow,” said Intel’s Moscow-based regional director Dmitry Konash about the complex structure predicament.Carol Matlack, “The Peril and Promise of Investing in Russia,” BusinessWeek, October 5, 2009, 48–51.

Did You Know?

Some foreign companies believe that owning their own operations in China is an easier option than having to deal with a Chinese partner. For example, many foreign companies still fear that their Chinese partners will learn too much from them and become competitors. However, in most cases, the Chinese partner knows the local culture—both that of the customers and workers—and is better equipped to deal with Chinese bureaucracy and regulations. In addition, even wholly owned subsidiaries can’t be totally independent of Chinese firms, on whom they might have to rely for raw materials and shipping as well as maintenance of government contracts and distribution channels.

Collaborations offer different kinds of opportunities and challenges than self-handling Chinese operations. For most companies, the local nuances of the Chinese market make some form of collaboration desirable. The companies that opt to self-handle their Chinese operations tend to be very large and/or have a proprietary technology base, such as high-tech or aerospace companies—for example, Boeing or Microsoft. Even then, these companies tend to hire senior Chinese managers and consultants to facilitate their market entry and then help manage their expansion. Nevertheless, navigating the local Chinese bureaucracy is tough, even for the most-experienced companies.

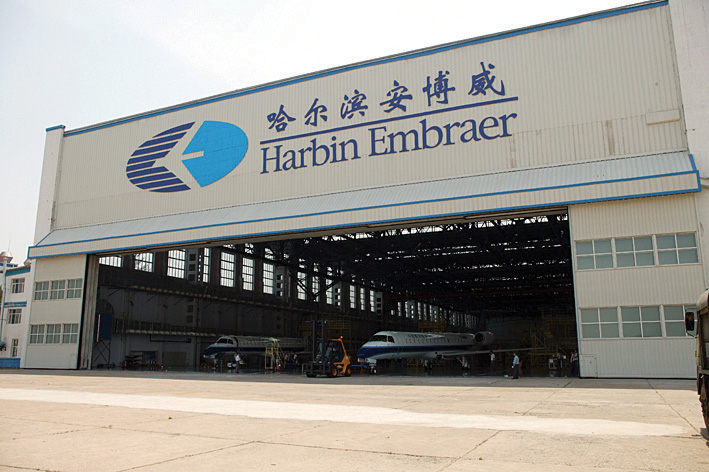

Let’s take a deeper look at one company’s entry path and its wholly owned subsidiary in China. Embraer is the largest aircraft maker in Brazil and one of the largest in the world. Embraer chose to enter China as its first foreign market, using the joint-venture entry mode. In 2003, Embraer and the Aviation Industry Corporation of China jointly started the Harbin Embraer Aircraft Industry. A year later, Harbin Embraer began manufacturing aircraft.

Source: © Embraer

In 2010, Embraer announced the opening of its first subsidiary in China. The subsidiary, called Embraer China Aircraft Technical Services Co. Ltd., will provide logistics and spare-parts sales, as well as consulting services regarding technical issues and flight operations, for Embraer aircraft in China (both for existing aircraft and those on order). Embraer will invest $18 million into the subsidiary with a goal of strengthening its local customer support, given the steady growth of its business in China.

Guan Dongyuan, president of Embraer China and CEO of the subsidiary, said the establishment of Embraer China Aircraft Technical Services demonstrates the company’s “long-term commitment and confidence in the growing Chinese aviation market.”United Press International, “Brazil’s Embraer Expands Aircraft Business into China,” July 7, 2010, accessed August 27, 2010, http://www.upi.com/Business_News/2010/07/07/Brazils-Embraer-expands-aircraft-business-into-China/UPI-10511278532701.

Building Long-Term Relationships

Developing a good relationship with regulators in target countries helps with the long-term entry strategy. Building these relationships may include keeping people in the countries long enough to form good ties, since a deal negotiated with one person may fall apart if that person returns too quickly to headquarters.

Did You Know?

One of the most important cultural factors in China is guanxi (pronounced guan shi), which is loosely defined as a connection based on reciprocity. Even when just meeting a new company or potential partner, it’s best to have an introduction from a common business partner, vendor, or supplier—someone the Chinese will respect. China is a relationship-based society. Relationships extend well beyond the personal side and can drive business as well. With guanxi, a person invests with relationships much like one would invest with capital. In a sense, it’s akin to the Western phrase “You owe me one.”

Guanxi can potentially be beneficial or harmful. At its best, it can help foster strong, harmonious relationships with corporate and government contacts. At its worst, it can encourage bribery and corruption. Whatever the case, companies without guanxi won’t accomplish much in the Chinese market. Many companies address this need by entering into the Chinese market in a collaborative arrangement with a local Chinese company. This entry option has also been a useful way to circumvent regulations governing bribery and corruption, but it can raise ethical questions, particularly for American and Western companies that have a different cultural perspective on gift giving and bribery.

Conclusion

In summary, when deciding which mode of entry to choose, companies should ask themselves two key questions:

- How much of our resources are we willing to commit? The fewer the resources (i.e., money, time, and expertise) the company wants (or can afford) to devote, the better it is for the company to enter the foreign market on a contractual basis—through licensing, franchising, management contracts, or turnkey projects.

- How much control do we wish to retain? The more control a company wants, the better off it is establishing or buying a wholly owned subsidiary or, at least, entering via a joint venture with carefully delineated responsibilities and accountabilities between the partner companies.

Regardless of which entry strategy a company chooses, several factors are always important.

- Cultural and linguistic differences. These affect all relationships and interactions inside the company, with customers, and with the government. Understanding the local business culture is critical to success.

- Quality and training of local contacts and/or employees. Evaluating skill sets and then determining if the local staff is qualified is a key factor for success.

- Political and economic issues. Policy can change frequently, and companies need to determine what level of investment they’re willing to make, what’s required to make this investment, and how much of their earnings they can repatriate.

- Experience of the partner company. Assessing the experience of the partner company in the market—with the product and in dealing with foreign companies—is essential in selecting the right local partner.

Companies seeking to enter a foreign market need to do the following:

- Research the foreign market thoroughly and learn about the country and its culture.

- Understand the unique business and regulatory relationships that impact their industry.

- Use the Internet to identify and communicate with appropriate foreign trade corporations in the country or with their own government’s embassy in that country. Each embassy has its own trade and commercial desk. For example, the US Embassy has a foreign commercial desk with officers who assist US companies on how best to enter the local market. These resources are best for smaller companies. Larger companies, with more money and resources, usually hire top consultants to do this for them. They’re also able to have a dedicated team assigned to the foreign country that can travel the country frequently for the later-stage entry strategies that involve investment.

Once a company has decided to enter the foreign market, it needs to spend some time learning about the local business culture and how to operate within it.

Key Takeaways

- Exporting is the sale of products and services in foreign countries that are sourced or made in the home country. Importing refers to buying goods and services from foreign sources and bringing them back into the home country.

- Companies export because it’s the easiest way to participate in global trade, it’s a less costly investment than the other entry strategies, and it’s much easier to simply stop exporting than it is to extricate oneself from the other entry modes. The benefits of exporting include access to new markets and revenues as well as lower manufacturing costs due to higher manufacturing volumes.

- Contractual forms of entry (i.e., licensing and franchising) have lower up-front costs than investment modes do. It’s also easier for the company to extricate itself from the situation if the results aren’t favorable. On the other hand, investment modes (joint ventures and wholly owned subsidiaries) may bring the company higher returns and a deeper knowledge of the country.

Exercises

(AACSB: Reflective Thinking, Analytical Skills)

- What are the risks and benefits associated with exporting?

- Name two contractual modes of entry into a foreign country. Which do you think is better and why?

- Why would a company choose to use a contractual mode of entry rather than an investment mode?

- What are the advantages to a company using a joint venture rather than buying or creating its own wholly owned subsidiary when entering a new international market?

9.2 Countertrade

Learning Objectives

- Understand what countertrade is.

- Recognize why companies engage in countertrade.

- Know two structures of countertrade.

What Is Countertrade?

Some countries limit the profits (currency) a company can take out of a country. As a result, many companies resort to countertradeThe situation in which companies trade goods and services for other goods and services; actual monies are only involved to a lesser degree, if at all., where companies trade goods and services for other goods and services; actual monies are involved only to a lesser degree, if at all. You can imagine that limitations on transferring profits would make the world less flat; so too would the absence of countertrade opportunities in situations where currency transfer limitations are in place. Countertrade is also a resourceful way for exporters to sell their products and services to foreign companies or countries that would be unable to pay for them using hard currency alone.

All kinds of companies, from food and beverage company PepsiCo to power and automation technologies giant the ABB Group, engage in countertrade. When PepsiCo wanted to enter the Indian market, the government stipulated that part of PepsiCo’s local profits had to be used to purchase tomatoes. This requirement worked for PepsiCo, which also owned Pizza Hut and could export the tomatoes for overseas consumption.

This is one example of countertrade, specifically counterpurchase. By establishing this requirement, the Indian government was able to help a local agricultural industry, thereby mitigating criticism of letting a foreign beverage company into the country.

Another example in which companies exchanged goods and services rather than paying hard currency is Bharat Heavy Electricals Limited (BHEL), the largest power generation equipment manufacturer in India. BHEL wanted to secure additional overseas orders. To accomplish this, BHEL looked for countertrade opportunities with other state-owned firms. The company entered into a joint effort with an Indian, state-owned mineral-trading company, MMTC Ltd., to import palm oil worth $1 billion from Malaysia, in return for setting up a hydropower project in that nation. Malaysia is the second-largest producer of palm oil in the world. Because India imports an average of 8 million tons of edible oil every year but consumes 15 million tons, importing edible oil is valuable.Utpal Bhaskar and Asit Ranjan, “Bhel Looking at Counter-Trade Deals to Secure Overseas Orders,” Live Mint, May 11, 2010, accessed November 18, 2010, http://www.livemint.com/2010/05/11224356/Bhel-looking-at-countertrade.html.

Why Do Companies Engage in Countertrade?

One reason that companies engage in this practice is that some governments mandate countertrade on very large-scale (over $1 million) deals or if the deal is in a certain industry. For example, South Korea mandates countertrade for government telecommunications procurement over $1 million. When governments impose counterpurchase obligations, firms have no choice but to engage in countertrade if they wish to sell goods into that country.

Countertrade also can mitigate the risk of price movements or currency-exchange-rate fluctuations. Because both sides of a countertrade deal in real goods, not financial instruments, countertrade can solve the inflation risk involved in foreign currency procurement. In effect, countertrade can be a better mechanism than financial instruments as a way to hedge against inflation or currency fluctuations.Sang-Rim Choi and Adrian E. Tschoegl, “Currency Risks, Government Procurement and Counter-Trade: A Note,” Applied Financial Economics 13, no. 12 (December 2003): 885–89.

Finally, countertrade offers a way for companies to repatriate profits. As you’ll see in Chapter 15 "Understanding the Roles of Finance and Accounting in Global Competitive Advantage", some governments restrict how much currency can flow out of their country. (Governments do this to preserve foreign exchange reserves.) Countertrade offers a way for companies to get profits back to the home country via goods rather than money.

Structures in Countertrade

The very first trading—thousands of years ago—was based on barter. BarterThe direct exchange of one good for another, with no money involved. is simply the direct exchange of one good for another, with no money involved. Thus, barter predates even the invention of money.

Does barter still take place today? Yes—and not just among two local businesses exchanging something like a haircut for a therapeutic massage. Thanks to new innovations and the Internet, barter is taking place across international borders. For example, consider the Bartercard. Established in 1991, Bartercard functions like a credit card, but instead of funding the card through cash in a bank account, a company funds the card with its own goods and services. No cash is needed. Over 75,000 trading members in thirteen countries are using the Bartercard, doing $1.3 billion in cashless transactions annually.Bartercard website, accessed November 23, 2010, http://bci.bartercard.com.

In a counterpurchaseThe situation in which the seller receives cash contingent on the seller buying local products or services in the amount of (or a percentage of) the cash. structure, the seller receives cash contingent on the seller buying local products or services in the amount of (or a percentage of) the cash. Simply put, counterpurchase occurs when the seller receives cash but contractually agrees to buy local products or services with that cash.

Disadvantages of Countertrade

Countertrade has a tarnished image due to its associations with command economies during the Cold War, when the goods received were often useless or of poor quality but were forced upon companies by command-economy government regulations. New research is showing that countertrade transactions have legitimate economic rationales, but the risk of receiving inferior goods continues.Peter W. Liesch and Dawn Birch, “Research on Business-to-Business Barter in Australia,” in Getting Better at Sensemaking, ed. Arch G. Woodside, Advances in Business Marketing and Purchasing, vol. 9 (Bingley, UK: Emerald Group Publishing, 2001), 353–84. Most countertrade structures, except for barter, make sense only for very large firms that can take a product like palm oil and—in turn—trade it in a useful way. That’s why BHEL partnered with MMTC on the Malaysia countertrade deal—because MMTC specializes in bulk commodities. Similarly, PepsiCo was able to make use of the tomatoes it was required to counterpurchase because it also operates a pizza business.

Key Takeaways

- Countertrade refers to companies that trade goods and services for other goods and services; actual monies are involved only to a lesser degree, if at all. Although countertrade had a tainted reputation during the Cold War days, it’s a useful way for exporters to trade with developing countries that may not be able to pay for the goods in hard currency.

- Companies engage in countertrade for three main reasons: (1) to satisfy a foreign-government mandate, (2) to hedge against price and currency fluctuations, and (3) to repatriate profits from countries that limit the amount of currency that can be taken out of the country.

- Barter is a structure of countertrade that has been around for thousands of years and continues today. Counterpurchase is a countertrade structure that involves the seller receiving cash contingent on the seller buying local products or services in the amount of (or a percentage of) the cash.

Exercises

(AACSB: Reflective Thinking, Analytical Skills)

- What are some of the disadvantages of countertrade?

- Describe an example of how counterpurchasing works.

- Does barter still make sense in the modern world? Who might engage in barter? What advantages might they gain?

9.3 Global Sourcing and Its Role in Business

Learning Objectives

- Identify what global sourcing is.

- Learn what comprises the best practices in global sourcing.

- Recognize the difference between outsourcing and global sourcing.

What Is Global Sourcing?

Global sourcingBuying raw materials, components, or services from companies outside the home country. refers to buying the raw materials, components, or services from companies outside the home country. In a flat world, raw materials are sourced from wherever they can be obtained for the cheapest price (including transportation costs) and the highest comparable quality.

Recall the discussion of the spice trade in Section 9.1 "What is Importing and Exporting?". Europeans sourced spices from China and India. The long overland trade routes required many payments to intermediaries and local rulers, raising prices of spices 1,000 percent by the end of the journey. Such a markup naturally spurred Europeans to look for other trade routes and sources of spices. The desire for spices and gold is what ultimately led Christopher Columbus to secure funding for his voyage across the Atlantic Ocean. Even before that, Portuguese ships were sailing down the coast of Africa. In the 1480s, Portuguese ships were returning to Europe laden with African melegueta pepper. This pepper was inferior to the Far Eastern varieties, but it was much cheaper. By 1500, pepper prices dropped by 25 percent due to the new sources of supply.Edwin S. Hunt and James M. Murray, A History of Business in Medieval Europe, 1200–1550 (Cambridge, UK: Cambridge University Press, 1999), 229.

Today, the pattern of global sourcing continues as a way to obtain commodities and raw materials. But sourcing now is much more expanded; it includes the sourcing of components, of complete manufactured products, and of services as well.

There are many companies that export to a country while sourcing from that same country. For example, Apple sells iPods and iPads to China, and it also manufactures and sources components in China.

Best Practices in Global Sourcing

Given the challenges of global sourcing, large companies often have a staff devoted to overseeing the company’s overseas sourcing process and suppliers, managing the relationships, and handling legal, tax and administrative issues.

Judging Quality from Afar: ISO 9000 Certification

How can companies know that the products or services they’re sourcing from a foreign country are of good quality? The mark of good quality around the world is ISO 9000 certification. In 1987, the International Organization of Standardization (ISO) developed uniform standards for quality guidelines. Prior to December 2000, three ISO standards were used: ISO 9001, ISO 9002, and ISO 9003. These standards were collectively referred to as ISO 9000. In 2000, the standards were merged into a revised ISO 9001 standard named ISO 9001:2000. In 2008, a new revision was issued, ISO 9001:2008. The standards are voluntary, but companies can demonstrate their compliance with the standard by passing certification. (Companies that had achieved ISO 9001:2000 certification were required to be recertified to meet ISO 9001:2008 standards.) The certification is a mark that the company’s products and services have met quality standards and that the company has quality management processes in place. Companies of any size can get certified. To ensure high-quality products, some companies require that their suppliers be certified before they will source products or services from them. ISO 9001:2008 certification is a “seal of quality” that is trusted around the world.

In addition to quality standards, ISO also developed ISO 14000 standards, which focus on the environment. Specifically, ISO 14000 certification shows that the company works to minimize any harmful effects it may have on the environment.

Over the years, companies have learned to manage for quality and consistency.

- Companies can use unannounced inspections to verify that their suppliers meet quality-assurance standards (although this is costly when suppliers are far away).

- For consistency, to avoid disruption in getting goods, Walmart makes sure that no supplier does more than 25 percent of their business with Walmart.

- Companies can evaluate supplier performance. Cost isn’t everything. Many companies use scorecards to evaluate suppliers from whom they source components. Cost is part of the scorecard, of course, but often it represents only part of the evaluation, not all of it. Instead, companies look at issues such as supply continuity, as well as whether the relationship is based on openness and trust.

Trends in Sourcing: Considering Carbon Costs

One of the rising concerns about global sourcing is that of the carbon footprint of goods traveling long distances. A carbon footprintA measure of the impact that activities like transportation and manufacturing have on the environment, especially on climate change. Includes daily activities, such as using electricity or driving, because of the greenhouse gases produced through burning fossil fuels for electricity, heating, transportation, and so on. The higher the carbon footprint, the worse the impact on the environment. is a measure of the impact that activities like transportation and manufacturing have on the environment, especially on climate change. (The “footprint” is the impact, and “carbon” is shorthand for all the different greenhouse gases that contribute to global warming.Mike Berners-Lee and Duncan Clark, “What Is a Carbon Footprint?,” Green Living Blog, Guardian, June 4, 2010, accessed September 12, 2010, http://www.guardian.co.uk/environment/blog/2010/jun/04/carbon-footprint-definition.) Everyone’s daily activities, such as using electricity or driving, have a carbon footprint because of the greenhouse gases produced by burning fossil fuels for electricity, heating, transportation, and so on. The higher the carbon footprint, the worse the activity is for the environment.

In global sourcing, although transporting goods by air and truck has a high carbon footprint due to the fossil fuels burned, ocean transport doesn’t. Also, the carbon-footprint measure doesn’t just focus on distance; it looks at all the fossil fuels used in the manufacture of an item. For example, when one looks at the total picture of how much energy is required to make a product, the carbon footprint of transportation may be less than the carbon footprint of the manufacturing process. Some regions have natural advantages. For example, it is more environmentally friendly to smelt aluminum in Iceland than locally because of the tremendous amount of electricity required for smelting. Iceland has abundant geothermal energy, which has no carbon footprint compared to generating electricity by burning coal. It’s better for the environment to smelt the aluminum in Iceland and then ship it elsewhere.

Similarly, it is more environmentally sound for people in the United Kingdom to buy virgin wood from Sweden than to buy recycled paper made in the United Kingdom. Why? Sweden uses nuclear energy to make paper, which has a much lower carbon footprint than electricity in the United Kingdom, which is generated by burning coal. Even though the paper is recycled, the electricity costs of recycling make it more harmful to the environment.

Perhaps one of the most-effective changes companies can make to help the environment is to work collaboratively with their trading partners. For example, an agreement between potato-chip manufacturers and potato suppliers eliminated wasted resources. Specifically, the physics of frying potato chips requires boiling off the water in the potato, which consumes a large amount of energy. Although boiling off the water would seem to be a requirement in the cooking process, UK-based Carbon Trust discovered a man-made practice that increased these costs. Potato-chip manufacturers buy potatoes by weight. Potato suppliers, to get the most for their potatoes, soak the potatoes in water to boost their weight, thus adding unnecessary water that has to be boiled off. By changing the contracts so that suppliers are paid more for less-soggy potatoes, suppliers had an incentive to use less water, chip makers needed to expend less energy to boil off less water, and the environment benefited from less water and energy waste. These changes had a much more beneficial impact on the environment than would have been gained by a change in transportation.MIT Center for Transportation and Logistics and Council of Supply Chain Management Professionals, “Achieving the Energy-Efficient Supply Chain” (symposium, Royal Sonesta Hotel, Cambridge, MA, April 30, 2007).

Outsourcing versus Global Sourcing

In outsourcingThe company delegates an entire process (e.g., accounts payable) to the outsource vendor. The vendor takes control of the operations and runs the operations as they see fit. The company pays the outsource vendor for the end result; how the vendor achieves the end result is up to the vendor., the company delegates an entire process (e.g., accounts payable) to an outsource vendor. The vendor takes control of the operation and runs the operation as it sees fit. The company pays the outsource vendor for the end result; how the vendor achieves those end results is up to the vendor.

Companies outsource for numerous reasons. There are many advantages to outsourcing:

- Reducing costs by moving labor to a lower-cost country

- Speeding up the pace of innovation by hiring engineers in a developing market at much lower cost

- Funding development projects that would otherwise be unaffordable

- Liberating expensive home-country-based engineers and salespeople from routines tasks, so that they can focus on higher value-added work or interacting with customers

- Putting a standard business practice out to bid, in order to lower costs and let the company respond with flexibility. If a new method of performing the function becomes advantageous, the company can change vendors to take advantage of the new development, without incurring the delays of hiring and training new employees on the process.

Pharmaceutical company Eli Lilly and Company uses outsourcing to bring down the cost of developing a new drug, which stands at $1.1 billion. Lilly hopes to bring down the cost to $800 million through outsourcing. The company is outsourcing the heart of the research effort—drug development—to contract research organizations (CROs).Jonathan D. Rockoff, “Lilly Taps Contractors to Revive Pipeline,” Wall Street Journal, January 5, 2010, accessed September 7, 2010, http://online.wsj.com/article/SB10001424052748704247504574604503922019082.html. It does 20 percent of its chemistry work in China, for one-quarter the US cost. Lilly hopes to reduce the cost of clinical trials as well, by expanding those efforts to BRIC countries (i.e., Brazil, Russia, India, and China).Paul McDougall, “Drug Company Eli Lilly Outsources Clinical Data to India,” InformationWeek, November 20, 2006, accessed September 7, 2010, http://www.informationweek.com/news/global-cio/outsourcing/showArticle.jhtml?articleID=194500067; Patricia Van Arnum, “Outsourcing Clinical Trial Development and Materials,” Pharmaceutical Technology 6, no. 34 (June 2, 2010): 44–46.

The Hidden Costs of Outsourcing

Although outsourcing’s costs savings, such as labor costs, are easy to see, some of the hidden costs aren’t as visible. For example, high-tech products that spend months traveling by ocean face product obsolescence, deterioration, spoilage, taxes, loss due to damage or theft, and increased administrative and business travel costs. Threats of terrorism, religious strife, changing governments, and failing economies are further issues of concern. Stanley Furniture, a US maker of home furnishings, decided to bring its offshore production back home after product recalls from cribs made in Slovenia, transportation costs, and intellectual property issues outweighed the advantages of cheap goods and labor.Sarah Kabourek, “Back in the USA,” Fortune, September 28, 2009, 30. All of these hidden costs add up to a world that is less than flat.

Manufacturing outsourcing is also called contract manufacturing. The move to contract manufacturingThe outsourcing of manufacturing. means that companies like IBM have less control over manufacturing than they did when they owned the factories. Contract-manufacturing companies such as Celestica are making IBM products alongside Hewlett-Packard (HP) and Dell products. Celestica’s own financial considerations influence whether it gives preference to IBM, HP, or Dell if there is a rush on manufacturing. The contract manufacturer’s best efforts will go to whichever client negotiated the best terms and highest price; this makes companies more vulnerable to variability.

Quanta Computer, based in Taiwan, is the largest notebook-computer contract manufacturer in the world. Quanta makes laptops for Sony, Dell, and HP, among others. In June 2010, Quanta shipped 4.8 million laptops, a laptop-shipment record.Carter Sprunger, “Quanta Computer Breaks Laptop Shipment Record in June,” Notebooks, July 9, 2010, accessed October 28, 2010, http://notebooks.com/2010/07/09/quanta-computer-breaks-laptop-shipment-record-in-june. For consumer electronics, outsourcing has become the dominant way of doing business.

Managing Outsourced Services

If a company outsources a service, how does it guarantee the quality of that service? One way is through service-level agreements. Service-level agreements (SLAs)A contract that specifies the service levels that an outsourcer must meet when performing the service to ensure quality and performance when outsourcing services. contractually specify the service levels that the outsourcer must meet when performing the service. SLAs are one way that companies ensure quality and performance when outsourcing services. SLAs typically include the following components:

-

Scope of services

- Frequency of service

- Quality expected

- Timing required

- Cost of service

-

Communications

- Dispute-resolution procedures

- Reporting and governance

- Key contacts

- Performance-improvement objectives

Johns Hopkins Enterprise’s SLA for Accounts Receivable

Johns Hopkins Enterprise expects the following service levels for accounts receivable:

- Contact the customer after forty-five days if the open invoice is greater than $10,000.

- Contact the customer after sixty days if the open invoice is between $3,000 and $10,000.

- Contact the customer after ninety days if the open invoice is less than $3,000.

- Contact the department within two days if the customer claims the invoice will not be paid due to performance. At this point, it is the department’s responsibility to resolve and the invoice will be closed as uncollectible. Once the disagreement with the customer is resolved, a new invoice will be issued.

- All issues that the A/R Service Center can fix will be completed within three business days. Follow-up calls will be made within five business days.“Accounts Receivable Shared Service Center Service Level Agreement,” Johns Hopkins Enterprise, last updated July 1, 2009, accessed November 23, 2010, http://ssc.jhmi.edu/accountsreceivable/inter_entity.html.

Entrepreneurial Opportunities from Outsourcing

Crimson Consulting Group is a California-based firm that performs global market research on everything from routers to software for clients including Cisco Systems, HP, and Microsoft. Crimson has only fourteen full-time employees, which would be too few to handle these market research inquiries. But Crimson outsources some of the market research to Evalueserve in India and some to independent experts in China, the Czech Republic, and South Africa. “This allows a small firm like us to compete with McKinsey and Bain on a very global basis with very low costs,” said Crimson CEO Glenn Gow.Pete Engardio with Michael Arndt and Dean Foust, “The Future of Outsourcing,” BusinessWeek, January 30, 2006, accessed November 18, 2010, http://www.businessweek.com/magazine/content/06_05/b3969401.htm.

For example, imagine a company that has an idea for a new medical device, but lacks market research into the opportunity. The company could outsource its market research to a firm like Evalueserve. For a relatively small fee, the outsourced firm could, within a day, assemble a team of Indian patent attorneys, engineers, and business analysts, start mining global databases, and call dozens of US experts and wholesalers to provide an independent market-research report.

Key Takeaways

- Global sourcing refers to buying the raw materials, components, complete products, or services from companies located outside the home country.

- Information technology and communications have enabled the outsourcing of business processes, enabling those processes to be performed in different countries around the world.

-

Best practices in global sourcing include the following components:

- Using ISO 9001:2008 certification to help ensure the quality of products regardless of where they are produced

- Considering not just the quality of products but also the environmental practices of the company providing the products, through ISO 14000 certification

- Using service-level agreements to ensure the quality of services

- Entrepreneurs benefit from outsourcing because they can acquire services as needed, without having to build those capabilities internally.

Exercises

(AACSB: Reflective Thinking, Analytical Skills)

- Why do companies source globally?

- What are some ways in which to ensure quality from unknown suppliers?

- When and how would you use a service-level agreement?

- Is contract manufacturing the same as outsourcing?

- Explain the advantages and disadvantages of outsourcing.

9.4 Managing Export and Import

Learning Objectives

- Learn the main players in export and import.

- Recognize the role of intermediaries.

- Identify some of the documents needed for export and import transactions.

Who Are the Main Actors in Export and Import?

The size of exports in the world grew from less than $100 million after World War II to well over $11 trillion today. Export and import is big business, but it isn’t just for big businesses. Most of the participants are small and midsize businesses, making this an exciting opportunity for entrepreneurs.

Importing and exporting require much documentationThe official forms that must be presented to satisfy the import and export regulations of countries and for payment to be processed. (i.e., filing official forms) to satisfy the regulations of countries. The value of the documentation is that it enables trade between entities who don’t know each other. The parties are able to trust each other because the documentation provides a common framework and process to ensure that each party will do what they say in the import/export transaction.

The main parties involved in export and import transactions are the exporter, the importer, and the carrier. The exporterA person or organization that sells products and services in foreign countries that are sourced from the home country. is the person or entity sending or transporting the goods out of the country. The importerA person or organization that sells products and services that are sourced from other countries. is the person or entity buying or transporting goods from another country into the importer’s home country. The carrierThe entity handling the physical transportation of the goods, such as UPS, FedEx, and DHL. is the entity handling the physical transportation of the goods. Well-known carriers across the world are United Parcel Service (UPS), FedEx, and DHL.

CustomsA governmental agency that monitors imports and collects import duties on goods coming into the country. administration offices in both the home country and the country to which the item is being exported are involved in the transaction. In the United States, the US Customs Service became the US Bureau of Customs and Border Protection (CBP) after the terrorist attacks on September 11, 2001. The mandate now isn’t simply to move goods through customs quickly and efficiently to facilitate international trade; it also ensures that the items coming into the United States are validated and safe as well. Robert Bonner took the position as commissioner of the Customs Service on September 10, 2001. On his second day on the job at 10:05 a.m. EDT, he had to close all the airports, seaports, and border ports of entry. The priority mission of the Customs Service became security—preventing terrorists and terrorist weapons from entering the country. On the third day, however, the trade and business implications of shutting down the borders became visible. Border crossings that used to take ten to twenty minutes were taking ten to twelve hours. Automobile plants in Detroit, using just-in-time delivery of parts for cars, began to shut down on September 14 due to a lack of incoming supplies and parts. Businesses were going to have a difficult time operating if the borders were closed. Thus, the twin goals of the newly created CBP became security as well as trade facilitation. As Bonner explained, “In the past, the United States had no way to detect weapons coming into our borders. We had built a global trading system that was fast and efficient, but that had no security measures.”Robert Bonner, “Supply Chain Security: Government-Industry Partnership” (presentation at the Resilient and Secure Supply Chain symposium, MIT, Cambridge, MA, September 29, 2005).

Mary Murphy-Hoye, a senior principal engineer at Intel, put it simply: “Our things move in big containers, and the US Department of Homeland Security is worried about them. Security means knowing what is it, where is it, where has it been, and has anyone messed with it.”Mary Murphy Hoye, “Future Capabilities in the Supply Chain” (presentation at the MIT Center for Transportation and Logistics conference, MIT, Cambridge, MA, May 8, 2007).

After September 11, the twin goals of safety and facilitation were met through three interrelated initiatives:

- The twenty-four-hour rule, requiring advanced information prior to loading

- An automated targeting system to evaluate all inbound freight

- Sophisticated detection technology for scanning high-risk containers

Cooperation for Security

The World Customs Organization (WCO) created a framework that calls for cooperation between the customs administrations of different countries. Under the WCO Framework of Standards to Secure and Facilitate Global Trade, if a customs administration in one country identifies problems in cargo from another country, that customs administration could ask the exporting country to do an inspection before goods are shipped. Businesses across the world benefit (in terms of speed and cost) if there is one common set of security standards globally, and the WCO is working toward that goal.World Customs Organization, “WCO Presents Draft Framework of Standards at Consultative Session in Hong Kong, China,” news release, March 25, 2005, accessed September 7, 2010, http://www.wcoomd.org/press/default.aspx?lid=1&id=78.

Role of Intermediaries

In addition to the main players described above, intermediaries can get involved at the discretion of the importer or exporter. Entrepreneurs and small and midsize businesses, in particular, make use of these intermediaries, rather than expending their resources to build these capabilities in-house.

A freight forwarderEntity that typically prepares the documentation, suggests shipping methods, navigates trade regulations, and assists with details like packing and labeling. typically prepares the documentation, suggests shipping methods, navigates trade regulations, and assists with details like packing and labeling. At the foreign port, the freight forwarder arranges to have the exported goods clear customs and be shipped to the buyer. The process ends with the freight forwarder sending the documentation to the seller, buyer, or intermediary, such as a bank.

As you learned in Chapter 14 "Competing Effectively through Global Marketing, Distribution, and Supply-Chain Management", Section 14.1 "Fundamentals of Global Marketing", an export management company (EMC) is an independent company that performs the duties a firm’s export department would execute. The EMC handles the necessary documentation, finds buyers for the export, and takes title of the goods for direct export. In return, the EMC charges a fee or a commission for its services.

Banks perform the vital role of finance transactions. The role of banks will be examined in Chapter 14 "Competing Effectively through Global Marketing, Distribution, and Supply-Chain Management", Section 14.5 "Global Production and Supply-Chain Management".

What’s Needed for Import and Export Transactions?

Various forms of documentation are required for import and export transactions.

The bill of ladingThe contract between the exporter and the carrier, authorizing the carrier to transport the goods to the buyer’s destination; acts as proof that the shipment was made and that the goods have been received. is the contract between the exporter and the carrier (e.g., UPS or FedEx), authorizing the carrier to transport the goods to the buyer’s destination. The bill of lading acts as proof that the shipment was made and that the goods have been received.

A commercial or customs invoiceThe bill for the goods shipped from the exporter to the importer or buyer. is the bill for the goods shipped from the exporter to the importer or buyer. Exporters send invoices to receive payment, and governments use these invoices to determine the value of the goods for customs-valuation purposes.

Did You Know?

IBM does business with 160 countries. Daily, it sends 2,500 customs declarations and ships 5.5 million pounds of products worth $68 million.Theo Fletcher, “Global Collaboration for Security” (presentation at the Resilient and Secure Supply Chain symposium, MIT, Cambridge, MA, September 29, 2005).

The export declarationDocumentation that provides the contact information of both the exporter and the importer (i.e., buyer) as well as a full description, declared value, and destination of the products being shipped. is given to customs and port authorities. The declaration provides the contact information for both the exporter and the importer (i.e., buyer) as well as a description of the items being shipped, which the CPB uses to verify and control the export. The government also uses the information to compile statistics about exports from the country.

Humorous Anecdote

Customs regulations in some countries—particularly emerging-market countries—may impede or complicate international trade. A study of the speed and efficiency of items getting through customs in different countries found that it can take anywhere from three to twenty-one days to clear incoming goods. This variation causes problems because companies can’t plan on a steady flow of goods across the border. Some countries have customs idiosyncrasies. In Brazil, for example, no goods move within the country on soccer game days and documents that are not signed in blue ink will incur delays for their accompanying goods.“Supply Chain Strategies in Emerging Markets” (roundtable discussion at the MIT Center for Transportation and Logistics, MIT, Cambridge, MA, March 7, 2007).

The certificate of originDocumentaion that declares the country from which the product originates., as its name implies, declares the country from which the product originates. These certificates are required for import duties. These import duties are lower for countries that are designated as a “most favored nation.”

Certificate of Origin as Marketing Tool

Not all governments or industries require certificates of origin to be produced, but some companies are seeing that a certificate of origin can be used for competitive advantage. For example, Eosta, an importer of organic fruit, puts a three-digit number on each piece of fruit. At the website http://www.natureandmore.com, customers can type in that number and get a profile of the farmer who grew the fruit, getting a glimpse into that farmer’s operations. For example, Fazenda Tamanduá, a farm in Brazil, grows mangoes using a variety that needs less water to grow and a drip-irrigation system that optimizes water use. This database gives customers a way to learn about growers and provides a way for growers and others to share what they learn.Daniel Goleman, Ecological Intelligence (New York: Crown Business, 2009), 191. Providing this type of certification to customers differentiates Eosta products and makes them more attractive to sustainability-minded consumers.

Although not required, insurance certificatesDocumentation that shows the amount of insurance coverage on the goods and identifies the merchandise. show the amount of coverage on the goods and identify the merchandise. Some contracts or invoices may require proof of insurance in order to receive payment.

Some governments require the purchase of a licensePurchased permission to export goods from a country. (i.e., permission to export) for goods due to national security or product scarcity. Interestingly, licenses for import and export date back to the 1500s at least, when Japan required a system of licenses to combat the smuggling of goods taking place.Maritza Manresa, How to Open and Operate a Financially Successful Import Export Business (Ocala, FL: Atlantic Publishing, 2010), 20.

Impact of Trade Agreements

Trade agreements impact the particulars of doing business. For example, the North American Free Trade Agreement (NAFTA) makes Mexico different from other Latin American countries due to the ease of movement of goods between that country and the United States. Changes in agreements can affect the competitiveness of different countries. When China joined the World Trade Organization (WTO), the rapid elimination of tariffs and quotas on textiles harmed US makers.

The letter of creditA legal document issued by a bank at the importer’s (or buyer’s) request in which the importer promises to pay a specified amount of money when the bank receives documents about the shipment. is a legal document issued by a bank at the importer’s (or buyer’s) request. The importer promises to pay a specified amount of money when the bank receives documents about the shipment. Simply put, the letter of credit is like a loan against collateral (in this case, the goods being shipped) in which the funds are placed in an escrow account held by the bank. Letters of credit are trusted forms of payment in international trade because the bank promises to make the payment on behalf of the importer (i.e., buyer) and the bank is a trusted entity. Given that the letter of credit is like a loan, getting one issued from the bank requires proof of the importer’s (or buyer’s) ability to pay the amount of the loan.

Chapter 14 "Competing Effectively through Global Marketing, Distribution, and Supply-Chain Management", Section 14.5 "Global Production and Supply-Chain Management" is devoted to the broad topic of the payment and financing associated with import and export transactions.

Key Takeaways

-

There are several main parties involved in export and import transactions:

- The exporter, who is the person or entity sending or transporting the goods out of the country

- The importer, who is the person or entity buying or transporting goods from another country into the importer’s home country

- The carrier, which is the entity handling the physical transportation of the goods

- The customs-administration offices from both the home country and the foreign country

- Intermediaries, such as freight forwarders and export management companies (EMC), provide companies with expert services so that the firms don’t have to build those capabilities in-house. You could argue that such intermediaries make the world flatter, while the regulations and institutions that they help the firm deal with actually make the world less flat. Freight forwarders specialize in identifying the best shipping methods, understanding trade regulations, and arranging to have exported goods clear customs. EMCs handle the necessary documentation, find buyers for the export, and take title of the goods for direct export.

- Essential documents for importing and exporting include the bill of lading, which is the contract between the exporter and the carrier; the export declaration, which the customs office uses to verify and control the export; and the letter of credit, which is the legal document in which the importer promises to pay a specified amount of money to the exporter when the bank receives proper documentation about the shipment.

Exercises

(AACSB: Reflective Thinking, Analytical Skills)

- Name the four main players in export and import transactions.

- What role do intermediaries play in export and import transactions?

- Explain the purpose of a letter of credit.

- What is the difference between the export declaration and the commercial or customs invoice? How are they related?

9.5 What Options Do Companies Have for Export and Import Financing?

Learning Objectives

- Understand how companies receive or pay for goods and services.

- Learn the basics of export financing.

- Discover the role of organizations like OPIC, JETRO, and EX-IM Bank.

How Companies Receive or Pay for Goods and Services