This is “You Need Quality Resources as Well as Quantity”, chapter 6 from the book Business Strategy (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 6 You Need Quality Resources as Well as Quantity

Overview

Not all resources of a given type are identical: Customers differ in size and profitability, staff differ in experience, and so on. This chapter will show you the following:

- how to assess the quality of your resources

- how resources bring with them potential access to others

- how you can improve resource quality

- how to upgrade the quality of an entire strategic architecture

6.1 Assessing the Quality of Resources

Few resources are as uniform as cash: Every dollar bill is the same as all the others. Most resources, however, vary in important ways:

- Customers may be larger or smaller, highly profitable or less so.

- Products may appeal to many customers or few, and satisfy some, many, or all of their needs.

- Staff may have more experience or less, and cost you high salaries or low.

A single resource may even carry several characteristics that influence how the resource stock as a whole affects other parts of the system. Individual bank customers, for example, feature different balances in their accounts, different numbers of products they use from the bank, different levels of risk of defaulting on loans, and so on. A resource attributeA characteristic that varies among different items in a single pool of resources. is a characteristic that varies between different items in a single pool of resources. These differences within each type of resource will themselves change through time. For example, if we lose our most profitable customers our operating profits will fall faster than if we lose only average customers.

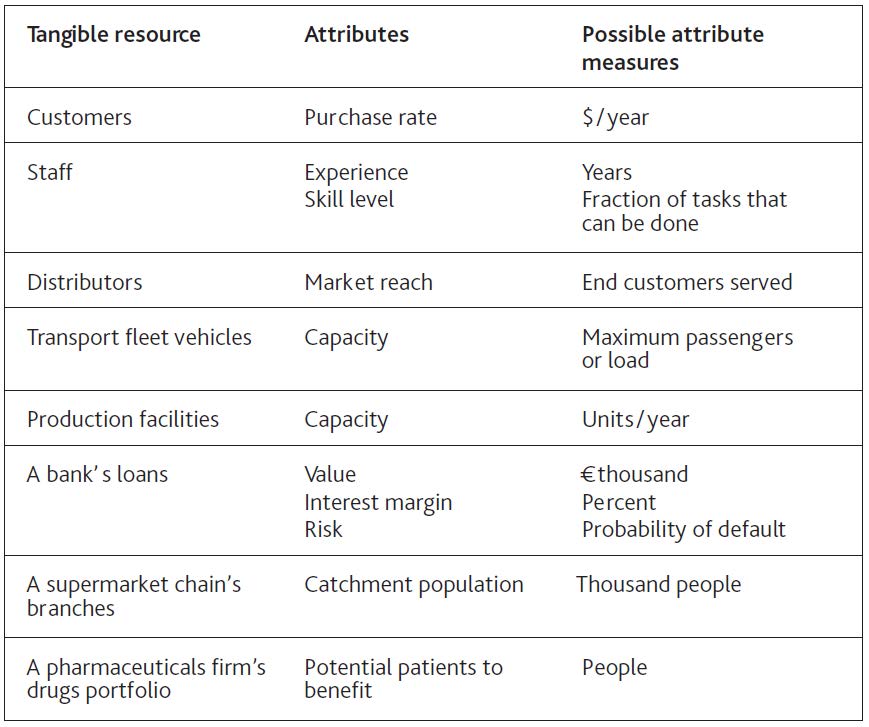

If we are to understand how much difference such attributes make, it is just as important to measure each resource’s attributes as they change through time as it is to measure that resource’s overall quantity. Figure 6.1 "Examples of Attributes for Certain Resources" offers some measures that may apply in different cases. The right choice of measures will depend on the particular attribute influencing the issue you are concerned with.

We know that managing resources is tricky because they fill and drain away over time and depend on each other. To this challenge we must now add the problem that when a resource is won or lost, it brings or takes these attributes with it.

Figure 6.1 Examples of Attributes for Certain Resources

Moreover, attributes may be potential rather than actual and still require efforts on our part if they are to be developed. Opening a new retail store, for example, brings with it access to the population around that store. Those potential customers will only become actual customers if our stores provide attractive products, prices, and service.

Understanding Resource Attributes

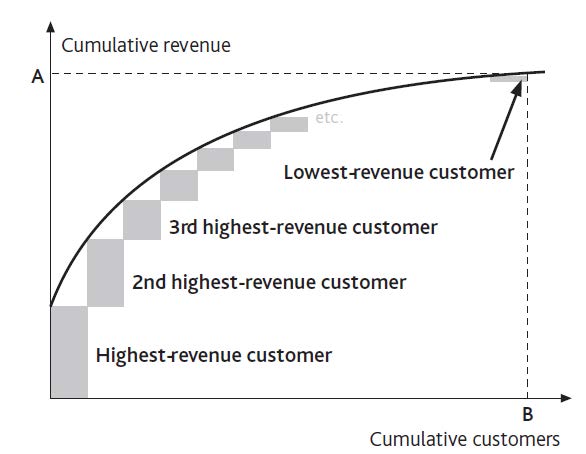

Consider a firm concerned that it has too many small customers. To picture the extent of the problem, take the annual revenue contributed by the largest customer alone and add to it the contribution from the second largest, then the third, and so on. If we carry on doing this until the entire customer base is accounted for, we get a curve of cumulative revenue versus cumulative customers (Figure 6.2 "Revenue-Generating Profile of a Customer Base").

Not only is this a record of the present situation, but it can also be used to decide policy. The extent of the “tail” of small customers is visible, and average customer revenue can be easily calculated. Managers can discuss the relative merits of pruning the customer base by various degrees:

- If the customer base is reduced, what reduction in support costs should be feasible?

- What is the risk that cutting off small customers may cause others to leave?

- Could we inadvertently strengthen rivals by giving them a more viable business with the customers we are abandoning?

- What is the scope for replacing poor customers with better ones?

Figure 6.2 Revenue-Generating Profile of a Customer Base

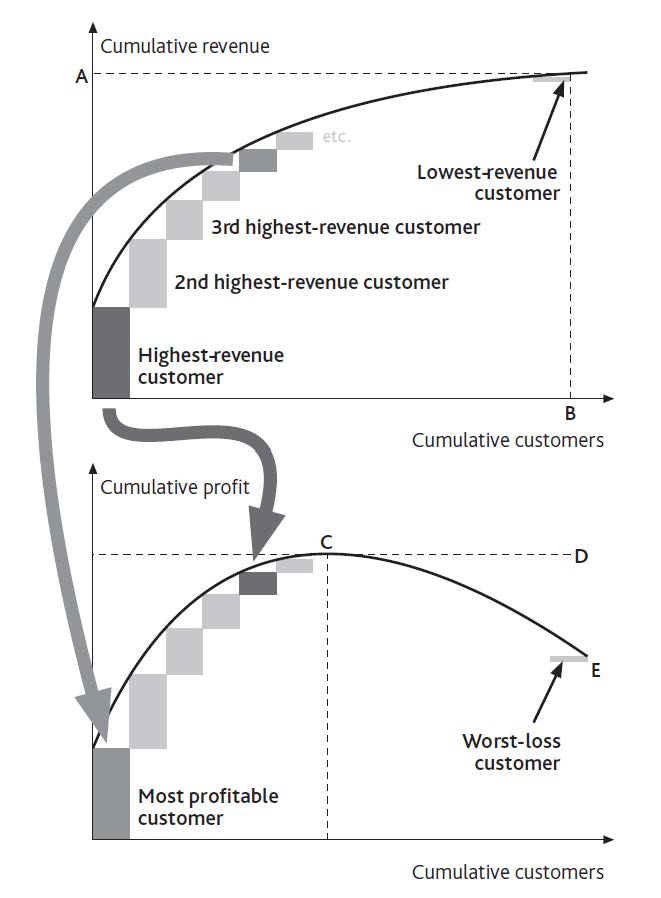

It is important, however, to focus on the correct attribute for the intended purpose. Customer revenue is one useful measure but does not necessarily correspond to customer profitability. Figure 6.3 "Profitability Profile of a Customer Base" shows the link between the two attributes. It includes loss-makers: The positive contribution from the profitable customers on the left is partly negated by the losses from unprofitable customers on the right.

Here are two common observations to bear in mind:

- The biggest customer (or product, or salesperson) is often not the biggest contributor to profit. The biggest customers, for example, often drive the hardest bargain on price, and may even be unprofitable to serve. The products that best meet customers’ needs may incur higher than average production costs or require heavy service support. And one law firm found that its star partner who brought in the most clients actually produced losses for the firm by underpricing the work sold to them!

- Conversely, the customers (products or staff) who contribute most to profitability may not be the biggest.

You may need to think more widely about which attributes are important, apart from revenue and profit contribution. Most banks, for example, are engaged in a competitive pursuit of individuals with high net worth. These customers have large potential deposits and borrowing needs on which a bank can make a good margin. However, they are also the best informed and least loyal of customers, often following the best deals from bank to bank. Far from being the most valuable customers, they can be the most costly to serve.

The shape of the curves in Figure 6.3 "Profitability Profile of a Customer Base" should not simply be accepted as given but should be challenged. The airline industry offers a dramatic example. Customers who were willing to pay only low fares have been unprofitable to the major carriers for decades; they were far to the right on Figure 6.3 "Profitability Profile of a Customer Base". Southwest, Ryanair, easyJet, and the others rewrote the rule book, and the profit curve kept on climbing as more customers were added. They lifted point E above point D.

Figure 6.3 Profitability Profile of a Customer Base

There can be a limit to this potential, however, especially if fierce competition develops. In an effort to push revenues and profits still higher, these airlines risk extending the curves far out to the right. Sure, you might be able to capture another 1,000 customers by offering flights for $10, but if those passengers now cost more to win and serve than they contribute, they generate very little revenue and negative profits. This certainly proved to be the case for those banks who got overenthusiastic in offering subprime mortgages in the years up to 2008.

The tail of problem customers can completely wipe out the contribution from the profitable ones: Point E in Figure 6.3 "Profitability Profile of a Customer Base" can drop below zero. Such situations are especially punishing, and not simply because the business is unprofitable overall. The problematic resources impose heavy demands on the rest of the system and take up managers’ attention.

In retailing, for example, unprofitable branches are often disproportionately costly in terms of delivery, are frequently left with the least able management, and suffer from high staff turnover. Both McDonald’s (in the years up to 2002) and Starbucks (prior to 2005) fell into this trap, and both had to dig their way out of the problem caused by overexpansion. As the returning CEO of McDonald’s said in 2002, “We are in transition from a company that emphasizes ‘adding restaurants to customers’ to one that emphasizes ‘adding customers to restaurants’” (McDonald’s Corporation, 2003). This will continue to be a challenging issue for Blockbuster to manage as its stores suffer erosion of their sales by postal and online movie supply services.

Managing the Profit Distribution Curve

Figure 6.3 "Profitability Profile of a Customer Base" is an improvement on Figure 6.2 "Revenue-Generating Profile of a Customer Base" but must still be handled with care. It may be unwise to eliminate all customers to the right of point C, for several reasons:

- It may not be possible to cut overheads in line with customer numbers. Eliminating all customers between points C and E would simply raise the overhead burden on the profitable customers to the left. The curve could be squashed to the left but with the profit peak at an even lower level than point E.

- Individual resources often develop along the quality curve. Banks know that they have to put up with unreliable and unprofitable students because when they get good jobs, they will become less risky and their financial needs will develop.

- Poor resources may be linked to good ones. Banks take good care of nuisance youngsters for another reason: Their parents are often customers. If banks are too hard on the kids, they risk losing profitable business from the parents.

These cautionary points should not be overstated. When people argue that customers or products are interdependent and have great potential, take care to make an objective assessment. Do they really have great potential? Would you really lose some important business if you removed them?

Finally, note that it may be possible to do good business serving customers that, for other companies, are unattractive. The large information technology (IT) service providers such as EDS, Infosys, and CSC, for example, would not be interested for a moment in serving small business clients, but there is a thriving market for small computer support service providers among those same small clients. Taken to the extreme, it is even possible to develop attractive business models that focus exclusively on serving the poorest customers (Prahalad, 2006).

6.2 Managing Resource Attributes: The “Coflow” Structure

If we are to add a clear picture of resource attributes to our strategic architecture, we need to capture their dynamics accurately. Three mechanisms cause attribute levels to change:

- Directly increasing the attribute without making any change to the tangible resource itself. Banks, for example, may win a larger share from existing customers by getting more of their savings or borrowing requirements.

- Obtaining new, better quality resources with more of the desired attribute. This raises the average quality of our total resource pool. Bringing in poorer quality resources, on the other hand, dilutes the average quality. As noted above, many retailers have fallen into the trap of adding stores that reach fewer and fewer new customers. Similarly, low-fare airlines are struggling to find as yet undeveloped routes that attract sufficient new passengers to be worthwhile.

- Losing resources that have too little of the desired attribute. This raises the average quality of those that remain; for example, dropping unprofitable customers or discontinuing unpopular products.

These three mechanisms are all positive, raising the quality of the resource in question, but each has a negative counterpart. An attribute may simply decline, as when staff forget key skills, be diluted by adding lower quality items (hiring unskilled staff), or disappear, as when a high-quality resource is lost (losing skilled staff).

This process is captured by a framework known as a “coflowA framework of assessing and managing attributes by viewing the inflow of a given resource relative to the connected flow of its attributes.,” so called because the inflow of a given resource (staff, say) brings with it a connected flow of its attribute (their skill). Similar effects occur for many other resources in many other contexts (Sterman, 2000, chap. 12).

Doing It Right: How to Think About Attributes

A helpful way to think about an attribute builds on the idea of resources as water in a bathtub. You can think of the attribute as the heat the water holds:

- If your bath is too cold, you can raise the temperature by turning on the hot tap. The hotter the new water is, the less you have to add to raise the overall temperature.

- You could also add heat by putting a heater in the bath (do not try this for real!). Product obsolescence, a decline in your customers’ business, and staff forgetting their skills can be thought of as your bath cooling down. Management, however, works like a heater directly in the bath: training can be used to raise skill levels, product development to improve the product range, and business development to boost the profitability of an account base.

- Lastly, resources have a neat characteristic that bath water does not share: You can selectively remove the coldest water (the least skilled staff, the worst customer accounts, the least successful products) and so leave hotter water behind. You cannot do this with your bath, but you can with your organization’s resources.

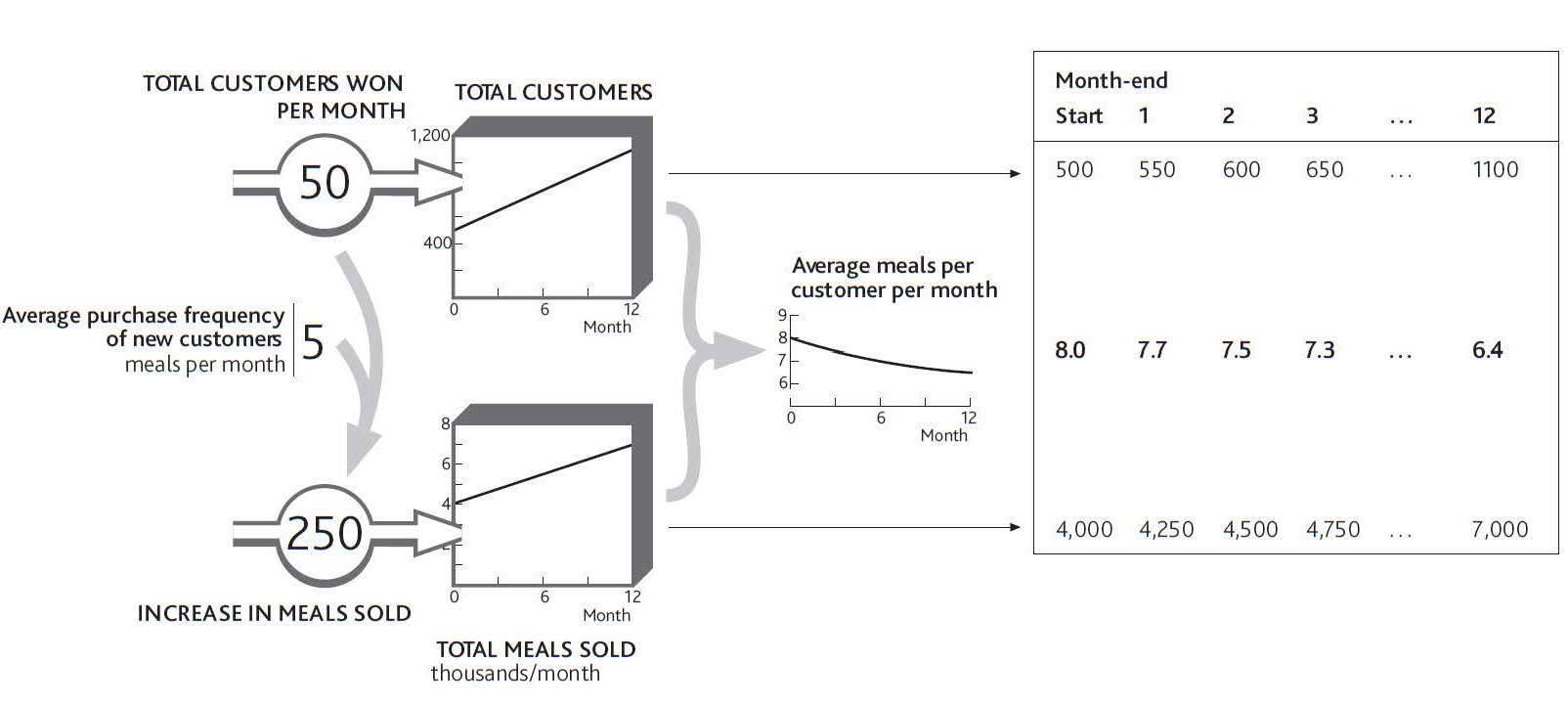

Let us go back to the example of your restaurant from earlier chapters. Imagine that it starts to win more customers, but these new customers eat with you less often than your regulars do (Figure 6.4 "Dilution of Average Client Quality"). Regular customers all visited eight times per month, but these new people only visit five times per month. After one month of adding 50 customers per month, you now have 550 regulars. If they visited as often as the 500 initial customers, you would be selling at the rate of 4,400 meals per month. Instead, these 50 new people bring just 250 extra meals per month, so on average your customers are now visiting just over 7.7 times per month.

This framework does have an important limitation, in that you lose some of the detail by lumping all these customers together. Inside the stock of 550 customers at the end of month 1, for example, there may be some making 12 visits per month, others 10 per month, others 8 per month, and so on. To see this detail you would need to build a quality curve like that in Figure 6.2 "Revenue-Generating Profile of a Customer Base". But this can mean extra work, so explore the detailed resource quality profile (Figure 6.2 "Revenue-Generating Profile of a Customer Base") only if it is essential to answer the specific issue of concern.

Figure 6.4 Dilution of Average Client Quality

Doing It Right: Calculating Average Attributes

You might think that the easiest way to work out these attributes is to put their average quantity in the stock that “coflows” with the resource. In Figure 6.4 "Dilution of Average Client Quality", surely you should show the average meals per customer in the resource tank instead of the total meals sold per month. Unfortunately it is very difficult to work out the numbers that way.

The lower tank in such cases (total meals sold per month) is keeping a check on the total heat in your bathtub. This can have some curious effects. For example, if you want to track employees’ average experience, your resource stock carries the number of staff, say 200, and the lower stock carries their total combined experience: say 2,200 person-years. The average experience is thus the resource quantity divided by the attribute quantity, that is, 2,200/200 = 11 years.

A further result of this approach is that it can lead you seemingly to break the rules of what is or is not a resource. Telecom firms, for example, track average revenue per user (ARPU). If you have 1.5 million subscribers, each giving you an average of $40 per month in revenue, then the 1.5 million subscribers go in the top tank, but the bottom tank holds $60 million per month, that is, your total revenue. ARPU is thus the ratio between these two stocks. “But surely,” you may remind us, “we agreed in Chapter 2 "Resources: Vital Drivers of Performance" that revenue is not a resource?” It is not; we are using it here only to track an important quality of the subscribers.

If the telecom firm wants a higher ARPU, it has three options: increase the average revenue from existing customers, add higher usage customers, or lose low-revenue customers.

6.3 Problems Caused by Resource Attributes

Understanding resource attributes and how to manage them gives you still more control over the performance you can develop from your business architecture. But you also need to be conscious of the troubles they can cause. Some of the most common challenges that attributes produce are as follows:

- Resources only bring access to other resources, which means that you still have to work to develop them. In Figure 6.4 "Dilution of Average Client Quality", your restaurant attracted new customers and you immediately enjoyed new sales. But such immediacy does not always apply. Sometimes resources bring with them only potential resources that we then have to develop if we are to turn them into active resources. A new product may bring with it the possibility of serving the needs of many new customers, but we still have to develop these customers. A newly appointed dealer may provide access to new end users for our products, but that dealer still has to sell the benefits to them before they will become active users.

- Potential resources can dry up. I mentioned in Chapter 3 "Resources and Bathtub Behavior" that managers can easily be blind to the drying up of potential resources; now we have the further problem that any resources that do remain are likely to be of poorer quality too. This challenge of diminishing returns is often simply ignored. It is more comfortable to assume that the great opportunity associated with the early expansion of our business is going to continue on the same attractive trajectory.

- Cannibalization can set in. To these two problems we must add a third: cannibalization. There will come a point when new routes opened by an airline start to divert active passengers away from existing routes. Leisure travelers in particular select from a range of possible destinations, so if you add a new one, some people will probably migrate to the new offering. The bigger you get, the more this is going to happen. So resource items that were originally high in quality deteriorate as you take more away from them.

Action Checklist: Upgrading Your Resources

As you assess how your organization is doing and where it may be capable of going, extend your thinking beyond the quantity of resources that you have and can win and focus on their quality. Obvious resources to view in this way include customers, staff, and products.

- Consider the attributes of the resources you currently have. What exactly is the quality of each resource, and how is this quality distributed? Do you have a uniformly valuable group of key staff, products, or customers, for example, or do you rely on a handful of stars?

- Find out how those qualities are changing. Are your customer base and revenue growing but only through the addition of low-value business? Or are you making inroads into really good-quality customers? At what rate do you hope to improve that quality over time and to what level?

- How healthy are your resources overall? Do you have low-value customers, marginally valued products, and staff working unproductively to support these poor-quality resources? If so, you may have to consider rationalizing the whole system to a smaller but more powerful and competitive core.

- Consider potential resources. Are you focusing on building business with a new potential resource, but failing to capture that potential? Or is there an opportunity to use new markets or products, that bring with them the chance to reach out to new customers?

- Finally, be sure you are not approaching any quality problems. Is any potential resource in danger of running out? Are resources declining in quality? Is there a danger of resources cannibalizing each other? If any of these problems are approaching, can you do anything to escape their grip, or do you have to recognize the resulting limits and begin reconfiguring your organization?

Remember, the only way to understand what these phenomena really mean for your organization is to work out the numbers.