This is “Corporations”, section 11.3 from the book Business and the Legal and Ethical Environment (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

11.3 Corporations

Learning Objectives

- Learn about the advantages and disadvantages of corporations.

- Study roles and duties of shareholders, directors, and officers in corporations.

- Explore issues surrounding corporate governance.

- Understand how corporations are taxed.

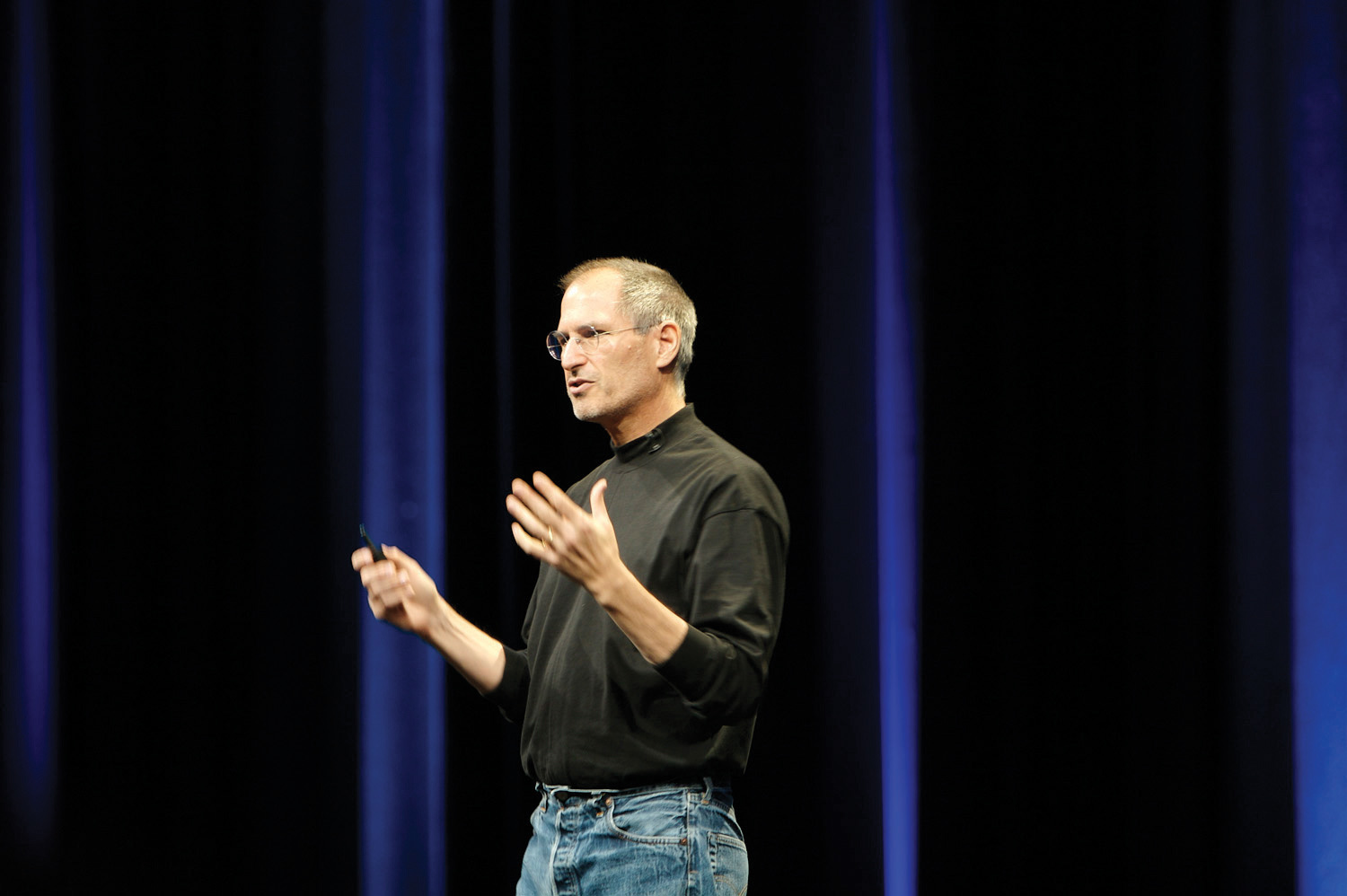

Figure 11.4 Apple Cofounder Steve Jobs

Source: Photo courtesy of acaben, http://www.flickr.com/photos/acaben/541334636/sizes/o.

So far in this chapter, we have explored sole proprietorships and partnerships, two common and relatively painless ways for persons to conduct business operations. Both these forms of business come with significant disadvantages, however, especially in the area of liability. The idea that personal assets may be placed at risk by business debts and obligations is rightfully scary to most people. Businesses therefore need a form of business organization that provides limited liability to owners and is also flexible and easy to manage. That is where the modern corporationA legal entity chartered by the state, with a separate and distinct existence from its owners. comes in.

Consider, for example, tech entrepreneur and Apple cofounder Steve Jobs (Figure 11.4 "Apple Cofounder Steve Jobs"). As a young man, he was a college dropout without much ability for computer engineering. If doing business as a sole proprietor was his only option, Apple would not exist today. However, Jobs met a talented computer engineer named Steve Wozniak, and the two decided to pool their talents to form Apple Computer in1976. A year later, the company was incorporatedOrganized and created into a legal corporation. and in 1980 went public in an initial public offering (IPO)The first time a corporation sells its shares to members of the public.. Incorporation allowed Jobs much more flexibility in carrying out business operations than a mere sole proprietorship could. It allowed him to bring in other individuals with distinct skills and capabilities, raise money in the early stage of operations by promising shares in the new company, and eventually become very wealthy by selling stockCapital raised by a corporation through issuance of shares entitling owners to an ownership interest., or securitiesAny negotiable instruments representing financial value, such as a bond or stock., in the company.

Hyperlink: Great Things in Business

http://cnettv.cnet.com/60-minutes-steve-jobs/9742-1_53-50004696.html

Sole proprietorships are limiting not just in a legal sense but also in a business sense. As Steve Jobs points out in this video, great things in business are never accomplished with just one person; they are accomplished with a team of people. While Jobs may have had the vision to found Apple Inc. and maintains overall strategic leadership for the company, the products the company releases today are very much the result of the corporation, not any single individual.

Unlike a sole proprietorship or general partnership, a corporation is a separate legal entity, separate and distinct from its owners. It can be created for a limited duration, or it can have perpetual existence. Since it is a separate legal entity, a corporation has continuity regardless of its owners. Entrepreneurs who are now dead founded many modern companies, and their companies are still thriving. Similarly, in a publicly traded company, the identity of shareholders can change many times per hour, but the corporation as a separate entity is undisturbed by these changes and continues its business operations.

Since corporations have a separate legal existence and have many legal and constitutional rights, they must be formed in compliance with corporate law. Corporate law is state law, and corporations are incorporated by the states; there is no such thing as a “U.S. corporation.” Most corporations incorporate where their principal place of business is located, but not all do. Many companies choose to incorporate in the tiny state of Delaware even though they have no business presence there, not even an office cubicle. Delaware chanceryA court with jurisdiction to decide cases based on equity as well as law. courts have developed a reputation for fairly and quickly applying a very well-developed body of corporate law in Delaware. The courts also operate without a jury, meaning that disputes heard in Delaware courts are usually predictable and transparent, with well-written opinions explaining how the judges came to their conclusions.

Hyperlink: How to Incorporate in Your State

http://www.business.gov/register/incorporation

Since corporations are created, or chartered, under state law, business founders must apply to their respective state agencies to start their companies. These agencies are typically located within the Secretary of State. Click the link to explore how to fill out the forms for your state to start a company. You may be surprised at how quickly, easily, and inexpensively you can form your own company! Don’t forget that your company name must not be the same as another company’s name. (Most states allow you to do a name search first to ensure that name is available.)

To start a corporation, the corporate founders must file the articles of incorporationA legal document that creates a corporation when filed and approved by the relevant state authority. with the state agency charged with managing business entities. These articles of incorporation may vary from state to state but typically include a common set of questions. First, the founders must state the name of the company and whether the company is for-profit or nonprofit. The name has to be unique and distinctive, and must typically include some form of the words “Incorporated,” “Company,” “Corporation,” or “Limited.” The founders must state their identity, how long they wish the company to exist, and the company’s purpose. Under older common law, shareholders could sue a company that conducted business beyond the scope of its articles (these actions are called ultra viresAn act in excess of designated legal power.), but most modern statutes permit the articles to simply state the corporation can carry out “any lawful actions,” effectively rendering ultra vires lawsuits obsolete in the United States. The founders must also state how many sharesUnits of account for a financial instrument, such as stocks. the corporation will issue initially, and the par valueThe face vale of a security as determined by the corporation. Par value has no relation to market value. of those shares. (Of course, the company can issue more shares in the future or buy them back from shareholders.)

Unlike sole proprietorships, corporations can be quite complicated to manage and typically require attorneys and accountants to maintain corporate books in good order. In addition to the foundation requirements, corporate law requires ongoing annual maintenance of corporations. In addition to filing fees due at the time of incorporation, there are typically annual license fees, franchise fees and taxes, attorney fees, and fees related to maintaining minute books, corporate seals, stock certificates and registries, as well as out-of-state registration. A domestic corporationA corporation operating in the state in which it was incorporated. is entitled to operate in its state of incorporation but must register as a foreign corporationA corporation incorporated in a state other than where it is seeking to operate. to do business out of state. Imagine filing as a foreign corporation in all fifty states, and you can see why maintaining corporations can become expensive and unwieldy.

Video Clip: Monstrous Obligations

(click to see video)Video Clip: The Pathology of Commerce

(click to see video)Owners of companies are called shareholdersOwners of a corporation.. Corporations can have as few as one shareholder or as many as millions of shareholders, and those shareholders can hold as few as one share or as many as millions of shares. In a closely held corporationA corporation whose stock is held by only a small number of shareholders., the number of shareholders tends to be small, while in a publicly traded corporation, the body of shareholders tends to be large. In a publicly traded corporation, the value of a share is determined by the laws of supply and demand, with various markets or exchanges providing trading space for buyers and sellers of certain shares to be traded. It’s important to note that shareholders own the share or stock in the company but have no legal right to the company’s assets whatsoever. As a separate legal entity, the company owns the property.

Shareholders of a corporation enjoy limited liability. The most they can lose is the amount of their investment, whatever amount they paid for the shares of the company. If a company is unable to pay its debts or obligations, it may seek protection from creditors in bankruptcy court, in which case shareholders lose the value of their stock. Shareholders’ personal assets, however, such as their own homes or bank accounts, are not reachable by those creditors.

Shareholders can be human beings or can be other corporate entities, such as partnerships or corporations. If one corporation owns all the stock of another corporation, the owner is said to be a parent company, while the company being owned is a wholly owned subsidiaryA company wholly owned or controlled by another company.. A parent company that doesn’t own all the stock of another company might call that other company an affiliateA commercial enterprise with some sort of contractual or equity relationship with another commercial enterprise. instead of a subsidiary. Many times, large corporations may form subsidiaries for specific purposes, so that the parent company can have limited liability or advantageous tax treatment. For example, large companies may form subsidiaries to hold real property so that premises liabilityThe liability of landowners and leaseholders for torts that occur on their real property. is limited to that real estate subsidiary only, shielding the parent company and its assets from tort lawsuits. Companies that deal in a lot of intellectual property may form subsidiaries to hold their intellectual property, which is then licensed back to the parent company so that the parent company can deduct royalty payments for those licenses from its taxes. This type of sophisticated liability and tax planning makes the corporate form very attractive for larger business in the United States.

Corporate law is very flexible in the United States and can lead to creative solutions to business problems. Take, for example, the case of General Motors Corporation. General Motors Corporation was a well-known American company that built a global automotive empire that reached virtually every corner of the world. In 2009 the General Motors Corporation faced an unprecedented threat from a collapsing auto market and a dramatic recession, and could no longer pay its suppliers and other creditors. The U.S. government agreed to inject funds into the operation but wanted the company to restructure its balance sheet at the same time so that those funds could one day be repaid to taxpayers. The solution? Form a new company, General Motors Company, the “new GM.” The old GM was brought into bankruptcy court, where a judge permitted the wholesale cancellations of many key contracts with suppliers, dealers, and employees that were costing GM a lot of money. Stock in the old GM became worthless. The old GM transferred all of GM’s best assets to new GM, including the surviving brands of Cadillac, Chevrolet, Buick, and GMC; the plants and assets those brands rely on; and the shares in domestic and foreign subsidiaries that new GM wanted to keep. Old GM (subsequently renamed as “Motors Liquidation Company”) kept all the liabilities that no one wanted, including obsolete assets such as shuttered plants, as well as unpaid claims from creditors. The U.S. federal government became the majority shareholder of General Motors Company, and may one day recoup its investment after shares of General Motors Company are sold to the public. To the public, there is very little difference in the old and new GM. From a legal perspective, however, they are totally separate and distinct from each other.

One exception to the rule of limited liability arises in certain cases mainly involving closely held corporations. Many sole proprietors incorporate their businesses to gain limited liability but fail to realize when they do so that they are creating a separate legal entity that must be respected as such. If sole proprietors fail to respect the legal corporation with an arm’s-length transactionA transaction made by parties as if they were unrelated, in a free market system, each acting in its own best interest., then creditors can ask a court to pierce the corporate veilAn equitable doctrine allowing creditors to petition a court to not permit limited liability to a corporate shareholder.. If a court agrees, then limited liability disappears and those creditors can reach the shareholder’s personal assets. Essentially, creditors are arguing that the corporate form is a sham to create limited liability and that the shareholder and the corporation are indistinguishable from each other, just like a sole proprietorship. For example, if a business owner incorporates the business and then opens a bank account in the business name, the funds in that account must be used for business purposes only. If the business owner routinely “dips into” the bank account to fund personal expenses, then an argument for piercing the corporate veil can be easily made.

Not all shareholders in a corporation are necessarily equal. U.S. corporate law allows for the creation of different types, or classes, of shareholders. Shareholders in different classes may be given preferential treatment when it comes to corporate actions such as paying dividends or voting at shareholder meetings. For example, founders of a corporation may reserve a special class of stock for themselves with preemptive rightsSometimes known as rights of first refusal, rights given to existing shareholders in a corporation to purchase any newly issued stock to maintain same proportion of their existing holdings.. These rights give the shareholders the right of first refusal if the company decides to issue more stock in the future, so that the shareholders maintain the same percentage ownership of the company and thus preventing dilutionThe result when a corporation issues additional shares, resulting in a reduction of percentage of the corporation owned by shareholders. of their stock.

A good example of different classes of shareholders is in Ford Motor Company stock. The global automaker has hundreds of thousands of shareholders, but issues two types of stock: Class A for members of the public and Class B for members of the Ford family. By proportion, Class B stock is far outnumbered by Class A stock, representing less than 10 percent of the total issued stock of the company. However, Class B stock is given 40 percent voting rights at any shareholder meeting, effectively allowing holders of Class B stock (the Ford family) to block any shareholder resolution that requires two-thirds approval to pass. In other words, by creating two classes of shareholders, the Ford family continues to have a strong and decisive voice on the future direction of the company even though it is a publicly traded company.

Shareholder rights are generally outlined in a company’s articles of incorporation or bylawsRules and regulations adopted by a corporation for its own internal goverance.. Some of these rights may include the right to obtain a dividend, but only if the board of directorsA group of persons elected by shareholders of company to set high-level strategy for the company. approves one. They may also include the right to vote in shareholder meetings, typically held annually. It is common in large companies with thousands of shareholders for shareholders to not attend these meetings and instead cast their votes on shareholder resolutions through the use of a proxyA person authorized to act on behalf of a shareholder at a shareholders’ meeting..

Video Clip: Activist Shareholders at Wal-Mart

(click to see video)Under most state laws, including Delaware’s business laws, shareholders are also given a unique right to sue a third party on behalf of the corporation. This is called a shareholder derivative lawsuitA lawsuit brought by a shareholder on behalf of a corporation against a third party. (so called because the shareholder is suing on behalf of the corporation, having “derived” that right by virtue of being a shareholder). In essence, a shareholder is alleging in a derivative lawsuit that the people who are ordinarily charged with acting in the corporation’s best interests (the officers and directors) are failing to do so, and therefore the shareholder must step in to protect the corporation. These lawsuits are very controversial because they are typically litigated by plaintiffs’ lawyers working on contingency fees and can be very expensive for the corporation to litigate. Executives also disfavor them because oftentimes, shareholders sue the corporate officers or directors themselves for failing to act in the company’s best interest.

One of the most important functions for shareholders is to elect the board of directors for a corporation. Shareholders always elect a director; there is no other way to become a director. The board is responsible for making major decisions that affect a corporation, such as declaring and paying a corporate dividendA portion of a corporation’s net income designated by the board of directors and returned to shareholders on a per share basis. to shareholders; authorizing major new decisions such as a new plant or factory or entry into a new foreign market; appointing and removing corporate officers; determining employee compensation, especially bonus and incentive plans; and issuing new shares and corporate bondsA debt obligation issued by corporations to raise money without selling stock.. Since the board doesn’t meet that often, the board can delegate these tasks to committees, which then report to the board during board meetings.

Shareholders can elect anyone they want to a board of directors, up to the number of authorized board members as set forth in the corporate documents. Most large corporations have board members drawn from both inside and outside the company. Outside board members can be drawn from other private companies (but not competitors), former government officials, or academe. It’s not unusual for the chief executive officer (CEO) of the company to also serve as chair of the board of directors, although the recent trend has been toward appointing different persons to these functions. Many shareholders now actively vie for at least one board seat to represent the interests of shareholders, and some corporations with large labor forces reserve a board seat for a union representative.

Board members are given wide latitude to make business decisions that they believe are in the best interest of the company. Under the business judgment ruleA legal assumption that prevents courts or juries from second-guessing decisions made by directors, unless they are proven to act with bad faith or corrupt motive., board members are generally immune from second-guessing for their decisions as long as they act in good faith and in the corporation’s best interests. Board members owe a fiduciary duty to the corporation and its shareholders, and therefore are presumed to be using their best business judgment when making decisions for the company.

Shareholders in derivative litigation can overcome the business judgment rule, however. Another fallout from recent corporate scandals has been increased attention to board members and holding them accountable for actually managing the corporation. For example, when WorldCom fell into bankruptcy as a result of profligate spending by its chief executive, board members were accused of negligently allowing the CEO to plunder corporate funds. Corporations pay for insurance for board members (known as D&O insuranceAlso known as Directors and Officers Liability Insurance, insurance that protects board members and senior officers of corporations from liability arising from their actions. D&O insurance is usually paid by the corporation., for directors and officers), but in some cases D&O insurance doesn’t apply, leaving board members to pay directly out of their own pockets when they are sued. In 2005 ten former outside directors for WorldCom agreed to pay $18 million out of their own pockets to settle shareholder lawsuits.

One critical function for boards of directors is to appoint corporate officersSenior management, often “C-Level,” or “Chief Level,” appointed by the board of directors of a corporation to execute strategy and manage day-to-day matters for the corporation.. These officers are also known as “C-level” executives and typically hold titles such as chief executive officer, chief operating officer, chief of staff, chief marketing officer, and so on. Officers are involved in everyday decision making for the company and implementing the board’s strategy into action. As officers of the company, they have legal authority to sign contracts on behalf of the corporation, binding the corporation to legal obligations. Officers are employees of the company and work full-time for the company, but can be removed by the board, typically without cause.

In addition to being somewhat cumbersome to manage, corporations possess one very unattractive feature for business owners: double taxationThe imposition of two or more separate taxes on the same pool of money.. Since corporations are separate legal entities, taxing authorities consider them as taxable persons, just like ordinary human beings. A corporation doesn’t have a Social Security number, but it does have an Employer Identification Numbers (EIN)A unique nine-digit number issued by the IRS to business entities for purposes of identification., which serves the same purpose of identifying the company to tax authorities. As a separate legal entity, corporations must pay federal, state, and local tax on net income (although the effective tax rate for most U.S. corporations is much lower than the top 35 percent income tax rate). That same pile of profit is then subject to tax again when it is returned to shareholders as a dividend, in the form of a dividend taxAn income tax on dividend payments to shareholders..

One way for closely held corporations (such as small family-run businesses) to avoid the double taxation feature is to elect to be treated as an S corporationA corporation that, after meeting certain eligibility criteria, can elect to be treated like a partnership for tax purposes, thus avoiding paying corporate income tax.. An S corporation (the name comes from the applicable subsection of the tax law) can choose to be taxed like a partnership or sole proprietorship. In other words, it is taxed only once, at the shareholder level when a dividend is declared, and not at the corporate level. Shareholders then pay personal income tax when they receive their share of the corporate profits. An S corporation is formed and treated just like any other corporation; the only difference is in tax treatment. S corporations provide the limited liability feature of corporations but the single-level taxation benefits of sole proprietorships by not paying any corporate taxes. There are some important restrictions on S corporations, however. They cannot have more than one hundred shareholders, all of whom must be U.S. citizens or resident aliens; can have only one class of stock; and cannot be members of an affiliated group of companies. These restrictions ensure that “S” tax treatment is reserved only for small businesses.

Key Takeaways

A corporation is a separate legal entity. Owners of corporations are known as shareholders and can range from a few in closely held corporations to millions in publicly held corporations. Shareholders of corporations have limited liability, but most are subject to double taxation of corporate profits. Certain small businesses can avoid double taxation by electing to be treated as S corporations under the tax laws. State law charters corporations. Shareholders elect a board of directors, who in turn appoint corporate officers to manage the company.

Exercises

- Henry Ford (Ford Motor Company), Ray Croc (McDonald’s), and Levi Strauss (Levi’s) were all entrepreneurs who decided to incorporate their businesses and in doing so created long-lasting legacies that outlive them. Why do you think these entrepreneurs were motivated to incorporate when incorporation meant giving up control of their companies?

- Some corporations are created for just a limited time. Can you think of any strategic reasons why founders would create a corporation for just a limited time?

- Recently some companies have come under fire for moving their corporate headquarters out of the country to tax havens such as Bermuda or Barbados. Which duty do you believe is higher, the duty of corporations to pay tax to government or the duty of corporations to pay dividends to shareholders? Why?

- Some critics believe that the corporate tax code is a form of welfare, since many U.S. corporations make billions of dollars and don’t pay any tax. Do you believe this criticism is fair? Why or why not?

- It is very easy to start a corporation in the United States. Take a look at how easy it is to start a corporation in China or India. Do you believe there is a link between ease of starting businesses and overall economic efficiency?

- Do you agree with filmmaker Achbar that a corporation might be psychopathic? What do you think the ethical obligations of corporations are? Discuss.