This is “End-of-Chapter Exercises”, section 14.7 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

14.7 End-of-Chapter Exercises

Questions

- The Lohr Company needs $40 million in cash to expand several of its facilities. Company officials chose to issue bonds to raise this money rather than capital stock. What are some of the possible reasons for this decision?

- Officials for the Bohannon Corporation have always avoided incurring noncurrent liabilities as a company policy. Over the years, they have raised long-term financing through operations or from the issuance of capital stock. Why might these officials have preferred that money be raised by means other than noncurrent liabilities?

- The president of the Nelson Company is a fan of financial leverage. He wants to expand operations into California and Oregon and borrows $70 million on 8 percent term bonds to finance this decision. How does he hope to make financial leveraging work for the Nelson Company in this expansion?

- What is a term bond?

- What is a serial bond?

- What is an indenture?

- A company is forced into bankruptcy. Assuming that the bankruptcy petition is not dismissed by the court, what are the two possible outcomes of a bankruptcy?

- The Arapo Corporation issued $10 million in term bonds that are callable. What information does the term “callable” indicate to decision makers?

- On January 1, Year One, the Rexal Company issues term bonds with a face value of $30 million that pay a stated cash interest rate of 6 percent. The bonds are actually issued for $27 million to yield an effective interest rate of 8 percent. If the first payment is made on December 31, Year One, how much cash is paid?

- What is a mortgage agreement?

- The Philadelphia Corporation issues $17 million in debentures. What is a debenture?

- A company issues $12 million in term bonds on March 1, Year One, for face value. The bonds pay a stated cash interest rate of 10 percent per year. Interest payments are made every February 28 and August 31. On financial statements for Year One, what is recognized as interest expense on the income statements? What interest payable is reported on the December 31, Year One, balance sheet?

- A company issues $18 million in term bonds on March 1, Year One, for face value plus accrued interest. The bonds pay a stated cash interest rate of 10 percent per year. Interest payments are made every January 31 and July 31. Prepare journal entries on March 1, Year One, July 31, Year One, and December 31, Year One?

- The Shelby Corporation issues $10 million in zero-coupon bonds. What is a zero-coupon bond? Why would an investor be willing to acquire a zero-coupon bond? How is the price of a zero-coupon bond determined?

- What is meant by the term “compounding”?

- On January 1, Year One, a zero-coupon bond with a face value of $12 million is issued for $7.8 million to create an effective annual interest rate of 9 percent. The bond will be paid in exactly five years. If the effective rate method is applied, what liability balance is reported on December 31, Year One, and also on December 31, Year Two?

- Do Problem 16 again but assume that the straight-line method is used rather than the effective rate method.

- Why is the straight-line method of recognizing interest on a bond that is issued at a discount not viewed as theoretically appropriate? When can the straight-line method be used in connection with the reporting of bond interest?

- On January 1, Year One, a company issues term bonds with a face value of $20 million and an annual stated cash interest rate of 6 percent. Assume the bonds are issued for $18 million to earn an effective yield rate of 8 percent per year. If the first interest payment is made on December 31, Year One, what is the liability balance reported on the balance sheet at the end of that day?

- On January 1, Year One, the Vallee Corporation issues a five-year $10 million serial bond paying a stated annual cash interest rate each December 31 of 5 percent. What are the cash payments specified by this bond contract?

True or False

- ____ A company borrows $1 million on a term bond that pays 8 percent cash interest each year. The money is used by the company to create additional profits of $93,000 per year. This company is using financial leverage.

- ____ One advantage of debt financing is that the payments made on the liability are tax deductible.

- ____ Companies that are forced into bankruptcy will have their assets liquidated with the resulting money going to pay the creditors.

- ____ Banks typically charge stronger companies higher interest rates than weaker ones because a financially healthy company can better afford to pay the extra amounts each period.

- ____ All bonds are issued for cash amounts equal to their face value.

- ____ A callable bond can be exchanged by the creditor for the capital stock of the debtor company.

- ____ A serial bond is a debt that pays interest more frequently than just once each year.

- ____ A debenture is a debt that is not secured.

- ____ The term “indenture” refers to a bond contract.

- ____ A term bond pays interest each February 1 and August 1. It is issued on February 1, Year One. The company will report interest expense on its Year One income statement for 11 months.

- ____ When a company issues a bond between interest dates, the first interest payment will be reduced.

- ____ A zero-coupon bond is issued for a price determined by computing the present value of the stated cash interest payments.

- ____ A company recognizes interest expense for the current year of $23,000 but pays cash interest of only $18,000. The $5,000 difference is compounded.

- ____ On January 1, Year One, a company issues a $1 million term bond that pays a stated cash interest rate of 8 percent per year at the end of each year. To determine the price of this bond, the present value of a single amount of $1 million must be determined along with the present value of an annuity due of $80,000.

- ____ A company issues a $1 million term bond for $700,000. The $300,000 discount can never be recognized as interest expense through the use of the straight-line method.

- ____ A serial bond is issued on December 31, Year One, for $885,000. Interest of $17,000 is compounded at the end of Year Two, and the first principal payment of $50,000 is made on that date. The liability balance to be reported on the December 31, Year Two, balance sheet is $818,000.

Multiple Choice

-

A company needs to raise $9 million and issues bonds for that amount rather than additional capital stock. Which of the following is not a likely reason the company chose debt financing?

- Management hopes to increase profits by using financial leveraging.

- The cost of borrowing is reduced because interest expense is tax deductible.

- Adding new owners increases the possibility of bankruptcy if economic conditions get worse.

- If money becomes available, the company can rid itself of debts.

-

A company issues bonds with a face value of $12 million on June 1, Year One, for the face value plus accrued interest. The bonds pay an annual cash interest rate of 10 percent with payments made on April 1 and October 1 of each year. On financial statements as of December 31, Year One, and the year then ended, which of the following balances will appear?

- Interest expense: $400,000; interest payable: -0-

- Interest expense: $600,000; interest payable: -0-

- Interest expense: $700,000; interest payable: $300,000

- Interest expense: $900,000; interest payable: $300,000

-

The Akimbo Company issues bonds with a face value of $12 million on June 1, Year One, for 93 percent of face value plus accrued interest. The bonds pay an annual cash interest rate of 10 percent with payments made on April 1 and October 1 of each year. The bonds were sold at a discount to create an effective interest rate of 12 percent per year. What amount of cash interest will Akimbo actually pay during Year One?

- $400,000

- $600,000

- $700,000

- $900,000

-

Kitten Inc. issued $105,000 in bonds on September 1 for face value plus any accrued interest. The annual interest rate is 6 percent, and interest is paid on the bonds every June 30 and December 31. When the bonds are issued on September 1, how much cash will the company collect?

- $105,000

- $106,050

- $106,575

- $108,150

-

The Alexander Company issues a fifteen-year, zero-coupon bond with a face value of $500,000. The effective interest negotiated by the parties to the exchange was an annual rate of 7 percent. The present value of $1 in 15 periods at an annual interest rate of 7 percent is $0.36245. The present value of an ordinary annuity of $1 for 15 periods at an annual interest rate of 7 percent is $9.10791. The present value of an annuity due of $1 for 15 periods at an annual interest rate of 7 percent is $9.74547. What was the exchange price for the bond (rounded)?

- $181,225

- $192,687

- $318,777

- $341,091

-

A zero coupon bond with a face value of $900,000 is issued on January 1, Year One. It will mature in ten years and was issued for $502,550 to earn an annual effective rate of 6 percent. If the effective rate method is used, what interest expense does the company recognize for Year Two (rounded)?

- $30,153

- $31,962

- $38,128

- $39,745

-

A zero coupon bond with a face value of $600,000 is issued on January 1, Year One. It will mature in five years and was issued for $408,350 to earn an annual effective rate of 8 percent. If the effective rate method is used, what liability balance does the company report at the end of Year Two (rounded)?

- $476,299

- $478,821

- $482,678

- $485,010

-

A zero coupon bond with a face value of $800,000 is issued on January 1, Year One. It will mature in eight years and was issued for $541,470 to earn an annual effective rate of 5 percent. If the straight-line method is used, what liability balance does the company report at the end of Year Two (rounded)?

- $601,350

- $602,974

- $604,755

- $606,102

-

On January 1, Krystal Corporation issued bonds with a face value of $100,000 and a 4 percent annual stated interest rate. The effective annual rate of interest negotiated by the parties was 6 percent. Interest is paid semiannually on June 30 and December 31. The bonds mature in ten years. The present value of $1 in 10 periods at a 4 percent interest rate is $0.67556, in 10 periods at 6 percent interest is $0.55839, in 20 periods at a 2 percent interest rate is $0.67297, and in 20 periods at a 3 percent interest rate is $0.55368. The present value of an ordinary annuity of $1 for 10 periods at a 4 percent interest rate is $8.11090, for 10 periods at 6 percent interest is $7.36009, for 20 periods at a 2 percent interest rate is $16.35143, and in 20 periods at a 3 percent interest rate is $14.87747. What will be the price of the bonds on January 1 (rounded)?

- $85,123

- $85,279

- $86,054

- $86,311

-

On January 1, Year One, Giant Company decides to issue term bonds with a total face value of $1 million. The bonds come due in ten years and pay cash interest of 4 percent each year on December 31. An investor is found for these bonds, but that person wants to earn an annual effective rate of 8 percent. After some serious negotiations, Giant agrees to a 7 percent annual rate, and the bonds are issued for a total of $789,292. The effective rate method is applied to recognize interest. What amount of interest expense should be recognized by Giant on its Year Two income statement (rounded)?

- $48,515

- $50,375

- $52,936

- $56,318

-

On January 1, Year One, Super Company decides to issue term bonds with a total face value of $600,000. The bonds come due in six years and pay cash interest of 3 percent each year on December 31. An investor is found and an effective annual interest rate of 8 percent is agreed to by all parties. As a result, the bond is issued for $461,315. The effective rate method is applied. What was the reported balance of this liability at the end of Year One (rounded)?

- $473,018

- $476,550

- $477,105

- $480,220

-

On January 1, Year One, the Elizabeth Corporation issues a $1 million serial bond. Beginning on December 31, Year One, the company will pay $100,000 per year plus interest at an 8 percent rate on the unpaid balance during that year. The bond will be issued at an effective rate of 9 percent per year. How much cash will the company pay on December 31, Year Two?

- $162,000

- $172,000

- $180,000

- $184,000

-

On January 1, Year One, the Benson Company issues a $400,000 serial bond. Beginning on December 31, Year One, the company will pay $100,000 per year plus interest at a 4 percent rate on the unpaid balance during that year. The bond is issued for $373,740 to earn an effective annual interest rate of 7 percent. What is the liability balance reported on this company’s balance sheet as of December 31, Year One (rounded)?

- $278,750

- $281,865

- $283,902

- $285,776

Video Problems

Professor Joe Hoyle discusses the answers to these two problems at the links that are indicated. After formulating your answers, watch each video to see how Professor Hoyle answers these questions.

-

Your roommate is an English major. The roommate’s parents own a chain of ice cream shops located throughout Florida. One day, while warming up to go jogging, your roommate poses this question: “My parents plan to build four new shops in the next year or so. They will need several million dollars to construct these facilities and add the necessary equipment and furniture. I thought they were going to obtain this money by adding one or two new owners. Instead, they borrowed the money by issuing bonds to a number of investors throughout the state. I don’t like debt; it scares me. I don’t understand why they would have taken on so much debt when they could simply have gotten new ownership involved. Why would they have made this decision? How will this affect their financial statements in the future?” How would you respond?

-

Your uncle and two friends started a small office supply store several years ago. The company has grown and now has several large locations. Your uncle knows that you are taking a financial accounting class and asks you the following question: “We are beginning a major expansion project that will cost us about $10 million. We plan to raise the needed money by issuing bonds. One of my partners wants to issue zero-coupon bonds. Our lawyer tells us that we really should issue serial bonds. Our financial advisor suggests term bonds. I am not even sure I know the difference. Can you explain how these three types of bonds differ? How do those differences impact the financial reporting?” How would you respond?

Problems

-

Joni Corporation borrows $500,000 from Friendly Bank on February 1, Year One. The principal will not be repaid until the end of six years, but interest payments are due every February 1 and August 1 beginning on August 1, Year One. The interest rate is 4 percent annually. Record the journal entry or adjusting entry necessary for each of the following.

- The signing of the loan on February 1, Year One.

- The payment of interest on August 1, Year One.

- The recognition of accrued interest on December 31, Year One.

- The payment of interest on February 1, Year Two.

-

Colson Corporation produces women’s clothing. Company officials decide to issue $50,000 in long-term bonds to finance an expansion of its swimwear line. These bonds are issued for face value on April 1, Year One and pay interest in the amount of 5 percent annually. Interest payments are made semiannually, every April 1 and October 1. Record the journal entry or the adjusting necessary for each of the following.

- The issuance of the bonds.

- The first payment of interest on October 1, Year One.

- The accrual of interest on December 31, Year One, so that financial statements can be prepared.

- The payment of interest on April 1, Year Two.

-

Assume the same facts as in problem 2, but instead of April 1, Year One, the bonds are issued on July 1, Year One. The bonds are issued for face value plus accrued interest. Record the journal entry or adjusting entry necessary for each of the following.

- The issuance of the bonds on July 1, Year One.

- The first payment of interest on October 1, Year One.

- The accrual of interest on December 31, Year One, so that financial statements can be prepared.

- The payment of interest on April 1, Year Two.

-

Keller Corporation offers to issue zero-coupon bonds of $80,000 on January 1, Year One. The bonds will come due on December 31, Year Three. Keller and several potential creditors negotiate an annual interest rate of 7 percent on the bonds. The present value of $1 in 3 periods at an annual interest rate of 7 percent is $0.81630. The present value of an ordinary annuity of $1 for 3 periods at an annual interest rate of 7 percent is $2.62432. The present value of an annuity due of $1 for 3 periods at an annual interest rate of 7 percent is $2.80802.

- Determine the amount the creditors will pay on January 1, Year One, for these bonds.

- Record the issuance of the bonds on January 1, Year One.

- Make the necessary adjusting entry at the end of Year One. What is the liability balance at the end of Year One?

- Make the necessary adjusting entry at the end of Year Two. What is the liability balance at the end of Year Two?

- The Rangaletta Company issues a five-year, zero-coupon bond on January 1, Year One. The bond has a face value of $200,000 and is issued to yield an effective interest rate of 9 percent. Rangaletta receives $129,986. On January 1, Year Three, Rangaletta pays off the bond early by making a payment of $155,000 to the bondholder. Make all journal entries from January 1, Year One, through January 1, Year Three assuming the effective rate method is applied.

- Do problem 5 again but assume that the straight-line method is used.

-

A company issues $600,000 in zero-coupon bonds on January 1, Year One. They come due in exactly six years and are sold to yield an effective interest rate of 4 percent per year. They are issued for $474,186. The effective rate method is applied.

- What interest expense was recognized for Year One and for Year Two?

- How would the company’s net income have been affected in each of the first two years if the straight-line method had been used rather than the effective rate method?

-

On January 1, Year One, Gijulka Corporation offers to issue a $100,000 bond coming due in exactly ten years. This bond pays a stated cash interest rate of 6 percent per year on December 31. A buyer is found. After some negotiations, the parties agree on an effective annual yield rate of 7 percent. Consequently, the bond is issued for $92,974. The effective rate method is applied.

- What figures will be reported for this bond in Gijulka’s Year One financial statements?

- What figures will be reported for this bond in Gijulka’s Year Two financial statements?

-

Jaguar Corporation issues term bonds with a face value of $300,000 on January 1, Year One. The bonds have a stated rate of interest of 7 percent per year and a life of four years. They pay this interest annually on December 31. Because the market rate of interest at that time was 9 percent, the bonds were issued at a discount to create an effective annual rate of 9 percent. The present value of $1 in 4 periods at an annual interest rate of 9 percent is $0.70843. The present value of an ordinary annuity of $1 for 4 periods at an annual interest rate of 9 percent is $3.23972.

- What amount will Jaguar receive when the bonds are issued?

- What journal entry does the company make on January 1, Year One, when the bonds are issued?

- What journal entry or entries does the company make on December 31, Year One?

- What is the liability balance reported on the December 31, Year One, balance sheet?

- What journal entry or entries does the company make on December 31, Year Two?

- What is the liability balance reported on the December 31, Year Two, balance sheet?

-

Arizona Corporation issues term bonds with a face value of $800,000 on January 1, Year One. The bonds have a stated rate of interest of 7 percent per year and a life of six years. They pay interest annually on December 31. These bonds were issued at $695,470 to create an effective annual rate of 10 percent.

- What journal entry does the company make on January 1, Year One, when the bonds are issued?

- What journal entry or entries does the company make on December 31, Year One?

- What is the liability balance reported on the December 31, Year One, balance sheet?

- What journal entry or entries does the company make on December 31, Year Two?

- What is the liability balance reported on the December 31, Year Two, balance sheet?

-

Collins Company issues term bonds with a face value of $100,000 on January 1, Year One. The bonds have an annual stated rate of interest of 4 percent and a life of ten years. They pay interest semiannually on June 30 and December 31. The bonds were issued to yield an effective annual interest rate of 6 percent.

The present value of $1 in 10 periods at a 4 percent interest rate is $0.67556, in 10 periods at 6 percent interest is $0.55839, in 20 periods at a 2 percent interest rate is $0.67297, and in 20 periods at a 3 percent interest rate is $0.55368.

The present value of an ordinary annuity of $1 for 10 periods at a 4 percent interest rate is $8.11090, for 10 periods at 6 percent interest is $7.36009, for 20 periods at a 2 percent interest rate is $16.35143, and in 20 periods at a 3 percent interest rate is $14.87747.

- Prepare the journal entry to record the issuance of the bonds on January 1, Year One.

- Prepare the journal entry to record the first payment of interest on June 30, Year One.

- Prepare the journal entry to record the second payment of interest on December 31, Year One.

- What amount of interest expense is reported on the Year One income statement?

- What is the liability balance to be reported for this bond on a December 31, Year One, balance sheet?

-

Chyrsalys Corporation issues $4,000,000 in serial bonds on January 1, Year One, with a stated cash interest rate of 4 percent. The bonds are issued at face value. The bond terms specify that interest and $2,000,000 in principal will be paid on December 31, Year One and December 31, Year Two.

- What journal entry, or entries, is recorded on December 31, Year One?

- What journal entry, or entries, is recorded on December 31, Year Two?

-

The Empire Company issues $3 million in bonds on January 1, Year One. The bonds are for three years with $1 million paid at the end of each year plus interest of 6 percent on the unpaid balance for that period. These bonds are sold to yield an effective rate of 8 percent per year. The present value of $1 at an 8 percent interest rate in one year is $0.92593, in two years is $0.85734, and in three years is $0.79383. The present value of an ordinary annuity of $1 at an 8 percent interest rate over three years is $2.57710.

- What amount of cash will Empire pay on December 31 of each of these three years?

- What is the present value of these cash payments at an 8 percent effective annual interest rate?

- What journal entry or entries is recorded on December 31, Year One?

- What journal entry or entries is recorded on December 31, Year Two?

-

The Althenon Corporation issues bonds with a $1 million face value on January 1, Year One. The bonds pay a stated interest rate of 5 percent each year on December 31. They come due in eight years. The Zephyr Corporation also issues bonds with a $1 million face value on January 1, Year One. These bonds pay a stated interest rate of 8 percent each year on December 31. They come due in eight years. Both companies actually issue their bonds to yield an effective annual interest rate of 10 percent. Both companies use the effective rate method. The present value of $1 at a 10 percent interest rate in eight years is $0.46651. The present value of an ordinary annuity of $1 at a 10 percent interest rate over eight years is $5.33493.

- What interest expense does Althenon report for Year One and also for Year Two?

- What interest expense does Zephyr report for Year One and also for Year Two?

-

On January 1, Year One, the Pulaski Corporation issues bonds with a face value of $1 million. These bonds come due in twenty years and pay an annual stated interest rate (each December 31) of 5 percent. An investor offers to buy the entire group of bonds for an amount that will yield an effective interest rate of 10 percent per year. Company officials negotiate and are able to reduce the effective rate by 2 percent to 8 percent per year. The present value of $1 at a 10 percent interest rate in twenty years is $0.14864. The present value of an ordinary annuity of $1 at a 10 percent interest rate over twenty years is $8.51356. The present value of $1 at an 8 percent interest rate in twenty years is $0.21455. The present value of an ordinary annuity of $1 at an 8 percent interest rate over twenty years is $9.81815.

- As a result of the 2 percent reduction in the annual effective interest for this bond, what is the decrease in the amount of interest expense that Pulaski recognizes in Year One?

- As a result of the 2 percent reduction in the annual effective interest for this bond, what is the decrease in the amount of interest expense that Pulaski recognizes in Year Two?

Comprehensive Problem

This problem will carry through several chapters, building in difficulty. It allows students to continually practice skills and knowledge learned in previous chapters.

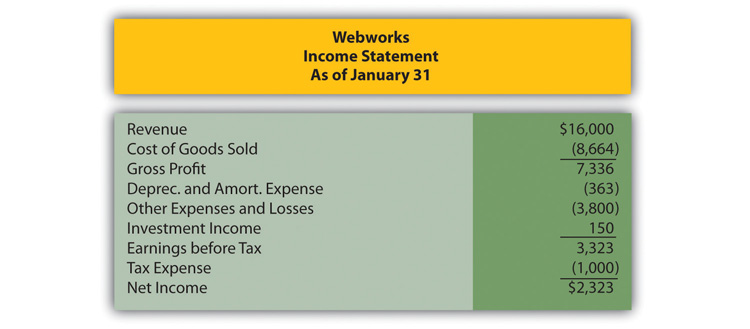

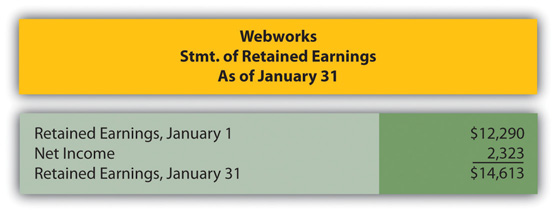

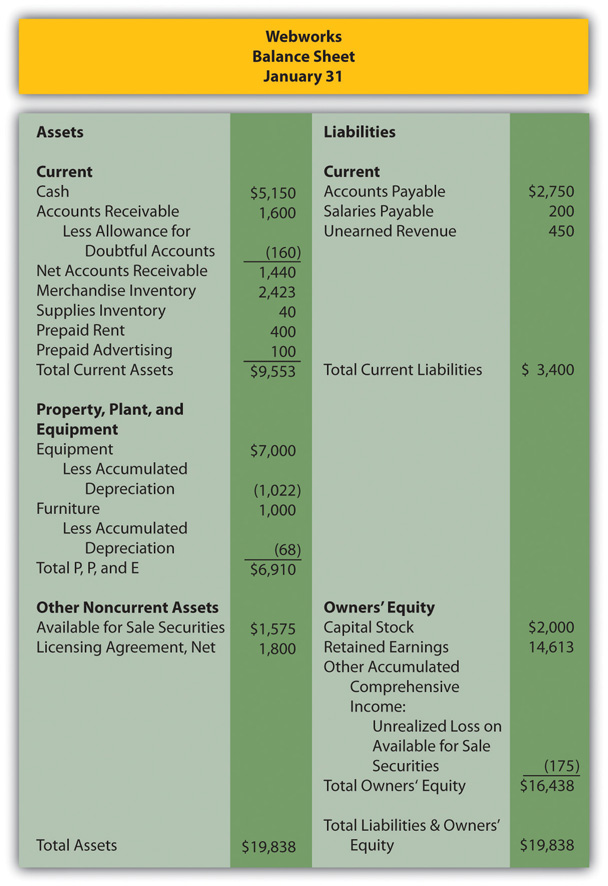

In Chapter 13 "In a Set of Financial Statements, What Information Is Conveyed about Current and Contingent Liabilities?", financial statements for January were prepared for Webworks. They are included here as a starting point for the required recording for February.

Figure 14.29 Webworks Financial Statements

Figure 14.30

Figure 14.31

The following events occur during February:

- Webworks starts and completes nine more sites and bills clients for $5,400.

- Webworks purchases supplies worth $150 on account.

- At the beginning of February, Webworks had nineteen keyboards costing $117 each and ten flash drives costing $20 each. Webworks uses periodic FIFO to cost its inventory.

- On account, Webworks purchases seventy keyboards for $118 each and one hundred of the new flash drives for $22 each.

- On February 1, Webworks borrows $3,000 from Local Area Bank. The loan plus accrued interest will be repaid at the end of two years. The interest rate is 6 percent.

- Webworks purchases new computer equipment for use in designing Web sites. The equipment costs $5,500 and was paid for in cash.

- Webworks pays Nancy Po (company employee) $800 for her work during the first three weeks of February.

- Webworks sells seventy keyboards for $11,250 and ninety of the new flash drives for $2,700 cash.

- Webworks collects $5,200 in accounts receivable.

- Webworks purchases one hundred shares of RST Company for $18 per share in cash. This is considered a trading security.

- Webworks pays off its salaries payable from January.

- Webworks is hired to design Web sites for a local photographer and bakery. It is paid $600 in advance.

- Webworks pays off $11,300 of its accounts payable.

- Webworks pays Leon Jackson (company owner) a salary of $2,000.

- Webworks completes the salon Web site and earns the $450 paid in January.

- RST Company pays Webworks a dividend of $25.

-

Webworks pays taxes of $1,558 in cash.

Required:

- Prepare journal entries for the previous events.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for Webworks for February.

- Prepare adjusting entries for the following and post them to your T-accounts.

- Webworks owes Nancy Po $220 for her work during the last week of February.

- Leon’s parents let him know that Webworks owes $300 toward the electricity bill. Webworks will pay them in March.

- Webworks determines that it has $70 worth of supplies remaining at the end of January.

- Prepaid rent should be adjusted for February’s portion.

- Prepaid advertising should be adjusted for February’s portion.

- Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

- Webworks continues to depreciate its equipment over four years and its furniture over five years, using the straight-line method. The new equipment will also be depreciated over five years using the straight-line method.

- The license agreement should be amortized over its one-year life.

- QRS Company is selling for $12 per share and RST is selling for $16 per share on February 28.

- Interest should be accrued for February.

-

Record cost of goods sold.

- Prepare an adjusted trial balance.

- Prepare financial statements for February.

Research Assignment

Assume that you take a job as a summer employee for an investment advisory service. One of the partners for that firm is currently looking at the possibility of investing in Marriott International. The partner is aware that Marriott builds a lot of hotels and, therefore, probably has to borrow a significant amount of money. The partner is curious as to the cost of the interest on the money that Marriott borrows. The partner asks you to look at the 2010 financial statements for Marriott by following this path:

- Go to http://www.marriott.com.

- At the bottom of this screen, click on “About Marriott.”

- At the top of the next screen, on the right, click on “Investors.”

- On the next screen, on the right side, click on “2010 Annual Report” to download.

- On the next screen, click on “Financials” at the top right side.

- On the next screen, click on “Financial Statements” on the left side.

- The company’s income statement should appear. Review the contents of that statement.

- Click the number 2 at the top of the screen to see the balance sheet. Review the contents of that statement.

- On the left side of the screen, click on “Notes to Financial Statements.”

- Go to note 13 “Long-term debt.” A schedule of the company’s senior notes can be found in that note.

- What was the amount of interest expense the company recognized on its 2010 income statement? How did that number compare with the interest expense recognized in 2009?

- What was the amount of long-term debt reported by the company on its balance sheet at the end of 2010? How did that number compare with the long-term debt at the end of 2009?

- According to the information in note 13, what was the stated cash interest rate for the various senior notes that the company has outstanding? What was the effective interest rate on each of these senior notes?