This is “In a Set of Financial Statements, What Information Is Conveyed about Equity Investments?”, chapter 12 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 12 In a Set of Financial Statements, What Information Is Conveyed about Equity Investments?

Video Clip

(click to see video)In this video, Professor Joe Hoyle introduces the essential points covered in Chapter 12 "In a Set of Financial Statements, What Information Is Conveyed about Equity Investments?".

12.1 Accounting for Investments in Trading Securities

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Realize that the financial reporting of investments in the ownership shares of another company depends on the purpose of the acquisition.

- Explain the characteristics of investments that are classified as trading securities.

- Account for changes in the value of investments in trading securities and understand the rationale for this handling.

- Record dividends received from investments that are classified as trading securities.

- Determine the gain or loss to be recorded on the sale of a trading security.

The Reasons Why One Company Buys Ownership Shares of Another

Question: Businesses frequently acquire ownership shares (often referred to as equity or capital shares) of other companies. On September 30, 2011, Microsoft disclosed that it held “equity and other investments” reported at nearly $8.6 billion. Many such investments are only made to acquire a small percentage of the ownership. However, that is not always the case. In April, 2011, Johnson & Johnson announced the $21.3 billion purchase of Swiss medical device maker Synthes Inc. Whether a few shares are bought, or the entire company is bought, such investments offer many potential benefits. What are the most common reasons for one company to buy the ownership shares of another company?

Answer: Potentially, many benefits can accrue from obtaining shares of the capital stock issued by another business. Interestingly, the specific method of financial reporting depends on the owner’s purpose for holding such investments. Thus, the accounting process here is quite unique. The reporting of most assets (such as inventory and equipment) does not vary because of the rationale for making the purchase and then retaining the property. In contrast, the accounting process used to report the ownership of stock in another company falls within one of several methods based solely on the reason for the investment.

Companies frequently find that they are holding excess cash not needed at the moment for operating purposes. Such money can be temporarily invested to increase net income. Traditional savings accounts or money market funds offer only very low returns. Company officials often seek greater profit by using surplus money to buy the ownership shares of other organizations. The hope is that the market price of these shares will appreciate in value and/or dividends will be received before the cash is needed for operations. Such investments can be held for a few days (or even hours) or many years. Although earnings can improve through this strategy, the buyer does face additional risk. Share prices do not always go up. They can also decline in value, resulting in losses for the investor.

When equity shares are bought solely as a way to store cash and increase profits, the investor has no desire to influence or control the decisions of the other company. That is not the reason for the purchase; the ownership interest is much too small.

Investors, though, may also embrace a strategy of acquiring enough shares to gain some degree of influence over the other organization. Often, profitable synergies can be developed by having two companies connected in this way. For example, as of October 3, 2010, Starbucks Corporation held 39.9 percent of the outstanding stock of Starbucks Coffee Japan Ltd. Starbucks does not own a sufficient number of shares to controlAccording to U.S. GAAP, it exists when one company owns more than 50 percent of the outstanding common shares of another company so that the parent can direct all decision making; for external reporting purposes, the financial information of both companies must be consolidated to form a single set of financial statements. the operations of the Japanese company, but it certainly can apply significant influence if it so chooses.

Finally, as in the acquisition of Synthes by Johnson & Johnson, the investor may seek to obtain a controlling interest in the other company (in U.S. GAAP that is viewed as being over 50 percent of the outstanding capital stock). In many cases, the parent company chooses to buy 100 percent ownership of the other business to gain complete control. Such acquisitions are common as large companies attempt to (a) move into new industries or geographical areas, (b) become bigger players in their current markets, (c) gain access to valuable assets, or (d) eliminate competitors. Many smaller companies are started by entrepreneurs with the specific hope that success will attract acquisition interest from a larger organization. Often, significant fortunes are earned by the original owners as a result of the sale of their company to a bigger business.

Trading Securities

Question: As can be seen in the previous answer, several different reasons exist for buying capital stock. Applicable accounting rules can best be demonstrated by focusing on one of these types of investments at a time.

Assume that Valente Corporation is holding $25,000 in cash that it will not need for several weeks. This money is currently in a money market fund earning only a 1 percent annual rate of return. In hopes of generating a higher profit, the president of Valente has studied the financial statements of Bayless Corporation, a company with capital stock trading on the New York Stock Exchange for $25 per share. By November 30, Year One, the president has come to believe that Bayless stock will make a rather significant jump in market price in the near future. Consequently, Valente uses the $25,000 to acquire one thousand shares of stock in Bayless that will be held for only a few weeks or months. How does a company report an equity investment that is bought with the expectation that the shares will be sold shortly after the purchase is made?

Answer: If management intends to sell the equity shares of another company shortly after buying them, the purchase is classified on the balance sheet as an investment in trading securitiesClassification of investments in stocks and bonds when management’s intentions are to sell them quickly in the near term; they are reported as assets on the balance sheet at fair value with all changes in value affecting net income.. On the acquisition date, as shown in Figure 12.1 "Purchase of Ownership Shares Classified as Trading Securities", the asset is recorded by Valente at historical cost.

Figure 12.1 Purchase of Ownership Shares Classified as Trading Securities

As an owner, even if the shares are only held for a short time, Valente might receive a cash dividend from Bayless. Many companies distribute dividends to their stockholders periodically as a way of sharing a portion of any income that has been earned.

Assume that Bayless has been profitable and, as a result, a $0.20 per share cash dividend is declared by its board of directors and paid in December, Year One. Valente receives $200 of this dividend ($0.20 per share × 1,000 shares), which is reported as revenue on the owner’s Year One income statement. The journal entry is presented in Figure 12.2 "Receipt of Dividend from Investment in Stock".

Figure 12.2 Receipt of Dividend from Investment in Stock

Because of the short-term nature of this investment, Valente might sell these shares prior to the end of Year One. The purchase of Bayless stock was made anticipating a quick sale. Consequently, a gain is reported if more than $25,000 is received, whereas a loss results if the shares are sold for less than $25,000. Such gains and losses appear on the owner’s income statement when created by the sale of a trading security.

The Value of Trading Securities at Year’s End

Question: The accounting process for trading securities becomes more complicated if Valente continues to own this investment in Bayless at year end. Should equity shares held as a trading security be reported on the owner’s balance sheet at historical cost or current fair value? Which reporting provides the most helpful information to outside decision makers?

Answer: U.S. GAAP requires investments in trading securities to be reported on the owner’s balance sheet at fair value. Therefore, if the shares of Bayless are worth $28,000 at December 31, Year One, Valente must adjust the reported value from $25,000 to $28,000 by reporting a gain as shown in Figure 12.3 "Shares of Bayless (a Trading Security) Adjusted to Fair Value at End of Year One".

Figure 12.3 Shares of Bayless (a Trading Security) Adjusted to Fair Value at End of Year One

The gain here is labeled as unrealizedA gain or loss created by an increase or decrease in the value of an asset although not yet finalized by a sale. to indicate that the value of the asset has appreciated but no final sale has yet taken place. Therefore, the gain is not guaranteed; the value might go back down before the shares are sold. However, the $3,000 unrealized gain is reported on Valente’s Year One income statement so that net income is affected.

Test Yourself

Question:

James Attenborough is studying the financial statements published for the Hawthorne Roberts Corporation. This company owns shares in Microsoft and several other companies. Consequently, it reports an investment in trading securities account on its year-end balance sheet as an asset with a balance of $18,765. What does that figure represent?

- It is impossible to tell without reading the notes to the financial statements.

- The $18,765 was the historical cost of these shares.

- The $18,765 is the fair value of the shares on the balance sheet date.

- The $18,765 is the lower of the cost or market value of these shares at the end of the year.

Answer:

The correct answer is choice c: The $18,765 is the fair value of the shares on the balance sheet date.

Explanation:

Investments in trading securities are held for a relatively quick sale. They are always reported at fair value regardless of whether that figure is above or below the cost of acquisition. Fair value is easy to determine and the company knows that it can get that amount on the balance sheet date.

Reporting Trading Securities at Fair Value

Question: The reporting demonstrated above for an investment in a trading security raises a theoretical question that has long been debated in financial accounting. Is recognizing a gain in the value of a trading security (or a loss if the stock price has declined) on the owner’s income statement appropriate before an actual sale takes place? In this illustration, for example, a $3,000 gain is reported, but the value of these shares might suddenly plummet and eliminate that gain prior to a sale. The gain might never be received. In previous chapters, assets such as buildings and inventory were never adjusted to fair value unless impairment had taken place. Why is an investment in a trading security always reported at fair value regardless of whether that value is above or below historical cost?

Answer: Changes in the value of trading securities are recognized and the resulting gains or losses are included within current net income for several reasons:

- The Bayless shares sell on a stock exchange. Thus, the reported value of $28,000 can be objectively determined. It is not an estimated amount subject to manipulation as is the fair value of assets such as buildings and inventory.

- The stock can be sold immediately; Valente does not even have to find a buyer. The stock exchange provides a workable mechanism to create a sale whenever the owner wants to liquidate the investment. No question exists that these shares can be sold at any time. Once again, the same assertion cannot be made for assets such as buildings and inventory.

- As a trading security, a sale is anticipated in the near term. The owner does not plan to hold the stock for a long period of time. Further changes in value can certainly take place but are less likely to be severe. The shortness of time limits the chance of radical fluctuations in value after the balance sheet date.

For these reasons, U.S. GAAP requires that investments in trading securities be reported on the owner’s balance sheet at fair value ($28,000 in this example). Therefore, Valente will report both the dividend revenue of $200 and the unrealized gain of $3,000 on its Year One income statement.

If, instead, the fair value at year-end had been only $21,000, a $4,000 unrealized loss appears on Valente’s income statement to reflect the decline in value ($25,000 historical cost dropping to $21,000 fair value).

Test Yourself

Question:

During Year One, Hancock Corporation buys 2,000 shares of Waltz Inc. for $34 per share. Hancock appropriately records this acquisition as an investment in trading securities because it plans to make a sale in the near future. In December of Year One, Waltz pays a $1 per share cash dividend to its owners. On the last day of December, the stock is selling on a stock exchange for $39 per share. What is the impact of these events on the income reported by Hancock for Year One?

- No effect

- Increase of $2,000

- Increase of $10,000

- Increase of $12,000

Answer:

The correct answer is choice d: Increase of $12,000.

Explanation:

The dividend that is received ($2,000 or $1.00 per share × 2,000 shares) is reported as revenue by the recipient (Hancock). In addition, because these shares are classified as trading securities, the change in value this year also impacts net income. The price of the stock went up $5 per share ($39 less $34) so that Hancock reports a gain of $10,000 ($5 per share × 2,000 shares). Total increase in income reported by Hancock is $12,000 ($2,000 plus $10,000).

The Sale of a Trading Security

Question: In this ongoing illustration, Valente Corporation bought one thousand shares of Bayless Corporation which it planned to sell in a relatively short period of time. At the end of Year One, this trading security was adjusted from the historical cost of $25,000 to its fair value of $28,000. The $3,000 unrealized gain was reported within net income on the Year One income statement.

Assume that these shares are sold by Valente on February 3, Year Two, for $27,000 in cash. What financial reporting is appropriate when an investment in trading securities is sold in a subsequent period? What effect does this final transaction have on reported income?

Answer: Following the Year One adjustment, this investment is recorded in the general ledger at the fair value of $28,000 rather than historical cost. When eventually sold, any difference between the sales price and this carrying amount is recorded as a gain or a loss on the Year Two income statement.

Because the sales price of these shares ($27,000) is less than the balance now being reported ($28,000), recognition of a $1,000 loss is appropriate, as can be seen in Figure 12.4 "Sale of Shares of Bayless (a Trading Security) for $27,000 in Year Two". This loss reflects the drop in value of the shares that took place during Year Two.

Figure 12.4 Sale of Shares of Bayless (a Trading Security) for $27,000 in Year Two

This investment was originally bought for $25,000 and later sold for $27,000 so an overall gain of $2,000 was earned. For reporting purposes, this income effect is spread between the two years of ownership. A gain of $3,000 was recognized in Year One to reflect the appreciation in value during that period of time. Then, in Year Two, a loss of $1,000 is reported because the stock price fell by that amount prior to being sold.

Investments in trading securities are always shown on the owner’s balance sheet at fair value. The gains and losses reported in the income statement will parallel the movement in value that took place each period.

Test Yourself

Question:

Late in Year One, a company buys one share of a publicly traded company for $75. This investment is reported as a trading security because the owner plans to sell the stock in the near future. At the end of Year One, this share is only worth $62. However, early in Year Two, the stock price soars to $80 and the stock is sold. A $2 cash dividend is also received by the owner in January of Year Two. What is the reported income effect of this ownership?

- No change in income in Year One but a $5 increase in Year Two.

- No change in income in Year One but a $7 increase in Year Two.

- Net income is reduced $13 in Year One but an $18 increase in Year Two.

- Net income is reduced $13 in Year One but a $20 increase in Year Two.

Answer:

The correct answer is choice d: Net income is reduced $13 in Year One but a $20 increase in Year Two.

Explanation:

As a trading security, the $13 drop in value in Year One ($75 less $62) is reported as a loss on the owner’s income statement. Then, the $18 rise in value in Year Two ($80 less $62) increases net income. In addition, the $2 dividend increases the Year Two income reported by the owner bringing it up to $20.

Key Takeaway

Many companies acquire the equity shares of other companies as investments. The applicable accounting procedures depend on the purpose for the ownership. If the stock is only to be held for a short period of time, it is labeled a trading security. The investment is then adjusted to fair value whenever financial statements are to be produced. Any change in value creates a gain or loss that is reported within net income because fair value is objectively determined, the shares can be liquidated easily, and a quick sale is anticipated before a significant change in fair value is likely to occur. Dividends received by the owner are recorded as revenue. Whenever trading securities are sold, only the increase or decrease in value during the current year is reported within net income since earlier changes have already been reported in that manner.

12.2 Accounting for Investments in Securities That Are Classified as Available-for-Sale

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Identify the types of investments classified as available-for-sale.

- Record the receipt of dividends from an investment that is viewed as available-for-sale.

- Explain the financial reporting of changes in the fair value of investments in available-for-sale securities.

- Calculate the gain or loss to be reported when available-for-sale securities are eventually sold.

- Understand the need for reporting comprehensive income as well as net income.

- Explain the adjustment made to net income in order to arrive at comprehensive income.

Reporting Available-For-Sale Investments

Question: Not all investments in stock are bought for quick sale. Assume that Valente Corporation bought one thousand shares of Bayless Corporation for $25 each in Year One but does not anticipate selling this investment in the near term. Company officials intend to hold these shares for the foreseeable future until the money is clearly needed. Although the stock could be sold at any time, the president of Valente believes the investment might well be retained for years. During Year One, a $200 cash dividend is received from the Bayless shares. At the end of that period, the stock is selling for $28 per share. How does the decision to hold equity shares for an extended period of time impact the financial reporting process?

Answer: Valente does not anticipate a quick sale of its investment in Bayless. Because Valente’s intention is to retain these shares for an indefinite period, they will be classified on the company’s balance sheet as an investment in available-for-sale securitiesAccounting classification for investments in stocks and bonds when management’s intentions are to retain them for an indefinite period; they are reported on the balance sheet at fair value although unrealized gains and losses are included in stockholders’ equity and not within net income. rather than as trading securities. Despite the difference in the plan for holding these shares, they are—once again—recorded at historical cost when acquired, as shown in Figure 12.5 "Purchase of Ownership Shares Classified as Available-for-Sale Securities".

Figure 12.5 Purchase of Ownership Shares Classified as Available-for-Sale Securities

The receipt of the dividend is also reported in the same manner as before with the dividend revenue increasing Valente’s net income. No difference is created between the accounting for trading securities and accounting for available-for-sale securities as a result of a dividend.

Figure 12.6 Receipt of Dividend from Investment in Available-for-Sale Securities

The difference in reporting begins at the end of the year. U.S. GAAP requires available-for-sale investments to be included on the investor’s balance sheet at fair value (in the same manner as trading securities). As before, this adjustment to fair value creates an unrealized gain of $3,000, as is reflected in Figure 12.7 "Shares of Bayless (an Available-for-Sale Security) Are Adjusted to Fair Value at End of Year One". However, reported net income is not affected as it was with the investment in the trading security.

Figure 12.7 Shares of Bayless (an Available-for-Sale Security) Are Adjusted to Fair Value at End of Year One

Accumulated Other Comprehensive Income

Question: Based on the previous discussion, an immediate question is obvious: If the $3,000 unrealized gain shown in Figure 12.7 "Shares of Bayless (an Available-for-Sale Security) Are Adjusted to Fair Value at End of Year One" is not presented on the income statement, where is that amount reported by the owner? How are changes in the fair value of available-for-sale securities reported?

Answer: Because no sale is anticipated in the near term, the fair value of available-for-sale shares will possibly go up and down numerous times before being sold. Hence, the current gain is not viewed as “sure enough.” As a result of this uncertainty, a change in the owner’s reported net income is not considered appropriate.

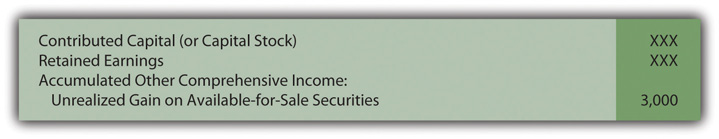

Instead, any unrealized gain (or loss) in the value of an investment that is classified as available-for-sale is reported within the stockholders’ equity section of the balance sheet. The figure is listed either just above or below the retained earnings account. A few other unrealized gains and losses are handled in this manner and are combined and reported as accumulated other comprehensive incomeA section of the stockholders’ equity of a balance sheet where unrealized gains and losses on available-for-sale securities (as well as a few other specified gains and losses) are shown rather than being presented on the reporting company’s income statement. as shown in Figure 12.8 "Stockholders’ Equity Including Accumulated Other Comprehensive Income".

Figure 12.8 Stockholders’ Equity Including Accumulated Other Comprehensive Income

Consequently, the primary difference in the financial accounting for trading securities and available-for-sale securities is in the placement of unrealized gains and losses from changes in value:

- Changes in the value of trading securities are reported in the income statement.

- Changes in the value of available-for-sale securities are shown in stockholders’ equity and not net income.

The described procedures were first created in 1993 and have been used since that time. Interestingly, in 2007, FASB passed a rule that allows companies to elect to report available-for-sale investments as trading securities. This option must be selected when the investment is purchased. Thus, if that election is made, the $3,000 unrealized gain is reported on the income statement despite the intention to hold the securities for an indefinite period. This is another example of accounting rules that are not as rigid as sometimes perceived.

Test Yourself

Question:

Company A buys shares of a well-known company in Year One for $130,000. Company officials plan to hold this investment for only a short period of time so that it is classified as a trading security. Coincidentally, Company B makes the same investment at the same time for the same cost. However, Company B officials expect to hold these shares indefinitely. Company B reports this investment as available-for-sale and does not elect to report it in the same manner as a trading security. Both companies continue to hold their investments at the end of the year when they are each worth $144,000. Which of the following is not true?

- Both companies will report their investment at $144,000.

- Net income will increase more for Company A than for Company B because of these investments.

- Company A reports other accumulated comprehensive income on the December 31, Year One, balance sheet of $14,000.

- Company B reports other accumulated comprehensive income on the December 31, Year One, balance sheet of $14,000.

Answer:

The correct answer is choice c: Company A reports other accumulated comprehensive income on the December 31, Year One, balance sheet of $14,000.

Explanation:

Both companies report the asset as $144,000, its fair value at the end of the year. Company A views these shares as trading securities so that the increase in value of $14,000 is reported as an unrealized gain in net income. However, Company B has classified the investment as available-for-sale. Thus, the $14,000 unrealized gain is not shown within net income but, rather, in stockholders’ equity as “other accumulated comprehensive income.”

The Sale of Available-For-Sale Securities

Question: Assume that Valente did not choose to report the available-for-sale investment as a trading security but rather by means of the traditional approach. Thus, the $3,000 unrealized gain created by the appreciation of value is reported within stockholders’ equity at the end of Year One. In Year Two, these shares are sold on the stock exchange for $27,000. What reporting is made at that time? How is the eventual sale of investments that are classified as available-for-sale securities reported?

Answer: When available-for-sale securities are sold, the difference between the original cost ($25,000) and the selling price ($27,000) appears as a realized gain (or loss) on the owner’s income statement. Because no change in net income was reported in the previous year, this entire amount has to be recognized at the date of sale. Having presented the unrealized gain within stockholders’ equity in Year One, the change in value only touches net income when sold.

However, mechanical complexities now exist. The investment has been adjusted to a $28,000 carrying amount, and a $3,000 unrealized gain still remains within stockholders’ equity. As a balance sheet account, this $3,000 figure is not closed out at the end of Year One. Therefore, when the investment is sold, both the $28,000 asset and the $3,000 unrealized gain must be removed. The net amount mirrors the $25,000 historical cost of these shares. By eliminating the previous gain in this manner, the asset is brought back to the original $25,000. Thus, as shown in Figure 12.9 "Sale of Available-for-Sale Security in Year Two", the appropriate realized gain of $2,000 is recognized. The shares were bought for $25,000 and sold for $27,000, and the previous unrealized gain is removed.

Figure 12.9 Sale of Available-for-Sale Security in Year Two

Test Yourself

Question:

Company A buys ownership shares of a well-known company for $68,000 in Year One and classifies the asset as an investment in trading securities. Company B also buys shares of this company on the same date for $68,000. However, the investment is reported by this owner as available-for-sale. Company B does not elect to report this investment in the same manner as a trading security. Both investments are worth $70,000 at the end of Year One. Both investments are sold in Year Two for $60,000. Which of the following is true?

- Company B reports a bigger gain on its income statement in Year One than does Company A.

- Company B reports a bigger loss on its income statement in Year Two than does Company A.

- Company A reports a bigger loss on its income statement in Year One than does Company B.

- Company A reports a bigger loss on its income statement in Year Two than does Company B.

Answer:

The correct answer is choice d: Company A reports a bigger loss on its income statement in Year Two than does Company B.

Explanation:

Company A reports a trading security; the $2,000 increase in value is an income statement gain in Year One. The $10,000 drop in value is an income statement loss in Year Two. Because Company B reports these shares as available-for-sale, no income effect is recognized in Year One. In Year Two, the $8,000 difference between cost and amount received is a loss on the income statement. The gain reported by Company A is larger in Year One but the loss reported by Company A is larger in Year Two.

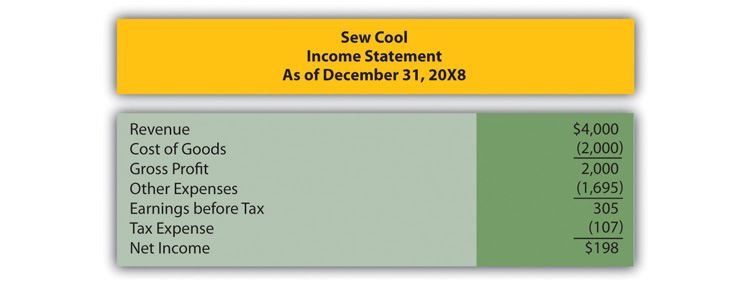

The Reporting of Comprehensive Income

Question: In Year One, Valente’s investment in the shares of Bayless Corporation rose in value by $3,000. As discussed earlier, if those securities are classified as available-for-sale, the unrealized gain does not impact reported net income but, rather, stockholders’ equity. This handling is justified because a number of additional changes in value (both increases and decreases) are likely to take place prior to the eventual sale of the investment.

As a result, the net income figure reported by Valente seems a bit misleading. It does not include the increase in the reported worth of this asset. Are decision makers well-served by an income figure that omits certain gains and losses? Assume, for example, that Valente reports total net income for Year One of $80,000. This figure includes no part of the $3,000 unrealized gain. What reporting is necessary to help investors and creditors understand the impact on income of a change in value when investments are labeled as available-for-sale?

Answer: As noted, changes in the value of available-for-sale securities create unrealized gains or losses that appear in the stockholders’ equity section of the balance sheet but not in net income. The completeness of reported net income in such situations can be questioned.

To help decision makers better evaluate reporting companies with such unrealized items, a second income figure is presented that does include these gains or losses. The resulting balance, known as comprehensive incomeNet income plus any unrealized gains and less any unrealized losses that appear in stockholders’ equity rather than within net income., is shown within a company’s financial statements. In Figure 12.10 "Net Income Converted to Comprehensive Income", by adding in the $3,000 change in fair value, Valente’s net income figure is adjusted to the more complete total.

Figure 12.10 Net Income Converted to Comprehensive Income

Decision makers can choose to emphasize one figure (net income) or another (comprehensive income) in their analysis of a reporting company. More appropriately, they can view these two figures as simply different ways to portray the results of the current year and make use of both.

Comprehensive income includes all changes in stockholders’ equity other than (a) amounts contributed by stockholders and (b) dividend distributions made to stockholders. Unrealized gains and losses on available-for-sale securities are common but several other unrealized gains and losses are also included in moving from net income to comprehensive income.

Sometimes comprehensive income makes a company appear more successful, sometimes less so. For example, for the year ended December 31, 2010, Yahoo! Inc. reported its net income as $1.245 billion. However, the financial picture seems improved by disclosure of comprehensive income for the period of $1.367 billion. Conversely, The Dow Chemical Company reported net income for the same year of $2.321 billion but comprehensive income of only $1.803 billion.

Test Yourself

Question:

The Jelanizada Company reports revenue of $800,000 in Year One along with expenses of $700,000. In addition, the company bought shares of a publicly held company for $50,000 that was worth $70,000 by year’s end. This investment was reported as available-for-sale. Which of the following is true?

- Jelanizada should report net income for Year One of $80,000.

- Jelanizada should report net income for Year One of $120,000.

- Jelanizada should report comprehensive income for Year One of $100,000.

- Jelanizada should report comprehensive income for Year One of $120,000.

Answer:

The correct answer is choice d: Jelanizada should report comprehensive income for Year One of $120,000.

Explanation:

As an investment in an available-for-sale security, the $20,000 increase in value is reported as a gain in other accumulated comprehensive income in the stockholders’ equity section of the balance sheet. Net income is revenue minus expenses or $100,000 ($800,000 less $700,000). The gain, though, must then be included in arriving at a more inclusive comprehensive income figure of $120,000 (net income of $100,000 plus gain of $20,000).

Key Takeaway

Investments in equity securities are often held by the owner for an indefinite period of time. As such, the asset is classified as available-for-sale and shown at fair value each period. Any change in the reported amount is not included in net income but is rather listed within accumulated other comprehensive income in the stockholders’ equity section of the balance sheet. However, dividends that are received from the investment are reported as revenue and do impact the computation of net income. When eventually sold, the difference between the original cost of the securities and the proceeds received is reported as a gain or loss shown within net income. Because the periodic changes in value are not factored into the calculation of net income, they are included in the calculation of comprehensive income. Thus, both net income and comprehensive income are reported to decision makers to provide them with a better understanding of the impact of these unrealized gains and losses.

12.3 Accounting for Investments by Means of the Equity Method

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Describe the theoretical criterion for applying the equity method to an investment in stock and explain the practical standard that is often used.

- Compute the amount of income to be recognized when using the equity method and make the journal entry for its recording.

- Understand the handling of dividends that are received when the equity method is applied and make the journal entry.

- Indicate the impact that a change in fair value has on the reporting of an equity method investment.

- Prepare the journal entry to record the sale of an equity method security.

The Need to Apply the Equity Method

Question: Not all investments in capital stock are made solely for the possibility of gaining dividends and share price appreciation. As mentioned earlier, Starbucks holds 39.9 percent ownership of Starbucks Coffee Japan Ltd. The relationship between those two companies is different. The investor has real power; it can exert some amount of authority over the investee. Starbucks owns a large enough stake in Starbucks Coffee Japan Ltd. so that operating and financing decisions can be influenced. When one company holds a sizable portion of another company, is accounting for the investment as either an available-for-sale or trading security a reasonable approach?

Answer: The answer to this question depends on the size of ownership. As the percentage of shares being held grows, the investor gradually moves from having little or no authority over the investee to a position where significant influence can be exerted. At that point, for financial reporting purposes, the investment no longer qualifies as a trading security or an available-for-sale security. Instead, the shares are reported by means of the equity methodA method of reporting an investment in stock that is applied when the owner has the ability to exert significant influence on the decisions of an investee; in practice, it is used to report investments where 20 percent or more and less than or equal to 50 percent of the shares are held, unless evidence exists that significant influence does not exist.. The owner’s rationale for holding the investment has changed. The equity method views the connection between the two companies in an entirely different fashion. The accounting process applied by the investor is altered to more closely mirror this relationship.

The equity method is applied when the investor has the ability to apply significant influence to the operating and financing decisions of the investee. Unfortunately, the precise point at which one company gains that ability is impossible to ascertain. A bright line distinction simply does not exist. Although certain clues such as membership on the board of directors and the comparative size of other ownership interests can be helpful, the degree of influence is a nebulous criterion. When a question arises as to whether the ability to apply significant influence exists, the percentage of ownership can be used to provide an arbitrary standard.

According to U.S. GAAP, unless signs of significant influence are present, an investor owning less than 20 percent of the outstanding shares of another company reports the investment as either a trading security or available-for-sale security. In contrast, an investor holding 20 percent or more but less than or equal to 50 percent of the shares of another company is assumed to possess the ability to exert significant influence. Consequently, unless evidence is present that significant influence does not exist, the equity method is applied by the investor to report all investments in this 20–50 percent range of ownership.

Test Yourself

Question:

Howard Company acquires 26 percent of the outstanding stock of Birmington Bottling Company. Unfortunately, the Larito Company holds the other 74 percent of Birmington and pays no attention to the ideas and suggestions put forth by Howard. Which of the following is true about Howard’s reporting of this investment?

- The equity method should be applied because Howard holds 20–50 percent of the shares of Birmington Bottling.

- The equity method should not be applied because Howard only holds 26 percent of the shares of Birmington Bottling.

- The equity method should be applied because Howard has significant influence over Birmington Bottling.

- The equity method should not be applied because Howard does not have significant influence over Birmington Bottling.

Answer:

The correct answer is choice d: The equity method should not be applied because Howard does not have significant influence over Birmington Bottling.

Explanation:

Normally, if one company holds 20–50 percent of the outstanding stock of another company, significant influence is assumed and the equity method is applied. However, in this situation, Howard Company has virtually no influence because Larito Company holds a majority of the stock and does not pay any attention to Howard Company. Without the ability to apply significant influence, the equity method should not be adopted regardless of the amount of stock that is held.

The Reporting of Investments When Applying the Equity Method

Question: One company holds shares of another and has the ability to apply significant influence. Thus, the equity method of accounting is appropriate. What financial reporting is made of an investment when the equity method is used? What asset value is reported on the owner’s balance sheet and when is income recognized from the investment under this approach?

Answer: When applying the equity method, the investor does not wait until dividends are received to recognize profit from its investment. Because of the close relationship between the two companies, the investor reports income as it is earned by the investee. That is a key element of using the equity method. If, for example, a company reports net income of $100,000 in the current year, an investor holding a 40 percent ownership interest immediately records an increase in its own income of $40,000 ($100,000 × 40 percent). The appropriate percentage of the investee’s income is recognized by the investor. The investor also increases its investment account by $40,000 to reflect the growth in the size of the investee company.

Because income is recognized by the investor as earned by the investee, it cannot be reported again when a subsequent dividend is collected. That would double-count the impact. Income must be recognized either when earned by the investee or when later distributed to the investor in the form of a dividend, but not at both times. The equity method uses the earlier date rather than the latter.

Eventual payment of a dividend actually shrinks the size of the investee company because it has fewer assets. To reflect that change in size, the investor decreases the investment account when a dividend is received if the equity method is applied. No additional income is recorded because it was recorded by the investor when earned by the investee.

Because of the fair value option, companies are also allowed to report equity investments as if they were trading securities. However, few investors seem to have opted to make this election. If chosen, the investment is reported at fair value despite the degree of ownership with gains and losses in the change of fair value reported within net income.

Application of the Equity Method Illustrated

Question: In applying the equity method, income is recognized by the investor when earned by the investee. Subsequent dividend collections are not reported as revenue by the investor but rather as a reduction in the size of the investment account to avoid including the income twice.

To illustrate, assume that Big Company buys 40 percent of the outstanding stock of Little Company on January 1, Year One, for $900,000. No evidence is present to indicate that Big lacks the ability to exert significant influence over the financing and operating decisions of Little. Thus, application of the equity method is appropriate. During Year One, Little reports net income of $200,000 and distributes a total cash dividend to its stockholders of $30,000. What journal entries are appropriate for an investor when the equity method is applied to an investment?

Answer: The purchase of 40 percent of Little Company for cash is merely the exchange of one asset for another. Thus, the investment is recorded initially by Big at its historical cost, as shown in Figure 12.11 "Acquisition of Shares of Little to Be Reported Using the Equity Method".

Figure 12.11 Acquisition of Shares of Little to Be Reported Using the Equity Method

Ownership here is in the 20 to 50 percent range and no evidence is presented to indicate that the ability to apply significant influence is missing. Thus, according to U.S. GAAP, the equity method should be applied. That means Big recognizes its portion of Little’s $200,000 net income as soon as it is earned by the investee. As a 40 percent owner, Big accrues income of $80,000 ($200,000 × 40%). Because earning this income caused Little Company to grow, Big increases its investment account to reflect the change in the size of the investee. Big’s journal entry is shown in Figure 12.12 "Income of Investee Recognized by Investor Using the Equity Method".

Figure 12.12 Income of Investee Recognized by Investor Using the Equity Method

Big recognized its share of the income from this investee as it was earned. Consequently, any eventual dividend received from Little is a reduction in the investment rather than a new revenue. The investee company is smaller as a result of the cash payout. The balance in this investment account rises when the investee reports income but falls (by $12,000 or 40 percent of the dividend distribution of $30,000) when that income is later passed through to the stockholders.

Figure 12.13 Dividend Received from Investment Accounted for by the Equity Method

At the end of Year One, the investment account appearing on Big’s balance sheet reports a total of $968,000 ($900,000 + 80,000 − 12,000). This balance does not reflect fair value as was appropriate with investments in trading securities and available-for-sale securities. Unless impaired, fair value is ignored in reporting an equity method investment.

The reported amount also does not disclose historical cost. Rather, the asset figure determined under the equity method is an unusual mixture. It is the original cost of the shares plus the investor’s share of the investee’s subsequent income less any dividends received since the date of acquisition. Under the equity method, the investment balance is a conglomerate of amounts.

Test Yourself

Question:

Giant Company buys 30 percent of the outstanding stock of Tiny Company on January 1, Year One for $300,000. This ownership provides Giant with the ability to significantly influence the operating and financing decisions of Tiny. Subsequently, Tiny reports net income of $70,000 each year and pays an annual cash dividend of $20,000. Giant does not elect to report this investment as a trading security. Which of the following statements is true?

- Giant will report this investment at $342,000 on December 31, Year Two.

- Giant will report this investment at $363,000 on December 31, Year Three.

- Giant will report income from this investment of $27,000 in Year Two.

- Giant will report income from this investment of $21,000 in Year Three.

Answer:

The correct answer is choice d: Giant will report income from this investment of $21,000 in Year Three.

Explanation:

Because the ability to apply significant influence is held, Giant uses the equity method. Each year, income of $21,000 is recognized ($70,000 × 30 percent) with an increase in the investment. Dividends are reported by Giant as a $6,000 reduction in the investment and not as income. The investment balance grows at a rate of $15,000 per year ($21,000 increase less $6,000 decrease) so that it is reported as $315,000 at the end of Year One, $330,000 (Year Two), and $345,000 (Year Three).

Selling an Investment Reported by Means of the Equity Method

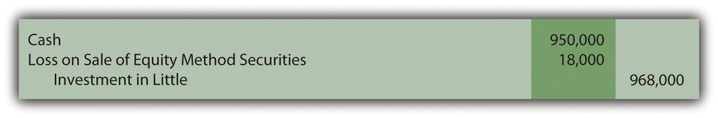

Question: Assume, at the end of Year One, after the above journal entries have been made, Big sells all of its shares in Little Company for $950,000 in cash. When the equity method is applied to an investment, what is the appropriate recording of an eventual sale?

Answer: Any investment reported using the equity method quickly moves away from historical cost as income is earned and dividends received. After just one year in this illustration, the asset balance reported by Big has risen from $900,000 to $968,000 (income of $80,000 was added and $12,000 in dividends were subtracted). If these shares are then sold for $950,000, a loss of $18,000 is recognized, as shown in Figure 12.14 "Sale of Investment Reported Using the Equity Method".

Figure 12.14 Sale of Investment Reported Using the Equity Method

If the shares of Little had been sold for more than their $968,000 carrying value, a gain on the sale is recorded.

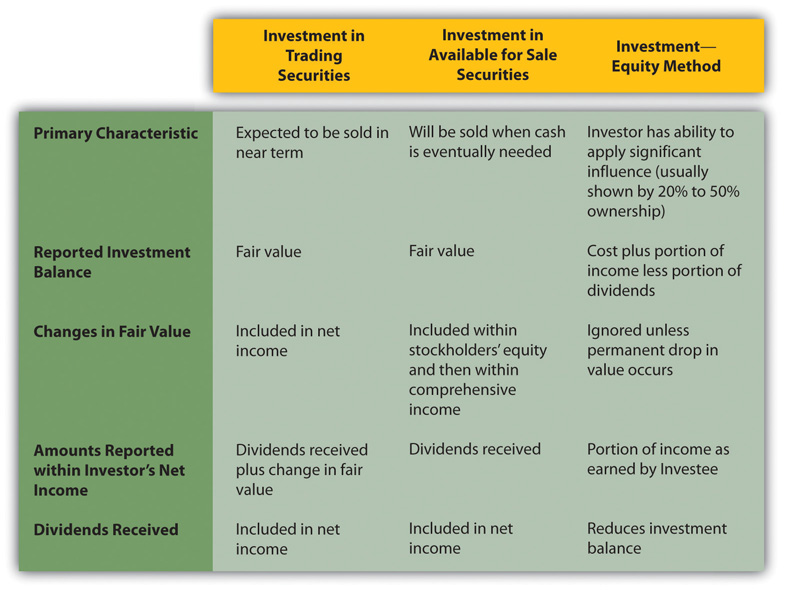

Summary. All investments in the stock of another company—where ownership is no more than 50 percent—must be accounted for in one of three ways depending on the degree of ownership and the intention of the investor: as trading securities, as available-for-sale securities, or according to the equity method. Figure 12.15 "Comparison of Three Methods to Account for Investments" provides an overview of the essential differences in these three accounting approaches. Note here that the available-for-sale securities and the investment using the equity method will have the same accounting as the trading securities if the fair value option is chosen.

Figure 12.15 Comparison of Three Methods to Account for Investments

Test Yourself

Question:

A company holds many investments in the stock of other companies. A dividend is received from one of these investments. Which of the following is true?

- If the equity method is applied, the investment balance is increased.

- If the investment is a trading security, the investment balance is reduced.

- If the investment is available-for-sale, net income is increased.

- If the equity method is applied, net income is increased.

Answer:

The correct answer is choice c: If the investment is available-for-sale, net income is increased.

Explanation:

For trading securities and available-for-sale securities, dividends are recorded as income and have no impact on the investment balance. For an equity method investment, dividends are recorded as a reduction in the investment account with no change reported in net income.

Test Yourself

Question:

A company holds many investments in the stock of other companies. One of these investments goes up in value by $10,000. Which of the following is true?

- Net income increases if the investment is available-for-sale.

- Net income increases if the investment is a trading security.

- Net income increases if the equity method is applied.

- Comprehensive income increases if the equity method is applied.

Answer:

The correct answer is choice b: Net income increases if the investment is a trading security.

Explanation:

Increases in value are not recorded when the equity method is in use. For trading securities, they increase net income. For available-for-sale securities, they do not increase net income but are recorded as other accumulated comprehensive income in the stockholders’ equity section of the balance sheet. They are then used in adjusting net income to arrive at comprehensive income.

Key Takeaway

An investor can gain enough equity shares of another company to have the ability to apply significant influence to its operating and financing decisions. For accounting purposes, use of the equity method then becomes appropriate. The point where significant influence is achieved can be difficult to gauge, so ownership of 20–50 percent of the stock is the normal standard applied in practice. However, if specific evidence is found indicating that significant influence is either present or does not exist, that information takes precedence regardless of the degree of ownership. According to the equity method, income is recognized by the investor as soon as earned by the investee. The investment account also increases as a result of this income recognition. Conversely, dividends are not reported as income but rather as reductions in the investment balance. Unless an impairment occurs, fair value is not taken into consideration in accounting for an equity method investment. When sold, the book value of the asset is removed, and any difference with the amount received is recognized as a gain or loss.

12.4 Reporting Consolidated Financial Statements

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- List various reasons for one company to seek to gain control over another.

- Recognize that consolidated financial statements must be prepared if one company has control over another which is normally assumed at the point when ownership is over 50 percent of the other company’s outstanding stock.

- Explain the reporting of a subsidiary’s revenues and expenses when consolidated financial statements are prepared at the date of acquisition.

- Explain the reporting of a subsidiary’s assets and liabilities when consolidated financial statements are prepared at the date of acquisition.

Accounting for Mergers and Acquisitions

Question: Companies frequently buy more than 50 percent of the stock of other companies in order to gain control. In a large number of these transactions, one company obtains all the outstanding shares of the other so that ownership is complete. If two companies are brought together to form a third, a merger has taken place. If one company simply buys another, the transaction is referred to as an acquisition. These corporate purchases can be monetarily huge and have a long-lasting impact on an industry or the economy as a whole. “Global dollar volume in announced mergers and acquisitions rose 23.1 percent in 2010, to $2.4 trillion, according to Thomson Reuters data. In the United States, merger volume rose 14.2 percent, to $822 billion.”Michael J. de la Merced and Jeffrey Cane, “Confident Deal Makers Pulled Out Checkbooks in 2010,” DealB%k (January 3, 2011), http://dealbook.nytimes.com/2011/01/03/confident-deal-makers-pulled-out-checkbooks-in-2010/.

- Such investments are often made to expand operations into new markets or new industries. Google, for example, acquired YouTube for $1.65 billion to provide an entrance into online videos.

- As discussed earlier in the coverage of intangible assets, one company might buy another to obtain valuable assets such as patents, real estate, trademarks, technology, and the like. The purchase by Walt Disney of Pixar and its digital animation expertise certainly falls into this category.

- A takeover can also be made to eliminate competition or in hopes of gaining economies of scale. The $35 billion merger of Sprint with Nextel was projected to increase profits for the combined companies by lowering operating expenses while also reducing the number of competitors in the wireless communication industry.

To help demonstrate the appropriate method of accounting for such investments, assume that Giant Company acquires 100 percent of Tiny Company. Obviously, Giant has gained control of Tiny. How is the reporting by Giant affected? Because over 50 percent of the stock was purchased, none of the previously described accounting methods are applicable. How does a company report the acquisition of another company where control is established?

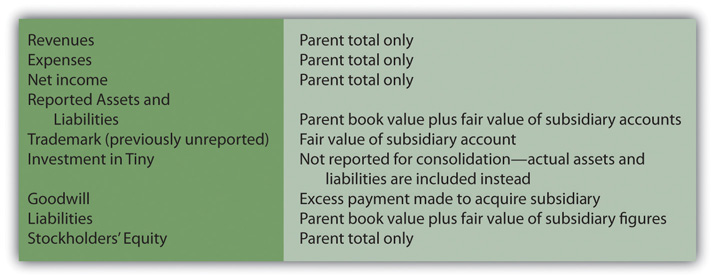

Answer: The stockholders of Giant now control both Giant and Tiny. As a result, a business combination has been formed from the two previously independent companies. For external reporting purposes, consolidated financial statementsStatements that are prepared when one company holds control over another company so that all assets, liabilities, revenues, and expenses must be combined in a method stipulated by U.S. GAAP; control is assumed to exist when more than 50 percent of the ownership shares are owned. are required. Giant does not report an investment in Tiny on its balance sheet as with the other accounting methods described previously. Instead, the individual account balances from each organization are put together in a prescribed fashion to represent the single economic entity that has been created. In simple terms, the assets, liabilities, revenues, and expenses of Tiny (the subsidiary) are consolidated with those of Giant (the parent) to reflect the united business.

Because such acquisitions are common, the financial statements reported by most well-known corporations actually include consolidated financial data from dozens, if not hundreds, of different subsidiaries where control has been gained over a number of years. As just one example, Cisco Systems made over 40 acquisitions of other companies between 2006 and 2011. Consolidated financial statements published today by Cisco Systems will include the revenues, expenses, assets, and liabilities of each of those subsidiaries along with those same accounts for the parent.

Consolidation of financial statements is one of the most complex topics in all of financial accounting. However, the basic process is quite straightforward.

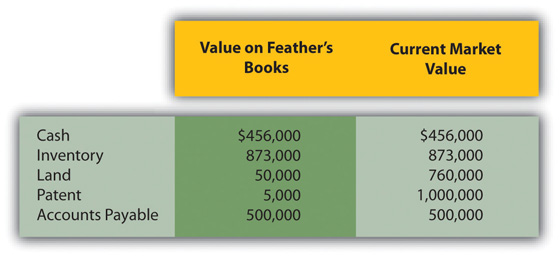

Subsidiary revenues and expenses. The revenues and expenses reported by each subsidiary are included in consolidated figures but only for the period of time after control is obtained. Consequently, if Giant obtains Tiny by buying 100 percent of its stock on April 1, Year One, a consolidated income statement will contain no revenues and expenses recognized by Tiny prior to that date. Income statement balances accrued under previous owners have no financial impact on the new owner (Giant). Only the revenues earned and expenses incurred by this subsidiary after April 1 are included in consolidated totals.

Subsidiary assets and liabilities. Consolidation of subsidiary assets and liabilities is a more complicated process. On the date of the takeover, a total acquisition price is determined based on the fair value surrendered by the parent to gain control. A search is then made to identify all of the individual assets and liabilities held by the subsidiary at that time. As discussed previously, the parent recognizes subsidiary assets (1) that provide contractual or legal rights or (2) that can be separated from the subsidiary and then sold. Fair value is established and recorded for each of these assets as if the parent were acquiring them individually. A transaction has taken place that brings all of the subsidiary properties under the control of the parent.

Also, as explained previously, if the acquisition price is more than the total fair value of these identifiable assets and liabilities, the intangible asset goodwill is reported for the excess. As a going concern, a total value is usually attributed to a company that exceeds the individual values of its assets and liabilities. Having loyal customers and trained employees, for example, helps a company generate more profits than its assets could otherwise earn. When a company is being bought, such anticipated profitability usually leads to an increase in the negotiated price. This excess amount necessitates the recognition of goodwill on the consolidated balance sheet.

Test Yourself

Question:

Tall Company buys all the outstanding stock of Small Company on November 1, Year One for $500,000 and is now preparing consolidated financial statements at the end of Year One. Small earned revenues of $10,000 per month during Year One along with expenses of $8,000 per month. On November 1, Year One, Small had one asset—a piece of land with a cost of $300,000 and a fair value of $450,000—and no liabilities. The land continues to appreciate in value and is worth $470,000 at the end of Year One. Which of the following statements is true about the consolidated financial statements at the end of Year One?

- Consolidated net income will include $4,000 earned by Small.

- Goodwill at the end of Year One is reported as $30,000.

- The land owned by Small is reported at the end of Year One at $470,000.

- On consolidated financial statements, a $150,000 gain is reported on the land that was owned by Small.

Answer:

The correct answer is choice a: Consolidated net income will include $4,000 earned by Small.

Explanation:

In consolidation, only revenues and expenses recognized by Small after the purchase are included. Revenues of $20,000 ($10,000 × 2 months) for November and December are recorded this year as well as expenses of $16,000 ($8,000 × two months). The value of subsidiary assets and liabilities at the date of acquisition serves as the basis for reporting so the land will be shown in consolidation at $450,000. Because $500,000 was paid by the parent, goodwill is the excess $50,000.

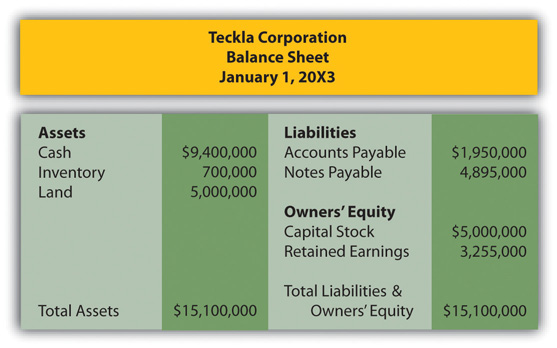

The Consolidation of Financial Information

Question: To illustrate the consolidation process, assume that Tiny has earned revenues of $800,000 and incurred expenses of $500,000 during the year to date. In addition, the company reports a single asset, land costing $400,000 but with a $720,000 fair value. The only liability is a $300,000 note payable. Thus, the company’s reported net book value is $100,000 ($400,000 land less $300,000 note payable). Tiny also owns the rights to a well-known trademark that has no book value because it was developed many years ago at little or no cost. However, it is now estimated to be worth $210,000.

The assets and liabilities held by Tiny have a net fair value of $630,000 ($720,000 land plus $210,000 trademark less $300,000 note payable). Over the years, the company has been extremely popular and developed a large customer base. Therefore, after extensive negotiations, Giant agrees to pay $900,000 in cash to acquire all the outstanding stock of Tiny. If consolidated financial statements are created at the time of a corporate acquisition, what figures are reported by the business combination?

Answer: In consolidating Giant and its subsidiary Tiny at the date of this acquisition, neither the subsidiary revenues of $800,000 nor its expenses of $500,000 are included. Their financial impact occurred prior to the takeover by Giant. Those profits benefited the previous owners. Therefore, only revenues and expenses reported by Giant make up the consolidated income statement totals determined on the day the parent acquires this subsidiary.

At the same time, consolidated balance sheet totals will not show any “investment in Tiny Company” as in the other methods demonstrated earlier. Instead, Tiny’s land is added to Giant’s own totals at its $720,000 fair value, and the trademark is consolidated at its $210,000 fair value. These balances reflect the amounts paid by Giant to acquire ownership of the subsidiary. The note payable is included in the consolidated figures at $300,000, which was its fair value as well as its book value. Subsidiary assets and liabilities are consolidated as if purchased by the parent on an open market.

The acquisition price of $900,000 paid by Giant exceeds the net value of the subsidiary’s identifiable assets and liabilities ($630,000 or $720,000 + $210,000 − $300,000) by $270,000. In consolidation of a parent and subsidiary, any excess acquisition payment is assumed to represent goodwill and is reported as an intangible asset.

Figure 12.16 Consolidated Totals—Date of Acquisition

Test Yourself

Question:

Large Company produces a balance sheet that shows patents with a book value of $200,000. The next day, Large Company buys all of Short Company for $3 million. Consolidated financial statements are then produced that show patents with a book value of $300,000. What does the reader of these financial statements know about the patents held by Large and its consolidated subsidiary?

- Acquiring Short made the patents held by Large more valuable.

- At the date of acquisition, Short held patents with a fair value of $100,000.

- At the date of acquisition, Short held patents with a historical cost of $100,000.

- At the date of acquisition, Short held patents with a net book value (cost minus accumulated amortization) of $100,000.

Answer:

The correct answer is choice b: At the date of acquisition, Short held patents with a fair value of $100,000.

Explanation:

On the date that a business combination is formed, the fair value of all identifiable assets and liabilities of the subsidiary are added to those same accounts of the parent. Because the patent account balance went up by $100,000 as a result of the purchase, that figure was the apparent fair value of any patents held by Short Company at that time.

Analyzing a Company’s Use of Its Assets

Question: This chapter completes coverage of the assets reported by an organization on its balance sheet. In earlier chapters, vital signs were computed and explained in connection with receivables, inventory, and property and equipment. Figures and ratios were presented that are often used in evaluating a business—especially its financial health and future prospects. Do any similar vital signs exist for assets as a whole that decision makers will typically determine as part of an overall examination of an organization such as PepsiCo or The Coca-Cola Company?

Answer: A company controls a specific amount of assets. Investors and other decision makers are interested in how effectively management is able to make use of these resources. Individuals who study specific companies search for signs that an appropriate level of income was generated from the assets on hand.

Total asset turnover. Total asset turnoverA ratio used to measure the efficient use of assets; it is computed by dividing sales revenue by average total assets for the period. is one such figure. It indicates management’s efficiency at generating sales revenue. Sales must occur before profits can be earned from normal operations. If assets are not well used to create sales, profits are unlikely to arise.

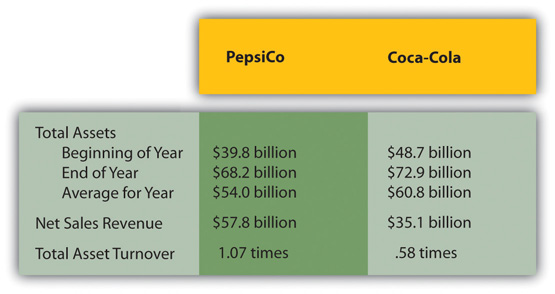

total asset turnover = sales revenue/average total assetsTo illustrate, here is information reported for 2010 by PepsiCo Inc. and The Coca-Cola Company. Based on these figures, the total asset turnover can be computed for each company for comparison purposes as shown in Figure 12.17 "2010 Comparison of ".

Figure 12.17 2010 Comparison of PepsiCo Inc. and The Coca-Cola Company

Return on assets. Probably one of the most commonly used vital signs employed in studying the financial health of a company is its return on assetsA ratio used to measure the profitable use of assets by a company’s management; it is computed by dividing net income by the average total assets for the period., often known as ROA. It is computed by taking net income and then dividing that figure by the average total assets for the period. It is viewed by many as an appropriate means of measuring management’s efficiency in using company resources.

return on assets (ROA) = net income/average total assetsVariations of this formula do exist. For example, some analysts modify the income figure by removing interest expense to eliminate the impact of different financing strategies so that the computation focuses on operations.

For 2010, PepsiCo reported net income of $6.3 billion so that its ROA for the year was 11.7 percent ($6.3 billion net income/$54.0 billion as the average total assets). For the same period, The Coca-Cola Company reported net income of $11.8 billion for an ROA of 19.4 percent ($11.8 billion net income/$60.8 billion in average total assets).

Key Takeaway

Companies attempt to obtain control of other companies for many reasons including obtaining access to valuable assets, gaining entry into new industries, and eliminating competition. According to U.S. GAAP, control is established over another company by acquiring 50 percent or more of its ownership shares. At that point, consolidated financial statements must be prepared bringing together the financial accounts from both companies. For the subsidiary, only revenues and expenses since the takeover are included. In consolidating the assets and liabilities of the subsidiary, the fair value at the date of acquisition is assumed to represent the cost incurred by the parent. The intangible asset goodwill is reported for any unexplained excess payment made by the parent in acquiring control over the subsidiary. To evaluate the efficiency of management’s use of company assets, many analysts compute total asset turnover and return on assets (ROA).

Talking with a Real Investing Pro (Continued)

Following is a continuation of our interview with Kevin G. Burns.

Question: For the year ended December 31, 2010, The Dow Chemical Company reported its net income as approximately $2.321 billion. The company also disclosed comprehensive income for the same period of only $1.803 billion. That’s a 22 percent reduction. Are you disturbed that a company can report two separate income figures that are so significantly different? Or, do you find disclosing income in two distinct ways to be helpful when you analyze a business?

Kevin Burns: Actually I think the idea of disclosing income in two different ways makes sense. Having said that, if I were a shareholder of Dow Chemical, I would want to know why these numbers are so far apart? What exactly is included in (or excluded from) each of these income figures? Is the company’s core business sound? This question is probably best answered by net income. The reduction in arriving at comprehensive income is likely to have come from losses in the value of available-for-sale investments and from holding foreign currency balances. That can provide interesting information. Perhaps the management is distracted by trying to manage a large stock investment portfolio. How much of the difference comes from currency rate changes, and is there a way to hedge this volatility to reduce the impact? If there is a way to hedge that risk, why did company officials choose not to do so?

In sum, the reason I like including both income numbers is that anything that increases disclosure is a positive, especially when investing money. The more transparency the better is my feeling. Then, investors can make up their own minds as to management’s competence and the future success of the overall business operations.

Video Clip

(click to see video)Professor Joe Hoyle talks about the five most important points in Chapter 12 "In a Set of Financial Statements, What Information Is Conveyed about Equity Investments?".

12.5 End-of-Chapter Exercises

Questions

- On January 1, Year One, the Lawrence Company acquires 10,000 shares of the Memphis Company for $39 per share. What are possible reasons why Lawrence chose to use its cash to make this acquisition?

- Wilson Company buys 200 shares of Pepitone Corporation for $17 per share, an asset that is classified as an investment in trading securities. Why is an investment classified in this manner?

- An investor owns equity shares of a number of companies. Some of these investments are reported as trading securities while others are shown as available-for-sale securities. The investor receives a cash dividend of $1,000. How is that receipt reported by the investor?

- The Amos Corporation bought 1,000 shares of Jones Company during Year One for $18 per share. The investment is labeled as a trading security. Amos plans to sell these shares on the stock market for $27 each and is trying to decide whether to make the sell on December 30, Year One, or January 2, Year Two. How will reported net income differ in Year One and in Year Two based on the timing of this sale?

- Unless value is impaired, equipment and inventory are reported based on historical cost. Why is the financial accounting of an investment in trading securities handled differently from these other assets?

- StampCo Corporation bought 1,000 shares of Bates Corporation on December 1, Year One. Company officials are trying to decide whether to report this asset as an investment in trading securities or as an investment in available-for-sale securities. How is this decision made?

- Company A bought 1,000 shares of Company Y for $13 per share and 2,000 shares of Company Z for $18 per share. At the end of the year, the stock of Company Y is worth $15 per share and the stock of Company Z is worth $14 per share. What is reported at year-end if these investments are both classified as investments in trading securities? What is reported at year-end if these investments are both classified as investments in available-for-sale securities?

- An investment is bought during Year One for a total of $9,000. At the end of Year One, these shares are worth $10,000. However, they are sold on February 11, Year Two, for only $6,000. What is the income effect for these two years if this stock is viewed by company officials as a trading security? What is the income effect for these two years if this stock is viewed by company officials as available-for-sale?

- A company acquires an investment in available-for-sale securities during Year one for $23,000. At the end of the year, this investment was worth $19,000. Reported net income was $200,000. What should the company report as its comprehensive income?

- The Lincoln Corporation bought 1,000 shares of Illinois Company during Year One for $21 per share. The investment is labeled as available-for-sale. Lincoln plans to sell these shares on the stock market for $26 each and is trying to decide whether to make the sell on December 30, Year One, or January 2, Year Two. How will reported net income differ in Year One and in Year Two based on the timing of this sale?

- Big Company acquired enough shares of Little Company so that it has gained the ability to exert significant influence over its operating and financing decisions. How should Big report this investment?

- Mama Corporation acquired a rather large block of the capital shares of Child Corporation. Currently, company officials for Mama are trying to decide whether application of the equity method is appropriate. In theory, how is that decision made? In practice, how is that decision made?

- Archibald Corporation owns 30 percent of Saratoga Corporation and will apply the equity method to this investment. During the current year, Saratoga reported net income of $150,000 and paid a total cash dividend of $60,000. What reporting is required of Archibald in connection with this investment?

- Why are dividends that are received from an investment that is being accounted for by means of the equity method not reported as revenue?

- The Walters Company acquired 40 percent of the Ameston Company on January 1, Year One, for $388,000. Ameston reported net income of $100,000 for Year One and paid a total cash dividend of $40,000. At the end of Year One, this investment was worth $460,000. What is reported on the owner’s balance sheet for this investment, and what does that figure represent?

- Giant Corporation buys 54 percent of the outstanding stock of Small Corporation. Under normal conditions, how will this investment be reported?

- Lauderdale Corporation has two assets. The land cost $100,000 and is worth $220,000. A building has a net book value of $650,000 and a fair value of $730,000. Yarrow Corporation buys 100 percent of the outstanding stock of Lauderdale for cash of $1 million. What journal entry does Yarrow make to consolidate Lauderdale’s assets within its own financial records?

- Donnelly Corporation generated revenues of $900,000 during Year One while Nelson Company generated revenues of $600,000 during the same period. On the last day of the year, Donnelly buys all of the ownership shares of Nelson. In consolidated financial statements for December 31, Year One, and the year then ended, what is the reported amount of revenues?

- Financial analysts determine the total asset turnover for the Paquet Corporation as 2.3. How did these decision makers arrive at this figure?

- Financial analysts study the financial statements reported by Williamston Corporation and calculate a return on assets of 11.3 percent. How did they arrive at that figure?

True or False

- ____ To keep the information relatively simple for financial statement users, all investments in the ownership shares of other companies are accounted for in the same way according to U.S. GAAP.

- ____ If the owner of trading securities receives a cash dividend, it should be recorded as revenue at that time and shown on the income statement.

- ____ All investments in other companies should be reported at the historical cost of the investment.

- ____ A company buys trading securities in Year One for $11,000. They increase in value by $2,000 in Year One and are then sold in Year Two for $14,000. A gain of $3,000 is recognized on the company’s income statement in Year Two.

- ____ The Argentina Company buys shares of another company and is currently attempting to determine whether this ownership qualifies as an investment in trading securities or available-for-sale securities. The total amount of assets reported by Argentina will vary depending on which approach is selected.

- ____ Changes in the value of available-for-sale securities do not affect the reported net income of the investor until the securities are sold.

- ____ The Nile Company buys 100 shares of a company for $7,000 in cash in Year One. The shares increase in value by $1,000 in Year One and then by $2,000 in Year Two and are then sold. In addition, a dividend is received from this investment of $300. In Year Two, the Nile Company will increase its net income by $3,300 if this investment is judged to be a trading security.

- ____ At the beginning of Year One, the Barksdale Corporation buys shares of another company for $7,000. The stock goes up in value during Year One by $5,000. Dividends of $1,000 are also collected. Company officials view this as an investment in available-for-sale securities. If net income is reported as $40,000, then comprehensive income will be $45,000.

- ____ Accumulated other comprehensive income is included by a company on its income statement within the computation of net income.

- ____ If one company owns 25 percent of another company, it must use the equity method to account for this investment.

- ____ Equity method investments are reported at current fair value on the owner’s balance sheet.

- ____ On January 1, Year One, Ajax Company spends $200,000 on an investment. In this purchase, the company gains 30 percent ownership of another company and the ability to apply significant influence. During Year One, the other company reports net income of $50,000 and distributes a cash dividend of $10,000. Ajax should report dividend revenue of $3,000.