This is “Reporting Consolidated Financial Statements”, section 12.4 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

12.4 Reporting Consolidated Financial Statements

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- List various reasons for one company to seek to gain control over another.

- Recognize that consolidated financial statements must be prepared if one company has control over another which is normally assumed at the point when ownership is over 50 percent of the other company’s outstanding stock.

- Explain the reporting of a subsidiary’s revenues and expenses when consolidated financial statements are prepared at the date of acquisition.

- Explain the reporting of a subsidiary’s assets and liabilities when consolidated financial statements are prepared at the date of acquisition.

Accounting for Mergers and Acquisitions

Question: Companies frequently buy more than 50 percent of the stock of other companies in order to gain control. In a large number of these transactions, one company obtains all the outstanding shares of the other so that ownership is complete. If two companies are brought together to form a third, a merger has taken place. If one company simply buys another, the transaction is referred to as an acquisition. These corporate purchases can be monetarily huge and have a long-lasting impact on an industry or the economy as a whole. “Global dollar volume in announced mergers and acquisitions rose 23.1 percent in 2010, to $2.4 trillion, according to Thomson Reuters data. In the United States, merger volume rose 14.2 percent, to $822 billion.”Michael J. de la Merced and Jeffrey Cane, “Confident Deal Makers Pulled Out Checkbooks in 2010,” DealB%k (January 3, 2011), http://dealbook.nytimes.com/2011/01/03/confident-deal-makers-pulled-out-checkbooks-in-2010/.

- Such investments are often made to expand operations into new markets or new industries. Google, for example, acquired YouTube for $1.65 billion to provide an entrance into online videos.

- As discussed earlier in the coverage of intangible assets, one company might buy another to obtain valuable assets such as patents, real estate, trademarks, technology, and the like. The purchase by Walt Disney of Pixar and its digital animation expertise certainly falls into this category.

- A takeover can also be made to eliminate competition or in hopes of gaining economies of scale. The $35 billion merger of Sprint with Nextel was projected to increase profits for the combined companies by lowering operating expenses while also reducing the number of competitors in the wireless communication industry.

To help demonstrate the appropriate method of accounting for such investments, assume that Giant Company acquires 100 percent of Tiny Company. Obviously, Giant has gained control of Tiny. How is the reporting by Giant affected? Because over 50 percent of the stock was purchased, none of the previously described accounting methods are applicable. How does a company report the acquisition of another company where control is established?

Answer: The stockholders of Giant now control both Giant and Tiny. As a result, a business combination has been formed from the two previously independent companies. For external reporting purposes, consolidated financial statementsStatements that are prepared when one company holds control over another company so that all assets, liabilities, revenues, and expenses must be combined in a method stipulated by U.S. GAAP; control is assumed to exist when more than 50 percent of the ownership shares are owned. are required. Giant does not report an investment in Tiny on its balance sheet as with the other accounting methods described previously. Instead, the individual account balances from each organization are put together in a prescribed fashion to represent the single economic entity that has been created. In simple terms, the assets, liabilities, revenues, and expenses of Tiny (the subsidiary) are consolidated with those of Giant (the parent) to reflect the united business.

Because such acquisitions are common, the financial statements reported by most well-known corporations actually include consolidated financial data from dozens, if not hundreds, of different subsidiaries where control has been gained over a number of years. As just one example, Cisco Systems made over 40 acquisitions of other companies between 2006 and 2011. Consolidated financial statements published today by Cisco Systems will include the revenues, expenses, assets, and liabilities of each of those subsidiaries along with those same accounts for the parent.

Consolidation of financial statements is one of the most complex topics in all of financial accounting. However, the basic process is quite straightforward.

Subsidiary revenues and expenses. The revenues and expenses reported by each subsidiary are included in consolidated figures but only for the period of time after control is obtained. Consequently, if Giant obtains Tiny by buying 100 percent of its stock on April 1, Year One, a consolidated income statement will contain no revenues and expenses recognized by Tiny prior to that date. Income statement balances accrued under previous owners have no financial impact on the new owner (Giant). Only the revenues earned and expenses incurred by this subsidiary after April 1 are included in consolidated totals.

Subsidiary assets and liabilities. Consolidation of subsidiary assets and liabilities is a more complicated process. On the date of the takeover, a total acquisition price is determined based on the fair value surrendered by the parent to gain control. A search is then made to identify all of the individual assets and liabilities held by the subsidiary at that time. As discussed previously, the parent recognizes subsidiary assets (1) that provide contractual or legal rights or (2) that can be separated from the subsidiary and then sold. Fair value is established and recorded for each of these assets as if the parent were acquiring them individually. A transaction has taken place that brings all of the subsidiary properties under the control of the parent.

Also, as explained previously, if the acquisition price is more than the total fair value of these identifiable assets and liabilities, the intangible asset goodwill is reported for the excess. As a going concern, a total value is usually attributed to a company that exceeds the individual values of its assets and liabilities. Having loyal customers and trained employees, for example, helps a company generate more profits than its assets could otherwise earn. When a company is being bought, such anticipated profitability usually leads to an increase in the negotiated price. This excess amount necessitates the recognition of goodwill on the consolidated balance sheet.

Test Yourself

Question:

Tall Company buys all the outstanding stock of Small Company on November 1, Year One for $500,000 and is now preparing consolidated financial statements at the end of Year One. Small earned revenues of $10,000 per month during Year One along with expenses of $8,000 per month. On November 1, Year One, Small had one asset—a piece of land with a cost of $300,000 and a fair value of $450,000—and no liabilities. The land continues to appreciate in value and is worth $470,000 at the end of Year One. Which of the following statements is true about the consolidated financial statements at the end of Year One?

- Consolidated net income will include $4,000 earned by Small.

- Goodwill at the end of Year One is reported as $30,000.

- The land owned by Small is reported at the end of Year One at $470,000.

- On consolidated financial statements, a $150,000 gain is reported on the land that was owned by Small.

Answer:

The correct answer is choice a: Consolidated net income will include $4,000 earned by Small.

Explanation:

In consolidation, only revenues and expenses recognized by Small after the purchase are included. Revenues of $20,000 ($10,000 × 2 months) for November and December are recorded this year as well as expenses of $16,000 ($8,000 × two months). The value of subsidiary assets and liabilities at the date of acquisition serves as the basis for reporting so the land will be shown in consolidation at $450,000. Because $500,000 was paid by the parent, goodwill is the excess $50,000.

The Consolidation of Financial Information

Question: To illustrate the consolidation process, assume that Tiny has earned revenues of $800,000 and incurred expenses of $500,000 during the year to date. In addition, the company reports a single asset, land costing $400,000 but with a $720,000 fair value. The only liability is a $300,000 note payable. Thus, the company’s reported net book value is $100,000 ($400,000 land less $300,000 note payable). Tiny also owns the rights to a well-known trademark that has no book value because it was developed many years ago at little or no cost. However, it is now estimated to be worth $210,000.

The assets and liabilities held by Tiny have a net fair value of $630,000 ($720,000 land plus $210,000 trademark less $300,000 note payable). Over the years, the company has been extremely popular and developed a large customer base. Therefore, after extensive negotiations, Giant agrees to pay $900,000 in cash to acquire all the outstanding stock of Tiny. If consolidated financial statements are created at the time of a corporate acquisition, what figures are reported by the business combination?

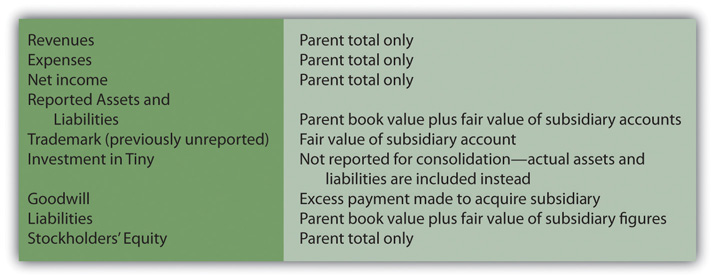

Answer: In consolidating Giant and its subsidiary Tiny at the date of this acquisition, neither the subsidiary revenues of $800,000 nor its expenses of $500,000 are included. Their financial impact occurred prior to the takeover by Giant. Those profits benefited the previous owners. Therefore, only revenues and expenses reported by Giant make up the consolidated income statement totals determined on the day the parent acquires this subsidiary.

At the same time, consolidated balance sheet totals will not show any “investment in Tiny Company” as in the other methods demonstrated earlier. Instead, Tiny’s land is added to Giant’s own totals at its $720,000 fair value, and the trademark is consolidated at its $210,000 fair value. These balances reflect the amounts paid by Giant to acquire ownership of the subsidiary. The note payable is included in the consolidated figures at $300,000, which was its fair value as well as its book value. Subsidiary assets and liabilities are consolidated as if purchased by the parent on an open market.

The acquisition price of $900,000 paid by Giant exceeds the net value of the subsidiary’s identifiable assets and liabilities ($630,000 or $720,000 + $210,000 − $300,000) by $270,000. In consolidation of a parent and subsidiary, any excess acquisition payment is assumed to represent goodwill and is reported as an intangible asset.

Figure 12.16 Consolidated Totals—Date of Acquisition

Test Yourself

Question:

Large Company produces a balance sheet that shows patents with a book value of $200,000. The next day, Large Company buys all of Short Company for $3 million. Consolidated financial statements are then produced that show patents with a book value of $300,000. What does the reader of these financial statements know about the patents held by Large and its consolidated subsidiary?

- Acquiring Short made the patents held by Large more valuable.

- At the date of acquisition, Short held patents with a fair value of $100,000.

- At the date of acquisition, Short held patents with a historical cost of $100,000.

- At the date of acquisition, Short held patents with a net book value (cost minus accumulated amortization) of $100,000.

Answer:

The correct answer is choice b: At the date of acquisition, Short held patents with a fair value of $100,000.

Explanation:

On the date that a business combination is formed, the fair value of all identifiable assets and liabilities of the subsidiary are added to those same accounts of the parent. Because the patent account balance went up by $100,000 as a result of the purchase, that figure was the apparent fair value of any patents held by Short Company at that time.

Analyzing a Company’s Use of Its Assets

Question: This chapter completes coverage of the assets reported by an organization on its balance sheet. In earlier chapters, vital signs were computed and explained in connection with receivables, inventory, and property and equipment. Figures and ratios were presented that are often used in evaluating a business—especially its financial health and future prospects. Do any similar vital signs exist for assets as a whole that decision makers will typically determine as part of an overall examination of an organization such as PepsiCo or The Coca-Cola Company?

Answer: A company controls a specific amount of assets. Investors and other decision makers are interested in how effectively management is able to make use of these resources. Individuals who study specific companies search for signs that an appropriate level of income was generated from the assets on hand.

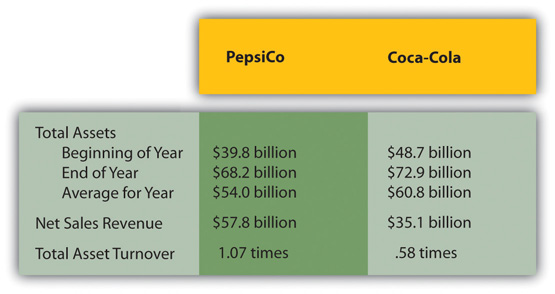

Total asset turnover. Total asset turnoverA ratio used to measure the efficient use of assets; it is computed by dividing sales revenue by average total assets for the period. is one such figure. It indicates management’s efficiency at generating sales revenue. Sales must occur before profits can be earned from normal operations. If assets are not well used to create sales, profits are unlikely to arise.

total asset turnover = sales revenue/average total assetsTo illustrate, here is information reported for 2010 by PepsiCo Inc. and The Coca-Cola Company. Based on these figures, the total asset turnover can be computed for each company for comparison purposes as shown in Figure 12.17 "2010 Comparison of ".

Figure 12.17 2010 Comparison of PepsiCo Inc. and The Coca-Cola Company

Return on assets. Probably one of the most commonly used vital signs employed in studying the financial health of a company is its return on assetsA ratio used to measure the profitable use of assets by a company’s management; it is computed by dividing net income by the average total assets for the period., often known as ROA. It is computed by taking net income and then dividing that figure by the average total assets for the period. It is viewed by many as an appropriate means of measuring management’s efficiency in using company resources.

return on assets (ROA) = net income/average total assetsVariations of this formula do exist. For example, some analysts modify the income figure by removing interest expense to eliminate the impact of different financing strategies so that the computation focuses on operations.

For 2010, PepsiCo reported net income of $6.3 billion so that its ROA for the year was 11.7 percent ($6.3 billion net income/$54.0 billion as the average total assets). For the same period, The Coca-Cola Company reported net income of $11.8 billion for an ROA of 19.4 percent ($11.8 billion net income/$60.8 billion in average total assets).

Key Takeaway

Companies attempt to obtain control of other companies for many reasons including obtaining access to valuable assets, gaining entry into new industries, and eliminating competition. According to U.S. GAAP, control is established over another company by acquiring 50 percent or more of its ownership shares. At that point, consolidated financial statements must be prepared bringing together the financial accounts from both companies. For the subsidiary, only revenues and expenses since the takeover are included. In consolidating the assets and liabilities of the subsidiary, the fair value at the date of acquisition is assumed to represent the cost incurred by the parent. The intangible asset goodwill is reported for any unexplained excess payment made by the parent in acquiring control over the subsidiary. To evaluate the efficiency of management’s use of company assets, many analysts compute total asset turnover and return on assets (ROA).

Talking with a Real Investing Pro (Continued)

Following is a continuation of our interview with Kevin G. Burns.

Question: For the year ended December 31, 2010, The Dow Chemical Company reported its net income as approximately $2.321 billion. The company also disclosed comprehensive income for the same period of only $1.803 billion. That’s a 22 percent reduction. Are you disturbed that a company can report two separate income figures that are so significantly different? Or, do you find disclosing income in two distinct ways to be helpful when you analyze a business?

Kevin Burns: Actually I think the idea of disclosing income in two different ways makes sense. Having said that, if I were a shareholder of Dow Chemical, I would want to know why these numbers are so far apart? What exactly is included in (or excluded from) each of these income figures? Is the company’s core business sound? This question is probably best answered by net income. The reduction in arriving at comprehensive income is likely to have come from losses in the value of available-for-sale investments and from holding foreign currency balances. That can provide interesting information. Perhaps the management is distracted by trying to manage a large stock investment portfolio. How much of the difference comes from currency rate changes, and is there a way to hedge this volatility to reduce the impact? If there is a way to hedge that risk, why did company officials choose not to do so?

In sum, the reason I like including both income numbers is that anything that increases disclosure is a positive, especially when investing money. The more transparency the better is my feeling. Then, investors can make up their own minds as to management’s competence and the future success of the overall business operations.

Video Clip

(click to see video)Professor Joe Hoyle talks about the five most important points in Chapter 12 "In a Set of Financial Statements, What Information Is Conveyed about Equity Investments?".