This is “End-of-Chapter Exercises”, section 11.6 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

11.6 End-of-Chapter Exercises

Questions

- Define “intangible asset” and give three common examples.

- For accounting purposes, at what amount are intangible assets typically reported?

- What are the six general types of intangibles that are reported as assets?

- In connection with intangible assets, what is the purpose of amortization?

- A company owns an intangible asset that is being amortized to expense over fifteen years. How was this fifteen-year period determined?

- The Ladorne Company owns a patent with a historical cost of $130,000 and a net book value of $82,000. The patent has become extremely valuable and is now worth $2.2 million. What does Ladorne report on its balance sheet for this intangible asset? Explain the reason for that method of accounting.

- The Bailor Company has a copyright with a cost of $200,000 and annual amortization of $40,000. In recording amortization, why might the company reduce the copyright’s cost directly rather than set up a separate accumulated amortization account?

- The Winston Corporation holds a patent with a cost of $2.1 million and a net book value of $1.5 million. Winston has to defend its right to this patent in court at a cost of $212,000. In what ways can this legal cost be reported?

- Large Corporation purchases all of the outstanding capital stock of Small Corporation. Large paid an especially large amount because Small had a certain attribute that was valued at over $3 million. Under what condition will Large be able to recognize this attribute as an identifiable intangible asset after the purchase has been finalized?

- Large Corporation purchases all of the outstanding capital stock of Small Corporation. Large paid an especially large amount because Small had a certain attribute that was valued at over $3 million. Assume that this attribute does not qualify for separate recognition as an identifiable intangible asset. What reporting will Large make of this $3 million on consolidated financial statements after the acquisition is finalized?

- A decision maker looks at the financial statements produced by the Rotolo Corporation for the current year. On the balance sheet, an account titled “goodwill” is reported with a balance of $13.8 million. What does the decision maker know from this information?

- Goodwill is recognized on a consolidated balance sheet on January 1, Year One. What happens to that asset balance over subsequent years?

- Giant Corporation acquires all of the outstanding capital stock of Little Corporation on January 1, Year One. As a result, goodwill of $15 million is reported. On a balance sheet produced 5 years later, will the goodwill balance still be reported and, if so, will $15 million be the figure that appears?

- Hammerstine Corporation pays $3 million for research and $5 million for development in connection with the creation of a new product that the company believes will generate over $19 million in revenue. How are the research and development costs reported under U.S. GAAP?

- How does U.S. GAAP differ in its method of reporting research and development costs from the rules established by IFRS?

- The Albright Corporation spends millions each year on research and development and, as a result, has been able to create a number of valuable patents and copyrights. Because of the handling required by U.S. GAAP, what can a decision maker say about a balance sheet reported by the Albright Corporation?

- What are the advantages of reporting research and development costs in the method required by U.S. GAAP?

- A company pays $2 million to acquire a patent. Under two different conditions, no determination of present value is required. What are those two conditions?

- The NortonRidge Corporation buys an intangible asset for $11 million to be paid in five years. No other payment is to be made. The present value of this cash payment is computed as $7.6 million using a reasonable interest rate. Mechanically, what does a present value computation accomplish?

- An intangible asset with a five-year useful life and no residual value is bought on January 1, Year One, for $4 million. However, the purchase is made with a future cash payment that has a present value of only $3 million based on a reasonable annual interest rate of 10 percent. What is the total amount of expense to be reported by the acquiring company in Year One?

- An intangible asset with a five-year useful life and no residual value is bought on January 1, Year One, for $4 million. However, the purchase is made with a future cash payment that has a present value of only $3 million based on a reasonable annual interest rate of 10 percent. What is the total amount of expense to be reported by the acquiring company in Year Two?

- A company has agreed to pay $6 million in the future and needs to determine the present value of that cash flow. What three pieces of information are needed to calculate present value?

- What is meant by the term “compounding”?

- What is the difference between an ordinary annuity and an annuity due?

True or False

- ____ On December 31, Year One, a company acquires a trademark and reports the intangible asset on its balance sheet at that date at $1.3 million. This figure represents the historical cost of this asset.

- ____ A company has a technology-related asset. It also has a marketing-related asset. These two assets cannot both be reported as intangible assets at the same time.

- ____ Amortization of intangibles is usually done over the asset’s legal life.

- ____ If an intangible asset is successfully defended from a legal challenge, the incurred legal costs are capitalized to the asset account.

- ____ Typically, intangible assets are shown on a company’s balance sheet at fair value.

- ____ One company acquires another. Subsequently, the acquiring company continues to report any intangible assets owned by the acquired company at the same historical cost basis that had been used by the acquired company.

- ____ A company has bought another company and is in the process of identifying the acquired intangible assets. To be reported as an intangible asset on a consolidated balance sheet, the parent company must be able to separate the item from the subsidiary and sell it.

- ____ A balance sheet reports goodwill as an intangible asset at $745,000. This figure indicates that the reporting company has an especially talented workforce.

- ____ A balance sheet reports goodwill as an intangible asset at $745,000. This figure indicates that the reporting company has given an extensive amount of money to charities.

- ____ Goodwill is an intangible asset that is usually written off to expense over forty years, although its actual life is likely to be much shorter than that.

- ____ After a company records goodwill, it will remain on the company’s balance sheet forever because it is not amortized.

- ____ A company must be able to connect goodwill with a specific intangible (such as the quality of a company’s workforce) before the asset can be recognized on a balance sheet.

- ____ Research and development costs that help a company to develop successful products are capitalized under U.S. GAAP.

- ____ Because of the handling of research and development costs required by U.S. GAAP, companies that spend significant amounts to develop new products will normally have exceptionally high amounts reported as assets on their balance sheets.

- ____ U.S. GAAP and IFRS handle research and development costs in the same manner.

- ____ A company agrees to pay $2 million for a patent in six years plus interest at an annual rate of 5 percent, which is considered a reasonable rate. A present value calculation must be carried out to determine the amount to be reported for the asset and the related liability.

- ____ A company buys a copyright for $400,000 on January 1, Year One. If four payments are to be made annually on each January 1, starting on January 1, Year One, the asset balance is determined by finding the present value of an annuity due.

- ____ On January 1, Year One, a company buys an intangible asset by agreeing to make a single payment of $300,000 in five years. Assume that, at a 10 percent annual interest rate which is viewed as reasonable, the present value is $170,000. On December 31, Year One, the liability is reported as $187,000.

- ____ On January 1, Year One, a company buys an intangible asset by agreeing to make a single payment of $500,000 in five years. Assume that, at a 10 percent annual interest rate which is viewed as reasonable, the present value is $310,000. Interest expense to be recognized in Year Two is $34,100.

- ____ On January 1, Year One, a company buys an intangible asset by agreeing to make a single payment of $700,000 in five years. Assume that, at a 10 percent annual interest rate which is viewed as reasonable, the present value is $400,000. The asset is expected to last for eight years and have no residual value. Amortization expense recognized on the asset for Year One is $50,000.

Multiple Choice

-

A company spends $600,000 on research and $800,000 on development to earn a patent on a new invention. All of the legal costs to establish the patent amounted to $50,000. The company also had to spend an additional $90,000 to defend the patent (successfully) against a law suit. What is the capitalized cost of this patent?

- $50,000

- $90,000

- $140,000

- $1,540,000

-

On January 1, Year One, a company acquires the rights to an intangible asset for $300,000 with no residual value. The intangible has a legal life of ten years but is only expected to help generate revenues for six years. The straight-line method is always used. What is the net book value of this intangible asset at the end of Year Two?

- Zero

- $200,000

- $240,000

- $300,000

-

Which of the following intangible assets would not be subject to amortization?

- Goodwill

- Patent

- Copyright

- All intangible assets are subject to amortization

-

The Birmingham Corporation buys a patent from an inventor on January 1, Year One, for $350,000. The company expects the patent to help generate revenues for ten years. It has no residual value, and the straight-line method is always used. On December 31, Year Two, the patent has a fair value of $500,000. What is reported for this asset on the company’s balance sheet on that date?

- $280,000

- $350,000

- $400,000

- $500,000

-

Krypton Corporation offers Earth Company $800,000 for a patent held by Earth Company. The patent is currently recorded by Earth Company at $14,000, the legal cost required to register the patent. Krypton had appraisers examine the patent before making an offer to purchase it, and those experts determined that it was worth between $459,000 and $1,090,000. If the purchase falls through, at what amount should Earth Company now report the patent?

- $14,000

- $459,000

- $800,000

- $1,090,000

-

Mitchell Inc. developed a product, spending $4,000,000 in research and $1,100,000 in development to do so. Mitchell applied for and received a patent for the product on January 1, Year One, spending $34,000 in legal and filing fees. The patent is valid for twenty years and is expected to generate revenue for that period of time. The patent has no expected residual value after that date. The straight-line method is always applied. What would be the net book value of the patent at the end of Year One?

- $32,300

- $34,000

- $4,832,000

- $5,134,000

-

The Goodin Corporation purchases all of the outstanding stock of the Winslow Corporation for $62 million. In buying Winslow, Goodin acquired several items that might qualify to be reported as identifiable intangible assets. Which of the following criteria are applied to determine whether Goodin can report an intangible?

- Goodin must have obtained contractual or other legal rights or the item can be separated from Winslow and sold.

- The item must have a life of over one year and generate revenue that the parent company can assess.

- The item must have a tangible element to it or be legally valid in nature.

- The item must improve the operations of Goodin or have a value that can be objectively determined.

-

A decision maker picks up a set of financial statements for the Barnes Corporation. On the balance sheet, the largest asset is titled “Goodwill.” Which of the following statements is most likely to be true about this company?

- The company has donated significant amounts of money to charities in the local area.

- The company has bought other companies and paid more for those companies than the fair value of their identifiable net assets.

- The company has a large workforce of well-trained employees.

- The company has a superior management team in place.

-

On January 1, Year One, the Curry Corporation pays $7 million for all of the outstanding capital stock of a company that holds three assets and no liabilities. It has a building with a net book value of $2.3 million and a fair value of $2.8 million. It has equipment with a net book value of $1.1 and a fair value of $900,000. It holds several patents with no book value but a fair value of $1.3 million. Curry believes that this new subsidiary will be especially profitable for at least ten years. On a consolidated balance sheet as of December 31, Year One, what will Curry report as its goodwill balance?

- $1.3 million

- $1.8 million

- $2.0 million

- $3.6 million

-

Kremlin Company pays $2,900,000 for all of the outstanding common stock of Reticular Corporation. Reticular has assets on its balance sheet with a net book value of $1,500,000 and a fair value of $2,500,000. Reticular had no liabilities at this time. What is goodwill in this purchase?

- $0

- $400,000

- $1,000,000

- $1,400,000

-

Which of the following statements concerning research and development costs is not true?

- According to U.S. GAAP, research and development costs must be expensed as incurred.

- Current U.S. GAAP rules for reporting research and development costs violate the matching principle.

- International Financial Reporting Standards allow some development costs to be capitalized.

- U.S. GAAP reporting for research and development costs creates exceptionally large asset balances.

-

The Barcelona Company is a technology company and spends an enormous amount on research and development. The company has been successful in the past on a very high percentage of these projects. In connection with financial reporting, which of the following statements is true?

- Company officials must evaluate each project each year to estimate the possibility of success.

- All research and development costs will be capitalized and then amortized to expense over a reasonable period of time.

- Any project where the possibility of success is more than 50 percent must be capitalized.

- The company’s total assets are probably worth more than shown on the balance sheet.

-

Lincoln Company has an accounting policy for internal reporting purposes whereby the costs of any research and development projects that are over 70 percent likely to succeed are capitalized and then depreciated over a five-year period with a full year of depreciation in the year of capitalization. In the current year, $400,000 was spent on Project One, and it was 55 percent likely to succeed, $600,000 was spent on Project Two, and it was 65 percent likely to succeed, and $900,000 was spent on Project Three, and it was 75 percent likely to succeed. In converting the internal financial statements to external financial statements, by how much will net income for the current year have to be reduced?

- $180,000

- $380,000

- $720,000

- $900,000

-

The El Paso Corporation buys a significant intangible asset for $900,000, an amount that will be paid in six years. If a reasonable annual interest rate is 5 percent, what is the capitalized cost of the asset?

- $522,743

- $671,594

- $754,090

- $900,000

-

The Vaska Company buys a patent on January 1, Year One, and agrees to pay $100,000 per year for the next five years. The first payment is made immediately, and the payments are made on each January 1 thereafter. If a reasonable annual interest rate is 8 percent, what is the recorded value of the patent?

- $378,425

- $431,213

- $468,950

- $500,000

-

On January 1, Year One, the Anderson Corporation buys a copyright and agrees to make a single payment of $700,000 in exactly four years. A reasonable annual interest rate is viewed as 10 percent, and a present value of $478,107 was determined. What amount of interest expense should Anderson recognize for Year One?

- Zero

- $47,811

- $70,000

- Cannot be determined from the information provided.

-

On January 1, Year One, the Maroni Corporation buys an intangible asset and agrees to make a single payment of $800,000 in exactly six years. A reasonable annual interest rate is viewed as 10 percent, and a present value of $451,580 was determined. What amount of interest expense should Maroni recognize for Year Two?

- Zero

- $45,158

- $49,674

- $80,000

-

The Heinline Company buys a patent on January 1, Year One, and agrees to pay exactly $100,000 per year for the next eight years (or $800,000 in total). The first payment is made immediately, and the payments are made on each January 1 thereafter. A reasonable annual interest rate is 10 percent, which gives an assumed present value of $586,840. What amount of interest expense should Heinline recognize for Year Two?

- Zero

- $43,552

- $58,684

- $60,000

Video Problems

Professor Joe Hoyle discusses the answers to these two problems at the links that are indicated. After formulating your answers, watch each video to see how Professor Hoyle answers these questions.

-

Your roommate is an English major. The roommate’s parents own a chain of ice cream shops located throughout Florida. One day, while reading a play by Shakespeare, your roommate poses this question: “My parents recently bought a new shop in Tallahassee. They bought it from an elderly couple who wanted to retire. It is in a great location and already has a huge number of regular customers. However, I don’t understand why they paid so much. The building and land were worth $1 million, and the equipment and ice cream on hand couldn’t have been worth more than $25,000. So, I expected them to pay around $1,025,000. But they paid $1.5 million. Why in the world did they pay so much? How are they ever going to report that shop in the future since they clearly overpaid?” How would you respond?

-

Your uncle and two friends started a small office supply store several years ago. The company has expanded and now has several large locations. Your uncle knows that you are taking a financial accounting class and asks you the following question: “In the office supply business, the North Lakeside Company is the best known name in the world. They manufacture great products, and everyone has heard of their high quality. We started selling their merchandise recently. We wanted to let people know of this relationship. We want to put the North Lakeside logo on each of our stores so that our customers would associate us with that same level of quality. It is good for our business, and it will bring us more customers who will buy more goods. We contacted North Lakeside about using their logo. They told us they would give us that right for $400,000. Well, we don’t have that type of cash available at this time just for a logo. We tried to negotiate with them, and they said they still wanted exactly $400,000, but we could wait for four years before making the payment. By that time, the logo should have produced a lot of extra profits for us. We’ve certainly never done something like this before. When we sign the contract, how do we report this transaction?” How would you respond?

Problems

-

At the beginning of Year One, Jaguar Corporation purchased a license from Angel Corporation that gives Jaguar the legal right to use a process Angel developed. The purchase price of the license was $1,500,000, including legal fees. According to the agreement, Jaguar will be able to use the process for five years.

- Record Jaguar’s purchase of the license.

- Record amortization of the license at the end of Year One assuming the straight-line method is used and there is no expected residual value.

- What is the net book value of the license reported on Jaguar’s balance sheet at the end of Year Three?

-

Yolanda Company created a product for which it was able to obtain a patent. Yolanda sold this patent to Christiana Inc. for $4 million at the beginning of Year One. Christiana paid an additional $200,000 in legal fees to properly record the patent. On that date, Christiana determined that the patent had a remaining legal life of ten years but a useful life of only seven years. The straight-line method is to be applied with no expected residual value.

- Record Christiana’s purchase of the patent.

- Record amortization of the patent at the end of Year One and Year Two.

- What is the book value of the patent reported on Christiana’s balance sheet at the end of Year Three?

- During Year Four, Christiana is sued by Bushnell Corporation. Bushnell claims that it has a patent on a product very similar to the one held by Christiana and that Bushnell’s patent was registered first. Christiana spends $600,000 during Year Four and successfully defends the patent. What entry is made for these expenditures?

- Use the same facts as in 2.d. except assume that Christiana is not able to successfully defend its right to this patent. What journal entry is made?

-

As of January 1, Year One, Company Z has no liabilities and only two assets: a donut maker with a net book value of $300,000 (and a fair value of $360,000) and a cookie machine with a net book value of $400,000 (and a fair value of $440,000). Each of these assets has a remaining useful life of ten years and no expected residual value. Company A offers $1 million to acquire all of the ownership of Company Z. The owners of Company Z hold out and manage to get $1.2 million in cash.

- Make the journal entry to be recorded by Company A for this acquisition.

- What depreciation/amortization expense will Company A recognize in connection with these acquired assets at the end of Year One?

- What is the appropriate handling of any goodwill resulting from this transaction?

-

On January 1, Year One, a pharmaceutical company starts work on creating three new medicines that could lead to valuable products. The company will spend millions on each project and would not undertake this endeavor if it did not believe that it has a reasonable chance of recovering its investment. Historically for this company, one out of every three new projects actually became a successful product on the market. If that happens, the company expects to generate over $10 million in revenue at a minimum. By the end of Year One, the company spent exactly $1 million in research and development for each of three projects. Based on a careful evaluation, company officials believe the first project has a 30 percent chance of success, the second project has a 60 percent chance of success, and the third project has a 90 percent chance of success.

- Assume U.S. GAAP does not have an official standard in this area of accounting. Provide as many viable methods as possible to record the $3 million cost that has been incurred to date. For each, provide at least one reason the method could be appropriate.

- How does U.S. GAAP account for the $3 million in costs incurred here for research and development?

- How does IFRS account for the $3 million in costs incurred here for research and development?

-

The Wisconsin Corporation spends $100,000 in research and $200,000 in development during Year One. The company spends the same amounts in Year Two. For its internal reporting, the company has a policy whereby all research costs are expensed as incurred but all development costs are capitalized. These capitalized costs are then amortized to expense over five full years beginning with the year after the cost is incurred.

- What change is necessary to reduce the internally reported net income figure for Year One to the amount that should be shown for external reporting purposes according to U.S. GAAP?

- What change is necessary to reduce the internally reported net income figure for Year Two to the amount that should be shown for external reporting purposes according to U.S. GAAP?

-

The Baltimore Corporation reported net income in Year One of $90,000 and in Year Two of $140,000. The company spent $16,000 for research and development in Year One and another $24,000 for research and development in Year Two. The company follows the policy of capitalizing its research and development costs and then amortizing them over four years (using the half-year convention for the initial year). The straight-line method is used for amortization with no expected residual value.

- If U.S. GAAP is to be applied, what was the correctly reported net income for Year One?

- If U.S. GAAP is to be applied, what was the correctly reported net income for Year Two?

-

The American Corporation and the French Corporation are identical in every way. Both companies spend $200,000 for research costs in Year One as well as $100,000 in development costs during that same year. The American Corporation follows U.S. GAAP. The French Corporation follows IFRS and believes these development costs meet the criteria for capitalization. The capitalized costs are amortized over four years using the straight-line method and the half-year convention.

- What is the difference in reported net income between these two companies for Year One?

- Assuming no further amounts were spent for research and development in Year Two, what is the difference in reported net income between these two companies in that second year?

-

Star Corporation purchases Trek Inc. Through this acquisition, Star Corporation is gaining the following assets and liabilities:

Value on Trek’s Books Current Market Value Inventory $480,000 $480,000 Land $1,050,000 $50,000,000 Trademarks $64,000 $20,000,000 Patent $15,000 $1,850,000 Accounts Payable $650,000 $650,000 - Assume Star pays cash of exactly $71,680,000 to acquire all of the outstanding ownership shares of Trek Inc. Prepare the appropriate journal entry for Star.

- Assume the negotiations between Star and Trek are fierce and, eventually, Star agrees to pay $83 million for all of the outstanding ownership shares of Trek Inc. Prepare the appropriate journal entry for Star.

- What subsequent accounting is applied in reporting any goodwill that results from this acquisition?

-

Calculate the present value of each of the following single payment amounts based on the indicated reasonable rate of annual interest and the number of time periods until the payment is made.

Future Cash Flow Annual Interest Rate Number of Periods Present Value $400,000 4% 7 years $400,000 6% 7 years $400,000 4% 12 years $400,000 6% 12 years - Does the present value of the future cash flows increase or decrease when the interest rate increases? What causes that effect?

- Does the present value of the future cash flows increase or decrease as the number of time periods increases? What causes that effect?

-

On January 1, Year One, Fred Corporation purchases a patent from Barney Company for $10 million, payable at the end of three years. The patent itself has an expected life of ten years and no anticipated residual value. No interest rate is stated in the contract, but Fred could borrow that amount of money from a bank at 6 percent interest. Amortization is recorded using the straight-line method.

- Record the journal entry for the patent acquisition on January 1, Year One.

- Record the year-end adjusting entries to recognize both interest expense and amortization expense for each of these three years.

- Record the journal entry for Fred’s payment on December 31, Year Three.

-

Calculate the present value of each of the following annuity amounts based on the reasonable interest rate that is specified and the number of time periods. Assume that the first payment is made immediately so that the cash payments create an annuity due.

Payment per Period Annual Interest Rate Number of Periods Present Value $30,000 5% 8 years $60,000 4% 7 years $25,000 8% 10 years $56,000 6% 4 years -

Highlight Company purchases the right to use a piece of music from the original musician who created it. Officials hope to make this music the company’s “signature song.” Therefore, the contract (which is signed on January 1, Year One) is for four years. The agreed upon price is $800,000, with no stated interest rate to be paid. Highlight could borrow this amount of money at a 5 percent annual interest rate at the current time. The arrangement states that Highlight will make this $800,000 payment on December 31, Year Four.

- Record the journal entry for Highlight for the acquisition of this copyright on January 1, Year One.

- Record the adjusting entries to recognize interest expense and amortization expense on December 31 of each of the subsequent four years.

- Record the journal entry for the payment of the $800,000 on December 31, Year Four.

-

Moonbeam Company purchases the right to use a piece of music from the original musician who created it. Officials hope to make this music the company’s “signature song.” Therefore, the contract (which is signed on January 1, Year One) is for four years. The agreed upon price is $800,000, with no stated interest rate. Moonbeam could borrow this amount of money at an 8 percent annual interest at the current time. The arrangement states that Moonbeam will actually make an annual payment of $200,000 for four years on each January 1 starting on January 1, Year One.

- Record the journal entry for Moonbeam for the acquisition of this copyright on January 1, Year One.

- Record the adjusting entries for Moonbeam to recognize amortization expense on December 31, Year One. Assume the straight-line method is applied.

- Record the journal entries and the adjusting entries for Moonbeam for these payments and to recognize interest expense from December 31, Year One through January 1, Year Four.

Comprehensive Problem

This problem will carry through several chapters, building in difficulty. It allows students to continually practice skills and knowledge learned in previous chapters.

In Chapter 10 "In a Set of Financial Statements, What Information Is Conveyed about Property and Equipment?", you prepared Webworks statements for October. They are included here as a starting point for November.

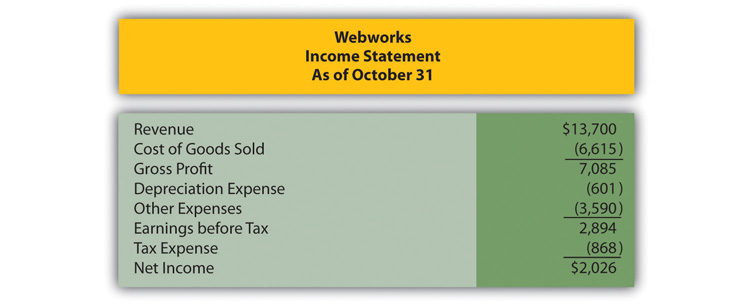

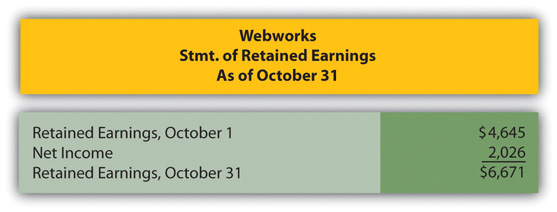

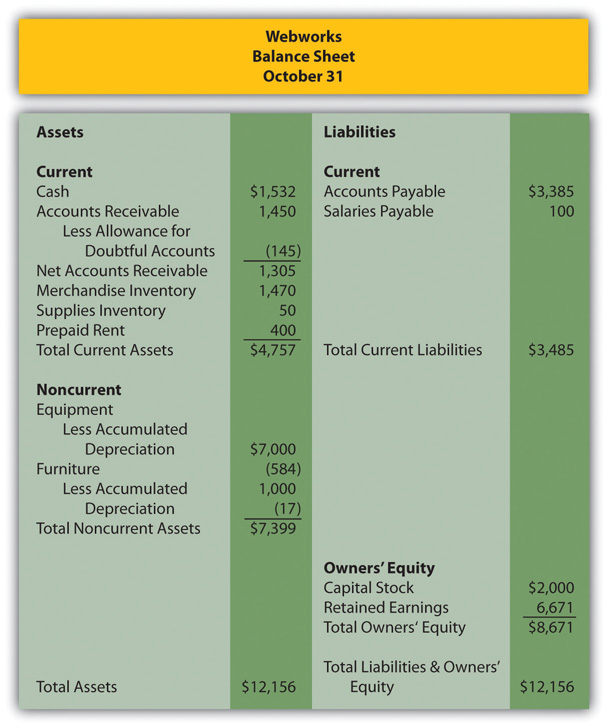

Figure 11.12 Webworks Financial Statements

Figure 11.13

Figure 11.14

The following events occur during November:

- Webworks starts and completes eight more sites and bills clients for $4,600.

- Webworks purchases supplies worth $80 on account.

- At the beginning of November, Webworks had nine keyboards in stock costing $110 each and forty flash drives costing $12 each. Webworks uses periodic FIFO to monitor the cost of its inventory.

- Webworks purchases sixty keyboards for $111 each and ninety flash drives for $13 each. These purchases were on account.

- Webworks pays Nancy Po (an employee) $800 for her work during the first three weeks of October.

- Webworks sells 60 keyboards for $9,000 and 120 flash drives for $2,400 cash.

- A local realtor pays $400 in advance for a Web site. It will not be completed until December.

- Leon Jackson (the owner of the business) read in a trade publication about a new software program that could enhance the Web sites Webworks is developing for clients. He purchases a license to use this program for one year by paying $2,400 cash.

- Webworks collects $5,000 in accounts receivable.

- Webworks pays off its salaries payable from November.

- Webworks pays off $8,500 of its accounts payable.

- Webworks pays Leon Jackson a salary of $2,000.

- Webworks wrote off an uncollectible account in the amount of $100.

-

Webworks pays taxes of $1,304 in cash.

Required:

- Prepare journal entries for the previous events.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for Webworks for November.

- Prepare adjusting entries for the following and post them to your T-accounts.

- Webworks owes Nancy Po $150 for her work during the last week of November.

- Leon’s parents let him know that Webworks owes $290 toward the electricity bill. Webworks will pay them this amount in December.

- Webworks determines that it has $20 worth of supplies remaining at the end of November.

- Prepaid rent should be adjusted for November’s portion.

- Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

- Webworks continues to depreciate its equipment over four years and its furniture over five years, using the straight-line method.

- The license agreement should be amortized over its one-year life.

-

Record cost of goods sold.

- Prepare an adjusted trial balance.

- Prepare financial statements for November.

Research Assignment

Assume that you take a job as a summer employee for an investment advisory service. One of the partners for that firm is currently looking at the possibility of investing in Amazon.com. The partner believes that the company’s assets increased by a rather large amount during 2010. The partner is curious as to how much of that increase is from intangible assets that were acquired through the purchase of other companies. The partner asks you to look at the 2010 financial statements for Amazon by following this path:

- Go to http://www.amazon.com.

- At the very bottom of this screen, click on “Investor Relations.”

- On the left side of the next screen, click on “Annual Reports and Proxies.”

- On the next screen, click on “2010 Annual Report” to download.

- Go to page 39 and find the balance sheet for December 31, 2010.

- Go to page 51 and read the first part of “Note 4 – Acquisitions, Goodwill, and Acquired Intangible Assets” that is titled “2010 Acquisition Activity.”

- Using the balance sheet information above, determine the amount of goodwill reported at the end of 2009 and also at the end of 2010. What does that indicate?

- Using the balance sheet information above, determine the amount of goodwill as percentage of total assets at the end of 2009 and also at the end of 2010. Has goodwill become a larger percentage of assets in 2010 than it was in 2009?

- What information is found in the first part of Note 4 that will be of interest to the partner who is looking at this company?