This is “End-of-Chapter Exercises”, section 5.4 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

5.4 End-of-Chapter Exercises

Questions

- What is the purpose of adjusting entries?

- Name the four general types of adjustments.

- Give three examples of accrued expenses.

- If a company’s employees earn $2,000 each day, seven days per week, and they are last paid on December 25, what adjusting entry is required at the end of the period?

- Briefly explain why accountants can find it difficult to determine whether revenue has been earned or not.

- A company buys $9,000 in supplies on December 11, Year One. On the last day of that year, only $1,000 of these supplies remains with the company. The company’s year-end trial balance shows a Supplies account of $9,000. What adjusting entry is needed?

- A company buys $9,000 in supplies on December 11, Year One. On the last day of that year, only $1,000 of these supplies remains with the company. The company’s year-end trial balance shows a Supplies Expense account of $9,000. What adjusting entry is needed?

- A company owns a building that it rents for $3,000 per month. No payment was received for November or December although company officials do expect payment to be collected. If nothing has yet been recorded, what adjusting entry is needed at the end of the year?

- Give an example of a business or industry where customers usually pay for the product or service in advance.

- What type of account is unearned revenue? Why is that classification appropriate?

- When should a company reclassify unearned revenue to revenue?

- How often does a company produce a trial balance?

- In preparing financial statements, what accounts are reported on the income statement, and what accounts are reported on the balance sheet?

- Why do accountants prepare closing entries?

- Into which account are revenues and expenses closed?

True or False

- ____ Determining when to recognize revenue can be difficult for accountants.

- ____ Only permanent accounts are closed at the end of the financial accounting process each year.

- ____ According to U.S. GAAP, revenue cannot be recorded until cash is collected.

- ____ Some changes to account balances occur because of the passage of time.

- ____ Accounting is a profession where judgment is rarely needed because so many rules exist that must be followed.

- ____ Assets, liabilities and stockholders’ equity accounts will all start each new accounting period with the same balance they had at the end of the previous period.

- ____ An accrued revenue is one that is earned gradually over time.

- ____ Companies have some discretion in how and when they record accruals such as rent expense or interest expense.

- ____ The purpose of adjusting entries is to reduce the balance in temporary accounts to zero at the end of the reporting cycle.

- ____ Only one trial balance is prepared during each separate accounting period.

- ____ Employees for the Saginaw Corporation earn a salary of $8,000 per day, an amount that the accounting system recognizes automatically at the end of each day. If no salary is paid for the last nine days of the year, an adjusting entry is required before financial statements can be prepared.

- ____ In producing financial statements for the Night Corporation, rent expense is accidentally reported as an asset rather than an expense. As a result, reported net income will be overstated for that period.

- ____ In producing financial statements for the Day Corporation, rent expense is accidentally reported as an asset rather than an expense. As a result, the balance sheet will not balance.

- ____ A company owes $9,000 in interest on a note payable at the end of the current year. The accountant accidentally overlooks that information and no adjusting entry is made. As a result, the balance sheet will not balance.

- ____ A company owes $9,000 in interest on a note payable at the end of the current year. The accountant accidentally overlooks that information and no adjusting entry is made. As a result, reported net income will be overstated for that period.

Multiple Choice

-

Which of the following accounts is closed at the end of the year after financial statements are produced?

- Accounts receivable

- Accounts payable

- Cost of goods sold

- Unearned revenue

-

Jenkins Company received $600 from a client in December for work to be performed by Jenkins over the following months. That cash collection was properly recorded at that time. The accountant for Jenkins believes that this work is really three separate jobs. What adjusting entry is recorded by this accountant on December 31 if one of these jobs is substantially completed by that time?

-

Figure 5.9

-

Figure 5.10

-

Figure 5.11

-

Figure 5.12

-

-

Which of the following accounts increases retained earnings when closing entries are prepared?

- Dividends

- Sales revenue

- Loss of sale of land

- Rent expense

-

Which of the following is the sequence of the accounting process?

- Analyze, Record, Adjust, Report

- Record, Report, Adjust, Analyze

- Adjust, Report, Record, Analyze

- Report, Analyze, Record, Adjust

-

On September 1, Year Three, the LaToya Corporation paid $42,000 for insurance for the next six months. The appropriate journal entry was made at that time. On December 31, LaToya’s accountant forgot to make the adjusting entry that was needed. Which of the following is true about the Year Three financial statements?

- Assets are understated by $42,000.

- Net income is understated by $14,000.

- Expenses are overstated by $42,000.

- Net income is overstated by $28,000.

-

Starting on December 21, Year One, the Shakespeare Corporation begins to incur an expense of $1,000 per day. On January 21, Year Two, the company makes a payment of $31,000 for the previous thirty-one days. Assume the company failed to make an adjusting entry at December 31, Year One. Which of the following is true for the Year One financial statements?

- Net income is understated, and the total of the liabilities is understated.

- Net income is overstated, and the total of the liabilities is understated.

- Net income is understated, and the total of the liabilities is overstated.

- Net income is overstated, and the total of the liabilities is overstated.

-

Starting on December 21, Year One, the Shakespeare Corporation begins to incur an expense of $1,000 per day. On January 21, Year Two, the company makes a payment of $31,000. The company made the proper adjusting entry at December 31. When the payment was eventually made, what account or accounts were debited?

- Expense was debited for $31,000.

- A liability was debited for $31,000.

- Expense was debited for $11,000, and a liability was debited for $20,000.

- Expense was debited for $20,000, and a liability was debited for $11,000.

-

Starting on December 21, Year One, the Shakespeare Corporation begins to incur an expense of $1,000 per day. On January 21, Year Two, the company makes a payment of $31,000 for the previous thirty-one days. Assume the company failed to make the proper year-end adjusting entry. However, when payment was made, the journal entry was prepared as if the adjusting entry had been made (the accountant did not realize the adjusting entry was not made). After recording the erroneous journal entry, which of the following is true?

- Recorded expense in Year Two is too low.

- Recorded expense in Year Two is too high.

- Recorded liability balance is now too low.

- Recorded liability balance is now too high.

-

The Cone Company has prepared a trial balance that includes the following: accounts receivable—$19,000, inventory—$30,000, cost of goods sold—$72,000, sales revenue—$191,000, prepaid rent—$8,000, salary payable—$12,000, rent expense—$23,000, salary expense—$34,000, and dividends paid—$7,000. What should be reported as net income for the period?

- $50,000

- $55,000

- $62,000

- $70,000

-

A company pays $40,000 to rent a building for forty days. After nineteen days, financial statements are to be prepared. If the company originally recorded the $40,000 payment in rent expense, which of the following adjusting entries should be made prior to producing financial statements.

- Debit rent expense $19,000, and credit prepaid rent $19,000.

- Debit prepaid rent $21,000, and credit rent expense $21,000.

- Debit prepaid rent $19,000, and credit rent expense $19,000.

- Debit rent expense $21,000, and credit prepaid rent $21,000.

Video Problems

Professor Joe Hoyle discusses the answers to these two problems at the links that are indicated. After formulating your answers, watch each video to see how Professor Hoyle answers these questions.

-

Your roommate is an English major. The roommate’s parents own an ice cream shop in a resort community in Florida. One day, on the way to the local shopping center, your roommate blurts out this question: “My parents write down every penny they get and spend in their business. They are meticulous in their record keeping. However, at the end of each year, they pay money to hire an accountant. If they keep such perfect records every day, why could they possibly need an accountant after they have done all the work?” How would you respond?

-

Your uncle and two friends started a small office supply store at the beginning of the current year. Your uncle knows that you are taking a financial accounting class and asks you the following question: “We keep very careful records of all our transactions. At the end of the year, we will prepare financial statements to help us file our income taxes. We will also show the statements to the officers at the bank that gave us the loan that got us started. I know that we will need to make some changes in our records before we produce those financial statements, but I do not know what kinds of changes I should be making. Can you give me some suggestions on what kinds of changes I should think about making?” How would you respond?

Problems

-

Determine if the following adjusting entries involve the following:

- Accrued expense (AE)

- Prepaid expense (PE)

- Accrued revenue (AR)

- Unearned revenue (UR)

- _____ Atlas Magazine had previously collected $400,000 from its subscribers but has now delivered half of the magazines that were ordered.

- _____ Several weeks ago, the Hornsby Company agreed to provide 1,000 units of its product to Michaels Inc. and has now substantially completed that agreement with payment to be received in thirty days.

- _____ Nancy and Sons owes its employees $30,000 for work done over the past two weeks with payment to be made within the next ten days.

- _____ Replay Inc. advertised on television Channel 44 during the past month but has not yet made an entry to record the event because no payment has been made.

- _____ Four months ago, the Centurion Company paid Reliable Insurance Company $54,000 for insurance for the subsequent twelve months.

- _____ Four months ago, Reliable Insurance Company received a payment of $54,000 for insurance for the subsequent twelve months from Centurion Company.

-

For each of the following adjusting entries, describe what has probably taken place that necessitated these entries.

-

Figure 5.13

-

Figure 5.14

-

Figure 5.15

-

Figure 5.16

-

Figure 5.17

-

Figure 5.18

-

-

For each of the following transactions of the Marlin Corporation determine if an adjusting entry is now needed. If an adjustment is required, provide that entry. Assume each journal entry was made properly.

- At the beginning of the month, Marlin agreed to perform services for the subsequent three months for Catsui Corporation for $30,000 per month. Catsui paid Marlin all $90,000 in advance. One month has now passed. Each month is viewed as an independent job.

- Marlin pays its employees every two weeks. At the end of the month, Marlin owes its employees $480,000, but will not pay them until the following week.

- Marlin paid $300,000 for rent at the beginning of the month by debiting prepaid rent and crediting cash. The $300,000 covered six months of occupancy, but only one month has passed.

- At the beginning of the month, Marlin agreed to perform services for Ryland Company for $16,000 per month for the next six months. Ryland has not yet paid any cash to Marlin, and no part of the work is yet viewed as being substantially complete.

-

Keating Inc. rents its headquarters from Starling Enterprises for $10,000 per month. On September 1, 20XX, Keating pays Starling $60,000 for six months worth of rent.

- Record the entry that Keating Inc. would make on September 1 when the payment is made to Starling.

- Record the entry that Starling Enterprises would make on September 1 when they receive the rent payment from Keating.

- Record the adjusting entry that Keating should make on December 31, when the company begins to prepare its annual financial statements.

- Record the adjusting entry that Starling should make on December 31, when the company begins to prepare its annual financial statements.

-

The accountant for the Osgood Company is preparing to produce financial statements for December 31, Year One, and the year then ended. The accountant has uncovered several interesting figures within the company’s trial balance at the end of the year:

Figure 5.19 Financial Figures Reported by the Osgood Company

Other information:

- The company collected $32,000 from a customer during the early part of November. The amount was recorded as revenue at that time although very little of the work has yet to be accomplished.

- The company paid $36,000 for nine months of rent on a building on January 1, Year One, and then paid $20,000 on October 1, Year One, for five additional months.

- A count of all supplies at the end of the year showed $2,000 on hand.

- An interest payment was made at the end of December. Although no previous recognition had been made of this amount, the accountant debited interest payable.

- On January 1, Year One, the company paid $24,000 for insurance coverage for the following six months. On July 1, Year One, the company paid another $27,000 for an additional nine months of coverage.

-

The company did work for a customer throughout December and finished on December 30. Because it was so late in the year, no journal entry was recorded, and no part of the $17,000 payment has been received.

Required:

- Prepare any necessary entries as of December 31, Year One.

- Provide the appropriate account balances for each account impacted by these adjusting entries.

-

The Warsaw Corporation began business operations on December 1, Year One. The company had the following transactions during the time when it was starting:

- An employee was hired on December 1 for $4,000 per month with the first payment to be made on January 1.

- The company made an $18,000 payment on December 1 to rent a building for the following six months.

- Supplies were bought on account for $10,000 on December 1. Supplies are counted at the end of the year and $3,600 is still on hand.

- The company receives $9,000 for a service that it had expected to provide immediately. However, a problem arises because of a series of delays and the parties agree that the service will be performed on January 9.

-

A job was completed near the end of the year, and the customer will pay Warsaw all $8,000 early in the following year. Because of the late date, no entry was made at that time.

Required:

- Prepare the proper journal entries for each of these transactions as well as the year-end adjustment (if needed) for each.

-

The Rohrbach Company has the following trial balance at the end of Year Four before adjusting entries are prepared. During the year, all cash transactions were recorded, but no other journal entries were made.

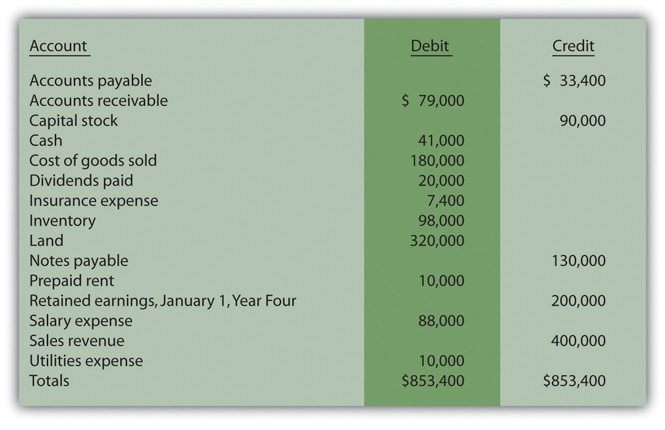

Figure 5.20 Rohrbach Company Unadjusted Trial Balance, December 31, Year Four

Other Information:

- Utilities were not paid for or recorded for the months of November and December at a total of $2,000.

- On January 1, Year Four, insurance for six months was obtained for $2,000 in cash. On July 1, Year Four, insurance for another eighteen months was obtained for $5,400 in cash.

- On January 1, Year Four, the company paid $2,000 to rent a building for four months. On May 1, Year Four, the company paid another $8,000 to rent the same building for an additional sixteen months.

-

Employees are paid $8,000 for each month with payments seven days after the end of the month.

Required:

- Prepare the needed adjusting entries.

- Prepare an updated trial balance.

-

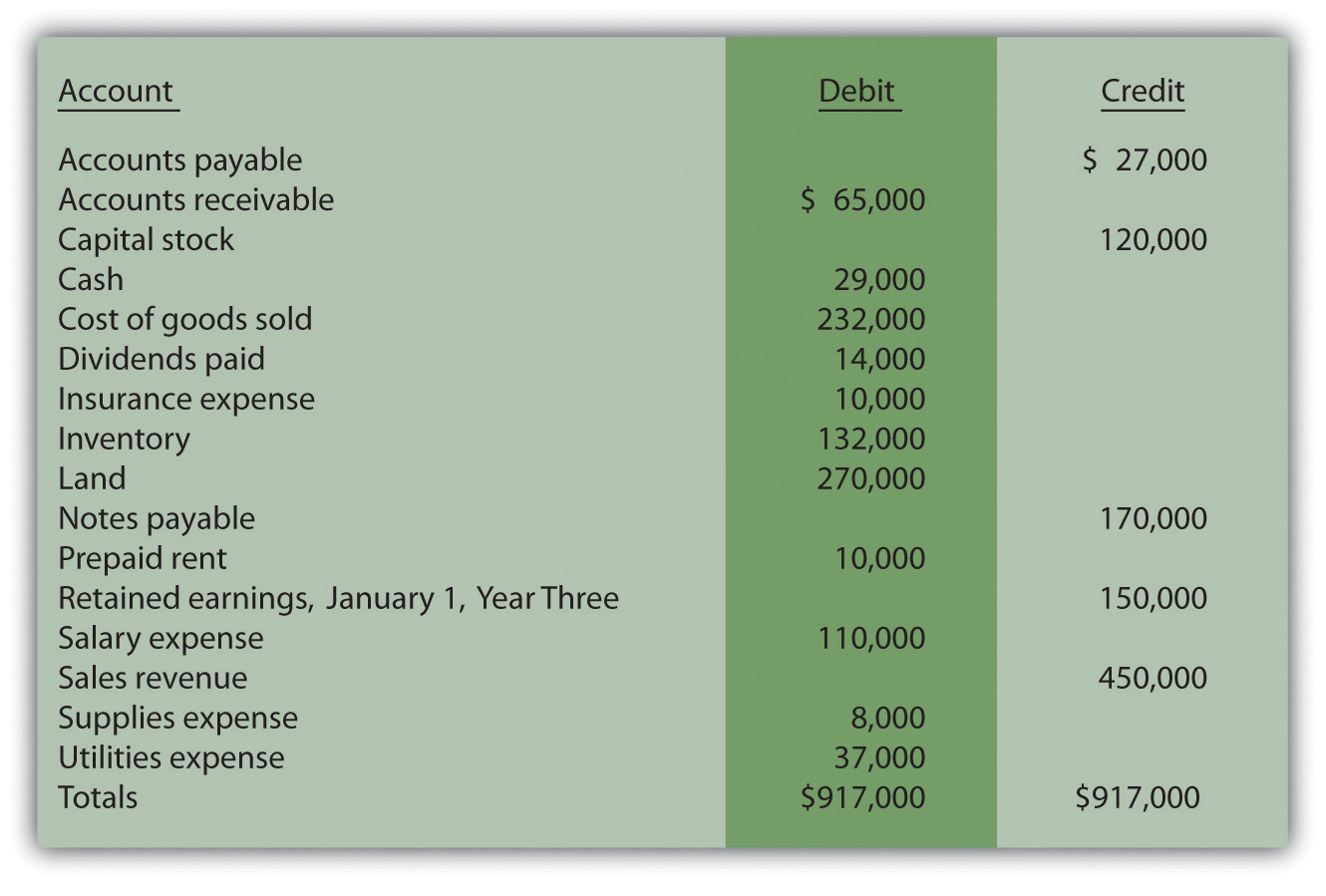

The following trial balance (at the end of Year Three) was produced by an accountant working for the Washburn Company. No adjusting entries have yet been made. During the year, all cash transactions were recorded, but no other journal entries were prepared.

Figure 5.21 Washburn Company Unadjusted Trial Balance, December 31, Year Three

Other Information:

- Income taxes of $9,000 will have to be paid for Year Three early in Year Four.

- Supplies were bought for $8,000 early in the year, but $3,000 of that amount is still on hand at the end of the year.

- On January 1, Year Three, insurance for eight months was obtained for $4,000 in cash. On September 1, Year Three, insurance for another fifteen months was obtained for $6,000 in cash.

- During November, a payment of $5,000 was made for advertising during that month. By accident, the debit was made to utilities expense.

- On January 1, Year Three, the company paid $2,000 to rent a building for four months. On May 1, Year Three, the company paid another $8,000 to rent the same building for an addition sixteen months.

-

Employees are paid $10,000 for each month with payments two weeks after the end of the month.

Required:

- Prepare the needed adjusting entries.

- Prepare an income statement, statement of retained earnings, and a balance sheet for the Washburn Company.

-

Leon Jackson is an entrepreneur who plans to start a Web site design and maintenance business called Webworks. The First National Bank just approved a loan so he is now ready to purchase needed equipment, hire administrative help, and begin designing sites. During June, his first month of business, the following events occur.

- Webworks signs a note at the bank and is given $10,000 cash.

- Jackson deposits $2,000 of his own money into the company checking account as his capital contribution.

- Webworks purchases a new computer and other additional equipment for $3,000 in cash.

- Webworks purchases supplies worth $200 on account that should last Webworks two months.

- Webworks hires Nancy Po to assist with administrative tasks. She will charge $100 per Web site for her assistance.

- Webworks begins working on its first two Web sites, one for Juan Sanchez (a friend of Jackson’s dad) and the other for Pauline Smith, a local businessperson.

- Webworks completes the site for Mr. Sanchez and sends him a bill for $600.

- Webworks completes the site for Ms. Smith and sends her a bill for $450.

- Webworks collects $600 in cash from Mr. Sanchez.

- Webworks pays Nancy Po $100 for her work on Sanchez’s Web site.

- Webworks receives $500 in advance to work on a Web site for a local restaurant. Work on the site will not begin until July.

-

Webworks pays taxes of $200 in cash.

Required:

- Prepare journal entries for the previous events if needed.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for Webworks for June.

- Prepare adjusting entries for the following events and post them to the proper T-accounts, adding any additional T-accounts as necessary.

- Webworks owes Nancy Po another $100 for her work on Smith’s Web site.

- The business is being operated in the house owned by Jackson’s parents. They let him know that Webworks owes $80 toward the electricity bill for June. Webworks will pay them in July.

-

Webworks only used half of the supplies purchased in (d) above.

- Prepare an adjusted trial balance for Webworks for June.

-

Jan Haley owns and operates Haley’s Dry Cleaners. The ledger for this company is presented in the next figure with balances as of December 1, Year Two. The following occurred during that month.

- On December 1, Haley prepaid rent on her store for December and January for $2,000 in cash.

- On December 1, Haley purchased insurance with cash in the amount of $2,400. The coverage will last for six months.

- Haley paid $900 of her accounts payable balance.

- Haley paid off all of her salaries payable balance.

- Haley purchased supplies on account in the amount of $2,400.

- Haley paid a salary to her assistant of $1,000 in cash for work done in the first two weeks of December.

- Haley dry-cleaned clothes for customers on account in the amount of $8,000.

- Haley collected $6,300 of her accounts receivable balance.

-

Haley paid tax of $750 in cash.

Required:

- Prepare the journal entry for each of these transactions.

-

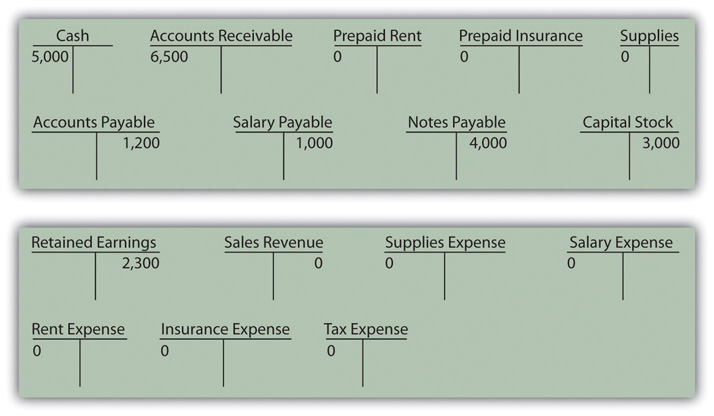

Prepare all necessary T-accounts with opening balances for the month of December.

Figure 5.22 Opening T-Account Balances for Haley’s Dry Cleaners

- Prepare a trial balance dated December 31, Year Two.

- Make the following adjusting entries for the month of December and post them to the T-accounts:

- Rent expense:

- Insurance expense:

- Haley owes her assistant $1,000 for work done during the last two weeks of December.

-

An inventory of supplies shows $400 in supplies remaining on December 31.

- Prepare an adjusted trial balance dated December 31, Year Two.

- Prepare an income statement, statement of retained earnings, and balance sheet.

-

On January 1, Kevin Reynolds, a student at State U, decides to start a business. Kevin has noticed that various student organizations around campus are having more and more need for mass produced copies of programs on CDs. While a lot of students have a CD drive on their computers that can write to CDs, it is a slow process when a high volume of CDs is needed.

Kevin believes that with a beginning investment in specialty equipment, he can provide a valuable product to the college community and earn some profit. On January 1, Year One, Kevin officially begins “Kevin’s CD Kopies.”

Part 1

The following occur during January:

- Kevin deposits $500 of his own money into the company’s checking account as his capital contribution.

- As president of the company, Kevin signs a note payable in the amount of $1,000 from Neighborhood Bank. The note is due from the company in one year.

- KCDK (Kevin’s CD Kopies) purchases a CD duplicator (a piece of equipment), which can copy seven CDs at one time. The cost is $1,300, and he pays cash.

- KCDK purchases 500 blank CDs for $150 on account.

- KCDK pays $20 cash for flyers that are used as advertising.

- KCDK quickly catches on with the student groups on campus. KCDK sells 400 CDs to various groups for $0.80 per CD. KCDK receives cash payment for 300 of the CDs, and the student groups owe for the other 100 CDs.

- KCDK pays $100 on its accounts payable.

- KCDK receives $40 in advance to copy 50 CDs for a student group. He will not begin work on the project until February.

-

KCDK incurs $40 in tax expense. The taxes will be paid in February.

Required:

- Prepare journal entries for the previous events as needed.

- Post the journal entries to T-accounts.

- Prepare an unadjusted trial balance for KCDK for January.

- Prepare adjusting entries for the following and post them to the company’s T-accounts.

- Kevin’s roommate, Mark, helps with copying and delivering the CDs. KCDK pays Mark a salary of $50 per month. Mark will get his first check on February 1.

-

KCDK incurs $10 in interest expense. The interest will be paid with the note at the end of the year.

- Prepare an adjusted trial balance for KCDK for January.

- Prepare financial statements for KCDK for January.

- Prepare closing entries for the month of January.

Part 2

The following occur in February:

- Kevin decides to expand outside the college community. On the first day of the month, KCDK pays $20 in advance for advertising in the local newspaper. The advertisements will run during February and March.

- The student groups paid for the 100 CDs not paid for in January.

- KCDK paid off its remaining accounts payable, salaries payable, taxes payable and interest payable.

- KCDK purchases 450 CDs for $135 on account.

- KCDK sells 500 CDs during the month for $0.80 each. KCDK receives cash for 450 of them and is owed for the other 50.

- KCDK completes and delivers the advanced order of 50 CDs described in number 11.8.

-

KCDK incurs $80 in tax expense. The taxes will be paid in March.

Required:

- Prepare journal entries for the previous events if needed.

- Post the journal entries to the T-accounts.

- Prepare an unadjusted trial balance for KCDK for February.

- Prepare adjusting entries at the end of February for the following and post them to your T-accounts.

- Mark continues to earn his salary of $50, and the next payment will be made on March 1.

- An adjustment is made for advertising in number 11.12.

-

KCDK incurs $10 in interest expense. The interest will be paid with the note.

- Prepare an adjusted trial balance for KCDK for February.

- Prepare the financial statements for February.

Research Assignment

A company places an ad in a newspaper late in Year Five. Is this an expense or an asset? When unsure, companies often investigate how other companies handle such costs.

Go to http://www.jnj.com/. At the Johnson & Johnson Web site, click on “Our Company” at the top right side. Scroll down and under “Company Publications,” click on “2010 Annual Report On-Line.” Click on “Financial Results” at the top of the next page.

Next, click on “Consolidated Balance Sheets.” Under assets, what amount is reported by the company as “prepaid expenses and other receivables?”

Assume the question has been raised whether any amount of advertising is included in the prepaid expense figure reported by Johnson & Johnson. Close down the balance sheet page to get back to the “Financial Results” page. Click on “Notes to Consolidated Financial Statements.” Scroll to page 47 and find the section for “Advertising.” What does the first sentence tell decision makers about the handling of these costs?