This is “End-of-Chapter Exercises”, section 4.6 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

4.6 End-of-Chapter Exercises

Questions

- What is a transaction?

- When and where was the basic accounting system developed that is still used by organizations today?

- What is meant by the term “double-entry bookkeeping”?

- What are the four basic steps followed in an accounting system?

- How is information about the impact of a transaction initially captured in an accounting system?

- How is information about specific account balances accumulated?

- Which accounts are increased with a debit?

- Which accounts are increased with a credit?

- Susan Osgood works as an accountant and maintains the journal for the Nelson Corporation. What is the purpose of a journal?

- In a journal entry, why do the debit figures always agree with the credit figures?

- What is a trial balance?

- What function does accrual accounting serve?

- Accrual accounting is composed of which two principles? Define each.

- An accountant indicates that a certain expense was recognized in the current year because of the matching principle. What does that mean?

- The Abraham Company receives $27,000 to do a job. However, the work is not yet completed. How is the receipt of this money recognized for financial reporting purposes?

True or False

- ____ Debits and credits must equal for every transaction.

- ____ A list of all recorded journal entries is recorded in the ledger, which is maintained by a company.

- ____ Revenue may not be recorded until cash is collected.

- ____ A transaction is any event that has a financial impact on a company.

- ____ The balance of an expense account is increased with a credit.

- ____ Examples of accrued expenses include salary, rent, and interest.

- ____ The term “revenue” and the term “gain” are interchangeable.

- ____ Posting refers to the process of analyzing transactions and producing journal entries.

- ____ A company must recognize each accrued expense as it is incurred.

- ____ The matching principle states that expenses should be recognized in the same period as the revenue they help generate.

- ____ Unearned revenue is reported on the balance sheet as a liability account.

- ____ The Hampstone Company buys 20,000 pieces of inventory (all identical) for $70,000. The company sells 8,000 units of this inventory for $5 each in cash. The company should debit cash for $40,000, credit inventory for $28,000, and credit gain for $12,000.

- ____ Assume a company buys inventory for $8,000 for cash. It then spends $700 in cash on advertising in order to sell 60 percent of the inventory for $11,000. Of that amount, it collects $5,000 immediately and will collect the remaining $6,000 next year. The company pays a cash dividend of $1,000. The amount of net income to be recognized this year will be $5,500.

- ____ A company buys inventory for $6,000 on credit on December 31, Year One. By accident, the journal entry is made backward (debits are shown as credits and credits are shown as debits). The company reports working capital of $140,000. The correct amount of working capital is $134,000.

- ____ A matching principle is the portion of U.S. GAAP that sets the rule for the timing of recognition of revenues.

- ____ Assume a company buys inventory for $3,000 on credit. It then spends $400 on advertising in order to sell 30 percent of the inventory for $9,000. Of that amount, it collects $5,000 immediately and will collect the remaining $4,000 next year. The amount of gross profit to be recognized this year will be $7,700.

Multiple Choice

-

Which of the following is not true about double-entry bookkeeping?

- It originated in Italy.

- Debits and credits must equal.

- It is still used today by most businesses.

- Each entry can have only one credit and one debit.

-

Which of the following entries could Yeats Company not make when they perform a service for a client?

-

Figure 4.22

-

Figure 4.23

-

Figure 4.24

-

Figure 4.25

-

-

Which of the following is a transaction for Tyler Corporation?

- Tyler pays its employees $400 for work done.

- Tyler considers renting office space that will cost $1,500 per month.

- Tyler agrees to perform services for a client, which will cost $7,000.

- Tyler places an order for supplies that will be delivered in two weeks. The supplies cost $200.

-

Elenor Company sells 400 units of inventory for $40 each. The inventory originally cost Elenor $26 each. What is Elenor’s gross profit on this transaction?

- $ 5,600

- $ 9,600

- $10,400

- $16,000

-

Which of the following increases with a debit?

- Retained earnings

- Sales revenue

- Inventory

- Note payable

-

In January, Rollins Company is paid $500 by a client for work that Rollins will not begin until February. Which of the following is the correct journal entry for Rollins to make when the $500 is received?

-

Figure 4.26

-

Figure 4.27

-

Figure 4.28

-

Figure 4.29

-

-

The accountant for the Babson Corporation determines that the current Cash balance held by the company is $32,564. Which of the following could not have been the source of that information?

- Trial balance

- Journal

- T-account

- Ledger

-

In the accounting system for the Caldwell Company, which of the following comes first?

- Journal

- Financial statements

- T-account

- Ledger

-

Which of the following T-accounts is least likely to have a credit balance?

- Revenue

- Equipment

- Accounts payable

- Capital stock

-

The Brooklyn Corporation rents a building for $100 per day. The company’s accounting system accrues this expense each day. After twelve days, payment is made. What account is debited when that payment is made?

- Rent expense

- Rent payable

- Cash

- Cannot be determined based on the information provided

-

The Bronx Corporation rents a building for $100 per day. The company’s accounting system makes no recognition of this expense as it accrues. After twelve days, payment is made. What account is debited when that payment is made?

- Rent expense

- Rent payable

- Cash

- Cannot be determined based on the information provided

Video Problems

Professor Joe Hoyle discusses the answers to these two problems at the links that are indicated. After formulating your answers, watch each video to see how Professor Hoyle answers these questions.

-

Your roommate is an English major. One of the roommate’s parents works as an accountant for the family’s business, a corporation that owns a number of ice cream stores in Florida. The parent is constantly talking about working with debits and credits, which seems like some foreign language to your roommate. One day, on the way to the fitness center, your roommate blurts out this question: “What in the world are debits and credits? How can they possibly be so important?” How would you respond?

-

Your uncle and two friends started a small office supply store at the beginning of the current year. Almost immediately, it becomes obvious to them that they need some system for keeping their financial records. They will eventually have to report their income taxes, and they may well need monetary information for a bank loan. Your uncle knows that you are taking a financial accounting course in college. He sends you an e-mail and asks if you can provide some suggestions on getting started with this record-keeping process. He realizes that you have just started your course, but he hopes that you can give him some basic ideas on how to gather the needed information. How would you respond?

Problems

-

For each of the following transactions of the Hamner Corporation, indicate what accounts are affected and whether they increase or decrease.

- Owners put $30,000 in cash into the business.

- The company borrows $15,000 in cash from the bank on a note payable.

- The company buys equipment for $19,000 using cash.

- The company buys machinery at a cost of $11,000 that will be paid within thirty days.

- The company sells services for $14,000. It collects $2,000 immediately (when the work is done) with the rest due at the end of the month.

- The company pays $5,000 in rent on a building that was used during the past month. The expense has not been accrued over that time.

- The company pays a $3,000 dividend to its owners.

- The company buys inventory for $10,000 on credit.

- The company sells the above inventory for $18,000. It collects $7,000 immediately with the rest to be received within the next few weeks.

- The company pays for inventory bought in transaction h.

- The company collects money due from the sale in transaction i.

-

For each of the following is a debit or credit needed to reflect the impact?

- Equipment increases

- Salary payable increases

- Cash decreases

- Rent expense increases

- Sales revenue increases

- Accounts receivable decreases

- Capital stock increases

- Inventory decreases

- Accounts payable decreases

- Salary expense decreases

-

Record the following journal entries for Taylor Company for the month of March:

- Borrowed $4,500 from Local Bank and Trust

- Investors contributed $10,000 in cash for shares of the company's stock.

- Bought inventory costing $2,000 on credit

- Sold inventory that originally cost $400 for $600 on credit

- Purchased a new piece of equipment for $500 cash

- Collected $600 in cash from sale of inventory in (d)

- Paid for inventory purchased in (c)

- Paid $1,200 in cash for an insurance policy that covers the next year

- Employees earned $3,000 during the month but have not yet been paid; this amount has been recorded by the company as it was earned.

- Paid employees $2,900 of the wages earned and recorded during February

-

For each of the following transactions, determine if Raymond Corporation has earned revenue during the month of May and, if so, how much has been earned.

- Customer A paid Raymond $1,500 for work Raymond will perform in June.

- Customer B purchased $6,000 in inventory with the total payment expected to be received in four weeks. Those items had cost Raymond $3,600 in February.

- Raymond performed a service for Customer C and was paid $3,400 in cash.

- Customer D paid Raymond $2,300 for inventory that was purchased previously in April.

- Record the journal entries for the transactions in number 4 above.

-

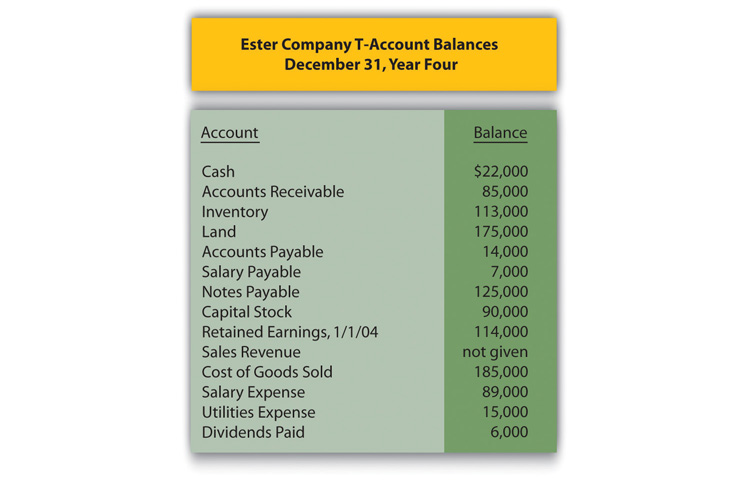

The following are the account balances for the Ester Company for December 31, Year Four, and the year that ended. All accounts have normal debit or credit balances. For some reason, company accountants do not know the amount of sales revenue earned this year. What is the balance of that account?

Figure 4.30 Trial Balance—Ester Company

-

State whether a debit or credit balance is normal for each of the following T-accounts:

- Cash

- Dividends paid

- Notes payable

- Unearned revenue

- Cost of goods sold

- Prepaid rent

- Accounts receivable

- Capital stock

-

Near the end of her freshman year at college, Heather Miller is faced with the decision of whether to get a summer job, go to summer school, or start a summer dress-making business. Heather has some experience designing and sewing and believes that third option might be the most lucrative of her summer alternatives. Consequently, she starts “Sew Cool.”

During June, the first month of business, the following occur:

- Heather deposits $1,000 of her own money into Sew Cool’s checking account.

- Sew Cool purchases equipment for $1,000. The company signs a note payable for this purchase.

- Sew Cool purchases $1,000 in sewing supplies and material paying cash.

- Sew Cool gives Heather’s parents a check for $80 for rent ($70) and utilities ($10) for the past four weeks.

- Heather sews and sells twenty dresses during the month. Each dress has a price of $60. Cash is received for twelve of the dresses, with customers owing for the remaining eight.

- The dresses sold cost $35 each to make.

- Sew Cool purchases advertising for $50 cash.

- Sew Cool pays Heather a cash dividend of $10 cash.

-

Sew Cool’s taxes, paid in cash, amount to $87.

Required:

- Prepare journal entries for the previous transactions.

- Prepare t-accounts for each account used.

- Prepare a trial balance for June.

-

Bowling Corporation had the following transactions occur during January:

- Bowling purchased $450,000 in inventory on credit.

- Bowling received $13,000 in cash from customers for subscriptions that will not begin until the following month.

- Bowling signed a note from Midwest Bank for $67,000.

- Bowling sold all the inventory purchased in (a) for $700,000 on account.

- Bowling paid employees $120,000 for services performed (and recorded) during the previous year.

- Bowling purchased land for $56,000 in cash.

- Bowling received $650,000 in cash from customers paying off previous accounts receivable.

- Bowling paid dividends to stockholders in the amount of $4,000.

- Bowling owes its employees $123,000 for work performed during the current month but not yet paid.

- Bowling paid $300,000 on its accounts payable.

-

Bowling paid taxes in cash of $45,000.

Required:

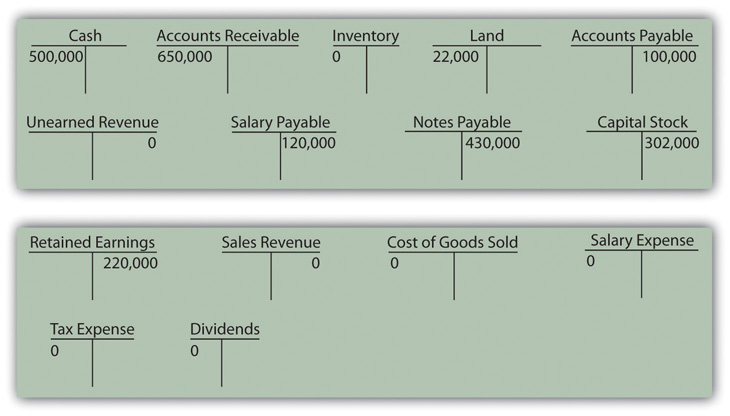

- Prepare journal entries for the previous transactions.

-

Complete the following T-accounts. Numbers already under the accounts represent the prior balance in that account.

Figure 4.31 Opening T-Account Balances

- Prepare a trial balance for the end of January.

-

The following events occurred during the month of January for McLain Company.

- McLain purchases inventory costing $1,800 on account.

- McLain sells 240 units for $20 each. McLain collects cash for 200 of these units. These specific units cost McLain $8 each to purchase.

- McLain collects $500 in cash on its accounts receivable.

- McLain takes out a loan for $400.

- McLain pays out $350 cash in dividends.

- McLain receives a contribution of $600 in cash from its owners in exchange for capital stock shares.

- McLain purchased a new piece of equipment. The new equipment cost $1,000 and was paid for in cash.

- McLain pays $500 of its accounts payable.

- McLain incurs $500 in salaries expense, but will not pay workers until next month.

- McLain incurs $300 in rent expense and pays it in cash.

- McLain prepays $200 in cash for insurance.

- Taxes, paid in cash, are $110.

Required:

- Prepare journal entries for the earlier transactions.

-

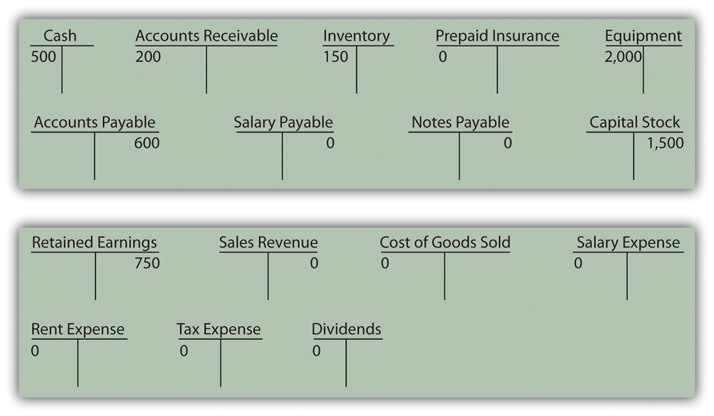

Complete the following T-accounts. Numbers already under the accounts represent the prior balance in that account.

Figure 4.32 Opening T-Account Balances

- Prepare a trial balance for January.

Research Assignment

A newspaper company collects money for subscriptions before its newspapers are physically delivered. How large is that liability, and when does it become revenue?

Go to http://www.nytimes.com/. At The New York Times Web site, scroll to the bottom of the screen and click on “The New York Times Company.” Click on “Investors” at the top of the next screen. Click on “Financials” on the left side of the next screen. In the center of the next page, click on “2010 Annual Report & Form 10-K” to download.

After the document has downloaded, scroll to page 63 to look at the company’s balance sheet. Does The New York Times Company report any unearned revenue within its liabilities?

Next, scroll to page 72. Within the notes to financial statements, a description is provided of the revenue recognition procedures used by The New York Times Company. What information is presented to decision makers by the last sentence in the fourth bullet point?