This is “The Essential Role of Transaction Analysis”, section 4.1 from the book Business Accounting (v. 2.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

4.1 The Essential Role of Transaction Analysis

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Define “transaction” and provide several common examples.

- Define “transaction analysis” and explain its importance to the accounting process.

- Identify the account changes created by the purchase of inventory, the payment of a salary, and the borrowing of money.

- Understand that corporate accounting systems can be programmed to record expenses such as salary automatically as they accrue.

The Nature of a Transaction

Question: Information provided by a set of financial statements is essential to any individual analyzing a business or other organization. The availability of a fair representation of a company’s financial position, operations, and cash flows is invaluable for a wide array of decision makers. However, the sheer volume of data that a business such as General Mills, McDonald’s, or PepsiCo must gather in order to prepare these statements has to be astronomical. Even a small enterprise—a local convenience store, for example—generates a significant quantity of information virtually every day. How does an accountant begin the process of accumulating all the necessary data so that financial statements can be produced and distributed to decision makers?

Answer: The accounting process starts by analyzing the effect of transactionsEvents that have a financial impact on an organization; information on the resulting changes must be gathered, sorted, classified, and turned into financial statements by means of an accounting system.—any event that has an immediate financial impact on a company. Large organizations participate in literally millions of transactions each year. The resulting information must be gathered, sorted, classified, and turned into a set of financial statements that cover a mere four or five pages. Over the decades, accountants have had to become very efficient to fulfill this seemingly impossible assignment. Despite the volume of transactions, the goal remains the same: to prepare financial statements that are presented fairly because they contain no material misstatements according to U.S. GAAP or IFRS.

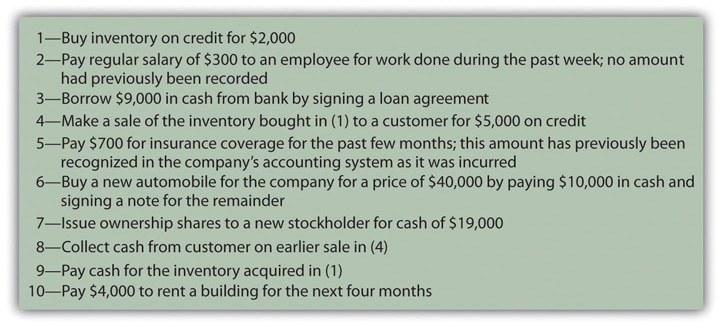

For example, all the occurrences listed in Figure 4.1 "Transactions Frequently Encountered by a Business" are typical transactions that any business might encounter. Each causes some measurable effect on the company’s assets, liabilities, revenues, expenses, gains, losses, capital stock, or dividends paid. The accounting process begins with an analysis of each transaction to determine the specific financial changes that took place. Was revenue earned? Did a liability increase? Has an asset been acquired? What changed as a result of this event?

Figure 4.1 Transactions Frequently Encountered by a Business

In any language, successful communication is only possible if the information to be conveyed is properly understood. Likewise, in accounting, transactions must be analyzed so that their impact is understood. A vast majority of transactions are relatively straightforward so that, with experience, the accountant can ascertain the financial impact almost automatically. Within this process, each individual asset, liability, revenue, expense, and the like is referred to as an account. For example, rent expense and salary expense are both expense accounts. The monetary amount attributed to an account is known as an account balance.

For transactions with greater complexity, the necessary analysis becomes more challenging. However, the importance of this initial step in the production of financial statements cannot be overstressed. The well-known computer aphorism captures the essence quite succinctly: “garbage in, garbage out.” There is little hope that financial statements can be fairly presented unless the entering information is based on an appropriate identification of the changes in account balances created by each transaction.

Test Yourself

Question:

Each of the following events took place this week in connection with the operations of the Hammond Corporation. Which does not qualify as a transaction?

- An employee is hired who will be paid $1,000 per month.

- Inventory is bought on account for $2,000 with payment to be made next month.

- An owner invests $3,000 cash in the business to receive capital stock.

- A truck is bought for $39,000 by signing a note payable.

Answer:

The correct answer is choice a: An employee is hired who will be paid $1,000 per month.

Explanation:

A transaction is any event that has a financial impact on an organization. The purchase of inventory increases that asset and the company liabilities. The investment increases the company’s cash. The acquisition of the truck raises the assets as well as the note payable. However, hiring an employee is not, by itself, a transaction because there is no financial impact at that time. There will be an impact only after the person has done work and earned a salary.

Analyzing the Impact of a Transaction

Question: Transaction 1—A company buys inventory on credit for $2,000. How does transaction analysis work here? What accounts are affected by the purchase of merchandise?

Answer: Inventory, which is an asset, increases by $2,000 because of the purchase. The organization has more inventory than it did previously. Because no money was paid for these goods when bought, a liability for the same amount has been created. The term accounts payableShort-term liabilities to pay for goods and services that have been acquired on credit. is often used in financial accounting to represent debts resulting from the acquisition of inventory and supplies.

Transaction 1: Inventory Purchased on Credit Inventory (asset) increases by $2,000 Accounts Payable (liability) increases by $2,000Note that the accounting equation described in the previous chapter remains in balance here. Assets have gone up by $2,000 while the liability side of the equation has also increased by the same amount to reflect the source of this increase.

Test Yourself

Question:

A company incurred a transaction where its assets as well as its liabilities increased. Which of the following transactions does not result in this impact?

- Money is borrowed from a bank.

- A sale is made to a customer for cash.

- Supplies are bought and will be paid for next week.

- A truck is bought by signing a note payable.

Answer:

The correct answer is choice b: A sale is made to a customer for cash.

Explanation:

In all four of these cases, assets increase. Cash goes up in the first two, while supplies and a truck increase assets in the last two, respectively. The company owes the bank in A and the supplier in C. In D, the company has a liability to the party that provided the money for the truck. In B, there is no debt or other obligation to any party.

The Financial Impact of Paying an Employee

Question: Transaction 2—A company pays a salary of $300 to one of its employees for work performed during the past week. No amount had previously been recorded by the accounting system for this amount. What accounts are affected by payment of a salary?

Answer: Cash (an asset) is decreased here by $300. Whenever cash is involved in a transaction, identifying that change is a good place to start the analysis. Increases and decreases in cash are often obvious.

The cash balance declined because salary was paid to an employee. Assets were reduced as a result of the payment. That is a cost to the company. Recognizing an expense as a result is appropriate rather than an asset because the employee’s work reflects a past benefit. The person’s effort has already been carried out, generating revenues for the company in the previous week rather than in the future. Thus, a salary expense of $300 is reported.

Transaction 2: Salary Paid to Employee Salary Expense (expense) increases by $300 Cash (asset) decreased by $300The continued equilibrium of the accounting equation does exist here although it is less apparent. Assets are decreased. At the same time, an expense is recognized. This expense reduces reported net income. On the statement of retained earnings, current net income becomes a component of retained earnings. The reduction in income serves to decrease retained earnings. An expense ultimately reduces reported retained earnings. Because both assets and retained earnings go down by the same amount as a result of this transaction, the accounting equation continues to balance.

Recording Accrued Expenses

Question: In Transaction 2, the company paid a salary of $300 that it owed to a worker. Why does a payment to an employee not always reduce a salary payable balance?

Answer: Costs such as salary, rent, or interest increase gradually over time and are often referred to as accrued expenses because the term “accrue” means “to grow.” How should the very slow growth of an expense be recognized? An accounting system can be mechanically structured to record such costs in either of two ways. On the financial statements, reported results are the same but the steps in the process differ.

- Some companies simply ignore accrued expenses until paid. At that time, the expense is recognized and cash is reduced. No liability is entered into the accounting system or removed. Because the information provided specifies that nothing has been recorded to date, this approach was apparently used here. When financial statements are produced, any amount that is still owed must be recognized for a fair presentation.

- Other companies choose to program their computer systems so that both the expense and the related liability are recognized automatically as the amount grows. For salary, as an example, this increase could literally be recorded each day or week based on the amount earned by employees. At the time payment is finally conveyed, the expense has already been recorded. Thus, the liability is removed because that debt is being settled. Later, in Transaction 5, this second possible approach to recording accrued expenses is illustrated.

A company can recognize an accrued expense (such as a salary) as it is incurred or wait until payment is made. This decision depends on the preference of company officials. The end result (an expense is reported and cash decreased) is the same, but the recording procedures differ. As mentioned, if no entry has been made prior to the production of financial statements (the first alternative), both the expense and the payable have to be recognized at that time so that all balances are properly included for reporting purposes.

Test Yourself

Question:

The Abraham Company rents a building for $4,000 per month with payment being made on the tenth day following that month. The accounting system is organized so that the expense and liability are recorded throughout the month. In that way, the accounting records are kept up to date. However, when the appropriate payment was made for November on December 10 of the current year, the accountant increased the rent expense and decreased cash. Which of the following statements is true in connection with this recording?

- Reported expenses are understated by $4,000.

- Net income is understated by $4,000.

- Liabilities are understated by $4,000.

- All account balances are stated properly.

Answer:

The correct answer is choice b: Net income is understated by $4,000.

Explanation:

Because the expense and the liability have already been recorded as incurred in November, the accountant should have decreased the liability rather than increased the expense when payment was made. The liability balance was not properly reduced; it is overstated. The expense was erroneously increased, so it is overstated. Simply stated, the expense was recorded twice and is overstated by $4,000. That causes reported net income to be understated by that amount.

Borrowing Money from the Bank

Question: Transaction 3—A company borrows $9,000 from a bank on a long-term note. What is the financial impact of signing a loan agreement with a bank or other lending institution?

Answer: In this transaction, cash is increased by the amount of money received from the lender. The company is obligated to repay this balance and, thus, has incurred a new liability. As with many common transactions, the financial impact is reasonably easy to ascertain.

Transaction 3: Money Borrowed on Loan Cash (asset) increases by $9,000 Note Payable (liability) increases by $9,000Key Takeaway

Most organizations must gather an enormous quantity of information as a prerequisite for the periodic preparation of financial statements. This process begins with an analysis of the impact of each transaction (financial event). After the effect on all account balances is ascertained, the recording of a transaction is relatively straightforward. The changes caused by most transactions—the purchase of inventory or the signing of a note, for example—can often be determined quickly. For accrued expenses, such as salary or rent that grow over time, the accounting system can record the amounts gradually as incurred or only at the point of payment. However, the figures to be reported on the financial statements are not impacted by the specific mechanical steps that are taken.