This is “Quantification”, chapter 3 from the book Beginning Economic Analysis (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

Chapter 3 Quantification

Practical use of supply and demand generally requires quantifying effects. If a hurricane wipes out a gasoline refinery, by how much will the price rise, and for how long will it stay high? When the price of energy efficient light bulbs falls, how long does it take to replace 50% of our incandescent stock of bulbs? This chapter introduces the basic tools of quantification, the elasticities of demand and supply. Economists use elasticityThe percentage change in one variable for a small percentage change in another., the percentage change in one variable for a small percentage change in another, in many different settings.

3.1 Elasticity

Learning Objectives

- What is the best way of measuring the responsiveness of demand?

- What is the best way of measuring the responsiveness of supply?

Let x(p) represent the quantity purchased when the price is p, so that the function x represents demand. How responsive is demand to price changes? One might be tempted to use the derivative, , to measure the responsiveness of demand, since it measures how much the quantity demanded changes in response to a small change in price. However, this measure has two problems. First, it is sensitive to a change in units. If I measure the quantity of candy in kilograms rather than in pounds, the derivative of demand for candy with respect to price changes even if the demand itself is unchanged. Second, if I change price units, converting from one currency to another, again the derivative of demand will change. So the derivative is unsatisfactory as a measure of responsiveness because it depends on units of measure. A common way of establishing a unit-free measure is to use percentages, and that suggests considering the responsiveness of demand to a small percentage change in price in percentage terms. This is the notion of elasticity of demandThe percentage change in one variable for a small percentage change in another..The concept of elasticity was invented by Alfred Marshall (1842–1924) in 1881 while sitting on his roof. The elasticity of demand is the percentage decrease in quantity that results from a small percentage increase in price. Formally, the elasticity of demand, which is generally denoted with the Greek letter epsilon, ε, (chosen mnemonically to indicate elasticity) is

The minus sign is included in the expression to make the elasticity a positive number, since demand is decreasing. First, let’s verify that the elasticity is, in fact, unit free. A change in the measurement of x doesn’t affect elasticity because the proportionality factor appears in both the numerator and denominator. Similarly, a change in the measure of price so that p is replaced by r = ap, does not change the elasticity, since as demonstrated below,

the measure of elasticity is independent of a, and therefore not affected by the change in units.

How does a consumer’s expenditure, also known as (individual) total revenue, react to a change in price? The consumer buys x(p) at a price of p, and thus total expenditurePrice times the quantity purchased., or total revenue, is TR = px(p). Thus,

Therefore,

In other words, the percentage change of total revenue resulting from a 1% change in price is one minus the elasticity of demand. Thus, a 1% increase in price will increase total revenue when the elasticity of demand is less than one, which is defined as an inelastic demandWhen the elasticity of demand is less than one.. A price increase will decrease total revenue when the elasticity of demand is greater than one, which is defined as an elastic demandWhen the elasticity of demand is less than one.. The case of elasticity equal to one is called unitary elasticityWhen elasticity is equal to one., and total revenue is unchanged by a small price change. Moreover, that percentage increase in price will increase revenue by approximately 1 – ε percent. Because it is often possible to estimate the elasticity of demand, the formulae can be readily used in practice.

Table 3.1 "Various Demand Elasticities" provides estimates on demand elasticities for a variety of products.

Table 3.1 Various Demand Elasticities

| Product | ε | Product | ε |

|---|---|---|---|

| Salt | 0.1 | Movies | 0.9 |

| Matches | 0.1 | Shellfish, consumed at home | 0.9 |

| Toothpicks | 0.1 | Tires, short-run | 0.9 |

| Airline travel, short-run | 0.1 | Oysters, consumed at home | 1.1 |

| Residential natural gas, short-run | 0.1 | Private education | 1.1 |

| Gasoline, short-run | 0.2 | Housing, owner occupied, long-run | 1.2 |

| Automobiles, long-run | 0.2 | Tires, long-run | 1.2 |

| Coffee | 0.25 | Radio and television receivers | 1.2 |

| Legal services, short-run | 0.4 | Automobiles, short-run | 1.2-1.5 |

| Tobacco products, short-run | 0.45 | Restaurant meals | 2.3 |

| Residential natural gas, long-run | 0.5 | Airline travel, long-run | 2.4 |

| Fish (cod) consumed at home | 0.5 | Fresh green peas | 2.8 |

| Physician services | 0.6 | Foreign travel, long-run | 4.0 |

| Taxi, short-run | 0.6 | Chevrolet automobiles | 4.0 |

| Gasoline, long-run | 0.7 | Fresh tomatoes | 4.6 |

From http://www.mackinac.org/archives/1997/s1997-04.pdf; cited sources: James D. Gwartney and Richard L. Stroup,, Economics: Private and Public Choice, 7th ed., 1995; 8th ed., 1997; Hendrick S. Houthakker and Lester D. Taylor, Consumer Demand in the United States, 1929–1970 (1966; Cambridge: Harvard University Press, 1970); Douglas R. Bohi, Analyzing Demand Behavior (Baltimore: Johns Hopkins University Press, 1981); Hsaing-tai Cheng and Oral Capps, Jr., "Demand for Fish," American Journal of Agricultural Economics, August 1988; and U.S. Department of Agriculture.

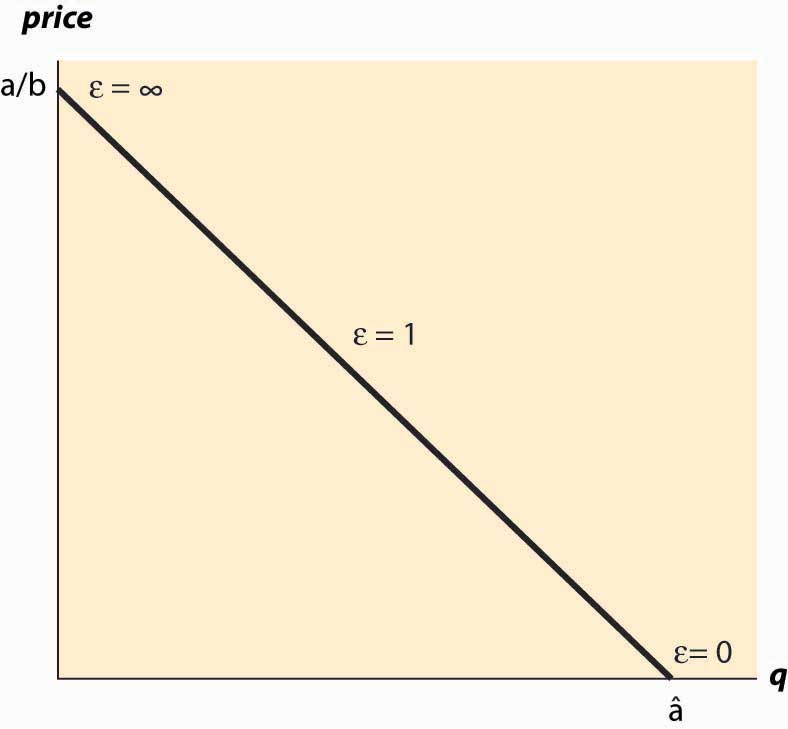

When demand is linear, x(p) = a – bp, the elasticity of demand has the form

This case is illustrated in Figure 3.1 "Elasticities for linear demand".

Figure 3.1 Elasticities for linear demand

If demand takes the form x(p) = a * p−ε, then demand has constant elasticityCondition in which the elasticity remains at the same level while the underlying variables change., and the elasticity is equal to ε. In other words, the elasticity remains at the same level while the underlying variables (such as price and quantity) change.

The elasticity of supplyThe percentage increase in quantity supplied resulting from a small percentage increase in price. is analogous to the elasticity of demand in that it is a unit-free measure of the responsiveness of supply to a price change, and is defined as the percentage increase in quantity supplied resulting from a small percentage increase in price. Formally, if s(p) gives the quantity supplied for each price p, the elasticity of supply, denoted by η (the Greek letter “eta,” chosen because epsilon was already taken) is

Again, similar to demand, if supply takes the form s(p) = a * pη, then supply has constant elasticity, and the elasticity is equal to η. A special case of this form is linear supply, which occurs when the elasticity equals one.

Key Takeaways

- The elasticity of demand is the percentage decrease in quantity that results from a small percentage increase in price, which is generally denoted with the Greek letter epsilon, ε.

- The percentage change of total revenue resulting from a 1% change in price is one minus the elasticity of demand.

- An elasticity of demand that is less than one is defined as an inelastic demand. In this case, increasing price increases total revenue.

- A price increase will decrease total revenue when the elasticity of demand is greater than one, which is defined as an elastic demand.

- The case of elasticity equal to one is called unitary elasticity, and total revenue is unchanged by a small price change.

- If demand takes the form x(p) = a * p−ε, then demand has constant elasticity, and the elasticity is equal to ε.

- The elasticity of supply is defined as the percentage increase in quantity supplied resulting from a small percentage increase in price.

- If supply takes the form s(p) = a * pη, then supply has constant elasticity, and the elasticity is equal to η.

Exercises

- Suppose a consumer has a constant elasticity of demand ε, and demand is elastic (ε > 1). Show that expenditure increases as price decreases.

- Suppose a consumer has a constant elasticity of demand ε, and demand is inelastic (ε < 1). What price makes expenditure the greatest?

- For a consumer with constant elasticity of demand ε > 1, compute the consumer surplus.

- For a producer with constant elasticity of supply, compute the producer profits.

3.2 Supply and Demand Changes

Learning Objectives

- What are the effects of changes in supply and demand on price and quantity?

- What is a useful approximation of these changes?

When the price of a complement changes—what happens to the equilibrium price and quantity of the good? Such questions are answered by comparative statics, which are the changes in equilibrium variables when other things change. The use of the term “static” suggests that such changes are considered without respect to dynamic adjustment; instead, one just focuses on the changes in the equilibrium level. Elasticities will help us quantify these changes.

How much do the price and quantity traded change in response to a change in demand? We begin by considering the constant elasticity case, which allows us to draw conclusions for small changes for general demand functions. We will denote the demand function by qd(p) = a * p−ε and supply function by qs(p) = bpη. The equilibrium price p* is determined at the point where the quantity supplied equals to the quantity demanded, or by the solution to the following equation:

Substituting the constant elasticity formulae,

Thus,

or

The quantity traded, q*, can be obtained from either supply or demand, and the price:

There is one sense in which this gives an answer to the question of what happens when demand increases. An increase in demand, holding the elasticity constant, corresponds to an increase in the parameter a. Suppose we increase a by a fixed percentage, replacing a by a(1 + ∆). Then price goes up by the multiplicative factor and the change in price, as a proportion of the price, is Similarly, quantity rises by

These formulae are problematic for two reasons. First, they are specific to the case of constant elasticity. Second, they are moderately complicated. Both of these issues can be addressed by considering small changes—that is, a small value of ∆. We make use of a trick to simplify the formula. The trick is that, for small ∆,

The squiggly equals sign ≅ should be read, “approximately equal to.”The more precise meaning of ≅ is that, as ∆ gets small, the size of the error of the formula is small even relative to δ. That is, means Applying this insight, we have the following:

For a small percentage increase ∆ in demand, quantity rises by approximately percent and price rises by approximately percent.

The beauty of this claim is that it holds even when demand and supply do not have constant elasticities because the effect considered is local and, locally, the elasticity is approximately constant if the demand is “smooth.”

Key Takeaways

- For a small percentage increase ∆ in demand, quantity rises by approximately percent and price rises by approximately percent.

- For a small percentage increase ∆ in supply, quantity rises by approximately percent and price falls by approximately percent.

Exercises

- Show that, for a small percentage increase ∆ in supply, quantity rises by approximately percent and price falls by approximately percent.

- If demand is perfectly inelastic (ε = 0), what is the effect of a decrease in supply? Apply the formula and then graph the solution.

- Suppose demand and supply have constant elasticity equal to 3. What happens to equilibrium price and quantity when the demand increases by 3% and the supply decreases by 3%?

- Show that elasticity can be expressed as a constant times the change in the log of quantity divided by the change in the log of price (i.e., show ). Find the constant A.

- A car manufacturing company employs 100 workers and has two factories, one that produces sedans and one that makes trucks. With m workers, the sedan factory can make m2 sedans per day. With n workers, the truck factory can make 5n3 trucks per day. Graph the production possibilities frontier.

- In Exercise 5, assume that sedans sell for $20,000 and trucks sell for $25,000. What assignment of workers maximizes revenue?