This is “Corporations and Corporate Governance”, section 2.4 from the book Basics of Product Liability, Sales, and Contracts (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

2.4 Corporations and Corporate Governance

Learning Objectives

- Explain the basic structure of the typical corporation and how the shareholders own the company and elect directors to run it.

- Understand how the shareholder profit-maximization model is different from stakeholder theory.

- Discern and describe the ethical challenges for corporate cultures.

- Explain what conscious capitalism is and how it differs from stakeholder theory.

Legal Organization of the Corporation

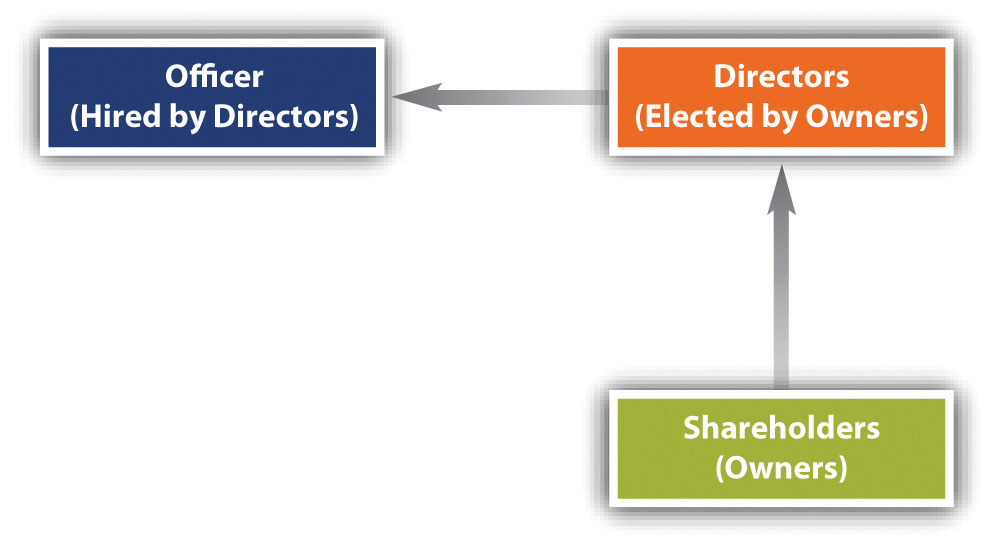

Figure 2.1 Corporate Legal Structure

Figure 2.1 "Corporate Legal Structure", though somewhat oversimplified, shows the basic legal structure of a corporation under Delaware law and the laws of most other states in the United States. Shareholders elect directors, who then hire officers to manage the company. From this structure, some very basic realities follow. Because the directors of a corporation do not meet that often, it’s possible for the officers hired (top management, or the “C-suite”) to be selective of what the board knows about, and directors are not always ready and able to provide the oversight that the shareholders would like. Nor does the law require officers to be shareholders, so that officers’ motivations may not align with the best interests of the company. This is the “agency problem” often discussed in corporate governance: how to get officers and other top management to align their own interests with those of the shareholders. For example, a CEO might trade insider information to the detriment of the company’s shareholders. Even board members are susceptible to misalignment of interets; for example, board members might resist hostile takeover bids because they would likely lose their perks (short for perquisites) as directors, even though the tender offer would benefit stockholders. Among other attempted realignments, the use of stock options was an attempt to make managers more attentive to the value of company stock, but the law of unintended consequences was in full force; managers tweaked and managed earnings in the bubble of the 1990s bull market, and “managing by numbers” became an epidemic in corporations organized under US corporate law. The rights of shareholders can be bolstered by changes in state and federal law, and there have been some attempts to do that since the late 1990s. But as owners, shareholders have the ultimate power to replace nonperforming or underperforming directors, which usually results in changes at the C-suite level as well.

Shareholders and Stakeholders

There are two main views about what the corporation’s duties are. The first view—maximizing profits—is the prevailing view among business managers and in business schools. This view largely follows the idea of Milton Friedman that the duty of a manager is to maximize return on investment to the owners. In essence, managers’ legally prescribed duties are those that make their employment possible. In terms of the legal organization of the corporation, the shareholders elect directors who hire managers, who have legally prescribed duties toward both directors and shareholders. Those legally prescribed duties are a reflection of the fact that managers are managing other people’s money and have a moral duty to act as a responsible agent for the owners. In law, this is called the manager’s fiduciary duty. Directors have the same duties toward shareholders. Friedman emphasized the primacy of this duty in his writings about corporations and social responsibility.

Maximizing Profits: Milton Friedman

Economist Milton Friedman is often quoted as having said that the only moral duty a corporation has is to make the most possible money, or to maximize profits, for its stockholders. Friedman’s beliefs are noted at length (see sidebar on Friedman’s article from the New York Times), but he asserted in a now-famous 1970 article that in a free society, “there is one and only one social responsibility of business: to use its resources and engage in activities designed to increase its profits as long as it stays within the rules of the game, which is to say, engages in open and free competition without deception and fraud.” What follows is a major portion of what Friedman had to say in 1970.

“The Social Responsibility of Business Is to Increase Its Profits”

Milton Friedman, New York Times Magazine, September 13, 1970

What does it mean to say that “business” has responsibilities? Only people can have responsibilities. A corporation is an artificial person and in this sense may have artificial responsibilities, but “business” as a whole cannot be said to have responsibilities, even in this vague sense.…

Presumably, the individuals who are to be responsible are businessmen, which means individual proprietors or corporate executives.…In a free enterprise, private-property system, a corporate executive is an employee of the owners of the business. He has direct responsibility to his employers. That responsibility is to conduct the business in accordance with their desires, which generally will be to make as much money as possible while conforming to the basic rules of the society, both those embodied in law and those embodied in ethical custom.…

…[T]he manager is that agent of the individuals who own the corporation or establish the eleemosynary institution, and his primary responsibility is to them…

Of course, the corporate executive is also a person in his own right. As a person, he may have other responsibilities that he recognizes or assumes voluntarily—to his family, his conscience, his feeling of charity, his church, his clubs, his city, his country. He may feel impelled by these responsibilities to devote part of his income to causes he regards as worthy, to refuse to work for particular corporations, even to leave his job…But in these respects he is acting as a principal, not an agent; he is spending his own money or time or energy, not the money of his employers or the time or energy he has contracted to devote to their purposes. If these are “social responsibilities,” they are the social responsibilities of individuals, not of business.

What does it mean to say that the corporate executive has a “social responsibility” in his capacity as businessman? If this statement is not pure rhetoric, it must mean that he has to act in some way that is not in the interest of his employers. For example, that he is to refrain from increasing the price of the product in order to contribute to the social objective of preventing inflation, even though a price increase would be in the best interests of the corporation. Or that he is to make expenditures on reducing pollution beyond the amount that is in the best interests of the corporation or that is required by law in order to contribute to the social objective of improving the environment. Or that, at the expense of corporate profits, he is to hire “hardcore” unemployed instead of better qualified available workmen to contribute to the social objective of reducing poverty.

In each of these cases, the corporate executive would be spending someone else’s money for a general social interest. Insofar as his actions…reduce returns to stockholders, he is spending their money. Insofar as his actions raise the price to customers, he is spending the customers’ money. Insofar as his actions lower the wages of some employees, he is spending their money.

This process raises political questions on two levels: principle and consequences. On the level of political principle, the imposition of taxes and the expenditure of tax proceeds are governmental functions. We have established elaborate constitutional, parliamentary, and judicial provisions to control these functions, to assure that taxes are imposed so far as possible in accordance with the preferences and desires of the public.…

Others have challenged the notion that corporate managers have no real duties except toward the owners (shareholders). By changing two letters in shareholder, stakeholder theorists widened the range of people and institutions that a corporation should pay moral consideration to. Thus they contend that a corporation, through its management, has a set of responsibilities toward nonshareholder interests.

Stakeholder Theory

Stakeholders of a corporation include its employees, suppliers, customers, and the community. Stakeholder is a deliberate play on the word shareholder, to emphasize that corporations have obligations that extend beyond the bottom-line aim of maximizing profits. A stakeholder is anyone who most would agree is significantly affected (positively or negatively) by the decision of another moral agent.

There is one vital fact about corporations: the corporation is a creation of the law. Without law (and government), corporations would not have existence. The key concept for corporations is the legal fact of limited liability. The benefit of limited liability for shareholders of a corporation meant that larger pools of capital could be aggregated for larger enterprises; shareholders could only lose their investments should the venture fail in any way, and there would be no personal liability and thus no potential loss of personal assets other than the value of the corporate stock. Before New Jersey and Delaware competed to make incorporation as easy as possible and beneficial to the incorporators and founders, those who wanted the benefits of incorporation had to go to legislatures—usually among the states—to show a public purpose that the company would serve.

In the late 1800s, New Jersey and Delaware changed their laws to make incorporating relatively easy. These two states allowed incorporation “for any legal purpose,” rather than requiring some public purpose. Thus it is government (and its laws) that makes limited liability happen through the corporate form. That is, only through the consent of the state and armed with the charter granted by the state can a corporation’s shareholders have limited liability. This is a right granted by the state, a right granted for good and practical reasons for encouraging capital and innovation. But with this right comes a related duty, not clearly stated at law, but assumed when a charter is granted by the state: that the corporate form of doing business is legal because the government feels that it socially useful to do so.

Implicitly, then, there is a social contract between governments and corporations: as long as corporations are considered socially useful, they can exist. But do they have explicit social responsibilities? Milton Friedman’s position suggests that having gone along with legal duties, the corporation can ignore any other social obligations. But there are others (such as advocates of stakeholder theoryThe view that all stakeholders to a corporate decision deserve some kind of moral consideration and that corporations that keep all stakeholders in mind will, over the long term, deliver superior results to shareholders.) who would say that a corporation’s social responsibilities go beyond just staying within the law and go beyond the corporation’s shareholders to include a number of other important stakeholders, those whose lives can be affected by corporate decisions.

According to stakeholder theorists, corporations (and other business organizations) must pay attention not only to the bottom line but also to their overall effect on the community. Public perception of a company’s unfairness, uncaring, disrespect, or lack of trustworthiness often leads to long-term failure, whatever the short-term successes or profits may be. A socially responsible corporation is likely to consider the impact of its decisions on a wide range of stakeholders, not just shareholders. As Table 2.1 "The Stakes of Various Stakeholders" indicates, stakeholders have very different kinds of interests (“stakes”) in the actions of a corporation.

Table 2.1 The Stakes of Various Stakeholders

| Ownership | The value of the organization has a direct impact on the wealth of these stakeholders. | Managers |

| Directors who own stock | ||

| Shareholders | ||

| Economic Dependence | Stakeholders can be economically dependent without having ownership. Each of these stakeholders relies on the corporation in some way for financial well-being. | Salaried managers |

| Creditors | ||

| Suppliers | ||

| Employees | ||

| Local communities | ||

| Social Interests | These stakeholders are not directly linked to the organization but have an interest in making sure the organization acts in a socially responsible manner. | Communities |

| Government | ||

| Media |

Corporate Culture and Codes of Ethics

A corporation is a “person” capable of suing, being sued, and having rights and duties in our legal system. (It is a legal or juridical person, not a natural person, according to our Supreme Court.) Moreover, many corporations have distinct cultures and beliefs that are lived and breathed by its members. Often, the culture of a corporation is the best defense against individuals within that firm who may be tempted to break the law or commit serious ethical misdeeds.

What follows is a series of observations about corporations, ethics, and corporate culture.

Ethical Leadership Is Top-Down

People in an organization tend to watch closely what the top managers do and say. Regardless of managers’ talk about ethics, employees quickly learn what speech or actions are in fact rewarded. If the CEO is firm about acting ethically, others in the organization will take their cues from him or her. People at the top tend to set the target, the climate, the beliefs, and the expectations that fuel behavior.

Accountability Is Often Weak

Clever managers can learn to shift blame to others, take credit for others’ work, and move on before “funny numbers” or other earnings management tricks come to light.See Robert Jackall, Moral Mazes: The World of Corporate Managers (New York: Oxford University Press, 1988). Again, we see that the manager is often an agent for himself or herself and will often act more in his or her self-interest than for the corporate interest.

Killing the Messenger

Where organizations no longer function, inevitably some employees are unhappy. If they call attention to problems that are being covered up by coworkers or supervisors, they bring bad news. Managers like to hear good news and discourage bad news. Intentionally or not, those who told on others, or blew the whistle, have rocked the boat and become unpopular with those whose defalcations they report on and with the managers who don’t really want to hear the bad news. In many organizations, “killing the messenger” solves the problem. Consider James Alexander at Enron Corporation, who was deliberately shut out after bringing problems to CEO Ken Lay’s attention.John Schwartz, “An Enron Unit Chief Warned, and Was Rebuffed,” New York Times, February 20, 2002. When Sherron Watkins sent Ken Lay a letter warning him about Enron’s accounting practices, CFO Andrew Fastow tried to fire her.Warren Bennis, “A Corporate Fear of Too Much Truth,” New York Times, February 17, 2002.

Ethics Codes

Without strong leadership and a willingness to listen to bad news as well as good news, managers do not have the feedback necessary to keep the organization healthy. Ethics codes have been put in place—partly in response to federal sentencing guidelines and partly to encourage feedback loops to top management. The best ethics codes are aspirational, or having an ideal to be pursued, not legalistic or compliance driven. The Johnson & Johnson ethics code predated the Tylenol scare and the company’s oft-celebrated corporate response.University of Oklahoma Department of Defense Joint Course in Communication, Case Study: The Johnson & Johnson Tylenol Crisis, accessed April 5, 2011. The corporate response was consistent with that code, which was lived and modeled by the top of the organization.

It’s often noted that a code of ethics is only as important as top management is willing to make it. If the code is just a document that goes into a drawer or onto a shelf, it will not effectively encourage good conduct within the corporation. The same is true of any kind of training that the company undertakes, whether it be in racial sensitivity or sexual harassment. If the message is not continuously reinforced, or (worse yet) if the message is undermined by management’s actions, the real message to employees is that violations of the ethics code will not be taken seriously, or that efforts to stop racial discrimination or sexual harassment are merely token efforts, and that the important things are profits and performance. The ethics code at Enron seems to have been one of those “3-P” codes that wind up sitting on shelves—“Print, Post, and Pray.” Worse, the Enron board twice suspended the code in 1999 to allow outside partnerships to be led by a top Enron executive who stood to gain financially from them.FindLaw, Report of Investigation by the Special Investigative Committee of the Board of Directors of Enron Corp., February 1, 2002, accessed April 5, 2011, http://news.findlaw.com/wsj/docs/enron/sicreport.

Ethics Hotlines and Federal Sentencing Guidelines

The federal sentencing guidelines were enacted in 1991. The original idea behind these guidelines was for Congress to correct the lenient treatment often given to white-collar, or corporate, criminals. The guidelines require judges to consider “aggravating and mitigating” factors in determining sentences and fines. (While corporations cannot go to jail, its officers and managers certainly can, and the corporation itself can be fined. Many companies will claim that it is one bad apple that has caused the problem; the guidelines invite these companies to show that they are in fact tending their orchard well. They can show this by providing evidence that they have (1) a viable, active code of ethics; (2) a way for employees to report violations of law or the ethics code; and (3) an ethics ombudsman, or someone who oversees the code.

In short, if a company can show that it has an ongoing process to root out wrongdoing at all levels of the company, the judge is allowed to consider this as a major mitigating factor in the fines the company will pay. Most Fortune 500 companies have ethics hotlines and processes in place to find legal and ethical problems within the company.

Managing by the Numbers

If you manage by the numbers, there is a temptation to lie about those numbers, based on the need to get stock price ever higher. At Enron, “15 percent a year or better earnings growth” was the mantra. Jeffrey Pfeffer, professor of organizational behavior at Stanford University, observes how the belief that “stock price is all that matters” has been hardwired into the corporate psyche. It dictates not only how people judge the worth of their company but also how they feel about themselves and the work that they are doing. And, over time, it has clouded judgments about what is acceptable corporate behavior.Steven Pearlstein, “Debating the Enron Effect,” Washington Post, February 17, 2002.

Managing by Numbers: The Sears Auto Center Story

If winning is the most important thing in your life, then you must be prepared to do anything to win.

—Michael Josephson

Most people want to be winners or associate with winners. As humans, our desire to associate with those who have status provides plenty of incentive to glorify winners and ignore losers. But if an individual, a team, or a company does whatever it takes to win, then all other values are thrown out in the goal to win at all costs. The desire of some people within Sears & Roebuck Company’s auto repair division to win by gaining higher profits resulted in the situation portrayed here.

Sears Roebuck & Company has been a fixture in American retailing throughout the twentieth century. At one time, people in rural America could order virtually anything (including a house) from Sears. Not without some accuracy, the company billed itself as “the place where Americans shop.” But in 1992, Sears was charged by California authorities with gross and deliberate fraud in many of its auto centers.

The authorities were alerted by a 50 percent increase in consumer complaints over a three-year period. New Jersey’s division of consumer affairs also investigated Sears Auto Centers and found that all six visited by investigators had recommended unnecessary repairs. California’s department of consumer affairs found that Sears had systematically overcharged by an average of $223 for repairs and routinely billed for work that was not done. Sears Auto Centers were the largest providers of auto repair services in the state.

The scam was a variant on the old bait-and-switch routine. Customers received coupons in the mail inviting them to take advantage of hefty discounts on brake jobs. When customers came in to redeem their coupons, sales staffers would convince them to authorize additional repairs. As a management tool, Sears had also established quotas for each of their sales representatives to meet.

Ultimately, California got Sears to settle a large number of lawsuits against it by threatening to revoke Sears’ auto repair license. Sears agreed to distribute $50 coupons to nearly a million customers nationwide who had obtained certain services between August 1, 1990, and January 31, 1992. Sears also agreed to pay $3.5 million to cover the costs of various government investigations and to contribute $1.5 million annually to conduct auto mechanic training programs. It also agreed to abandon its repair service quotas. The entire settlement cost Sears $30 million. Sears Auto Center sales also dropped about 15 to 20 percent after news of the scandal broke.

Note that in boosting sales by performing unnecessary services, Sears suffered very bad publicity. Losses were incalculable. The short-term gains were easy to measure; long-term consequences seldom are. The case illustrates a number of important lessons:

- People generally choose short-term gains over potential long-term losses.

- People often justify the harm to others as being minimal or “necessary” to achieve the desired sales quota or financial goal.

- In working as a group, we often form an “us versus them” mentality. In the Sears case, it is likely that Sears “insiders” looked at customers as “outsiders,” effectively treating them (in Kantian terms) as means rather than ends in themselves. In short, outsiders were used for the benefit of insiders.

- The long-term losses to Sears are difficult to quantify, while the short-term gains were easy to measure and (at least for a brief while) quite satisfying financially.

- Sears’ ongoing rip-offs were possible only because individual consumers lacked the relevant information about the service being offered. This lack of information is a market failure, since many consumers were demanding more of Sears Auto Center services than they would have (and at a higher price) if relevant information had been available to them earlier. Sears, like other sellers of goods and services, took advantage of a market system, which, in its ideal form, would not permit such information distortions.

- People in the organization probably thought that the actions they took were necessary.

Noting this last point, we can assume that these key people were motivated by maximizing profits and had lost sight of other goals for the organization.

The emphasis on doing whatever is necessary to win is entirely understandable, but it is not ethical. The temptation will always exist—for individuals, companies, and nations—to dominate or to win and to write the history of their actions in a way that justifies or overlooks the harm that has been done. In a way, this fits with the notion that “might makes right,” or that power is the ultimate measure of right and wrong.

Conscious Capitalism

One effort to integrate the two viewpoints of stakeholder theory and shareholder primacy is the conscious capitalism movement. Companies that practice conscious capitalismCompanies that practice conscious capitalism embrace the idea that profit and prosperity can and must go hand in hand with social justice and environmental stewardship. embrace the idea that profit and prosperity can and must go hand in hand with social justice and environmental stewardship. They operate with a holistic or systems view. This means that they understand that all stakeholders are connected and interdependent. They reject false trade-offs between stakeholder interests and strive for creative ways to achieve win-win-win outcomes for all.Milton Friedman, John Mackey, and T. J. Rodgers, “Rethinking the Social Responsibility of Business,” Reason.com, October 2005, http://reason.com/archives/2005/10/01/rethinking-the-social-responsi.

The “conscious business” has a purpose that goes beyond maximizing profits. It is designed to maximize profits but is focused more on its higher purpose and does not fixate solely on the bottom line. To do so, it focuses on delivering value to all its stakeholders, harmonizing as best it can the interests of consumers, partners, investors, the community, and the environment. This requires that company managers take a “servant leadership” role, serving as stewards to the company’s deeper purpose and to the company’s stakeholders.

Conscious business leaders serve as such stewards, focusing on fulfilling the company’s purpose, delivering value to its stakeholders, and facilitating a harmony of interests, rather than on personal gain and self-aggrandizement. Why is this refocusing needed? Within the standard profit-maximizing model, corporations have long had to deal with the “agency problem.” Actions by top-level managers—acting on behalf of the company—should align with the shareholders, but in a culture all about winning and money, managers sometimes act in ways that are self-aggrandizing and that do not serve the interests of shareholders. Laws exist to limit such self-aggrandizing, but the remedies are often too little and too late and often catch only the most egregious overreaching. Having a culture of servant leadership is a much better way to see that a company’s top management works to ensure a harmony of interests.