This is “Sole Proprietorship”, section 4.2 from the book An Introduction to Business (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

4.2 Sole Proprietorship

Learning Objective

- Describe the sole proprietorship form of organization, and specify its advantages and disadvantages.

A sole proprietorshipBusiness owned by only one person. is a business owned by only one person. The most common form of ownership, it accounts for about 75 percent of all U.S. businesses.U.S. Census Bureau, “Legal Form of Organization,” http://www.census.gov/prod/2000pubs/cc92-s-1.pdf (accessed May 3, 2006). It’s the easiest and cheapest type of business to form: if you’re using your own name as the name of your business, you just need a license to get started, and once you’re in business, you’re subject to few government regulations.

Advantages and Disadvantages of Sole Proprietorships

As sole owner, you have complete control over your business. You make all important decisions, and you’re generally responsible for all day-to-day activities. In exchange for assuming all this responsibility, you get all the income earned by the business. Profits earned are taxed as personal income, so you don’t have to pay any special federal and state income taxes.

Figure 4.2

Sole proprietors enjoy complete control but also face increased risks.

© 2010 Jupiterimages Corporation

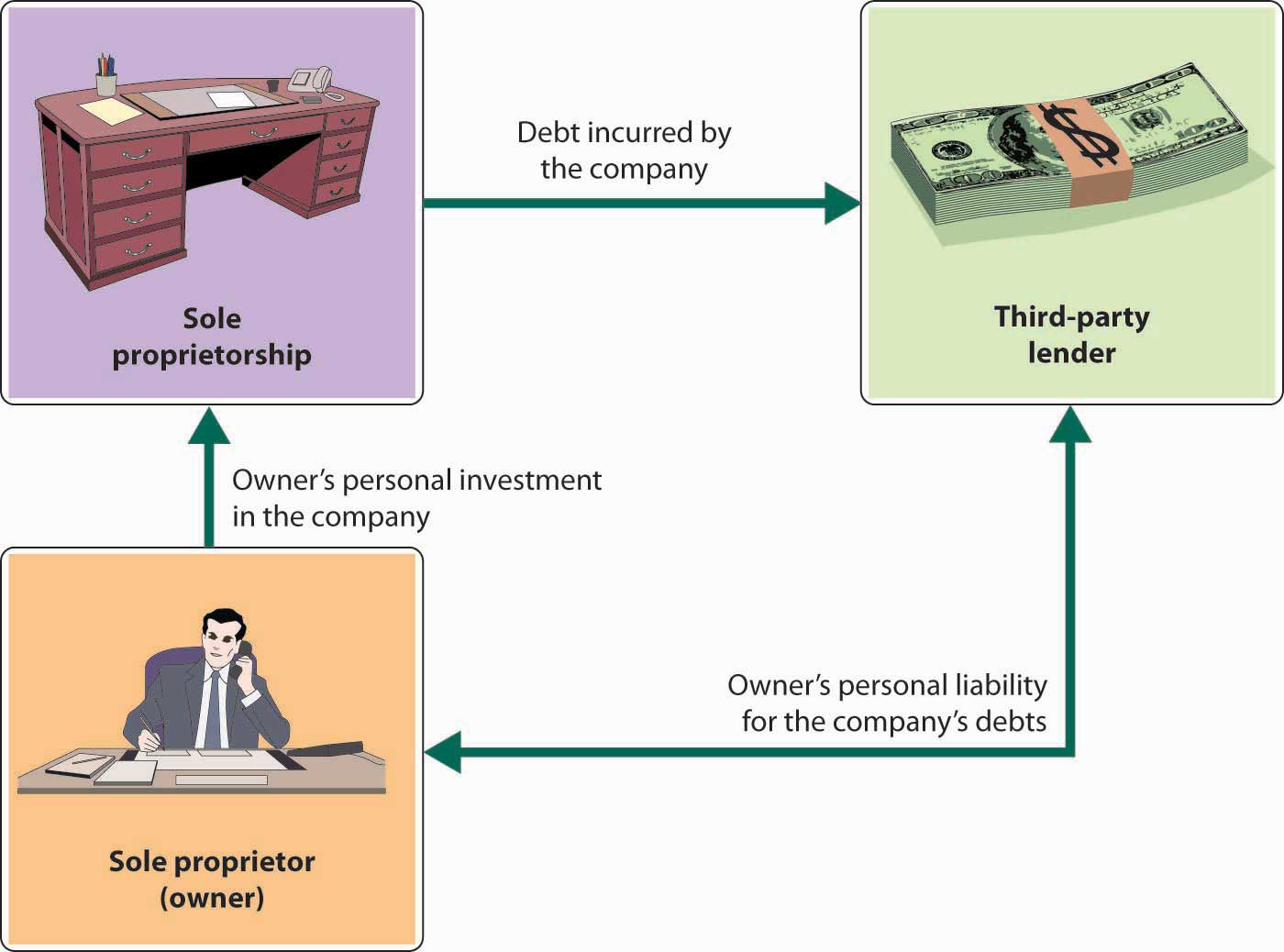

For many people, however, the sole proprietorship is not suitable. The flip side of enjoying complete control, for example, is needing to supply all the different talents that may be necessary to make the business a success. And if you die, the business dissolves. You also have to rely on your own resources for financing: in effect, you are the business, and any money borrowed by the business is loaned to you personally. Even more important, the sole proprietor bears unlimited liabilityLegal condition under which an owner or investor is personally liable for all debts of a business. for any losses incurred by the business. As you can see from Figure 4.3 "Sole Proprietorship and Unlimited Liability", the principle of unlimited personal liability means that if the company incurs a debt or suffers a catastrophe (say, getting sued for causing an injury to someone), the owner is personally liable. As a sole proprietor, you put your personal assets (your bank account, your car, maybe even your home) at risk for the sake of your business. You can lessen your risk with insurance, yet your liability exposure can still be substantial.

Figure 4.3 Sole Proprietorship and Unlimited Liability

Key Takeaways

- A sole proprietorship is a business owned by only one person.

- It’s the most common form of ownership and accounts for about 75 percent of all U.S. businesses.

-

Advantages of a sole proprietorship include the following:

- Easy and inexpensive to form; few government regulations

- Complete control over your business

- Get all the profits earned by the business

- Don’t have to pay any special income taxes

-

Disadvantages of a sole proprietorship include the following:

- Have to supply all the different talents needed to make the business a success

- If you die, the business dissolves

- Have to rely on your own resources for financing

- If the company incurs a dept or suffers a catastrophe, you are personally liable (you have unlimited liability)

Exercise

(AACSB) Communication

Talk with a sole proprietor about his or her selected form of business ownership. Ask him or her which of the following dimensions (discussed in this section) were important in deciding to operate as a proprietor: setup costs and government regulations, control, profit sharing, income taxes, skills, continuity and transferability, ability to obtain financing, and liability exposure. Write a report detailing what you learned from the business owner.