This is “Appendix: Recording Standard Costs and Variances”, section 10.9 from the book Accounting for Managers (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

10.9 Appendix: Recording Standard Costs and Variances

Learning Objective

- Explain how to record standard costs and variances using journal entries.

This chapter has focused on performing variance analysis to evaluate and control operations. Standard costing systems assist in this process and often involve recording transactions using standard cost information. When accountants use a standard costing system to record transactions, companies are able to quickly identify variances. In addition, inventory and related cost of goods sold are valued using standard cost information, which simplifies the bookkeeping process.

Recording Direct Materials Transactions

Question: In Figure 10.4 "Direct Materials Variance Analysis for Jerry’s Ice Cream", we calculated two variances for direct materials at Jerry’s Ice Cream: materials price variance and materials quantity variance. How are these variances recorded for transactions related to direct materials?

Answer: Two journal entries are needed to record direct materials transactions that include these variances. An example of each is shown next. (Typically, many more journal entries would be made throughout the year for direct materials. For the purposes of this example, we will make one journal entry for each variance to summarize the activity for the year.)

Materials Price Variance

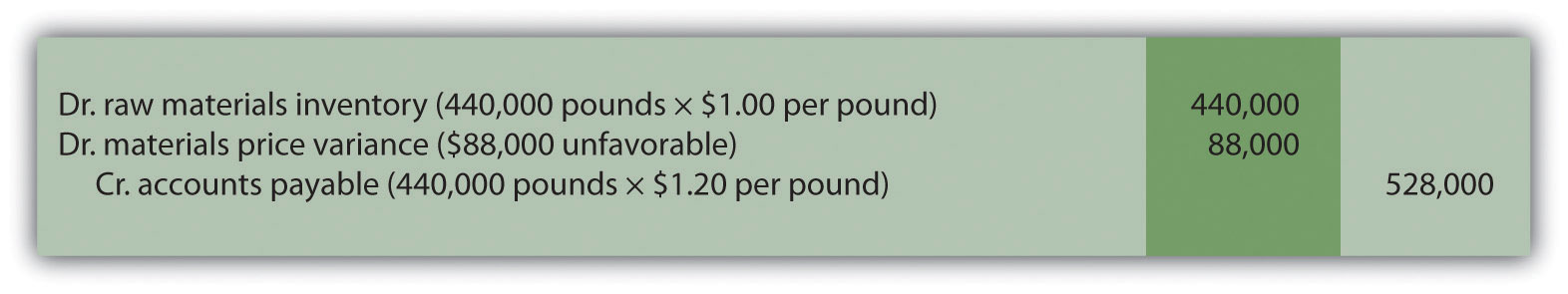

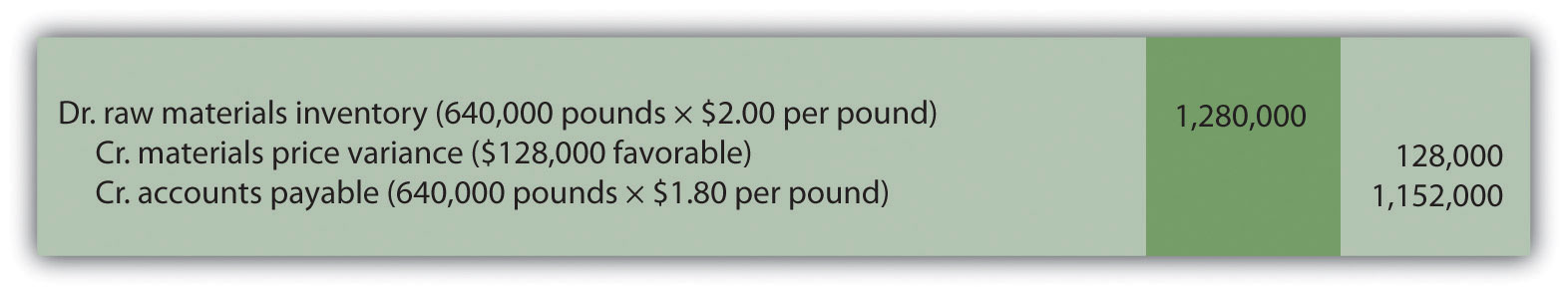

The entry to record the purchase of direct materials and related price variance shown in Figure 10.4 "Direct Materials Variance Analysis for Jerry’s Ice Cream" is

Notice that the raw materials inventory account contains the actual quantity of direct materials purchased at the standard price. Accounts payable reflects the actual cost, and the materials price variance account shows the unfavorable variance. Unfavorable variances are recorded as debits and favorable variances are recorded as credits. Variance accounts are temporary accounts that are closed out at the end of the financial reporting period. We show the process of closing out variance accounts at the end of this appendix.

Materials Quantity Variance

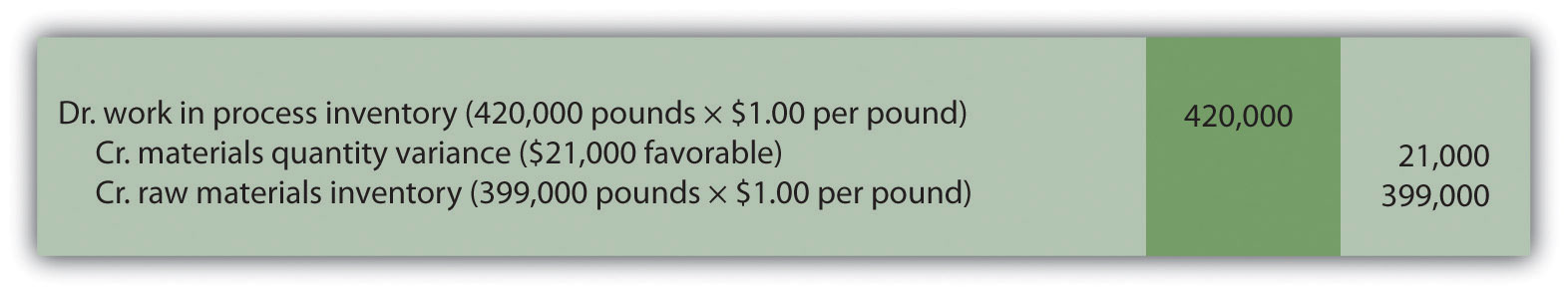

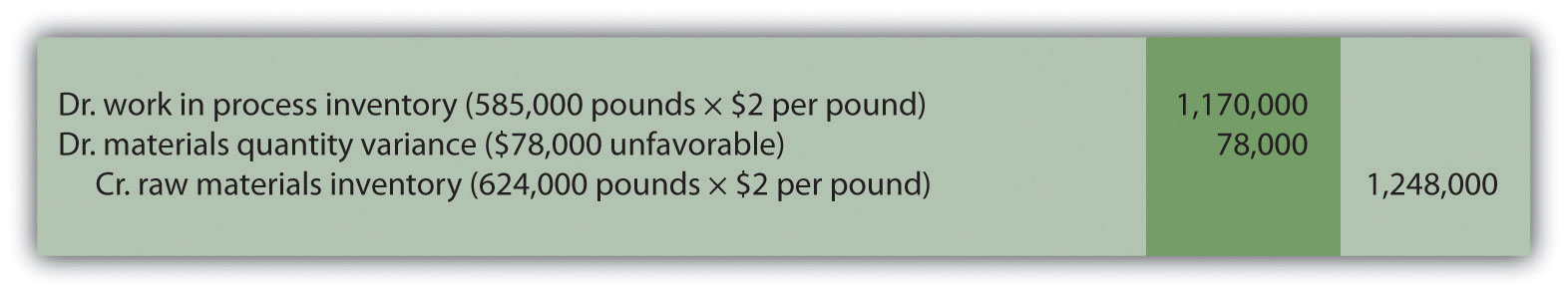

The entry to record the use of direct materials in production and related quantity variance shown in Figure 10.4 "Direct Materials Variance Analysis for Jerry’s Ice Cream" is

Work-in-process inventory reflects the standard quantity of direct materials allowed at the standard price. The reduction in raw materials inventory reflects the actual quantity used at the standard price, and the materials quantity variance account shows the favorable variance.

Recording Direct Labor Transactions

Question: In Figure 10.6 "Direct Labor Variance Analysis for Jerry’s Ice Cream", we calculated two variances for direct labor at Jerry’s Ice Cream: labor rate variance and labor efficiency variance. How are these variances recorded for transactions related to direct labor?

Answer: Because labor is not inventoried for later use like materials, only one journal entry is needed to record direct labor transactions that include these variances. (Again, many more journal entries would typically be made throughout the year for direct labor. For the purposes of this example, we will make one journal entry to summarize the activity for the year.)

Labor Rate and Efficiency Variances

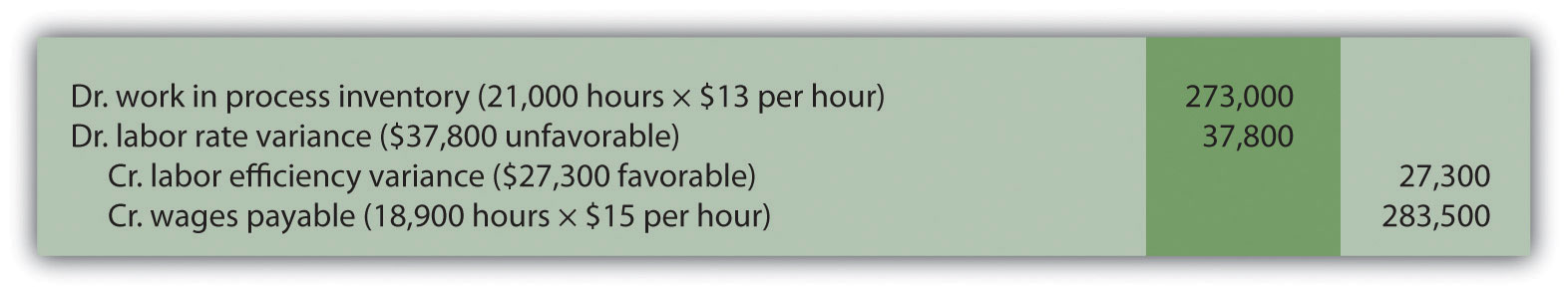

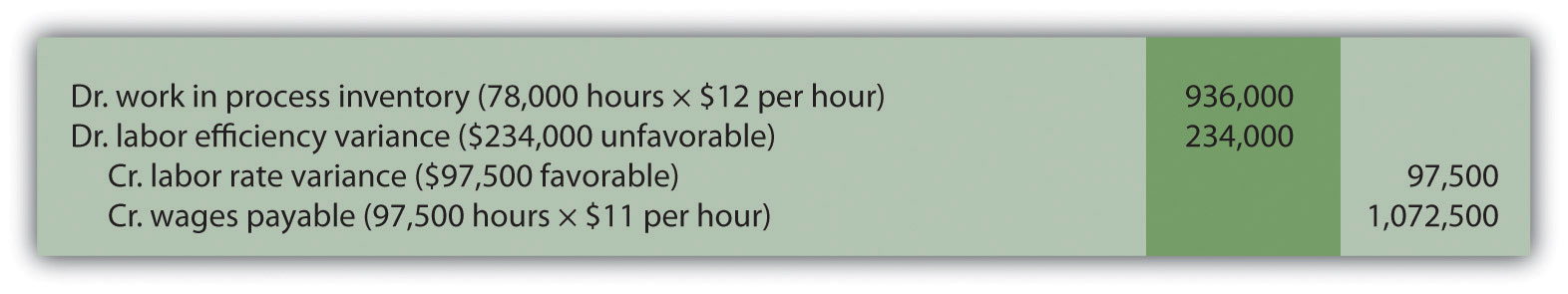

The entry to record the cost of direct labor and related variances shown in Figure 10.6 "Direct Labor Variance Analysis for Jerry’s Ice Cream" is

Work-in-process inventory reflects the standard hours of direct labor allowed at the standard rate. The labor rate and efficiency variances represent the difference between work-in-process inventory (at the standard cost) and actual costs recorded in wages payable.

Recording Manufacturing Overhead Transactions

Question: As discussed in Chapter 2 "How Is Job Costing Used to Track Production Costs?", the manufacturing overhead account is debited for all actual overhead expenditures and credited when overhead is applied to products. At the end of the period, the balance in manufacturing overhead, representing overapplied or underapplied overhead, is closed out to cost of goods sold. This overapplied or underapplied balance can be explained by combining the four overhead variances summarized in this chapter in Figure 10.14 "Comparison of Variable and Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream". How are these variances recorded for transactions related to manufacturing overhead?

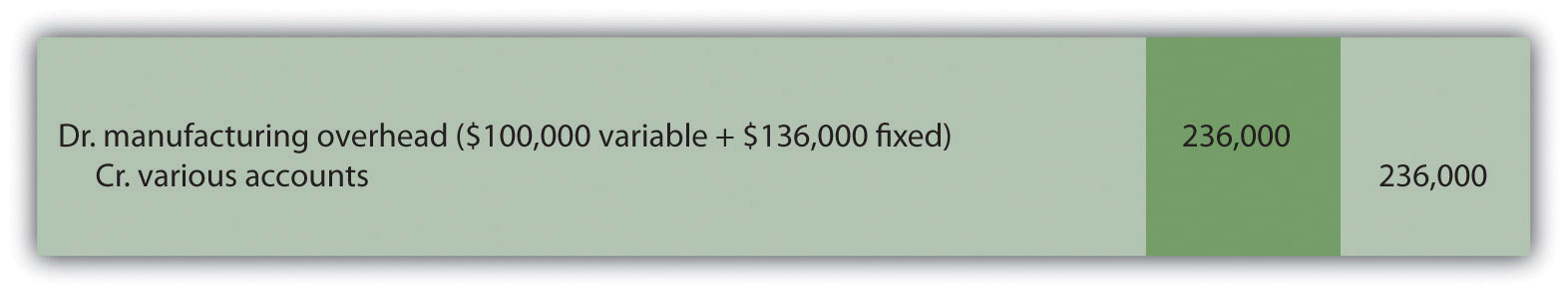

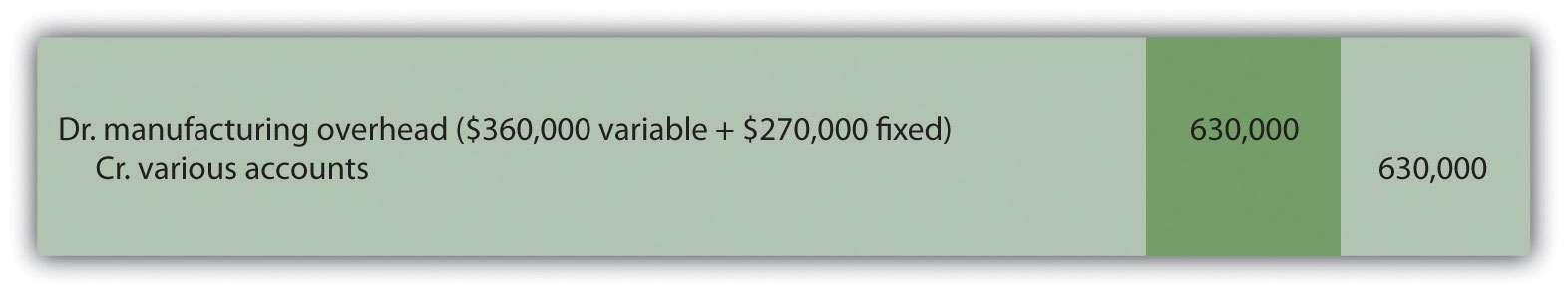

Answer: Based on the information at the left side of Figure 10.14 "Comparison of Variable and Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream", the entry to record actual overhead expenditures is

The credit goes to several different accounts depending on the nature of the expenditure. For example, if the expenditure is for indirect materials, the credit goes to accounts payable. If the expenditure is for indirect labor, the credit goes to wages payable.

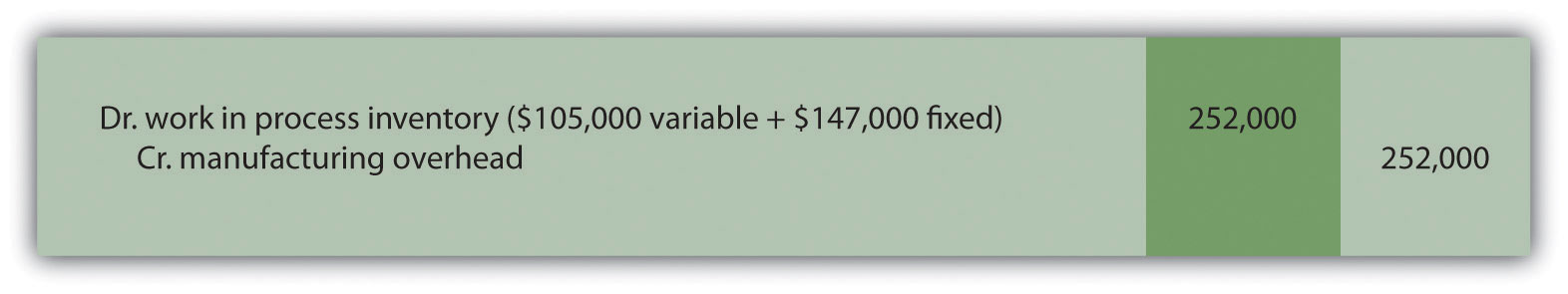

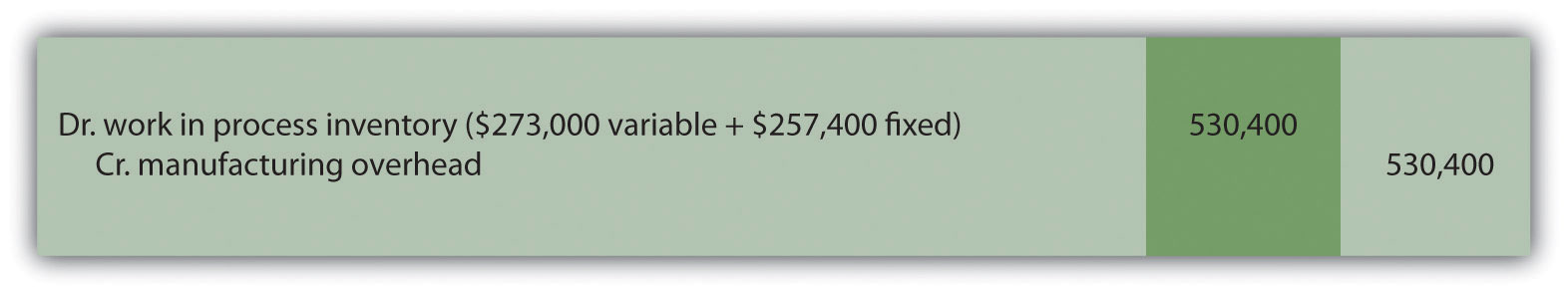

The next entry reflects overhead applied to products. This information comes from the right side of Figure 10.14 "Comparison of Variable and Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream".

At this point, manufacturing overhead has a $16,000 credit balance, which represents overapplied overhead ($16,000 = $252,000 applied overhead – $236,000 actual overhead). The following summary of fixed and variable overhead variances shown in Figure 10.14 "Comparison of Variable and Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream" explains the overapplied amount of $16,000:

Recording Finished Goods Transactions

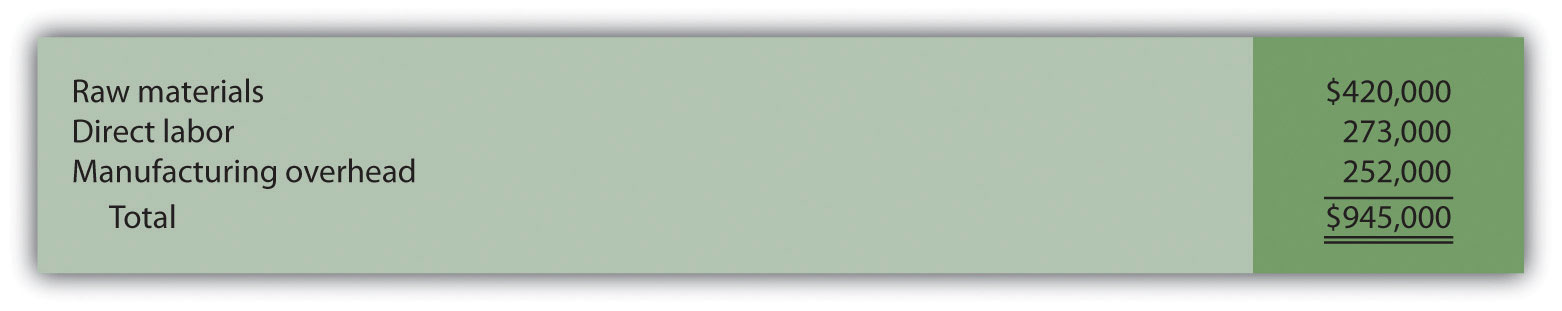

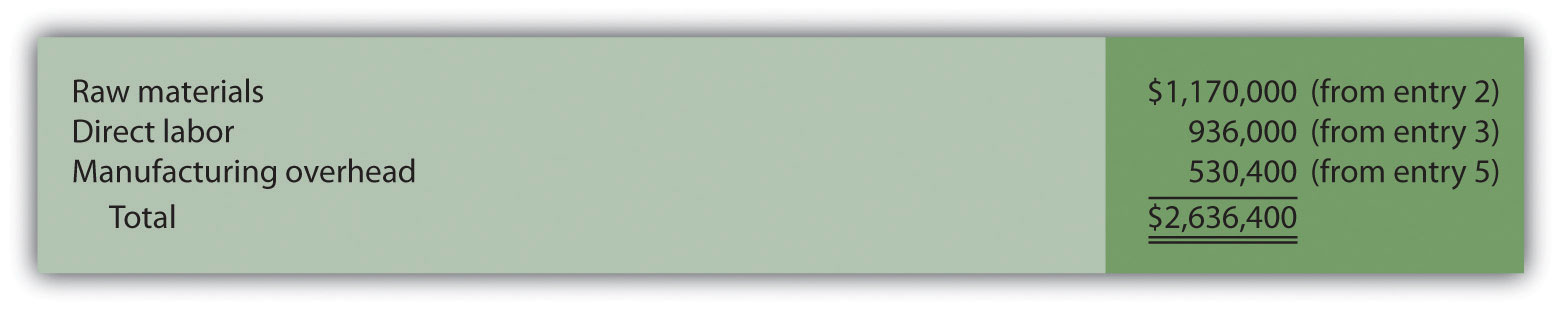

Question: Review all the debits to work-in-process inventory throughout this appendix and you will see the following costs (all recorded at standard cost):

How are these costs transferred from work-in-process inventory to finished good inventory when the goods are completed?

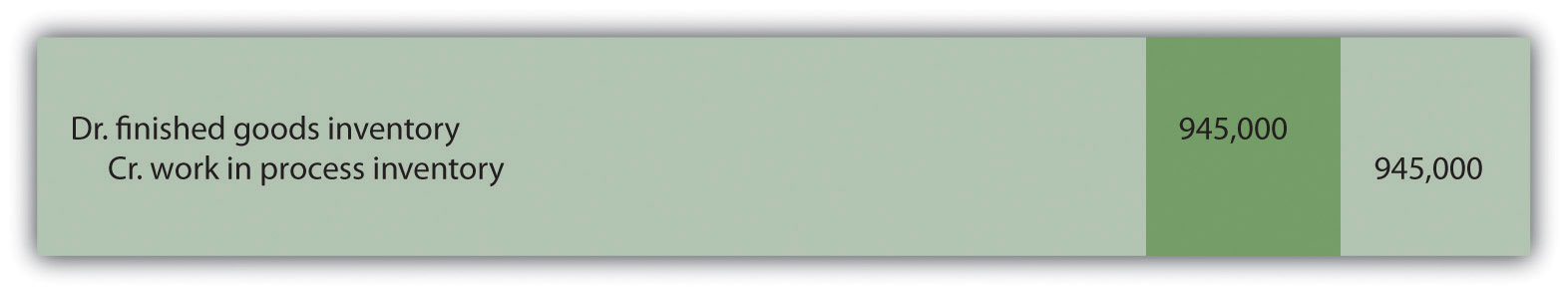

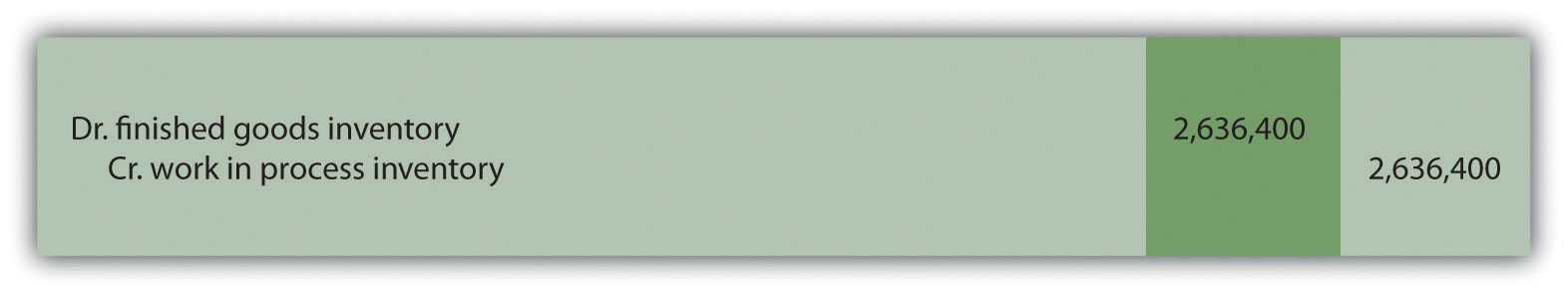

Answer: When the 210,000 units are completed, the following entry is made to transfer the costs out of work-in-process inventory and into finished goods inventory.

Note that the standard cost per unit was established at $4.50, which includes variable manufacturing costs of $3.80 (see Figure 10.1 "Standard Costs at Jerry’s Ice Cream") and fixed manufacturing costs of $0.70 (see footnote to Figure 10.12 "Fixed Manufacturing Overhead Information for Jerry’s Ice Cream"). Total production of 210,000 units × Standard cost of $4.50 per unit equals $945,000; the same amount you see in the entry presented previously.

Recording Cost of Goods Sold Transactions

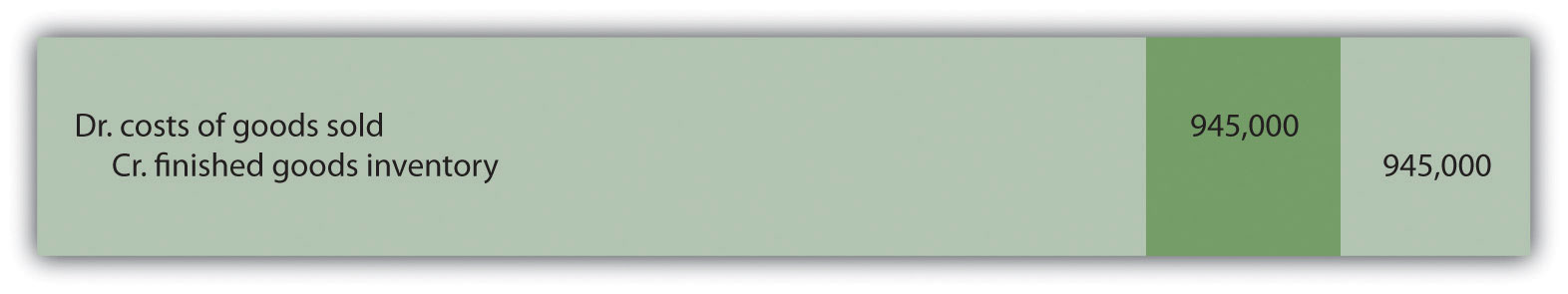

Question: How do we record the costs associated with products that are sold?

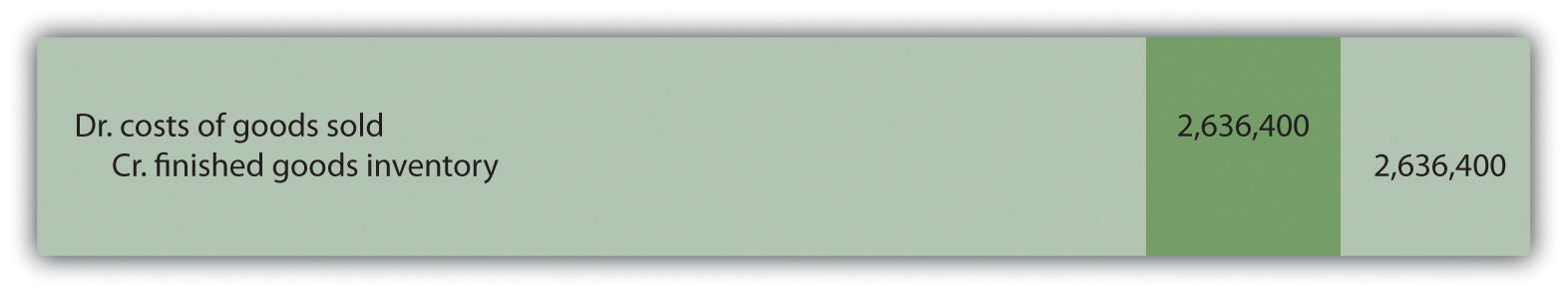

Answer: When finished product is sold, the following entry is made:

Note that the entry shown previously uses standard costs, which means cost of goods sold is stated at standard cost until the next entry is made.

Closing Manufacturing Overhead and Variance Accounts

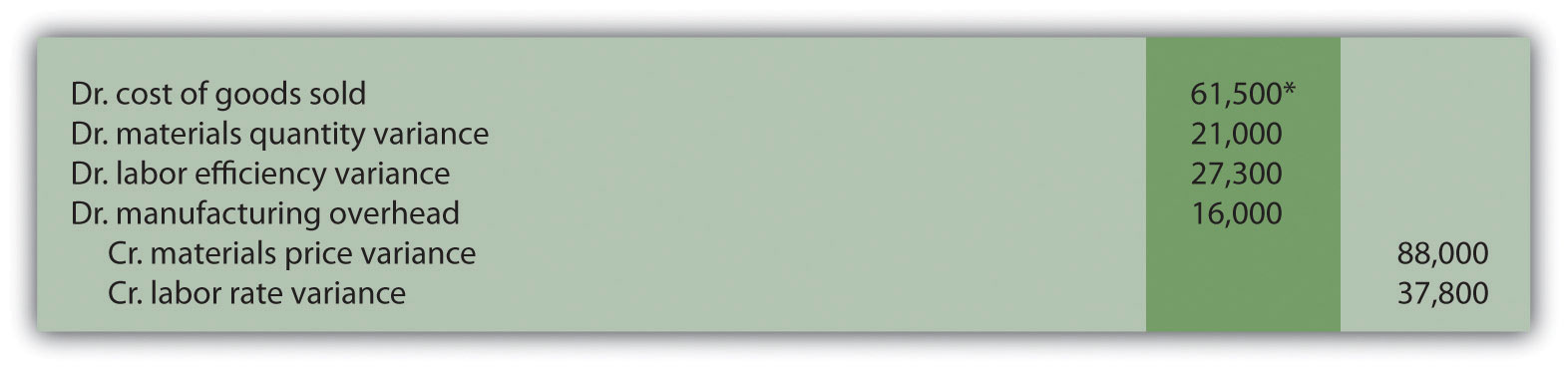

Question: At the end of the period, Jerry’s Ice Cream has balances remaining in manufacturing overhead along with all the variance accounts. These accounts must be closed out at the end of the period. How is this accomplished?

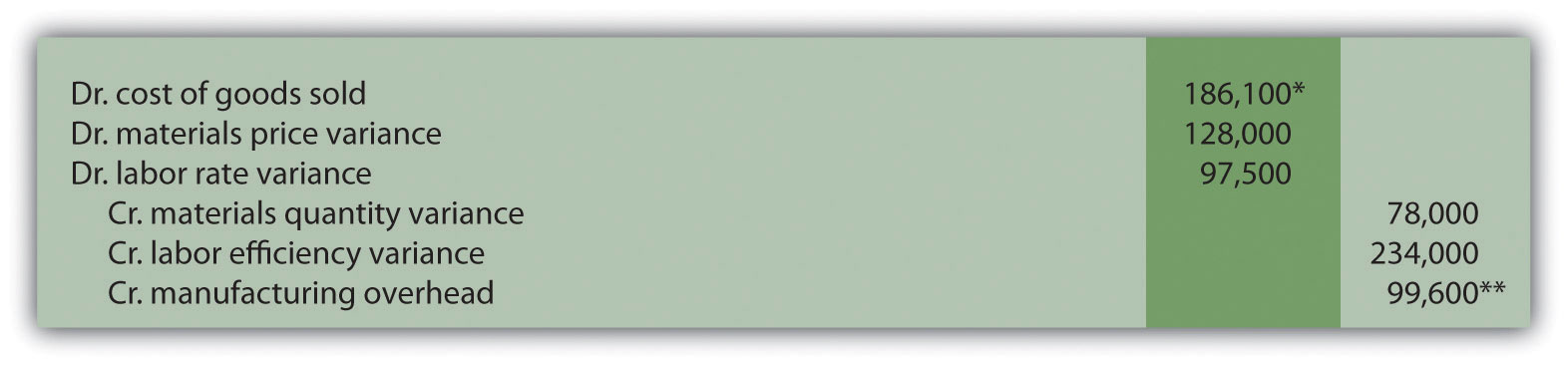

Answer: These accounts are closed out to cost of goods sold, after which point cost of goods sold will reflect actual manufacturing costs for the products sold during the period. The following entry is made to accomplish this goal:

*$61,500 = $88,000 + $37,800 – $21,000 – $27,300 – $16,000.

Key Takeaway

- In a standard costing system, all inventory accounts reflect standard cost information. The difference between standard and actual data are recorded in the variance accounts and the manufacturing overhead account, which are ultimately closed out to cost of goods sold at the end of the period.

Review Problem 10.9

- Using the solution to Note 10.30 "Review Problem 10.3", prepare a journal entry to record the purchase of raw materials.

- Using the solution to Note 10.30 "Review Problem 10.3", prepare a journal entry to record the use of raw materials.

- Using the solution to Note 10.40 "Review Problem 10.4", prepare a journal entry to record direct labor costs.

- Using the solutions to Note 10.49 "Review Problem 10.5" and Note 10.67 "Review Problem 10.8", prepare a journal entry to record actual variable and fixed manufacturing overhead expenditures.

- Using the solutions to Note 10.49 "Review Problem 10.5" and Note 10.67 "Review Problem 10.8", prepare a journal entry to record variable and fixed manufacturing overhead applied to products.

- Based on the entries shown in items 1 through 5, prepare a journal entry to transfer all work-in-process inventory costs to finished goods inventory.

- Assume all finished goods are sold during the period. Prepare a journal entry to transfer all finished goods inventory costs to cost of goods sold.

- Based on the entries shown in items 1 through 7, close manufacturing overhead and all variance accounts to cost of goods sold.

Solution to Review Problem 10.9

-

The following is a journal entry to record purchase of raw materials:

-

The following is a journal entry to record usage of raw materials:

-

The following is a journal entry to record direct labor costs:

-

The following is a journal entry to record actual overhead expenditures:

-

The following is a journal entry to record overhead applied to production:

-

The product cost data recorded in work-in-process inventory for the period is as follows:

Thus the journal entry to transfer these production costs from work in process to finished goods is:

-

The following is a journal entry to record transfer of finished goods to cost of goods sold:

-

The following is a journal entry to close out manufacturing overhead and all variance accounts:

*$186,100 = $78,000 + $234,000 + $99,600 – $128,000 – $97,500.

**$99,600 underapplied overhead = $630,000 actual overhead costs – $530,400 applied overhead. Because this represents a debit balance in manufacturing overhead, the account must be credited to close it. To further prove this is accurate, the sum of all overhead variances must equal $99,600 unfavorable as shown in the following:

Variable overhead spending variance $18,750 unfavorable (from Note 10.49 "Review Problem 10.5") Variable overhead efficiency variance $68,250 unfavorable (from Note 10.49 "Review Problem 10.5") Fixed overhead spending variance $5,340 unfavorable (from Note 10.67 "Review Problem 10.8") Fixed overhead production volume variance $7,260 unfavorable (from Note 10.67 "Review Problem 10.8") Total manufacturing overhead variance $99,600 unfavorable

End-of-Chapter Exercises

Questions

- Explain how a flexible budget differs from a master budget.

- Assume you are the production manager for a manufacturing company that anticipated selling 40,000 units of product for the master budget and actually sold 50,000 units. Why would you prefer to be evaluated using a flexible budget for direct labor rather than the master budget?

- What is a standard cost, and how does it differ from a budgeted cost?

- How are standards established for direct materials, direct labor, and variable manufacturing overhead?

- Explain what management is trying to evaluate in reviewing the materials price variance and materials quantity variance. Be sure to include the formula for each variance in your explanation.

- Explain what management is trying to evaluate in reviewing the labor rate variance and labor efficiency variance. Be sure to include the formula for each variance in your explanation.

- Explain how an unfavorable labor rate variance might cause a favorable labor efficiency variance and favorable materials quantity variance.

- The production manager just received a report indicating an unfavorable labor rate variance. Further investigation reveals that the sales department accepted a large rush order. Who should be held responsible for the unfavorable variance? Explain.

- Refer to Note 10.38 "Business in Action 10.3" Why is direct labor variance analysis particularly important for United Airlines?

- Are favorable variances always a result of good management decisions? Explain.

- Do most companies investigate all variances? Explain.

- How is variable overhead variance analysis similar for companies using activity-based costing and companies using traditional costing?

- What causes the fixed overhead production volume variance?

- (Appendix). Why are direct materials and direct labor variance accounts needed in a standard costing system? What happens to these accounts at the end of the period?

Brief Exercises

- Analyzing Costs at Jerry’s Ice Cream. Refer to the dialogue at Jerry’s Ice Cream presented at the beginning of the chapter. What happened with direct labor and direct materials costs at Jerry’s Ice Cream? What did Jerry, the owner, ask Michelle to do?

- Direct Materials Standard Cost and Flexible Budget. Manhattan Company produces high-quality chairs. Each chair requires a standard quantity of 10 board feet of wood at $5 per board foot. Production for July totaled 3,000 units. Calculate (a) standard cost per unit for direct materials and (b) flexible budget amount for direct materials for the month of July.

- Direct Labor Standard Cost and Flexible Budget. Manhattan Company produces high-quality chairs. Each chair requires a standard quantity of 8 direct labor hours at $15 per hour. Production for July totaled 3,000 units. Calculate (a) standard cost per unit for direct labor and (b) flexible budget amount for direct labor for the month of July.

- Variable Overhead Standard Cost and Flexible Budget. Manhattan Company produces high-quality chairs. Variable manufacturing overhead is applied at a standard rate of $10 per machine hour. Each chair requires a standard quantity of three machine hours. Production for July totaled 3,000 units. Calculate (a) standard cost per unit for variable overhead and (b) flexible budget amount for variable overhead for the month of July.

- Materials Price Variance. Sweets Company produces boxes of chocolate. The company expects to pay $5 a pound for chocolate. Sweets purchased 4,000 pounds of chocolate during the month of April for $4.80 per pound. Calculate the materials price variance for the month of April.

- Materials Quantity Variance. Sweets Company produces boxes of chocolate. A standard of 2 pounds of material is expected to be used for each box produced, at a cost of $5 per pound. Sweets produced 1,000 boxes of chocolate during the month of April and used 2,200 pounds of chocolate. Calculate the materials quantity variance for the month of April.

- Labor Rate Variance. Tech Company produces computer servers. The company’s standards show an expected direct labor rate of $20 per hour. Tech’s direct labor workforce worked 3,200 hours to produce 300 units during the month of August and was paid $22 per direct labor hour. Calculate the labor rate variance for the month of August.

- Labor Efficiency Variance. Tech Company produces computer servers. The company’s standards show that each server will require 10 hours of direct labor at $20 per hour. Tech produced 300 units during the month of August and direct labor hours totaled 3,200 for the month. Calculate the labor efficiency variance for the month of August.

- Variable Overhead Spending Variance. Tech Company produces computer servers. Variable overhead is allocated to each server based on a standard of $100 per machine hour. A total of 850 machine hours were used during the month of August and variable overhead costs totaled $96,000. Calculate the variable overhead spending variance for the month of August.

- Variable Overhead Efficiency Variance. Tech Company produces computer servers. Variable overhead is allocated to each server based on a standard of $100 per machine hour and 3 machine hours per server. A total of 850 machine hours were used during the month of August to produce 300 servers. Calculate the variable overhead efficiency variance for the month of August.

- Investigating Variances. Fiber Optic, Inc., investigates all variances above 10 percent of the flexible budget. The flexible budget for direct materials is $50,000. The direct materials price variance is $4,000 unfavorable and the direct materials quantity variance is $(6,000) favorable. Which variances should be investigated according to company policy? Show calculations to support your answer.

- Spending Variance Using Activity-Based Costing. Albany, Inc., uses activity-based costing to allocate variable manufacturing overhead costs to products. One of the activities used to allocate these costs is product testing. The standard rate is $15 per test hour. The cost for this activity during June totaled $2,000, and actual test time during June totaled 120 hours. Calculate the spending variance for this activity for the month of June, and clearly label whether the variance is favorable or unfavorable.

- Fixed Overhead Spending Variance. Sampson Company applies fixed manufacturing overhead costs to products based on direct labor hours. Budgeted direct labor hours for the month of January totaled 30,000 hours, with a standard cost per direct labor hour of $12. Actual fixed overhead costs totaled $350,000 for January. Calculate the fixed overhead spending variance for January, and clearly label whether the variance is favorable or unfavorable.

- (Appendix) Journalizing the Purchase of Raw Materials. Mill Company purchased 40,000 pounds of raw materials on account for $3.40 per pound. The standard price is $3 per pound. Prepare a journal entry to record this transaction assuming the company uses a standard costing system.

Exercises: Set A

-

Standard Cost and Flexible Budget. Hal’s Heating produces furnaces for commercial buildings. The company’s master budget shows the following standards information.

Expected production for January 300 furnaces Direct materials 3 heating elements at $40 per element Direct labor 35 hours per furnace at $18 per hour Variable manufacturing overhead 35 direct labor hours per furnace at $15 per hour Required:

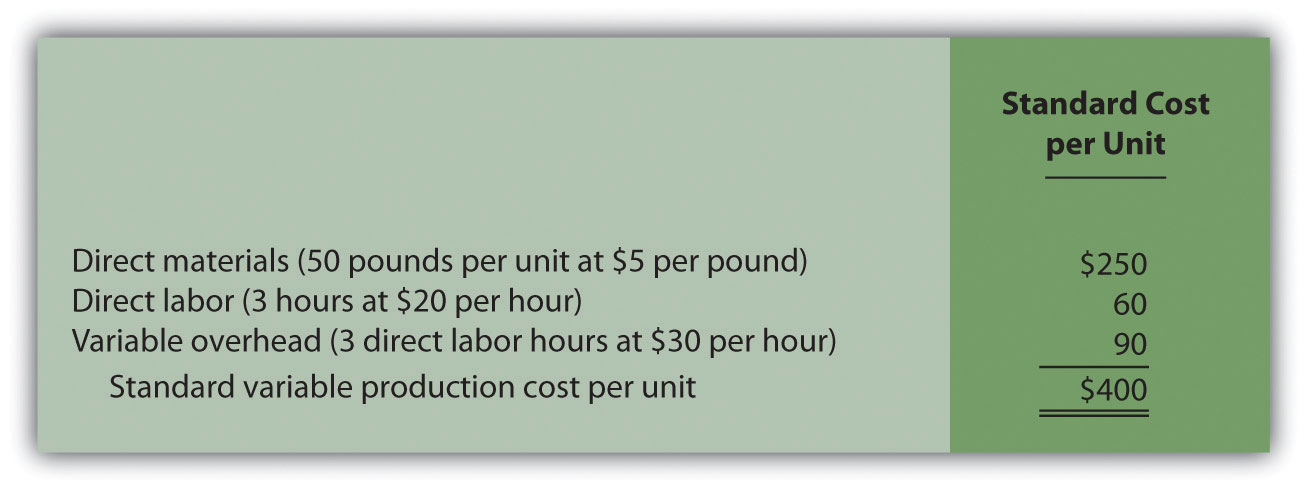

- Calculate the standard cost per unit for direct materials, direct labor, and variable manufacturing overhead using the format shown in Figure 10.1 "Standard Costs at Jerry’s Ice Cream".

- Assume Hal’s Heating produced 320 furnaces during January. Prepare a flexible budget for direct materials, direct labor, and variable manufacturing overhead using the format shown in Figure 10.2 "Flexible Budget for Variable Production Costs at Jerry’s Ice Cream".

-

Materials and Labor Variances. Hal’s Heating produces furnaces for commercial buildings. (This is the same company as the previous exercise. This exercise can be assigned independently.)

For direct materials, the standard price for a heating element part is $40. A standard quantity of 3 heating elements is expected to be used in each furnace produced. During January, Hal’s Heating purchased 1,000 heating elements for $38,000 and used 980 heating elements to produce 320 furnaces.

For direct labor, Hal’s Heating established a standard number of direct labor hours at 35 hours per furnace. The standard rate is $18 per hour. A total of 10,000 direct labor hours were worked during January, at a cost of $190,000, to produce 320 furnaces.

Required:

- Calculate the materials price variance and materials quantity variance using the format shown in Figure 10.4 "Direct Materials Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Calculate the labor rate variance and labor efficiency variance using the format shown in Figure 10.6 "Direct Labor Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

-

Variable Overhead Variances. Hal’s Heating produces furnaces for commercial buildings. (This is the same company as the previous exercises. This exercise can be assigned independently.) The company applies variable manufacturing overhead at a standard rate of $15 per direct labor hour. The standard quantity of direct labor is 35 hours per unit. Variable overhead costs totaled $190,000 for the month of January. A total of 10,000 direct labor hours were worked during January to produce 320 furnaces.

Required:

Calculate the variable overhead spending variance and variable overhead efficiency variance using the format shown in Figure 10.8 "Variable Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

-

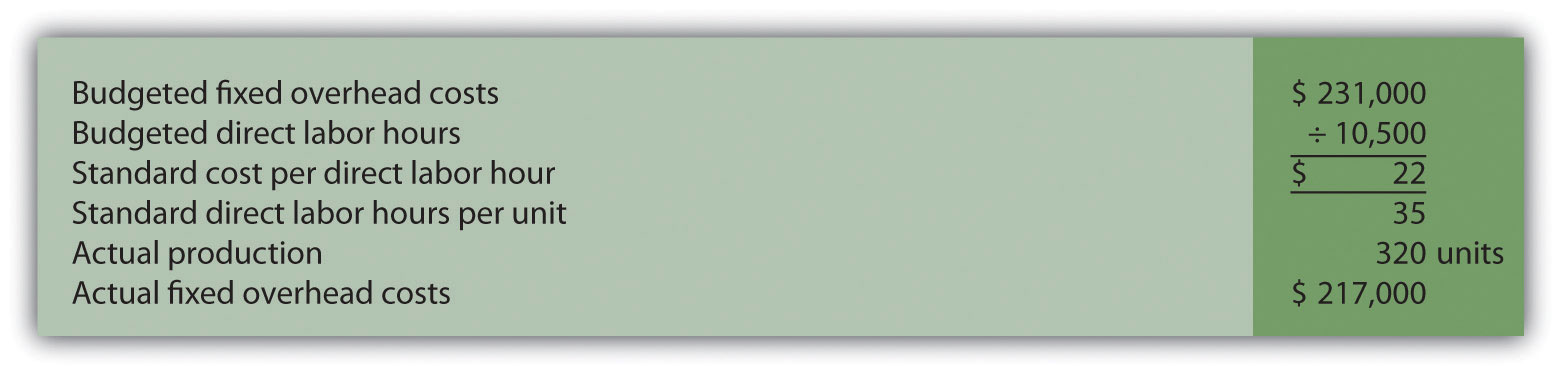

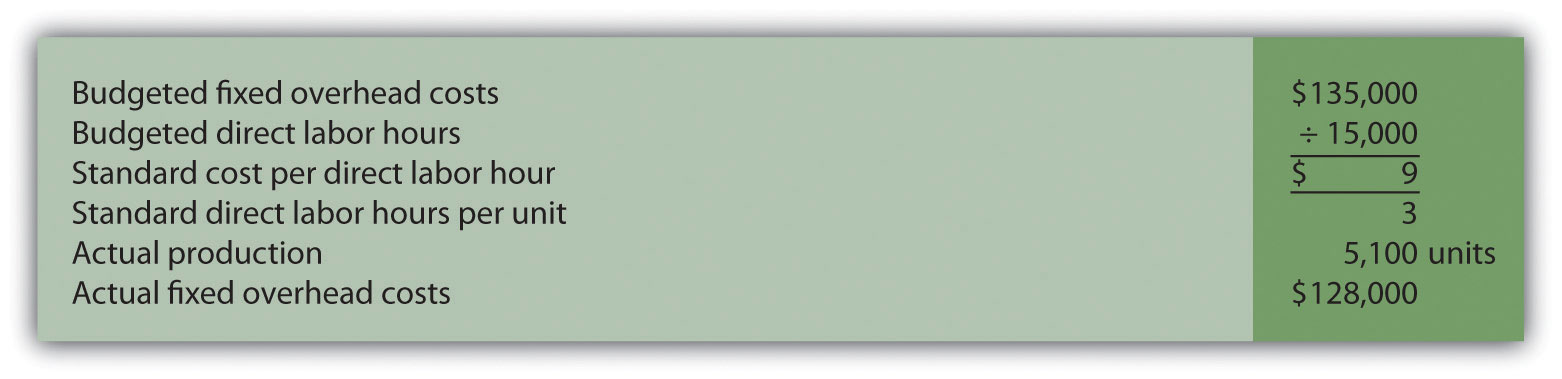

Fixed Overhead Variance Analysis. Hal’s Heating produces furnaces for commercial buildings. (This is the same company as the previous exercises. This exercise can be assigned independently.) The company applies fixed manufacturing overhead costs to products based on direct labor hours. Information for the month of January appears as follows. Hal’s expected to produce and sell 300 units for the month.

Required:

Calculate the fixed overhead spending variance and production volume variance using the format shown in Figure 10.13 "Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

-

Journalizing Direct Materials and Direct Labor Transactions (Appendix). Hal’s Heating produces furnaces for commercial buildings. (This is the same company as the previous exercises. This exercise can be assigned independently.)

Direct materials and direct labor variances for the month of January are shown as follows.

Materials price variance $(2,000) favorable Materials quantity variance $ 800 unfavorable Labor rate variance $ 10,000 unfavorable Labor efficiency variance $(21,600) favorable Required:

- The company purchased 1,000 elements during the month for $38 each. Assuming a standard price of $40 per element, prepare a journal entry to record the purchase of raw materials for the month.

- The company used 980 elements in production for the month, and the flexible budget shows the company expected to use 960 elements. Assuming a standard price of $40 per element, prepare a journal entry to record the usage of raw materials in production for the month.

- The company used 10,000 direct labor hours during the month with an actual rate of $19 per hour. The flexible budget shows the company expected to use 11,200 direct labor hours at a standard rate of $18 per hour. Prepare a journal entry to record direct labor costs for the month.

-

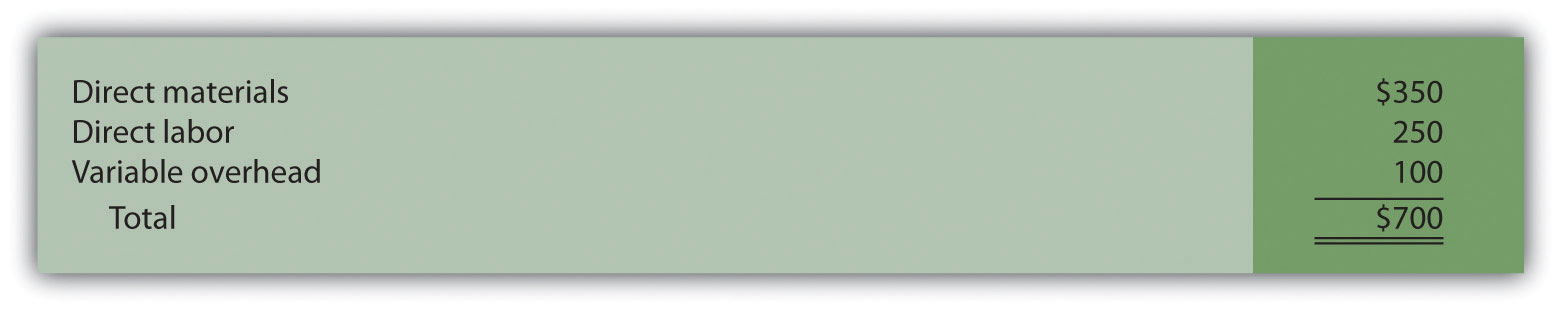

Investigating Variances. Quality Tables, Inc., produces high-end coffee tables. Standard cost information for each table is presented as follows.

Quality Tables produced and sold 2,000 tables for the year and encountered the following production variances:

Required:

Company policy is to investigate all unfavorable variances above 10 percent of the flexible budget amount for direct materials, direct labor, and variable overhead.

- Identify the variances that should be investigated according to company policy. Show calculations to support your answer.

- What potential weakness exists in the company’s current policy?

-

Variance Analysis with Activity-Based Costing. Assume Mammoth Company uses activity-based costing to allocate variable manufacturing overhead costs to products. The company identified three activities with the following information for last quarter.

Activity Standard Rate Standard Quantity per Unit Produced Actual Costs Actual Quantity Indirect materials $2.40 per yard 7 yards per unit $691,650 265,000 yards Product testing $1.50 per test minute 5 minutes per unit $301,000 215,000 test minutes Indirect labor $4.50 per direct labor hour 4 hours per unit $930,000 180,000 direct labor hours Required:

Assume Mammoth Company produced 40,000 units last quarter. Prepare a variance analysis using the format shown in Figure 10.11 "Variable Overhead Variance Analysis for Jerry’s Ice Cream Using Activity-Based Costing". Clearly label each variance as favorable or unfavorable.

-

Closing Variance and Overhead Accounts (Appendix). Gonzaga Products had the following balances at the end of its fiscal year.

Debit Credit Materials price variance $10,000 Materials quantity variance $8,000 Labor rate variance 6,000 Labor efficiency variance 5,000 Manufacturing overhead 14,000 Required:

- Prepare a journal entry to close the variance and manufacturing overhead accounts. Assume the balances are not significant and thus are closed to cost of goods sold.

- Assume all products were sold and the company has no ending inventories. After making the entry in requirement a, does the balance of cost of goods sold on the income statement reflect standard costs or actual costs? Explain.

Exercises: Set B

-

Standard Cost and Flexible Budget. Outdoor Products, Inc., produces extreme-weather sleeping bags. The company’s master budget shows the following standards information.

Expected production for September 5,000 units Direct materials 8 yards per unit at $5 per yard Direct labor 3 hours per unit at $16 per hour Variable manufacturing overhead 3 direct labor hours per unit at $2 per hour Required:

- Calculate the standard cost per unit for direct materials, direct labor, and variable manufacturing overhead using the format shown in Figure 10.1 "Standard Costs at Jerry’s Ice Cream".

- Assume Outdoor Products produced 5,100 sleeping bags during the month of September. Prepare a flexible budget for direct materials, direct labor, and variable manufacturing overhead using the format shown in Figure 10.2 "Flexible Budget for Variable Production Costs at Jerry’s Ice Cream".

-

Materials and Labor Variances. Outdoor Products, Inc., produces extreme-weather sleeping bags. (This is the same company as the previous exercise. This exercise can be assigned independently.)

For direct materials, the standard price for 1 yard of material is $5 per yard. A standard quantity of 8 yards of material is expected to be used for each sleeping bag produced. During September, Outdoor Products, Inc., purchased 45,000 yards of material for $238,500 and used 39,000 yards to produce 5,100 sleeping bags.

For direct labor, Outdoor Products, Inc., established a standard number of direct labor hours at three hours per sleeping bag. The standard rate is $16 per hour. A total of 14,700 direct labor hours were worked during September, at a cost of $238,140, to produce 5,100 sleeping bags.

Required:

- Calculate the materials price variance and materials quantity variance using the format shown in Figure 10.4 "Direct Materials Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Calculate the labor rate variance and labor efficiency variance using the format shown in Figure 10.6 "Direct Labor Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

-

Variable Overhead Variances. Outdoor Products, Inc., produces extreme-weather sleeping bags. (This is the same company as the previous exercises. This exercise can be assigned independently.) The company applies variable manufacturing overhead at a standard rate of $2 per direct labor hour. The standard quantity of direct labor is three hours per unit. Variable overhead costs totaled $32,000 for the month of September. A total of 14,700 direct labor hours were worked during September to produce 5,100 sleeping bags.

Required:

Calculate the variable overhead spending variance and variable overhead efficiency variance using the format shown in Figure 10.8 "Variable Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

-

Fixed Overhead Variance Analysis. Outdoor Products, Inc., produces extreme-weather sleeping bags. (This is the same company as the previous exercises. This exercise can be assigned independently.) The company applies fixed manufacturing overhead costs to products based on direct labor hours. Information for the month of September appears as follows. Outdoor Products expected to produce and sell 5,000 units for the month.

Required:

Calculate the fixed overhead spending variance and production volume variance using the format shown in Figure 10.13 "Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

-

Journalizing Direct Materials and Direct Labor Transactions (Appendix). Outdoor Products, Inc., produces extreme-weather sleeping bags. (This is the same company as the previous exercises. This exercise can be assigned independently.)

Direct materials and direct labor variances for the month of September are shown as follows.

Materials price variance $13,500 unfavorable Materials quantity variance $(9,000) favorable Labor rate variance $ 2,940 unfavorable Labor efficiency variance $(9,600) favorable Required:

- The company purchased 45,000 yards of material during the month for $5.30 per yard. Assuming a standard price of $5 per yard, prepare a journal entry to record the purchase of raw materials for the month.

- The company used 39,000 yards of material in production for the month, and the flexible budget shows the company expected to use 40,800 yards. Assuming a standard price of $5 per yard, prepare a journal entry to record the usage of raw materials in production for the month.

- The company used 14,700 direct labor hours during the month with an actual rate of $16.20 per hour. The flexible budget shows the company expected to use 15,300 direct labor hours at a standard rate of $16 per hour. Prepare a journal entry to record direct labor costs for the month.

-

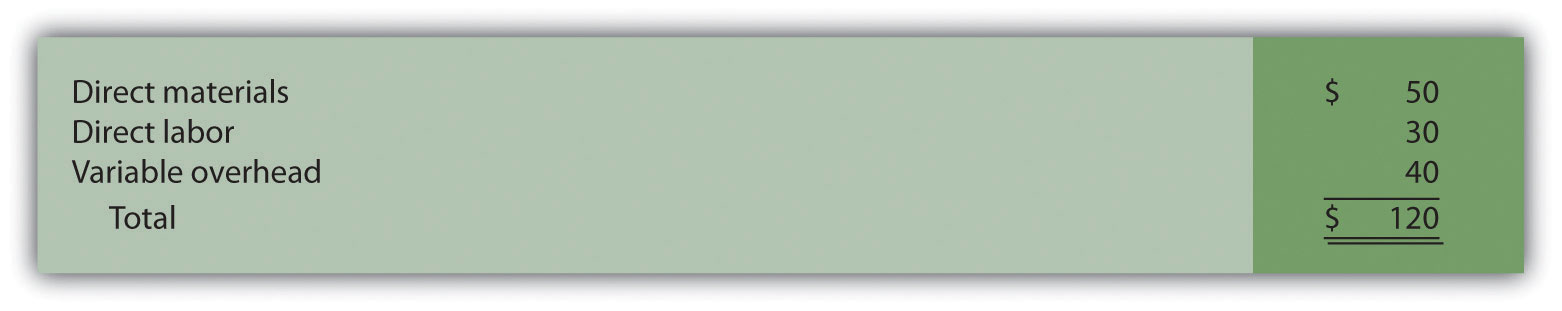

Investigating Variances. Tool Box, Inc., produces tool boxes sold at a variety of retail stores throughout the world. Standard cost information for each toolbox is presented as follows.

Tool Box produced and sold 100,000 toolboxes for the year and encountered the following production variances:

Required:

Company policy is to investigate all unfavorable variances above 5 percent of the flexible budget amount for direct materials, direct labor, and variable overhead.

- Identify the variances that should be investigated according to company policy. Show calculations to support your answer.

- What recommendations would you make for the company’s current policy?

-

Variance Analysis with Activity-Based Costing. Assume Hillside Hats, LLC, uses activity-based costing to allocate variable manufacturing overhead costs to products. The company identified three activities with the following information for last month.

Activity Standard Rate Standard Quantity per Unit Produced Actual Costs Actual Quantity Purchase orders $50 per order 0.10 order per unit $65,000 1,600 orders Product testing $2 per test minute 0.50 minutes per unit $17,000 8,000 test minutes Indirect labor $3 per direct labor hour 1 hour per unit $43,000 13,000 direct labor hours Required:

Assume Hillside Hats produced 15,000 units last month. Prepare a variance analysis using the format shown in Figure 10.11 "Variable Overhead Variance Analysis for Jerry’s Ice Cream Using Activity-Based Costing". Clearly label each variance as favorable or unfavorable.

-

Closing Variance and Overhead Accounts (Appendix). Shasta Company had the following balances at the end of its fiscal year.

Debit Credit Materials price variance $8,000 Materials quantity variance 2,000 Labor rate variance $12,000 Labor efficiency variance 5,000 Manufacturing overhead 4,000 Required:

- Prepare a journal entry to close the variance and manufacturing overhead accounts. Assume the balances are not significant and thus are closed to cost of goods sold.

- Assume all products were sold and the company has no ending inventories. After making the entry in requirement a, does the balance of cost of goods sold on the income statement reflect standard costs or actual costs? Explain.

Problems

-

Variance Analysis for Direct Materials, Direct Labor, and Variable Overhead. Rain Gear, Inc., produces rain jackets. The master budget shows the following standards information and indicates the company expected to produce and sell 28,000 units for the year.

Direct materials 4 yards per unit at $3 per yard Direct labor 2 hours per unit at $10 per hour Variable manufacturing overhead 2 direct labor hours per unit at $4 per hour Rain Gear actually produced and sold 30,000 units for the year. During the year, the company purchased 130,000 yards of material for $429,000 and used 118,000 yards in production. A total of 65,000 labor hours were worked during the year at a cost of $637,000. Variable overhead costs totaled $231,000 for the year.

Required:

- Calculate the materials price variance and materials quantity variance using the format shown in Figure 10.4 "Direct Materials Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Calculate the labor rate variance and labor efficiency variance using the format shown in Figure 10.6 "Direct Labor Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Calculate the variable overhead spending variance and variable overhead efficiency variance using the format shown in Figure 10.8 "Variable Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Company policy is to investigate all variances greater than 10 percent of the flexible budget amount for each of the three variable production costs: direct materials, direct labor, and variable overhead. Identify which of the six variances calculated in requirements a through c should be investigated.

- Provide two possible explanations for each variance identified in requirement d.

-

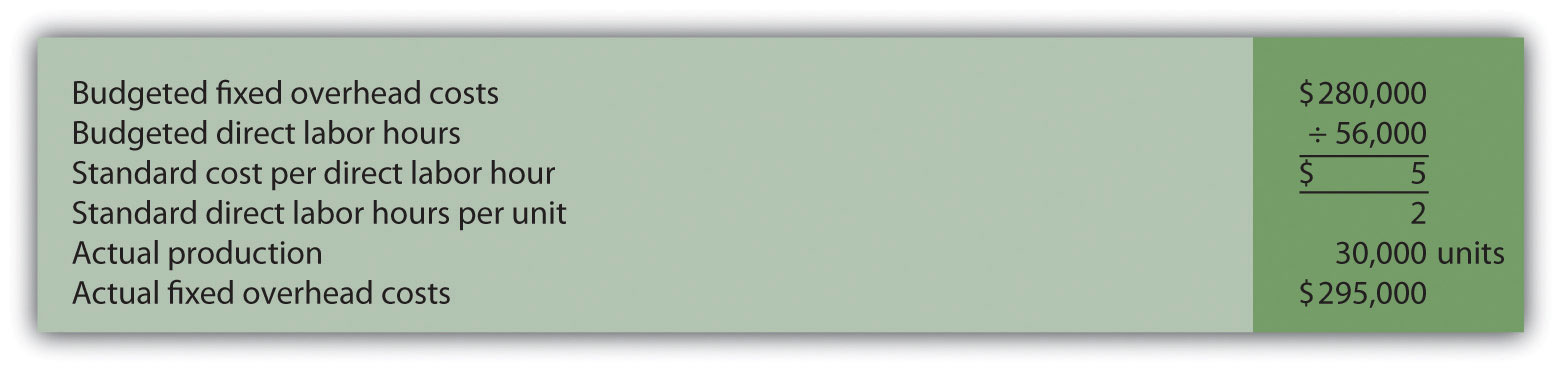

Fixed Overhead Variance Analysis. (This problem is a continuation of the previous problem but can also be worked independently.) Rain Gear, Inc., produces rain jackets and applies fixed manufacturing overhead costs to products based on direct labor hours. Information for the year appears as follows. Rain Gear expected to produce and sell 28,000 units for the year.

Required:

- Calculate the fixed overhead spending variance and production volume variance using the format shown in Figure 10.13 "Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Company policy is to investigate all variances greater than 5 percent of the flexible budget amount. Identify whether either of the two fixed overhead variances calculated in requirement a should be investigated.

- Provide one possible explanation for variance(s) identified in requirement b.

-

Journalizing Direct Materials, Direct Labor, and Overhead Transactions (Appendix). Complete the following requirements for Rain Gear, Inc., using your solutions to the previous two problems.

Required:

- Prepare a journal entry to record the purchase of raw materials.

- Prepare a journal entry to record the use of raw materials.

- Prepare a journal entry to record direct labor costs.

- Prepare a journal entry to record actual variable and fixed manufacturing overhead expenditures.

- Prepare a journal entry to record variable and fixed manufacturing overhead applied to products.

- Based on the entries shown in requirements a through e, prepare a journal entry to transfer all work-in-process inventory costs to finished goods inventory.

- Assume all finished goods are sold during the period. Prepare a journal entry to transfer all finished goods inventory costs to cost of goods sold.

- Based on the entries shown in requirements a through g, close manufacturing overhead and all variance accounts to cost of goods sold.

-

Variance Analysis for Direct Materials, Direct Labor, and Variable Overhead; Journalizing Direct Materials and Direct Labor Transactions (Includes Appendix). Prefab Pools Company produces large prefabricated in-ground swimming pools made of a specialized plastic material. The master budget shows the following standards information and indicates the company expected to produce and sell 600 units for the month of April.

Direct materials 500 pounds per unit at $7 per pound Direct labor 46 hours per unit at $12 per hour Variable manufacturing overhead 46 direct labor hours per unit at $30 per hour Prefab Pools actually produced and sold 580 units for the month. During the month, the company purchased 330,000 pounds of material for $2,277,000 and used 295,800 pounds in production. A total of 25,520 labor hours were worked during the month at a cost of $313,896. Variable overhead costs totaled $790,000 for the month.

Required:

- Calculate the materials price variance and materials quantity variance using the format shown in Figure 10.4 "Direct Materials Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Calculate the labor rate variance and labor efficiency variance using the format shown in Figure 10.6 "Direct Labor Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Calculate the variable overhead spending variance and variable overhead efficiency variance using the format shown in Figure 10.8 "Variable Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Company policy is to investigate all variances at or above 2 percent of the flexible budget for direct materials and 4 percent for direct labor and variable overhead. Identify which of the six variances calculated in requirements a through c should be investigated.

- Provide two possible explanations for each variance identified in requirement d.

- Based on your answer to requirement a, prepare a journal entry to record the purchase of raw materials.

- Based on your answer to requirement a, prepare a journal entry to record the usage of raw materials.

- Based on your answer to requirement b, prepare a journal entry to record direct labor costs.

-

Fixed Overhead Variance Analysis. (This problem is a continuation of the previous problem but can be worked independently.) Prefab Pools Company produces prefabricated in-ground swimming pools and applies fixed manufacturing overhead costs to products based on direct labor hours. Information for the month of April appears as follows. Prefab Pools expected to produce and sell 600 units for the month.

Required:

- Calculate the fixed overhead spending variance and production volume variance using the format shown in Figure 10.13 "Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Company management has asked you to investigate the cause of the fixed overhead spending variance calculated in requirement a. Provide one possible explanation for this variance.

-

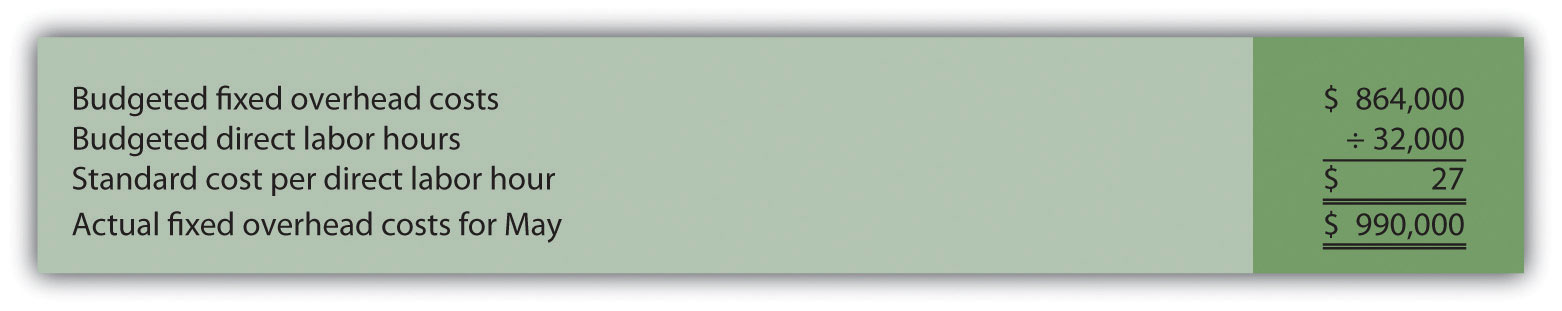

Variance Analysis for Direct Materials, Direct Labor, Variable Overhead, and Fixed Overhead. Equipment Products, Inc., produces large ladders made of a specialized metal material. The master budget shows the following standards information and indicates the company expected to produce and sell 4,000 units for the month of May.

Direct materials 60 pounds per unit at $3 per pound Direct labor 8 hours per unit at $14 per hour Variable manufacturing overhead 8 direct labor hours per unit at $6 per hour Equipment Products actually produced and sold 4,400 units for the month. During the month, the company purchased 300,000 pounds of material for $960,000 and used 286,000 pounds in production. A total of 30,800 labor hours were worked during the month at a cost of $462,000. Variable overhead costs totaled $195,000 for the month.

With regards to fixed manufacturing overhead, the company also applies these overhead costs to products based on direct labor hours. Fixed manufacturing overhead information for the month of May appears as follows.

Required:

- Calculate the materials price variance and materials quantity variance using the format shown in Figure 10.4 "Direct Materials Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Calculate the labor rate variance and labor efficiency variance using the format shown in Figure 10.6 "Direct Labor Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Calculate the variable overhead spending variance and variable overhead efficiency variance using the format shown in Figure 10.8 "Variable Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Company policy is to investigate all variances greater than 10 percent of the flexible budget amount for each of the 3 variable production costs: direct materials, direct labor, and variable overhead. Identify which of the six variances calculated in requirements a through c should be investigated.

- Provide two possible explanations for each variance identified in requirement d.

- Calculate the fixed overhead spending variance and production volume variance using the format shown in Figure 10.13 "Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

-

Journalizing Direct Labor and Overhead Transactions (Appendix). Complete the following requirements for Equipment Products, Inc., using your solutions to the previous problem.

Required:

- Prepare a journal entry to record direct labor costs.

- Prepare a journal entry to record actual variable and fixed manufacturing overhead expenditures.

- Prepare a journal entry to record variable and fixed manufacturing overhead applied to products.

-

Variance Analysis with Activity-Based Costing. Assume Spindle Company uses activity-based costing to allocate variable manufacturing overhead costs to products. The company identified three activities with the following information for last quarter.

Activity Standard Rate Standard Quantity per Unit Produced Actual Costs Actual Quantity Indirect materials $5 per yard 14 yards per unit $4,850,000 990,000 yards Product testing $3 per test minute 10 minutes per unit $2,000,000 650,000 test minutes Indirect labor $9 per direct labor hour 6 hours per unit $3,800,000 410,000 direct labor hours Required:

- Assume Spindle Company produced 70,000 units last quarter. Prepare a variance analysis using the format shown in Figure 10.11 "Variable Overhead Variance Analysis for Jerry’s Ice Cream Using Activity-Based Costing". Clearly label each variance as favorable or unfavorable.

- Company policy is to investigate all variances above 5 percent of the flexible budget amount for each activity. Identify the variances that should be investigated according to company policy. Show calculations to support your answer.

One Step Further: Skill-Building Cases

- Variance Analysis and Fraud. Refer to Note 10.47 "Business in Action 10.4" and to Note 10.52 "Business in Action 10.5" Explain how cost variance analysis might help detect fraud.

-

Group Activity: Setting Standards. Form groups of two to four students. Each group is to complete the following requirements.

Required:

- Define and discuss the differences between ideal standards and attainable standards.

- Assume your group works for a company that produces wood desks and you are in the process of creating attainable direct material and direct labor standards. Provide specific examples of the items that might be included in (1) the standard quantity and standard price for direct materials and (2) the standard hours and standard rate for direct labor. Explain where this information might be obtained, and identify specific production inefficiencies your group included in creating these standards that would not be included in ideal standards.

- Discuss the findings of your group with the class. (Optional: your instructor may ask you to submit your findings in writing.)

- Internet Project: Standard Costs and Cost Variances. Systems Applications and Products (SAP) is the world’s largest business software company with 38,000 customers worldwide. Go to the SAP Web site at http://www.sap.com and find the search feature. Type in “standard costing” or “cost variance” and find an article that discusses standard costs and/or cost variances (there are several articles to choose from). Summarize the article in a one-page report, and submit a printed copy of the article with your report.

-

Ethics and Setting Standards. Wilkes Golf, Inc., produces golf carts that are sold throughout the world. The company’s management is in the process of establishing the standard hours of direct labor required to complete one golf cart. Assume you are the production supervisor, and you receive a bonus for each quarter that shows a favorable labor efficiency variance. That is, you receive a bonus for each quarter showing actual direct labor hours that are fewer than budgeted direct labor hours.

The management has asked for your input in establishing the standard number of direct labor hours required to complete one golf cart.

Required:

- As the production supervisor, describe the ethical conflict you face when asked to help with establishing direct labor hour standards.

- How might the management of Wilkes Golf, Inc., avoid this conflict and still achieve the goal of obtaining reliable direct labor hour information?

-

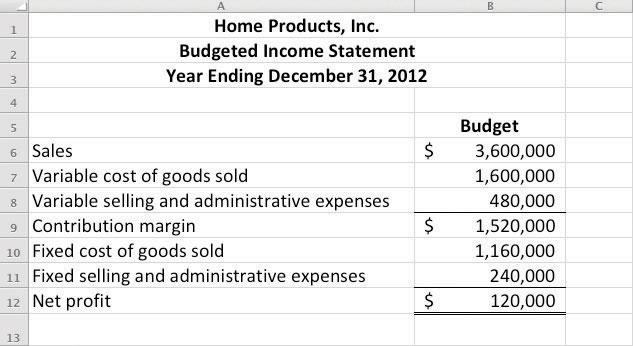

Using Excel to Perform Budget Versus Actual Analysis. The management of Home Products, Inc., prepared the following budgeted income statement for the year ending December 31, 2012.

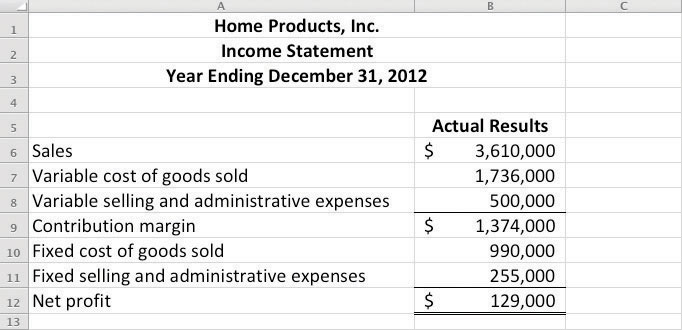

At the end of 2012, the company prepared the following income statement showing actual results:

Required:

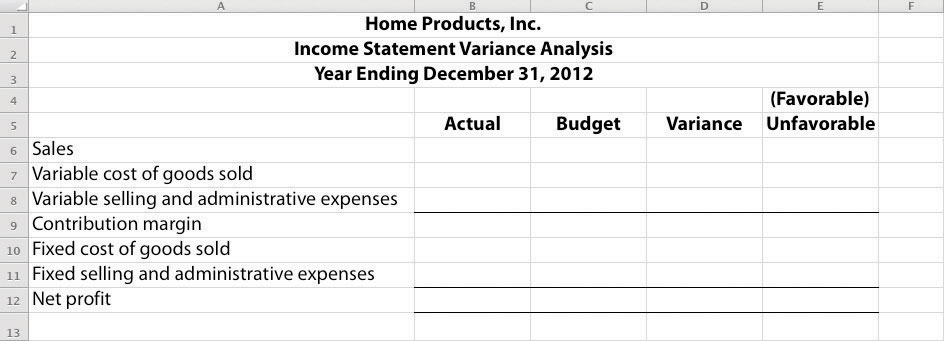

Prepare an Excel spreadsheet comparing the actual results to budgeted amounts using the format shown as follows, and comment on the results.

Comprehensive Cases

-

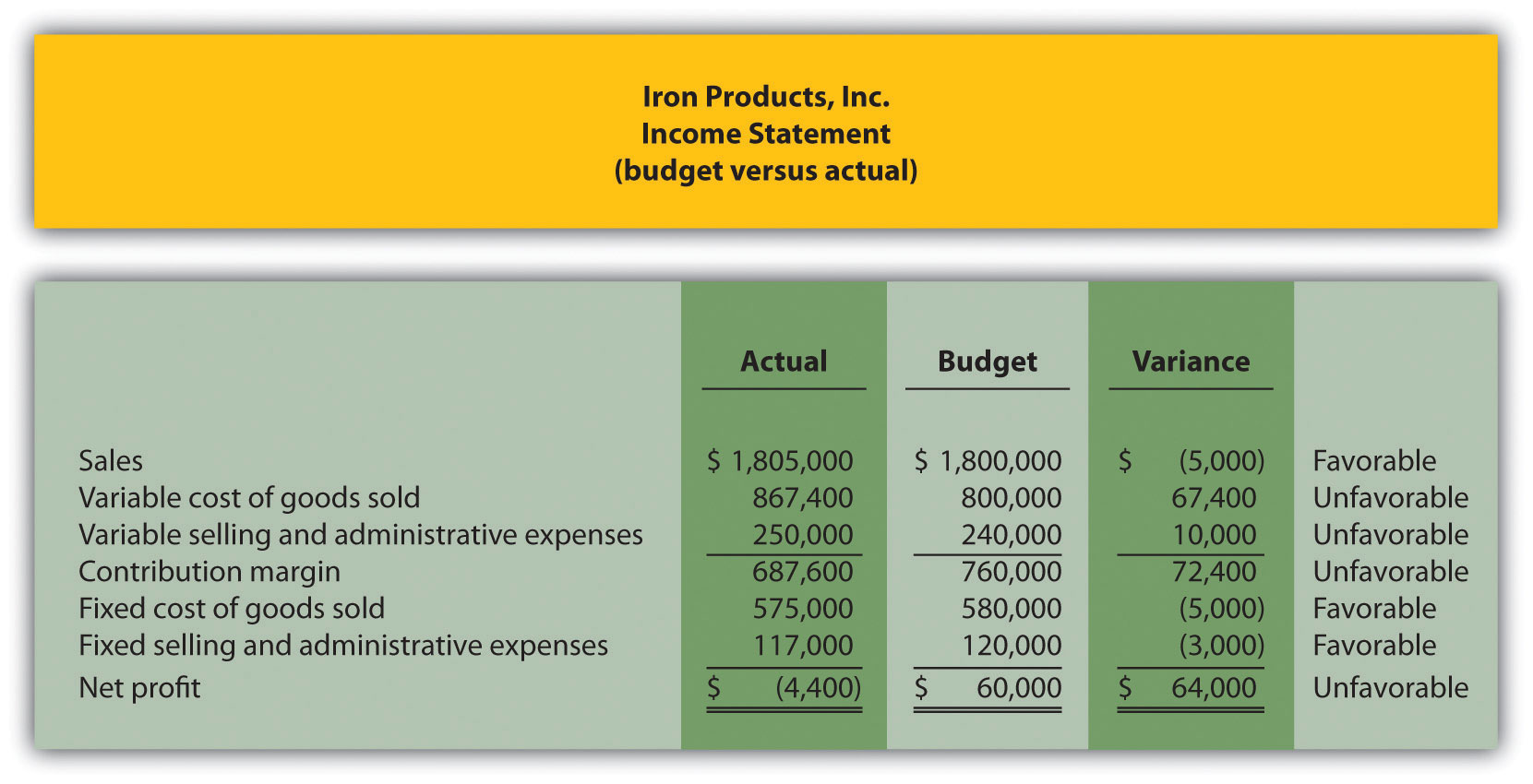

Variable Production Cost Variance Analysis. Iron Products, Inc., produces prefabricated iron fencing used in commercial construction. Variable overhead is applied to products based on direct labor hours. The company uses a just-in-time production system and thus has insignificant inventory levels at the end of each month. The income statement for the month of November comparing actual results with the flexible budget based on actual sales of 2,000 units is shown as follows.

Iron Products is disappointed with the actual results and has hired you as a consultant to provide further information as to why the company has been struggling to meet budgeted net profit. Your review of the previously presented budget versus actual analysis identifies variable cost of goods sold as the main culprit. The unfavorable variance for this line item is $67,400.

After further research, you are able to track down the following standard cost information for variable production costs:

Actual production information related to variable cost of goods sold for the month of November is as follows:

- 2,000 units were produced and sold.

- 110,000 pounds of material were purchased and used at a total cost of $528,000.

- 5,600 direct labor hours were used during the month at a total cost of $134,400.

- Variable overhead costs totaled $205,000.

Required:

- Calculate the materials price variance and materials quantity variance using the format shown in Figure 10.4 "Direct Materials Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Calculate the labor rate variance and labor efficiency variance using the format shown in Figure 10.6 "Direct Labor Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Calculate the variable overhead spending variance and variable overhead efficiency variance using the format shown in Figure 10.8 "Variable Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- List each of the six variances calculated in requirements a, b, and c, and total the variances to show one net variance. Clearly label the net variance as favorable or unfavorable. Explain how this net variance relates to variable cost of goods sold on the income statement.

- Identify the highest favorable variance and highest unfavorable variance from the six listed in requirement d, and provide one possible cause of each variance.

-

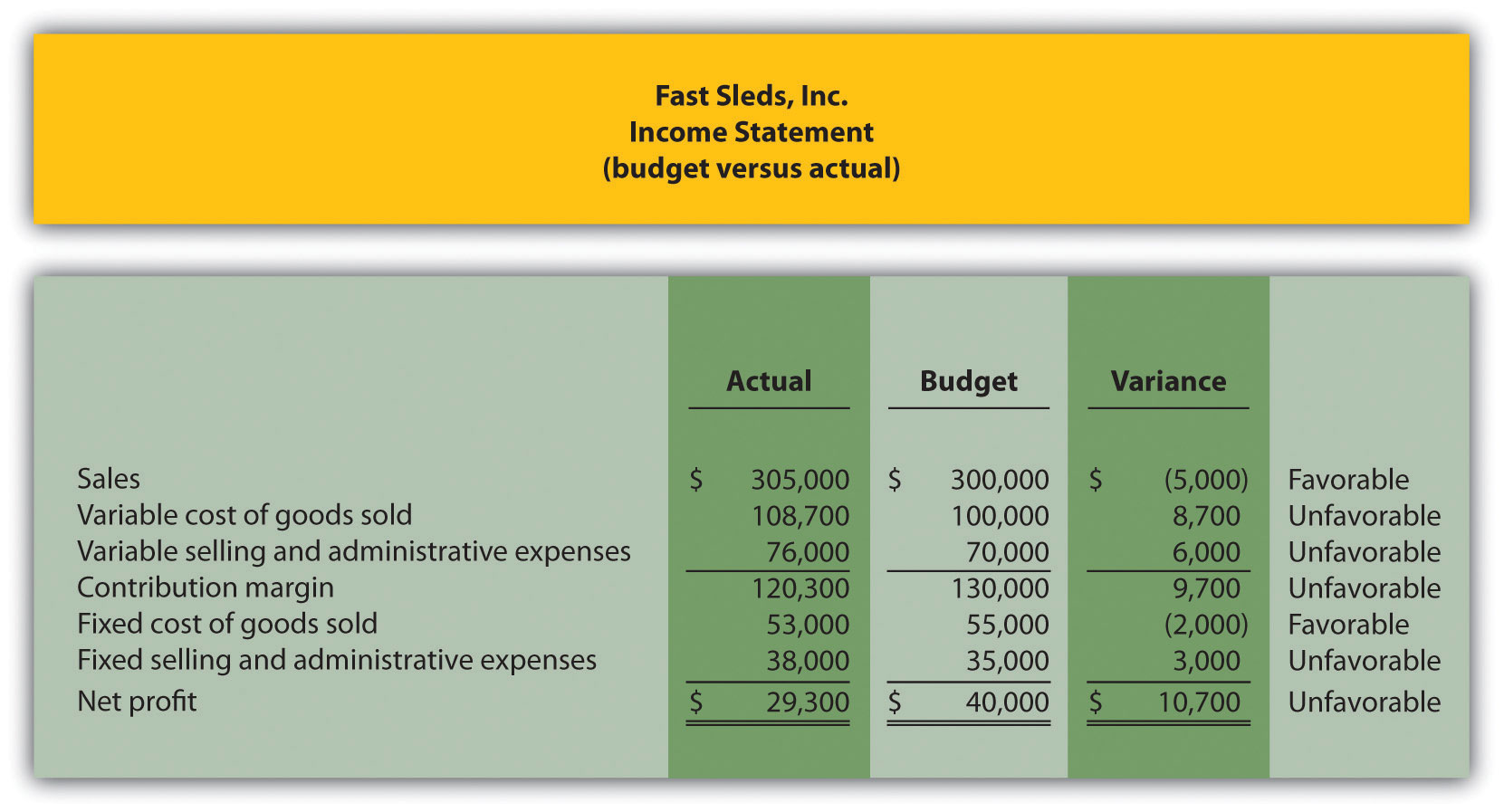

Variable Production Cost Variance Analysis and Performance Evaluation. Fast Sleds, Inc., produces snow sleds used for winter recreation. Variable overhead is applied to products based on machine hours. The company uses a just-in-time production system, and thus has insignificant inventory levels at the end of each month. The income statement for the month of January comparing actual results with the flexible budget is shown in the following based on actual sales of 10,000 units.

Fast Sleds is disappointed with the actual results and has hired you as a consultant to provide further information as to why the company has been struggling to meet budgeted net income. Your review of the budget presented previously versus actual analysis identifies variable cost of goods sold as the main culprit. The unfavorable variance for this line item is $8,700.

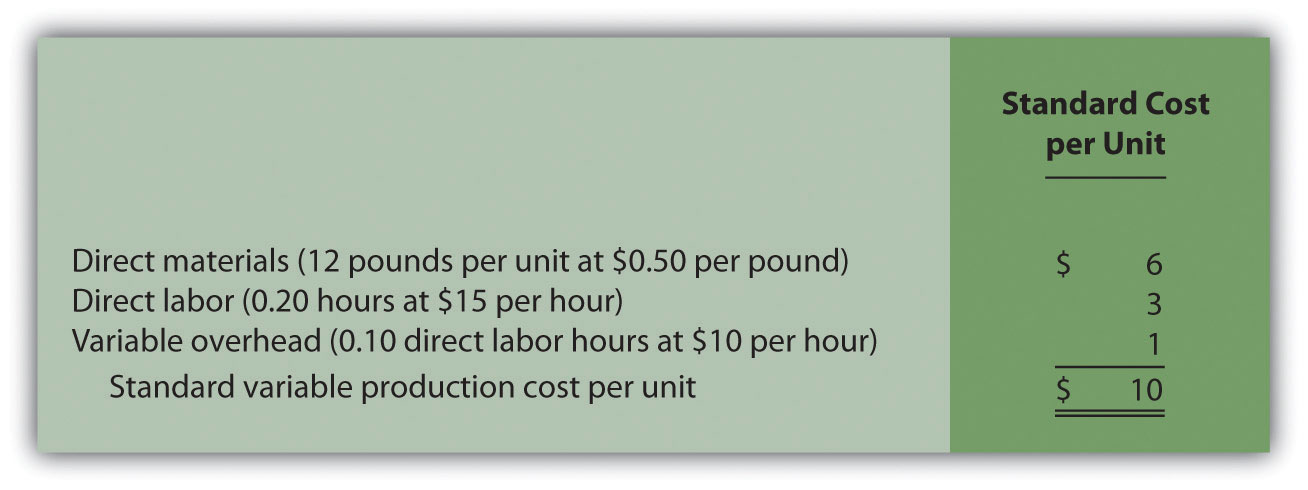

After further research, you are able to track down the standard cost information for variable production costs:

Actual production information related to variable cost of goods sold for the month of January is as follows:

- 10,000 units were produced and sold.

- 150,000 pounds of material was purchased and used at a total cost of $67,500.

- 1,900 direct labor hours were used during the month at a total cost of $30,400.

- 1,200 machine hours were used during the month.

- Variable overhead costs totaled $10,800.

Required:

- Calculate the materials price variance and materials quantity variance using the format shown in Figure 10.4 "Direct Materials Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Calculate the labor rate variance and labor efficiency variance using the format shown in Figure 10.6 "Direct Labor Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- Calculate the variable overhead spending variance and variable overhead efficiency variance using the format shown in Figure 10.8 "Variable Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream". Clearly label each variance as favorable or unfavorable.

- List each of the six variances calculated in requirements a, b, and c, and total the variances to show one net variance. Clearly label the net variance as favorable or unfavorable. Explain how this net variance relates to variable cost of goods sold on the income statement.

- Identify the highest favorable variance and highest unfavorable variance from the six listed in requirement d, and provide one possible cause of each variance.

- Sue Mays, the manager at Fast Sleds, Inc., reviewed the company’s variance analysis report for the month of January. The materials price variance of $(7,500) was the most significant favorable variance for the month, and the materials quantity variance of $15,000 was the most significant unfavorable variance. Sue would like to reward the company’s purchasing agent for achieving such substantial savings by giving him a $2,000 bonus while not providing any bonus for the production manager.

- Do you agree with Sue’s approach to awarding bonuses? Explain.

- What circumstances might lead to the conclusion that the purchasing agent should not receive a bonus for the month of January?