This is “The Master Budget”, section 9.3 from the book Accounting for Managers (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

9.3 The Master Budget

Learning Objective

- Develop the components of a master budget.

Question: Developing a master budget is a lengthy process. Where do companies start when preparing a master budget?

Answer: Study Figure 9.1 "Master Budget Schedules" carefully, as it serves as the road map for the master budget presented throughout this chapter for Jerry’s Ice Cream. Notice that the budgeting process starts with the sales budget. Also, note that the budgets described next are for a manufacturing company. Manufacturing companies tend to have more budget schedules than other types of organizations because their operations are more complex. Once you understand budgeting in a manufacturing environment, you can easily modify the process to perform budgeting in other organizations, as discussed later in the chapter. As we work through the master budget for Jerry’s Ice Cream, assume the company prepares quarterly budgets.

Sales Budget

Question: The sales budget is the starting point for the master budget, as shown in Figure 9.1 "Master Budget Schedules". What is a sales budget, and how is it prepared?

Answer: The sales budgetAn estimate of units of product the organization expects to sell times the expected sales price per unit. is an estimate of units of product the organization expects to sell times the expected sales price per unit. This is perhaps the most important budget as it drives most of the other budgets. For example, the production budget and related materials, labor, and overhead budgets are based on expected sales.

Forecasting sales often involves extensive research and numerous sources. Companies, such as Jerry’s Ice Cream, typically start with their sales staff since salespeople have daily contact with customers and direct information about customer demand. Some companies pay for market trend data to learn about industry and product trends. Many organizations hire market research consultants to obtain and review industry data and ultimately to predict customer demand. Larger companies sometimes employ economists to develop sophisticated models used to project sales. Smaller, less sophisticated organizations simply base their estimates on past trends. Figure 9.2 "Estimating Sales" shows how companies obtain sales information from sales people, market research consultants, and economists.

Figure 9.2 Estimating Sales

© Thinkstock

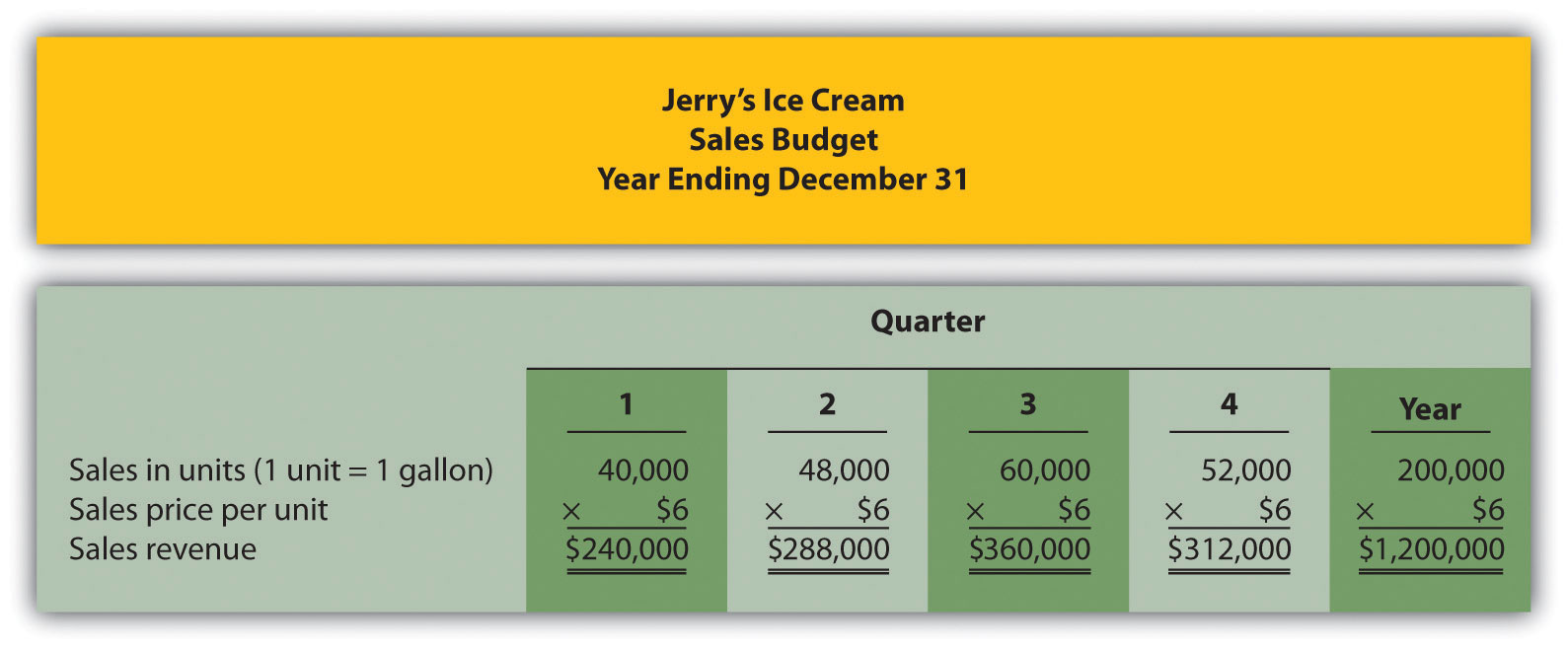

Tom Benson, sales manager at Jerry’s Ice Cream, talked with his salespeople and reviewed market trends for ice cream using data obtained from a market research firm. His estimate, shown in Figure 9.3 "Sales Budget for Jerry’s Ice Cream", assumes the company will increase sales 15 percent this coming year. Thus, to get projected sales for quarter 1, Tom simply multiplied last year’s first quarter sales by 1.15. The average price per unit last year was $6 (1 unit = 1 gallon), and Tom does not expect any change in this price. The sales budget is presented in Figure 9.3 "Sales Budget for Jerry’s Ice Cream".

Figure 9.3 Sales Budget for Jerry’s Ice Cream

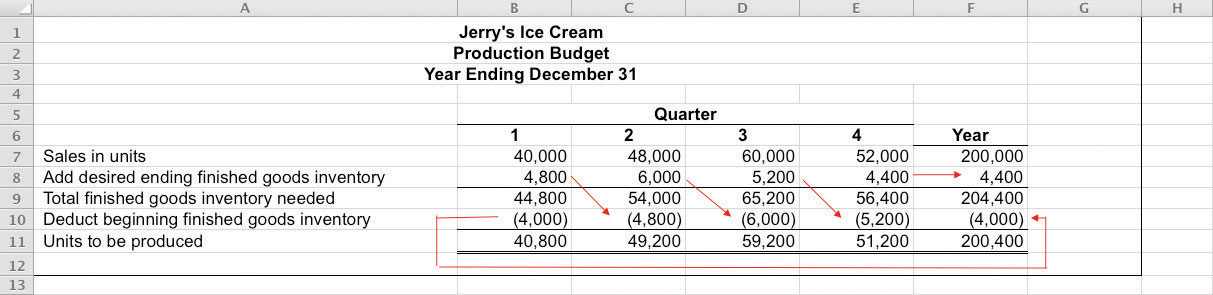

Production Budget

Question: The production budget is developed next and is based on sales budget projections. What is a production budget, and how is it prepared?

Answer: If the organization uses a just-in-time production system, where production occurs just in time to ship the products to the customer, units produced each quarter would be exactly the same as projected sales. However, most companies, including Jerry’s Ice Cream, maintain a certain level of finished goods inventory. Thus production is typically not the same as projected sales. The production budgetAn estimate of units to be produced, and it is based on sales projections plus an estimate of desired ending finished goods inventory less beginning finished goods inventory. is an estimate of units to be produced and is based on sales projections plus an estimate of desired ending finished goods inventory less beginning finished goods inventory, as summarized in the following:

Key Equation

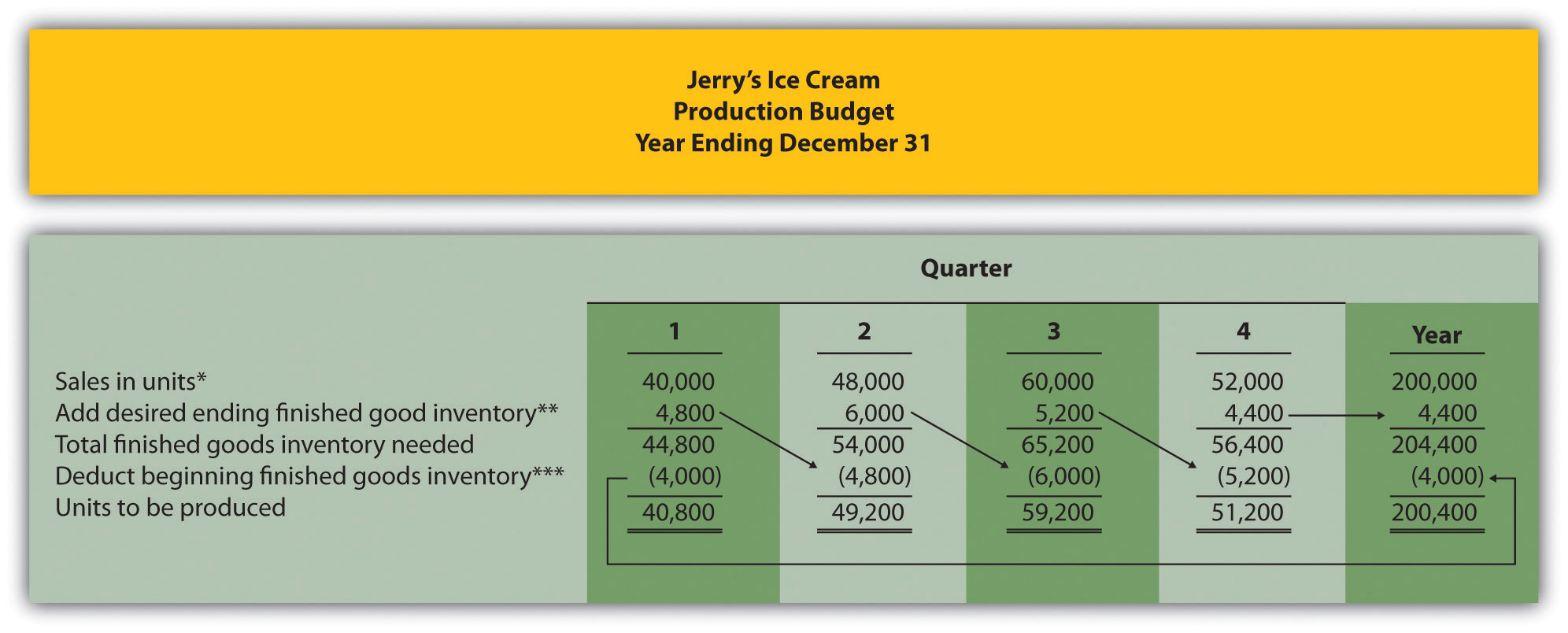

Jerry’s Ice Cream plans to sell 40,000 units in the first quarter, as shown in Figure 9.3 "Sales Budget for Jerry’s Ice Cream". For the sake of simplicity, assume work-in-process inventory is insignificant, and therefore beginning and ending work-in-process inventory is zero. (We assume beginning and ending work-in-process inventory is zero throughout this chapter.) The management prefers to maintain 10 percent of next quarter’s sales in ending inventory. Thus 4,800 units will be in inventory at the end of the first quarter (= 48,000 unit sales in second quarter × 10 percent). Units needed for the first quarter total 44,800 (= 40,000 unit sales + 4,800 units desired ending inventory). However, Jerry’s will not produce 44,800 units because inventory will be left over from the fourth quarter of last year. This beginning inventory will be 4,000 units (= 40,000 unit sales in first quarter × 10 percent). Thus actual production will total 40,800 units:

Figure 9.4 "Production Budget for Jerry’s Ice Cream" presents the production budget for each of the 4 quarters of the coming year. Examine this figure carefully, particularly the last line labeled units to be produced. Lynn Young, the production manager, will be concerned about the spike in production during the third quarter of 59,200 units. The third quarter, from July 1 through September 30, is the peak sales season for ice cream. It will be difficult for Lynn to plan for this increase in production from the first and second quarters to the third quarter. However, this is exactly why companies prepare budgets—to plan for the future!

Figure 9.4 Production Budget for Jerry’s Ice Cream

*Information from Figure 9.3 "Sales Budget for Jerry’s Ice Cream".

**Desired ending inventory = 10 percent × Next quarter sales; for the first quarter, 4,800 = 0.10 × 48,000. Fourth quarter desired ending inventory of 4,400 units is based on an estimate of sales in the first quarter of next year.

***Beginning inventory = Inventory at end of previous quarter; for example, second quarter beginning inventory = First quarter ending inventory.

Once Jerry’s Ice Cream knows how many units it must produce each quarter, budgets are established for the individual components of production: direct materials, direct labor, and manufacturing overhead. We present these budgets next.

Review Problem 9.3

Carol’s Cookies produces cookies for resale at grocery stores throughout North America. The company is currently in the process of establishing a master budget on a quarterly basis for this coming fiscal year, which ends December 31. Prior year quarterly sales were as follows (1 unit = 1 batch):

| First quarter | 64,000 units |

| Second quarter | 76,800 units |

| Third quarter | 96,000 units |

| Fourth quarter | 83,200 units |

Unit sales are expected to increase 25 percent, and each unit is expected to sell for $8. The management prefers to maintain ending finished goods inventory equal to 10 percent of next quarter’s sales. Assume finished goods inventory at the end of the fourth quarter budget period is estimated to be 9,000 units.

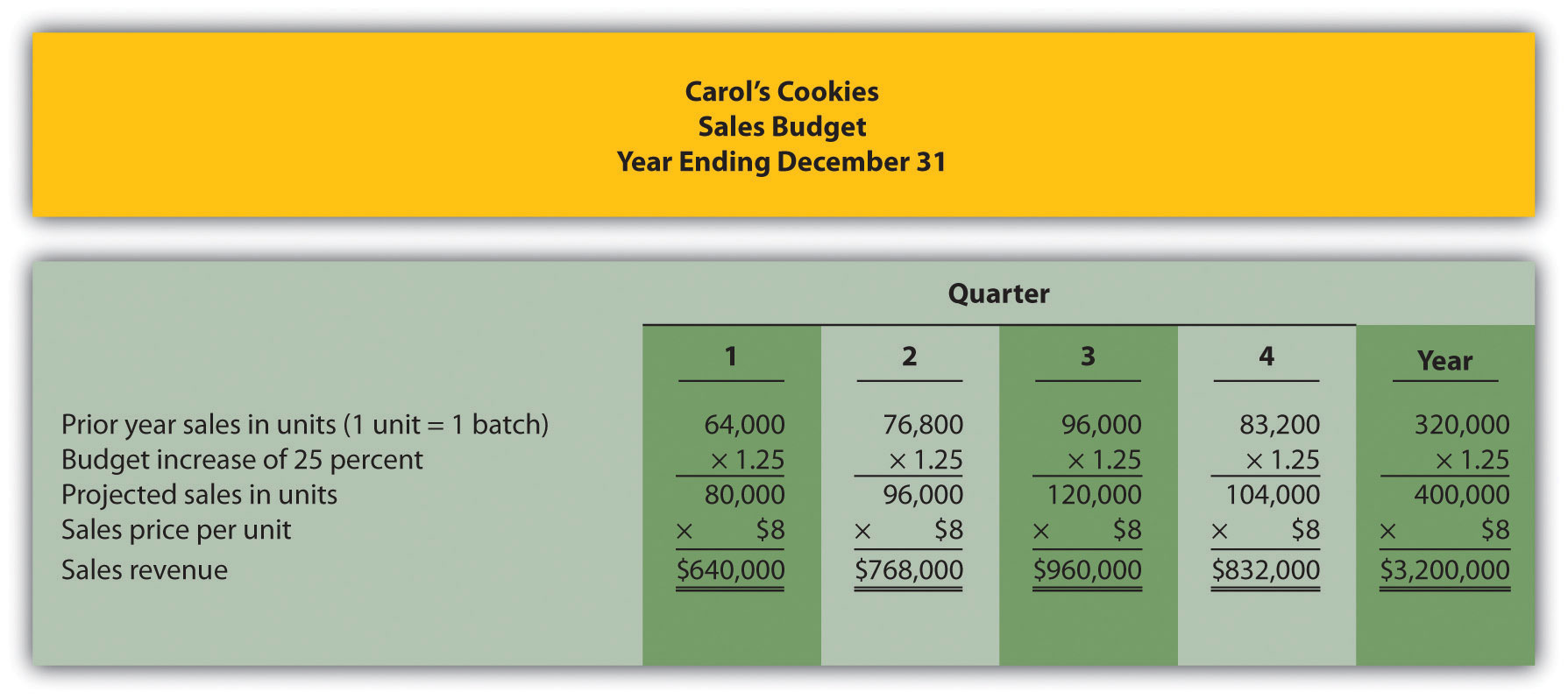

- Prepare a sales budget for Carol’s Cookies using a format similar to Figure 9.3 "Sales Budget for Jerry’s Ice Cream". (Hint: be sure to increase last year’s unit sales by 25 percent.)

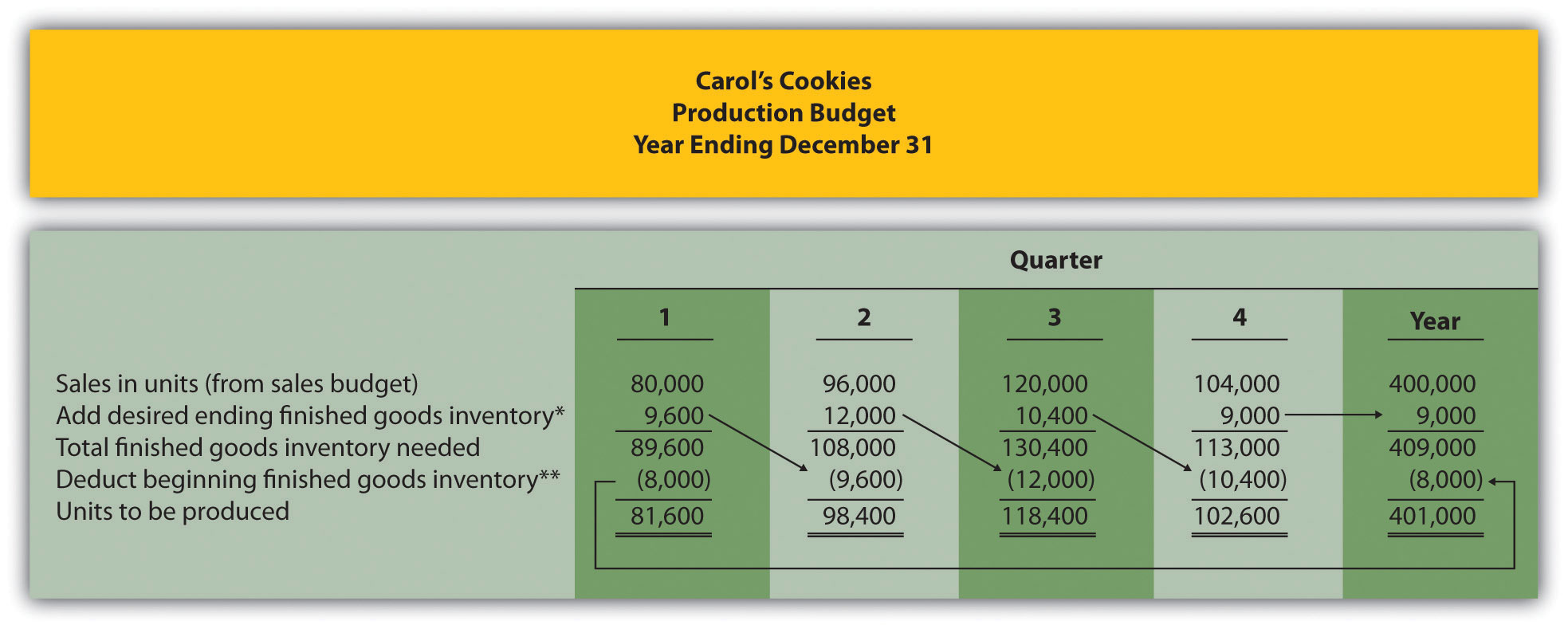

- Prepare a production budget for Carol’s Cookies using the format shown in Figure 9.4 "Production Budget for Jerry’s Ice Cream".

Solution to Review Problem 9.3

-

The following is a sales budget:

-

The following is a production budget:

*Desired ending inventory = 10 percent × Next quarter sales; for the first quarter, 9,600 = 0.10 × 96,000. Fourth quarter desired ending inventory of 9,000 units is given.

**Beginning inventory = Inventory at end of previous quarter; for example, Second quarter beginning inventory = First quarter ending inventory.

Direct Materials Purchases Budget

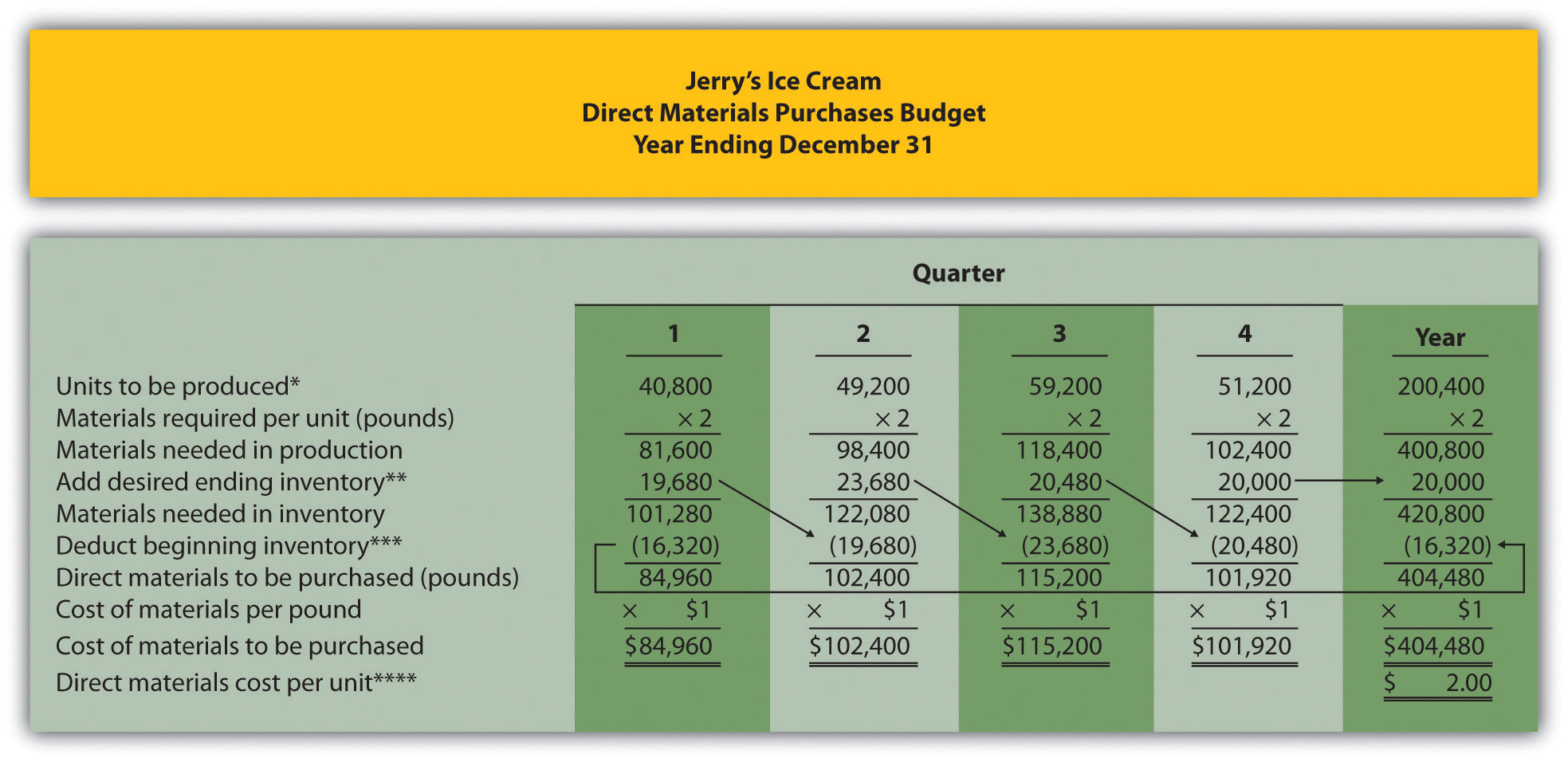

Question: The number of units of finished goods to be produced each quarter from the production budget is the starting point for the direct materials purchases budget. What is a direct materials purchases budget, and how is it prepared?

Answer: The direct materials purchases budgetAn estimate of raw materials needed to achieve a desired level of production. is an estimate of raw materials needed to achieve a desired level of production. Figure 9.4 "Production Budget for Jerry’s Ice Cream", the production budget, shows that 40,800 finished units will be produced in the first quarter. We will now establish a direct materials purchases budget that answers the questions: how many pounds of material must be purchased during the first quarter to achieve this production, and what is the cost of these materials?

Assume two pounds of material are required to produce one unit of product. Thus the amount of materials required to produce 40,800 units of ice cream is 81,600 pounds (= 40,800 units × 2 pounds per unit). This amount is labeled as materials needed in production in the direct materials purchases budget shown in Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream". (To simplify this example, assume sugar is the only material used. However, other materials, such as cream and vanilla, are typically required to produce ice cream.)

Figure 9.5 Direct Materials Purchases Budget for Jerry’s Ice Cream

*Information from Figure 9.4 "Production Budget for Jerry’s Ice Cream".

**Desired ending inventory = 20 percent × Next quarter production needs; for the first quarter, 19,680 = 0.20 × 98,400. Fourth quarter desired ending inventory of 20,000 pounds is based on an estimate of materials needed in production first quarter of next year.

***Beginning inventory = Inventory at end of previous quarter; for example, Second quarter beginning inventory = First quarter ending inventory.

****$2 direct materials cost per unit = 2 pounds of materials required per unit × $1 per pound.

Will the company buy 81,600 pounds of material in the first quarter? Probably not. Jerry’s will have materials in beginning raw materials inventory and prefers to maintain a certain level of ending raw materials inventory. Thus direct materials purchased is based on materials needed in production plus an estimate of desired ending raw materials inventory less beginning raw materials inventory. We summarize this in the following equation. Notice the similarity of this equation to the inventory equation presented earlier for the production budget.

Key Equation

Assume the management prefers to maintain raw materials ending inventory equal to 20 percent of next quarter’s materials needed in production. Thus 19,680 pounds of material will be in inventory at the end of the first quarter (= 98,400 pounds of materials needed in production in second quarter × 20 percent). Materials needed in inventory total 101,280 pounds (= 81,600 pounds of materials needed in production + 19,680 pounds of material in desired ending inventory). However, Jerry’s will not purchase 101,280 pounds of materials because inventory will be left over from the fourth quarter of last year. This beginning inventory will be 16,320 pounds (= 81,600 pounds of material needed in production in first quarter × 20 percent). Thus direct materials purchased in the first quarter will total 84,960 pounds:

To estimate the cost of purchasing 84,960 pounds of material, multiply the number of pounds to be purchased by the cost per pound. Assume the cost per pound of material for Jerry’s is $1. This results in a cost of $84,960 for materials to be purchased during the first quarter, as shown at the bottom of Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream" (= 84,960 pounds to be purchased × $1 per pound).

Review the direct materials purchases budget shown in Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream" carefully, particularly the line labeled direct materials to be purchased. The purchasing manager at Jerry’s Ice Cream uses this information, along with the price per pound, to negotiate the purchase of materials with suppliers.

Direct Labor Budget

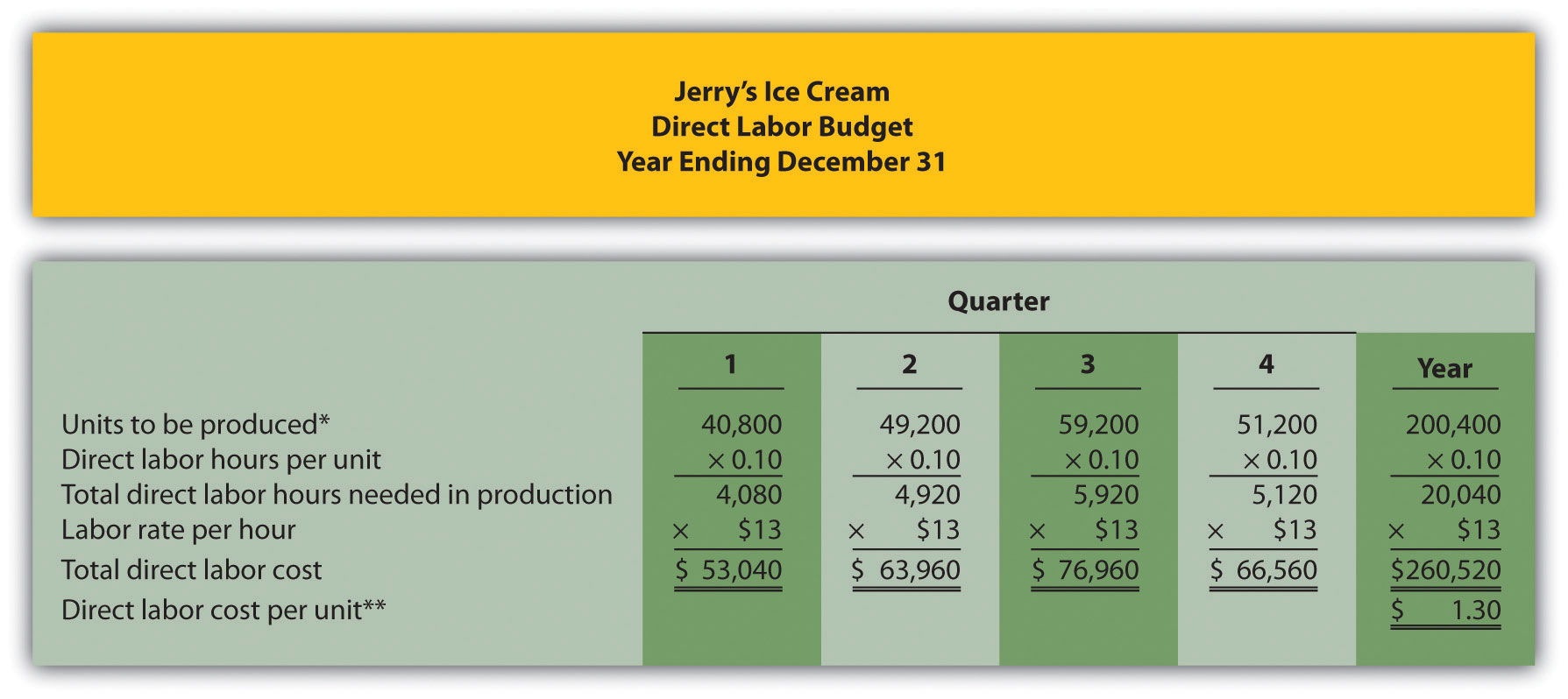

Question: The direct materials purchases budget is the first of three supporting budgets for production. The second is the direct labor budget. What is the direct labor budget, and how is it prepared?

Answer: The direct labor budgetAn estimate of direct labor hours, and related cost, necessary to achieve a desired level of production. is an estimate of direct labor hours, and related costs, necessary to achieve a desired level of production. Knowing Jerry’s Ice Cream plans to produce 40,800 units of ice cream during the first quarter, this budget answers the questions: how many direct labor hours will be necessary to achieve this production, and what will this labor cost?

Assume it takes 0.10 direct labor hours (or 6 minutes) to produce 1 unit of product. Thus 4,080 hours of direct labor will be required to produce 40,800 units of product (= 40,800 finished units produced × 0.10 direct labor hours per unit). Given an average hourly rate of $13, the direct labor cost for the first quarter totals $53,040 (= 4,080 hours × $13 per hour). This information is shown in the direct labor budget presented in Figure 9.6 "Direct Labor Budget for Jerry’s Ice Cream".

Figure 9.6 Direct Labor Budget for Jerry’s Ice Cream

*From Figure 9.4 "Production Budget for Jerry’s Ice Cream".

**$1.30 direct labor cost per unit = 0.10 direct labor hours per unit × $13 per hour.

Carefully review the direct labor budget shown in Figure 9.6 "Direct Labor Budget for Jerry’s Ice Cream". The production manager at Jerry’s Ice Cream, Lynn Young, uses this information to ensure the appropriate number of employees is available to meet production goals. Notice that the number of direct labor hours needed in production for the third quarter is significantly higher than each of the two previous quarters. Again, this is why organizations prepare budgets: to plan for these types of events. Lynn will have to start planning for this spike in direct labor hours, either by asking employees to work overtime or by hiring additional employees.

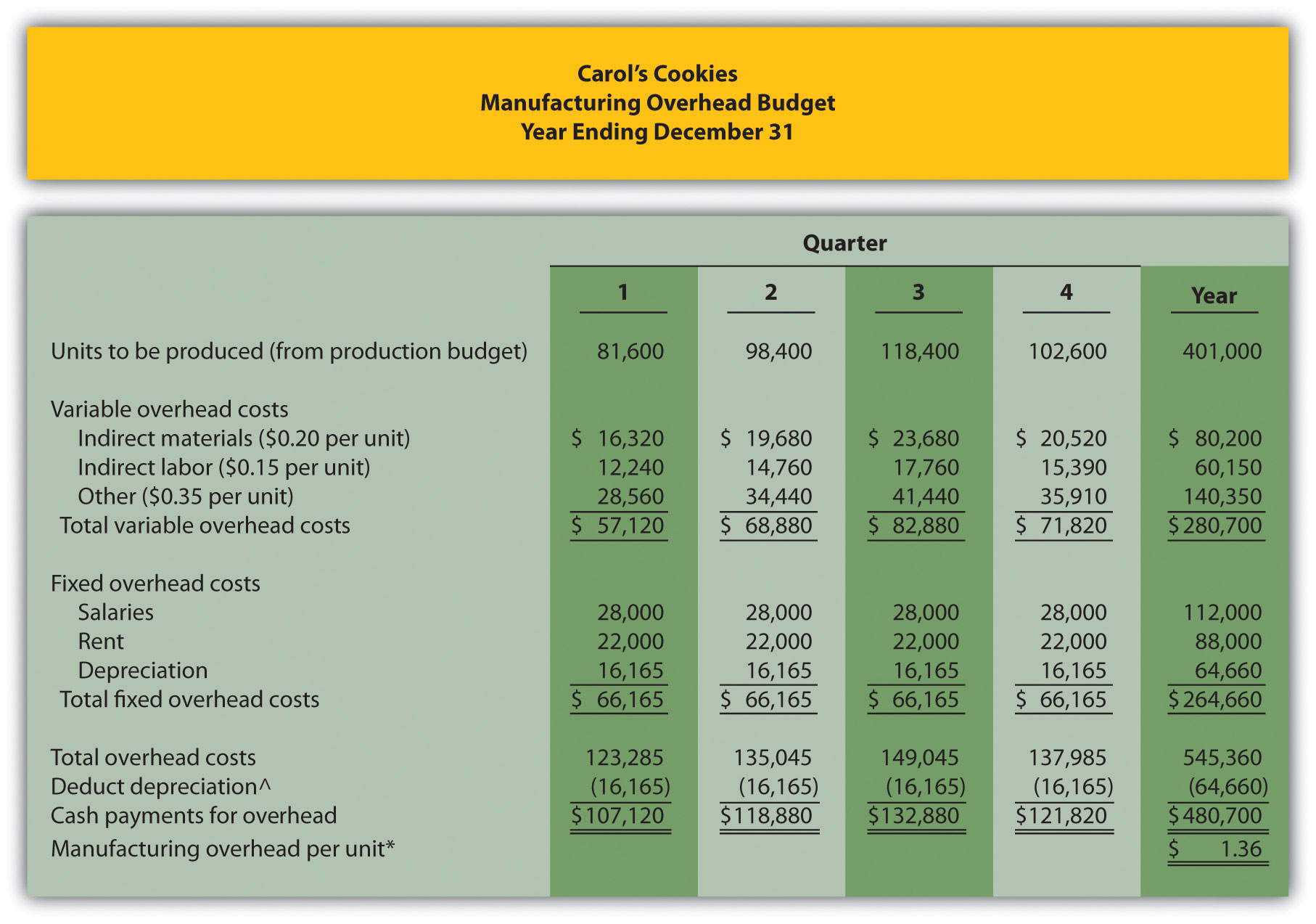

Manufacturing Overhead Budget

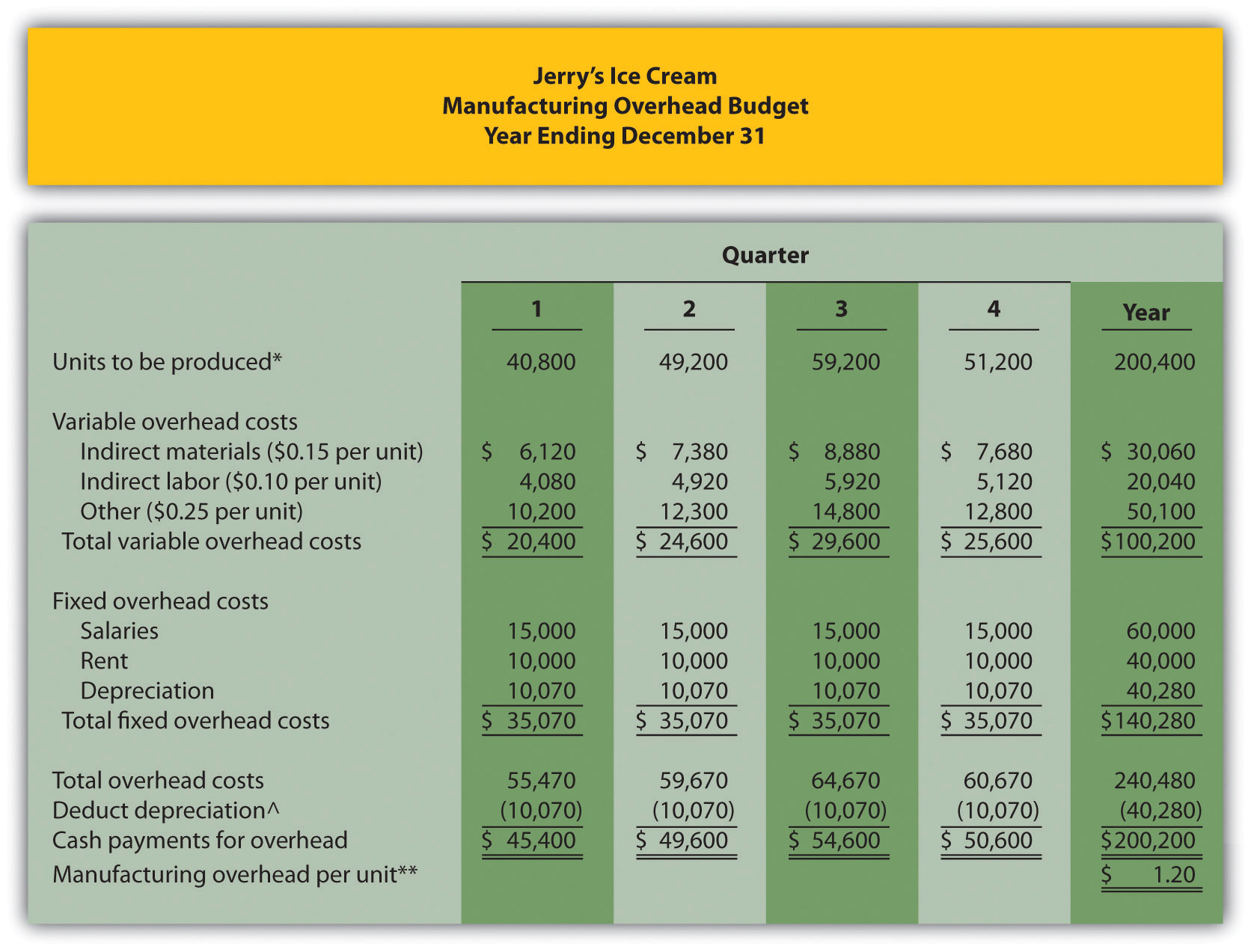

Question: The manufacturing overhead budget is the third of three supporting production budgets. What is a manufacturing overhead budget, and how is it prepared?

Answer: The manufacturing overhead budgetAn estimate of all production costs, other than direct materials and direct labor, necessary to achieve a desired level of production. is an estimate of all production costs, other than direct materials and direct labor, necessary to achieve a desired level of production. This budget is presented in Figure 9.7 "Manufacturing Overhead Budget for Jerry’s Ice Cream". Notice that overhead costs are separated into variable and fixed components.

Figure 9.7 Manufacturing Overhead Budget for Jerry’s Ice Cream

*From Figure 9.4 "Production Budget for Jerry’s Ice Cream".

**$1.20 = $240,480 total overhead cost ÷ 200,400 units to be produced for the year.

^Deduct depreciation to get the actual cash payment for overhead. This information is needed for the cash budget presented in Figure 9.11 "Cash Budget for Jerry’s Ice Cream".

By definition, total variable overhead costs change with changes in production and are calculated by multiplying units to be produced by the cost per unit. For example, indirect materials cost for the first quarter of $6,120 is calculated by taking 40,800 units to be produced × $0.15 cost per unit. Fixed costs generally do not change with changes in production and therefore remain the same each quarter. (Note: In some situations, fixed overhead costs can change from one quarter to the next. For example, hiring additional salaried personnel during the year would increase fixed overhead costs, and purchasing equipment during the year would increase depreciation costs. In this example, we assume fixed overhead costs do not change during the year.)

Depreciation is deducted at the bottom of the manufacturing overhead budget to determine cash payments for overhead because depreciation is not a cash transaction. We use this information later in the chapter for the cash budget.

Review Problem 9.4

Carol’s Cookies, the company featured in the last review problem and in the next three, is now preparing the budget for direct materials purchases, direct labor, and manufacturing overhead.

Direct Materials Purchases Budget Information

Each unit of product requires 1.5 pounds of direct materials per unit, and the cost of direct materials is $2 per pound. Management prefers to maintain ending raw materials inventory equal to 30 percent of next quarter’s materials needed in production. Assume raw materials inventory at the end of the fourth quarter budget period is estimated to be 41,000 pounds.

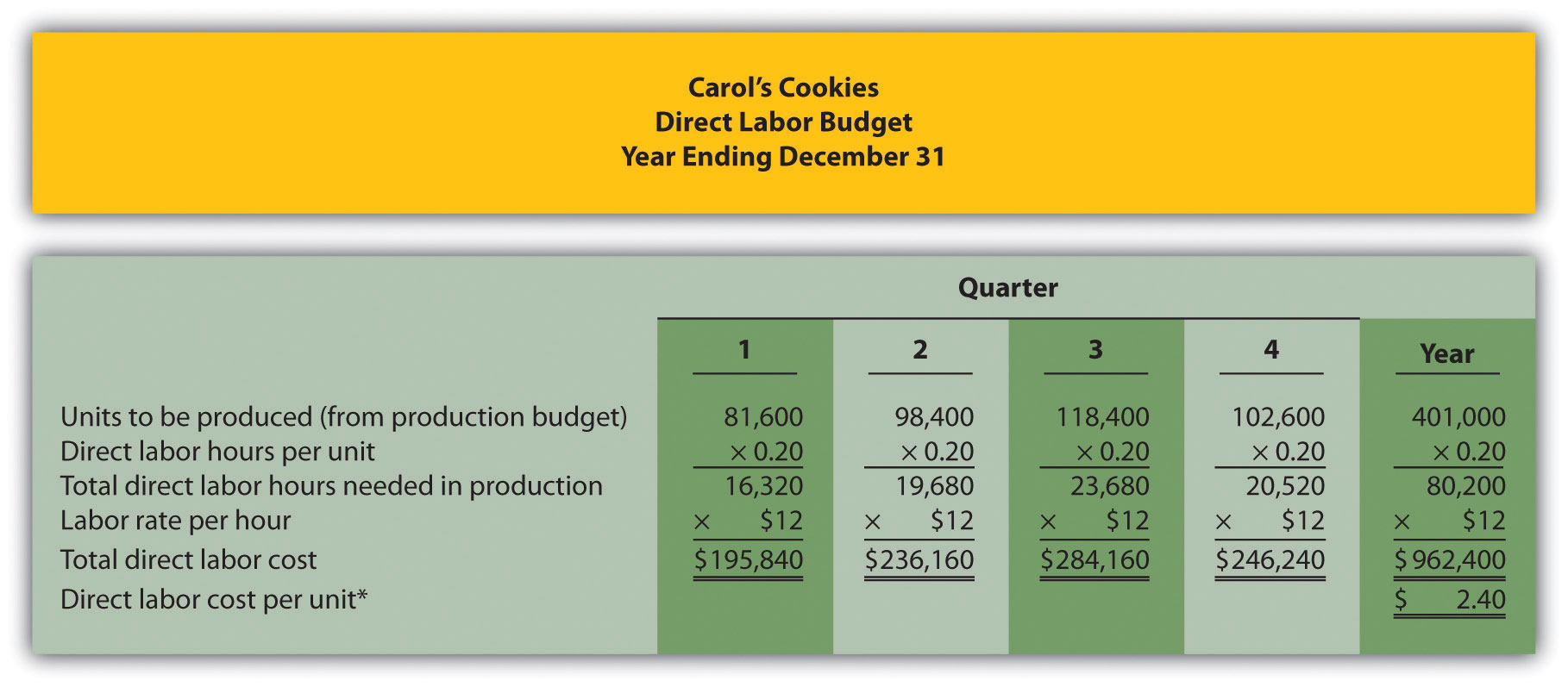

Direct Labor Budget Information

Each unit of product requires 0.20 direct labor hours at a cost of $12 per hour.

Manufacturing Overhead Budget Information

Variable overhead costs are:

| Indirect materials | $0.20 per unit |

| Indirect labor | $0.15 per unit |

| Other | $0.35 per unit |

Fixed overhead costs each quarter are:

| Salaries | $28,000 |

| Rent | $22,000 |

| Depreciation | $16,165 |

- Prepare a direct materials purchases budget for Carol’s Cookies using the format shown in Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream".

- Prepare a direct labor budget for Carol’s Cookies using the format shown in Figure 9.6 "Direct Labor Budget for Jerry’s Ice Cream".

- Prepare a manufacturing overhead budget for Carol’s Cookies using the format shown in Figure 9.7 "Manufacturing Overhead Budget for Jerry’s Ice Cream".

Solution to Review Problem 9.4

-

*Desired ending inventory = 30 percent × Next quarter production needs; for the first quarter, 44,280 = 0.30 × 147,600 pounds. Fourth quarter desired ending inventory of 41,000 pounds is given.

**Beginning inventory = Inventory at end of previous quarter; for example, Second quarter beginning inventory = First quarter ending inventory.

***$3 direct materials cost per unit = 1.5 pounds of materials required per unit × $2 per pound.

-

*$2.40 direct labor cost per unit = 0.20 direct labor hours per unit × $12 per hour.

-

*$1.36 = $545,360 total overhead cost ÷ 401,000 units to be produced for the year.

^Deduct depreciation to get the actual cash payment for overhead. This information is needed for the cash budget prepared later.

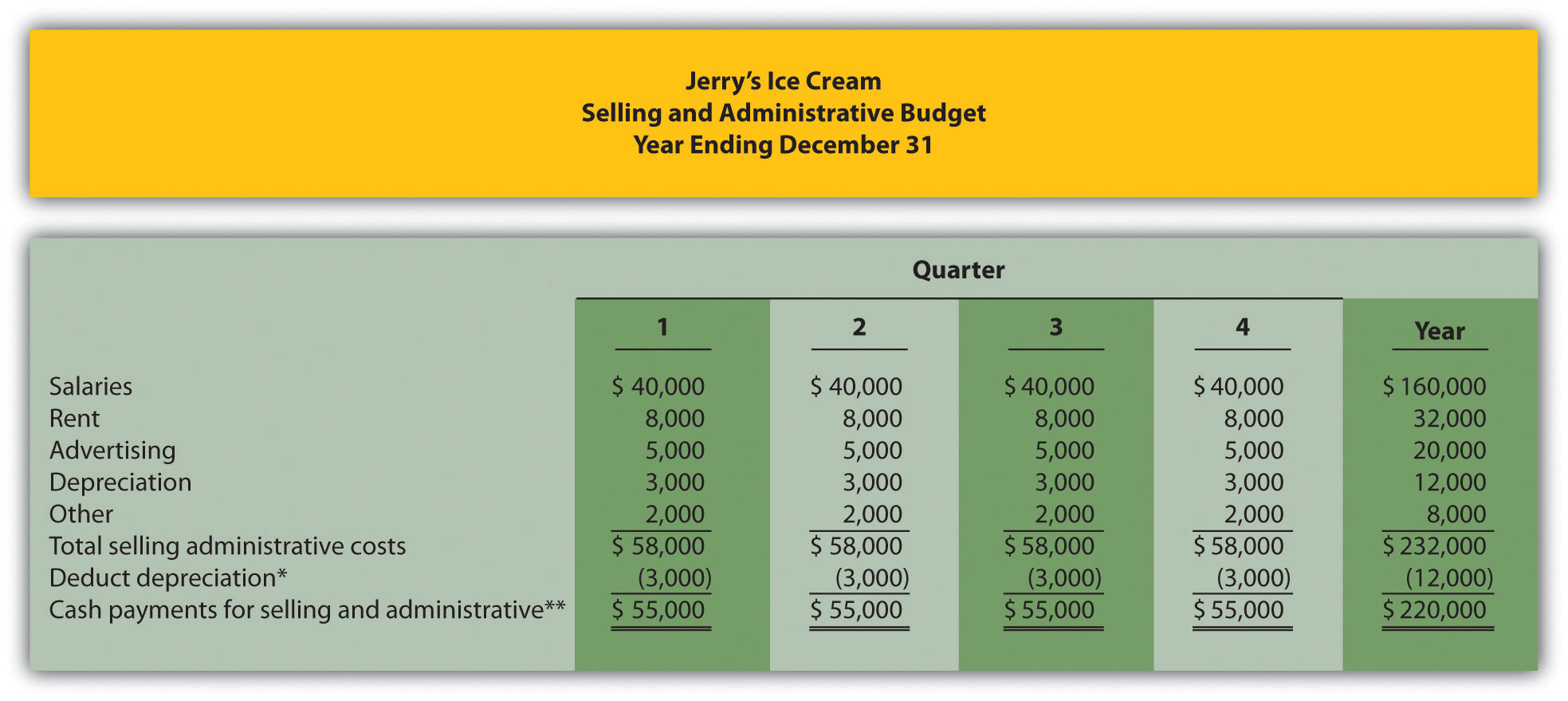

Selling and Administrative Budget

Question: Now that the sales and production-related budgets are complete, it is time to estimate selling and administrative costs. What is a selling and administrative budget, and how is it prepared?

Answer: The selling and administrative budgetAn estimate of all operating costs other than production. is an estimate of all operating costs other than production. This budget is presented in Figure 9.8 "Selling and Administrative Budget for Jerry’s Ice Cream".

Although many organizations may have variable and fixed costs in this budget, Jerry’s Ice Cream treats all selling and administrative costs as fixed costs. Once again, depreciation is deducted at the bottom of this budget to determine cash payments for selling and administrative costs, which we use later in the chapter for the cash budget.

Figure 9.8 Selling and Administrative Budget for Jerry’s Ice Cream

*Deduct depreciation to get the actual cash payment for selling and administrative costs.

**This information is needed for the cash budget presented in Figure 9.11 "Cash Budget for Jerry’s Ice Cream".

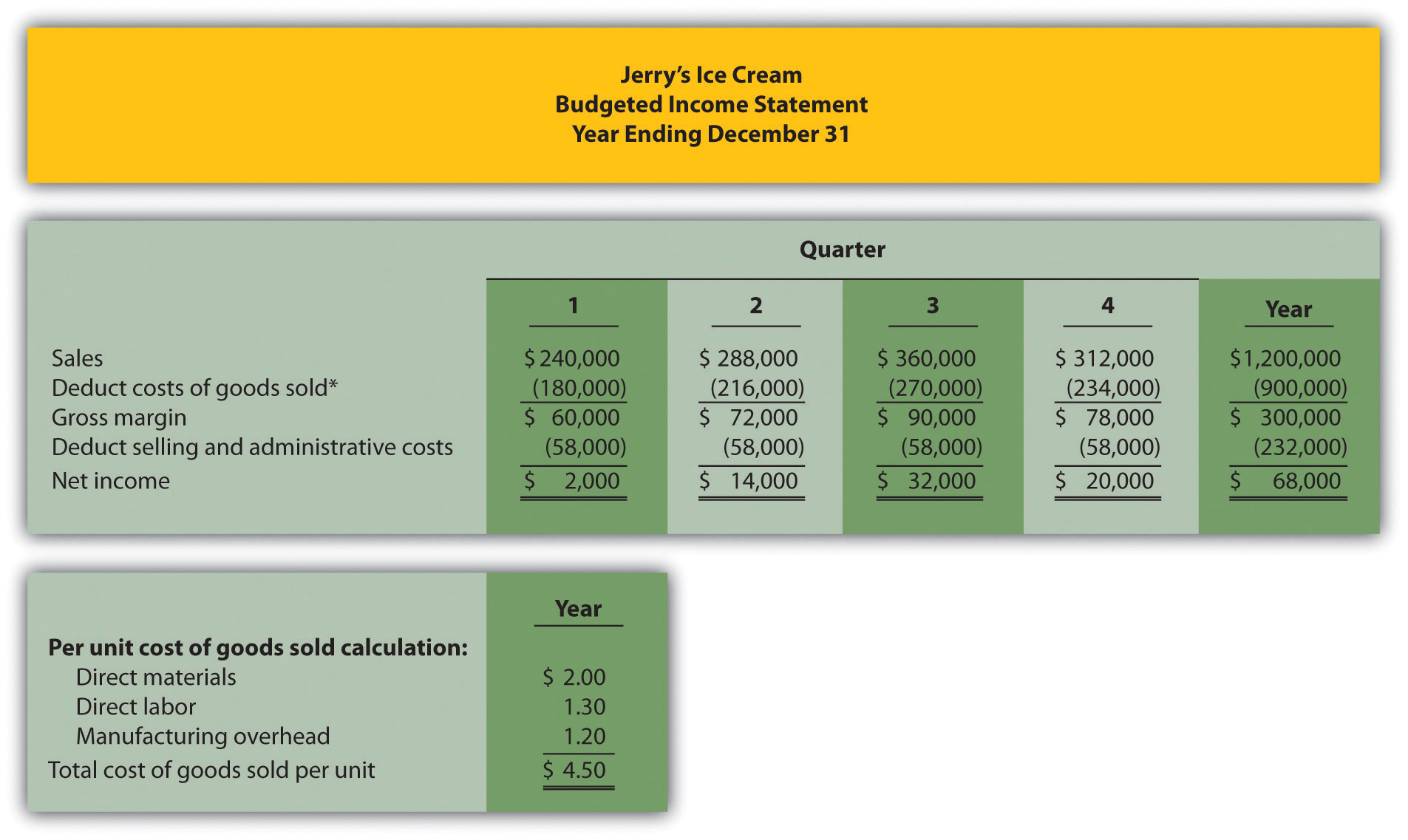

Budgeted Income Statement

Question: Budgets completed to this point include sales (Figure 9.3 "Sales Budget for Jerry’s Ice Cream"), production (Figure 9.4 "Production Budget for Jerry’s Ice Cream"), direct materials (Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream"), direct labor (Figure 9.6 "Direct Labor Budget for Jerry’s Ice Cream"), manufacturing overhead (Figure 9.7 "Manufacturing Overhead Budget for Jerry’s Ice Cream"), and selling and administrative (Figure 9.8 "Selling and Administrative Budget for Jerry’s Ice Cream"). Jerry’s Ice Cream now has enough information to prepare the budgeted income statement. What is a budgeted income statement, and how is it prepared?

Answer: The budgeted income statementAn estimate of the organization’s profit for a given budget period. is an estimate of the organization’s profit for a given budget period. Most organizations, including Jerry’s Ice Cream, prepare the budgeted income statement using the accrual basis of accounting: revenues are recorded when earned and expenses are recorded when incurred. The budgeted income statement for Jerry’s Ice Cream is presented in Figure 9.9 "Budgeted Income Statement for Jerry’s Ice Cream". The cash budget we prepare later in the chapter will show when cash is received and paid.

Figure 9.9 Budgeted Income Statement for Jerry’s Ice Cream

*Cost of goods sold = Per unit cost of $4.50 (see above) × Units sold (from Figure 9.3 "Sales Budget for Jerry’s Ice Cream"); for the first quarter, $180,000 cost of goods sold = $4.50 unit cost × 40,000 units.

The first line in the budgeted income statement, sales, comes from the sales budget in Figure 9.3 "Sales Budget for Jerry’s Ice Cream". The next line, cost of goods sold, is calculated by multiplying unit sales from Figure 9.3 "Sales Budget for Jerry’s Ice Cream" by the cost per unit. The cost per unit calculation is shown at the bottom of Figure 9.9 "Budgeted Income Statement for Jerry’s Ice Cream". Carefully review this calculation. Since Jerry’s Ice Cream uses full-absorption costing, all manufacturing costs related to goods sold are included (or fully absorbed) in cost of goods sold. Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream", Figure 9.6 "Direct Labor Budget for Jerry’s Ice Cream", and Figure 9.7 "Manufacturing Overhead Budget for Jerry’s Ice Cream" provide this information on a per unit basis for direct materials, direct labor, and manufacturing overhead, respectively.

The third line, gross margin, is simply sales minus cost of goods sold. The fourth line, selling and administrative costs, comes from the selling and administrative budget in Figure 9.8 "Selling and Administrative Budget for Jerry’s Ice Cream". The bottom line of the budgeted income statement, net income, is gross margin minus selling and administrative costs. Income tax expense is not included in this example for the sake of simplicity. However, income taxes can significantly reduce projected net income and cash flows.

Question: How do companies use the budgeted income statement to improve operations?

Answer: The budgeted income statement is perhaps the most carefully scrutinized component of the master budget. The management and employees throughout the organization use this information for planning purposes and to evaluate company performance. The board of directors and budget committee are responsible for approving the budget and often review periodic reports comparing actual net income to budgeted net income to determine if profit goals are being achieved. Lenders and owners often review the budget to ensure the organization is on track to meet its goals. The budgeted income statement answers the question: what profits does the organization expect to achieve?

After completing the budgeted income statement, only three budgets remain: the capital expenditures budget, the cash budget, and the budgeted balance sheet. We discuss the capital expenditures budget next.

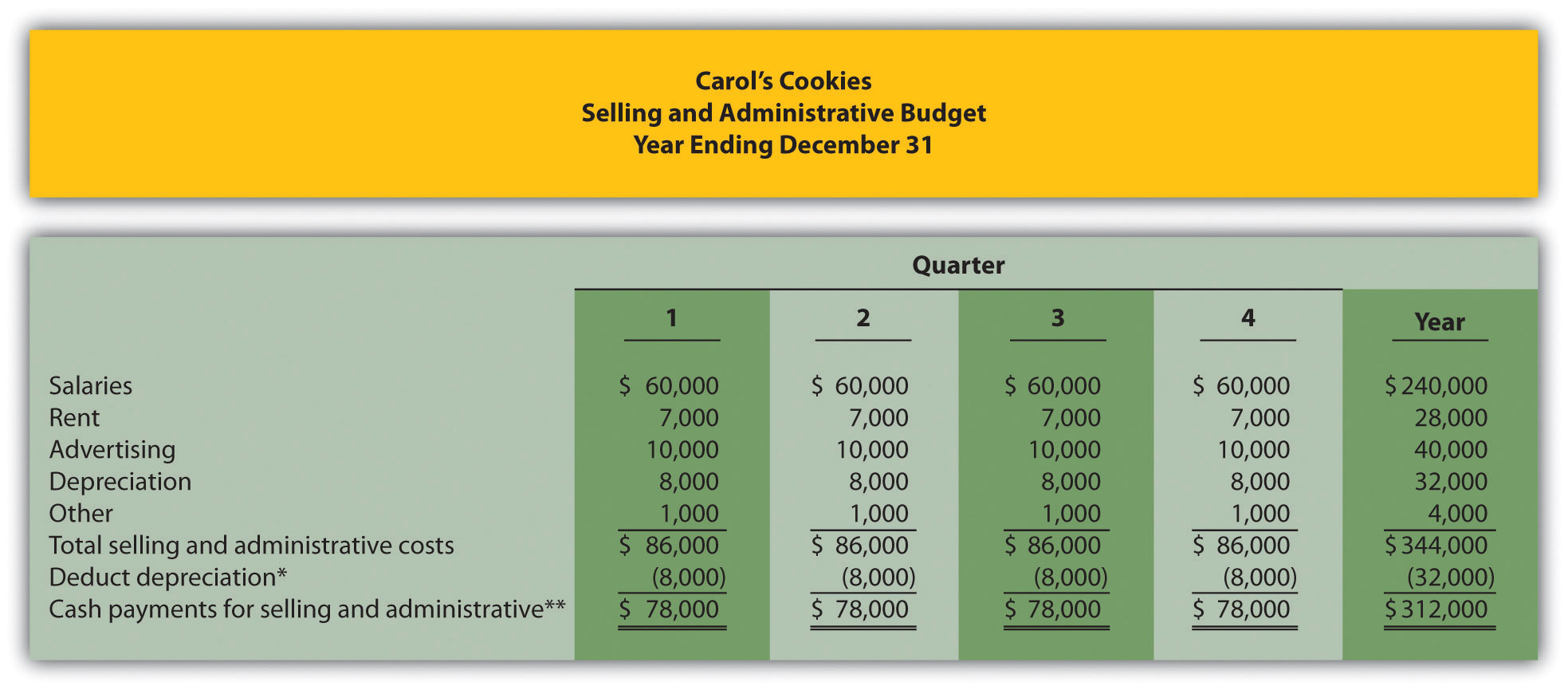

Review Problem 9.5

Carol’s Cookies estimates that all selling and administrative costs are fixed. Quarterly selling and administrative cost estimates for the coming year are

| Salaries | $60,000 |

| Rent | $ 7,000 |

| Advertising | $10,000 |

| Depreciation | $ 8,000 |

| Other | $ 1,000 |

- Prepare a selling and administrative budget for Carol’s Cookies using the format shown in Figure 9.8 "Selling and Administrative Budget for Jerry’s Ice Cream".

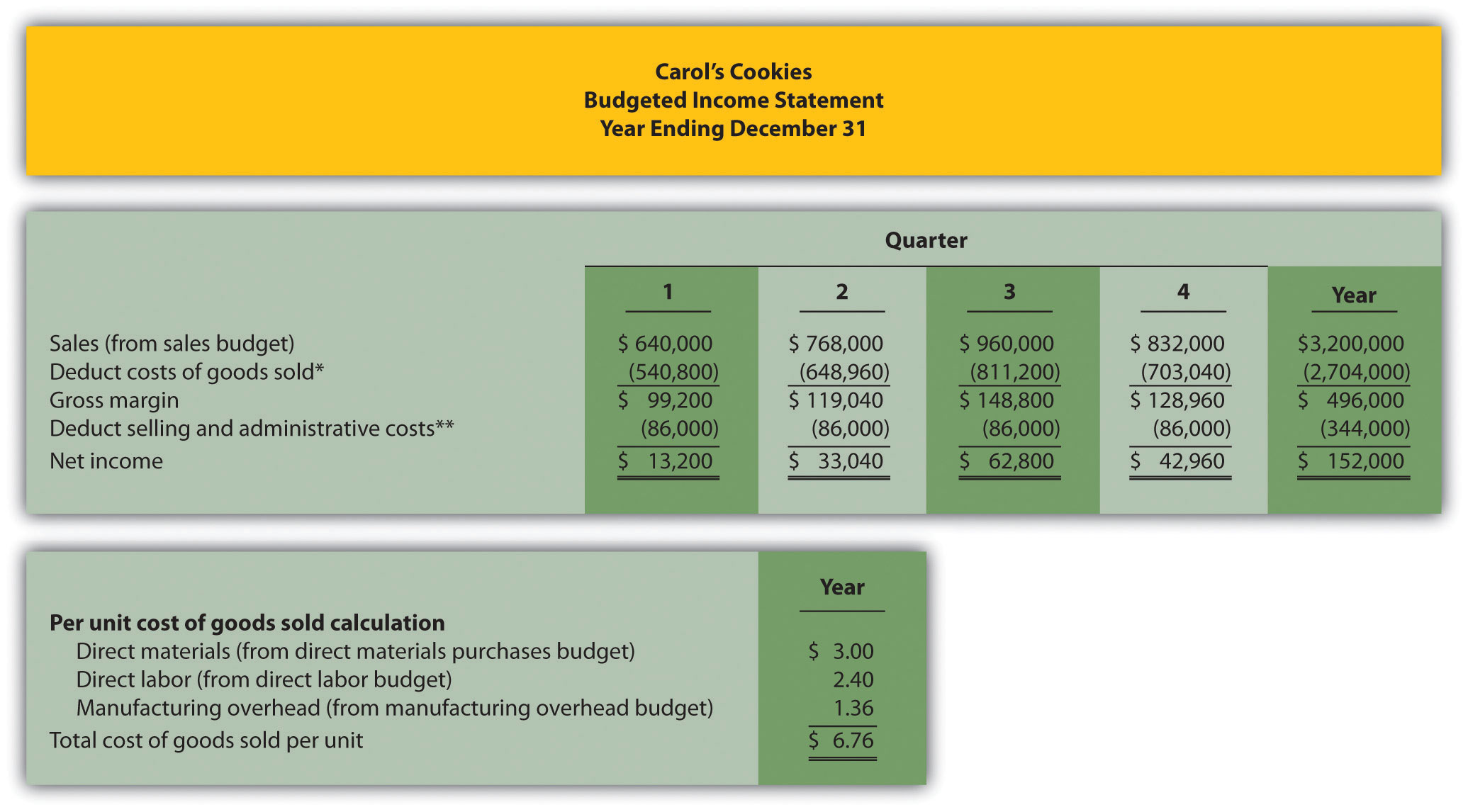

- Prepare a budgeted income statement for Carol’s Cookies using the format shown in Figure 9.9 "Budgeted Income Statement for Jerry’s Ice Cream".

Solution to Review Problem 9.5

-

*Deduct depreciation to get the actual cash payment for selling and administrative costs.

**This information is needed for the cash budget prepared later.

-

*Cost of goods sold = Per unit cost of $6.76 (see above) × Units sold (from sales budget); for first quarter, $540,800 cost of goods sold = $6.76 unit cost × 80,000 units.

**From selling and administrative budget.

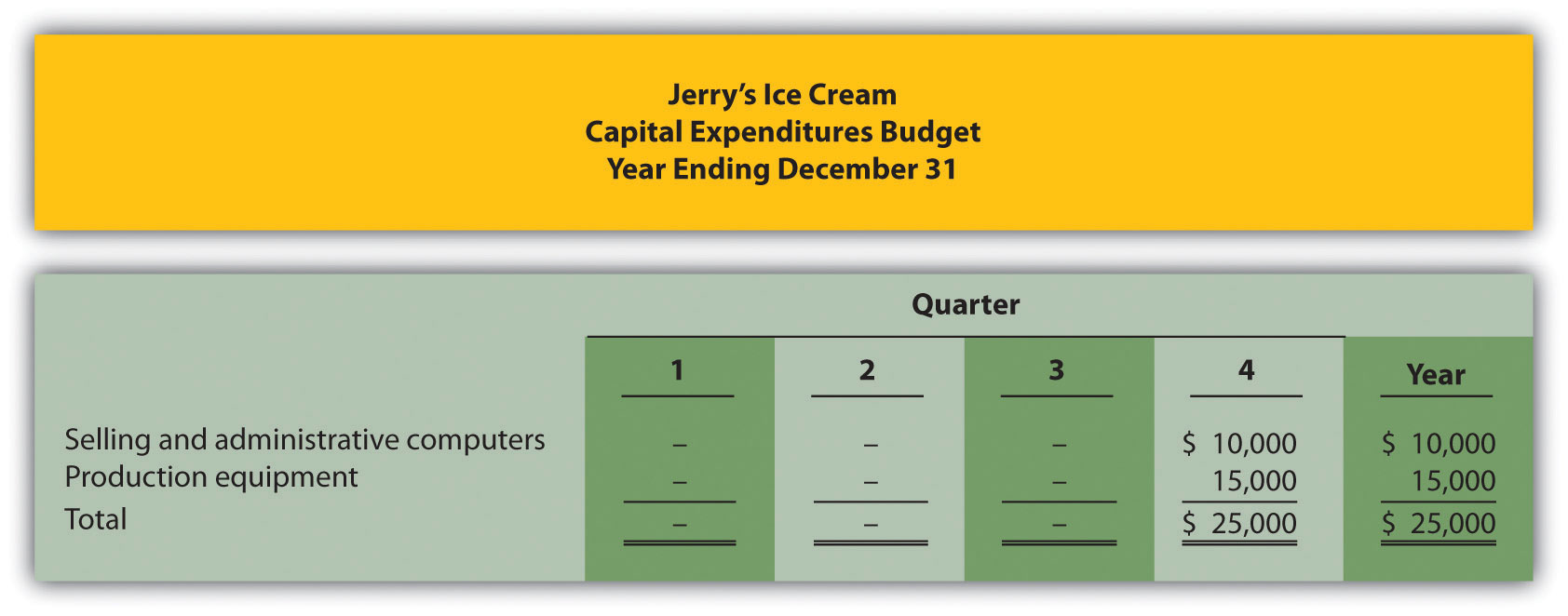

Capital Expenditures Budget

Question: What is a capital expenditures budget, and how is it prepared?

Answer: The capital expenditures budgetAn estimate of the long-term assets to be purchased during the budget period. is an estimate of the long-term assets to be purchased during the budget period. This includes purchases of tangible long-term assets such as property, plant, and equipment, and intangible assets, such as patents, copyrights, and trademarks. This budget can have a significant impact on cash flow and requires careful planning and analysis (Chapter 8 "How Is Capital Budgeting Used to Make Decisions?" presents a detailed discussion of capital budgeting). As shown in Figure 9.10 "Capital Expenditures Budget for Jerry’s Ice Cream", Jerry’s Ice Cream plans to purchase computers and production equipment at the end of the fourth quarter.

Figure 9.10 Capital Expenditures Budget for Jerry’s Ice Cream

Note: These acquisitions will have no effect on depreciation expense in the fourth quarter. Items will be purchased at the end of the year. Thus depreciation begins the following year.

Because long-term asset purchases occur at the end of the year, depreciation will begin the following year. Thus depreciation shown in the manufacturing overhead and selling and administrative budgets will not be affected until the following year. The cash outlay required to make these purchases is reflected in the cash budget presented next.

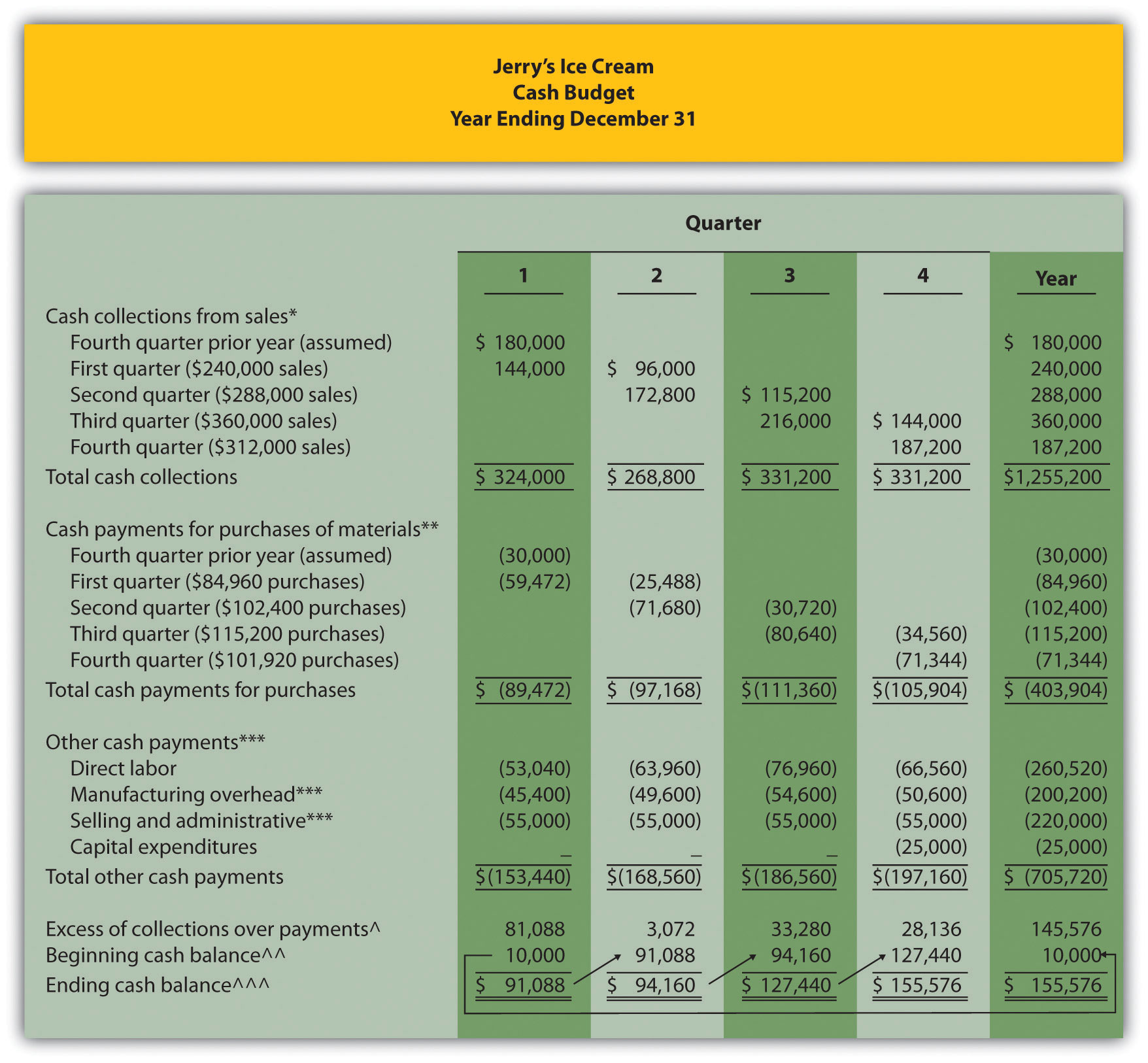

Cash Budget

Question: What is a cash budget, and how is it prepared?

Answer: The cash budgetAn estimate of the amount and timing of cash inflows and outflows for the budget period. is an estimate of the amount and timing of cash inflows and outflows for the budget period. Although the budgeted income statement provides an estimate of profitability, it stops short of providing cash flow information. For example, some of the $240,000 in first quarter sales revenue will be collected during the first quarter and some will be collected the following quarter. A section of the cash budget will show when cash from sales will be received.

The cash budget has the following sections, each of which is described after Figure 9.11 "Cash Budget for Jerry’s Ice Cream":

- Cash collections from sales

- Cash payments for purchases of materials

- Other cash collections and payments

Figure 9.11 "Cash Budget for Jerry’s Ice Cream" shows the cash budget for Jerry’s Ice Cream. Amounts shown in parentheses represent cash outflows; amounts without parentheses represent cash inflows.

Figure 9.11 Cash Budget for Jerry’s Ice Cream

*Based on sales budget shown in Figure 9.3 "Sales Budget for Jerry’s Ice Cream". All sales are on credit: 60 percent collected in the quarter of sale and 40 percent collected the following quarter.

**Based on purchases budget shown in Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream". All purchases are on credit: 70 percent paid in the quarter of purchase and 30 percent paid the following quarter.

***Does not include depreciation since depreciation expense does not involve a cash payment. See related figures for calculations.

^Excess of collections over payments = Cash collections from sales – Cash payments for materials purchases – Other cash payments.

^^ Beginning cash balance = Cash balance at end of previous period. Balance for first quarter is given.

^^^ Ending cash balance = Excess of collections over payments for the quarter + Beginning cash balance.

Cash Collections from Sales

Question: Assume all sales at Jerry’s Ice Cream are on credit. How long does it take, on average, for Jerry’s to collect on credit sales?

Answer: On average, 60 percent of credit sales are collected in the quarter sold and the remaining 40 percent is collected the following quarter. These percentage estimates are based on previous experience and take into consideration credit terms offered to customers. Since Jerry’s Ice Cream only sells to customers with an excellent credit record, it anticipates no bad debts.

As you examine the cash collections from sales section of Jerry’s cash budget, notice that $180,000 in cash will be collected in the first quarter related to credit sales made in the previous quarter (this amount is given). Next, you will see $144,000 in cash collected in the first quarter related to first quarter sales (= 60 percent collected in quarter of sale × $240,000 first quarter sales). The remaining $96,000 will be collected in the second quarter, as shown in Figure 9.11 "Cash Budget for Jerry’s Ice Cream" (= 40 percent × $240,000 first quarter sales).

Cash Payments for Purchases of Materials

Question: Assume all purchases at Jerry’s Ice Cream are on credit. How long does it take, on average, for Jerry’s to pay for these credit purchases?

Answer: On average, 70 percent of purchases are paid in the quarter purchased and the remaining 30 percent is paid the following quarter. These percentage estimates are based on previous experience and take into account credit terms offered by suppliers.

As you look at the cash payments for purchases of materials section of Jerry’s cash budget, notice that $30,000 in cash will be paid in the first quarter related to purchases made in the previous quarter (this amount is given). Next, you will see $59,472 in cash paid in the first quarter related to first quarter purchases (= 70 percent paid in quarter purchased × $84,960 first quarter purchases). The remaining $25,488 will be paid in the second quarter, as shown in Figure 9.11 "Cash Budget for Jerry’s Ice Cream" (= 30 percent × $84,960 first quarter purchases). Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream" shows how cash flows into the company for customer sales and out of the company for purchases of materials.

Other Cash Collections and Payments

Question: What other cash collections and cash payments must be considered at Jerry’s Ice Cream?

Answer: Assume Jerry’s Ice Cream has other cash payments but no other cash collections. Direct labor cash payments are from Figure 9.6 "Direct Labor Budget for Jerry’s Ice Cream". Manufacturing overhead cash payments are from Figure 9.7 "Manufacturing Overhead Budget for Jerry’s Ice Cream". Recall that depreciation was subtracted from total overhead costs in Figure 9.7 "Manufacturing Overhead Budget for Jerry’s Ice Cream" to calculate the cash payments for overhead. Selling and administrative cash payments are from Figure 9.8 "Selling and Administrative Budget for Jerry’s Ice Cream", where a similar depreciation adjustment was made. Capital expenditure cash payments are from Figure 9.10 "Capital Expenditures Budget for Jerry’s Ice Cream".

The other cash collections and payments section is also where organizations include financing activities such as cash collections from the sale of bonds or cash payments for the repayment of bank loans. Jerry’s Ice Cream does not have any of these financing activities.

The bottom section of the cash budget is where the ending cash balance is calculated for each budget period. The manager responsible for cash planning, typically the treasurer, scrutinizes this section carefully. Some organizations must borrow cash to fund the timing difference between when cash is used for production and when cash is received from sales. The cash budget will signal when short-term borrowing is necessary and allows time for the treasurer to arrange for financing. The cash budget presented in Figure 9.11 "Cash Budget for Jerry’s Ice Cream" shows that Jerry’s will not need to borrow cash in any of the four quarters. In fact, Jerry’s Ice Cream will have a hefty reserve of cash totaling $155,576 at the end of the fourth quarter.

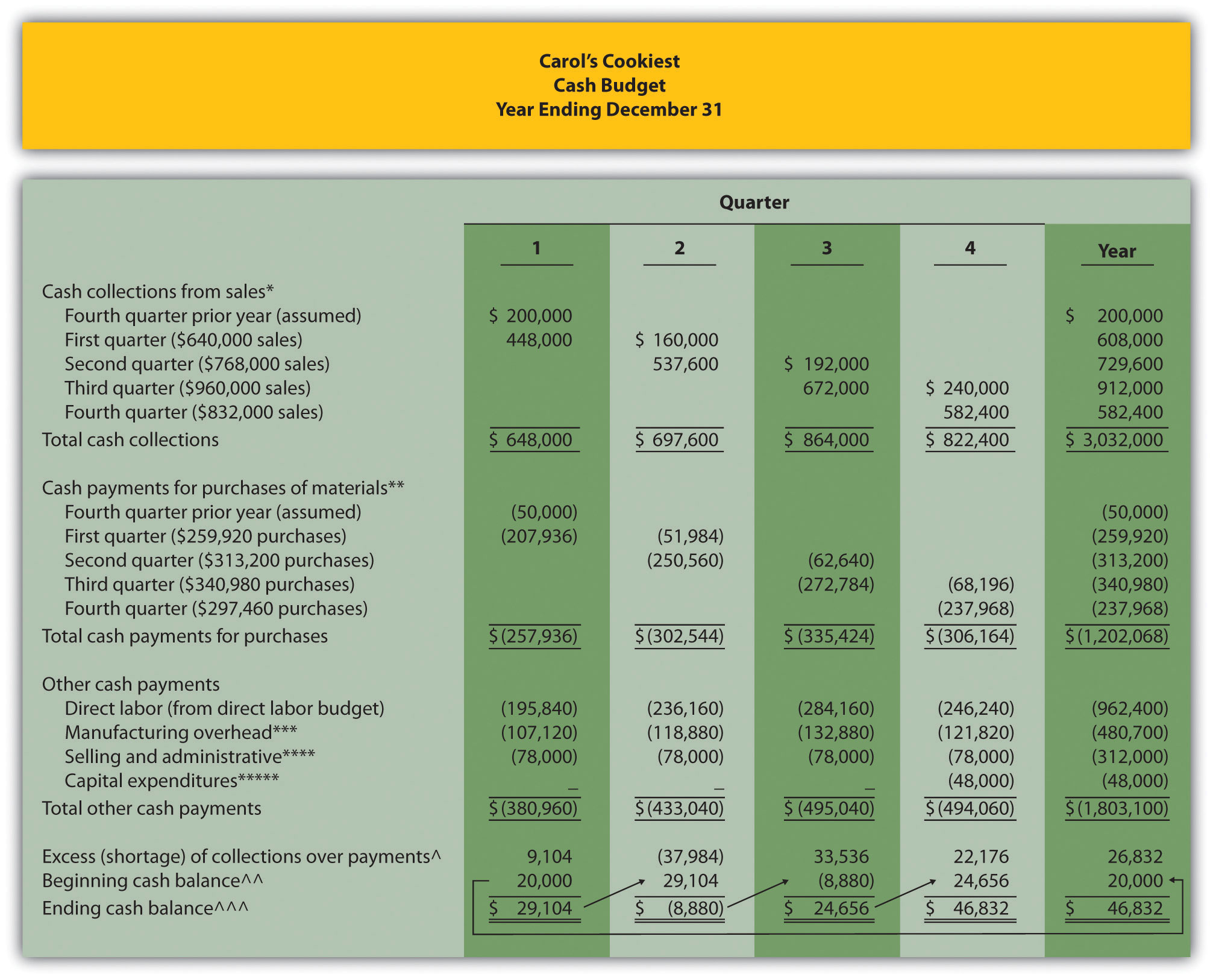

Review Problem 9.6

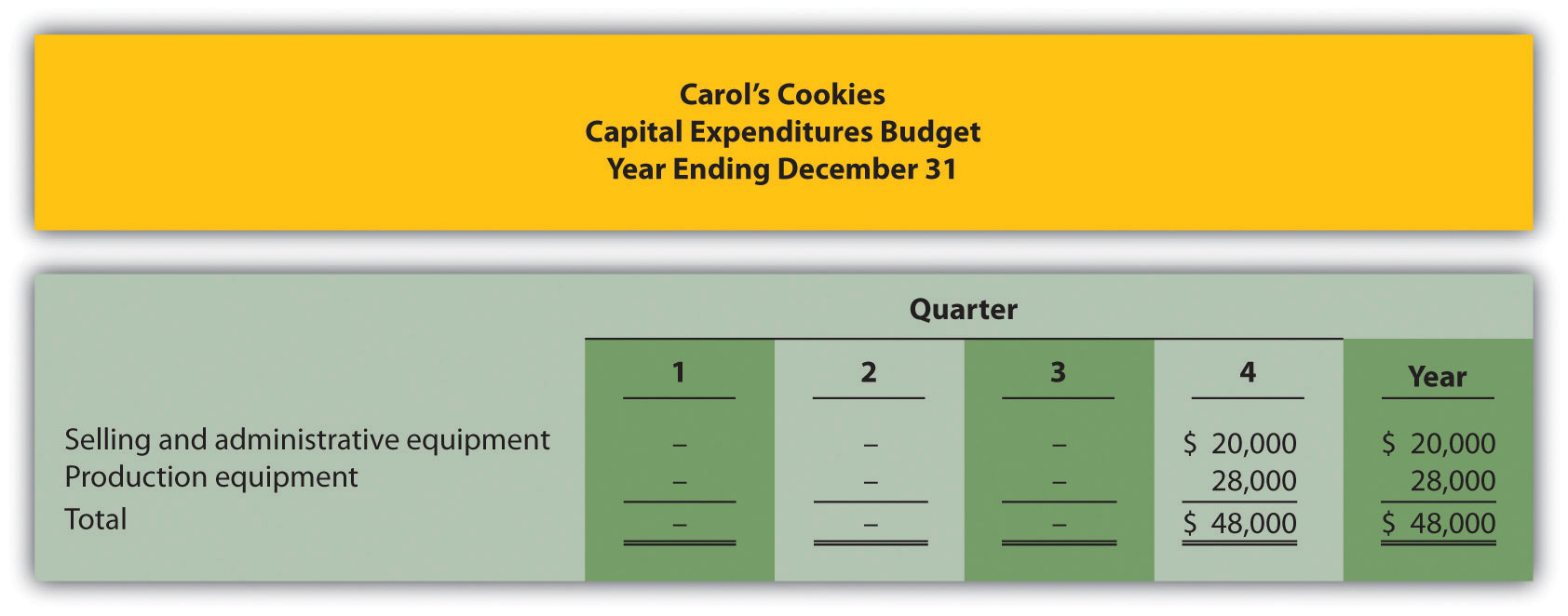

Carol’s Cookies has the following information pertaining to the capital expenditures and cash budgets.

Capital Expenditures

The company plans to purchase selling and administrative equipment totaling $20,000 and production equipment totaling $28,000. Both will be purchased at the end of the fourth quarter and will not affect depreciation expense for the coming year.

Cash Budget

All sales are on credit. The company expects to collect 70 percent of sales in the quarter of sale, 25 percent of sales in the quarter following the sale, and 5 percent will not be collected (bad debt). Accounts receivable at the end of last year totaled $200,000, all of which will be collected in the first quarter of this coming year.

All direct materials purchases are on credit. The company expects to pay 80 percent of purchases in the quarter of purchase and 20 percent the following quarter. Accounts payable at the end of last year totaled $50,000, all of which will be paid in the first quarter of this coming year.

The cash balance at the end of last year totaled $20,000.

- Prepare a capital expenditures budget for Carol’s Cookies using the format shown in Figure 9.10 "Capital Expenditures Budget for Jerry’s Ice Cream".

- Prepare a cash budget for Carol’s Cookies using the format shown in Figure 9.11 "Cash Budget for Jerry’s Ice Cream".

Solution to Review Problem 9.6

-

Note: These acquisitions will have no effect on depreciation expense in the fourth quarter. Items will be purchased at the end of the year. Thus depreciation begins the following year.

-

*Based on sales budget. All sales are on credit: 70 percent collected in the quarter of sale, 25 percent collected the following quarter, and 5 percent bad debt.

**Based on purchases budget. All purchases are on credit: 80 percent paid in the quarter of purchase and 20 percent paid the following quarter.

***From manufacturing overhead budget. Amount does not include depreciation.

****From selling and administrative budget. Amount does not include depreciation.

*****From capital expenditures budget.

^Excess of collections over payments = Cash collections from sales – Cash payments for materials purchases – other cash payments.

^^ Beginning cash balance = Cash balance at end of previous period. Balance for first quarter is given.

^^^ Ending cash balance = Excess of collections over payments for the quarter + Beginning cash balance.

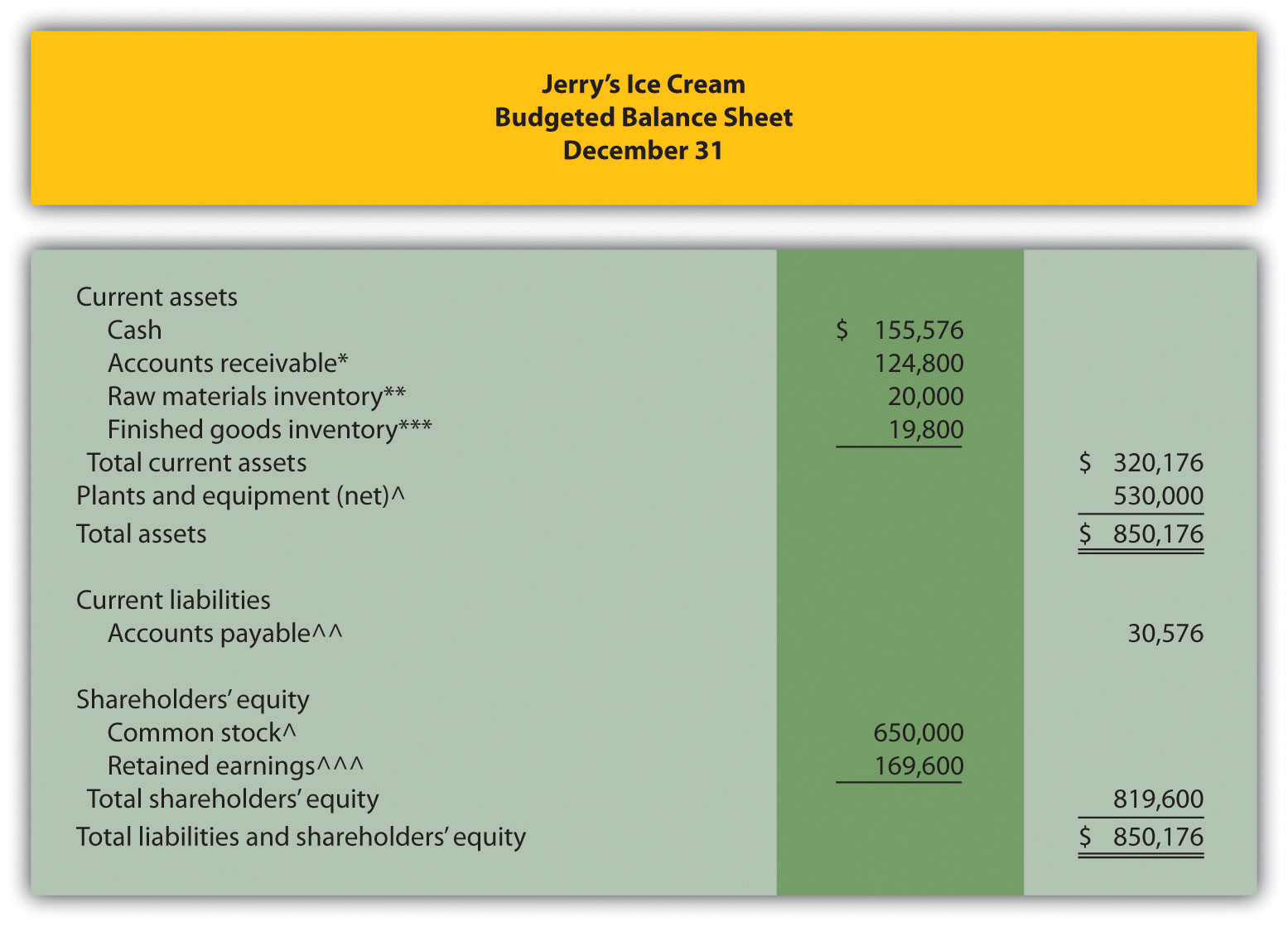

Budgeted Balance Sheet

Question: The budgeted balance sheet is the last piece of the budget process. What is the budgeted balance sheet, and how is it prepared?

Answer: The budgeted balance sheetAn estimate of the ending balances for all balance sheet accounts. is an estimate of the ending balances for all balance sheet accounts. Managers use this to assess the impact that budgeted sales and costs will have on the financial condition of the organization. We present the budgeted balance sheet for Jerry’s Ice Cream in Figure 9.12 "Budgeted Balance Sheet for Jerry’s Ice Cream".

Information needed to prepare the budgeted balance sheet for Jerry’s Ice Cream is shown throughout the chapter and is referenced in Figure 9.12 "Budgeted Balance Sheet for Jerry’s Ice Cream". Additional information is provided here:

- Plant and equipment (net) expected at the end of the budget period (December 31) is $530,000.

- Common stock issued and outstanding at the end of the budget period (December 31) is expected to be $650,000.

- Actual retained earnings at the end of last year totaled $101,600, and no cash dividends will be paid during the current budget period ending December 31.

Figure 9.12 Budgeted Balance Sheet for Jerry’s Ice Cream

*$124,800 = $312,000 in fourth quarter sales (Figure 9.3 "Sales Budget for Jerry’s Ice Cream") × 40 percent to be collected next quarter (Figure 9.11 "Cash Budget for Jerry’s Ice Cream").

**$20,000 = 20,000 pounds (Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream") × $1 per pound (Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream").

***$19,800 = 4,400 units (Figure 9.4 "Production Budget for Jerry’s Ice Cream") × $4.50 (Figure 9.9 "Budgeted Income Statement for Jerry’s Ice Cream").

^Given.

^^ $30,576 = $101,920 in fourth quarter purchases (Figure 9.5 "Direct Materials Purchases Budget for Jerry’s Ice Cream") × 30 percent to be paid next quarter (Figure 9.11 "Cash Budget for Jerry’s Ice Cream").

^^^$169,600 = $101,600 in retained earnings at end of last year (given) + $68,000 budgeted net income for the year (Figure 9.9 "Budgeted Income Statement for Jerry’s Ice Cream").

Computer Application

Using Excel to Develop an Operating Budget

Managers often use spreadsheets to develop operating budgets. Spreadsheets help managers perform what-if analysis by linking the components of the master budget and automatically making changes to budget schedules when certain estimates are revised. For example, if managers at Jerry’s Ice Cream wanted to see what would happen if sales in units were decreased by 10 percent from the initial projection shown in Figure 9.3 "Sales Budget for Jerry’s Ice Cream", they would simply reduce sales by 10 percent, and all budget schedules affected by this change would automatically be updated in the spreadsheet.

An example of how to use Excel to develop an operating budget for Jerry’s Ice Cream follows. Notice the tabs at the bottom of the spreadsheet. The first tab is for the sales budget worksheet, the second tab is for the production budget worksheet, the next tab is for the direct materials purchases budget worksheet, and so on. All these worksheets are linked so changes to certain estimates are reflected in the appropriate budget schedules.

Spreadsheet programs are not the only way managers use technology to facilitate the budgeting process. As indicated in Note 9.30 "Business in Action 9.2" the Web is also a useful tool when it comes to efficient budgeting.

Business in Action 9.2

Moving from Spreadsheets to Intranet Budgeting

The Pacific Northwest National Laboratory (PNNL) is one of nine multiprogram national laboratories of the U.S. Department of Energy. PNNL is operated by Battelle Science and Technology International, a global science and technology enterprise that conducts $3,000,000,000 worth of research and development annually.

The Facilities & Operations (F&O) Business Office at PNNL has over 130 budget activities, each of which requires an annual budget. The total annual budget is $70,000,000. Prior to 2000, activity managers were required to use Excel to process budget information. The F&O Business Office then uploaded this information to formulate the division’s budget.

As the F&O Business Office began the budget process for 2001, management decided to build a Web-based, or intranet, budget and planning system. The new system allowed managers to use the Web to input budget information directly, thus eliminating the need to upload initial budgets and subsequent budget changes.

Moving to intranet budgeting benefited PNNL’s F&O Business Office in several ways. Activity managers no longer had to use Excel to enter budget information, which saved 450 hours. The F&O Business Office saved 60 hours by no longer having to upload Excel budget information. Budget reports are easy to create, and the system provides real-time reports for analysis and project management.

Many organizations are adopting intranet budgeting as the primary source of planning and control. As the financial specialist at PNNL stated, intranet budgeting provides “a tool that is easy to use, accurate, and simple and will continue to save us time and money.”

Sources: Mary F. Astley, “Intranet Budgeting,” Strategic Finance, May 2003; Pacific Northwest National Laboratory, “Home Page,” http://www.pnl.gov.

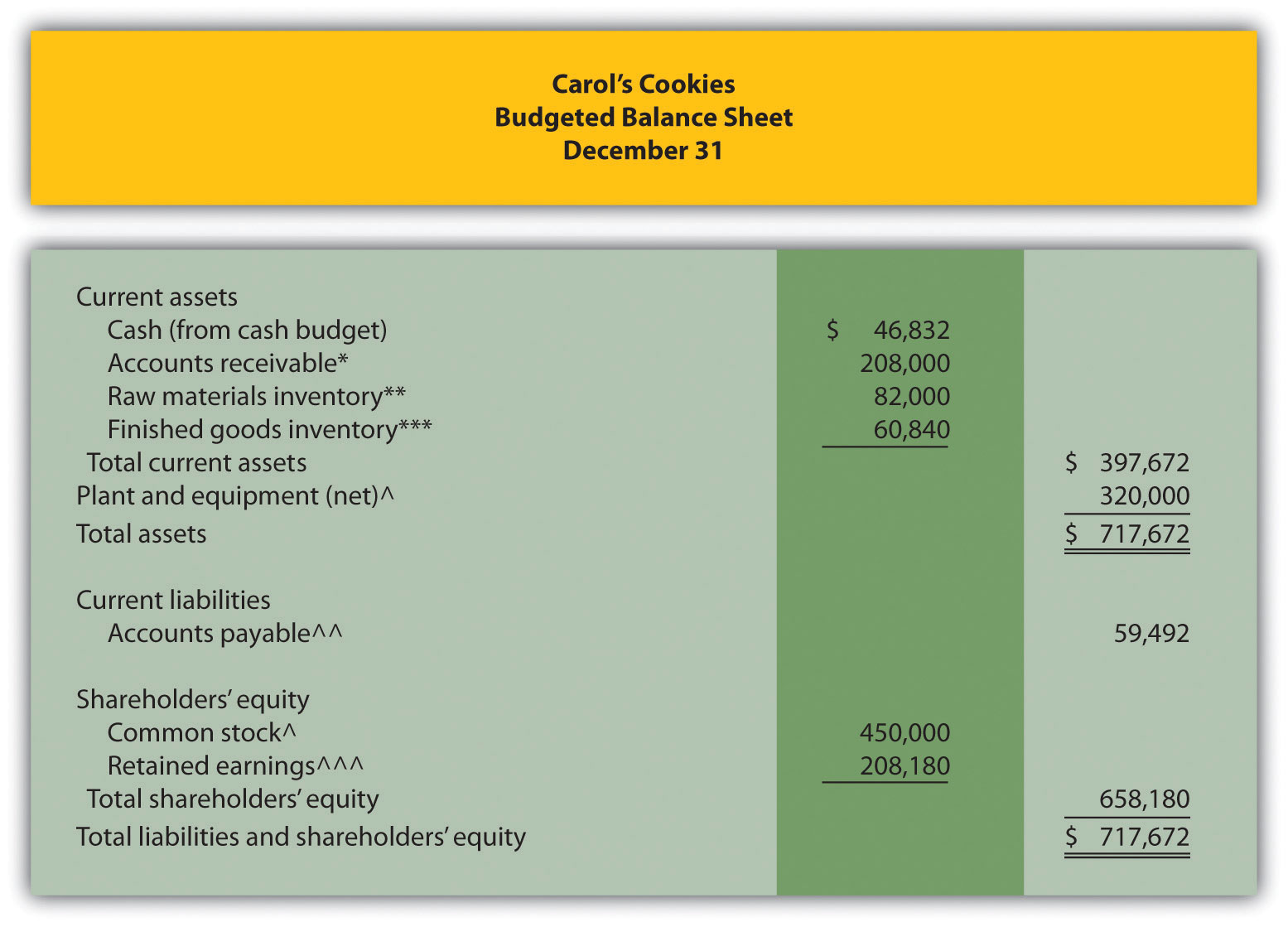

Review Problem 9.7

Assume Carol’s Cookies will collect 25 percent of fourth quarter budgeted sales in full next year (this represents accounts receivable at the end of the fourth quarter). The following account balances are expected at the end of the fourth quarter:

- Property, plant, and equipment (net): $320,000

- Common stock: $450,000

Retained earnings at the end of last year totaled $56,180, and no cash dividends are anticipated for the budget period ending December 31.

Prepare a budgeted balance sheet for Carol’s Cookies using the format shown in Figure 9.12 "Budgeted Balance Sheet for Jerry’s Ice Cream".

Solution to Review Problem 9.7

*$208,000 = $832,000 in fourth quarter sales (from sales budget) × 25 percent to be collected next quarter (given).

**$82,000 = 41,000 pounds × $2 per pound (from direct materials budget).

***$60,840 = 9,000 units (from production budget) × $6.76 cost per unit (from budgeted income statement).

^Given.

^^ $59,492 = $297,460 in fourth quarter purchases (from direct materials budget) × 20 percent to be paid next quarter (given).

^^^ $208,180 = $56,180 in retained earnings end of last year (given) + $152,000 budgeted net income (from budgeted income statement).

Wrap-Up of Chapter Example

The management group at Jerry’s Ice Cream is reconvening to discuss sales growth anticipated for the next budget period.

| Jerry: | Tom, I recall you saying we should expect growth between 10 percent and 25 percent next year. Have you been able to narrow this down a bit? |

| Tom: | Yes, I’ve talked with our salespeople and industry contacts. We also obtained trend data from a market research firm. Based on this information, sales should increase about 15 percent this coming year. Most agree this growth is a result of our high-quality product and our ability to quickly adjust flavors to accommodate consumer tastes. |

| Jerry: | This is great news. It looks like our ice cream is really catching on! |

| Michelle: | I received Tom’s projection a few days ago and already have a preliminary budget for next year. Lynn, you will have to do some serious planning to guarantee we have enough materials and employees for the third quarter spike in sales. |

| Lynn: | Yes, I realize we have some work to do to ensure we have enough resources to meet budgeted production levels. |

| Jerry: | Can’t we just hire a few more employees and let our suppliers know we will need more materials? |

| Lynn: | The problem is that we have a spike in production during the third quarter. Production goes from 49,200 units in the second quarter to 59,200 units in the third quarter and back down to 51,200 units in the fourth quarter. I don’t think materials will be an issue—our supplier has already assured me this will not be a problem. But I can’t just hire new employees in the third quarter and fire them in the fourth quarter. |

| Jerry: | Perhaps our existing employees can work overtime, or we can hire temporary employees. |

| Lynn: | Hiring temporary employees would be my preference, particularly since college students are looking for part-time work during the summer months. Working overtime would really cause problems with our budgeted hourly rate of $13. |

| Jerry: | Michelle, do we have any cash flow problems with the anticipated growth? |

| Michelle: | Fortunately not. If all goes as planned, we should have more than $90,000 in the bank at the end of each quarter. |

| Jerry: | Excellent! Let’s do our best to stay on track. Michelle, I’d like an update at the end of the first quarter to see if actual profit meets or exceeds budgeted profit. |

| Michelle: | No problem. I’ll have it for you as soon as the books are closed for the first quarter. |

| Jerry: | Now that we all have some idea of what to expect this coming year, we can make sure the resources are in place to make it happen. This should be an exciting and challenging year for us. Let’s meet again next month to discuss our progress in preparing for next year. |

This narrative provides an example of how the master budget is used for planning purposes. It is much more efficient to plan in advance for significant increases in sales and production than to wait and deal with production issues as they occur. The master budget can also be used for control purposes by evaluating company performance. We discuss the control phase of budgeting further in Chapter 10 "How Do Managers Evaluate Performance Using Cost Variance Analysis?".

Key Takeaway

- The master budget for a manufacturing company includes budget schedules for sales, production, direct materials, direct labor, manufacturing overhead, selling and administrative, the income statement, capital expenditures, cash, and the balance sheet. The sales budget is most important because sales projections drive the other budgets.