This is “Using Differential Analysis to Make Decisions”, section 7.1 from the book Accounting for Managers (v. 1.0). For details on it (including licensing), click here.

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. To download a .zip file containing this book to use offline, simply click here.

7.1 Using Differential Analysis to Make Decisions

Learning Objective

- Describe the format used for differential analysis.

Differential revenues and costsThe difference in revenues and costs from one alternative to another (also called relevant revenues and costs or incremental revenues and costs). (also called relevant revenues and costs or incremental revenues and costs) represent the difference in revenues and costs among alternative courses of action. Analyzing this difference is called differential analysisThe process of analyzing differential revenues and costs from one alternative to another (also called incremental analysis). (or incremental analysis). We begin with a relatively simple example to establish the format used to perform differential analysis and present more complicated examples later in the chapter. As you work through this example, notice that we also use the contribution margin income statement format presented in Chapter 5 "How Do Organizations Identify Cost Behavior Patterns?" and Chapter 6 "How Is Cost-Volume-Profit Analysis Used for Decision Making?".

Question: Assume Phillips Accountancy provides bookkeeping, tax, and audit services to its clients. Management believes Phillips Accountancy has several unprofitable customers and would like to perform differential analysis to find out how profits would change if Phillips dropped these customers. Alternative 1 includes the annual revenues, costs, and resulting profit if the company keeps all existing customers. Alternative 2 includes the annual revenues, costs, and resulting profit if the company drops what it believes are unprofitable customers. How should management decide whether to keep all existing customers or drop certain customers?

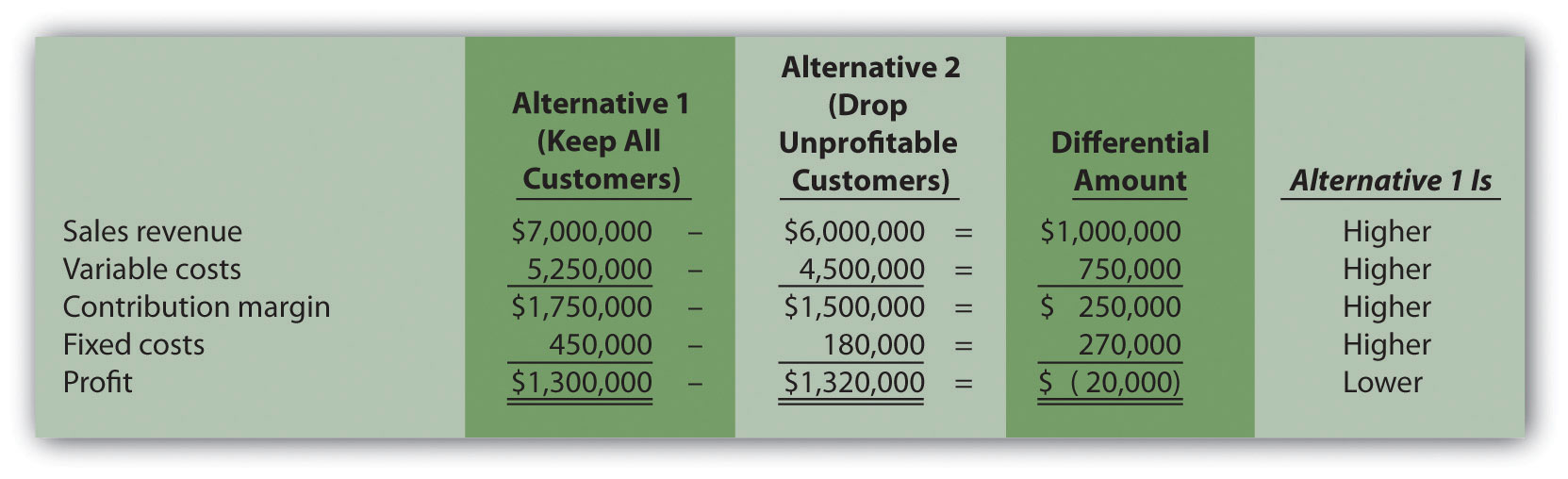

Answer: Figure 7.1 "Differential Analysis for Phillips Accountancy" presents the format used by management to perform differential analysis. In this case, differential analysis is used to evaluate whether Phillips Accounting should keep all customers or drop unprofitable customers. The information in Figure 7.1 "Differential Analysis for Phillips Accountancy" confirms that Phillips Accountancy would be better off dropping the unprofitable customers (Alternative 2), because company profits would increase by $20,000. The general rule is to select the alternative with the highest differential profit. Take a close look at Figure 7.1 "Differential Analysis for Phillips Accountancy" before reading the description of this information that follows.

Figure 7.1 Differential Analysis for Phillips Accountancy

Notice that in Figure 7.1 "Differential Analysis for Phillips Accountancy" the columns labeled Alternative 1 and Alternative 2 show revenues, costs, and profit for each alternative. The third column, labeled Differential Amount, presents the differential revenues and costs and resulting differential profit. Positive amounts appearing in this column indicate Alternative 1 is higher than Alternative 2. Negative amounts appearing in the Differential Amount column indicate Alternative 1 is lower than Alternative 2. The fourth column shows whether Alternative 1 is higher or lower than Alternative 2 for each line item.

For example, the differential amount of $1,000,000 for revenue indicates Alternative 1 produces $1,000,000 more in revenue than Alternative 2. The differential amount of $750,000 for variable costs indicates variable costs are $750,000 higher for Alternative 1 than for Alternative 2. Move to the bottom of Figure 7.1 "Differential Analysis for Phillips Accountancy". Notice that the differential amount for profit is negative ($20,000). This indicates that Alternative 1 results in profits that are $20,000 lower than Alternative 2. Thus Alternative 2 (dropping unprofitable customers) is the desirable course of action.

Notice that the columns labeled Alternative 1 and Alternative 2 show information in summary form (i.e., no detail is provided for revenues, variable costs, or fixed costs). Some managers may want only this type of summary information, whereas others may prefer more detailed information. It is important to be flexible with the format, to best meet the needs of managers. We will build upon the differential analysis format shown in Figure 7.1 "Differential Analysis for Phillips Accountancy" throughout this chapter, and show how more detail can easily be provided using the same format.

Next, this chapter focuses on how we use differential analysis to assist in making the following types of decisions:

- Make or buy products

- Keep or drop product lines

- Keep or drop customers

- Accept or reject special customer orders

Key Takeaway

- Differential revenues and costs represent the difference in revenues and costs among alternative courses of action. Analyzing this difference is called differential analysis. Differential analysis is useful in making managerial decisions related to making or buying products, keeping or dropping product lines, keeping or dropping customers, and accepting or rejecting special customer orders.

Review Problem 7.1

Coffee Express is a small coffee shop looking to expand its product offerings beyond coffee. The company is evaluating two alternatives—sandwiches and cookies. Annual projections for sales of sandwiches are as follows: sales, $18,000; variable costs, $13,000; and fixed costs, $500. Annual projections for sales of cookies are as follows: sales, $10,000; variable costs, $3,000; and no additional fixed costs.

Using the format in Figure 7.1 "Differential Analysis for Phillips Accountancy", perform differential analysis to determine which alternative is more profitable, and by how much. Assume adding sandwiches is Alternative 1 and adding cookies is Alternative 2.

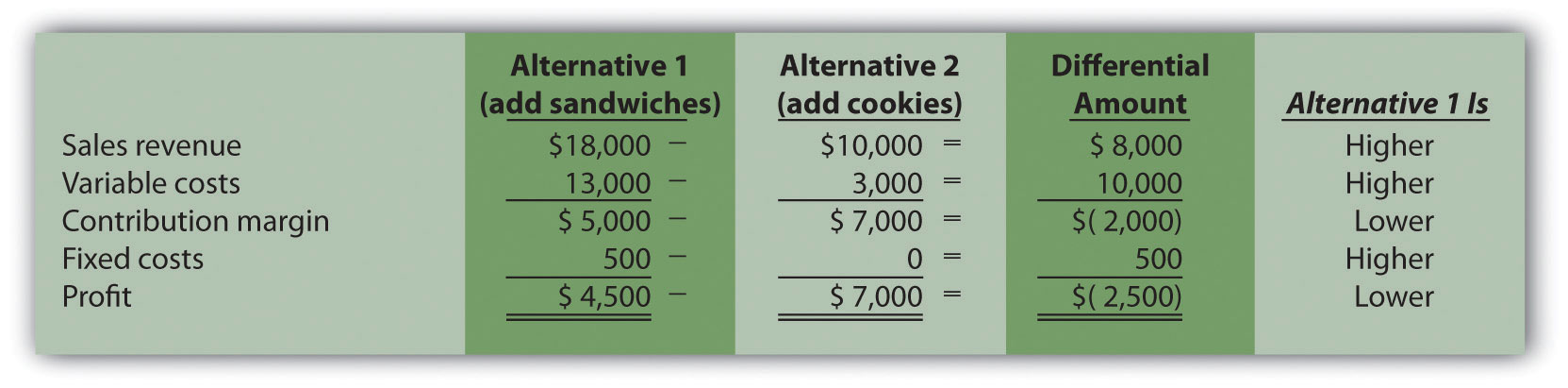

Solution to Review Problem 7.1

As shown in the differential analysis given, selling cookies is the most profitable alternative. Selling cookies results in profits of $7,000 for the year, which is $2,500 higher than the sandwich alternative.